Global Propionaldehyde Market Size, Share, And Business Benefits By Purity (Upto 99%, Above 99%), By Application (Plastics, Cellulose, Rubber Chemicals, Fragrance, Lacquers, Drugs, Others), By End-Use (Chemical, Automotive, Personal Care and Cosmetic, Construction, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156163

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

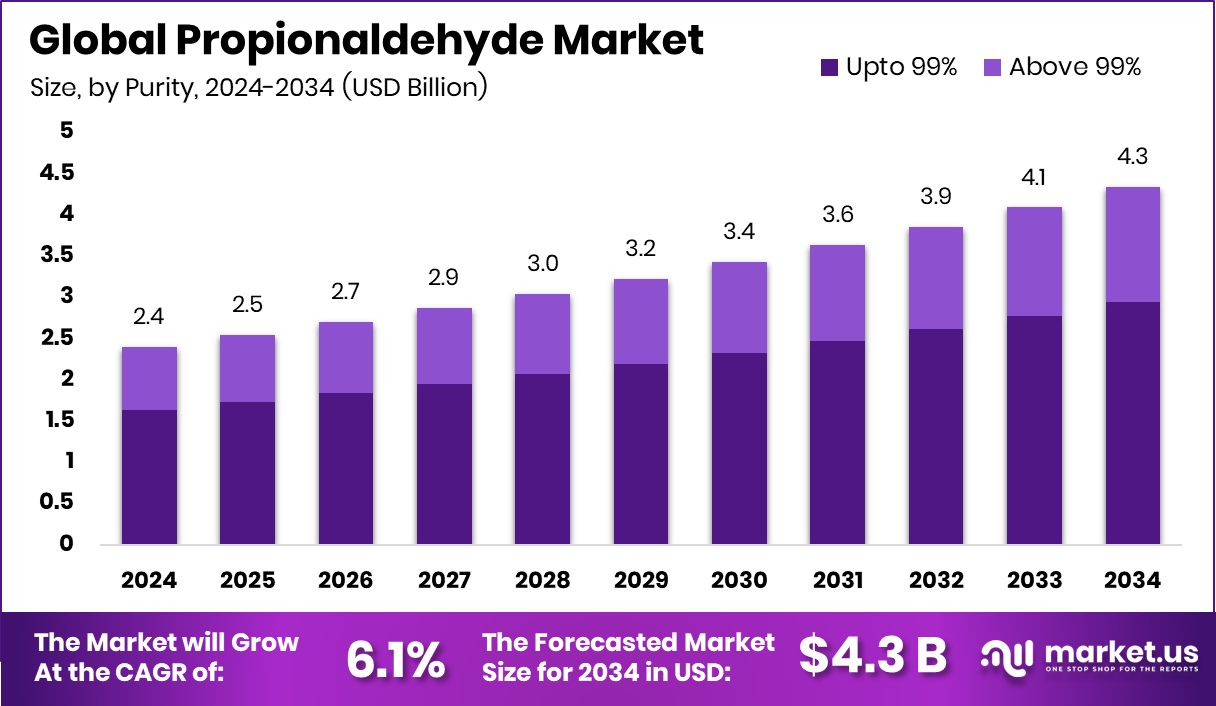

The Global Propionaldehyde Market is expected to be worth around USD 4.3 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Europe’s 42.80% market share, worth USD 1.0 Bn, reflects strong industrial demand.

Propionaldehyde is an organic chemical compound, also called propanal, that belongs to the aldehyde family. It is a colorless liquid with a sharp, pungent odor and is mainly used as an intermediate in chemical synthesis. Its reactive nature allows it to be converted into various resins, plastics, pharmaceuticals, and fragrances, making it valuable across several industries. Fraganote Fragrances has secured USD 1 million in funding from Rukam Capital, aimed at driving portfolio growth and launching offline retail pilots.

The propionaldehyde market refers to the global trade and application of this compound in different sectors such as chemicals, plastics, pharmaceuticals, and agrochemicals. Demand is influenced by its wide usage in producing alcohols, acids, and other derivatives that serve as raw materials for industrial processes. In agrifoodtech, Agtonomy closed a $32.8 million round, while NVentures invested in Orbital Materials and NotCo introduced its new ‘fragrance formulator.’ The market growth is tied closely to industries that rely on chemical intermediates for high-volume production.

