Global Iron Chromium Liquid Battery Market Size, Share Analysis Report By Type (Hybrid Flow Battery, Redox Flow Battery), By Materials (Vanadium, Zinc–Bromine, Others), By Application (Utility, Off Grid And Micro Grid, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164887

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

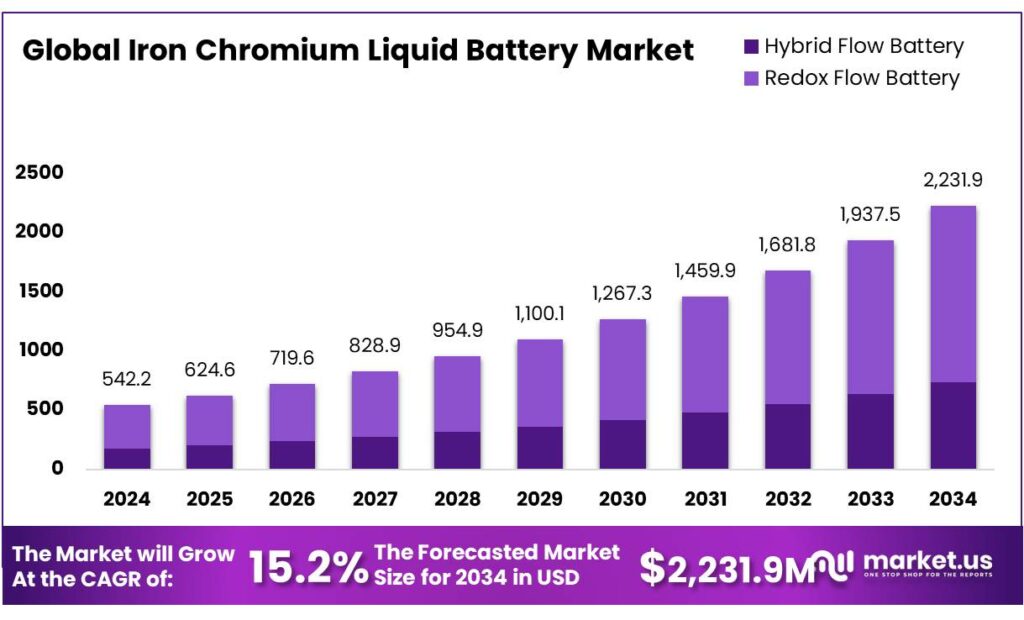

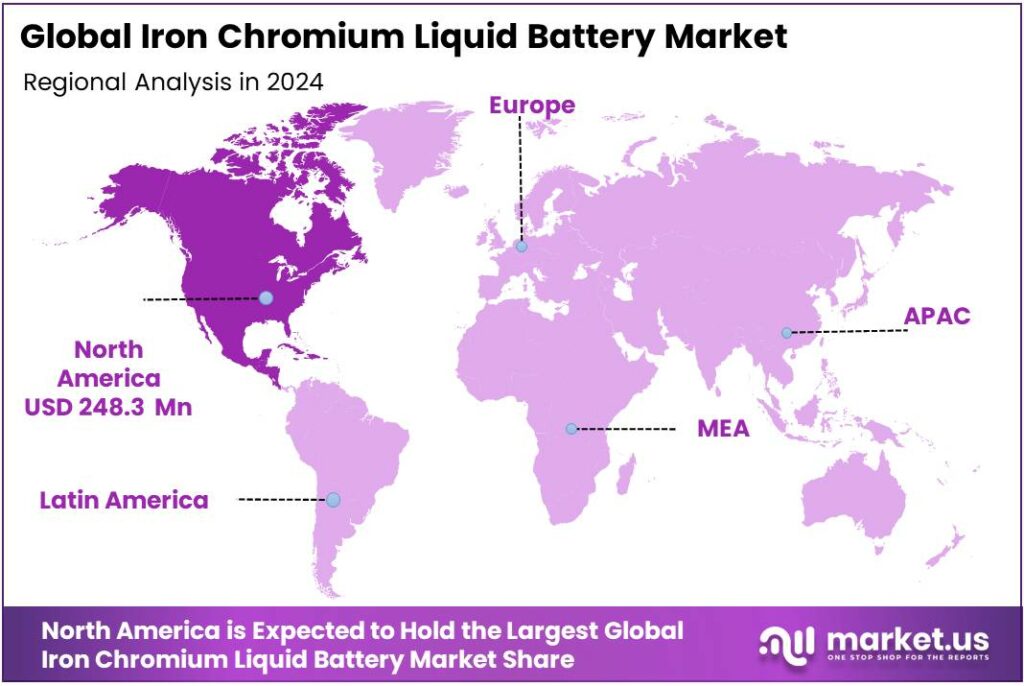

The Global Iron Chromium Liquid Battery Market size is expected to be worth around USD 2231.9 Million by 2034, from USD 542.2 Million in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 45.8% share, holding USD 248.3 Million in revenue.

