Medical Display Market By Panel Size (Under 22.9 Inch, 23.9-26.9 Inch, 27-41.9 Inch, and Above 42 Inch), By Technology (LED-Backlit LCD, CCFL-Backlit LCD, and OLED), By Application (Diagnostic Applications (Multi-Modality Applications, Mammography, General Radiology, and Digital Pathology), Surgical/Interventional Applications, Dentistry, and Other), By Resolution (Up to 2 MP Resolution Displays, 2.1-4 MP Resolution Displays, 4.1-8 MP Resolution Displays, and Above 8 MP Resolution Displays (4K Resolutions and 8K Resolutions)), By Display Color (Color Displays and Monochrome Displays), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144543

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

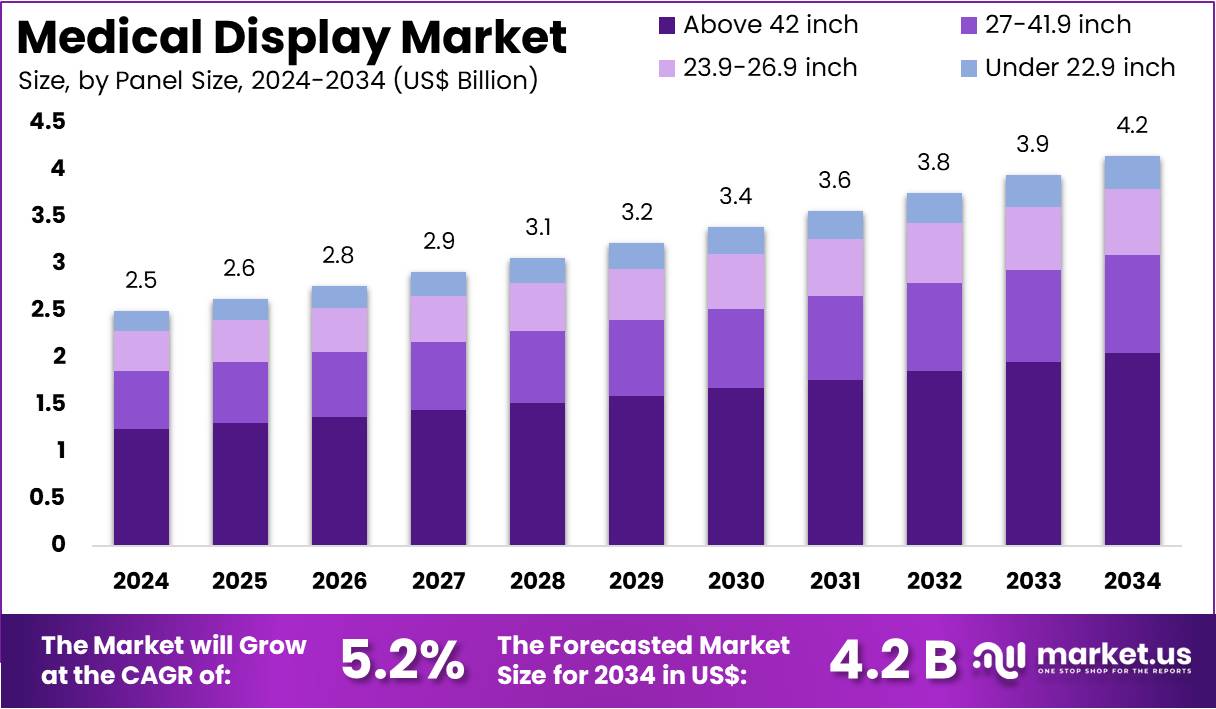

The Medical Display Market size is expected to be worth around US$ 4.2 billion by 2034 from US$ 2.5 billion in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.9% share and holds US$ 1.0 Billion market value for the year.

The growing demand for high-quality imaging in healthcare is driving the expansion of the medical display market. These displays play a crucial role in diagnostics, surgery, and patient monitoring. High-definition medical displays are essential in fields like oncology, cardiology, and radiology, where precision is critical. In November 2022, Barco launched two advanced models: the Io Gray 5.8 MP for breast imaging and the MDSC-8532 and MDSC-8527 4K UHD for surgical use. These high-resolution monitors enhance diagnostic accuracy and improve real-time imaging for critical procedures.

Technological advancements in medical displays are creating new opportunities for market growth. Features such as improved contrast ratios, better color accuracy, and seamless integration with electronic medical records (EMR) are enhancing efficiency in healthcare settings. These innovations help medical professionals make accurate diagnoses and improve patient care. The shift toward digital healthcare solutions has increased the demand for medical displays. As hospitals and clinics invest in advanced imaging solutions, the market for high-performance medical displays continues to expand.

