Global Protein Snacks Market Size, Share Analysis Report By Type (Plant-Based, Meat-Based), By Product Type (Protein Bars, Protein Cookies, Protein Drinks, Protein Flakes, Jerky, Granola, Yogurt), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, E-commerce, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152570

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

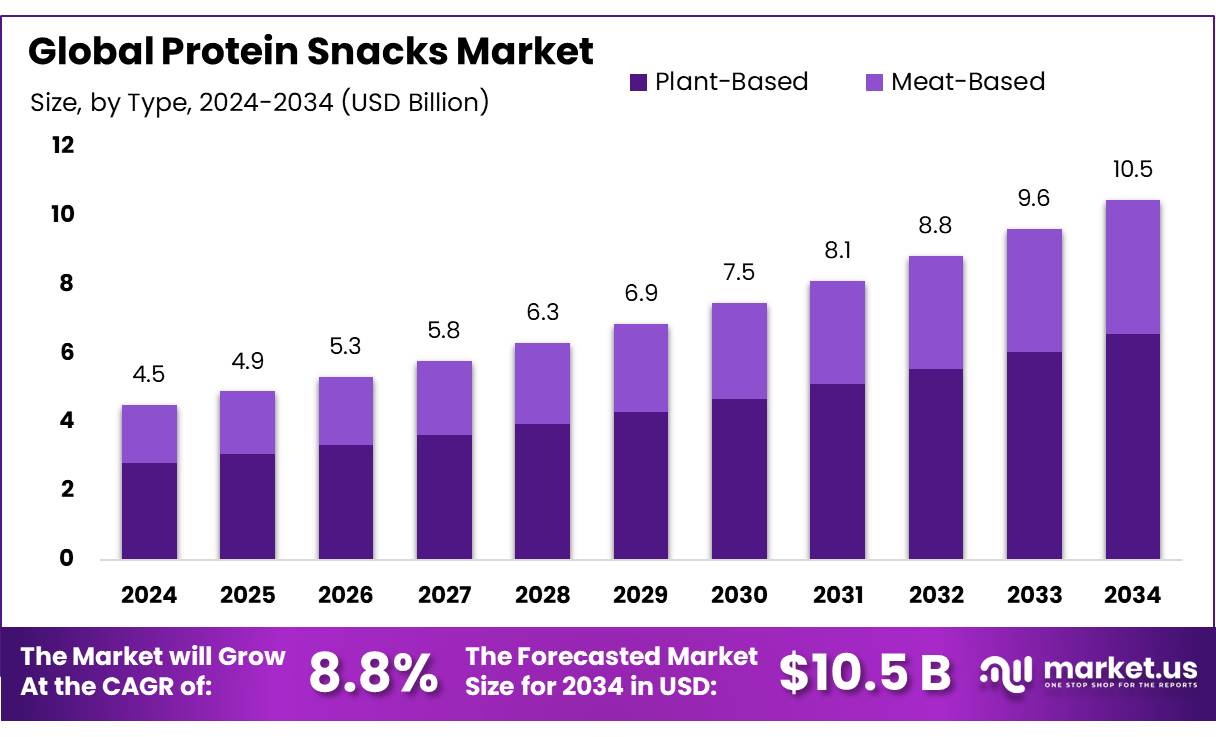

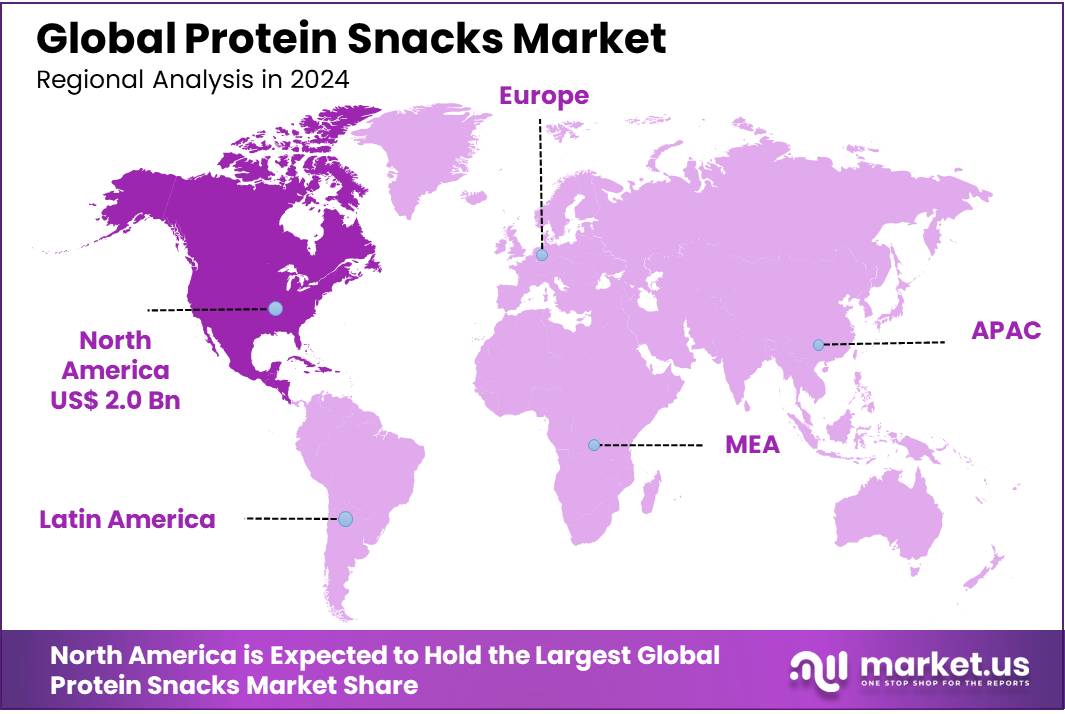

The Global Protein Snacks Market size is expected to be worth around USD 10.5 Billion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.2% share, holding USD 2.0 billion revenue.

Protein snack concentrates are specialized ingredients or ready-to-consume products engineered to deliver high protein content with convenient formats such as bars, powders, or fortified snacks. As dietary protein continues to be recognized as essential for satiety, muscle maintenance, and metabolic health, these concentrates serve as pivotal components in the functional snack industry. The market encompasses both animal‑derived and plant‑derived protein sources—including soy, pea, lentils, and dairy proteins.

Several factors drive the growth of the protein snacks concentrates industry. The increasing prevalence of lifestyle diseases such as obesity and diabetes has prompted consumers to seek healthier snack alternatives. Additionally, the rise in disposable incomes and urbanization has led to a demand for convenient and nutritious food options. The government’s initiatives, such as the Midday Meal Scheme, aim to improve the nutritional status of school-age children by providing free lunches, including protein-rich foods, to over 120 million children across India.

Government initiatives play a crucial role in promoting the protein snacks sector. The Pradhan Mantri Formalization of Micro Food Processing Enterprises (PMFME) scheme, launched in June 2020, aims to support micro food processing businesses. Under this scheme, Gujarat has emerged as a leader, onboarding 675 beneficiaries, the highest in the country.

The scheme offers a 35% capital subsidy for projects up to ₹10 lakh, ₹40,000 seed capital for each Self-Help Group (SHG) member, and 50% support for branding and marketing. In the United States, the USDA allocated over USD 5 billion since 2021 to school nutrition programs. This includes USD 100 million for the Healthy Meals Incentives Initiative to improve nutritional quality, and USD 10 million in FY 2024 as kitchen equipment grants, alongside USD 32 million for Team Nutrition training.

Key Takeaways

- Protein Snacks Market size is expected to be worth around USD 10.5 Billion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 8.8%.

- Plant-Based held a dominant market position, capturing more than a 62.8% share of the global protein snacks market.

- Protein Bars held a dominant market position, capturing more than a 37.2% share of the global protein snacks market.

