Global Lithium Ion Battery Pack Market Size, Share, And Industry Analysis Report By Cell Type (Cylindrical, Prismatic, Pouches), By Battery Capacity (Greater than 20 kWh, 30 to 60 kWh, 60 to 80 kWh, More than 80 kWh), By End-Use (Automotive, Consumer Electronics, Medical Devices, Industrial and Grid Energy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169569

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

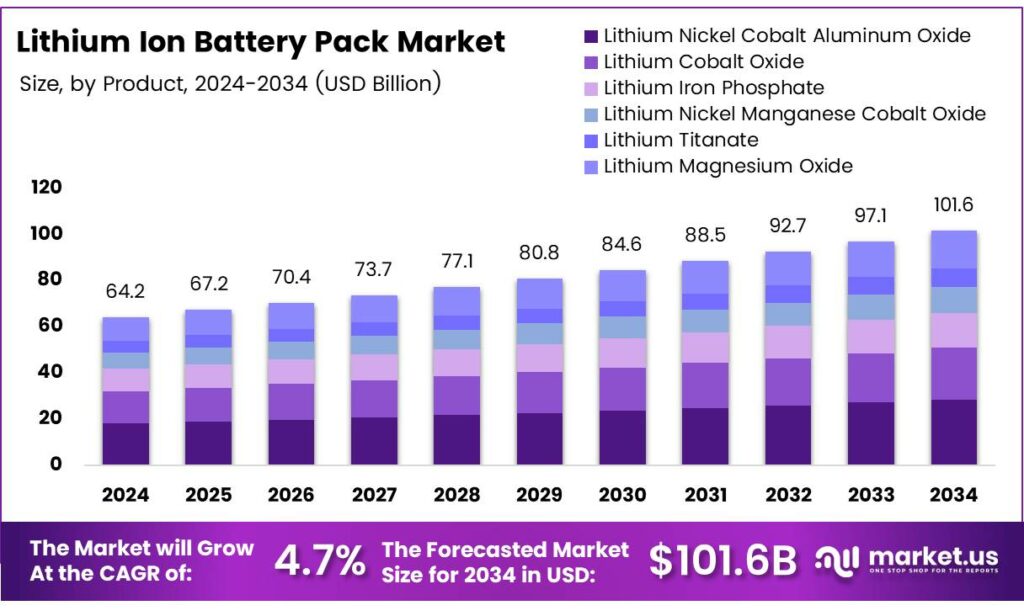

The Global Lithium Ion Battery Pack Market size is expected to be worth around USD 101.6 billion by 2034, from USD 64.2 billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The lithium-ion battery pack market represents the organized production, integration, and sale of battery modules combining multiple lithium-ion cells with electronics for protection, monitoring, and thermal control. These packs power electric vehicles, energy storage systems, and electronics, supporting electrification, mobility transition, and grid-scale energy resilience across regions.

Lithium-ion battery packs are evolving beyond simple energy storage solutions into strategic infrastructure assets. Consequently, demand rises across electric mobility, renewable integration, and backup power. Governments accelerate adoption through incentives, while declining manufacturing costs improve affordability and commercial viability for large-scale deployments worldwide.

- LFP battery packs are popular for their superior safety and longevity, typically lasting 2,000+ cycles (U.S. DOE) even at 80–100% depth of discharge without significant degradation. LMO batteries prioritize low cost and high power but offer only 300–700 cycles (Battery University), making them suitable only for applications where frequent replacement is acceptable.

From a design standpoint, cylindrical lithium-ion battery packs remain widely adopted due to mechanical stability and standardized manufacturing. The 18650 cylindrical cell measures 18 mm in diameter and 65 mm in length. Meanwhile, alternative formats like 2170 and 26650 cells support higher energy densities.

Key Takeaways

- The Global Lithium Ion Battery Pack Market is on a steady growth path, expanding from USD 64.2 billion in 2024 to an expected USD 101.6 billion by 2034, driven by electrification across mobility and energy systems.

- Product innovation remains critical, with Lithium Nickel Cobalt Aluminum Oxide leading the market at a 36.8% share due to its high energy density and balanced performance for long-range electric vehicles.

