Bacteriostatic Water for Injection Market by Type (Single-dose and Multiple-dose), By Application (Pharmaceuticals, Surgical Applications and IV Fluids & Parenteral Nutrition and Others), By End-User (Hospitals, Clinics, Pharmaceutical Companies Research Laboratories and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137577

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

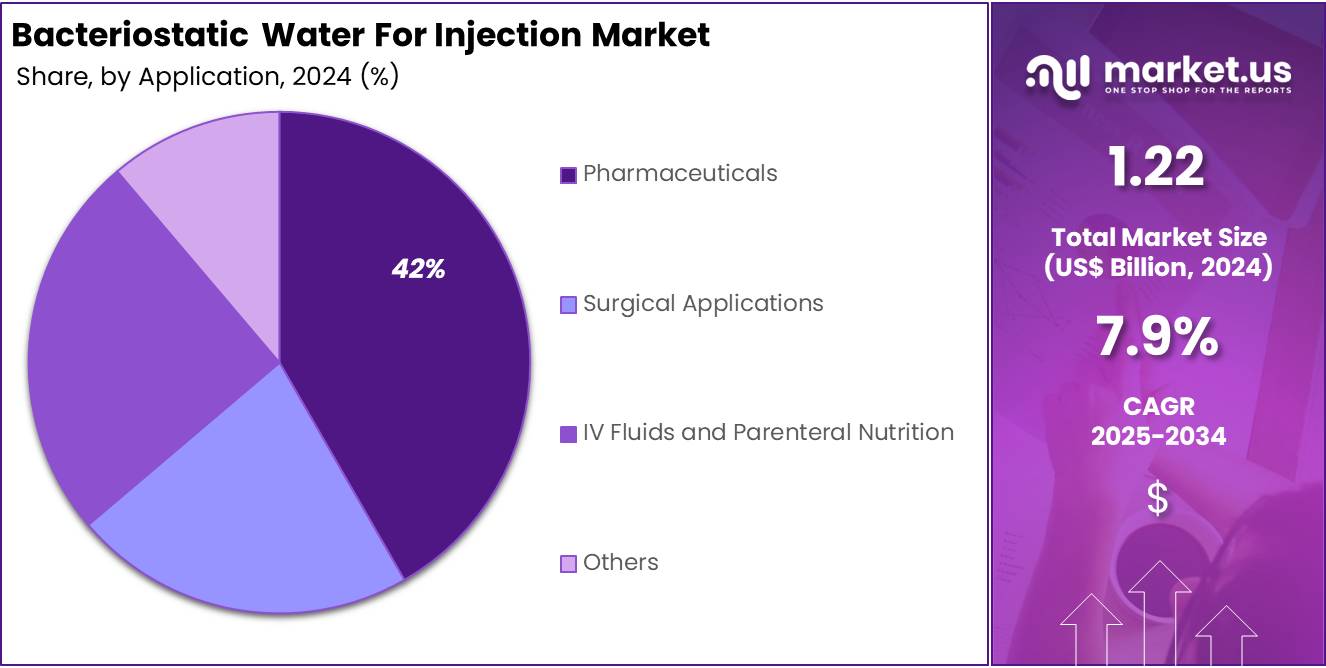

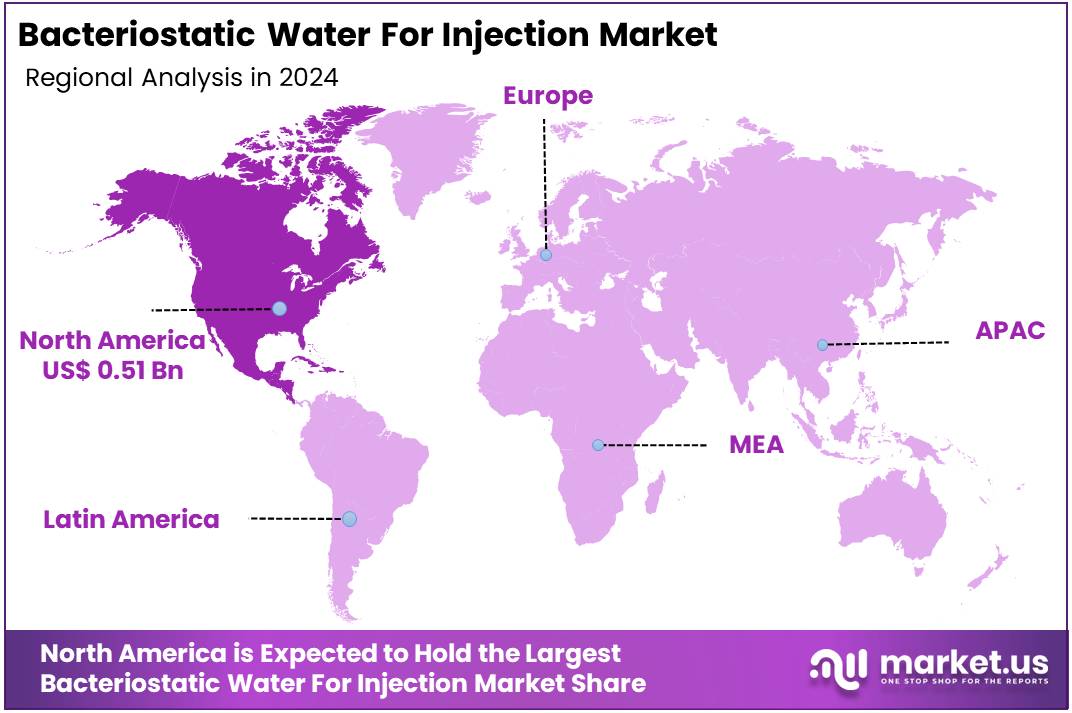

The Global Bacteriostatic Water for Injection Market size is expected to be worth around US$ 2.6 Billion by 2034, from US$ 1.2 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 41.7% share and holds US$ 0.51 Billion market value for the year.

Bacteriostatic Water for Injection (BWFI) is a sterile water solution used in medical and pharmaceutical settings for diluting or reconstituting injectable drugs. It contains a bacteriostatic agent, such as benzyl alcohol, to prevent bacterial growth once the vial is opened, allowing multiple uses within a specified period.

BWFI is primarily used in the preparation of drugs for intravenous (IV) administration, biologics, vaccines, and chemotherapy agents. It is widely used in hospitals, clinics, and pharmaceutical manufacturing. Its role is crucial in ensuring the proper formulation and safe administration of injectable medications, especially those that cannot be prepared in standard saline solutions.

