Global Irrigation Controllers Market Size, Share Analysis Report By Type (Weather-based, Sensor-based, Others), By Product (Smart Controllers, Tap Timers, Basic Controllers), By Irrigation Type (Drip/trickle, Sprinkler, Others), By Application (Agriculture, Non-agriculture) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159650

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

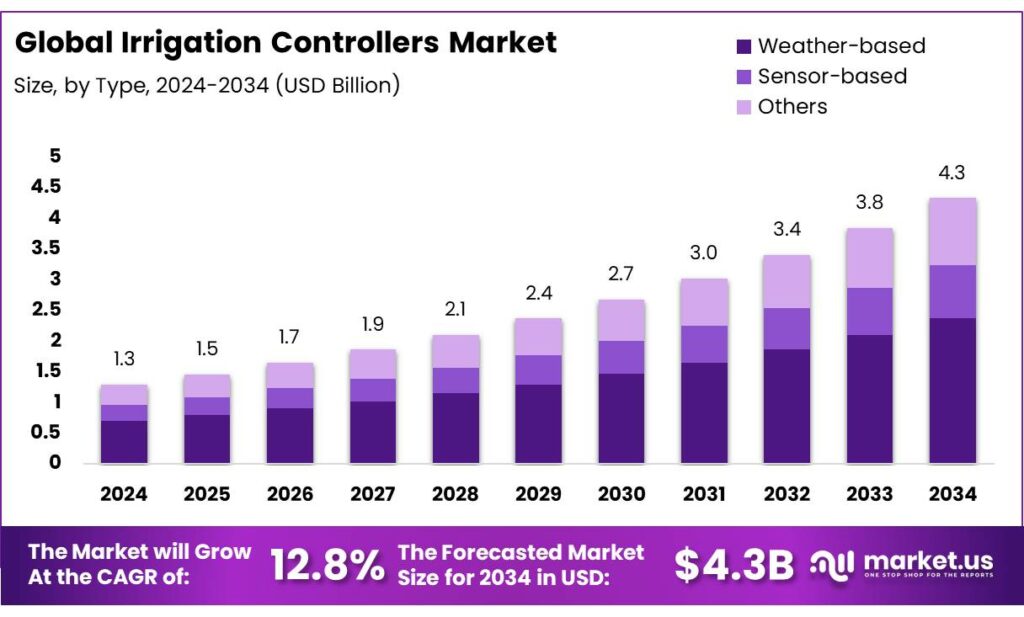

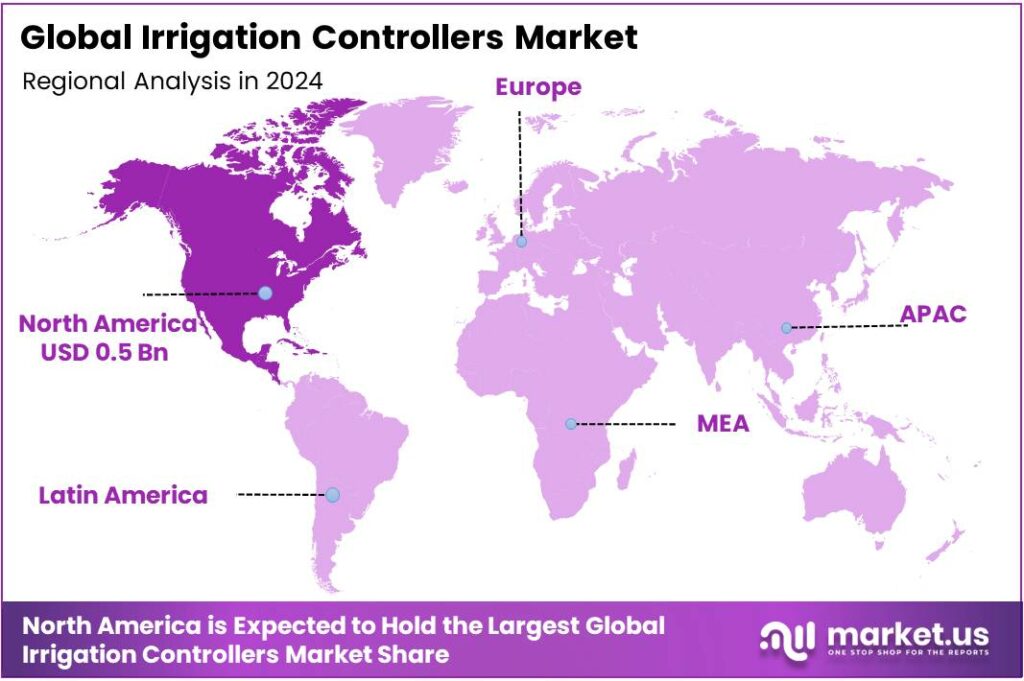

The Global Irrigation Controllers Market size is expected to be worth around USD 4.3 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 12.8% during the forecast period from 2025 to 2034. In 2024 North American held a dominant market position, capturing more than a 42.9% share, holding USD 0.6 Billion in revenue.

The irrigation controllers industry sits at the intersection of water-scarcity pressures and digitalization of field and landscape management. Controllers have evolved from fixed “clock” timers to weather-based and soil-moisture-based systems that ingest local weather, sensor inputs, and evapotranspiration (ET) data to schedule irrigation precisely. This shift is mission-critical because agriculture remains the dominant water user globally—about 70% of freshwater withdrawals—so any gains in scheduling efficiency translate into meaningful resource relief and operating savings across farms, municipalities, and commercial landscapes.

Industrial participation spans valve and solenoid makers, communications module suppliers (cellular/LoRaWAN), sensor OEMs, and software platforms offering remote management, alerts, and analytics. In turf/landscape, U.S. EPA WaterSense-labeled weather-based controllers illustrate the savings potential: replacing a standard controller can save an average home up to 15,000 gallons per year; scaled nationally , potential savings reach ~390 billion gallons and up to $4.5 billion in water costs annually. These figures underpin municipal rebate programs and codes that are accelerating adoption in residential and commercial segments.

