Global Paracetamol Market By Product Type (Tablet, Powder, Liquid Suspension, Capsule, and Others), By Application (Headache & Fever, Muscle Cramps, Cold & Cough, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 15339

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

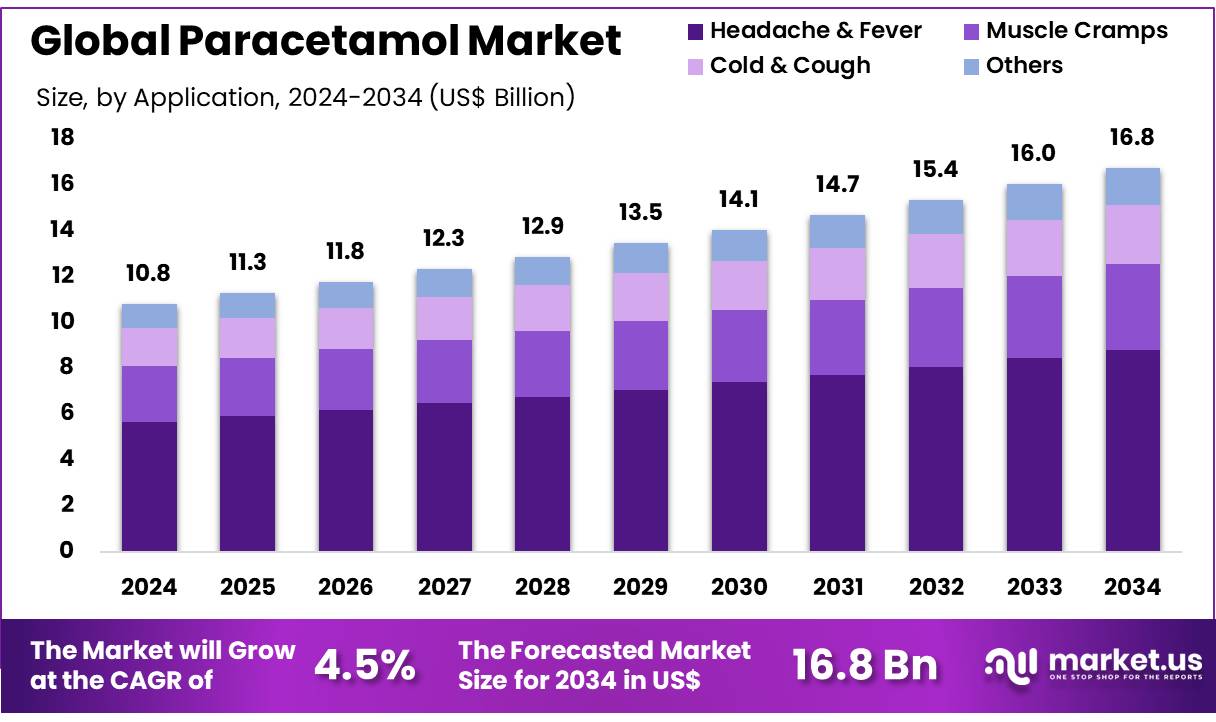

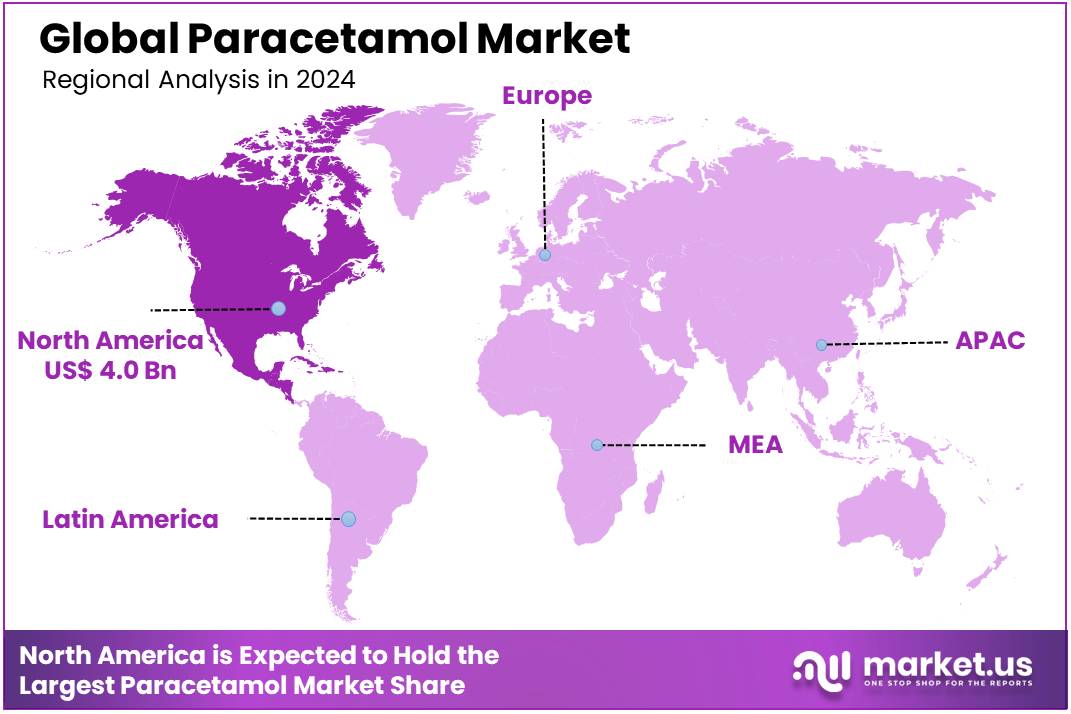

Global Paracetamol Market size is expected to be worth around US$ 16.8 billion by 2034 from US$ 10.8 billion in 2024, growing at a CAGR of 4.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.8% share with a revenue of US$ 4.0 Billion.

Rising prevalence of chronic pain conditions and growing awareness of over-the-counter (OTC) medication benefits are driving the expansion of the paracetamol market. Paracetamol, known for its analgesic and antipyretic properties, is widely used to relieve mild to moderate pain, such as headaches, muscle aches, and toothaches, as well as to reduce fever.

The increasing incidence of chronic conditions like arthritis, back pain, and migraines further fuels demand for this affordable and accessible pain relief solution. In January 2021, the American Migraine Foundation reported that over 4 million adults in the United States suffer from chronic daily migraines, experiencing at least 15 headache days per month, emphasizing the growing demand for effective pain relief solutions and driving the need for paracetamol-based products in the market.

Additionally, the rise of self-medication, especially in non-prescription drug categories, continues to boost market demand as consumers seek convenient and reliable treatment options for everyday ailments. The development of new paracetamol formulations, such as extended-release tablets and combination products, presents new opportunities in the market by catering to evolving patient needs.

Furthermore, expanding healthcare access and growing healthcare expenditures continue to contribute to the widespread use of paracetamol across various therapeutic areas. As the market adapts to changing consumer preferences and regulatory guidelines, paracetamol remains a key player in the global pain management landscape.

Key Takeaways

- In 2024, the market for paracetamol generated a revenue of US$ 10.8 billion, with a CAGR of 4.5%, and is expected to reach US$ 16.8 billion by the year 2034.

- The product type segment is divided into tablet, powder, liquid suspension, capsule, and others, with tablet taking the lead in 2024 with a market share of 50.3%.

- Considering application, the market is divided into headache & fever, muscle cramps, cold & cough, and others. Among these, headache & fever held a significant share of 52.6%.

