Global Polydextrose Market Size, Share, Analysis Report By Product (Powder, Liquid), By Application (Beverages, Cultured Dairy, Ready-to-Eat Meals, Bakery and Confectionery, Nutritional Food, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155843

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

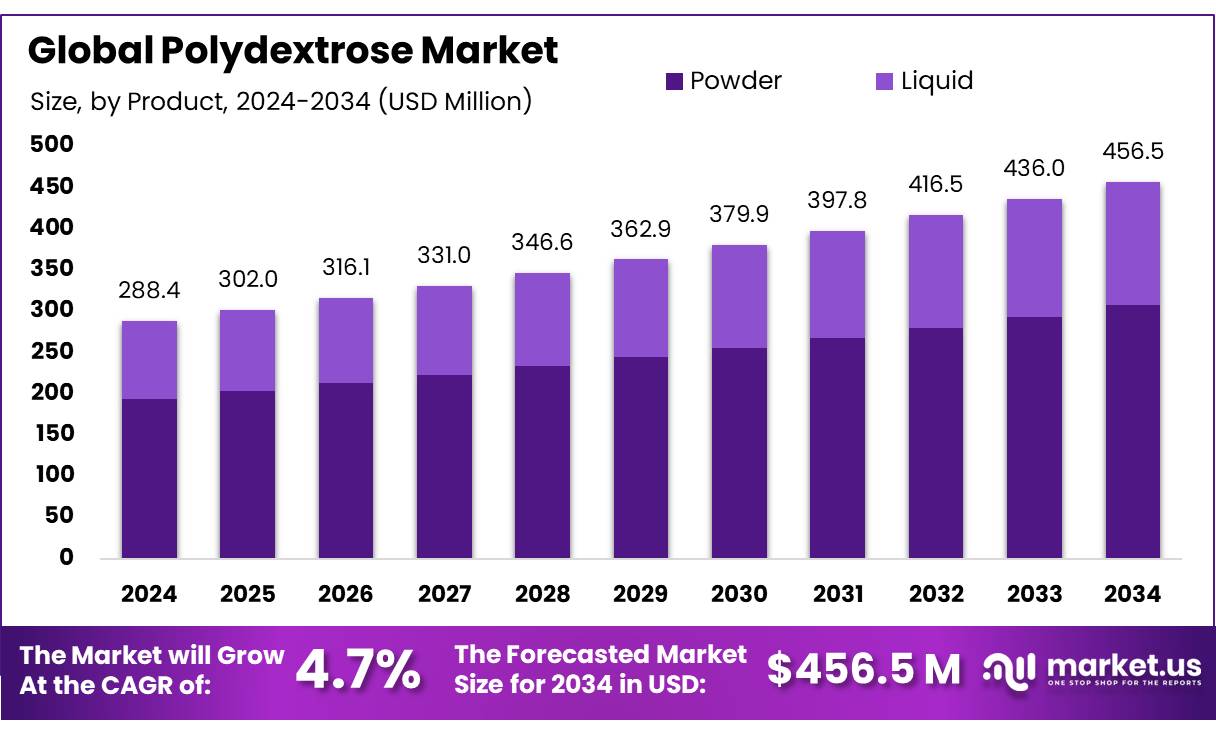

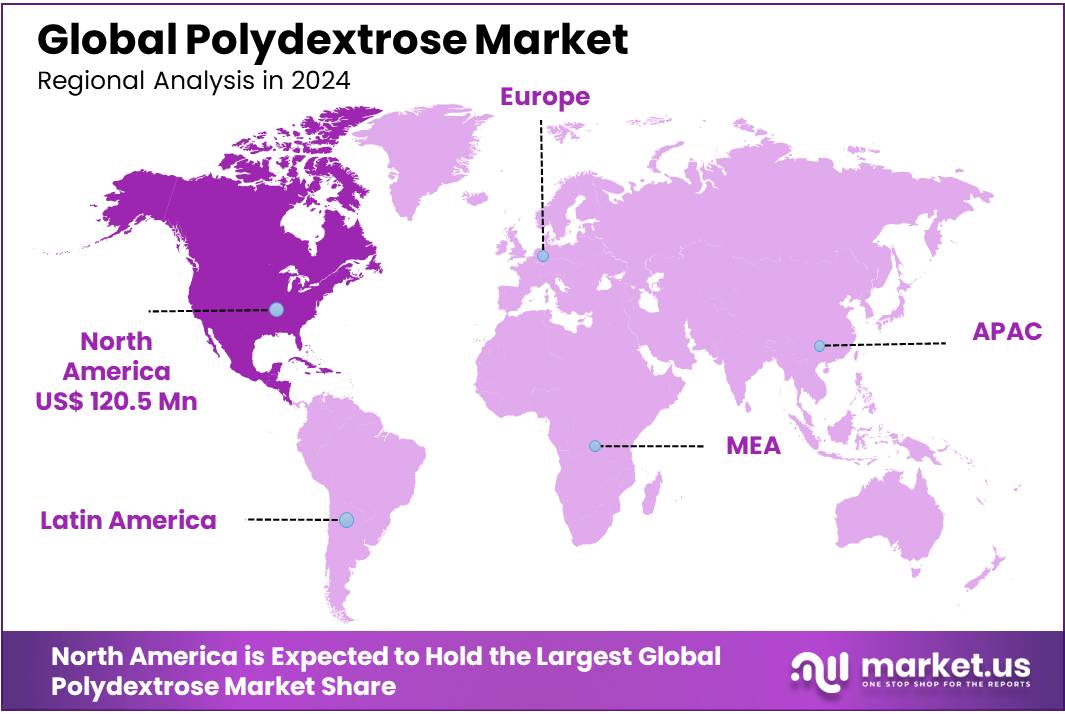

The Global Polydextrose Market size is expected to be worth around USD 456.5 Million by 2034, from USD 288.4 Million in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.80% share, holding USD 120.5 Million revenue.

Polydextrose, a synthetic polymer of glucose, sorbitol, and citric acid, has gained prominence as a low-calorie bulking agent and dietary fiber in the food and beverage industry. It is utilized to replace sugars and fats in products like baked goods, beverages, dairy, and confectionery, offering benefits such as improved texture, enhanced shelf life, and support for digestive health. Polydextrose typically has an energy value of approximately 1 kcal per gram, significantly lower than the roughly 2 kcal/g for most soluble fibers, which boosts its appeal for low-calorie formulations.

In industrial food production, polydextrose is valued for its versatility, safety, and labeling advantages. The U.S. FDA, through guidance issued in June 2018, declared that manufacturers may use an energy value of 1 kcal/g on product labeling for polydextrose, pending formal rulemaking—a significant regulatory allowance that enhances its commercial attractiveness. Clinical studies supporting this value show caloric measurements ranging from 0.77 to 1.46 kcal/g, with an average of 1.05 kcal/g, and individual studies such as Achour et al. reporting 0.96 kcal/g. These figures validate the regulatory stance and support formulators in designing lower‑calorie foods.

Government initiatives in India are further bolstering the growth of the polydextrose market. The Department of Biotechnology’s BioE3 Policy aims to position India as a global leader in biotechnology by driving innovation, sustainable growth, and job creation. With a projected target to achieve a $300 billion bioeconomy by the end of this decade, the policy serves as a pivotal initiative for economic, environmental, and technological advancement .

Key Takeaways

- Polydextrose Market size is expected to be worth around USD 456.5 Million by 2034, from USD 288.4 Million in 2024, growing at a CAGR of 4.7%.

- Powder held a dominant market position, capturing more than a 67.3% share of the global polydextrose market.