Policy and public funding are strong demand catalysts, particularly in drought-prone regions. In the United States, USDA announced up to $400 million (Aug. 1, 2024) for at least 18 irrigation districts to help producers maintain output while conserving water—capital that typically flows into on-farm distribution upgrades, flow measurement, automation, and controller-enabled scheduling. Parallel federal programs like Reclamation’s WaterSMART provide cost-share grants (often 50/50) for water- and energy-efficiency projects; in late 2024, 36 projects received $3.3 million for measures including automation and telemetry that frequently integrate with modern controllers.

The Micro Irrigation Fund (MIF) with NABARD was established with an initial ₹5,000 crore corpus to expand micro-irrigation; sanctioned projects target ~22.22 lakh hectares, with ~21.69 lakh hectares reported covered by states as of 31 March 2025 under PMKSY’s “Per Drop More Crop.” State-wise progress published by the Press Information Bureau further documents multi-year expansion of micro-irrigation area since 2015-16. These programs strengthen the installed base of drip/sprinkler systems, where smart controllers and fertigation timing deliver the highest payback.

Key Takeaways

- Irrigation Controllers Market size is expected to be worth around USD 4.3 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 12.8%

- Weather-based irrigation controllers held a dominant market position, capturing more than a 54.8% share.

- Smart Controllers held a dominant market position, capturing more than a 66.6% share.

- Drip/trickle irrigation held a dominant market position, capturing more than a 59.1% share.

