Global Sand Blasting Machine Market Size, Share, Growth Analysis By Product (Portable Sand Blaster, Stationary), By Operation (Manual, Semi-Automatic, Automatic), By Blasting Type (Dry Sand Blasting, Wet Sand Blasting), By Capacity (Less than 1,000 L, 1,000L to 2,000L, 2,000L to 3,000L, Above 3,000 L), By Pressure Rating (Low Pressure, Medium Pressure, High Pressure), By End-Use (Automotive, Construction, Marine, Oil & Gas, Metal Fabrication & Manufacturing, Others), By Type of Sales (Original Equipment, Aftermarket Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 29275

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Analysis

- Operation Analysis

- Blasting Type Analysis

- Capacity Analysis

- Pressure Rating Analysis

- End-use Analysis

- Type of Sales Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

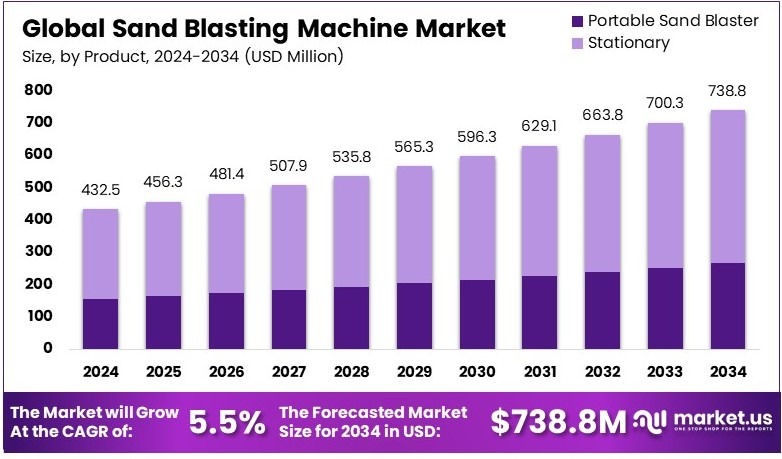

The Global Sand Blasting Machine Market size is expected to be worth around USD 738.8 Million by 2034, from USD 432.5 Million in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Sand Blasting Machines are industrial equipment that use high-pressure abrasive materials to clean, smooth, or etch surfaces. They operate by propelling sand or other media onto surfaces, effectively removing rust, paint, or contaminants. These machines are engineered for use in construction, automotive, and manufacturing sectors and provide reliable surface preparation.

The Sand Blasting Machine Market encompasses the commercial exchange and distribution of surface preparation equipment. It includes manufacturers, distributors, and service providers that supply these machines to various industrial sectors. The market operates under defined regulatory standards and trade practices, ensuring product reliability, standardized quality, and availability across supply channels.

The sand blasting machine market is currently experiencing robust growth, driven by increasing demand from critical sectors like automotive, aerospace, and construction. These industries rely heavily on efficient, precise surface preparation techniques, where sand blasting machines play a vital role. The integration of advanced technologies such as automation and robotics in sand blasting systems is enhancing their efficiency and precision, thereby boosting their adoption across these sectors.

Furthermore, as the market evolves, competitiveness among manufacturers is intensifying. Companies are continuously innovating to develop machines that are not only more efficient but also less harmful to the environment. These innovations include features like improved filtration systems and the use of recycled abrasives, which appeal to environmentally conscious consumers and businesses.

However, this market faces the challenge of high saturation, making it difficult for newer entrants to establish a foothold. In response, manufacturers are focusing on niche markets and specialized applications to differentiate their offerings.

Government regulations are also impacting the market significantly. Stricter safety standards and environmental regulations are pushing manufacturers to comply, which in turn is leading to the development of safer and more sustainable blasting solutions. These regulations not only ensure worker safety but also minimize the environmental footprint of sand blasting operations, aligning with global sustainability trends.

Key Takeaways

- The Sand Blasting Machine Market was valued at USD 432.5 million in 2024 and is expected to reach USD 738.8 million by 2034, with a CAGR of 5.5%.

- In 2024, Stationary sand blasting machines dominated the product segment with 64.4%, widely used in industrial applications for large-scale operations.