The rise of minimally invasive surgeries and telemedicine is further driving demand for high-quality imaging solutions. Medical displays support remote diagnostics and enhance precision in surgical procedures. The need for real-time, high-definition visuals in operating rooms and diagnostic centers is increasing. This trend reflects the growing reliance on advanced imaging technology to improve patient outcomes. As healthcare providers focus on accuracy and efficiency, the adoption of high-resolution medical displays is expected to rise. This market growth aligns with the broader digital transformation in the healthcare sector.

Key Takeaways

- In 2024, the market for medical display generated a revenue of US$ 2.5 billion, with a CAGR of 5.2%, and is expected to reach US$ 4.2 billion by the year 2034.

- The panel size segment is divided into under 22.9 inch, 23.9-26.9 inch, 27-41.9 inch, and above 42 inch, with above 42 inch taking the lead in 2024 with a market share of 49.5%.

- Considering technology, the market is divided into LED-backlit LCD, CCFL-backlit LCD, and OLED. Among these, LED-backlit LCD held a significant share of 63.3%.

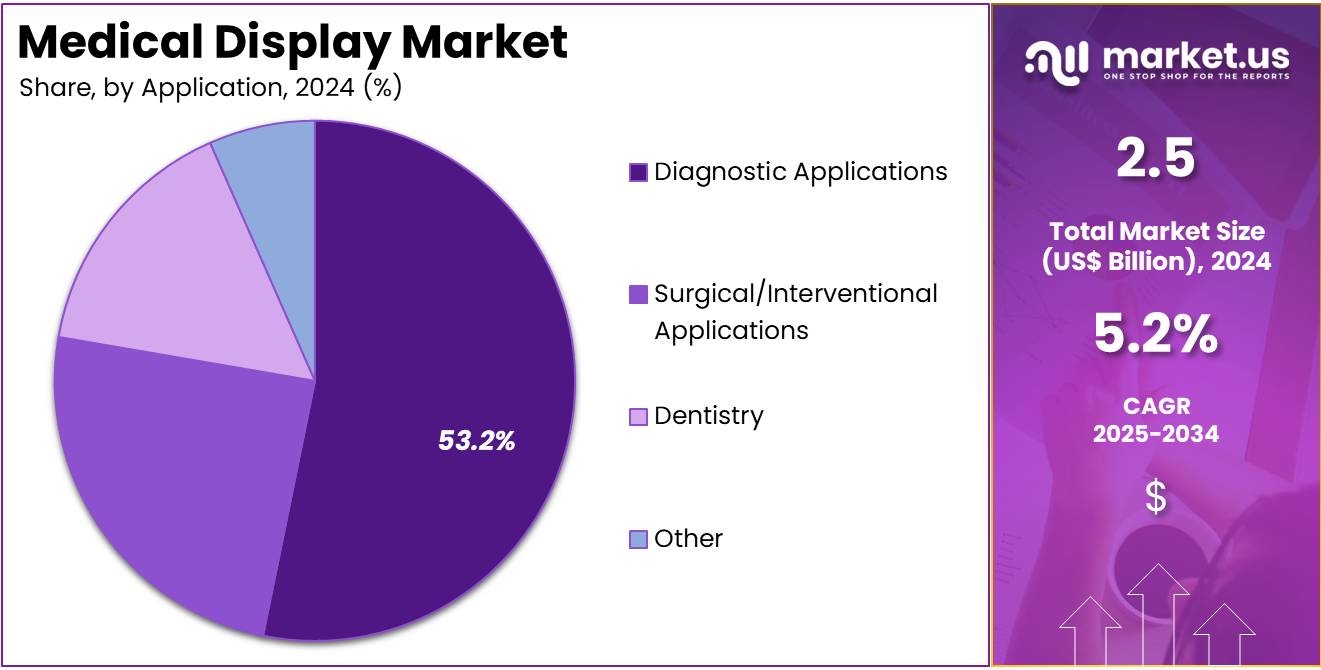

- Furthermore, concerning the application segment, the market is segregated into diagnostic applications, surgical/interventional applications, dentistry, and other. The diagnostic applications sector stands out as the dominant player, holding the largest revenue share of 53.2% in the medical display market.

