Global Primary Batteries Market Size, Share, And Business Benefits By Type (Primary Alkaline Battery, Primary Lithium Battery, Others), By End Use (Defense, Aerospace, Medical, Aviation, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165912

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

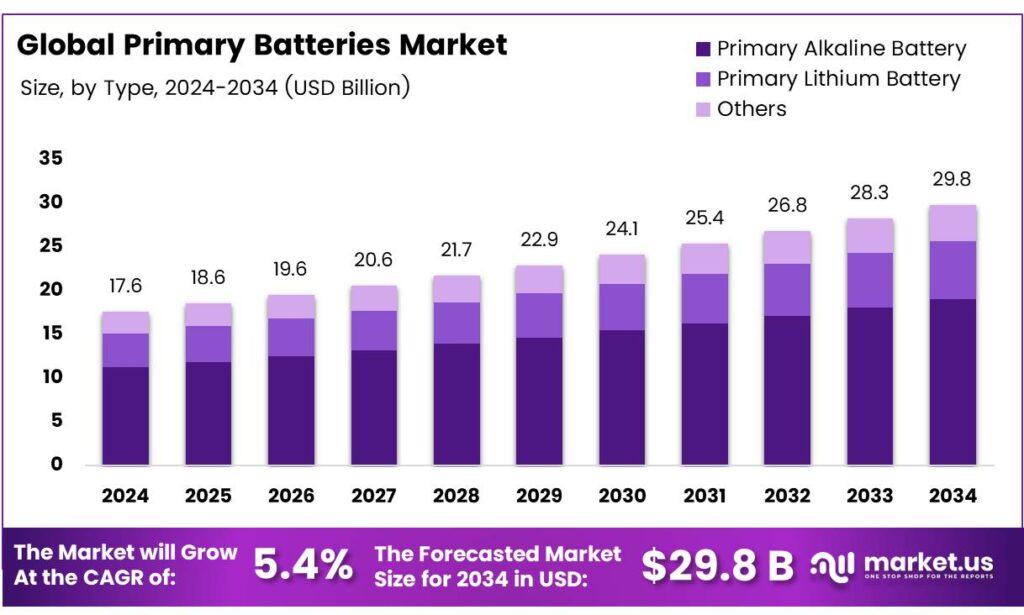

The Global Primary Batteries Market size is expected to be worth around USD 29.8 billion by 2034, from USD 17.6 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Primary batteries, also known as disposable batteries, are defined as batteries in which the electrochemical reaction is not reversible, requiring replacement once the electrode or electrolyte is degraded. The primary cell is essentially a fuel cell where the fuel is held in or on the electrodes rather than in a separate tank. As a result, the electrodes are consumed during the discharge process, limiting the cell’s lifetime. Primary cells cannot be recharged; they serve as stores of electrical energy derived from elsewhere.

New special battery chemistries have challenged older naming conventions. Rechargeable NiCd (Nickel Cadmium) and NiMH (Nickel Metal Hydride) batteries typically output 1.25 V per cell, a 16% reduction compared to standard cells, which may cause issues in some devices, though most modern ones adapt well. In contrast, lithium-ion rechargeable batteries deliver 3.7 V per cell, 23% higher than a pair of alkaline cells (3 V) that they often replace.

Non-rechargeable lithium-chemistry batteries offer exceptionally high energy density and produce about 1.5 V per cell, making them similar to alkaline batteries. The battery used in electric torches is a primary battery, consisting of a zinc anode and a manganese dioxide cathode in contact with an inert carbon collecting electrode. The electrolyte is a solution of ammonium chloride and ZnCl₂, usually in gel form. This type provides low energy density, ranging from 30,000 to 100,000 J kg⁻¹ depending on the discharge rate.

Batteries are classified as either primary or secondary. Primary batteries can be used only once because their chemical reactions are irreversible. Secondary batteries, also called storage batteries or accumulators, can be used, recharged, and reused, as their chemical reactions are readily reversed by supplying current. Primary batteries are the most common today due to their low cost and simplicity. Carbon-zinc dry cells and alkaline cells dominate portable consumer applications with low, sporadic currents.

Key Takeaways

- The Global Primary Batteries Market is projected to grow from USD 17.6 billion in 2024 to USD 29.8 billion by 2034 at a CAGR of 5.4%.

- Primary Alkaline batteries dominated the By Type segment in 2024 with 64.1% market share due to cost-effectiveness, stable voltage, and long shelf life.

