Global Non-woven Abrasives Market Size, Share, Growth Analysis By Product (Hand Pads & Rolls, Belts, Discs, Other), By End Use (Construction, Household, Electronics & Semiconductor, Transportation, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141697

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

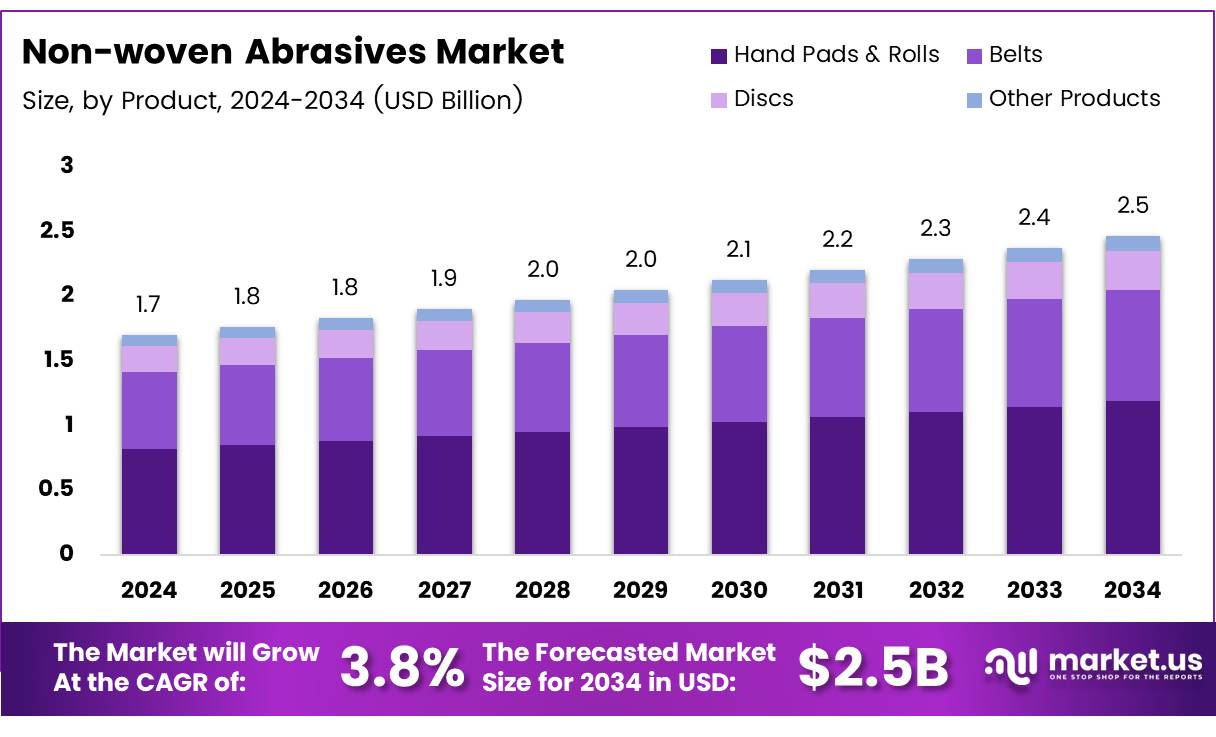

The Global Non-woven Abrasives Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

Non-woven abrasives are engineered, synthetic materials bonded with abrasive grains that are used to finish surfaces. They are characterized by their open mesh construction, which helps resist loading and reduces heat build-up during use. The Non-woven Abrasives Market includes a variety of products such as pads, rolls, discs, and belts that are essential in industries like automotive, aerospace, and construction for surface treatment, finishing, and polishing tasks.

Non-woven abrasives are integral to modern manufacturing due to their versatility and efficiency in surface conditioning jobs. Their durability and effective performance make them preferable for achieving desired finishes, particularly in metal fabrication and automotive industries. The unique structure of non-woven abrasives allows for consistent, controlled abrasion and a longer shelf life compared to traditional woven materials, supporting sustained demand in the market.

The Non-woven Abrasives Market is poised for growth driven by increasing demands in surface conditioning applications across various sectors. According to Empire Abrasives, coated abrasives, which include non-woven products, constitute 50% of the total sales in the global abrasive industry.