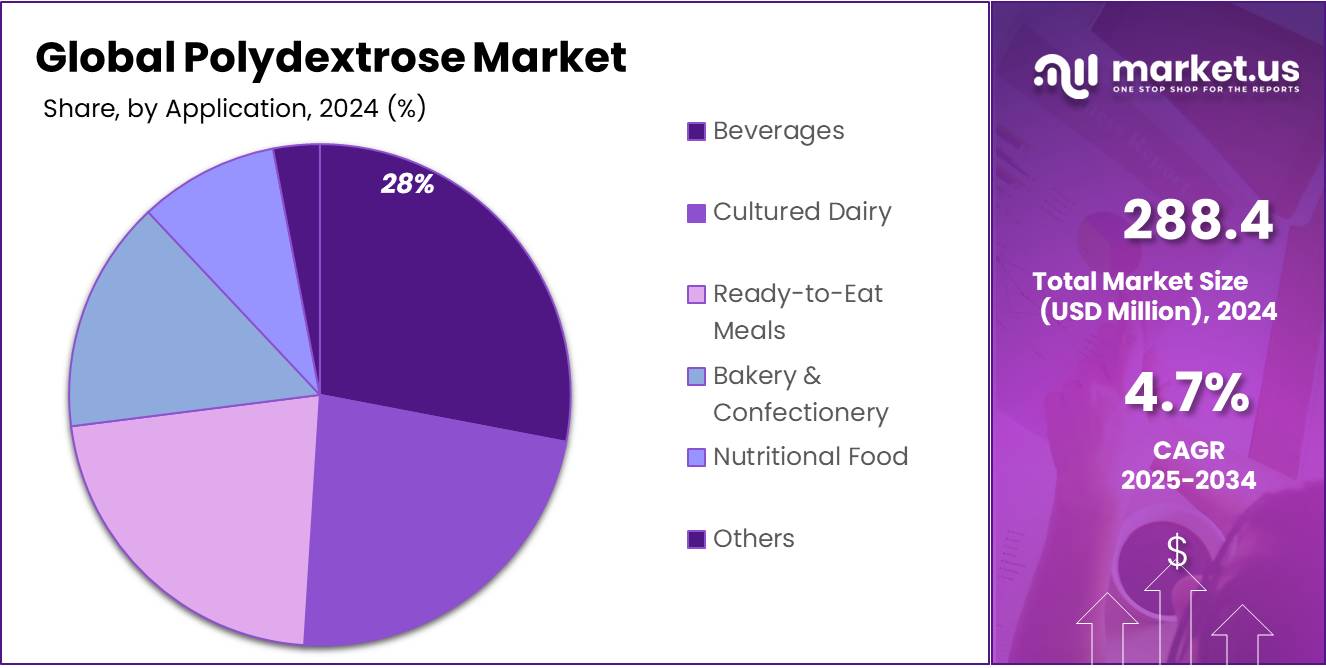

- Beverages held a dominant market position, capturing more than a 28.8% share of the polydextrose application.

- North America firmly established itself as the leading region, commanding 41.80% of the global polydextrose market—equivalent to a substantial USD 120.5 million.

By Product Analysis

Powder segment dominates with 67.3% share in 2024, thanks to its lasting appeal and flexibility.

In 2024, Powder held a dominant market position, capturing more than a 67.3% share of the global polydextrose market. This commanding lead reflects powder’s favorable properties—its excellent shelf stability, ease of storage, and adaptability to various food formats such as bakery items, supplements, and functional foods make it the ingredient-of-choice for manufacturers.

Year to year, this dominance has remained steadfast through 2024 and into 2025, as powder continues to be the most widely used form. Manufacturers favor powder due to its long shelf life stemming from low moisture content, which reduces spoilage risk. It also offers precise dosing, smooth blending into dry mixes, and retains functionality across diverse applications. Liquid forms, while growing modestly, still lag behind powder because of challenges with storage, stability, and higher logistical costs.

By Application Analysis

In 2024, Beverages lead with a 28.8% share, thanks to their refreshing functionality and health appeal.

In 2024, Beverages held a dominant market position, capturing more than a 28.8% share of the polydextrose application spectrum. That’s a significant slice of the market, and it speaks volumes about how much value beverage formulators see in this ingredient. Drinks—from functional beverages to smoothies and sports refreshments—favor polydextrose for its unique ability to add fiber, lower sugar content, and maintain a smooth mouthfeel without weighing the product down.