- In 2024, Semi-automatic machines led the operation segment with 43.4%, offering efficiency with minimal manual intervention.

- In 2024, Dry Sand Blasting dominated the blasting type segment with 74.4%, favored for its cost-effectiveness and efficiency.

- In 2024, 1,000L to 2,000L capacity machines led with 48.5%, suitable for medium-scale industrial applications.

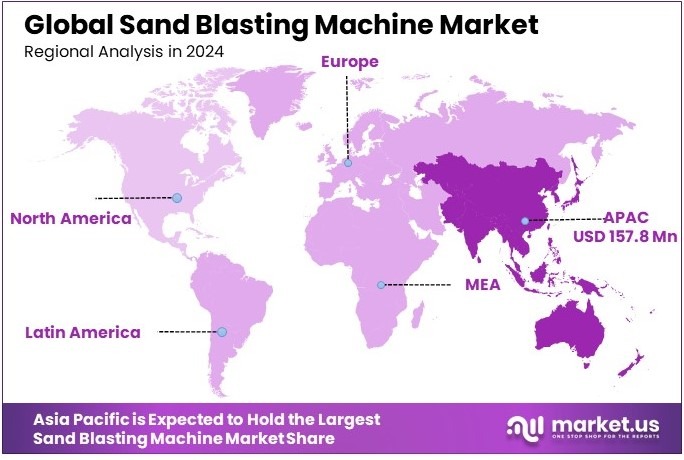

- In 2024, APAC dominated the regional market with 36.5% share, valued at USD 157.8 million, driven by rapid industrialization.

Product Analysis

Stationary sand blasters dominate with 64.4% due to their high efficiency and use in large-scale industrial applications.

The sand blasting machine market is divided into portable and stationary machines. Stationary sand blasters hold the highest market share at 64.4%. These machines are widely used in industries that require continuous, high-intensity surface treatment, such as construction, automotive, and metal fabrication.

Their ability to handle heavy-duty operations makes them the preferred choice for manufacturers and industrial users. Unlike portable models, stationary sand blasters can operate at a higher capacity, reducing downtime and increasing productivity.

Additionally, they provide better precision and uniform blasting, which is essential in applications like shipbuilding and aerospace. The increasing need for rust removal, paint stripping, and surface cleaning in large projects further supports the demand for stationary sand blasters. Their role in automation also enhances efficiency, leading to greater adoption across industries.

Portable sand blasters are popular for small-scale operations and fieldwork. They are used in automotive repairs, maintenance work, and home improvement projects. Their ease of transport and flexibility make them ideal for applications where mobility is essential.

Operation Analysis

Semi-automatic sand blasting machines dominate with 43.4% due to their balance between manual control and automation.

The market is segmented into manual, semi-automatic, and automatic machines. Semi-automatic sand blasting machines lead with a 43.4% market share. These machines offer a combination of manual operation and automated features, making them efficient yet cost-effective. Industries prefer semi-automatic models as they provide control over the blasting process while reducing labor costs.

The ability to adjust pressure and speed enhances their usability in different applications, from metal cleaning to surface preparation in construction. Semi-automatic machines are also more affordable than fully automated models, making them accessible to mid-sized and small businesses. Their increasing adoption in automotive and manufacturing industries is a major factor driving their growth.

Manual sand blasters are used for precise and small-scale applications where human control is necessary. They are common in workshops and repair centers. Fully automatic sand blasters, on the other hand, are gaining traction in industries focused on large-scale production and high-speed operations, improving overall efficiency.

Blasting Type Analysis

Dry sand blasting dominates with 74.4% due to its cost-effectiveness and widespread industrial use.

The market is divided into dry and wet sand blasting. Dry sand blasting holds a 74.4% share, making it the dominant segment. This method is preferred due to its efficiency in cleaning, rust removal, and surface preparation. It is widely used in the automotive, marine, and construction industries.

Dry sand blasting is more effective for heavy-duty applications as it removes contaminants quickly without the need for water. Additionally, it is compatible with a wide range of abrasive materials, offering flexibility for different surface treatment needs. Its lower operational costs make it more attractive to industries compared to wet sand blasting, which requires additional water treatment processes.

