Global Polyphenols Market Size, Share Analysis Report By Form (Liquid, Powder, Others), By Source (Fruits, Vegetables, Cocoa, Others), By Application (Functional Foods, Beverages, Dietary Supplements, Animal Feed, Cosmetics and Personal Care, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152735

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

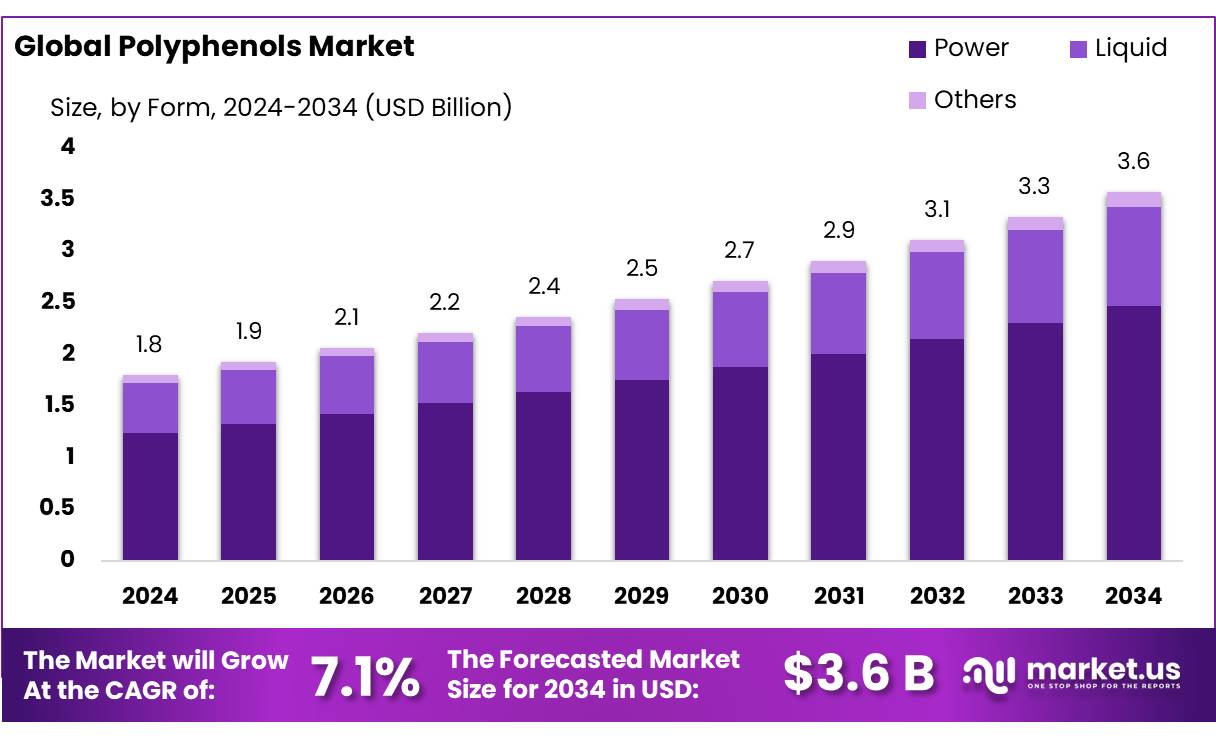

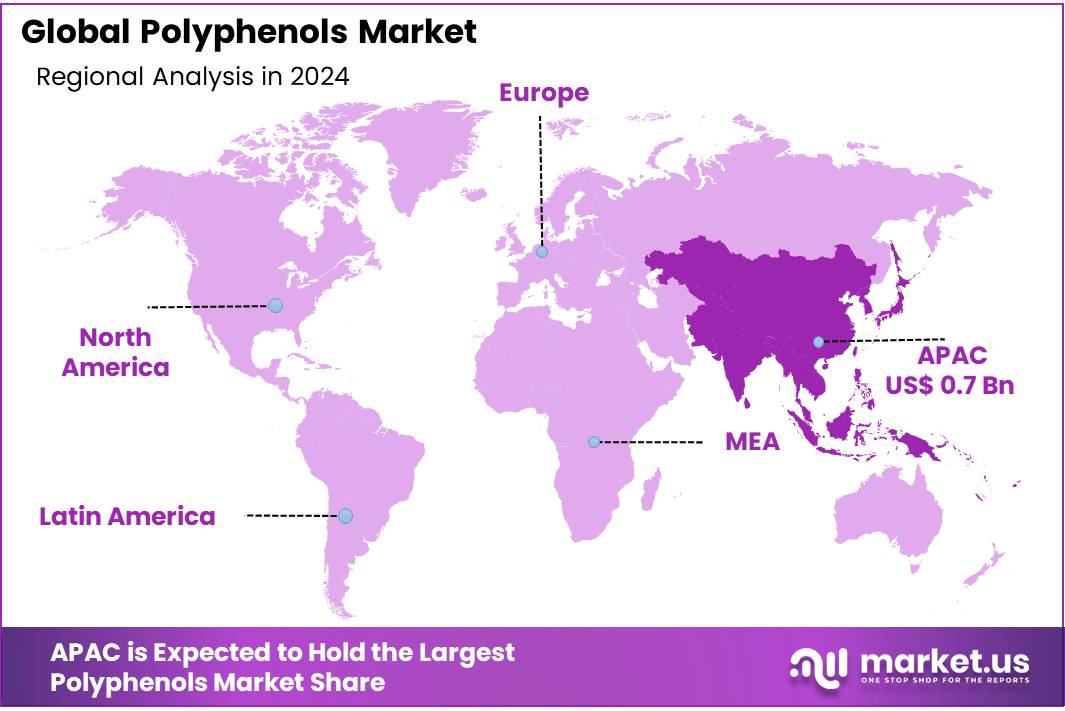

The Global Polyphenols Market size is expected to be worth around USD 3.6 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 42.8% share, holding USD 0.7 Billion revenue.

Polyphenol concentrates—highly purified formulations of plant-derived polyphenolic compounds—are gaining global prominence across functional food, nutraceutical, beverage, and cosmetic industries. Defined as concentrated extracts rich in antioxidants such as flavonoids, tannins, phenolic acids, lignans, and stilbenes, these concentrates are tailored for enhanced bioavailability and efficacy.

According to one review, approximately 16,380 tons of industrial-grade polyphenols were produced globally in 2015, with forecasts pointing to 33,880 tons by end 2024—valued at roughly USD 1.33 billion. The agricultural origin of these compounds—ranging from grape seeds and green tea to berries and citrus—is vital for traceability and sustainability in sourcing.