Looking at year‑to‑year trends through 2025, beverages continue to be a strong performer. Consumers increasingly favor low‑calorie, high‑fiber options in their daily liquids, and polydextrose delivers just that. Whether it’s hydrating sports drinks, probiotic beverages, or meal‑replacement smoothies, manufacturers lean into polydextrose’s versatility: it dissolves easily, retains clarity, and supports claims like “dietary fiber” or “low sugar” without compromising taste.

Key Market Segments

By Product

- Powder

- Liquid

By Application

- Beverages

- Cultured Dairy

- Ready-to-Eat Meals

- Bakery & Confectionery

- Nutritional Food

- Others

Emerging Trends

Regulatory Recognition and Health Benefits

Polydextrose, a synthetic polymer derived from glucose, has gained significant traction in the food industry due to its multifaceted benefits and regulatory endorsements. Recognized as a soluble fiber by the U.S. Food and Drug Administration (FDA) and Health Canada, polydextrose serves as a low-calorie bulking agent, dietary fiber supplement, and sugar replacer in various food products. Its inclusion in the FDA’s list of dietary fibers underscores its safety and potential health benefits, such as aiding in weight management, improving gut health, and enhancing satiety.

Government initiatives play a pivotal role in this growth. The FDA’s recognition of polydextrose as a dietary fiber has facilitated its incorporation into a wide range of food products, from baked goods to beverages. This regulatory support provides manufacturers with the confidence to use polydextrose in their formulations, knowing that it meets established safety and health standards.

Furthermore, the growing awareness among consumers about the importance of dietary fiber in maintaining digestive health and preventing chronic diseases has spurred the demand for functional foods containing polydextrose. As more individuals seek to improve their dietary habits, ingredients like polydextrose that offer health benefits without compromising on taste or texture are becoming increasingly popular.

Drivers

Government Recognition and Regulatory Support

Polydextrose is gaining traction in the food industry, not just due to its functional benefits but also because of its endorsement by regulatory bodies worldwide. In 2018, the U.S. Food and Drug Administration (FDA) officially recognized polydextrose as a dietary fiber, aligning it with other fibers like inulin and cellulose. This classification has paved the way for its inclusion in various food products, especially those targeting health-conscious consumers.

The European Food Safety Authority (EFSA) has also acknowledged polydextrose’s role as a food additive, providing guidelines on its acceptable daily intake. Such regulatory approvals not only validate the ingredient’s safety but also encourage manufacturers to incorporate it into their products, knowing that it meets stringent health standards.

These endorsements are significant because they offer a level of assurance to both producers and consumers. For manufacturers, regulatory backing means fewer hurdles in product development and marketing. For consumers, it provides confidence that the products they choose are both safe and beneficial to their health.

Restraints

Gastrointestinal Distress from Excessive Consumption

While polydextrose is widely recognized for its benefits as a low-calorie, soluble fiber, excessive consumption can lead to gastrointestinal discomfort. Health authorities, including Health Canada, have highlighted that consuming large amounts of polydextrose can cause bloating, gas, and stomach cramps.

These symptoms arise because polydextrose is partially fermented in the large intestine, producing gas as a byproduct. For individuals unaccustomed to high-fiber diets, introducing polydextrose suddenly can lead to more pronounced digestive issues.

The U.S. Food and Drug Administration (FDA) has established that doses exceeding 90 grams per day or 50 grams in a single dose may cause severe diarrhea in some individuals. Therefore, it’s crucial for consumers to be aware of their intake levels to avoid such adverse effects.

To mitigate these issues, it’s recommended to introduce polydextrose gradually into the diet, allowing the digestive system to adjust. Additionally, individuals should monitor their body’s response and consult healthcare professionals if they experience persistent discomfort.

Opportunity

Polydextrose in Functional Beverages

The global demand for functional beverages is on the rise, driven by consumers seeking health benefits beyond basic nutrition. Polydextrose, a low-calorie soluble fiber, is increasingly being used in these beverages to enhance fiber content without adding significant calories. This trend is particularly evident in regions like North America and Europe, where health-conscious consumers are actively seeking products that support digestive health and weight management.