- The resolution segment is segregated into up to 2 MP resolution displays, 2.1-4 MP resolution displays, 4.1-8 MP resolution displays, and above 8 MP resolution displays, with the above 8 MP resolution displays segment leading the market, holding a revenue share of 43.7%.

- Considering display color, the market is divided into color displays and monochrome displays. Among these, color displays held a significant share of 71.5%.

- North America led the market by securing a market share of 38.9% in 2024.

Panel Size Analysis

The above 42 inch segment led in 2024, claiming a market share of 49.5% as healthcare providers demand larger and higher-resolution displays for detailed imaging and diagnostics. Larger panel sizes offer superior visibility for complex diagnostic procedures, surgical planning, and patient monitoring, which is anticipated to drive demand in hospitals and diagnostic centers.

The rise in telemedicine, remote consultations, and collaborative medical settings is likely to further fuel the need for larger displays to improve visual clarity and ensure more effective decision-making. As medical technologies advance and the requirement for high-quality imaging increases, the above 42-inch segment is projected to grow rapidly in the coming years.

Technology Analysis

The LED-backlit LCD held a significant share of 63.3% as healthcare institutions increasingly adopt energy-efficient and high-performance display solutions. LED-backlit LCD displays offer superior brightness, contrast, and color accuracy compared to traditional CCFL-backlit LCDs. Additionally, the lower power consumption of LED-backlit LCDs aligns with the healthcare industry’s emphasis on energy efficiency and cost reduction.

The demand for displays with enhanced visual quality, reliability, and longevity in medical imaging applications is expected to further drive the growth of LED-backlit LCD displays, especially in diagnostic imaging and surgery.

Application Analysis

The diagnostic applications segment had a tremendous growth rate, with a revenue share of 53.2% owing to the increasing need for precise, real-time medical imaging in diagnosis. As diagnostic imaging techniques, such as MRI, CT scans, and X-rays, become more advanced, the demand for high-resolution medical displays to interpret and analyze images is expected to rise.

The growing prevalence of chronic diseases, the aging global population, and the emphasis on early detection and accurate diagnosis will likely drive demand for displays used in diagnostic applications. The need for clarity and detail in diagnostic images, combined with advancements in medical imaging technology, is anticipated to contribute to the expansion of the diagnostic applications segment.

Resolution Analysis

The above 8 MP resolution displays segment grew at a substantial rate, generating a revenue portion of 43.7% as healthcare providers require higher resolution displays for accurate diagnostics and surgical procedures. Higher resolution displays enable better visualization of fine details in medical imaging, which is crucial for tasks like detecting early-stage diseases or performing intricate surgeries.

As the demand for precision in diagnostics and treatments increases, particularly in fields like oncology and neurology, the use of above 8 MP resolution displays is projected to rise. Additionally, the continued development of imaging technologies that produce higher-resolution data is likely to further drive the growth of the above 8 MP resolution displays segment.

Display Color Analysis

The color displays held a significant share of 71.5% due to the increasing need for displays that can represent a wider range of colors for accurate interpretation of medical images. Color displays are particularly crucial in fields such as radiology, dermatology, and pathology, where accurate color differentiation is essential for diagnosis and treatment planning.

The rise in demand for more precise and detailed imaging, combined with advances in display technologies that improve color accuracy and clarity, is expected to drive the growth of color displays. As healthcare professionals continue to rely on color-coded imaging for better diagnosis, the color displays segment is projected to experience significant expansion in the medical display market.

Key Market Segments

By Panel Size

- Under 22.9 inch

- 23.9-26.9 inch

- 27-41.9 inch

- Above 42 inch

By Technology

- LED-backlit LCD

- CCFL-backlit LCD

- OLED

By Application

- Diagnostic applications

- Multi-modality Applications

- Mammography

- General Radiology

- Digital Pathology

- Surgical/Interventional Applications

- Dentistry

- Other

By Resolution

- Up to 2 MP Resolution Displays

- 2.1-4 MP Resolution Displays

- 4.1-8 MP Resolution Displays

- Above 8 MP Resolution Displays

- 4k Resolutions

- 8k Resolutions

By Display Color

- Color Displays

- Monochrome Displays

Drivers

Increasing Adoption of Digital Imaging Technologies is Driving the Market

The growing adoption of digital imaging technologies in healthcare is a major driver for the medical display market. High-resolution displays are essential for accurate diagnosis and treatment planning, particularly in radiology, mammography, and surgery. The shift from analog to digital imaging systems has increased the demand for advanced displays that offer superior clarity and color accuracy.