In the United States and Europe, industrial utilization remains concentrated in functional beverages (approximately 44%) and functional foods (33%). Government support also plays a significant role: the Indian Ministry of Food Processing Projects reports that food processing output is expected to reach USD 535 billion by 2025–26, underpinning growth in polyphenol extraction and application

In Europe, the European Food Safety Authority (EFSA) requires 5 mg hydroxytyrosol per 20g olive oil for approved claims protecting blood lipids. Meanwhile, EU funding supports research into extraction technologies that increase yield and purity, such as enzymatic hydrolysis and supercritical CO2 extraction. In the U.S., updated “healthy” nutrient-content labeling rules set to roll out by FDA in 2028—based on Department of Health and Human Services standards—ease market access for fortified products like polyphenol-infused foods and supplements.

The USDA has developed comprehensive flavonoid databases cataloging polyphenol content across 500+ foods; its latest release (2018) details, for instance, eryodictyol (hesperetin) concentrations of up to 11.95 mg/100 g in orange juice. The USDA’s antioxidant ORAC research highlights spinach and blueberries among the highest-ranked foods, reinforcing the need for natural antioxidant concentrates. These federally-published, publicly accessible data support product formulation, regulatory compliance, and substantiation in functional food and supplement markets.

Key Takeaways

- Powder held a dominant market position, capturing more than a 58.3% share in the global polyphenols market by form.