This statistic underscores the significant role non-woven abrasives play within the broader abrasive market. Additionally, the robust production of industrial sand and gravel in the U.S., reaching approximately 130 million tons in 2023 valued at about $7.0 billion (USGS), highlights a thriving raw material base supporting the abrasives industry’s expansion.

The growth trajectory of the Non-woven Abrasives Market is favorably influenced by technological advancements in abrasive materials and the expansion of end-use industries. Government investment in infrastructure and manufacturing, coupled with stringent regulations regarding worker safety and environmental conservation, drive the development and adoption of non-woven abrasives.

These regulations not only ensure safer working conditions but also promote the use of environmentally friendly abrasives, opening new avenues for market growth. The continuous evolution in manufacturing practices necessitates efficient, adaptable, and safer abrasive solutions, thereby presenting ongoing opportunities for market expansion.

Key Takeaways

- The Non-woven Abrasives Market is projected to decrease from USD 2.5 billion in 2024 to USD 1.7 billion by 2034, at a CAGR of 3.8%.

- Hand Pads & Rolls lead the Product Analysis segment with a 48.2% market share in 2024, due to their versatility in various industrial tasks.

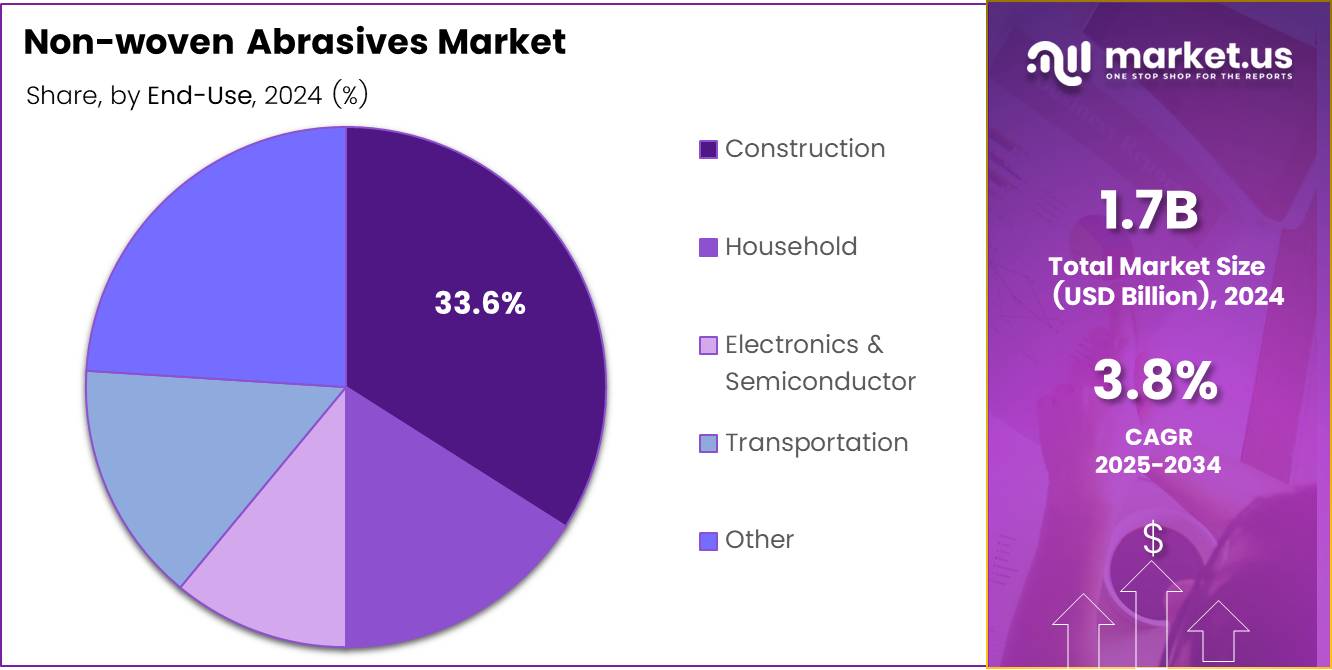

- The Construction sector dominates the End Use Analysis, holding 33.6% of the market share in 2024, driven by global growth in construction activities.