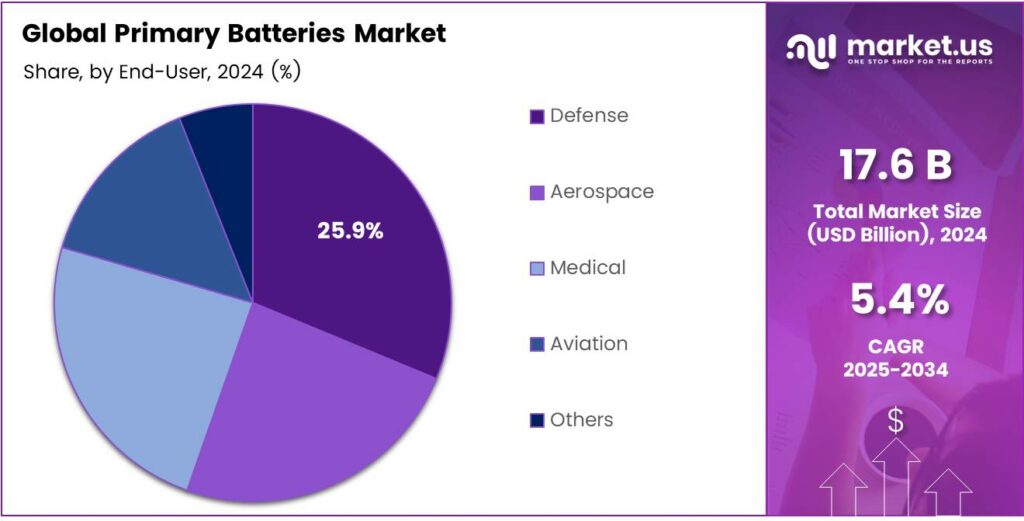

- The Defense sector led the By End Use segment in 2024 with a 25.9% share, driven by the need for communication devices, night vision gear, and unmanned systems in harsh environments.

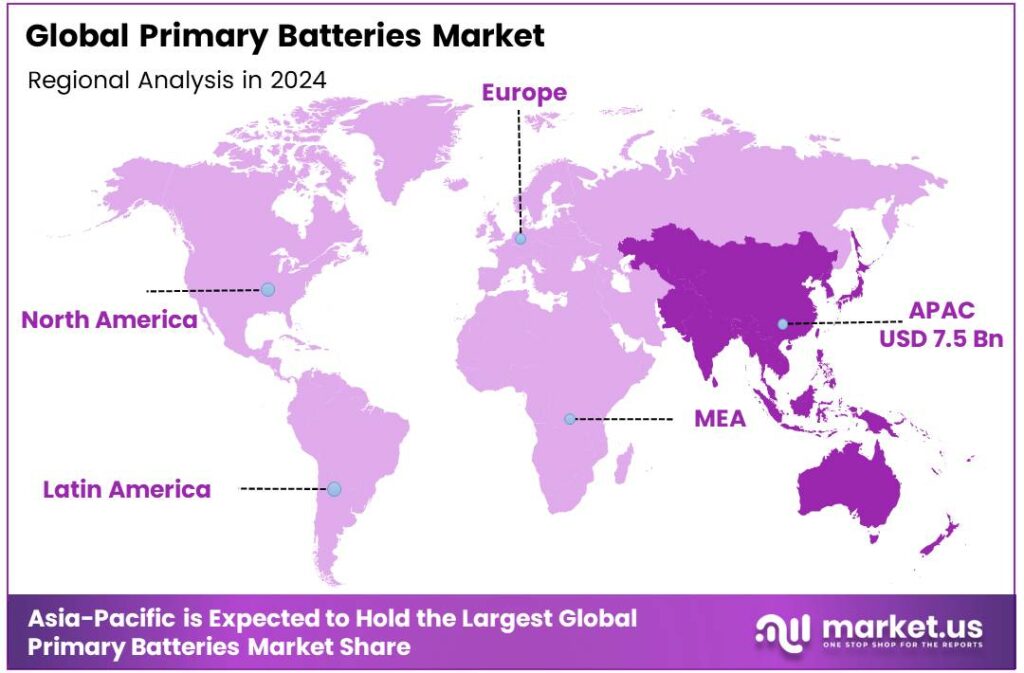

- Asia-Pacific commanded 43.1% of global market revenue in 2024, valued at USD 7.5 billion, fueled by demand in consumer electronics.

By Type Analysis

Primary Alkaline Battery dominates with 64.1% due to their affordability and reliability in everyday devices.

In 2024, Primary Alkaline Battery held a dominant market position in the By Type Analysis segment of the Primary Batteries Market, with a 64.1% share. This sub-segment leads owing to its cost-effectiveness and widespread use in household gadgets like remote controls and toys. Moreover, it offers stable voltage and long shelf life, boosting consumer preference.

Shifting focus, Primary Lithium Battery emerges as a strong contender in high-performance needs. It provides superior energy density and operates efficiently in extreme temperatures, ideal for cameras and medical devices. However, higher costs limit its mass adoption compared to alkaline types. Yet, advancements in lithium technology enhance safety and longevity, driving gradual growth.