- Fruits held a dominant market position, capturing more than a 62.4% share in the global polyphenols market.

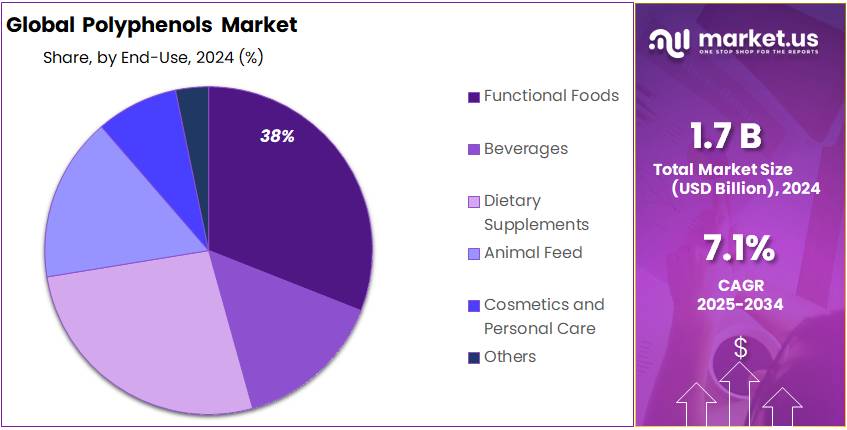

- Functional Foods held a dominant market position, capturing more than a 38.2% share in the global polyphenols market.

- Asia-Pacific (APAC) emerged as the dominant region in the global polyphenols market, capturing approximately 42.8% of the total market share, with an estimated market value of USD 0.7 billion.

By Form Analysis

Powder Form Leads with 58.3% Share in Polyphenols Market Due to Its Stability and Versatile Applications

In 2024, Powder held a dominant market position, capturing more than a 58.3% share in the global polyphenols market by form. This high preference for powder form is primarily driven by its long shelf life, ease of storage, and compatibility with a wide range of end-use industries such as dietary supplements, functional foods, beverages, and cosmetics. The powdered form offers greater formulation flexibility for manufacturers, making it easier to blend with other ingredients during product development.

The demand for powder-based polyphenol concentrates continued to strengthen into 2025, as industries increasingly shifted toward natural and plant-based ingredients. In addition to their antioxidant and anti-inflammatory properties, powdered polyphenols are valued for their ability to retain bioactive compounds during processing and storage. This quality makes them ideal for use in clean-label and health-oriented products, which are gaining strong consumer traction worldwide.

By Source Analysis

Fruits Dominate the Polyphenols Market with 62.4% Share Due to Their Rich Natural Content and Consumer Trust

In 2024, Fruits held a dominant market position, capturing more than a 62.4% share in the global polyphenols market by source. This leadership is largely attributed to the naturally high concentration of polyphenols found in fruits such as grapes, apples, berries, and citrus. Consumers tend to associate fruit-based sources with purity, safety, and nutritional value, which has significantly boosted their acceptance in dietary supplements, functional beverages, and health foods.

Throughout 2025, the demand for fruit-derived polyphenols remained strong, driven by rising interest in plant-based nutrition and clean-label products. The food and beverage industry, in particular, continued to rely on fruit extracts due to their natural antioxidant content, which not only enhances health benefits but also extends product shelf life. Grape seed and apple skin extracts stood out among the most widely used sources, as they are by-products of existing food production chains, supporting both cost-effectiveness and sustainability.

By Application Analysis

Functional Foods Lead the Polyphenols Market with 38.2% Share Due to Rising Health-Conscious Consumption

In 2024, Functional Foods held a dominant market position, capturing more than a 38.2% share in the global polyphenols market by application. This leading position is driven by the growing consumer demand for food products that offer added health benefits beyond basic nutrition. Polyphenols are widely recognized for their antioxidant, anti-inflammatory, and immune-boosting properties, making them a popular choice for fortifying cereals, dairy alternatives, snacks, and bakery items.