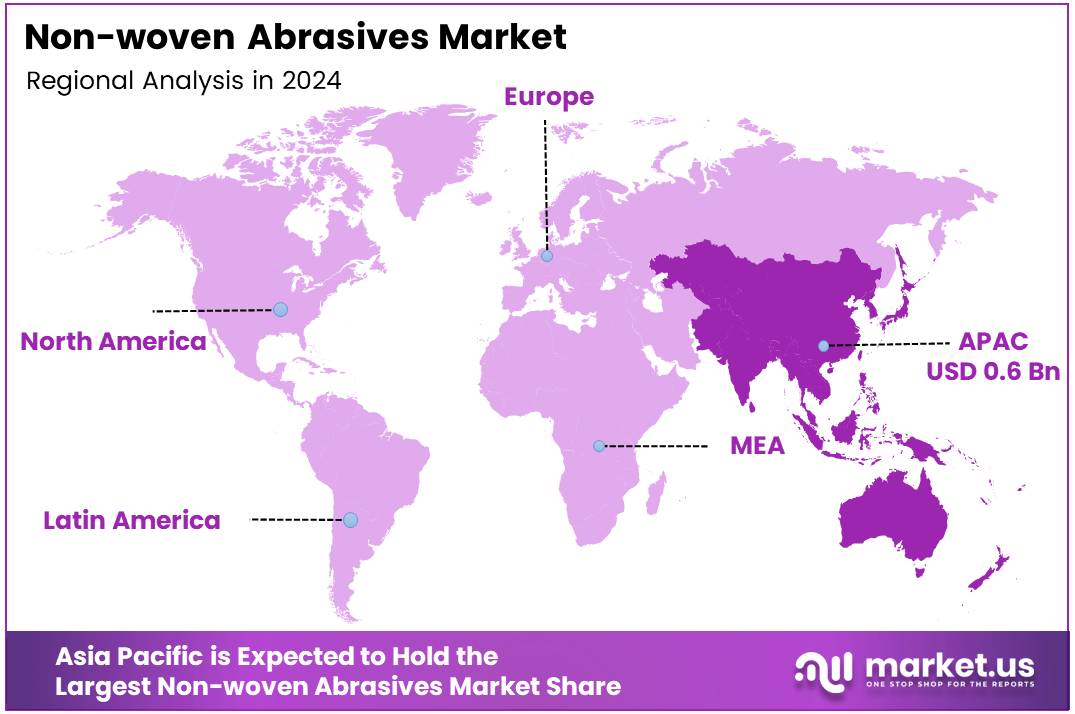

- Asia Pacific is the leading region for the Non-woven Abrasives Market, holding a 38% share valued at USD 0.6 billion.

Product Analysis

Hand Pads & Rolls Lead the Pack in Non-woven Abrasives Market with a Commanding 48.2% Share

In 2024, the Non-woven Abrasives Market observed a significant trend in its By Product Analysis segment, where Hand Pads & Rolls emerged as the frontrunner, capturing a substantial 48.2% of the market share. This product segment’s dominance can be attributed to its versatility and essential role in a multitude of applications ranging from heavy-duty cleaning to fine finishing tasks across various industries.

Following Hand Pads & Rolls, the Belts segment also marked its presence known but with a lesser share, emphasizing its specialized use in continuous sanding operations which demand durability and precision. Similarly, Discs, which are favored for their ability to handle edge work and contoured applications efficiently, contributed notably to the market composition.

Other Products within the Non-woven Abrasives category, including items such as buffs and brushes, filled the remaining market segment. These products, while smaller in total market share, play crucial roles in specific applications that require unique abrasive actions, thereby rounding out the diversity and comprehensive nature of the Non-woven Abrasives Market.

As industries continue to seek efficient and adaptable solutions for surface preparation and finishing, the dynamics within this market segment are expected to evolve, potentially altering the market standings of these key product types.

End Use Analysis

Construction Leads Non-Woven Abrasives Market with 33.6% Share Due to Robust Demand in 2024

In 2024, the Construction segment held a dominant position in the By End Use Analysis of the Non-woven Abrasives Market, accounting for 33.6% of the market share. This prominence is attributed to the escalating construction activities globally, where non-woven abrasives are essential for surface finishing tasks. The materials’ durability and effectiveness in providing excellent finish quality on various surfaces significantly drive their adoption in construction projects.

Following Construction, the Household sector also demonstrated a substantial uptake of non-woven abrasives, utilized primarily for DIY and maintenance activities, enhancing the aesthetics and longevity of household surfaces.