- Cylindrical cell formats dominate cell-type adoption, accounting for 51.9% of the market in 2024, supported by standardized production, strong mechanical stability, and efficient thermal management.

- Battery packs with capacities greater than 20 kWh hold a 38.5% share, reflecting growing demand for mid-range EVs and flexible stationary energy storage applications.

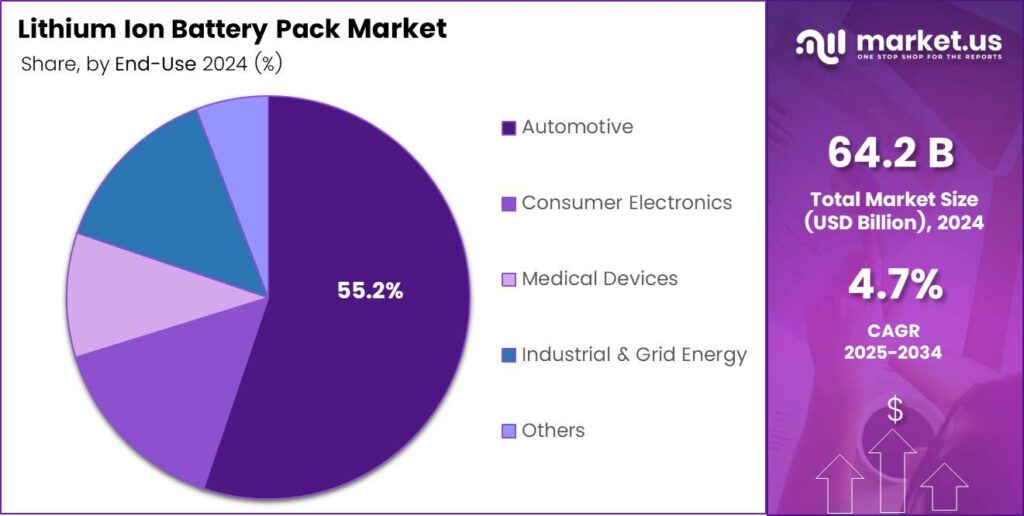

- The automotive sector represents the largest end-use segment with a 55.2% share, fueled by accelerating electric vehicle production, government incentives, and tightening emission regulations.