By 2025, the use of polyphenols in functional food applications continued to grow steadily, supported by increased awareness of preventive health and lifestyle-related diseases. As more consumers seek natural ways to support heart health, improve digestion, and maintain energy levels, food manufacturers have responded by incorporating fruit- and plant-based polyphenol extracts into everyday food products. The clean-label trend has further encouraged the use of naturally sourced bioactives like polyphenols.

Key Market Segments

By Form

- Liquid

- Powder

- Others

By Source

- Fruits

- Vegetables

- Cocoa

- Others

By Application

- Functional Foods

- Beverages

- Dietary Supplements

- Animal Feed

- Cosmetics and Personal Care

- Others

Emerging Trends

Rise of Green Extraction Methods for Sustainable Polyphenols

Over the past couple of years, one major trend transforming the polyphenols market is the increasing use of green extraction technologies—like ultrasound‑assisted extraction (UAE), microwave‑assisted extraction (MAE), and pressurized liquid extraction (PLE). These methods aim to cut energy consumption, reduce reliance on toxic solvents, and unlock higher yields of bioactive compounds from natural or agro‑food waste sources, making them attractive both economically and ethically.

Governments, universities, and trusted research organizations have recognized the importance of this shift. For instance, the U.S. Department of Agriculture (USDA) recently funded studies focused on how polyphenols in fruits and vegetables interact with the gut microbiome—underlining the role of extraction efficiency and purity in health-related outcomes . In India and across the EU, similar environmental grants are shaping policies that encourage low-impact manufacturing of nutraceutical ingredients, pushing companies to adopt greener processing practices.

In simple terms, manufacturers who invest in green extraction now are setting themselves up for long‑term success. They reduce waste and chemical usage, while meeting growing global demand for polyphenols in food, health, and beauty sectors. This trend is deeply human-centered—aimed at protecting the planet while delivering clear health benefits.

Drivers

Growing Focus on Chronic Disease Prevention Through Natural Food-Based Antioxidants

One of the most important factors driving the growth of the polyphenols market is the increasing consumer awareness about preventing chronic diseases like cardiovascular issues, diabetes, and cancer through natural food-based solutions. Polyphenols are known for their strong antioxidant and anti-inflammatory properties, which help reduce oxidative stress—a major contributor to many non-communicable diseases. As lifestyles become more sedentary and diets shift toward processed foods, health problems are rising globally. This trend has made many people turn back to plant-based ingredients that are both preventive and therapeutic.

According to the World Health Organization (WHO), non-communicable diseases (NCDs) are responsible for around 74% of all global deaths, with 17.9 million people dying from cardiovascular diseases alone each year. These numbers highlight the urgent need for preventive strategies, especially through diet and nutrition. Polyphenols—found abundantly in foods like berries, tea, dark chocolate, olives, and red wine—are now being studied and promoted as natural ways to improve metabolic health and reduce inflammation, which is at the root of many chronic diseases.

The Food and Agriculture Organization (FAO) has also encouraged the inclusion of more plant-based foods in daily diets, emphasizing the importance of fruits, vegetables, and whole grains. In its 2021 report, the FAO noted that over 3 billion people cannot afford a healthy diet, yet improving dietary diversity using plant-based sources is a key global nutrition target. With polyphenol-rich foods being easily sourced from natural, affordable ingredients, governments are beginning to support local cultivation and consumption of such crops.

Restraints

High Production Costs and Limited Standardization in Extraction Processes

A key factor holding back the growth of the polyphenols market is the high cost and complexity of extracting polyphenols in a consistent, standardized way. While the demand for natural antioxidants is increasing, the supply side faces serious challenges—mainly because polyphenols are highly sensitive compounds and require specialized technologies to be extracted efficiently without losing their health benefits. Most extraction processes involve advanced techniques like supercritical fluid extraction, solvent-based methods, or membrane separation. These processes are expensive, time-consuming, and often difficult to scale without affecting quality.