In the realm of Electronics & Semiconductor, these abrasives are crucial for manufacturing and assembly processes, ensuring precision and minimal damage to delicate components. The Transportation sector leverages non-woven abrasives in vehicle manufacturing and maintenance, benefiting from their ability to deliver fine finishes and resist wear under extreme conditions.

The Other category, encompassing industries like metal fabrication and healthcare, also integrates non-woven abrasives for their specific needs, further underscoring the versatility and wide-ranging applications of these materials. Collectively, these segments underscore the pervasive and growing influence of non-woven abrasives across various industries, anchored by robust demand in the construction sector.

Key Market Segments

By Product

- Hand Pads & Rolls

- Belts

- Discs

- Other

By End Use

- Construction

- Household

- Electronics & Semiconductor

- Transportation

- Other

Drivers

Increasing Demand for Metalworking and Fabrication Tools Drives Market Growth

The non-woven abrasives market is gaining momentum primarily due to the robust demand in the automotive industry, where these materials are indispensable for surface finishing and cleaning of various auto parts. This surge is bolstered by significant technological advancements in abrasive materials, which enhance their durability and performance, making them more appealing across multiple applications.

Moreover, the expansion in metal fabrication activities, which rely heavily on efficient, high-quality grinding and polishing solutions, further propels the demand for non-woven abrasives.

Additionally, the aerospace and defense sectors are increasingly adopting these abrasives for manufacturing and maintenance tasks, supporting the market’s growth trajectory. These drivers collectively underline a market that is evolving rapidly with industrial demands, focusing on efficiency and innovation in abrasive solutions.

Restraints

High Costs Challenge the Adoption of Non-woven Abrasives

the non-woven abrasives market, several factors appear to restrain its growth, despite the product’s benefits. Primarily, the higher costs associated with non-woven abrasives, compared to traditional abrasive products, pose a significant barrier to their widespread adoption.

These abrasives, which are essential for various industrial applications, including finishing and polishing, command a premium price due to their advanced material composition and manufacturing processes. This price factor makes them less attractive, especially in cost-sensitive markets. Additionally, the market faces challenges from the availability of substitute products.

These alternatives, often cheaper yet similarly effective, are readily chosen over non-woven options by budget-conscious consumers. As these substitutes continue to provide comparable outcomes at lower costs, they limit the growth potential of the non-woven abrasives market, compelling manufacturers to rethink pricing strategies and perhaps innovate towards more cost-effective solutions.

Growth Factors

Expanding Industrial Base Boosts Non-woven Abrasives Market

The non-woven abrasives market is poised for significant growth, driven primarily by the expanding industrial base in emerging markets like Asia and Africa. As these regions experience economic development, there’s a rising demand for manufacturing and processing activities, which in turn increases the need for effective and durable abrasives in metalworking, fabrication, and maintenance tasks.

Innovations in non-woven abrasive materials are also creating opportunities by enhancing the efficiency and applications of these products, allowing them to cater to more specialized and demanding industrial tasks. Furthermore, market players can leverage strategic partnerships and acquisitions to broaden their distribution networks and enhance their technological capabilities, ensuring a competitive edge.

Additionally, the growing regulatory focus on worker safety across various industries mandates the use of safer, high-quality abrasives, thus propelling the demand for non-woven abrasives that are less hazardous and offer superior performance. This multifaceted growth environment presents a fertile ground for stakeholders in the non-woven abrasives market to expand their reach and capitalize on new market opportunities.

Emerging Trends

Sustainability Driving Non-woven Abrasives Market Forward

In the non-woven abrasives market, there is a growing emphasis on sustainability, with manufacturers increasingly focusing on the use of recyclable and environmentally friendly materials. This shift is driven by regulatory pressures and a rising consumer preference for sustainable products.

Simultaneously, there is a notable trend towards customization, where abrasive solutions are specifically tailored to meet the diverse requirements of various industries, enhancing efficiency and performance.

Furthermore, companies are rapidly adopting digital marketing strategies to expand their reach and penetrate new markets, effectively increasing their customer base and sales. Continuous research and development efforts are also pivotal, as they focus on refining product capabilities to better suit emerging applications and adapt to new manufacturing technologies. These trends collectively signal a robust evolution within the non-woven abrasives market, poised for significant growth and transformation.