A key growth factor is its increasing use in producing resins and plasticizers. As industries look for durable and flexible materials, the role of propionaldehyde as a base chemical has become more important. Its role in synthesizing essential intermediates supports expansion in coatings, adhesives, and packaging materials. Phool, a fragrance label, raised $8 million in Series A financing, whereas Nirmalaya attracted $800,000 in seed capital.

On the demand side, pharmaceuticals and flavor industries are pushing consumption higher. The compound is used in creating vitamins, drugs, and fragrance ingredients, and this has kept demand stable even when industrial cycles fluctuate. Rising health awareness and consumer preferences for enriched products add further support. Perfume Lounge also secured $250,000 in seed funding, and niche fragrance start-up Elorea announced a $2 million seed round.

Key Takeaways

- The Global Propionaldehyde Market is expected to be worth around USD 4.3 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- In 2024, the Propionaldehyde market showed strong demand, with up to 99% purity capturing 67.9%.

- Plastics held a solid position in the Propionaldehyde market, accounting for 28.4% share.

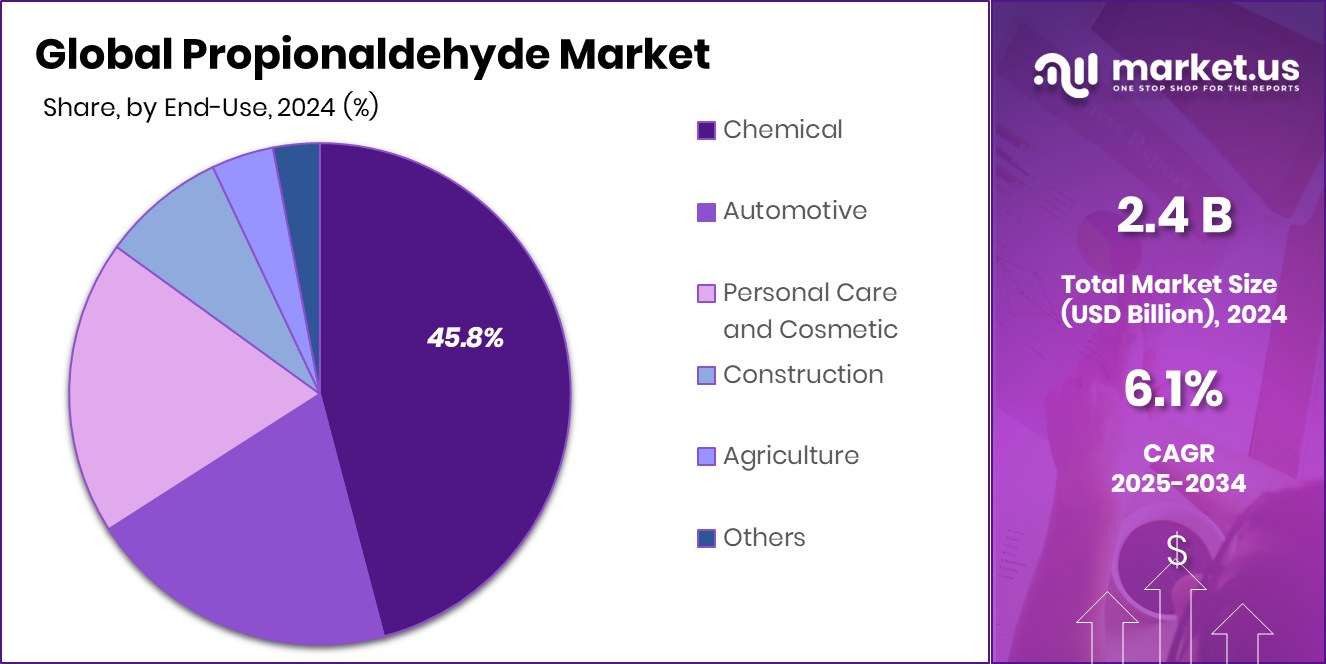

- The chemical sector dominated the Propionaldehyde market, representing 45.8% of overall consumption.