In 2022, Barco, a leading player in the market, reported a 12% increase in sales of medical-grade displays, driven by demand from hospitals and diagnostic centers. Similarly, the US Food and Drug Administration emphasized the importance of high-quality displays in improving diagnostic accuracy, further boosting market growth. This trend is expected to continue into 2024, with healthcare providers increasingly investing in advanced imaging solutions.

Restraints

High Costs and Long Replacement Cycles are Restraining the Market

The high cost of medical-grade displays and their long replacement cycles act as significant restraints. These displays are significantly more expensive than consumer-grade screens due to their specialized features, such as high brightness, calibration accuracy, and compliance with medical standards. In 2023, a survey by the American College of Radiology found that 35% of healthcare facilities delayed upgrading their displays due to budget constraints.

Companies like EIZO and Sony have acknowledged these challenges, focusing on developing cost-effective models to address affordability concerns. Despite these efforts, the high initial investment and infrequent replacement cycles limit the market’s growth potential, particularly in smaller healthcare facilities.

Opportunities

Expansion in Telemedicine is Creating Growth Opportunities

The rapid expansion of telemedicine presents significant growth opportunities for the medical display market. High-quality displays are critical for remote consultations, enabling healthcare providers to share and analyze medical images with precision. In 2023, the World Health Organization reported a 40% increase in telemedicine adoption globally, driven by the need for remote healthcare services.

Companies like LG and NEC have introduced displays specifically designed for telemedicine applications, catering to this growing demand. This trend is particularly prominent in rural and underserved areas, where telemedicine bridges the gap in healthcare access. As telemedicine continues to evolve, the demand for specialized displays is expected to rise significantly.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors strongly impact the medical display market. Economic growth in emerging markets like India and China has led to higher healthcare spending. This has increased demand for advanced imaging solutions. However, rising inflation and supply chain disruptions have raised production costs. Geopolitical tensions have further delayed deliveries. For example, the Russia-Ukraine conflict disrupted semiconductor supplies in 2022, affecting global manufacturers. Despite these challenges, the market remains adaptable, with companies adopting new strategies to mitigate risks and sustain growth.

On the positive side, government initiatives in North America and Europe are creating new opportunities. Increased funding for healthcare infrastructure supports market expansion. Technological advancements in medical imaging are also driving innovation. Strategic collaborations between manufacturers and healthcare providers enhance product development. These factors ensure steady market growth despite economic uncertainties. While challenges persist, ongoing investments and innovations continue to shape the future of the medical display industry.

Trends

Integration of AI and Advanced Analytics is a Recent Trend

The integration of artificial intelligence (AI) with medical displays is transforming the healthcare industry. AI-powered displays enhance diagnostic accuracy by providing real-time insights and automated image analysis. In 2023, Barco introduced an AI-enabled display that reduced diagnostic errors by 15%, based on clinical trials. This advancement reflects the increasing demand for intelligent imaging solutions. Similarly, Siemens Healthineers reported a 20% rise in sales of AI-integrated displays. This growth indicates a strong preference for smart medical imaging, improving efficiency and patient care.

Manufacturers are focusing on developing displays that integrate seamlessly with AI platforms. This trend aligns with the broader adoption of AI in healthcare. Medical providers seek advanced tools to improve workflows and clinical outcomes. AI-driven displays offer enhanced visualization, helping radiologists detect abnormalities more accurately. As a result, the market is shifting toward intelligent medical imaging solutions. Companies investing in AI-enabled displays are gaining a competitive edge, shaping the future of diagnostic imaging.

Regional Analysis

North America is leading the Medical Display Market

North America led the medical display market with a 38.9% revenue share, driven by advancements in diagnostic imaging and the adoption of digital healthcare solutions. The growing demand for high-resolution visualization tools has further fueled market expansion. In 2023, the US Food and Drug Administration (FDA) approved 15% more advanced imaging systems, many of which depend on high-performance displays for accurate diagnostics. This trend highlights the increasing reliance on cutting-edge display technology to enhance imaging accuracy and support medical professionals in delivering precise diagnoses.

Financial incentives have played a crucial role in market growth. The Centers for Medicare & Medicaid Services (CMS) reported a 12% rise in reimbursements for radiology and imaging services in 2022. This encouraged healthcare providers to upgrade their display technologies. Additionally, the Canadian Institute for Health Information (CIHI) noted a 10% increase in electronic health record (EHR) adoption in 2023. The need for high-quality displays to visualize medical data has surged, further driving the demand for advanced medical displays.