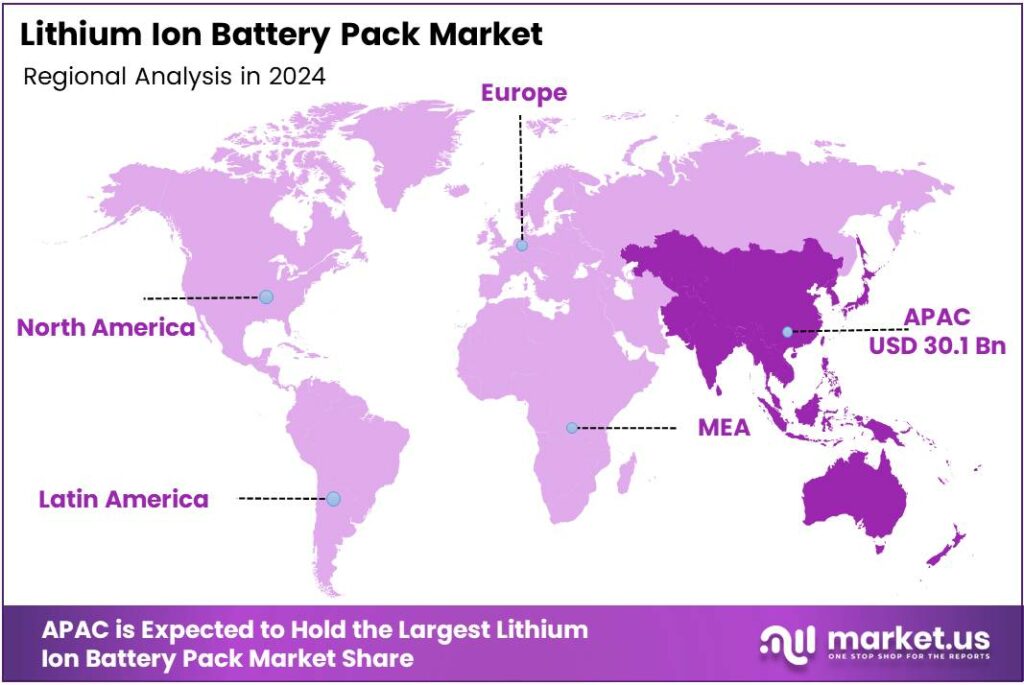

- Asia Pacific leads the global market with a 46.9% share, valued at USD 30.1 billion, supported by large-scale manufacturing capacity, strong EV adoption, and supportive energy transition policies.

By Product Type Analysis

Lithium Nickel Cobalt Aluminum Oxide dominates with 36.8% due to its strong energy density and performance balance.

In 2024, Lithium Nickel Cobalt Aluminum Oxide held a dominant market position in the By Product Type Analysis segment of the Lithium Ion Battery Pack Market, with a 36.8% share. Moreover, this chemistry supports high-energy applications, especially where long driving range and compact design matter, helping manufacturers maintain performance efficiency and product reliability.

Furthermore, Lithium Cobalt Oxide batteries are widely used in compact electronics. However, their thermal sensitivity limits large-scale deployment. Still, manufacturers prefer this chemistry for lightweight designs where space efficiency and steady discharge performance remain essential.

Meanwhile, Lithium Iron Phosphate batteries are gaining attention for safety and durability. Though energy density is lower, they deliver thermal stability and longer operational life, making them suitable for applications prioritizing reliability over compact size.

By Cell Type Analysis

Cylindrical dominates with 51.9% due to standardized manufacturing and efficient thermal control.

In 2024, Cylindrical held a dominant market position in the By Cell Type Analysis segment of the Lithium Ion Battery Pack Market, with a 51.9% share. Notably, these cells benefit from mature production lines, consistent performance, and effective heat dissipation, supporting large-scale battery pack assembly.

In contrast, Prismatic cells emphasize space optimization. Their flat structure enables efficient packing in electric vehicles, although manufacturing complexity and heat management challenges slightly limit wider adoption compared to cylindrical designs.

Meanwhile, Pouch cells offer lightweight flexibility. They allow custom shapes and improved energy density at the pack level. However, mechanical protection requirements increase system-level design considerations, influencing adoption across different end uses.

By Battery Capacity Analysis

Greater than 20 kWh dominates with 38.5% driven by growing demand for mid-range energy storage.

In 2024, Greater than 20 kWh held a dominant market position in the By Battery Capacity Analysis segment of the Lithium Ion Battery Pack Market, with a 38.5% share. This capacity range supports balanced performance, cost efficiency, and practical deployment across electric mobility and stationary storage systems.

Subsequently, 30 to 60 kWh battery packs enable extended usage without excessive weight. These capacities suit passenger electric vehicles where daily driving range and cost control remain critical decision factors. Moreover, 60 to 80 kWh packs address higher performance needs.

They support longer travel distances and higher power output, appealing to premium electric vehicles and advanced energy storage applications. More than 80 kWh batteries focus on heavy-duty applications. These packs support commercial vehicles and grid-scale energy systems that require sustained power delivery and long operation cycles.

By End-Use Analysis

Automotive dominates with a 55.2% share, driven by accelerating electric mobility adoption.

In 2024, Automotive held a dominant market position in the By End-Use Analysis segment of the Lithium Ion Battery Pack Market, with a 55.2% share. Rapid electric vehicle production and government-backed electrification programs continue driving large-scale battery pack demand across global markets.

Meanwhile, Consumer Electronics rely on compact lithium-ion packs for smartphones, laptops, and wearables. Demand remains steady as manufacturers focus on lightweight designs and longer battery life for daily-use devices. Furthermore, Medical Devices use lithium-ion battery packs for portable and reliable power.