The Bacteriostatic Water for Injection (BWFI) market is driven by its critical use in pharmaceuticals and healthcare, particularly in the preparation and dilution of injectable drugs. BWFI contains a bacteriostatic agent (usually benzyl alcohol) to prevent microbial growth, ensuring the safety and sterility of injectables. It is primarily used in hospitals, clinics, and healthcare settings for administering medications. The market is growing due to increasing demand for injectable medications, rising healthcare needs, and advancements in biopharmaceuticals.

Key Takeaways

- In 2024, the market for Bacteriostatic Water for Injection generated a revenue of US$ 1.2 billion, with a CAGR of 7.9%, and is expected to reach US$ 2.6 billion by the year 2034.

- The type segment is divided into Single-dose and Multiple-dose with Multiple-dose taking the lead in 2024 with a market share of 57.2%.

- Considering Application, the market is divided into Pharmaceuticals, Surgical Applications, and IV Fluids and Parenteral Nutrition and others. Among these, Pharmaceuticals held a significant share of 41.7%.

- By End-User, the market is classified into Hospitals, Clinics, Research Laboratories and others. Hospitals held a major share of 34.1%.

- North America led the market by securing a market share of 41.7% in 2024.

Type Analysis

Multiple-dose vials contain larger quantities and can be used for more than one injection which held 57.2% of the market share. They are typically used when a drug requires repeated administration over time, offering more convenience and cost-efficiency for both patients and healthcare providers. These are often found in settings like clinics and long-term care.