One of the major issues is the variability in polyphenol content from one source to another, and even from batch to batch within the same crop. According to a scientific review published by the U.S. National Institutes of Health (NIH), the polyphenol concentration in natural ingredients can vary by over 60% depending on factors like climate, soil, harvesting time, and storage methods (Source). This makes it difficult for manufacturers to ensure uniform product quality and dosage, which is crucial for dietary supplements and functional foods.

Additionally, global food safety agencies like the European Food Safety Authority (EFSA) have yet to set comprehensive regulatory standards for polyphenol dosage, purity levels, or labeling in food and beverage products. This regulatory uncertainty discourages large-scale investments in the sector. Without clear guidelines, many manufacturers hesitate to market polyphenol-enriched products, fearing recalls or compliance issues.

The lack of unified government support for polyphenol standardization is evident when compared to other functional ingredients like vitamins or probiotics. While the European Union has funded some research projects on polyphenols, such as the BACCHUS project, there are still no harmonized EU-wide standards for their use in food. This gap in policy slows market growth and limits consumer trust in polyphenol-based products.

Opportunity

Rising Demand for Functional Beverages and Fortified Foods

One major growth opportunity for the polyphenols market lies in the booming demand for functional beverages and fortified foods. People today are actively seeking out food and drink options that not only satisfy hunger or thirst but also support long-term health and immunity. Polyphenols, known for their antioxidant and anti-inflammatory properties, are now being infused into teas, juices, smoothies, yogurts, and even snack bars to attract health-conscious consumers. This growing preference for food-as-medicine is creating fresh opportunities for polyphenol-enriched products to move into the mainstream.

According to the Food and Agriculture Organization (FAO), global per capita fruit and vegetable consumption is rising steadily, especially in urban areas. Their data shows that between 2000 and 2020, global fruit consumption increased by over 20%, with much of that growth seen in processed and value-added forms like juices, concentrates, and extracts. Polyphenol-rich ingredients like grape seed extract, green tea, berries, and cocoa are ideal candidates for this trend due to their easy integration into various food matrices.

Governments are also encouraging this shift. For example, the U.S. Department of Agriculture (USDA) updated its Dietary Guidelines for Americans in 2020, emphasizing the role of plant-based foods in reducing chronic disease risk. These guidelines recommend increasing the intake of whole foods rich in antioxidants—like fruits, vegetables, legumes, and whole grains—which are all primary sources of polyphenols.

With food manufacturers racing to innovate in this space and consumers paying closer attention to product labels and ingredients, polyphenol applications in functional foods are poised to rise significantly. This shift not only benefits consumers but opens up new market potential for companies looking to invest in clean-label, science-backed nutrition.

Regional Insights

In 2024, Asia-Pacific (APAC) emerged as the dominant region in the global polyphenols market, capturing approximately 42.8% of the total market share, with an estimated market value of USD 0.7 billion. The region’s leadership is driven by a combination of strong consumer demand for functional foods, widespread adoption of traditional herbal medicine, and a robust manufacturing base for nutraceutical and cosmetic products. Countries such as China, Japan, India, and South Korea are at the forefront, where polyphenols—especially those derived from green tea, grapes, and traditional medicinal plants—are heavily used in beverages, supplements, and skincare.

A key factor propelling growth in APAC is the increasing consumer preference for plant-based antioxidants due to rising health awareness and dietary shifts. According to the China Food and Drug Administration (CFDA), the demand for functional food ingredients, including polyphenols, rose by over 16% in 2023, especially in urban regions where consumers are prioritizing wellness. Additionally, Japan’s Ministry of Health reported a consistent increase in polyphenol-rich food imports, particularly cocoa and berries, which are widely used in local formulations for cognitive health and cardiovascular support.