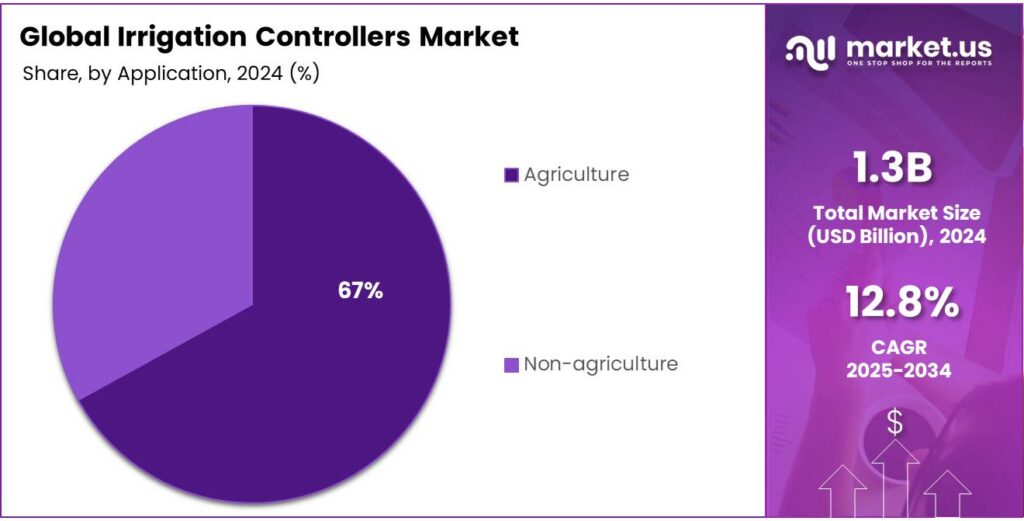

- Agriculture held a dominant market position, capturing more than a 67.3% share of the irrigation controllers market.

- North American greenhouse irrigation systems market holds a significant share of approximately 42.90%, valued at USD 0.6 billion in 2024.

By Type Analysis

Weather-based Controllers Lead the Market with 54.8% Share in 2024

In 2024, Weather-based irrigation controllers held a dominant market position, capturing more than a 54.8% share. This segment has become the preferred choice due to its ability to automatically adjust irrigation schedules based on real-time weather conditions, such as rainfall, temperature, and humidity. By using weather forecasts and local environmental data, these controllers help optimize water usage, making them an essential tool for water conservation in agriculture and landscaping.

The primary appeal of weather-based controllers lies in their capacity to reduce water waste. By adjusting watering schedules in response to weather patterns, these systems ensure that plants are watered only when necessary, without the risk of over-irrigation during rainfall or periods of high humidity. As global water scarcity issues continue to grow, farmers and landscapers are increasingly turning to weather-based solutions to reduce water consumption while maintaining healthy crops and landscapes.

By Product Analysis

Smart Controllers Dominate with 66.6% Share in 2024

In 2024, Smart Controllers held a dominant market position, capturing more than a 66.6% share. The widespread adoption of smart controllers is primarily driven by their advanced features that enhance water efficiency and convenience. These controllers integrate with various sensors and weather data, allowing users to automate irrigation schedules based on real-time conditions, such as soil moisture, temperature, and forecasted weather. This makes them highly effective in reducing water wastage and optimizing irrigation processes for agricultural and landscaping applications.

Smart controllers are particularly popular due to their connectivity features, allowing remote monitoring and control through mobile apps or cloud platforms. This capability enables farmers and property managers to adjust irrigation settings from virtually anywhere, ensuring that plants receive the right amount of water at the right time. Additionally, the increasing emphasis on sustainable practices in agriculture and landscaping has led to greater demand for smart controllers, as they contribute to more efficient water usage and lower operational costs.

By Irrigation Type Analysis

Drip/Trickle Irrigation Dominates with 59.1% Share in 2024

In 2024, Drip/trickle irrigation held a dominant market position, capturing more than a 59.1% share. This irrigation type is highly favored due to its water-efficient design, which delivers water directly to the root zone of plants, minimizing evaporation and runoff. Drip/trickle systems are particularly effective in regions facing water scarcity, as they ensure that water is used precisely where it is needed, thus conserving valuable resources.

