Global Petroleum Resin Market Size, Share, And Business Benefits By Type (C5 Resins, C9 Resins, C5 and C9 Resins, Hydrogenated Hydrocarbon Resins), By Application (Hot-melt Adhesives, Pressure-sensitive Adhesives, Rubber Compounding and Tires, Printing Inks and Flexible Packaging Films), By End-Use (Building and Construction, Tire Industry, Personal Hygiene, Consumer Goods, Automotive), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161198

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

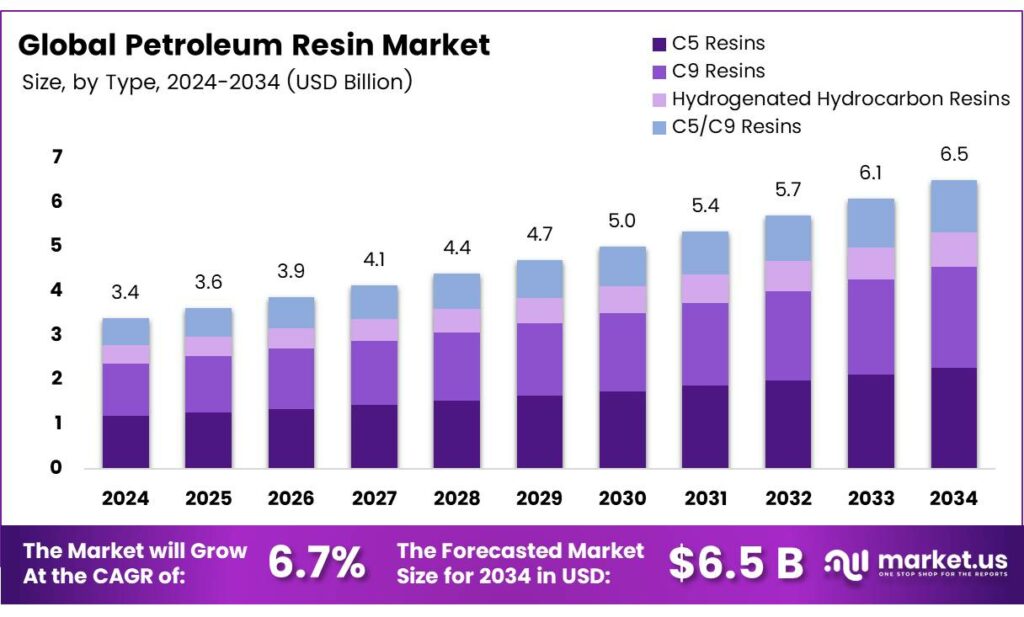

The Global Petroleum Resin Market size is expected to be worth around USD 6.5 billion by 2034, from USD 3.4 billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

Petroleum resin, also known as hydrocarbon resin, is a synthetic thermoplastic polymer derived from petroleum or natural gas. It is produced through the polymerization of petroleum-derived monomers like styrene, vinyltoluene, and alpha-methylstyrene. This versatile material is widely used in the manufacturing of various products, including adhesives, coatings, printing inks, and rubber compounds.

The resin’s typical properties make it a standout performer, with a softening point of 120°C (±5°C), a maximum Gardner color of 10 (in 50% toluene solids), a bromine number of 25 max, an acid value of 0.1 max, specific gravity of 1.05–1.10 at 25°C, and ash content of 0.05% max. These characteristics ensure SK-120 meets rigorous industry standards, including FDA approval under regulation 175.105 for adhesives. Available in 25kg paper bags or 500kg jumbo bags, it’s best stored indoors at temperatures below 30°C to maintain quality.

C9 petroleum resin, also called aromatic petroleum resin, is a resinous compound derived from the polymerization or copolymerization of aromatic hydrocarbons, aldehydes, and terpenes that typically contain nine carbon atoms. It appears as light yellow to light brown granules, flakes, or blocks that are solid, transparent, and shiny. The average molecular weight generally ranges between 2,000 and 5,000, with a relative density of 0.97–1.04.

Petroleum resin has key physical properties, including a softening point of 80–140°C, a glass transition temperature around 81°C, and a refractive index of 1.512. Its flash point is 260°C, with an acid value of 0.1–1.0 and an iodine value of 30–120, indicating moderate unsaturation. It is available in several types, such as aliphatic, aromatic, and modified resins, to meet different application needs. This versatile resin can be formulated for specific requirements and is valued for its high transparency.