Regional Analysis

Asia Pacific Leads Non-woven Abrasives Market with 38% Share Due to Strong Manufacturing Growth

The Non-woven Abrasives market showcases significant variations across different regions, reflecting diverse industrial applications and local economic conditions. In Asia Pacific, the market is particularly robust, commanding a dominant 38% share with a valuation of USD 0.6 billion.

Asia Pacific’s prominence is bolstered by extensive manufacturing activities and burgeoning industries in countries like China, India, and South Korea. The demand in Asia Pacific is primarily driven by the automotive and electronics sectors, which utilize non-woven abrasives for surface finishing and cleaning applications.

Regional Mentions:

North America, the market is characterized by advanced manufacturing techniques and the presence of major industry players who focus on technological innovations in abrasives. The region benefits from stringent regulatory standards requiring high-performance and environmentally friendly abrasives, which in turn drives the adoption of non-woven types.

In Europe, the market for non-woven abrasives is driven by the automotive and aerospace industries, with an increased focus on precision engineering and sustainable manufacturing practices. European countries such as Germany, France, and Italy are key contributors, emphasizing quality and efficiency in abrasive materials.

The Middle East & Africa region, though smaller in comparison, is experiencing gradual growth in the non-woven abrasives market. This growth is fueled by the development of construction and metal fabrication industries, particularly in the Gulf Cooperation Council (GCC) countries, where economic diversification strategies are increasing manufacturing activities.

Latin America shows potential for growth in the non-woven abrasives market, supported by the expansion of the manufacturing sector in countries like Brazil and Mexico. Despite economic volatility, the regional market is benefitting from industrial investments and a shift towards more sophisticated manufacturing techniques.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In analyzing the global non-woven abrasives market for 2024, we focus on key players that are instrumental in shaping industry dynamics. Among them, 3M and Saint-Gobain are prominent for their innovation and broad market reach.

3M, renowned for its R&D capabilities, consistently introduces advanced abrasives that offer superior performance and durability, catering to diverse industries such as automotive and construction. Saint-Gobain, with its extensive experience and global footprint, excels in providing customized solutions that meet the evolving demands of various end-users, thereby reinforcing its market presence.

Mirka Ltd. and DEWALT also play significant roles, with Mirka Ltd. leveraging its expertise in dust-free solutions to enhance workplace safety and efficiency. DEWALT continues to expand its portfolio with ergonomically designed abrasives that enhance user comfort and productivity, particularly in heavy-duty applications.

TGA Abrasives and Osborn are noteworthy for their specialized offerings. TGA Abrasives focuses on cost-effective products that do not compromise on quality, making them appealing in price-sensitive markets. Osborn, with its dedication to technical support and customer service, strengthens client relationships and ensures product effectiveness across applications.

Carborundum Universal Limited (CUMI) brings a strong presence in Asian markets, integrating local insights with global standards to optimize supply chain and production efficiencies. Sia Abrasives and PFERD distinguish themselves through their commitment to sustainability and eco-friendly products, aligning with global environmental trends.

Lastly, Steel Shine, though smaller in scale, is agile and responsive to niche market requirements, providing tailored products that cater to specific customer needs.

Top Key Players in the Market

- 3M

- Saint-Gobain

- Mirka Ltd.

- DEWALT

- TGA Abrasives

- Osborn

- Carborundum Universal Limited (CUMI)

- Sia Abrasives

- PFERD

- Steel Shine

Recent Developments

- In August 2024, Vibrantz Technologies expanded its portfolio by acquiring Micro Abrasives Corporation, a company specializing in the production of specialty alumina.

- In May 2023, Sak Abrasives enhanced its market presence through the acquisition of Jowitt & Rodgers, further diversifying its product offerings in the abrasive industry.

- In January 2025, SurfacePrep broadened its capabilities by acquiring Precision Abrasives, aiming to strengthen its position in the surface preparation market.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Hand Pads & Rolls, Belts, Discs, Other), By End Use (Construction, Household, Electronics & Semiconductor, Transportation, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, Saint-Gobain, Mirka Ltd., DEWALT, TGA Abrasives, Osborn, Carborundum Universal Limited (CUMI), Sia Abrasives, PFERD, Steel Shine Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Non-woven Abrasives MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Non-woven Abrasives MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Saint-Gobain

- Mirka Ltd.

- DEWALT

- TGA Abrasives

- Osborn

- Carborundum Universal Limited (CUMI)

- Sia Abrasives

- PFERD

- Steel Shine