The growing popularity of drip/trickle irrigation can also be attributed to its suitability for a wide range of applications, from large-scale agricultural farms to residential gardens. As more farmers and property managers look for cost-effective and sustainable irrigation solutions, the drip/trickle method provides significant advantages in reducing water usage and improving crop yields. This system also helps reduce the risk of disease by keeping foliage dry and minimizing the spread of waterborne pathogens.

By Application Analysis

Agriculture Leads the Irrigation Controllers Market with 67.3% Share in 2024

In 2024, Agriculture held a dominant market position, capturing more than a 67.3% share of the irrigation controllers market. This significant market share is largely driven by the increasing need for water-efficient irrigation solutions in farming. As agricultural practices face the dual challenges of climate change and water scarcity, irrigation controllers are becoming essential tools for optimizing water usage, improving crop yields, and ensuring sustainability in farming operations.

The agriculture sector’s preference for irrigation controllers is further supported by the growing adoption of precision farming techniques, which allow for the automation and monitoring of irrigation systems based on real-time data. These controllers help farmers manage irrigation more efficiently by adjusting water delivery based on factors such as soil moisture levels, weather conditions, and crop requirements. This leads to reduced water waste, lower costs, and improved crop health.

Key Market Segments

By Type

- Weather-based

- Sensor-based

- Others

By Product

- Smart Controllers

- Tap Timers

- Basic Controllers

By Irrigation Type

- Drip/trickle

- Sprinkler

- Others

By Application

- Agriculture

- Open Field

- Controlled Environment Agriculture

- Non-agriculture

- Sports ground/golf course

- Residential

- Others

Emerging Trends

Satellite-Powered, Data-Driven Scheduling Becomes Standard

A defining trend in irrigation controllers is the shift from simple timers to data-driven scheduling that blends on-farm sensors with weather services and satellite evapotranspiration (ET). In plain words: controllers are learning to water only when crops actually need it. This matters because agriculture is still the world’s largest water user—about 70% of freshwater withdrawals—so even small efficiency gains free up huge volumes for people, rivers, and ecosystems.

Two forces are accelerating this shift. First, governments and utilities want measurable savings. The U.S. EPA’s WaterSense program shows what’s possible: swapping a basic timer for a WaterSense-labeled weather-based controller can save the average home up to 15,000 gallons a year; scaled nationally, that’s up to 390 billion gallons and $4.5 billion in water costs if systems are installed and run correctly. These are landscape numbers, but they set expectations for agriculture and public green spaces—only irrigate when conditions justify it, and document the savings.

Second, high-quality water-use data are becoming accessible. OpenET, a collaboration supported by NASA and partners, provides satellite-based ET at field scale, exposing how much water crops actually consume. This allows controllers (and the platforms they connect to) to compare applied water with crop demand, close reporting gaps, and support performance-based incentives. NASA describes OpenET as a “web-based platform that puts Earth science data about water use by crops” into the hands of farmers and managers, and it continues to expand access via APIs. For controller vendors, tapping ET feeds means better scheduling and clearer proof of conservation.

The scale of irrigated production underscores why digital control is becoming the norm. In the United States, the 2023 Irrigation and Water Management Survey reports 81 million acre-feet of water applied across 53.1 million irrigated acres, averaging 1.5 acre-feet per acre. When controllers make each irrigation a little smarter—by pausing for forecast rain, responding to soil-moisture thresholds, or aligning to crop ET—the absolute savings across this base are substantial, and the records produced satisfy grant and compliance needs.

Drivers

Water-Scarcity Pressure and Efficiency Imperative

One of the most powerful driving forces pushing growth in the irrigation controller market is the urgent need to improve water use efficiency in agriculture and landscaping. As freshwater resources become scarcer, governments, food producers, and policy bodies are placing stronger demands on irrigation systems to conserve water while maintaining yields. Modern controllers—those that adjust scheduling based on weather forecasts, soil moisture sensors, or evapotranspiration data—serve as a bridge between infrastructure and actual “smart” water use.