This category includes zinc-carbon and specialty batteries. These serve budget-sensitive or specific industrial uses but trail in market share. Despite lower performance, they remain relevant in developing regions for basic electronics. Furthermore, innovation in alternative chemistries could spark future expansion, though currently overshadowed by established leaders.

By End Use Analysis

Defense dominates with 25.9% due to its critical demand for reliable, long-lasting power in mission-essential equipment.

In 2024, Defense held a dominant market position in the By End Use Analysis segment of the Primary Batteries Market, with a 25.9% share. This sector prioritizes batteries for communication devices, night vision gear, and unmanned systems. Additionally, stringent reliability standards fuel the adoption of high-quality primary cells. Transitioning to operations, defense applications demand an extended shelf life in harsh environments.

Turning to Aerospace, it relies on lightweight, high-energy batteries for satellites and aircraft instruments. These support navigation and emergency systems, where failure is unacceptable. However, specialized requirements increase costs, restricting volume. Yet, space exploration growth propels demand for advanced primary batteries. Consequently, aerospace contributes significantly through innovation-driven needs.

Exploring Medical, primary batteries power implantable devices like pacemakers and hearing aids. They offer biocompatibility and minimal maintenance, ensuring patient safety. Furthermore, miniaturization trends enhance portability in diagnostic tools. Although regulatory hurdles exist, life-saving applications drive consistent usage. Hence, the medical sector maintains vital reliance on dependable power sources.

Aviation utilizes batteries for cockpit electronics and backup systems in commercial flights. Safety protocols mandate robust, fail-safe options. Additionally, rising air travel boosts fleet expansions, indirectly supporting battery demand. Despite competition from rechargeables, primary types prevail in non-critical yet essential roles. Overall, aviation sustains growth through operational necessities.

Key Market Segments

By Type

- Primary Alkaline Battery

- Primary Lithium Battery

- Others

By End Use

- Defense

- Aerospace

- Medical

- Aviation

- Others

Emerging Trends

Rapid Growth of Self-Powered IoT Sensors Using Primary Batteries

One of the most compelling emerging trends in the primary-battery space is the meeting of two forces — the explosion of connected Internet of Things (IoT) devices, and the use of non-rechargeable (or very low-maintenance) primary batteries to power them in remote, hard-to-service environments.

- The number of connected IoT devices reached 18.5 billion in 2024, with year-on-year growth of about 12%. At the same time, an EU-funded research project forecast that up to 78 million batteries used in IoT devices will be discarded every day globally by 2025 unless battery lifespan and alternative power methods improve.

As sensor deployments scale across industrial monitoring, smart infrastructure, wearables, and logistics, many of these use primary batteries because they are low-cost, compact, and simple. The combination of huge device counts, remote or inaccessible locations, and maintenance cost/complexity is creating a strong push to design those batteries to last much longer and be more sustainable.

Drivers

Growing Consumer Electronics Usage

In many applications like remote sensors, smart tags, wearables, medical monitoring devices, and portable electronics, primary cells remain attractive because they avoid the infrastructure and maintenance of recharging. As the number of devices grows, so does the demand for reliable, low-maintenance power sources. Even though the industry is shifting toward reuse and rechargeables.

Government and policy support further stiffen this trend. Global efforts on energy efficiency and device connectivity push manufacturers to design compact gadgets with embedded batteries; the role of portable power is more visible. While major organisations such as the International Energy Agency (IEA) mainly highlight rechargeable battery demand in sectors like EVs and grid storage.

Their underlying stance reinforces that battery power in general is accelerating, thus providing contextual tailwinds for primary-battery demand too. Because primary batteries are inherently simpler, cheaper, and often better suited for low-power, long-life, or install-and-forget devices, they benefit from this growth of connected electronics.

Restraints

Environmental and Disposal Burden

One major restraint facing the primary-battery sector revolves around the environmental burden tied to disposal and recycling. As more single-use batteries (primary cells) are deployed, especially across consumer electronics, remote sensors, and low-maintenance devices, the challenge of end-of-life waste becomes increasingly acute.

- The United Nations Institute for Training and Research and the International Telecommunication Union, global electronic waste (which includes items with single-use batteries) reached about 62 million tonnes, a rise of 82%. Only around 22.3% of this waste was documented as formally collected and recycled that year.

From the vantage point of primary batteries, this means two things: first, large volumes of spent cells may end up as part of this growing waste stream. Second, the low collection/recycling rate signals a major sustainability and regulatory risk for manufacturers, users, and policy-makers alike. In many jurisdictions, primary cells contain metals and electrolytes that can leach into soil or water if disposed of improperly.

Opportunity

Off-Grid and Backup Power Needs Are Fueling Primary Battery Demand

A powerful growth engine for primary batteries is the global push to bring basic electricity to people and to keep power on when grids fail. The World Bank estimates that about 666 million people still have no access to electricity, even though 92% of the world’s population is now connected in some way.

