Global Isobutyraldehyde Market Size, Share, And Business Benefits By Form (Liquid, Solid), By Purity (97%, 98%, 99%), By Synthesis Method (Hydroformylation of Propene, Oxidation of Isobutene), By Application (Methacrylate Esters, Pharmaceutical Intermediates, Flavors and Fragrances, Manufacturing, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149851

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

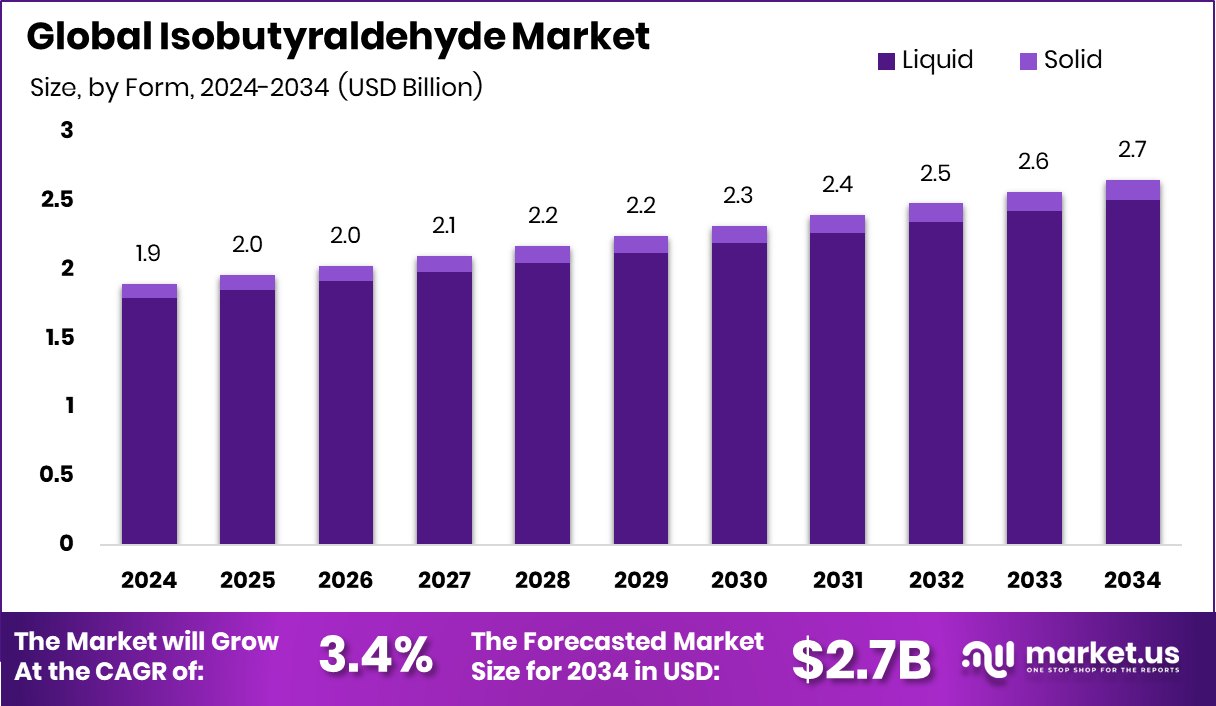

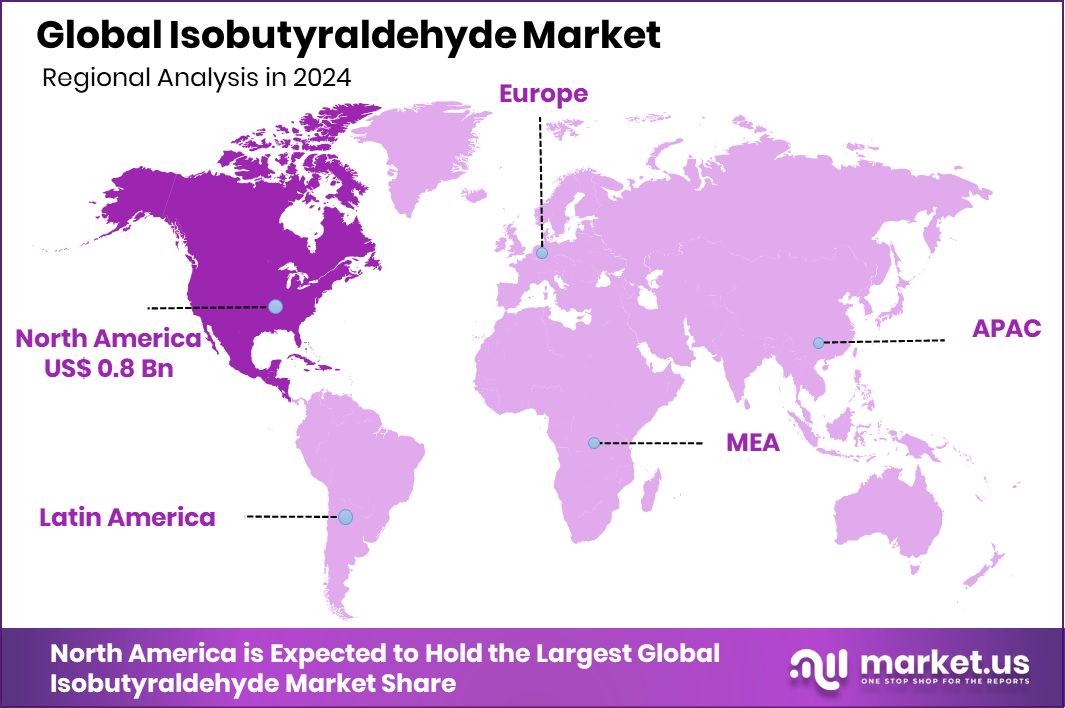

Global Isobutyraldehyde Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.9 billion in 2024, and grow at a CAGR of 3.4% from 2025 to 2034. High chemical consumption and manufacturing activity boosted North America’s USD 0.8 Bn isobutyraldehyde market dominance.

Isobutyraldehyde is a colorless, flammable liquid aldehyde with a sharp odor, chemically represented as (CH₃)₂CHCHO. It is primarily used as an intermediate in the production of various chemicals, including isobutanol, neopentyl glycol, and pharmaceuticals. Industrially, it is produced through the hydroformylation of propylene and is valued for its versatility in organic synthesis.

The Isobutyraldehyde Market refers to the global demand, production, and trade of isobutyraldehyde across various industries. It is driven by its application in agriculture, paints and coatings, plasticizers, and flavors. The market tracks usage trends, regulatory impacts, supply-demand dynamics, and downstream product development. Growth in the chemical processing and agrochemical sectors directly influences market expansion, while evolving environmental regulations and sustainability goals shape production techniques and investments.

Growth is mainly fueled by industrial chemical synthesis, where isobutyraldehyde serves as a precursor for value-added chemicals. With rising demand for coatings, agrochemicals, and resins, the need for this intermediate remains steady. As economies industrialize, especially in Asia, the demand is increasing for intermediate chemicals that support manufacturing chains.

Demand for isobutyraldehyde is also linked to the agricultural sector, where it helps produce crop protection ingredients. With global food demand rising, agrochemical inputs are in higher demand, indirectly boosting the consumption of isobutyraldehyde-based compounds. Additionally, it supports the production of plastic additives and fragrance chemicals in fast-moving consumer goods.

Key Takeaways

- Global Isobutyraldehyde Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.9 billion in 2024, and grow at a CAGR of 3.4% from 2025 to 2034.

- In 2024, Liquid held a 94.5% share in the Isobutyraldehyde Market by Form segment.

- 99% purity accounted for 48.6% of the total Isobutyraldehyde Market by Purity category.

- Hydroformylation of Propene dominated the synthesis methods with a 79.1% share in Isobutyraldehyde production.