Key Takeaways

- The Global Petroleum Resin Market is expected to reach USD 6.5 billion by 2034 from USD 3.4 billion in 2024, with a CAGR of 6.7%.

- C5 Resins held a 34.9% market share in 2024, valued for tackifying in adhesives and rubber compounding.

- Hot-melt Adhesives dominated with a 38.1% share in 2024, enhancing bonding in the packaging and automotive sectors.

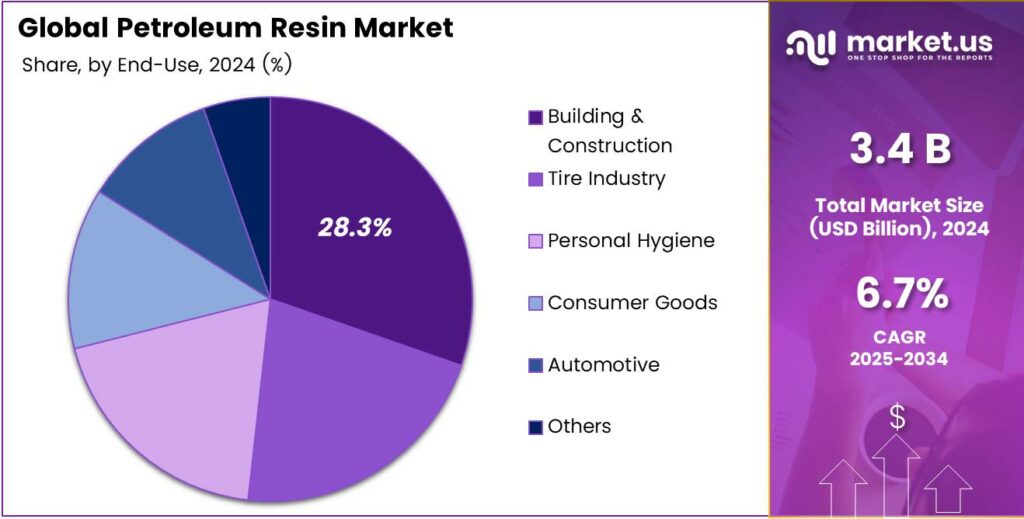

- The Building and Construction sector led with a 28.3% share in 2024, driven by coatings and sealants.

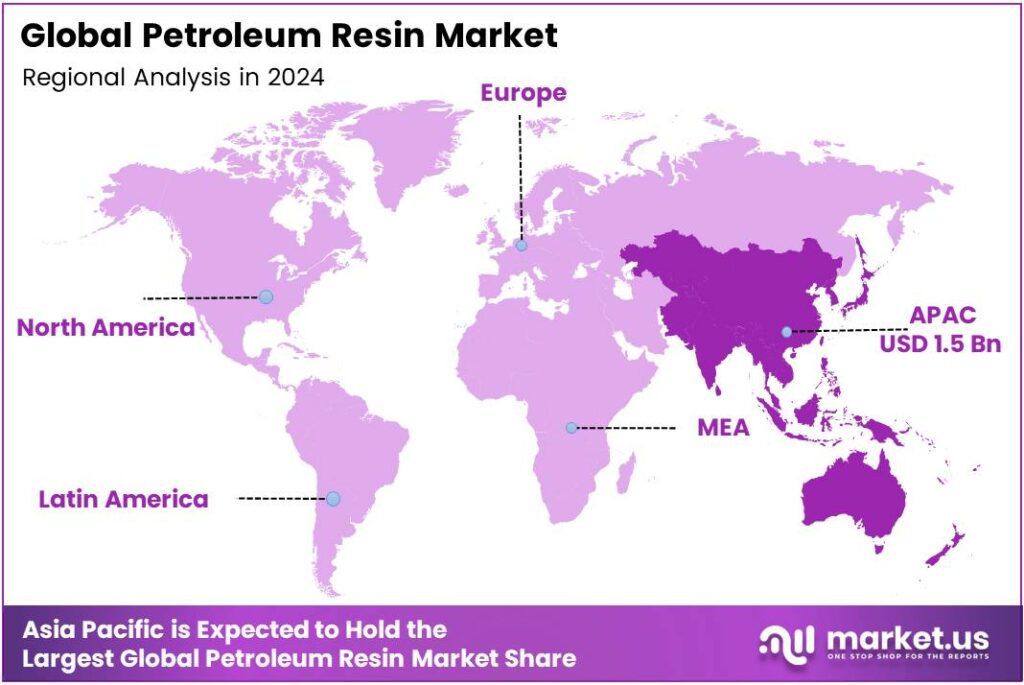

- Asia-Pacific captured a 45.8% market share in 2024, valued at USD 1.5 billion, led by China and India.