For families living off-grid, simple devices like lanterns, radios, flashlights, and small medical tools are not nice-to-haves — they are lifelines. Many of these products still run on primary batteries because they are cheap, easy to ship, and work straight out of the box. Even where solar kits are installed, households often keep battery-powered torches or radios as backup for cloudy days or emergencies.

- The World Bank–backed Off-Grid Solar Market Trends Report notes that off-grid solar solutions now provide energy to about 490 million people, an 18% rise, showing how fast basic energy access tools are spreading. Governments and development banks are responding with grants and results-based finance for off-grid solar kits, mini-grids, and clean lighting programs.

Regional Analysis

Asia-Pacific Leads the Primary Batteries Market with 43.1% Share Valued at USD 7.5 Billion

Asia-Pacific holds the leading position in the global primary batteries market with a commanding 43.1% revenue share, valued at USD 7.5 billion, driven by strong demand from consumer electronics, household lighting, medical devices, defense communication units, and industrial sensing equipment used in remote and rural locations.

The region also benefits from rapid urbanization and a rising preference for low-maintenance power solutions in IoT, smart metering, and utility monitoring applications, especially where grid reliability remains inconsistent. Large-scale manufacturing capabilities and expansive export operations make Asia-Pacific an attractive source of alkaline, lithium-based, and zinc-carbon primary cells for global distribution.

Asia-Pacific’s leadership is supported by innovation in miniaturized battery formats for smart healthcare devices, wearables, and compact diagnostic tools. Government support for localized manufacturing, renewable energy access programs, and incentives for electronics and semiconductor expansion add further momentum to the market.

Rural electrification programs in South and Southeast Asia still consider primary batteries essential for affordable, immediate, and maintenance-free power access. Asia-Pacific’s competitive edge is shaped by manufacturing scale, diversified applications, cost advantages, expanding digital consumer culture, and developing-region energy needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Camelion Batterien GmbH has established a strong global footprint by offering a cost-effective and diverse portfolio of primary batteries. Its strategy focuses on competitive pricing and wide availability across various retail channels, making it a popular choice for budget-conscious consumers. The company serves a broad market, from household electronics to specialty items, emphasizing reliability and value.

Duracell Inc. is a dominant market leader, renowned for its iconic brand identity and marketing emphasis on long-lasting power and reliability. Its signature copper-top batteries are trusted by consumers globally for high-drain devices. Backed by the manufacturing and distribution prowess of its parent, Berkshire Hathaway, Duracell maintains a premium position.

EaglePicher operates in a specialized, high-stakes segment of the primary battery market. It is a leading provider of custom, high-reliability power solutions for demanding applications in aerospace, defense, and medical industries. The company’s expertise lies in engineering critical battery systems for missions where failure is not an option.

Top Key Players in the Market

- Camelion Batterien GmbH

- Duracell Inc.

- EaglePicher Technologies

- Energizer Holdings Inc.

- Gold Peak Industries Limited

- Integer Holdings Corporation

- Hitachi Ltd.

- Panasonic Holdings Corporation

- TotalEnergies SE

- Ultralife Corporation

Recent Developments

- In 2024, Camelion Batterien GmbH, a Berlin-based global leader in energy solutions and lighting technologies, continues to focus on high-quality primary batteries such as alkaline, lithium, and zinc-carbon types. Camelion was recognized as one of the dominant players in the alkaline battery market, holding a significant market share alongside competitors like Energizer and Duracell.

- In 2024, Duracell Inc., a Berkshire Hathaway subsidiary and leading manufacturer of alkaline and specialty primary batteries, has seen steady innovation. A key development is the continued rollout of the Duracell Ultra alkaline battery line, which uses premium materials like refined steel canisters, graphite, manganese, and zinc for enhanced chemical-to-electrical energy conversion.

Report Scope

Report Features Description Market Value (2024) USD 17.6 Billion Forecast Revenue (2034) USD 29.8 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Primary Alkaline Battery, Primary Lithium Battery, Others), By End Use (Defense, Aerospace, Medical, Aviation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Camelion Batterien GmbH, Duracell Inc., EaglePicher Technologies, Energizer Holdings Inc., Gold Peak Industries Limited, Integer Holdings Corporation, Hitachi Ltd., Panasonic Holdings Corporation, TotalEnergies SE, Ultralife Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Primary Batteries MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Primary Batteries MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Camelion Batterien GmbH

- Duracell Inc.

- EaglePicher Technologies

- Energizer Holdings Inc.

- Gold Peak Industries Limited

- Integer Holdings Corporation

- Hitachi Ltd.

- Panasonic Holdings Corporation

- TotalEnergies SE

- Ultralife Corporation