Wet sand blasting is mainly used in applications where dust control is necessary. It is preferred for delicate surfaces to prevent damage and reduce airborne particles. However, its higher maintenance costs limit its adoption in certain industries.

Capacity Analysis

1,000L to 2,000L dominates with 48.5% due to its suitability for mid-to-large scale industrial applications.

The sand blasting machine market is segmented by capacity into four categories: less than 1,000L, 1,000L to 2,000L, 2,000L to 3,000L, and above 3,000L. The 1,000L to 2,000L category holds the highest share at 48.5%. This capacity range is ideal for industries that require medium-to-high volume sand blasting operations.

It provides a balance between efficiency and cost, making it a preferred choice for businesses in construction, automotive, and metal fabrication. Machines in this category offer sufficient power and storage capacity to handle continuous operations without excessive downtime. Their moderate size also allows for easier installation and maintenance compared to larger models.

Machines with a capacity of less than 1,000L are used in small-scale applications and mobile operations. The 2,000L to 3,000L range is preferred by industries that require extended operation time without frequent refilling. Models above 3,000L are used for large-scale industrial projects, mainly in shipbuilding and heavy machinery manufacturing.

Pressure Rating Analysis

Medium pressure (15-50 psi) dominates with 47.5% due to its versatility in different applications.

The pressure rating segment includes low, medium, and high-pressure machines. Medium pressure machines hold the highest share at 47.5% because they provide a balance between efficiency and cost. They are commonly used in automotive, construction, and manufacturing industries for tasks such as paint removal, rust cleaning, and surface finishing.

Medium pressure machines are versatile, handling both delicate and heavy-duty applications without causing excessive damage to surfaces. This flexibility makes them a preferred choice for businesses that require multi-purpose sand blasting solutions.

Low-pressure machines (up to 15 psi) are used for delicate materials where precision is important. High-pressure machines (above 50 psi) are used in industries where deep surface treatment and rapid cleaning are required, such as shipbuilding and oil & gas.

End-use Analysis

Construction dominates with 37.5% due to high demand for surface preparation in infrastructure projects.

The sand blasting machine market is divided into several end-use industries, including automotive, construction, marine, oil & gas, and metal fabrication. The construction industry holds the largest share at 37.5% due to the increasing demand for surface preparation in building projects.

Sand blasting is widely used for cleaning metal surfaces, removing paint, and preparing concrete structures before coating. The growing focus on infrastructure development, especially in emerging economies, is driving demand for sand blasting machines in this sector. Additionally, stricter regulations on surface treatment and maintenance in construction projects further support market growth.

The automotive industry uses sand blasting for paint stripping, rust removal, and component cleaning. The marine sector relies on it for ship maintenance and hull cleaning. Oil & gas companies use sand blasting for pipeline cleaning and maintenance. Metal fabrication industries depend on sand blasting for finishing and preparing metal components.

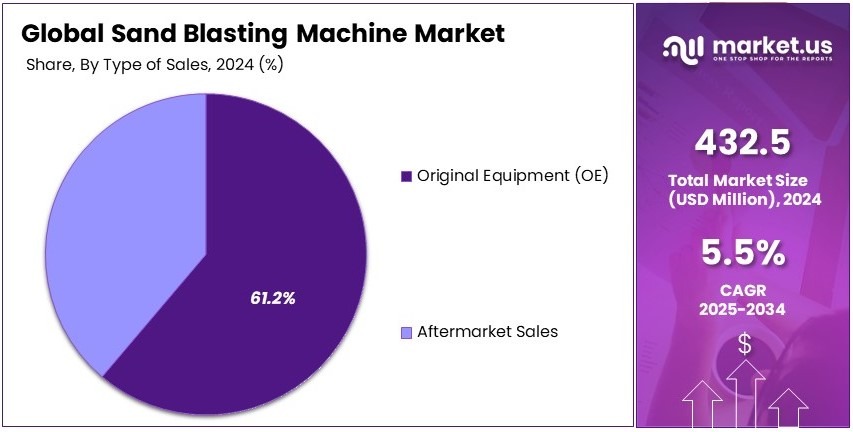

Type of Sales Analysis

Original Equipment (OE) dominates with 61.2% due to higher demand for new sand blasting machines in industrial applications.