Safety, consistency, and uninterrupted operation support growing adoption in diagnostic and monitoring equipment. In addition, Industrial and Grid Energy applications benefit from lithium-ion technology for energy storage and backup systems. The Others segment includes niche appliances and specialty equipment that require flexible, rechargeable power solutions.

Key Market Segments

By Cell Type

- Cylindrical

- Prismatic

- Pouches

By Battery Capacity

- Greater than 20 kWh

- 30 to 60 kWh

- 60 to 80 kWh

- More than 80 kWh

By End-Use

- Automotive

- BEVS

- PHEVS

- HEVS

- Consumer Electronics

- Laptops

- Digital Cameras

- AIDC

- Others

- Medical Devices

- Industrial and Grid Energy

- Others

Emerging Trends

Advancements in Battery Chemistry Shape Market Trends

A key trending factor in the lithium-ion battery pack market is the shift toward safer and longer-lasting chemistries. Lithium iron phosphate batteries are gaining attention due to improved safety and extended cycle life. Solid-state battery research is another major trend.

- These batteries promise higher energy density and lower fire risks, encouraging long-term investment by automakers and energy companies. International Energy Agency (IEA), annual battery demand crossed 1 TWh in 2024, a historic first. The IEA estimates that demand for EV batteries alone reached over 950 GWh in 2024, a 25% increase.

Fast-charging technology is also shaping the market. Improved charging protocols and better thermal control reduce charging time, making battery packs more user-friendly for EV and energy storage users. Sustainability trends influence design choices. Manufacturers focus on reducing cobalt content, improving recyclability, and lowering carbon footprints.

Drivers

Rising Electric Vehicle Adoption Drives Lithium-Ion Battery Pack Demand

The main driver of the lithium-ion battery pack market is the fast growth of electric vehicles worldwide. Governments are pushing EV adoption to reduce oil imports and cut carbon emissions. As a result, automakers are increasing battery capacity, energy density, and safety standards, which directly boosts battery pack demand.

- The energy sector (which includes EV-related storage and grid storage) used over 90% of the global annual lithium-ion battery output — a dramatic jump. The domestic lithium-ion battery demand in India is expected to reach 115 GWh by 2030, driven largely by EV growth, consumer electronics, and stationary storage demand.

Lithium-ion battery packs are preferred because they offer high efficiency, fast charging, and a compact size compared to traditional batteries. Consumer electronics also support market growth. Smartphones, laptops, power tools, and wearables continue to need lightweight and long-lasting batteries.

Restraints

Raw Material Price Volatility Restrains Market Growth

One major restraint in the lithium-ion battery pack market is the unstable supply of raw materials such as lithium, cobalt, and nickel. Price fluctuations increase production costs and affect profit margins for battery manufacturers, especially during supply shortages.

- Recycling — a potential way to relieve raw-material pressure — is still not mature enough. For instance, in India alone, it’s estimated that around 70,000 metric tons of lithium-ion batteries are discarded annually. Recycling could meet up to 14% of India’s battery-material demand by 2030.

Battery recycling challenges further restrain the market. Collection systems are still developing, and recycling lithium-ion battery packs remains expensive and complex. Limited recycling infrastructure creates environmental concerns and regulatory pressure.

Growth Factors

Grid-Scale Energy Storage Creates Strong Growth Opportunities

Rapid investment in grid-scale energy storage offers major growth opportunities for lithium-ion battery pack manufacturers. Utilities are deploying large battery systems to balance peak demand, prevent outages, and support renewable integration. Electric mobility beyond cars also opens new doors.

- Electric buses, delivery fleets, marine transport, and two-wheelers require customized battery packs. This creates demand for modular, high-capacity, and fast-charging battery solutions. battery storage capacity — using Li-ion and other technologies — is rising fast. Global battery storage capacity grew by around 120%, reaching roughly 55.7 GW.

Second-life battery usage presents another opportunity. Used EV battery packs can be repurposed for stationary energy storage, reducing costs and improving sustainability. This approach helps extend battery value beyond vehicle life. Emerging markets also offer long-term potential.