Analyst Viewpoint

From an investment lens, there’s a real sense of untapped potential here, especially as global construction and automotive sectors keep pushing forward. These resins, often tucked into adhesives, paints, and coatings, play a quiet but crucial role in making everyday products tougher and more reliable, think durable road markings that hold up in harsh weather or strong bonds in car parts that last longer on the highway.

Opportunities abound in emerging markets where infrastructure booms are underway, like building projects in Asia or expanded vehicle production worldwide; investors could tap into steady demand by backing producers who focus on versatile applications, such as sealants for packaging or modifiers for rubber goods.

From a consumer angle, people aren’t always aware of these resins, but they value the results: adhesives that stick without failing in hot-melt uses for DIY projects, or low-odor coatings in homes and cars that feel safer for families. Surveys and trends show a quiet appreciation for products that perform reliably in daily life, like tapes for shipping or inks in labels, driving indirect demand as shoppers prioritize quality over flash.

By Type

C5 Resins Leads Petroleum Resin Market with 34.9% Share

In 2024, C5 Resins held a dominant market position, capturing more than a 34.9% share in the global petroleum resin market. These resins, primarily derived from aliphatic hydrocarbons such as pentene and isoprene, are widely used for their excellent tackifying properties in adhesive and rubber compounding industries.

Their high compatibility with natural and synthetic rubbers has positioned them as a preferred choice in tire manufacturing, road marking paints, and hot-melt adhesives. The demand for C5 resins is projected to remain stable as industries continue to favor materials that enhance adhesion, flexibility, and durability.

The packaging and construction sectors, in particular, are expected to sustain consumption due to growing infrastructure activities and increasing use of pressure-sensitive adhesives. Additionally, expanding production capacities across Asia-Pacific is likely to strengthen supply reliability, supporting consistent growth momentum for C5 resins in the petroleum resin market.

By Application

Hot-melt Adhesives Lead Petroleum Resin Market with 38.1% Share

In 2024, Hot-melt Adhesives held a dominant market position, capturing more than a 38.1% share in the global petroleum resin market. These adhesives rely heavily on petroleum resins as tackifiers to improve bonding strength, flexibility, and heat resistance. Their quick-setting nature and strong adhesion to diverse substrates make them ideal for packaging, woodworking, automotive, and construction applications.

The growing demand for flexible packaging and furniture assembly has significantly driven resin consumption within this segment. The demand for hot-melt adhesives is expected to remain strong as manufacturers focus on cost-effective and solvent-free formulations.

Expanding industrial production and e-commerce packaging trends are supporting market growth across Asia-Pacific and North America. Moreover, the shift toward environmentally friendly and high-performance adhesive solutions continues to encourage steady adoption of petroleum resins, sustaining this segment’s leading market position in the coming years.

By End-Use

Building and Construction Leads Petroleum Resin Market with 28.3% Share

In 2024, Building and Construction, 28.3% held a dominant market position. The segment’s growth was driven by the extensive use of petroleum resins in coatings, sealants, waterproofing membranes, and road-marking applications.

These resins enhance adhesion, durability, and weather resistance, making them highly valuable in infrastructure and residential development projects. Rising construction activities in developing economies and the growing demand for long-lasting materials further supported segment expansion during the year.

The building and construction segment is expected to maintain steady growth as urban infrastructure projects continue to expand globally. Increased government spending on road modernization, housing, and smart city developments is expected to sustain resin demand. The preference for cost-effective and high-performance resins in construction adhesives and coatings will continue to reinforce the segment’s strong market presence.