The market is divided into original equipment (OE) and aftermarket sales. OE holds the highest share at 61.2%, as industries prefer purchasing new machines for long-term operations. The demand for durable, high-performance machines in sectors such as construction, oil & gas, and automotive has increased sales in this segment.

Companies are investing in new sand blasting equipment to improve efficiency and meet production requirements. Additionally, technological advancements have led to the development of more energy-efficient machines, encouraging businesses to upgrade their equipment.

Aftermarket sales include replacement parts, accessories, and refurbished machines. This segment is growing due to the need for maintenance and repairs. However, it remains secondary to the OE segment, as most industries prefer new machines with advanced features.

Key Market Segments

By Product

- Portable Sand Blaster

- Stationary

By Operation

- Manual

- Semi-automatic

- Automatic

By Blasting Type

- Dry Sand Blasting

- Wet Sand Blasting

By Capacity

- Less than 1,000 L

- 1,000L to 2,000L

- 2,000L to 3,000L

- Above 3,000 L

By Pressure Rating

- Low Pressure (Up to 15 psi)

- Medium Pressure (15-50 psi)

- High Pressure (50 psi and above)

By End-use

- Automotive

- Construction

- Marine

- Oil & Gas

- Metal Fabrication & Manufacturing

- Others

By Type of Sales

- Original Equipment (OE)

- Aftermarket Sales

Driving Factors

Industrial Expansion and Technological Advancements Drive Market Growth

The increasing demand for sand blasting machines in restoration and surface preparation is a key driver of market growth. These machines are widely used to clean and restore buildings, bridges, and historical structures, ensuring smooth and durable surfaces before repainting or coating.

Technological advancements have further boosted the industry. Automation in sand blasting machines has enhanced efficiency, reducing manual labor and increasing precision. Automated systems are now preferred in industries requiring uniform surface treatment, such as shipbuilding and manufacturing.

The automotive and aerospace industries are also contributing to the rising demand. In automobile production, sand blasting is essential for removing rust and preparing surfaces for painting or coating. Similarly, in aerospace, precision blasting ensures aircraft components meet safety and durability standards.

The construction and renovation industry is another significant growth driver. With increasing infrastructure projects, contractors rely on sand blasting for surface treatment of concrete and metal. The need for advanced surface finishing in modern construction materials is further driving adoption.

Restraining Factors

Regulations and Health Risks Restrain Market Growth

Stringent environmental regulations on silica sand blasting pose a challenge for manufacturers. Many countries have restricted or banned silica-based abrasives due to health hazards, forcing companies to adopt alternative materials that may be costlier or less effective.

High operational costs further limit market growth. The need for continuous abrasive material supply, regular maintenance, and energy consumption adds to expenses. Small and mid-sized businesses, in particular, find it challenging to invest in high-end sand blasting equipment.

Health concerns related to dust generation also restrict adoption. Prolonged exposure to airborne particles can lead to serious respiratory issues such as silicosis. This has led to stricter workplace safety regulations, requiring additional protective measures, which increase operational costs.

The availability of alternative surface treatment methods is another barrier. Techniques such as laser cleaning, chemical treatments, and ultrasonic cleaning offer similar results with lower environmental impact. Many industries are gradually shifting to these alternatives, affecting demand for traditional sand blasting machines.

Growth Opportunities

Eco-friendly Innovations and Digital Integration Provide Opportunities

The development of environmentally friendly blasting media presents a significant opportunity. Manufacturers are investing in biodegradable abrasives and advanced dust collection systems to reduce pollution. These innovations help companies comply with strict environmental laws while appealing to eco-conscious industries.

Expanding into emerging markets also offers growth potential. Industrial manufacturing in developing regions is increasing, leading to greater demand for surface treatment solutions. Countries with growing infrastructure projects, such as India and Brazil, are promising markets for sand blasting machine suppliers.

Customization of sand blasting machines to meet specific industry needs is another opportunity. Businesses require specialized equipment for different applications, such as delicate micro-finishing in electronics or heavy-duty blasting in shipbuilding. Providing tailored solutions can increase market competitiveness.