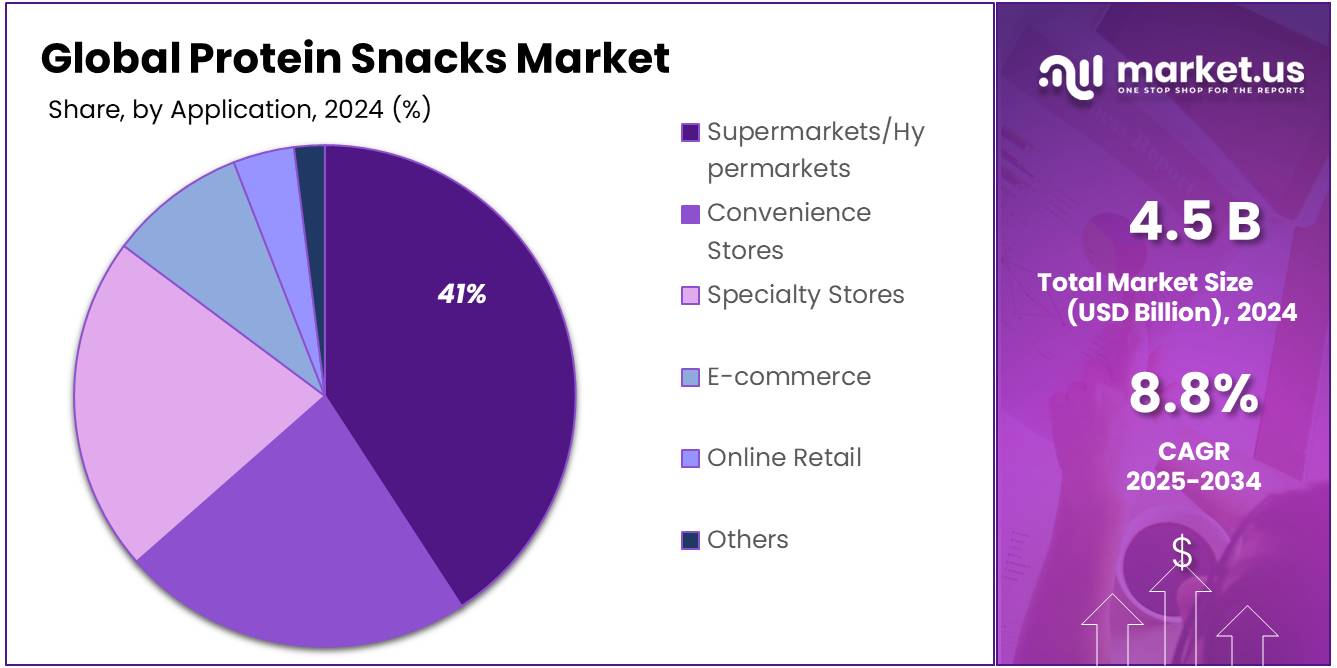

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 41.4% share of the global protein snacks market.

- North America held a commanding position in the protein snacks market, accounting for 45.2% of global revenue, approximately USD 2.0 billion.

By Type Analysis

Plant-Based Protein Snacks dominate with 62.8% share in 2024, driven by health and sustainability trends

In 2024, Plant-Based held a dominant market position, capturing more than a 62.8% share of the global protein snacks market. This significant lead can be attributed to growing consumer awareness around health, nutrition, and environmental sustainability. Consumers are increasingly opting for plant-based protein snacks as they are perceived to be cleaner, lighter on digestion, and aligned with vegan or flexitarian lifestyles. The demand has been further fueled by concerns over cholesterol, lactose intolerance, and ethical considerations related to animal welfare.

The year 2024 also saw an expansion in plant-based snack options across retail shelves—from protein bars made with pea or soy protein to lentil chips, nut-based clusters, and chickpea puffs. These snacks are being marketed not only as healthier alternatives but also as sources of dietary fiber, antioxidants, and essential amino acids. In addition, food brands are introducing fortified and flavored variations to appeal to mainstream snack buyers, including children and busy professionals.