India is also witnessing a surge in demand, with the Ayush Ministry supporting research and commercialization of polyphenol-enriched herbal formulations as part of its nutraceutical mission. Moreover, large-scale production of green tea and spices like turmeric has provided a natural and cost-effective source of polyphenols for domestic and export purposes. With growing investment in food technology, government-backed R&D, and the rise of clean-label trends across emerging economies, APAC is expected to maintain its dominance in the global polyphenols market in the years ahead.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ajinomoto is actively expanding its polyphenols portfolio, leveraging its deep expertise in amino acids and biotechnology. In 2024, the company focused on developing green tea and grape seed polyphenol applications for functional beverages and nutritional supplements. With a global presence and strong R&D capabilities, Ajinomoto is investing in sustainable extraction technologies and strategic collaborations in Asia and North America, aiming to meet the rising demand for clean-label, antioxidant-rich food ingredients.

Barry Callebaut has positioned itself as a key innovator in cocoa-based polyphenol ingredients, with a special focus on cardiovascular health and skin wellness. In 2024, the company expanded its R&D efforts in Switzerland and Malaysia, developing patented formulations for use in beverages and confectionery. With demand for flavanol-rich chocolate growing, Barry Callebaut is capitalizing on health claims tied to cocoa polyphenols. Its Cocoa Horizons sustainability program ensures traceability and supports ethical sourcing of polyphenol-rich beans.

Biolink Group, operating under the brand Polyphenols AS, is known for its high-purity apple and grape polyphenol extracts. In 2024, the company ramped up production at its Norwegian facility and expanded exports to Europe and Japan. Biolink focuses on pharmaceutical-grade polyphenols for use in anti-inflammatory and cardiovascular supplements. By adhering to EU quality regulations and employing solvent-free extraction techniques, the company meets the demand for safe, clean, and potent antioxidant solutions in both food and pharma markets.

Top Key Players Outlook

- Ajinomoto Co. Inc.

- Archer Daniels Midland (ADM)

- Barry Callebaut

- Biolink Group (Polyphenols AS)

- Botaniex, Inc

- Cargill, Incorporated.

- Diana Foods

- DSM-Firmenich

- GRAP’SUD

- HERZA Schokolade GmbH and Co. KG

- Indena S.p.A

- International Flavors and Fragrances

- Kemin Industries, Inc.

- Lallemand

- Layn Natural Ingredients

- SGS SA (NutraSource, Inc)

- Vidya Pvt. Ltd.

Recent Industry Developments

In 2024, Biolink Group’s subsidiary Polyphenols AS, founded in 1998 in collaboration with the University of Bergen, continued to excel as a niche supplier of high‑purity anthocyanins and other flavonoids. Operating from its laboratory in Sandnes, Norway, the company distributed more than 30 distinct polyphenolic products, each with an analytical purity of above 97% via HPLC, to clients across over 60 countries, including food, wine, pharmaceutical, forest, and academic sectors.

In 2024, Ajinomoto’s OmniChem Natural Specialities division unveiled a new series of polyphenol‑based natural colorants for food and beverage applications, marking a strategic extension into the polyphenols market. This launch led to a 10% increase in demand for its polyphenol solutions, reflecting strong customer adoption across clean-label segments.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder, Others), By Source (Fruits, Vegetables, Cocoa, Others), By Application (Functional Foods, Beverages, Dietary Supplements, Animal Feed, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Co. Inc., Archer Daniels Midland (ADM), Barry Callebaut, Biolink Group (Polyphenols AS), Botaniex, Inc, Cargill, Incorporated., Diana Foods, DSM-Firmenich, GRAP’SUD, HERZA Schokolade GmbH and Co. KG, Indena S.p.A, International Flavors and Fragrances, Kemin Industries, Inc., Lallemand, Layn Natural Ingredients, SGS SA (NutraSource, Inc), Vidya Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ajinomoto Co. Inc.

- Archer Daniels Midland (ADM)

- Barry Callebaut

- Biolink Group (Polyphenols AS)

- Botaniex, Inc

- Cargill, Incorporated.

- Diana Foods

- DSM-Firmenich

- GRAP'SUD

- HERZA Schokolade GmbH and Co. KG

- Indena S.p.A

- International Flavors and Fragrances

- Kemin Industries, Inc.

- Lallemand

- Layn Natural Ingredients

- SGS SA (NutraSource, Inc)

- Vidya Pvt. Ltd.