Iron–chromium liquid batteries store energy in circulating electrolytes of iron and chromium chlorides separated from the power-generating cell stack, allowing independent scaling of power and energy. First explored by NASA and Mitsui in the 1970s–80s, Fe–Cr RFBs remain attractive for grid-scale, long-duration storage because they use abundant commodities and non-flammable aqueous chemistries. Typical system output efficiency for current Fe–Cr designs is about 70–75%, with ongoing materials work reporting incremental gains via electrolyte and electrode optimization.

The industrial scenario is shaped by rising flexibility needs as renewables scale. The IEA’s Net Zero pathway calls for grid-scale battery capacity to expand 35-fold to nearly 970 GW by 2030, with ~170 GW added in 2030 alone—up from 11 GW in 2022—highlighting a massive addressable market for non-lithium storage where long duration is valuable. China is accelerating fastest: regulators reported 95 GW of “new energy storage” in place by June 2025 and a national plan targeting >180 GW by 2027. California’s policy environment has also supported alternatives; the state set a 1,325 MW procurement target that helped catalyze early demonstrations.

Recent milestones specific to iron–chromium include China’s 1 MW/6 MWh demonstration, tested and approved for commercial use on 28 Feb 2023—the largest Fe–Cr installation of its kind—plus historical U.S. field trials by EnerVault that validated grid operation at tens of kilowatts. In parallel, U.S.-based ESS, Inc. reported ~800 MWh/year manufacturing capacity for its all-iron flow batteries by end-2022, indicating broader supply-chain learning relevant to iron-salt chemistries and balance-of-plant commonalities for flow systems.

- Policy and public-sector direction are strong tailwinds. The U.S. Department of Energy’s Long-Duration Storage Shot targets an LCOS of $0.05/kWh for systems delivering ≥10 hours by 2030, a goal that explicitly includes flow batteries and drives R&D on stacks, membranes, catalysts and low-cost electrolytes—areas particularly pertinent to iron–chromium, which combats hydrogen evolution on the chromium side.

Key Takeaways

- Iron Chromium Liquid Battery Market size is expected to be worth around USD 2231.9 Million by 2034, from USD 542.2 Million in 2024, growing at a CAGR of 15.2%.

- Redox Flow Battery held a dominant market position, capturing more than a 67.1% share in the overall iron–chromium liquid battery market.

- Vanadium held a dominant market position, capturing more than a 57.9% share in the overall iron–chromium liquid battery materials.

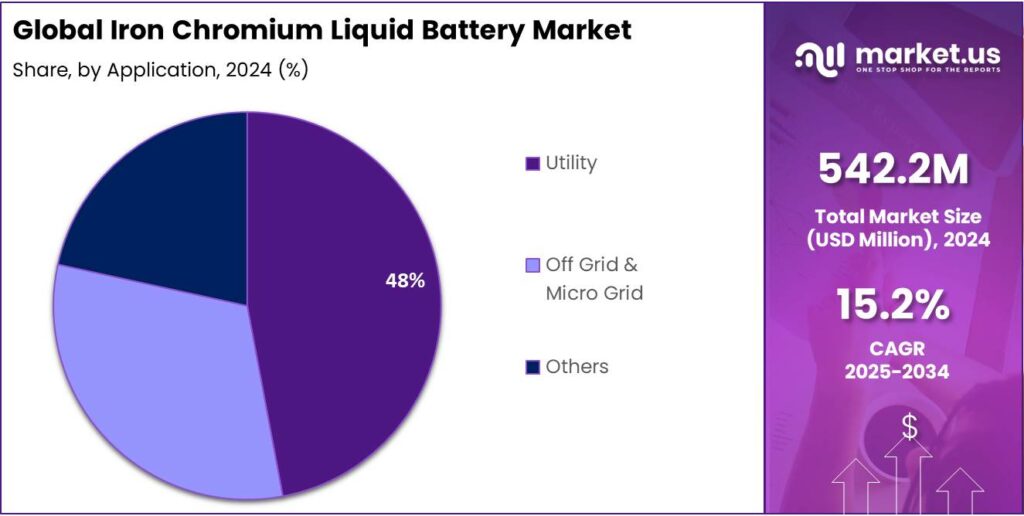

- Utility held a dominant market position, capturing more than a 48.2% share in the overall iron–chromium liquid battery market.