The segment dominates due to its cost-effectiveness and versatility in treating chronic conditions and in larger-scale medical settings, where repeated use of the same vial is more common. is designed for single-use and is typically found in smaller vial sizes. It ensures minimal risk of contamination, making it ideal for applications where a specific, one-time injection is required.

Application Analysis

Based on application, pharmaceuticals are the dominant segment, accounting for the 41.7% market share. The segment is driven by the increasing use of injectable medications and biologics. The demand for sterile, safe, and easily reconstituted drugs is growing, particularly with the rise in chronic diseases and biologic therapies.

In June 2024, Asahi Kasei launched a cutting-edge membrane system for producing Water for Injection (WFI). This new system provides a sterile water solution, crucial for injection preparations. It represents a significant shift from traditional distillation techniques. The system uses Microza hollow-fiber membranes, which are known for their superior water treatment and liquid filtration capabilities. This innovation highlights Asahi Kasei’s commitment to advancing pharmaceutical water production technology.

End-User Analysis

Hospitals led the share with 34.1% owing to the fact that they are the largest consumers of Bacteriostatic Water for Injection due to the high volume of injectable medications administered in various clinical settings. Bacteriostatic Water for Injection is crucial for preparing and diluting injectable drugs, providing sterile solutions for intravenous fluids, and facilitating parenteral nutrition, making it indispensable in patient care.

With the increasing number of surgeries, critical care requirements, and the growing demand for biologics and injectable drugs, hospitals continue to drive the demand for BWFI. Additionally, hospitals have strict regulations regarding sterility and patient safety, further contributing to the reliance on bacteriostatic water for safe medical procedures.

Key Market Segments

By Type

- Single-dose

- Multiple-dose

By Application

- Pharmaceuticals

- Surgical Applications

- IV Fluids and Parenteral Nutrition

- Others

By End-User

- Hospitals

- Clinics

- Pharmaceutical Companies

- Research Laboratories

- Others

Drivers

Increasing Demand for Injectable Medications

Injectable drugs are crucial in treating a wide range of medical conditions, including chronic diseases, cancer, infections, and biological therapies. The rise of biologics, such as monoclonal antibodies and vaccines, has significantly increased the demand for injectable formulations. These medications often require Bacteriostatic Water for Injection for reconstitution or dilution before administration.

Additionally, the growing aging population, rising prevalence of chronic diseases (e.g., diabetes, cancer), and advancements in personalized medicine contribute to the increasing reliance on injectable therapies. Injectable drugs are preferred for their fast action, higher bioavailability, and precise dosing, especially in critical care and hospital settings.

As the volume of injectable drug usage grows, so does the demand for BWFI, ensuring safe, sterile, and effective drug administration. This trend is expected to continue, further boosting market growth. For instance, in July 2023, Nexus Pharmaceuticals has received U.S. FDA approval for its Sterile Water for Injection, USP, available in 10mL and 20mL single-dose vials.

Restraints

Regulatory Challenges and Compliance Costs

Bacteriostatic Water for Injection (BWFI) has to meet stringent regulatory standards to ensure sterility, safety, and quality, as it is used in medical applications where contamination could lead to severe complications. Regulatory bodies like the U.S. FDA, European Medicines Agency (EMA), and other global authorities impose rigorous testing, quality assurance, and manufacturing protocols. This increases production and compliance costs, making it a barrier, particularly for small and medium-sized manufacturers.

Additionally, maintaining compliance with evolving regulatory requirements, such as changes in labeling, packaging, and quality control standards, can be resource-intensive. The cost of obtaining necessary certifications, ensuring traceability, and conducting frequent audits adds to the financial burden on manufacturers.

These challenges could lead to higher prices for BWFI products, limiting market access in price-sensitive regions and hindering the growth of the market in some areas. For example, Benzyl alcohol has been associated with serious adverse effects in neonates; thus, Bacteriostatic Water for Injection containing this preservative should not be used in this population. For neonates requiring water for injection, preservative-free alternatives are recommended.