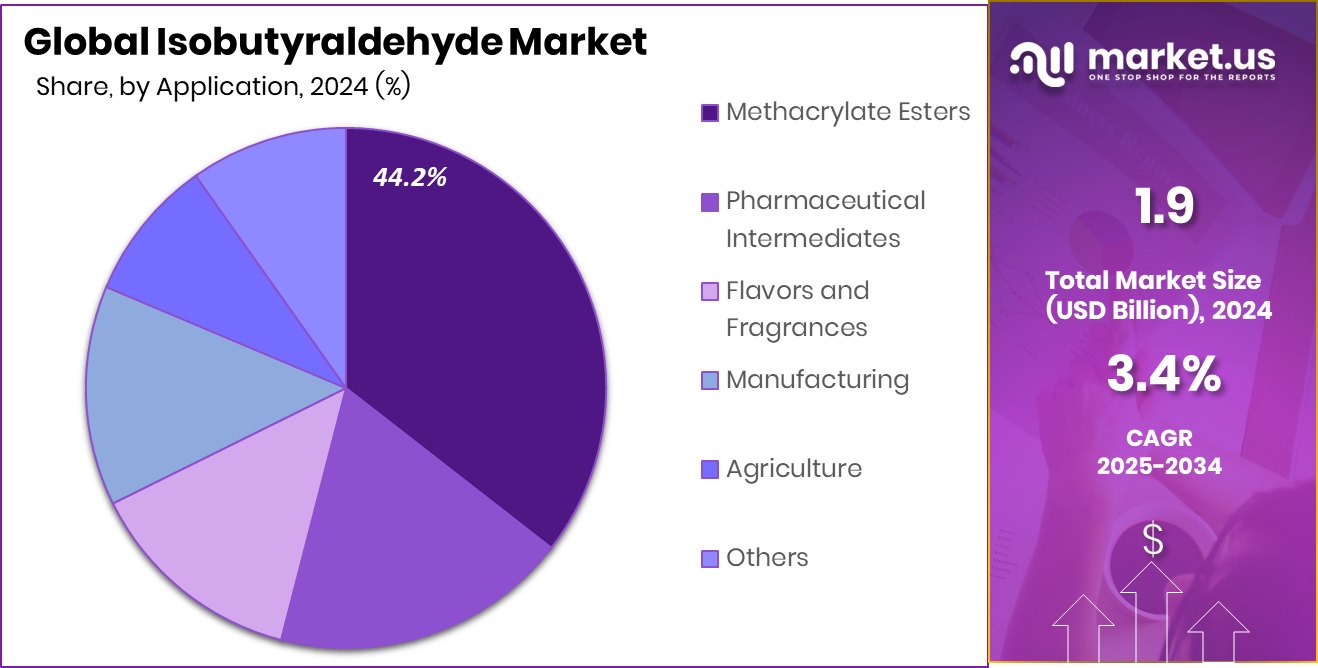

- Methacrylate Esters led the Application segment, contributing 44.2% to the Isobutyraldehyde Market in 2024.

- The North American market was valued at USD 0.8 billion, showing strong industrial demand.

By Form Analysis

In 2024, liquid form dominated the Isobutyraldehyde market with a 94.5% share.

In 2024, Liquid held a dominant market position in the By Form segment of the Isobutyraldehyde Market, with a 94.5% share. This significant dominance is attributed to the liquid form’s widespread suitability in large-scale industrial processing and chemical synthesis applications. The liquid state of isobutyraldehyde allows for easy handling, storage, and direct integration into continuous manufacturing systems, which is highly valued in sectors such as agrochemicals, coatings, and intermediates for plasticizers.

The high share of 94.5% also reflects the compound’s commercial availability, as isobutyraldehyde is primarily produced and distributed in liquid form due to its stability and ease of transportation. Liquid isobutyraldehyde offers higher reactivity and better compatibility with common production methods like hydroformylation, which further cements its dominance in chemical plants and formulation units.

This overwhelming preference for the liquid form also minimizes the need for further conversion steps, reducing operational costs for end users. Its efficient miscibility and consistent behavior in reaction conditions make it the standard form across multiple downstream applications.

By Purity Analysis

Purity level of 99% held the highest market share at 48.6%.

In 2024, 99% held a dominant market position in the By Purity segment of the Isobutyraldehyde Market, with a 48.6% share. This level of purity is widely preferred across industrial applications due to its balance between cost-efficiency and performance reliability. Industries that rely on isobutyraldehyde as a key intermediate, such as those producing plasticizers, solvents, or agricultural chemicals, often require a high level of purity to ensure process consistency and product quality, and 99% meets these technical standards without incurring the cost of ultra-high purities.

The 48.6% share indicates that nearly half the market consumption is tied to processes that do not require ultra-pure or lower-grade variants. The 99% purity form offers excellent chemical reactivity and minimizes the presence of impurities that could affect downstream reactions, making it a dependable input for controlled chemical environments. It also supports batch consistency for large-scale production environments.

Moreover, storage and transport conditions are optimized around this standard grade, ensuring smooth logistics and operational efficiency. As industries continue to scale and prioritize both cost control and reliable input quality, the 99% purity level remains the dominant choice in the purity segment of the isobutyraldehyde market.

By Synthesis Method Analysis

The hydroformylation of propene method led the synthesis segment with a 79.1% contribution.

In 2024, Hydroformylation of Propene held a dominant market position in the By Synthesis Method segment of the Isobutyraldehyde Market, with a 79.1% share. This method remains the most widely adopted process for producing isobutyraldehyde due to its efficiency, scalability, and well-established industrial infrastructure. Hydroformylation, which involves the reaction of propene with synthesis gas (a mixture of carbon monoxide and hydrogen), offers high selectivity and yield, making it the preferred route for bulk manufacturing.