The integration of IoT and smart technology is reshaping the industry. Advanced monitoring systems allow businesses to track machine performance, optimize energy use, and reduce downtime. These digital advancements improve efficiency and create new revenue streams for manufacturers.

Emerging Trends

Automation and Alternative Techniques Are Latest Trending Factors

Robotic sand blasting systems are gaining popularity for their precision and efficiency. Automated machines reduce human intervention, ensuring consistent surface treatment while improving workplace safety. Industries requiring high-accuracy finishing, such as aerospace and electronics, are rapidly adopting robotic systems.

Wet blasting techniques are also on the rise. Unlike traditional dry blasting, wet methods use water to reduce dust and waste, making the process safer and more environmentally friendly. This trend is particularly strong in regions with strict air quality regulations.

Sand blasting is also being adopted in novel applications, such as microchip manufacturing. Precision surface cleaning is crucial in the electronics industry, and advanced blasting techniques are now used to enhance semiconductor production. This expansion into high-tech industries is opening new market opportunities.

Partnerships with construction and automotive sectors are further driving growth. Equipment manufacturers are working closely with these industries to develop specialized sand blasting machines that meet specific performance and safety standards. These collaborations lead to customized solutions and improved market adoption.

Regional Analysis

APAC Dominates with 36.5% Market Share in Sand Blasting Machine Market

Asia Pacific leads the sand blasting machine market with a commanding 36.5% share, equivalent to USD 157.8 million. This prominent market position is supported by extensive industrial activities across the region, especially in emerging economies like China, India, and Southeast Asia.

Key factors propelling this dominance include rapid industrialization, the expansion of manufacturing sectors, and increasing investments in infrastructure projects. The region benefits from lower labor costs and abundant raw material availability, which attract multinational companies to set up production units here.

Looking forward, the APAC region’s influence in the global sand blasting machine market is expected to grow. Ongoing developments in automotive, construction, and metalworking industries, coupled with technological advancements in sand blasting techniques, will likely boost the demand further.

Regional Mentions:

- North America: North America maintains a strong position in the sand blasting machine market, driven by technological innovation and strict regulatory standards regarding worker safety and environmental impact. The region’s focus on high-efficiency and environmentally friendly machines sustains its market growth.

- Europe: Europe’s sand blasting machine market is driven by the automotive and aerospace industries, which require precision surface finishing. The region’s emphasis on sustainable practices and high-quality standards supports its steady market presence.

- Middle East & Africa: The Middle East and Africa are witnessing growth in the sand blasting machine market, spurred by the construction boom and the oil & gas sector’s maintenance needs. The region’s market is expected to expand with infrastructural developments.

- Latin America: Latin America sees increasing use of sand blasting machines, particularly in its growing automotive and construction sectors. Efforts to modernize industrial capabilities are gradually enhancing the market’s scope in this region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the competitive sand blasting machine market, four companies particularly stand out due to their market influence, technological innovations, and robust product offerings. These include Clemco Industries Corp., Graco Inc., Empire Abrasive Equipment, and Wheelabrator Group.

Clemco Industries Corp. is a major player with a strong focus on producing high-quality, durable sand blasting machines that cater to a variety of industrial applications. Known for reliability and efficiency, Clemco’s equipment is widely used in sectors such as automotive, shipbuilding, and infrastructure, where precision and longevity are paramount.

Graco Inc. specializes in fluid handling systems and components, providing a range of sand blasting solutions that emphasize automation and precision. Graco’s products are designed to reduce material waste and increase productivity, making them ideal for applications requiring detailed surface preparation.

Empire Abrasive Equipment operates with a focus on innovation and customization. Their sand blasting machines are known for their adaptability to different operational environments, incorporating advanced features that cater to the specific needs of their users. Empire’s commitment to technological advancement has positioned them as a leader in providing specialized solutions.

Wheelabrator Group offers a comprehensive range of surface preparation technologies, including air-blast and wheel-blast machines. Their extensive experience and commitment to R&D have led to the development of machines that can handle a wide variety of materials, sizes, and shapes, making them a favorite in industries like metalworking and foundry.

These top companies drive the sand blasting machine market through continuous improvement of their products and by setting standards in quality and innovation. Their efforts are characterized by a deep understanding of industry needs, a robust global presence, and comprehensive customer support, ensuring they remain leaders in the market. Each company’s distinct approach to meeting the demands of diverse industrial applications solidifies their position at the forefront of the market.