Opportunities

Growth in Biologics and Vaccine Production

Due to the shift in the pharmaceutical industry toward specialized and complex formulations that do not always require or use BWFI. Biologics, such as monoclonal antibodies, gene therapies, and cell-based treatments, often require highly specific excipients, buffers, or other solutions for reconstitution, which may not include bacteriostatic water.

Similarly, vaccines, particularly those that are freeze-dried or lyophilized, often utilize alternative diluents, such as saline or phosphate-buffered saline, rather than BWFI. As the production of biologics and vaccines increases, there is a growing trend toward using customized or proprietary diluents tailored to the needs of these therapies, which reduces the reliance on BWFI. This shift in formulation and delivery methods limits the demand for bacteriostatic water, thereby restraining the growth of the BWFI market in the long term.

Impact of Macroeconomic / Geopolitical Factors

Economic downturns or recessions can lead to budget cuts in healthcare spending, affecting the demand for certain medical products, including BWFI. In regions with strained economies, healthcare systems may prioritize cost-saving measures, which could reduce the volume of BWFI required for injectable drug preparations, particularly in non-critical care situations.

Conversely, economic growth in emerging markets can increase healthcare access and, in turn, boost demand for injectable medications, including BWFI. Political instability, trade wars, and changes in healthcare regulations can disrupt supply chains, affecting the availability and pricing of raw materials for BWFI production.

For example, trade restrictions or tariffs can lead to higher costs for manufacturers sourcing materials from specific regions, potentially increasing the price of BWFI. Additionally, geopolitical tensions may impact the distribution and supply of critical medicines, which indirectly influences the demand for sterile solutions like BWFI.

Trends

Advancements in Packaging and Delivery Systems

Bacteriostatic Water for Injection (BWFI) market. Innovations in packaging, such as pre-filled syringes and single-use vials, enhance the convenience and safety of BWFI by reducing the risk of contamination and dosage errors. These advanced packaging solutions offer improved sterility, ease of handling, and more precise delivery, which are crucial in healthcare settings.

Moreover, smart packaging technologies, including tamper-evident seals, RFID tracking, and temperature-sensitive indicators, provide additional layers of safety, ensuring the integrity of BWFI during transport and storage. These advancements also contribute to regulatory compliance by maintaining product quality from manufacturer to end-user.

Additionally, sustainable packaging is gaining traction, driven by growing environmental concerns. Manufacturers are increasingly adopting eco-friendly materials to minimize waste and reduce the carbon footprint, aligning with the broader shift toward sustainability in the pharmaceutical industry. These innovations not only improve the efficiency and safety of BWFI use but also meet the evolving demands of healthcare providers and patients, driving market growth.

Regional Analysis

North America is leading the Bacteriostatic Water for Injection Market

North America, led by the United States, commands a significant share of the Bacteriostatic Water for Injection market, holding 41.7% in 2024. The U.S. leads due to its robust pharmaceutical industry and advanced healthcare infrastructure. The country’s role as a major global exporter of bacteriostatic water further underscores its market dominance.

In the United States, stringent manufacturing standards and rigorous quality regulations ensure the reliability of bacteriostatic water products. These high standards are essential in a market characterized by a strong demand for injectable drugs and sterile solutions. Safety and regulatory compliance are paramount, driving the reliability and trust in U.S.-manufactured products.

The market’s growth is also propelled by significant regulatory approvals. For instance, in May 2022, the U.S. FDA approved Eli Lilly’s Mounjaro (tirzepatide) injection. This innovative treatment, which is administered weekly, combines the functions of a GIP and a GLP-1 receptor agonist, enhancing glycemic control in adults with type 2 diabetes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Bacteriostatic Water for Injection (BWI) Market is fiercely competitive with numerous companies vying for market dominance. Leading players like Pfizer Inc., Baxter International Inc., and B. Braun Melsungen AG focus on innovation and regulatory approvals to build consumer trust. Pfizer, renowned for its pharmaceutical expertise, especially in vaccines and biologics, relies heavily on BWI for sterile diluents, boosting demand for high-quality injection solutions.