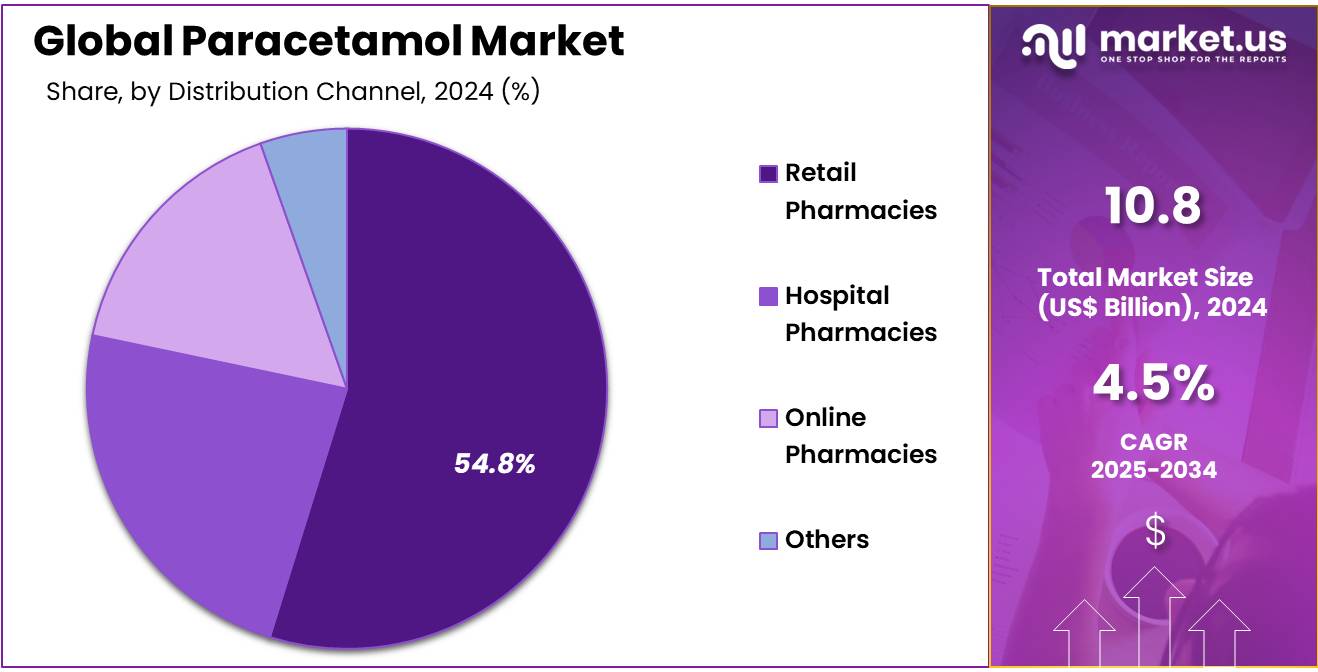

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, retail pharmacies, online pharmacies, and others. The retail pharmacies sector stands out as the dominant player, holding the largest revenue share of 54.8% in the paracetamol market.

- North America led the market by securing a market share of 36.8% in 2024.

Product Type Analysis

The tablet segment claimed a market share of 50.3% owing to the increasing consumer preference for easy-to-use and widely available dosage forms. Tablets are considered a convenient option for both over-the-counter and prescription use, offering precise dosages and long shelf-life. The growing self-medication trend, coupled with the widespread availability of paracetamol tablets in pharmacies, is projected to drive the demand for this form.

Furthermore, the increasing prevalence of mild pain conditions and fever, which are commonly treated with tablets, is likely to further fuel the growth of this segment. Additionally, the development of fast-dissolving or effervescent tablets is expected to attract more consumers seeking rapid relief, contributing to the segment’s expansion.

Application Analysis

The headache & fever held a significant share of 52.6% due to the rising incidence of conditions like headaches and fever, which are commonly managed with paracetamol. The increasing prevalence of stress-related headaches, seasonal infections, and viral diseases like the flu is expected to drive the demand for paracetamol as an effective and accessible solution.

As more consumers seek fast and effective relief from these conditions, the headache & fever segment is likely to see continued growth. Moreover, the expanding awareness of paracetamol’s effectiveness in treating both pain and fever is projected to make it a preferred choice for self-medication, further contributing to the expansion of this segment.

Distribution Channel Analysis

The retail pharmacies segment had a tremendous growth rate, with a revenue share of 54.8% as more consumers turn to pharmacies for over-the-counter medications. Retail pharmacies offer easy access to paracetamol products, making them a go-to choice for individuals seeking quick relief from mild pain or fever. The growing trend of self-medication and the increasing preference for buying medications from local pharmacies is likely to drive this segment’s growth.

Additionally, the expansion of retail pharmacy networks, including chain pharmacies and independent outlets, is expected to increase the availability and visibility of paracetamol products. As retail pharmacies continue to play a key role in providing essential health products, their share in the paracetamol distribution channel market is projected to rise.

Key Market Segments

Product Type

- Tablet

- Powder

- Liquid Suspension

- Capsule

- Others

Application

- Headache & Fever

- Muscle Cramps

- Cold & Cough

- Others

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Drivers

The high global prevalence of pain and fever is driving the market

The high global prevalence of conditions characterized by pain and fever is a primary driver for the paracetamol market. Paracetamol is a widely used over-the-counter analgesic and antipyretic, providing relief for symptoms associated with numerous common illnesses, headaches, and musculoskeletal conditions.

The widespread incidence of these ailments across all age groups and geographic regions sustains a consistent and high volume of demand for affordable and accessible pain and fever relief medications. This fundamental need forms the bedrock of the paracetamol market.