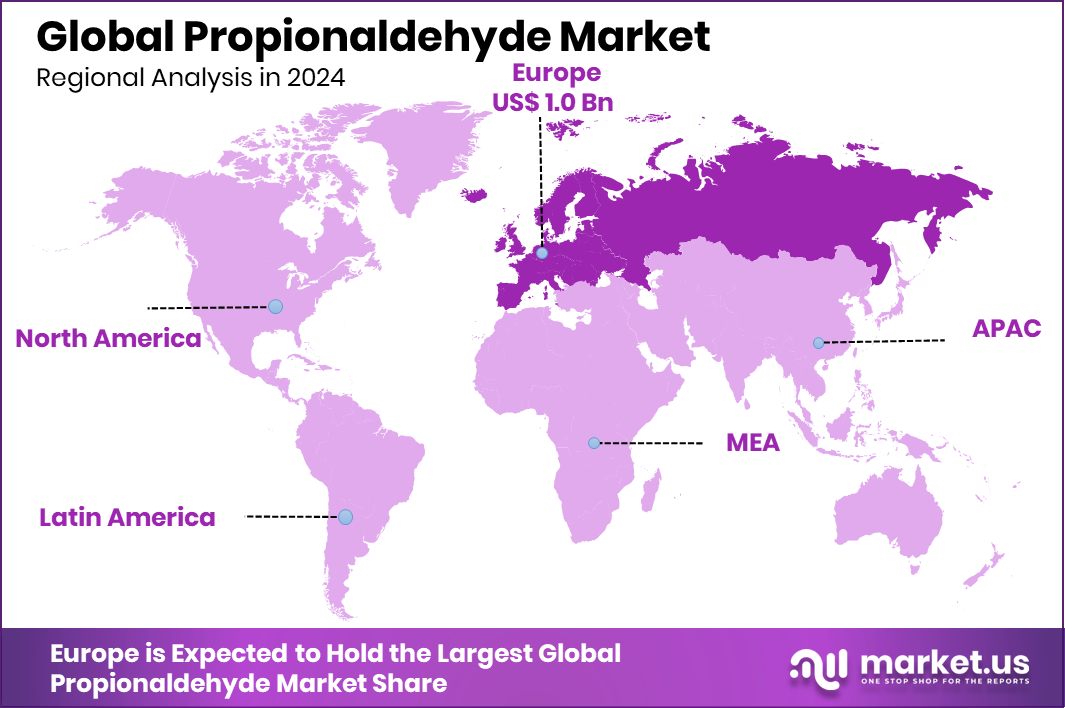

- With a 42.80% share and USD 1.0 Bn value, Europe dominates the regional market.

By Purity Analysis

In 2024, Propionaldehyde Market upto 99% captured 67.9%.

In 2024, up to 99% held a dominant market position in the By Purity segment of the Propionaldehyde Market, with a 67.9% share. This strong position highlights its extensive use across industries where high chemical reactivity and consistent quality are essential.

The 99% purity grade is widely preferred in manufacturing processes because it ensures stability in downstream applications such as resins, coatings, and intermediates for pharmaceuticals. Its suitability for large-scale industrial usage, while maintaining cost-effectiveness compared to higher purity grades, has made it the preferred choice for bulk production.

Industries producing plasticizers, adhesives, and fragrances rely heavily on this purity level to balance performance and affordability. The scale of adoption is further supported by strong demand from agrochemical and pharmaceutical manufacturing, where high-volume synthesis requires reliable purity without escalating input costs. With a 67.9% share, the segment also reflects the growing industrial trend of optimizing feedstock that delivers both efficiency and adaptability across multiple chemical pathways.

By Application Analysis

Propionaldehyde Market for plastics applications accounted for nearly 28.4% share.

In 2024, Plastics held a dominant market position in the By Application segment of the Propionaldehyde Market, with a 28.4% share. This dominance reflects the compound’s critical role as a building block in producing resins and plasticizers that enhance the durability, flexibility, and performance of plastic materials. Propionaldehyde is widely utilized in the synthesis of intermediates that go into coatings, adhesives, and polymers, which are in high demand across automotive, construction, and packaging industries.