In the United States, agriculture accounts for nearly 47 percent of all freshwater withdrawals (from both surface and groundwater) over the 2010–2020 period. That scale of demand exerts heavy pressure: even small percent gains in efficiency translate into huge absolute water savings. The latest USDA Irrigation and Water Management Survey showed that in 2023, U.S. farmers applied 81 million acre-feet of water across 53.1 million irrigated acres—representing a decline of 2.8% from 2018—but still a large volume overall.

This drive is not just coming from water scarcity but also from policy pressure. Subsidies, grants, cost-share programs, and incentives increasingly favor systems that can measure and report water saved.

- For example, in the U.S., the Water-Saving Commodities (WSC) Program allows grants of up to $15 million to irrigation entities that implement water-saving practices, with payments tied to acre-feet of water conserved. Also, the Environmental Quality Incentives Program (EQIP) gives farmers cost-share support to adopt improved irrigation technologies (including efficient equipment and scheduling).

Restraints

High Upfront Cost and Financial Risk

One of the biggest restraints holding back widespread adoption of irrigation controllers is the high initial investment cost and financial risk perceived by farmers, especially smallholders. Controllers that integrate soil moisture sensors, weather data, telemetry, and communication modules require electronics, wiring, and periodic maintenance. For a farmer already operating on thin margins, that upfront capital outlay can feel like a gamble—especially when returns may take years to fully manifest, or maintenance failures could erode gains.

In parts of India, for instance, even drip irrigation systems (which are simpler than smart controllers) incur average installation costs around ₹65,000 per hectare (~USD 790/ha). After accounting for government subsidies (often 50 %), the effective burden on the farmer is still about ₹32,500 (~USD 395/ha). It is not hard to imagine that adding a controller layer, communications, sensors, and remote-management capability would push that cost higher, potentially deterring those with limited capital or credit access.

Subsidies alone do not always solve the problem. In some regions of India, even with subsidies in place, only about 16 % of farmers adopted drip irrigation (b for borewells) in a semi-arid region, reflecting that financial incentives by themselves may not overcome perceived risk or lack of trust. In Iran, the government in one program covered 85 % of the cost for improved irrigation systems (leaving the farmer 15 %) under the Sixth Development Plan, yet adoption lagged, suggesting that generous subsidy does not always overcome behavioral or operational barriers.

Moreover, in many rural areas, access to credit is limited or comes with high interest rates, making such investments less feasible. According to FAO, smallholders face multiple constraints—lack of savings, limited credit, risk aversion—that often limit adoption of improved technologies. Even when subsidies or soft loans exist, the disbursement mechanism, delay in receiving benefits, or complexity in qualifying can discourage farmers from investing.

Opportunity

Integration with Digital Farming and Demand-Driven Irrigation

A promising growth opportunity for irrigation controllers lies in their seamless integration into broader digital farming ecosystems—transforming them from standalone devices into decision nodes in an Internet of Things (IoT) agricultural fabric. In simple terms: instead of just timing sprinklers or drip lines, future controllers will speak to sensors, weather services, drones, soil probes, farm management software, and water meters. This gives farmers far more precise, responsive control—and that extra precision opens up value.

To see why this matters, consider scale. In the U.S., farms with any irrigation in 2022 accounted for over 50 percent of crop value, even though irrigated land was less than 17 percent of harvested cropland. That means the irrigated acreage is disproportionately valuable—and farmers will invest where returns are highest. A controller that is just a timer is useful, but one that can factor in soil moisture, forecast rain, detect leaks, adjust with crop growth stage, and document water usage is far more compelling financially.

Government programs are already nudging demand in that direction. For example, the U.S. Department of Agriculture in August 2024 committed $400 million toward drought resilience and water-saving agriculture, asking participating irrigation districts to adopt or upgrade “innovative water savings technologies and farming practices.” That funding is expected to conserve 50,000 acre-feet of water across 250,000 irrigated acres. Projects funded under this scheme will frequently include smart scheduling, telemetry, and controlled automation.