- North America held a dominant market position in the global iron–chromium liquid battery market, capturing more than 45.8% share, valued at approximately USD 248.3 million.

By Type Analysis

Redox Flow Battery dominates with 67.1% share in 2024

In 2024, Redox Flow Battery held a dominant market position, capturing more than a 67.1% share in the overall iron–chromium liquid battery market. This strong share can be attributed to its high scalability, long operational life, and suitability for large-scale energy storage systems. Redox flow batteries gained preference across utility and industrial sectors, primarily due to their ability to store energy for extended durations ranging from 4 to 12 hours, which supports the integration of renewable energy sources such as solar and wind.

By 2025, the segment is expected to maintain its lead, supported by increasing investments in energy storage infrastructure and government-backed initiatives promoting long-duration storage technologies. The cost advantages of iron and chromium over vanadium and lithium materials have further strengthened its industrial relevance, offering a sustainable and affordable storage alternative. Additionally, its environmental safety, due to non-flammable electrolytes, continues to position the redox flow battery segment as a preferred choice for grid operators and large-scale energy projects.

By Materials Analysis

Vanadium dominates with 57.9% share in 2024

In 2024, Vanadium held a dominant market position, capturing more than a 57.9% share in the overall iron–chromium liquid battery materials segment. The strong share reflects the widespread use of vanadium-based electrolytes in redox flow systems due to their stable electrochemical performance and proven long cycle life. Vanadium’s high energy efficiency, ease of electrolyte regeneration, and compatibility with advanced flow battery designs made it the material of choice for large-scale installations and research prototypes throughout the year.

By 2025, the vanadium segment is expected to maintain its leadership as utilities and energy developers continue to prefer vanadium-infused chemistries for grid-level energy storage. Ongoing advancements in electrolyte formulation and recycling techniques are projected to enhance energy density and reduce lifecycle costs, strengthening its competitive edge. Additionally, the growing focus on renewable integration and long-duration storage across industrial grids is likely to sustain demand for vanadium-based materials.

By Application Analysis

Utility sector dominates with 48.2% share in 2024

In 2024, Utility held a dominant market position, capturing more than a 48.2% share in the overall iron–chromium liquid battery market. The dominance of this segment is largely driven by the increasing demand for large-scale energy storage solutions across power grids and renewable energy projects. Utilities adopted iron–chromium batteries for their long-duration discharge capability, low operational cost, and strong safety profile compared to conventional lithium-based systems. The technology’s ability to store excess renewable power and release it during peak demand made it highly suitable for grid balancing and frequency regulation.

By 2025, the utility segment is expected to strengthen its leading position as global power networks continue to expand renewable energy capacity. Supportive government initiatives promoting clean energy transition and energy security are anticipated to further drive installations of iron–chromium flow batteries within the utility sector. Growing investments in grid modernization and energy storage infrastructure are also expected to boost market penetration.

Key Market Segments

By Type

- Hybrid Flow Battery

- Redox Flow Battery

By Materials

- Vanadium

- Zinc–Bromine

- Others

By Application

- Utility

- Off Grid & Micro Grid

- Others

Emerging Trends

Policy-Backed Multi-Hour Storage is Moving From Pilots to Procurement

A clear trend shaping iron–chromium liquid batteriesis the mainstreaming of multi-hour storage, pushed by policy and grid needs rather than lab curiosity. At system level, batteries became the fastest-growing commercially available power technology in 2023, with global deployments doubling to ~42 GW across utility-scale, behind-the-meter, mini-grids and solar-home systems—expanding the market context into which long-duration chemistries like Fe–Cr can sell multi-hour services.

The investment backdrop has firmed up too: the IEA tracks > US$35 billion expected for battery energy storage investment in 2023, signalling deepening capital pools for storage assets that can discharge well beyond 2–4 hours.

Real-world operations are now creating long-duration use cases. California’s grid operator curtailed 3.4 million MWh of wind and solar in 2024, up 29% from 2023; 93% of curtailment was solar—evidence that grids need storage that can shift midday surpluses into evening peaks. Fe–Cr flow batteries target exactly this gap because energy scales independently of power, making 6–12-hour discharge windows economical.

Policies are explicitly steering the market toward long-duration capabilities. In the United States, the Department of Energy’s Long-Duration Storage Shot targets US$0.05/kWh LCOS by 2030 for technologies delivering ≥ 10 hours—a milestone that aligns RD&D funding with Fe–Cr pain points. DOE has followed with competitive awards to speed these pathways, reinforcing the commercialization runway for 10-hour-class storage.