By Product Type Analysis

Protein Bars dominate with 37.2% share in 2024, supported by on-the-go nutrition demand

In 2024, Protein Bars held a dominant market position, capturing more than a 37.2% share of the global protein snacks market. This strong presence is largely the result of rising consumer demand for convenient, high-protein options that can fit into busy, on-the-go lifestyles. Protein bars have become a popular choice for fitness enthusiasts, working professionals, and even students seeking quick energy and satiety without needing to prepare a full meal. Their shelf stability, portability, and wide range of flavors make them a go-to snack across multiple age groups.

In addition to their convenience, protein bars are also being favored for their nutritional balance—offering protein, fiber, and low sugar content in one bite. In 2024, food brands continued to introduce new formulations using ingredients like whey, pea protein, almonds, and oats, catering to both traditional and plant-based diets. These innovations helped protein bars gain more attention in supermarkets, gyms, and even pharmacies.

By Distribution Channel Analysis

Supermarkets/Hypermarkets lead with 41.4% share in 2024, thanks to high product visibility and bulk availability

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 41.4% share of the global protein snacks market. This strong performance is mainly due to the wide product range, easy accessibility, and the trust consumers place in organized retail outlets. Shoppers prefer supermarkets and hypermarkets for protein snacks because they can compare different brands, check nutritional labels, and benefit from promotions or bundled deals all in one place.

These large retail spaces also provide manufacturers with high visibility, giving their products a better chance to catch consumer attention. Throughout 2024, protein bars, plant-based puffs, and fortified snack packs were commonly seen on dedicated health food shelves or featured in wellness-themed aisles, helping drive impulse purchases as well. Supermarkets also played a key role in introducing new products to a broader audience, especially in urban areas where demand for healthy snacking continues to rise.

Key Market Segments

By Type

- Plant-Based

- Meat-Based

By Product Type

- Protein Bars

- Protein Cookies

- Protein Drinks

- Protein Flakes

- Jerky

- Granola

- Yogurt

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- E-commerce

- Online Retail

- Others

Emerging Trends

Plant-Based Proteins Gaining Traction in Snacks

A notable trend in the protein snacks market is the growing preference for plant-based proteins over traditional animal-derived sources. In 2024, sales of plant-based protein snacks surged by 28%, with pea and rice proteins surpassing soy as the preferred choices among consumers . This shift reflects a broader movement towards plant-based diets, driven by health considerations, environmental concerns, and ethical considerations regarding animal welfare.

Governments are recognizing this shift and are supporting the development and promotion of plant-based protein sources. For instance, the U.S. Department of Agriculture (USDA) has been actively involved in research and development initiatives aimed at enhancing the production and utilization of plant-based proteins. These efforts include funding for projects that explore the potential of various plant sources, such as peas and lentils, to meet the rising demand for sustainable protein alternatives. Such initiatives not only support the growth of the plant-based protein sector but also contribute to the diversification of protein sources in the food industry.

The increasing availability and consumer acceptance of plant-based protein snacks are reshaping the snack landscape. Companies are innovating to offer a variety of products, from protein bars to chips and shakes, that cater to the growing demand for plant-based options. This trend is not only expanding the market for protein snacks but also encouraging a more sustainable and health-conscious approach to snacking.

Drivers

Increasing Health Awareness and Shift Toward Healthier Snack Options

The growing awareness around health and wellness is one of the key driving factors propelling the protein snacks market. As consumers increasingly prioritize fitness and healthy living, the demand for snacks that contribute to nutritional goals is rising. This shift towards protein-based snacks is largely influenced by changing lifestyles, where individuals are seeking snacks that support their dietary needs without compromising on taste.

Government-backed initiatives have played a crucial role in promoting healthier eating habits. In the United States, the Centers for Disease Control and Prevention (CDC) has consistently advocated for better nutritional choices and the inclusion of protein in diets. Programs such as the “Healthy People 2030” initiative aim to improve dietary habits across the nation, encouraging people to choose healthier alternatives to traditional snacks. This campaign not only educates consumers but also promotes awareness about the benefits of proteins, encouraging the consumption of high-protein snacks.