Regional Analysis

Asia Pacific Dominates the Lithium-Ion Battery Pack Market with a Market Share of 46.9%, Valued at USD 30.1 Billion

Asia Pacific leads the Lithium Ion Battery Pack Market due to strong battery manufacturing ecosystems and large-scale adoption of electric mobility and energy storage. In 2024, the region accounted for 46.9% of the global share, reaching a value of USD 30.1 billion. Rapid urbanization, expanding EV production, and government-backed energy transition programs continue to strengthen regional demand.

North America shows steady growth driven by rising electric vehicle penetration and grid-scale battery storage projects. Strong policy support for clean energy, domestic battery manufacturing incentives, and recycling initiatives improves regional market resilience. The region also benefits from growing demand across industrial, residential, and utility-scale energy storage applications. Continued infrastructure spending supports long-term market expansion.

Europe’s market growth is supported by strict emission regulations and aggressive electrification targets. The region focuses heavily on sustainable battery supply chains and localized manufacturing capacity. Increasing renewable integration and electric public transportation adoption further drive demand. European policies emphasizing battery safety and lifecycle management enhance regional market maturity.

The U.S. market is characterized by strong demand from electric vehicles, energy storage systems, and industrial applications. Federal incentives and clean energy policies support domestic manufacturing and technology advancement. Increasing investments in grid modernization and battery recycling improve market sustainability.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CATL remained a cornerstone of the global lithium-ion battery pack market in 2024 due to its scale, manufacturing depth, and ability to consistently supply high-volume battery packs for electric mobility and stationary energy storage. The company’s strength lies in cost optimization, vertical integration, and rapid commercialization of advanced chemistries, helping stabilize supply chains during fluctuating raw material prices.

LG Energy Solution continued to strengthen its market position in 2024 by focusing on high-performance battery packs for premium electric vehicles and long-duration energy storage applications. Its emphasis on safety, energy density improvement, and long lifecycle performance supported demand from automotive OEMs seeking reliability and regulatory compliance across global markets.

Panasonic maintained a strong presence in the lithium-ion battery pack market by leveraging its expertise in cylindrical cell technology and strict quality control standards. In 2024, the company focused on improving pack efficiency and thermal stability, which supported adoption in electric vehicles, power tools, and industrial energy systems requiring consistent output and durability.

Samsung SDI played a strategic role in the global market by addressing demand for compact, high-energy-density battery packs used in electric vehicles and advanced electronics. Its focus on precision engineering, enhanced safety architectures, and next-generation materials helped meet rising expectations for performance and lifespan, especially in premium automotive and technology-driven end-use segments.

Top Key Players in the Market

- CATL

- LG Energy Solution

- Panasonic

- Samsung SDI

- BYD

- A123 Systems

- SK Innovation

- Toshiba

- Hitachi Chemical

Recent Developments

- In 2025, CATL unveiled three new EV battery products at its Super Tech Day, including the Freevoy Dual-Power Battery for extended range, Naxtra—the world’s first mass-producible sodium-ion battery breaking resource constraints with high performance—and the second-generation Shenxing Superfast Charging Battery.

- In 2025, LG outlined its battery technology roadmap, featuring Premium batteries with high-nickel cathodes and silicon anodes for superior energy density, and Standard batteries with mid-nickel compositions and elevated voltage for cost-effective performance.

Report Scope

Report Features Description Market Value (2024) USD 64.2 billion Forecast Revenue (2034) USD 101.6 billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Cell Type (Cylindrical, Prismatic, Pouches), By Battery Capacity (Greater than 20 kWh, 30 to 60 kWh, 60 to 80 kWh, More than 80 kWh), By End-Use (Automotive, Consumer Electronics, Medical Devices, Industrial and Grid Energy, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape CATL, LG Energy Solution, Panasonic, Samsung SDI, BYD, A123 Systems, SK Innovation, Toshiba, Hitachi Chemical Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Lithium Ion Battery Pack MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Lithium Ion Battery Pack MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CATL

- LG Energy Solution

- Panasonic

- Samsung SDI

- BYD

- A123 Systems

- SK Innovation

- Toshiba

- Hitachi Chemical