The 79.1% market share highlights the strong reliance on this method across industries that require isobutyraldehyde as a key intermediate. Its cost-effectiveness and compatibility with continuous flow systems further contribute to its widespread adoption. Additionally, the process allows for easy integration into petrochemical complexes where propene is already a key feedstock, ensuring supply chain efficiency.

Hydroformylation’s dominance also comes from its mature technology base and the availability of catalysts that enhance reaction control and output consistency. As industries continue to focus on process optimization and high-throughput chemical production, the hydroformylation of propene remains the most commercially viable and technically reliable method for producing isobutyraldehyde, solidifying its leading role in the synthesis method segment.

By Application Analysis

Methacrylate esters application accounted for a 44.2% share of the global market demand.

In 2024, Methacrylate Esters held a dominant market position in the by-application segment of the Isobutyraldehyde Market, with a 44.2% share. This dominance is largely driven by the extensive use of isobutyraldehyde as a precursor in the synthesis of methacrylate esters, which are crucial components in the production of paints, coatings, adhesives, and plastics. The strong demand from these downstream sectors has directly translated into increased consumption of isobutyraldehyde for this specific application.

The 44.2% share reflects the growing importance of methacrylate esters in industrial and consumer applications where durability, weather resistance, and flexibility are essential. These esters are widely used in both architectural and automotive coatings, where performance and chemical stability are non-negotiable. Isobutyraldehyde plays a critical role in achieving the required molecular structure during the esterification process.

Furthermore, the growing construction activities and increased spending on infrastructure globally have driven demand for coating solutions, reinforcing the upstream requirement for methacrylate esters. As manufacturers seek reliable intermediates for producing high-performance materials, isobutyraldehyde continues to secure its relevance in this segment.

Key Market Segments

By Form

- Liquid

- Solid

By Purity

- 97%

- 98%

- 99%

By Synthesis Method

- Hydroformylation of Propene

- Oxidation of Isobutene

By Application

- Methacrylate Esters

- Pharmaceutical Intermediates

- Flavors and Fragrances

- Manufacturing

- Agriculture

- Others

Driving Factors

Rising Demand for Chemical Intermediates in Manufacturing

One of the top driving factors for the isobutyraldehyde market is the increasing use of chemical intermediates in the production of various end-use products. Isobutyraldehyde is an important building block in the making of plasticizers, coatings, resins, and agrochemicals. As industries such as construction, automotive, and agriculture grow, the need for these materials also rises.

This has led to more demand for isobutyraldehyde as a starting chemical. Manufacturers prefer it because it reacts well and fits easily into large-scale production processes. Especially in growing economies across Asia, more factories and plants are using isobutyraldehyde-based products, making this demand a strong reason behind the market’s steady growth worldwide.

Restraining Factors

Health and Safety Concerns During Chemical Handling

A major restraining factor for the isobutyraldehyde market is the health and safety risks linked to its handling and storage. Isobutyraldehyde is a flammable and volatile chemical with a strong odor that can irritate the eyes, skin, and respiratory system. Workers in chemical plants must follow strict safety rules, and companies must invest in protective equipment and ventilation systems.

These extra safety measures increase the overall operating costs. Also, any accidental leak or improper handling can lead to workplace accidents or environmental issues. This makes many small manufacturers cautious about its use, which can slow down adoption and limit market expansion despite its usefulness in industrial processes.

Growth Opportunity

Green Chemistry Innovation for Sustainable Production Growth

A key growth opportunity for the isobutyraldehyde market lies in the development of greener, more sustainable production methods. As industries move toward environmentally friendly practices, there is a rising interest in producing isobutyraldehyde using bio-based raw materials or low-emission technologies.

Traditional methods rely on petrochemical feedstocks, but cleaner alternatives are gaining attention for reducing carbon footprints. Companies investing in green chemistry solutions can attract eco-conscious clients and meet stricter environmental rules. This shift also opens new business opportunities in regions promoting sustainable manufacturing.

With growing support from governments and industry groups, the cleaner production of isobutyraldehyde could become a strong driver of future growth, helping companies stay competitive while supporting global sustainability goals.