In fact, according to the International Food Information Council (IFIC), 61% of consumers are now opting for snacks that provide health benefits, including protein, with 48% actively seeking out high-protein products to supplement their meals. This aligns with broader trends seen in global markets, where consumers are more cautious about their caloric intake and are increasingly choosing snacks that enhance their protein intake to support muscle building, weight management, and overall health.

Moreover, the U.S. Department of Agriculture (USDA) reports that protein consumption has steadily increased, with protein-rich snacks now making up a significant portion of the market. In 2023, over 60% of consumers reported eating protein-rich snacks daily, reflecting a growing trend towards incorporating proteins into diets for a more balanced nutrition profile.

Restraints

High Cost of Protein Snacks

One of the main challenges restraining the growth of the protein snacks market is the high cost associated with these products. Protein-rich snacks, particularly those made with premium ingredients like whey protein, plant-based proteins, and other nutrient-dense components, often come with a higher price tag compared to traditional snacks. This pricing barrier makes it difficult for certain consumer segments, especially price-sensitive individuals, to adopt these healthier alternatives on a large scale.

Government data suggests that the cost of protein-rich foods is a significant concern for many consumers. A report from the U.S. Department of Agriculture (USDA) highlighted that in 2023, nearly 40% of American households struggled with food affordability, making it harder for them to regularly purchase protein-focused snacks. These costs are partly due to the higher production costs involved in sourcing premium protein ingredients and processing them into snack-friendly formats, which often includes additional packaging and preservation methods.

Further complicating matters is the rising inflation across the global food sector. According to the Food and Agriculture Organization (FAO), global food prices saw an 8% increase in 2023, with protein-based ingredients being among the most affected. As a result, many consumers are forced to choose between high-protein snacks and more affordable, less nutritious alternatives. This issue is particularly evident in lower-income communities, where the demand for protein snacks may be limited due to affordability concerns.

While the government is promoting healthier eating through various initiatives like the “Healthy People 2030” program, which advocates for better nutrition, the affordability gap remains a significant barrier. The challenge is to make protein snacks more accessible without compromising on quality or affordability.

Opportunity

Expanding Consumer Demand for Convenient, High-Protein Snacks

The protein snacks market is experiencing significant growth, driven by increasing consumer demand for convenient, nutritious, and high-protein snack options. This shift is particularly evident in regions like China, where meat snack sales are projected to account for over 14% of total snack product sales in 2023, reflecting a growing preference for protein-rich snacks among consumers.

In response to this demand, governments are implementing initiatives to promote healthier food choices. For instance, the U.S. Department of Agriculture’s “Smart Snacks in School” standards aim to ensure that snacks sold in schools contribute to a healthy diet by promoting the availability of snacks with whole grains, low-fat dairy, fruits, vegetables, or protein foods as their main ingredients.

Additionally, the USDA’s Organic Market Development Grant Program supports the development and expansion of markets for organic products, including protein-rich options. For example, Agoge Life, Inc. received a grant to introduce the USA’s first Organic Hemp Protein Isolate products, aiming to drive the expansion of the supply chain for this organic, sustainable rotational crop through education, marketing, and consumer outreach.

These government-backed initiatives are creating a favorable environment for the growth of the protein snacks market by increasing consumer awareness and accessibility to healthier snack options. As consumer preferences continue to evolve towards health-conscious choices, the protein snacks market is poised for sustained growth, presenting opportunities for both established brands and new entrants to meet the rising demand.

Regional Insights

North America dominates with 45.2% share (~USD 2.0 billion) in 2024, fueled by health-driven snacking habits

In 2024, North America held a commanding position in the protein snacks market, accounting for 45.2% of global revenue, approximately USD 2.0 billion. This dominance reflects a strong alignment of consumer behaviour, retail dynamics, and regulatory support favoring high-protein, convenient snack options. The United States, in particular, stood out as the largest contributor, with protein bars, jerky, and high-protein chips continuing to gain traction among health-conscious consumers.