Key Market Segments

By Type

- C5 Resins

- C9 Resins

- C5/C9 Resins

- Hydrogenated Hydrocarbon Resins

By Application

- Hot-melt Adhesives

- Pressure-sensitive Adhesives

- Rubber Compounding and Tires

- Road-marking Paints and Industrial Coatings

- Printing Inks and Flexible Packaging Films

By End-Use

- Building and Construction

- Tire Industry

- Personal Hygiene

- Consumer Goods

- Automotive

- Others

Drivers

Growing Demand from Adhesives & Coatings Applications

One major driving factor behind the rising use of petroleum resins is their broad and increasing demand in adhesives, sealants, coatings, and printing inks. These are downstream sectors that require tackifiers, binding agents, or film-forming resins and petroleum resins (especially C5, C9, and hydrogenated grades) fit very well because of their good compatibility, thermal stability, and cost-efficiency.

Adhesives and coatings are essential in packaging, labeling, construction, automotive, and consumer goods; any growth in those end-use industries translates into more demand for petroleum resins. For example, as more consumer products are packaged, more labels and adhesive films are used; as buildings and infrastructure expand, more coatings are applied.

Restraints

Regulatory & Environmental Burdens as a Key Restraint

One major restraint on the growth of the petroleum resin sector is the increasingly strict environmental and safety regulations imposed both by national governments and by international agreements. Because petroleum resins are derived from fossil feedstocks and involve volatile organic compounds (VOCs) and emissions during production, manufacturers must comply with many rules, which increases costs, complexity, and risk.

For instance, in India, chemical and petrochemical producers must follow rules under the Environment (Protection) Act, the Manufacture, Storage and Import of Hazardous Chemical Rules, and various state pollution control boards. Smaller firms often struggle to keep up with evolving norms.

The chemical industry is under pressure to reduce its carbon footprint, control emissions, adopt cleaner technologies, and handle waste responsibly. The push toward sustainability and “green chemistry” means that conventional petroleum-based resins may face extra scrutiny, potential carbon penalties, or regulatory disincentives.

Opportunity

Surge of Petrochemical Feedstock Demand

One powerful growth factor for petroleum resins is the rising share of petrochemicals in global oil usage. In other words, more and more of the oil we produce is being diverted into chemical feedstocks, which boosts demand for downstream materials like resins.

According to the International Energy Agency (IEA), petrochemical feedstock already accounts for about 12% of global oil demand, and this share is expected to rise as plastics, resins, adhesives, and specialty chemicals expand.

The world has seen steady growth in petrochemical capacity across regions, signaling that more infrastructure is being built precisely in that conversion chain from oil to chemical building blocks to value-added products. In India, especially, the government sees the chemical & petrochemical sector as a growth engine. The industry is currently valued at about USD 220 billion, and the goal is to scale it to USD 300 billion and ultimately USD 1 trillion.

Trends

Emergence of Chemical Recycling & Circular Feedstocks

One emerging factor likely to reshape the petroleum resin landscape is the growing push toward chemical recycling and circular-economy feedstocks. Rather than relying entirely on virgin petroleum streams, more and more industry players are exploring ways to break down waste plastics or resins back into usable hydrocarbon fragments, which can then be purified and converted into resins again.

This transition blurs the line between petroleum and recycled carbon sources, offering both environmental promise and new supply paths. For example, the International Finance Corporation (IFC) reports that by 2030, global chemical recycling capacity could reach about 5 million metric tons, up from less than 1 million metric tons in 2023.

On the policy front, India is stepping into this space. The Department of Biotechnology has launched a scheme titled Biomanufacturing of Bio-based Chemicals, Biopolymers, and APIs, signaling a push toward biological or bio-derived inputs in chemical manufacturing.

Regional Analysis

Asia-Pacific leads with a 45.8% share and a USD 1.5 Billion market value.

In 2024, Asia-Pacific held a dominant market position, capturing more than a 45.8% share of the global petroleum resin market, with an estimated market value of around USD 1.5 billion. This strong presence is driven by the region’s expanding industrial base, particularly in China, India, South Korea, and Japan, which together account for a large portion of global demand for adhesives, coatings, and rubber compounding applications.

The rapid growth of infrastructure and construction activities, coupled with surging automotive production, continues to strengthen petroleum resin consumption across the region. China remains the key production hub, supported by large petrochemical complexes and integrated refining capacities that ensure the steady availability of C5 and C9 feedstocks required for resin synthesis.