Government investments have also contributed to market expansion. In 2023, the US Department of Veterans Affairs (VA) allocated US$200 million to modernize medical imaging infrastructure. This included procuring advanced displays for healthcare facilities. Additionally, the rising emphasis on telemedicine and the demand for precise diagnostic tools have strengthened market growth. As healthcare providers continue to adopt digital solutions, the need for high-resolution medical displays is expected to rise, ensuring improved diagnostic accuracy and better patient outcomes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow at the fastest CAGR due to increasing healthcare digitization and rising demand for diagnostic imaging. Government initiatives are further boosting market expansion. The Indian Ministry of Health and Family Welfare (MoHFW) increased funding for digital health by 20% in 2023. This investment focuses on equipping hospitals with advanced visualization tools. Similarly, the Chinese National Health Commission (NHC) reported a 25% rise in digital imaging adoption in 2022. Urban healthcare facilities are leading this transformation, improving diagnostic accuracy and efficiency.

Japan and Australia are also making significant investments in medical display technology. Japan’s Ministry of Health, Labour, and Welfare (MHLW) allocated US$150 million in 2023 to upgrade medical imaging equipment. This aims to support the growing aging population. The Australian Government’s Department of Health invested US$100 million in 2022 to enhance telehealth capabilities. These advancements, combined with increasing demand for accurate diagnostics, are expected to drive strong growth in the Asia Pacific medical display market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medical display market focus on technological innovation, product diversification, and expanding their global presence to fuel growth. They invest in developing high-resolution, color-accurate, and reliable displays that enhance the accuracy of medical imaging in critical healthcare environments. Companies also collaborate with hospitals and healthcare institutions to provide tailored display solutions that integrate seamlessly into medical workflows.

Additionally, they target emerging markets with rising healthcare demand by offering cost-effective and high-quality display systems. Partnerships with technology providers help drive advancements in digital health and support the adoption of next-generation display solutions. Barco, headquartered in Kortrijk, Belgium, is a global leader in professional display solutions, including medical imaging displays.

The company offers a wide range of high-performance displays designed for use in radiology, surgery, and patient monitoring. Barco focuses on innovation, with its displays offering superior image quality, precise color calibration, and high durability for medical environments. With a strong global presence, Barco continues to expand its offerings through strategic partnerships and continuous development of cutting-edge technologies in the medical display sector.

Recent Developments

- In April 2023: LG Electronics introduced the 32HQ713D-B, an 8MP diagnostic medical monitor designed to provide superior image quality. The monitor combines an impressive 1000 nits of brightness with LG’s advanced IPS Black panel, enhancing contrast and delivering deep blacks for more precise diagnostics. Its integrated sensor and software simplify color calibration, ensuring accurate and consistent imaging. This innovation enhances the medical display market by offering healthcare professionals a high-performance solution for critical decision-making, particularly in environments requiring reliable visual clarity.

- In February 2023, Eizo introduced a 21.3-inch, 2-megapixel color monitor designed specifically for displaying patient charts and reviewing diagnostic images. Intended for use in clinical and hospital settings, this monitor offers high clarity and sharp resolution, ensuring enhanced visibility for medical professionals. Its launch aligns with the increasing demand for precise and efficient visual aids in healthcare environments, contributing to the growth of the medical display market by improving both patient care and operational efficiency.

Top Key Players in the Medical Display Market

- UTI Technology

- Stryker

- Steris

- Quest International

- LG Electronics

- Eizo Corporation

- Canvys

- Barco

Report Scope

Report Features Description Market Value (2024) US$ 2.5 billion Forecast Revenue (2034) US$ 4.2 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Panel Size (Under 22.9 Inch, 23.9-26.9 Inch, 27-41.9 Inch, and Above 42 Inch), By Technology (LED-Backlit LCD, CCFL-Backlit LCD, and OLED), By Application (Diagnostic Applications (Multi-Modality Applications, Mammography, General Radiology, and Digital Pathology), Surgical/Interventional Applications, Dentistry, and Other), By Resolution (Up to 2 MP Resolution Displays, 2.1-4 MP Resolution Displays, 4.1-8 MP Resolution Displays, and Above 8 MP Resolution Displays (4K Resolutions and 8K Resolutions)), By Display Color (Color Displays and Monochrome Displays) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape UTI Technology, Stryker, Steris, Quest International, LG Electronics, Eizo Corporation, Canvys, and Barco. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- UTI Technology

- Stryker

- Steris

- Quest International

- LG Electronics

- Eizo Corporation

- Canvys

- Barco