For instance, a systematic analysis of the Global Burden of Disease Study 2021 highlighted that low back pain alone affected 619 million people globally in 2020, with projections indicating an increase to 843 million prevalent cases by 2050, underscoring the massive and growing patient pool experiencing pain that is often managed with medications like paracetamol.

Restraints

Dependence on key raw material suppliers is restraining the market

Dependence on a limited number of key suppliers for the primary raw materials needed to produce paracetamol is restraining the market. The active pharmaceutical ingredient (API) for paracetamol is largely manufactured in specific regions, making the global supply chain vulnerable to disruptions stemming from production issues, geopolitical events, or trade restrictions in those key manufacturing hubs.

This concentration of supply can lead to price volatility and potential shortages of the API, impacting the production and availability of the finished paracetamol product worldwide. Ensuring a stable and diversified supply chain for key pharmaceutical ingredients is a recognized challenge for global health security.

While comprehensive global API production data from government sources for 2022-2024 is limited, trade data offers some insight; for example, US import data for acetaminophen (paracetamol) under HTS code 29242960 is available through the USITC DataWeb, indicating the reliance on international sources for this key ingredient.

Opportunities

Increasing demand in emerging economies creates growth opportunities

Increasing demand for affordable healthcare solutions in emerging economies is creating significant growth opportunities for the paracetamol market. Growing populations, rising healthcare awareness, and improving access to basic healthcare services in these regions are driving the consumption of essential medicines like paracetamol. Its low cost, proven efficacy, and availability in various formulations make it a staple for managing common symptoms, aligning well with the healthcare needs and economic conditions of these countries.

As disposable incomes gradually rise and healthcare infrastructure develops, the accessibility and utilization of over-the-counter medications like paracetamol are expected to increase substantially. Governments in some emerging economies are also promoting the availability of affordable generic medicines; for example, India’s Pradhan Mantri Bhartiya Janaushadhi Pariyojana aimed to provide quality generic medicines at affordable prices, with its product basket including paracetamol, contributing to increased access and demand in the country as noted in a Press Information Bureau report in December 2023.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the market for paracetamol. Economic conditions impact consumer purchasing power, affecting demand for over-the-counter medications, and also influence healthcare spending by governments and individuals, which can indirectly affect the market through prescribing patterns and healthcare access; in periods of economic stability, consumers may have more disposable income for healthcare products, while economic downturns can lead to a greater focus on essential, affordable options like paracetamol.

Geopolitical events and trade policies can disrupt the global supply chain for paracetamol API, which is concentrated in certain regions, leading to potential price increases or shortages of the finished product. Reports in early 2025 indicated that geopolitical risks were contributing to disruptions in various supply chains, which can impact pharmaceutical ingredients.

Despite potential negative impacts from economic volatility and supply chain vulnerabilities, the fundamental importance of understanding cellular processes for disease research, drug discovery, and the development of novel therapies provides a strong, persistent demand that underpins the market’s long-term resilience and drives continued investment in innovation.

Current US tariff policies can have an indirect impact on the paracetamol market by affecting the cost of imported paracetamol API or the chemicals used in its manufacturing. While paracetamol itself may not be subject to specific high tariffs, tariffs on various chemicals and manufactured goods imported from key manufacturing countries could increase production costs for companies producing paracetamol or paracetamol-containing products.

For example, US import data from the USITC DataWeb shows that total US imports for consumption of organic chemicals under HTS Chapter 29, which includes acetaminophen (paracetamol), were valued at hundreds of billions of US dollars in 2023. While specific tariff amounts for paracetamol are not detailed in aggregate reports, tariffs on components within this broad category can influence overall input costs for pharmaceutical manufacturing.

These increased input costs present a financial challenge for manufacturers and could potentially lead to higher prices for paracetamol products, impacting affordability for consumers, however, the high demand for this essential medicine means that manufacturers will likely seek to absorb some costs or find alternative sourcing, and the fundamental need for pain and fever relief ensures continued market activity despite potential tariff-related cost pressures.

Latest Trends

Focus on developing new formulations and combination products is a recent trend

A recent trend in the market is the increased focus on developing new formulations and combination products incorporating paracetamol. Pharmaceutical companies are investing in creating enhanced versions of paracetamol, such as rapid-release tablets, extended-release formulations, or liquid forms with improved taste or ease of administration, to offer greater convenience and cater to specific patient needs.