One next frontier is data-driven incentive models—for instance, governments or water districts could pay farmers based on documented water saved (rather than giving technology subsidies). In the U.S., the Water-Saving Commodities (WSC) Program allows grants up to $15 million over five years, with funding based on acre-feet saved. That model rewards actual performance—and therefore drives demand for controllers that can reliably measure, log, and report water use reductions.

Regional Insights

Greenhouse Irrigation Systems Market: North America

The North American greenhouse irrigation systems market holds a significant share of approximately 42.90%, valued at USD 0.6 billion in 2024. This dominant position can be attributed to the region’s advanced agricultural infrastructure, increasing adoption of water-efficient technologies, and growing demand for sustainable farming practices. In particular, the United States and Canada are leading the way in the deployment of innovative irrigation solutions, driven by factors such as environmental concerns, water scarcity, and the rising need for higher crop yields in controlled agricultural environments.

The United States, the largest market in the region, has seen widespread implementation of smart greenhouse irrigation systems, supported by both federal and state-level initiatives. Programs such as the EPA’s WaterSense initiative have encouraged the adoption of water-efficient systems, which are crucial in water-stressed areas like California. Additionally, state policies and regulations incentivize the use of precision irrigation technologies, which optimize water delivery based on real-time data from soil moisture sensors, weather forecasts, and other variables.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Established in 1933, Rain Bird Corporation is a leading manufacturer of irrigation products and services. With over 4,000 products, they serve various sectors, including agriculture, golf courses, and residential landscapes. Rain Bird’s commitment to the “Intelligent Use of Water” philosophy underscores their dedication to water conservation and efficient irrigation practices.

HydroPoint Data Systems, established in 2002, specializes in smart water management solutions. Their products, such as WeatherTRAK and Baseline, utilize IoT technology to optimize irrigation schedules, reduce water usage, and lower operational costs. HydroPoint’s focus on sustainability and efficiency has earned them recognition as an EPA WaterSense Manufacturer Partner of the Year.

Valmont Industries is a global leader in mechanized irrigation systems, specializing in center pivot and linear irrigation solutions. With nearly 80 years of experience, Valmont integrates advanced technologies like cellular, Bluetooth, and Ethernet connectivity into their irrigation controllers, enhancing water management efficiency for large-scale agricultural operations. Their commitment to innovation and sustainability positions them as a prominent player in the irrigation industry.

Top Key Players Outlook

- Valmont Industries, Inc.

- Hunter Industries

- Rain Bird Corporaion

- Netafim Ltd

- HydroPoint Data Systems, Inc.,

- Nelson Irrigation

- Galcon

- Smart Farm Systems, Inc.

- Tevatronic

Recent Industry Developments

In 2024, Valmont reported net sales of $4.08 billion, with a net income of $348.26 million, reflecting a 142.73% increase from the previous year.

In 2024, HydroPoint reported significant environmental impact through its technologies. Customers utilizing HydroPoint’s systems collectively saved 30 billion gallons of water, reduced water costs by $244 million, and decreased carbon dioxide equivalent emissions by 128,961 metric tons.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 4.3 Bn CAGR (2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Weather-based, Sensor-based, Others), By Product (Smart Controllers, Tap Timers, Basic Controllers), By Irrigation Type (Drip/trickle, Sprinkler, Others), By Application (Agriculture, Open Field, Controlled Environment Agriculture, Non-agriculture, Sports ground/golf course, Residential, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Valmont Industries, Inc., Hunter Industries, Rain Bird Corporaion, Netafim Ltd, HydroPoint Data Systems, Inc.,, Nelson Irrigation, Galcon, Smart Farm Systems, Inc., Tevatronic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Irrigation Controllers MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Irrigation Controllers MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Valmont Industries, Inc.

- Hunter Industries

- Rain Bird Corporaion

- Netafim Ltd

- HydroPoint Data Systems, Inc.,

- Nelson Irrigation

- Galcon

- Smart Farm Systems, Inc.

- Tevatronic