The segment’s strength is linked to the rising global need for lightweight and resilient materials. As industries move toward reducing costs while improving efficiency, the plastics sector benefits from propionaldehyde-derived intermediates that provide mechanical strength and processability. Its use in modifying polymer properties also supports innovation in specialty plastics, which are gaining importance in electronics, healthcare, and consumer goods.

The 28.4% share captured by plastics also mirrors strong downstream demand in fast-growing economies, where infrastructure growth and consumer markets are expanding rapidly. This sustained reliance positions plastics as the leading application segment within the propionaldehyde market, driving consistent consumption and long-term growth potential.

By End-Use Analysis

The chemical sector dominated the Propionaldehyde Market strongly with a 45.8% contribution.

In 2024, Chemical held a dominant market position in the end-use segment of the Propionaldehyde Market, with a 45.8% share. This reflects the compound’s strong role as an intermediate in a wide range of chemical manufacturing processes, where it is utilized to produce resins, solvents, plasticizers, and specialty derivatives. The large share demonstrates its indispensable position in the supply chain, as chemical producers rely on propionaldehyde for both bulk and specialty outputs that serve downstream industries.

The segment’s 45.8% share is closely tied to the rising need for industrial intermediates that can support mass production while offering flexibility in formulation. Propionaldehyde serves as a foundation for producing alcohols, acids, and other essential derivatives, all of which feed into applications ranging from coatings to pharmaceuticals. This broad adaptability ensures steady demand, even when individual end-use industries fluctuate.

The continued expansion of the global chemical sector, particularly in emerging economies, has reinforced the segment’s dominance. With increasing infrastructure and manufacturing investments worldwide, the demand for chemical intermediates remains high, positioning the chemical end-use segment as the core driver of propionaldehyde consumption.

Key Market Segments

By Purity

- Upto 99%

- Above 99%

By Application

- Plastics

- Cellulose

- Rubber Chemicals

- Fragrance

- Lacquers

- Drugs

- Others

By End-Use

- Chemical

- Automotive

- Personal Care and Cosmetic

- Construction

- Agriculture

- Others

Driving Factors

Rising Demand for Chemical Intermediates in Manufacturing

One of the top driving factors for the propionaldehyde market is the growing demand for chemical intermediates in large-scale manufacturing. Propionaldehyde is a key building block used to produce resins, plasticizers, solvents, and other derivatives that are essential in industries such as plastics, coatings, pharmaceuticals, and agrochemicals. As global manufacturing expands, especially in developing economies, the need for versatile and cost-effective intermediates is steadily increasing.

Its ability to convert into a wide range of value-added chemicals gives it a central role in industrial processes. This rising reliance on propionaldehyde as a foundation for downstream products ensures continuous consumption, making it one of the strongest forces driving market growth in 2024 and beyond.

Restraining Factors

Health and Safety Concerns in Industrial Usage

A key restraining factor for the propionaldehyde market is the health and safety concerns linked with its handling and usage. Propionaldehyde is a volatile and flammable liquid with a strong, irritating odor, and exposure can cause harmful effects on human health, including respiratory irritation and skin sensitivity. These risks require strict safety measures, protective equipment, and regulatory compliance, which increase operational costs for manufacturers.

Many industries are becoming more cautious about adopting chemicals that pose occupational hazards, especially where safer alternatives exist. Stricter environmental and workplace safety regulations in developed regions further limit its widespread application. These challenges act as barriers, slowing down the growth potential of propionaldehyde despite its industrial importance and wide utility.

Growth Opportunity

Expanding Role in Eco-Friendly Chemical Production

A major growth opportunity for the propionaldehyde market lies in its expanding role in eco-friendly chemical production. With industries worldwide shifting toward sustainable practices, there is an increasing demand for bio-based and green intermediates that can reduce environmental impact.

Propionaldehyde can be adapted for developing renewable derivatives and specialty chemicals that align with stricter environmental regulations and consumer preference for sustainable products. This opportunity is especially strong in sectors like plastics, coatings, and pharmaceuticals, where greener inputs are gaining importance.

Companies focusing on cleaner production technologies can leverage propionaldehyde as a versatile base to create innovative, eco-friendly solutions. This shift toward sustainability opens new pathways for growth, making it a key opportunity for the future market landscape.