Drivers

Firming variable renewables with long-duration, multi-hour storage

Iron–chromium liquid batteries are propelled by one clear market need: grids must turn growing, weather-dependent solar and wind into firm, round-the-clock power. Battery storage is scaling fast to meet that need—global additions doubled in 2023, reaching roughly 42 GW across utility-scale and distributed systems, making batteries the fastest-growing power technology that year. This uptake reflects real operational pressure on grids as renewable shares rise.

Curtailment data shows why multi-hour storage matters. In California, one of the world’s most solar-heavy systems, the system operator curtailed 3.4 million MWh of wind and solar in 2024, up 29% from 2023—lost clean electricity that better-matched storage could shift into evening peaks. Iron–chromium flow batteries, built for 6–12 hour duty cycles, directly target this gap by decoupling energy (electrolyte volume) from power (stack size), making longer durations economical.

- Policy is reinforcing the economics. The U.S. Department of Energy’s Long-Duration Storage Shot aims to cut levelized cost of storage to $0.05/kWh by 2030 for technologies delivering ≥10 hours—explicitly including flow batteries. That target guides RD&D on membranes, catalysts, stack designs and low-cost electrolytes—areas central to iron–chromium’s path to scale.

Macro system planning points in the same direction. To deliver the COP28 goal to triple renewables by 2030, the IEA indicates the world must add around 1,500 GW of energy storage this decade, in tandem with major grid expansion. That scale implicitly requires storage that is safe, durable, and cost-effective over long durations—precisely the design space of iron–chromium flow batteries, which use abundant materials and tolerate deep cycling with minimal degradation.

Restraints

Lower efficiency and technical maturity hurdles in iron-chromium flow batteries

One of the most significant challenges facing iron–chromium flow battery systems stems from their relatively modest efficiencies and the immature state of key technical components. Currently, published reviews show that Fe–Cr systems often achieve round-trip energy efficiencies in the range of 70% or less under practical conditions. This means that for every 100 kWh of electricity stored, only about 70 kWh may be returned, which is noticeably lower than the 85%–90% efficiencies typical of mature lithium-ion systems employed for shorter-duration applications.

From the perspective of policy-driven deployment, another restraining factor is that these performance gaps mean Fe–Cr systems are less likely to meet aggressive cost-targets and duration-performance thresholds set by governments. For example, the U.S. Department of Energy Long-Duration Storage Shot aims to achieve a levelised cost of storage (LCOS) of $0.05 /kWh for systems delivering ≥10 hours of duration by 2030.

If a system returns only ~70% of charged energy (versus ~90%), its effective usable cost is higher. And when the future grid is comparing many storage options—including lithium-ion, other flow chemistries, and emerging alternatives—the relative disadvantage of lower efficiency weighs heavily. Hence, even though material-costs for iron and chromium might be lower, the overall system-cost per kWh delivered escalates. This puts Fe–Cr systems at a strategic disadvantage until the efficiency, cycle life and manufacturing maturity improve.

In human terms: imagine storing 100 kWh of energy but only getting 70 kWh back while having to buy, install, operate and maintain the system over decades. Over the lifetime, those lost 30 kWh per cycle add up, eroding savings and undermining the value proposition. That makes utility owners and developers cautious. Until Fe–Cr systems can reliably push efficiency higher, reduce side-reaction losses and prove long lifetimes, their growth will be restrained. Research is ongoing, but the uncertainty on commercial scale-up, real field performance and fully bankable long-duration economics remains a key limitation.

Opportunity

Serving Grid Multi-Hour Needs as Renewables and Policies Scale Fast

Iron–chromium liquid batteries have a clear opening where grids need 6–12-hour shifting, not just short bursts. The growth signal is strong: battery storage was the fastest-growing commercially available power technology in 2023, with global additions doubling to ~42 GW across utility-scale, behind-the-meter, mini-grids and solar-home systems. That surge expands the addressable market for long-duration formats like Fe–Cr that decouple energy from power and can be scaled economically for multi-hour duty cycles.

Curtailment trends create immediate multi-hour opportunities. In California, the system operator curtailed 3.4 million MWh of utility-scale wind and solar in 2024, up 29% from 2023, with solar making up 93% of curtailed energy. Capturing even a fraction of those lost terawatt-hours and shifting them into the evening peak requires storage sized for many hours—exactly the niche where Fe–Cr flow batteries can compete on lifecycle cost and durability rather than peak round-trip efficiency.