Sandoz, a division of Novartis, and Mylan N.V., now part of Viatris, are significant contributors to the BWI market. These companies enhance the market’s growth by offering a broad array of generic injectables that require BWI for dilution. Their efforts provide cost-effective alternatives to more expensive brands, facilitating market expansion and accessibility.

Other key market participants include Hospira, Amgen Inc., Eli Lilly and Co., and Teva Pharmaceuticals. Each plays a crucial role in the BWI market, with companies like Hikma Pharmaceuticals, Siegfried Holding AG, and Luitpold Pharmaceuticals also making notable contributions. The diverse range of players and products ensures ongoing innovation and competition, underscoring the dynamic nature of the BWI market.

Top Key Players in the Bacteriostatic Water for Injection Market

- Pfizer Inc.

- Baxter International Inc.

- Braun Melsungen AG

- Hospira (Acquired by Pfizer)

- Amgen Inc.

- Sandoz (A division of Novartis)

- Mylan N.V. (now part of Viatris)

- Eli Lilly and Co.

- Teva Pharmaceuticals

- Hikma Pharmaceuticals

- Siegfried Holding AG

- Luitpold Pharmaceuticals (A Daiichi Sankyo Company)

- Baxter Healthcare Corporation

- Wockhardt Ltd.

- Fresenius Kabi AG

- Lonza Group

- Aspen Pharmacare

- Macopharma

- Viatris

- Others

Recent Developments

- In December 2024: Hikma Pharmaceuticals launched ePHEDrine Sulfate Injection, USP in the United States. This product is used for the treatment of low blood pressure during anesthesia. The launch was a result of receiving FDA approval, marking a significant addition to Hikma’s broad portfolio of injectable medicines. This development emphasizes the company’s commitment to expanding its range of essential medicines in critical care.

- In October 2024: Pfizer, through its subsidiary Hospira, issued a recall for a specific lot of Bacteriostatic Water for Injection, USP, 30 mL multi-dose vial, due to potential issues with sterility assurance. This action was taken to prevent risks such as severe infections, which could arise from the use of non-sterile products.

Report Scope

Report Features Description Market Value (2024) US$ 1.2 billion Forecast Revenue (2034) US$ 2.6 billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Single-dose and Multiple-dose), By Application (Pharmaceuticals, Surgical Applications and IV Fluids and Parenteral Nutrition), By End-User (Hospitals, Clinics, Pharmaceutical Companies, Research Laboratories and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer Inc., Baxter International Inc., B. Braun Melsungen AG, Hospira (Acquired by Pfizer), Amgen Inc., Sandoz (A division of Novartis), Mylan N.V. (now part of Viatris), Eli Lilly and Co., Teva Pharmaceuticals, Hikma Pharmaceuticals, Siegfried Holding AG, Luitpold Pharmaceuticals (A Daiichi Sankyo Company), Baxter Healthcare Corporation, Wockhardt Ltd., Fresenius Kabi AG, Lonza Group, Aspen Pharmacare, Macopharma, and Viatris. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bacteriostatic Water for Injection MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Bacteriostatic Water for Injection MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- Baxter International Inc.

- Braun Melsungen AG

- Hospira (Acquired by Pfizer)

- Amgen Inc.

- Sandoz (A division of Novartis)

- Mylan N.V. (now part of Viatris)

- Eli Lilly and Co.

- Teva Pharmaceuticals

- Hikma Pharmaceuticals

- Siegfried Holding AG

- Luitpold Pharmaceuticals (A Daiichi Sankyo Company)

- Baxter Healthcare Corporation

- Wockhardt Ltd.

- Fresenius Kabi AG

- Lonza Group

- Aspen Pharmacare

- Macopharma

- Viatris

- Others