In the United States, the Food and Drug Administration (FDA) has recognized polydextrose as a safe food ingredient, further encouraging its use in food and beverage products. This regulatory support has paved the way for manufacturers to incorporate polydextrose into a variety of functional beverages, including fiber-enriched drinks and low-calorie beverages.

As the functional beverage market continues to expand, the incorporation of polydextrose offers manufacturers a strategic opportunity to meet consumer demand for healthier, fiber-rich products. This aligns with the broader trend of clean-label products and the growing preference for ingredients that contribute to overall well-being.

Regional Insights

North America – 41.80% share, equivalent to approximately US$ 120.5 million in 2024

In 2024, North America firmly established itself as the leading region, commanding 41.80% of the global polydextrose market—equivalent to a substantial US$ 120.5 million in revenue. This commanding presence reflects the region’s strong consumer awareness of fiber-enriched, low-calorie ingredients and its robust food processing infrastructure.

U.S. consumers, in particular, have a growing appetite for functional food ingredients that promote digestive health, help control glycemic response, and support overall wellness. This trend is further reinforced by favorable regulatory frameworks: the U.S. FDA classifies polydextrose as a soluble dietary fiber and allows its labeling at 1 kcal per gram, enhancing its appeal in low-calorie product formulations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tate & Lyle supplies STA‑LITE® Polydextrose, a low‑calorie bulking and texturing fiber used to enhance taste and mouthfeel while boosting dietary fiber in food products. Notably, their Nantong (China) facility tripled its production capacity in 2017, making Tate & Lyle the only polydextrose producer with manufacturing lines on three continents.

IFF markets Litesse® Polydextrose, a scientifically backed prebiotic fiber that promotes satiety, appetite control, reduced calorie intake, and a lower glycemic load, while maintaining flavor and mouthfeel in food formulations. It is recognized for its dual role as a premium bulking agent and functional dietary fiber in diverse applications.

Henan Tailijie, the first polydextrose producer in Asia, holds over 28 years of experience and was pivotal in developing China’s national polydextrose standard (GB25541). The company led major national R&D projects—including the Ministry of Science and Technology’s “Polydextrose (soluble dietary fiber)” torch program—and now operates over 30,000 tons of production capacity across multiple global markets

Top Key Players Outlook

- Tate & Lyle

- International Flavors & Fragrances Inc.

- Medallion Labs (General Mills Inc.)

- Henan Tailijie Biotech Co., Ltd.

- CJ CheilJedang Corp.

- SAMYANG CORPORATION

- Cargill, Incorporated

- VW-Ingredients

Recent Industry Developments

In March 31 2024 Tate & Lyle, reported £1,647 million in revenue, £207 million in operating income, and £188 million in net income, while employing 3,431 people globally.

Henan Tailijie Biotech has long been a cornerstone in China’s polydextrose landscape, and its figures for 2024 show just how solid that standing is. The company’s production capacity surpassed 20,000 tonnes by 2020 and is now slated to expand to 60,000 tonnes by 2025.

Report Scope

Report Features Description Market Value (2024) USD 288.4 Mn Forecast Revenue (2034) USD 456.5 Mn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Powder, Liquid), By Application (Beverages, Cultured Dairy, Ready-to-Eat Meals, Bakery and Confectionery, Nutritional Food, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tate & Lyle, International Flavors & Fragrances Inc., Medallion Labs (General Mills Inc.), Henan Tailijie Biotech Co., Ltd., CJ CheilJedang Corp., SAMYANG CORPORATION, Cargill, Incorporated, VW-Ingredients Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tate & Lyle

- International Flavors & Fragrances Inc.

- Medallion Labs (General Mills Inc.)

- Henan Tailijie Biotech Co., Ltd.

- CJ CheilJedang Corp.

- SAMYANG CORPORATION

- Cargill, Incorporated

- VW-Ingredients