Policy tailwinds are intensifying, and they explicitly call for cost-effective long-duration storage. The U.S. Department of Energy’s Long-Duration Storage Shot targets an LCOS of $0.05/kWh by 2030 for technologies delivering ≥10 hours—a framework that includes electrochemical flow systems and funds advances in membranes, hydrogen-suppression strategies on the chromium side, and stack materials. If vendors align with this target, Fe–Cr can monetise multi-hour grid services at competitive delivered-energy costs.

System planners also need storage at scale to integrate the record build-out of renewables. The IEA reports renewable capacity additions of ~507 GW in 2023, almost 50% higher than 2022—an acceleration that increases the value of storage with long discharge windows to firm weather-dependent resources.

In parallel, REN21 notes global battery storage capacity reached 55.7 GW in 2023, with 27.1 GW in China and 16.2 GW in the U.S.—evidence that grids are buying storage at scale and that policy/market templates exist for financing multi-hour projects. For Fe–Cr vendors, those templates lower commercialization barriers and speed time-to-bankability in new markets.

Regional Insights

North America dominates with 45.8% share valued at USD 248.3 million in 2024

In 2024, North America held a dominant market position in the global iron–chromium liquid battery market, capturing more than 45.8% share, valued at approximately USD 248.3 million. The region’s leadership is primarily supported by a strong focus on renewable integration, large-scale energy storage projects, and favorable government policies promoting sustainable grid technologies.

The United States, in particular, has emerged as a key contributor, driven by the Department of Energy’s (DOE) strategic initiatives to develop long-duration energy storage systems under programs such as the Long Duration Storage Energy Earthshot, which aims to reduce the cost of grid-scale storage by 90% within a decade.

The rising penetration of solar and wind energy in the U.S. power generation mix has amplified the need for reliable, long-duration storage systems, where iron–chromium batteries are gaining traction due to their safety, low maintenance, and cost-effectiveness. In 2024, the region witnessed multiple pilot projects and commercial deployments focused on iron-based redox flow systems, supported by private investments and federal grants.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Aquaponic Source is exploring the integration of sustainable energy storage with closed-loop aquaponic systems. It leverages iron–chromium flow batteries to stabilize renewable power use in greenhouse operations, ensuring 24/7 pump and lighting reliability. In 2024, the company collaborated with clean-tech developers to test 50 kWh Fe–Cr pilot modules that balance solar input during peak generation.

Hydrofarm Holdings Group, a leading U.S. hydroponic and controlled-environment agriculture supplier, has been evaluating modular energy storage to reduce facility energy costs. In 2024, the company began assessing iron–chromium flow systems for warehouse and grow-light load management across its 200,000 ft² distribution network. By integrating flow batteries with rooftop solar, Hydrofarm targets carbon-neutral operations by 2030, echoing the 30% Investment Tax Credit for stand-alone storage under the Inflation Reduction Act that encourages multi-hour, renewable-aligned battery adoption.

Based in South Africa, Practical Cyclopentanone (Pty) Ltd has diversified from specialty chemical production into electrochemical energy systems, piloting Fe–Cr battery electrolytes using chromium salts derived from local sources. In 2025, the firm partnered with a regional power utility to develop a 250 kWh demonstration unit supporting grid resilience under South Africa’s renewable integration roadmap. The project aligns with the government’s Integrated Resource Plan 2023, which targets 11 GW of storage capacity by 2030—offering an emerging commercial platform for chromium-based battery chemistries.

Top Key Players Outlook

- Sumitomo Electric Industries Ltd.

- ViZn Energy Systems

- ESS Inc.

- Invinity Energy Systems

- Lockheed Martin Corporation

- CellCube Energy Storage Systems Inc

- VRB Energy

Recent Industry Developments

In 2024, Hydrofarm Holdings Group, reported net sales of $190.3 million and a net loss of $66.7 million, reflecting a market still normalizing after pandemic-era demand swings.

Report Scope

Report Features Description Market Value (2024) USD 542.2 Mn Forecast Revenue (2034) USD 2231.9 Mn CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hybrid Flow Battery, Redox Flow Battery), By Materials (Vanadium, Zinc–Bromine, Others), By Application (Utility, Off Grid And Micro Grid, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sumitomo Electric Industries Ltd., ViZn Energy Systems, ESS Inc., Invinity Energy Systems, Lockheed Martin Corporation, CellCube Energy Storage Systems Inc, VRB Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Iron Chromium Liquid Battery MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Iron Chromium Liquid Battery MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sumitomo Electric Industries Ltd.

- ViZn Energy Systems

- ESS Inc.

- Invinity Energy Systems

- Lockheed Martin Corporation

- CellCube Energy Storage Systems Inc

- VRB Energy