Latest Trends

Increasing Adoption in High-Value Pharmaceutical Synthesis

One of the latest trends in the propionaldehyde market is its increasing adoption in pharmaceutical synthesis, especially for high-value drugs and vitamins. Propionaldehyde serves as an important intermediate in producing compounds like propionic acid and other derivatives that are widely used in medicines and health supplements. As global healthcare demand rises and more emphasis is placed on preventive care, the need for reliable intermediates in drug production is also expanding.

This trend is further supported by advancements in fine chemical processing, where propionaldehyde provides efficiency and consistency. Its growing role in the pharmaceutical sector highlights a shift toward value-added applications, positioning it as a key input in modern healthcare-driven chemical production.

Regional Analysis

In 2024, Europe held a 42.80% share of the Propionaldehyde Market, USD 1.0 Bn.

The Propionaldehyde Market shows varied regional dynamics, shaped by industrial development, chemical manufacturing, and end-use applications. In 2024, Europe emerged as the leading region, holding a dominant 42.80% share valued at USD 1.0 billion. This leadership is largely supported by the region’s strong chemical industry, advanced pharmaceutical sector, and high demand for intermediates used in plastics, resins, and coatings.

Europe’s stringent regulations promoting sustainable and high-quality production also encourage wider adoption of propionaldehyde in eco-friendly chemical formulations. North America continues to be a significant consumer, driven by demand from healthcare, agrochemicals, and advanced materials, supported by steady R&D activities.

Asia Pacific is witnessing rapid expansion as industrialization and urbanization fuel demand for plastics and construction-related materials, with countries such as China and India contributing to growth momentum. Meanwhile, the Middle East & Africa and Latin America are gradually building their market presence, with growth opportunities arising from expanding manufacturing bases and rising consumer markets.

Although all regions contribute to global growth, Europe’s 42.80% share positions it as the most dominant hub, reflecting both established infrastructure and strong end-user industries that sustain high consumption levels of propionaldehyde in the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to be a front-runner with its broad chemical portfolio and strong integration across the value chain. Its expertise in intermediates and focus on sustainable production have reinforced its position in Europe, where demand for high-purity and eco-friendly derivatives remains strong. BASF’s operational scale provides stability in pricing and supply, which is crucial for downstream industries.

Eastman Chemical Company has leveraged its strengths in specialty chemicals to expand the applications of propionaldehyde. With a focus on innovation and niche markets, Eastman has positioned itself as a reliable supplier for high-value applications such as pharmaceuticals, coatings, and resins. Its balanced approach between commodity and specialty usage allows the company to capture growth in diverse industries.

Dow Chemical Company stands out for its global reach and robust R&D capabilities. Dow’s ability to scale production efficiently and adapt to varying regional demands has made it a key contributor in North America and the Asia Pacific. Its role in driving the use of propionaldehyde in plastics and adhesives highlights its importance in industrial manufacturing chains.

Top Key Players in the Market

- BASF SE

- Eastman Chemical Company

- Dow Chemical Company

- Nanjing Chemical Material Corp

- LG Chem Ltd.

- Oxea GMBH

Recent Developments

- In June 2025, Dow signed an agreement to sell its 50% stake in the DowAksa Advanced Composites joint venture to its partner Aksa Akrilik. This deal, valued at around USD 125 million, helps Dow concentrate on its core, high-value downstream businesses.

- In December 2024, BASF officially inaugurated its new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. This facility is designed for pilot‑scale synthesis of chemical catalysts and to advance solids processing technologies—enhancing speed and innovation in developing manufacturing processes. It strengthens BASF’s R&D capabilities, potentially benefiting intermediates such as propionaldehyde through improved process technologies.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 4.3 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Upto 99%, Above 99%), By Application (Plastics, Cellulose, Rubber Chemicals, Fragrance, Lacquers, Drugs, Others), By End-Use (Chemical, Automotive, Personal Care and Cosmetic, Construction, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Eastman Chemical Company, Dow Chemical Company, Nanjing Chemical Material Corp, LG Chem Ltd., Oxea GMBH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Eastman Chemical Company

- Dow Chemical Company

- Nanjing Chemical Material Corp

- LG Chem Ltd.

- Oxea GMBH