Major Companies in the Market

- Abrasive Blasting Service & Supplies Pty Ltd (ABSS)

- Airblast B.V.

- Axxiom Manufacturing, Inc.

- Beijing Coowor Network Technology Co., Ltd.

- Burwell Technologies

- Clemco Industries Corp.

- CONIEX SA

- Empire Abrasive Equipment

- Fratelli Pezza

- Graco Inc.

- Guyson Corporation

- Hangzhou Huashengtong Machinery Equipment Co., Ltd.

- Kramer Industries Inc.

- Laempe Mössner Sinto GmbH

- Micro Blaster’s

- Midwest Finishing Systems, Inc.

- MMLJ, Inc.

- Norton Sandblasting Equipment

- Sinto Group

- Surface Blasting Systems, LLC

- Torbo Engineering Keizers GmbH

- Trinco Trinity Tool Co.

- Wheelabrator Group

Recent Developments

- Aitiip Technology Center: On January 2025, Aitiip Technology Center enhanced its additive manufacturing capabilities by acquiring an S1 shot blasting machine from AM Solutions. This acquisition automates post‐processing operations, leading to significant time savings and improved surface finishes. The integration of the S1 machine has enabled the company to increase production capacity by incorporating 3D printed components in various assemblies for market-ready products.

- Metal Finishing Technologies: On March 2024, Metal Finishing Technologies announced the acquisition of Aqua Blasting Corp. This strategic move expands the company’s surface treatment offerings by incorporating Aqua Blasting’s expertise in shot peening and blasting services across various industries, including aerospace and defense. The acquisition aligns with its growth strategy to become a comprehensive provider of metal surface treatment solutions.

Report Scope

Report Features Description Market Value (2024) USD 432.5 Million Forecast Revenue (2034) USD 738.8 Million CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Portable Sand Blaster, Stationary), By Operation (Manual, Semi-Automatic, Automatic), By Blasting Type (Dry Sand Blasting, Wet Sand Blasting), By Capacity (Less than 1,000 L, 1,000L to 2,000L, 2,000L to 3,000L, Above 3,000 L), By Pressure Rating (Low Pressure, Medium Pressure, High Pressure), By End-Use (Automotive, Construction, Marine, Oil & Gas, Metal Fabrication & Manufacturing, Others), By Type of Sales (Original Equipment, Aftermarket Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abrasive Blasting Service & Supplies Pty Ltd (ABSS), Airblast B.V., Axxiom Manufacturing, Inc., Beijing Coowor Network Technology Co., Ltd., Burwell Technologies, Clemco Industries Corp., CONIEX SA, Empire Abrasive Equipment, Fratelli Pezza, Graco Inc., Guyson Corporation, Hangzhou Huashengtong Machinery Equipment Co., Ltd., Kramer Industries Inc., Laempe Mössner Sinto GmbH, Micro Blaster’s, Midwest Finishing Systems, Inc., MMLJ, Inc., Norton Sandblasting Equipment, Sinto Group, Surface Blasting Systems, LLC, Torbo Engineering Keizers GmbH, Trinco Trinity Tool Co., Wheelabrator Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sand Blasting Machine MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Sand Blasting Machine MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abrasive Blasting Service & Supplies Pty Ltd (ABSS)

- Airblast B.V.

- Axxiom Manufacturing, Inc.

- Beijing Coowor Network Technology Co., Ltd.

- Burwell Technologies

- Clemco Industries Corp.

- CONIEX SA

- Empire Abrasive Equipment

- Fratelli Pezza

- Graco Inc.

- Guyson Corporation

- Hangzhou Huashengtong Machinery Equipment Co., Ltd.

- Kramer Industries Inc.

- Laempe Mössner Sinto GmbH

- Micro Blaster’s

- Midwest Finishing Systems, Inc.

- MMLJ, Inc.

- Norton Sandblasting Equipment

- Sinto Group

- Surface Blasting Systems, LLC

- Torbo Engineering Keizers GmbH

- Trinco Trinity Tool Co.

- Wheelabrator Group