Policy frameworks have further reinforced this growth. Government dietary guidelines from the USDA and Health Canada emphasize balanced protein intake as part of healthy eating patterns. Additionally, schools and public wellness programs in the U.S. have introduced protein-enriched snack offerings to promote nutrition among students and athletes. These efforts enhance accessibility and consumer trust in fortified and protein-rich products.

Retail infrastructure also plays a critical role. Supermarkets and hypermarkets, which dominate organized retail in North America, offer extensive shelf space and visibility for protein snacks. More than 41% of protein bar sales occur through these channels, further reinforcing North America’s market position and enabling frequent consumer exposure and impulse buying.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Clif Bar & Company is widely recognized for its organic and plant-based protein snack offerings, including CLIF Builders Protein Bars, which have gained popularity among fitness-focused and health-conscious consumers. The company focuses on sustainability, sourcing non-GMO ingredients and using recyclable packaging. In recent years, it has expanded its product range to include high-protein, gluten-free options. Its strong distribution through health stores and supermarkets in North America supports its position in the premium protein snacks market segment.

FAGE USA specializes in high-protein Greek yogurt products that are widely consumed as healthy snack alternatives. Its flagship FAGE Total line delivers up to 18 grams of protein per serving, making it a top choice for consumers seeking natural, additive-free protein options. With a strong footprint in the U.S., FAGE has maintained its competitive edge through consistent product quality and nutritional transparency, appealing to both everyday consumers and fitness-oriented demographics looking for convenient, protein-rich snacks.

GNC Holdings, LLC is a specialty retailer of health and wellness products, with a strong focus on nutritional supplements and protein-enriched snacks. Its own-label products, including protein bars, shakes, and bites, are formulated to meet the needs of athletes and fitness consumers. GNC has leveraged its widespread store network and online platforms to promote high-protein, low-sugar options, often fortified with vitamins and minerals, making it a trusted destination for performance-oriented protein snack buyers.

Top Key Players Outlook

- Clif Bar & Company

- Danone S.A.

- FAGE USA Dairy Industry, Inc

- General Mills, Inc

- GNC Holdings, LLC

- Hormel Foods

- Jack Link’s

- Kellanova

- Kerrys Foods

- Mars, Inc.

- Mondelez International, Inc.

- Nestle S.A.

- Quest Nutrition LLC

- Vitaco Health Australia

Recent Industry Developments

GNC Holdings, LLC has maintained a noticeable presence in the protein snacks market through its dedicated line of in-store and private-label protein bars and bites. In 2024, the company generated around USD 1.78 billion in total revenue, of which a significant portion stemmed from its protein-focused products.

In 2024, Clif Bar’s protein bar segment achieved approximately $500 million in sales, reflecting the growing consumer demand for high-protein, on-the-go snacks.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Bn Forecast Revenue (2034) USD 10.5 Bn CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Plant-Based, Meat-Based), By Product Type (Protein Bars, Protein Cookies, Protein Drinks, Protein Flakes, Jerky, Granola, Yogurt), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, E-commerce, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Clif Bar & Company, Danone S.A., FAGE USA Dairy Industry, Inc, General Mills, Inc, GNC Holdings, LLC, Hormel Foods, Jack Link’s, Kellanova, Kerrys Foods, Mars, Inc., Mondelez International, Inc., Nestle S.A., Quest Nutrition LLC, Vitaco Health Australia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Clif Bar & Company

- Danone S.A.

- FAGE USA Dairy Industry, Inc

- General Mills, Inc

- GNC Holdings, LLC

- Hormel Foods

- Jack Link's

- Kellanova

- Kerrys Foods

- Mars, Inc.

- Mondelez International, Inc.

- Nestle S.A.

- Quest Nutrition LLC

- Vitaco Health Australia