Latest Trends

Shift Towards Sustainable and Bio-Based Production

A significant trend in the isobutyraldehyde market is the growing emphasis on sustainable and bio-based production methods. Industries are increasingly focusing on reducing their environmental impact, leading to the adoption of greener manufacturing processes. This shift is driven by regulatory pressures and consumer demand for eco-friendly products.

Companies are exploring renewable feedstocks and innovative technologies to produce isobutyraldehyde more sustainably. For instance, advancements in bio-based chemical production are enabling the use of alternative raw materials, such as biomass, to synthesize isobutyraldehyde, thereby reducing reliance on fossil fuels.

This trend not only aligns with global sustainability goals but also opens new avenues for market growth, as environmentally conscious practices become a competitive advantage in the chemical industry.

Regional Analysis

In 2024, North America led the isobutyraldehyde market with a 45.7% share.

In 2024, North America held the dominant position in the global Isobutyraldehyde market, accounting for 45.7% of the total share, with a market value of USD 0.8 billion. The region’s leadership is largely supported by its mature chemical manufacturing infrastructure, high demand from industrial end-users, and consistent consumption of chemical intermediates in the production of coatings, resins, and agrochemicals.

The U.S. continues to be the key contributor within North America due to its advanced industrial base and steady downstream demand. Meanwhile, Europe represents a stable market driven by regulatory focus on chemical quality and process optimization. Asia Pacific is experiencing gradual growth, fueled by increasing chemical output in emerging economies; however, specific data is not provided here.

Latin America and the Middle East & Africa hold smaller shares in the market, with slower adoption rates due to limited industrial capacity and dependence on imports. Despite rising interest in expanding chemical capabilities in these developing regions, North America remains firmly in the lead in 2024, both in terms of value and percentage share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Celanese Corporation, a prominent U.S.-based chemical company, faced challenges due to weak global demand in critical end-markets like automotive, paints, coatings, construction, and industrial sectors. Despite these headwinds, the company implemented cost-reduction measures, resulting in an adjusted EBIT of $1.6 billion and operating EBITDA of $2.4 billion, with margins of 16% and 23%, respectively. Celanese’s extensive product portfolio, including isobutyric anhydride used in esters, dyes, and agrochemicals, underscores its role in the isobutyraldehyde market.

Perstorp Holding AB, a Swedish specialty chemicals company, emphasized its commitment to the isobutyraldehyde market through its production of iso-butyraldehyde (IBAL), a key building block for products like neopentyl glycol and iso-butanol. In response to rising raw material costs, Perstorp announced a global price increase for its oxo products, effective. This move reflects the company’s proactive approach to maintaining profitability and market stability.

Mitsubishi Chemical Corporation, a major Japanese chemical company, continued to play a vital role in the isobutyraldehyde market by producing high-purity isobutyraldehyde used as a raw material for isobutanol and neopentyl glycol. The company also focused on sustainability, acquiring ISCC PLUS certification for its products, ensuring the use of recycled and biomass raw materials in its supply chain. Furthermore, Mitsubishi Chemical collaborated with Technip Energies to license an improved OXO-M technology, enhancing production efficiency by minimizing the production of isobutyraldehyde as a by-product.

Top Key Players in the Market

- BASF SE

- Celanese Corporation

- Perstorp Holding AB

- Mitsubishi Chemical Corporation

- LCY Chemical Corp

- Evonik Industries AG

- INEOS AG

- Arkema S.A.

- Sumitomo Chemical Co

Recent Developments

- In May 2025, BASF aimed to acquire the remaining 49% stake in Alsachimie from DOMO Chemicals, targeting full ownership. This move strengthens its role in the polyamide 6.6 chain and may impact broader intermediate markets like isobutyraldehyde.

- In September 2024, Celanese introduced new electric vehicle (EV) battery material options at the 2024 Battery Show North America. These materials offer superior stiffness, reduced warpage, and improved noise, vibration, and harshness performance, all while maintaining tensile strength.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Solid), By Purity (97%, 98%, 99%), By Synthesis Method (Hydroformylation of Propene, Oxidation of Isobutene), By Application (Methacrylate Esters, Pharmaceutical Intermediates, Flavors and Fragrances, Manufacturing, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Celanese Corporation, Perstorp Holding AB, Mitsubishi Chemical Corporation, LCY Chemical Corp, Evonik Industries AG, INEOS AG, Arkema S.A., Sumitomo Chemical Co Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Celanese Corporation

- Perstorp Holding AB

- Mitsubishi Chemical Corporation

- LCY Chemical Corp

- Evonik Industries AG

- INEOS AG

- Arkema S.A.

- Sumitomo Chemical Co