Reinforcing the local supply chain for downstream resin manufacturers. Meanwhile, India’s government policies, such as the Petrochemical Investment Regions (PCPIR) scheme and infrastructure expansion under “Make in India,” have encouraged both domestic and foreign investments in chemical and polymer manufacturing.

Asia-Pacific’s strong feedstock integration, cost advantage, and massive consumer demand make it the undisputed leader in petroleum resin production and consumption. This regional dominance is expected to continue, positioning Asia-Pacific as the center of global resin growth in the coming decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arakawa Chemical Industries Ltd. is a Japanese specialist renowned for its high-quality hydrogenated hydrocarbon resins. Its strategic focus on advanced, light-colored, and thermally stable products makes it a key supplier for demanding applications like adhesives, tapes, and rubber compounding. The company’s strong R&D capabilities and commitment to product purity have secured its position as a preferred partner in sectors where performance and consistency are critical, particularly in the Asia-Pacific region and global specialty markets.

Braskem holds a significant advantage in the petroleum resin market through vertical integration. It utilizes raw materials from its own massive cracker operations, ensuring a stable, cost-effective supply of C5 feedstocks. This allows Braskem to serve as a major volume producer, catering extensively to the adhesive, tire, and packaging industries primarily in North and South America, leveraging its vast production network and logistical strength.

China Petrochemical Corporation (Sinopec) is a dominant force in the global petroleum resin market. Its immense scale, integrated refinery and petrochemical infrastructure, and control over domestic feedstock supply give it a formidable production capacity and cost leadership. Sinopec primarily serves the massive domestic Chinese market for adhesives, rubber, and coatings, while also exerting significant influence on global trade flows and pricing dynamics due to its export volumes.

Top Key Players in the Market

- Arakawa Chemical Industries Ltd.

- Braskem

- China Petrochemical Corporation.

- Cray Valley

- Henghe Material and Science Technology Co., Ltd.

- Idemitsu Kosan Co., Ltd.

- Kolon Industries, Inc.

- Kumho Petrochemical Co., Ltd.

- Neville Chemical

- PetroChina Company Ltd.

- Puyang Tiancheng Chemical Co., Ltd.

- Shandong Qilong Chemical Co., Ltd.

Recent Developments

- In 2024, Arakawa Chemical Industries Ltd., a Japanese manufacturer specializing in rosin-based resins used in adhesives, inks, and electronic materials, reported steady financial performance. The company released its consolidated financial results for the three months ended under Japanese GAAP, showing operational stability in its core resin segments, though specific petroleum resin metrics were not detailed.

- In 2024, Braskem, a leading Latin American producer of thermoplastic resins, including hydrocarbon-based petroleum resins, advanced its sustainability efforts. The company completed its first sale of circular polyethylene (PE) resin produced via chemical recycling in South America, using feedstock from Neste, with applications in flexible packaging; this resin reduces carbon emissions compared to virgin materials.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 6.5 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (C5 Resins, C9 Resins, C5/C9 Resins, Hydrogenated Hydrocarbon Resins), By Application (Hot-melt Adhesives, Pressure-sensitive Adhesives, Rubber Compounding and Tires, Road-marking Paints and Industrial Coatings, Printing Inks and Flexible Packaging Films), By End-Use (Building and Construction, Tire Industry, Personal Hygiene, Consumer Goods, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arakawa Chemical Industries Ltd., Braskem, China Petrochemical Corporation, Cray Valley, Henghe Material and Science Technology Co., Ltd., Idemitsu Kosan Co., Ltd, Kolon Industries, Inc., Kumho Petrochemical Co., Ltd., Neville Chemical, PetroChina Company Limited, Puyang Tiancheng Chemical Co., Ltd, Shandong Qilong Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Arakawa Chemical Industries Ltd.

- Braskem

- China Petrochemical Corporation.

- Cray Valley

- Henghe Material and Science Technology Co., Ltd.

- Idemitsu Kosan Co., Ltd.

- Kolon Industries, Inc.

- Kumho Petrochemical Co., Ltd.

- Neville Chemical

- PetroChina Company Ltd.

- Puyang Tiancheng Chemical Co., Ltd.

- Shandong Qilong Chemical Co., Ltd.