Furthermore, paracetamol is increasingly being combined with other active ingredients, such as decongestants, antihistamines, or opioids, to provide multi-symptom relief in a single product. This trend reflects efforts to differentiate products, enhance therapeutic benefits for various conditions, and capture different segments of the analgesic and cold and flu markets.

Major pharmaceutical companies with consumer health divisions actively pursue product innovation in the over-the-counter pain relief space; for instance, companies like Kenvue (formerly part of Johnson & Johnson Consumer Health) and GSK Consumer Healthcare frequently update their product offerings to include new formulations and combinations featuring paracetamol.

Regional Analysis

North America is leading the Paracetamol Market

North America dominated the market with the highest revenue share of 36.8% owing to its widespread availability and use as an over-the-counter analgesic and antipyretic. The FDA plays a crucial role in regulating its availability and labeling, ensuring safe use. The FDA’s Adverse Event Reporting System (FAERS) data, while not a direct measure of market size, reflects the ongoing monitoring of medication safety, including paracetamol. This system processed over 1 million adverse event reports in 2022, offering insight into the scale of medication use within the US.

Additionally, public health initiatives by organizations like the National Institutes of Health (NIH) often include paracetamol as a recommended first-line treatment for mild to moderate pain and fever, further solidifying its market presence.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing population, rising disposable incomes, and expanding healthcare access. Many countries in the region are improving their healthcare infrastructure, making essential medicines like paracetamol more readily available. The World Health Organization (WHO) promotes the availability of essential medicines, including paracetamol, and supports national health systems in the Asia Pacific region.

WHO initiatives aimed at improving access to primary healthcare often include ensuring the availability of affordable analgesics and antipyretics like paracetamol. For instance, the WHO’s work in strengthening health systems in Southeast Asia has focused on improving access to essential medicines at the primary care level.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the global paracetamol market drive growth through strategic acquisitions, technological innovation, and geographic expansion. They enhance product portfolios by acquiring specialized companies, enabling the integration of advanced technologies such as high-throughput screening and 3D cell culture models.

Investments in research and development facilitate the introduction of novel assay platforms tailored for drug discovery, cancer research, and personalized medicine. Collaborations with academic institutions and biotechnology firms accelerate innovation and market penetration. Additionally, companies focus on expanding their presence in underserved regions, addressing the increasing demand for advanced research tools and services.

Granules India Ltd. is a leading player in the global paracetamol market, holding a 30% share and offering both active pharmaceutical ingredients (APIs) and finished dosage forms. The company reported a significant increase in first-quarter profit, nearly tripling from the previous year, driven by strong demand in Europe and North America. Granules India’s growth is attributed to its strategic focus on quality manufacturing and expanding its global footprint, catering to the rising demand for paracetamol in various therapeutic applications.

Top Key Players

- Sun Pharmaceutical Industries

- Sanofi

- Paraveganio

- Mallinckrodt Pharmaceuticals

- IOL Chemicals and Pharmaceuticals

- Granules India Ltd

- GlaxoSmithKline (GSK)

- Cipla Ltd

Recent Developments

- In April 2022, IOL Chemicals and Pharmaceuticals launched commercial production of paracetamol with a capacity of 1,800 MTPA, alongside backward integration of Para Amino Phenol (PAP). This move enhances production efficiency and supports the growing demand for affordable, high-quality paracetamol, helping to strengthen its market supply.

- In March 2022, Paraveganio became one of the first medicinal products globally to receive The Vegan Society’s Vegan Trademark. This certification caters to the increasing demand for vegan and ethically sourced products, expanding the appeal of paracetamol in the market, particularly among consumers seeking plant-based alternatives.

Report Scope

Report Features Description Market Value (2024) US$ 10.8 Billion Forecast Revenue (2034) US$ 16.8 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tablet, Powder, Liquid Suspension, Capsule, and Others), By Application (Headache & Fever, Muscle Cramps, Cold & Cough, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sun Pharmaceutical Industries, Sanofi, Paraveganio, Mallinckrodt Pharmaceuticals, IOL Chemicals and Pharmaceuticals, Granules India Ltd, GlaxoSmithKline (GSK), Cipla Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sun Pharmaceutical Industries

- Sanofi

- Paraveganio

- Mallinckrodt Pharmaceuticals

- IOL Chemicals and Pharmaceuticals

- Granules India Ltd

- GlaxoSmithKline (GSK)

- Cipla Ltd