Global Industrial Boilers Market Size, Share, And Business Benefits By Type (Package Boiler, Field Erected Boiler), By Boiler Type (Fire Tube, Water Tube), By Capacity (10-150 BHP, 151-300 BHP, 301-600 BHP, Above 600 BHP), By Fuel (Natural Gas, Coal, Oil), By Application (Chemicals and Petrochemicals, Paper and Pulp, Food and Beverages, Metals and Mining), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166642

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

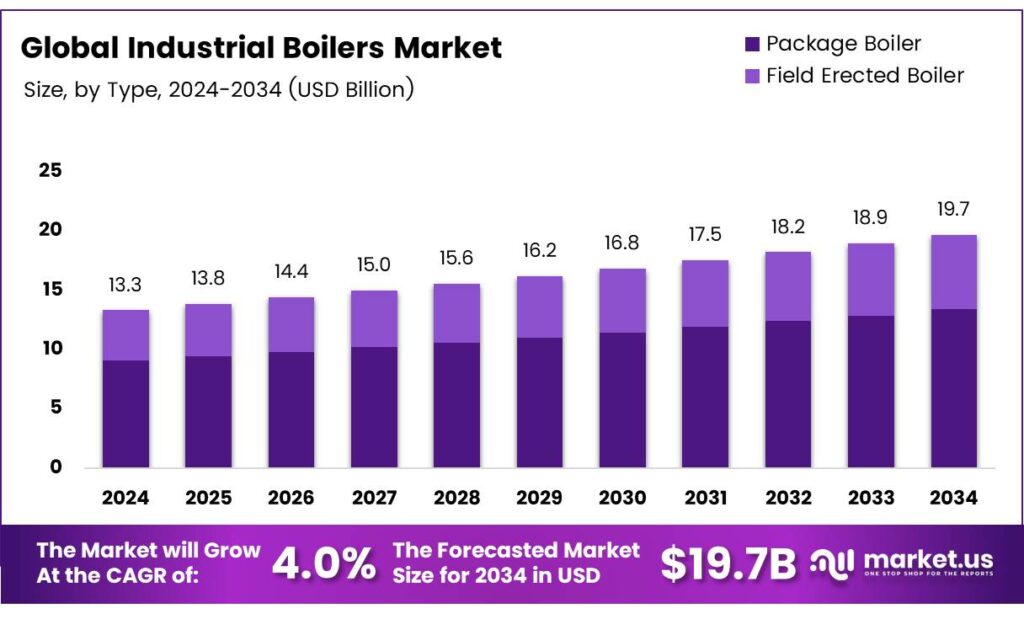

The Global Industrial Boilers Market size is expected to be worth around USD 19.7 billion by 2034, from USD 13.3 billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

The Industrial Boilers Market covers the manufacturing, deployment, and maintenance of high-pressure steam-generating systems used across chemicals, food processing, metals, paper, and other heavy industries. These boilers convert fuel energy into steam for heating, power generation, and process operations, supporting continuous industrial productivity. Their reliability, fuel flexibility, and thermal efficiency make them foundational to modern manufacturing.

- The market also benefits from India’s strong manufacturing capabilities, supported by a robust domestic engineering infrastructure. According to the Government of India, the country’s engineering sector can build a wide range of high-capacity utility boilers. State-owned industries can produce steam generators ranging from 30 MW to 660 MW and supercritical boilers up to 800 MW, using coal, lignite, oil, natural gas, or blended fuels.

India’s industrial boilers form the engine room of manufacturing, powering sectors with significant steam requirements. According to India’s energy and environment assessments, more than 45,000 process boilers generate 1.26 billion tonnes of steam annually. However, they also contribute over one-quarter of total industrial greenhouse-gas emissions, with particulate matter and SO₂ emissions surpassing those from the entire automobile sector.

Furthermore, industrial boilers present large-scale opportunities as companies shift toward greener technologies and energy-efficient heating equipment. Government incentives for clean energy, waste-heat recovery, and upgraded combustion systems encourage industries to modernise old boiler fleets. This regulatory push aligns with industrial decarbonization targets under India’s national climate commitments.

Key Takeaways

- The Global Industrial Boilers Market is valued at USD 13.3 billion in 2024 and is projected to reach USD 19.7 billion by 2034, at a CAGR of 4.0% from 2025 to 2034.

- Package Boiler is the top-performing type, capturing 68.2% of the market.

- Fire Tube boilers dominate the boiler type segment with a 56.6% share.

- The 10–150 BHP capacity range leads the capacity segment with 32.1% share.

- Natural Gas is the most preferred fuel, contributing 49.3% to the fuel segment.

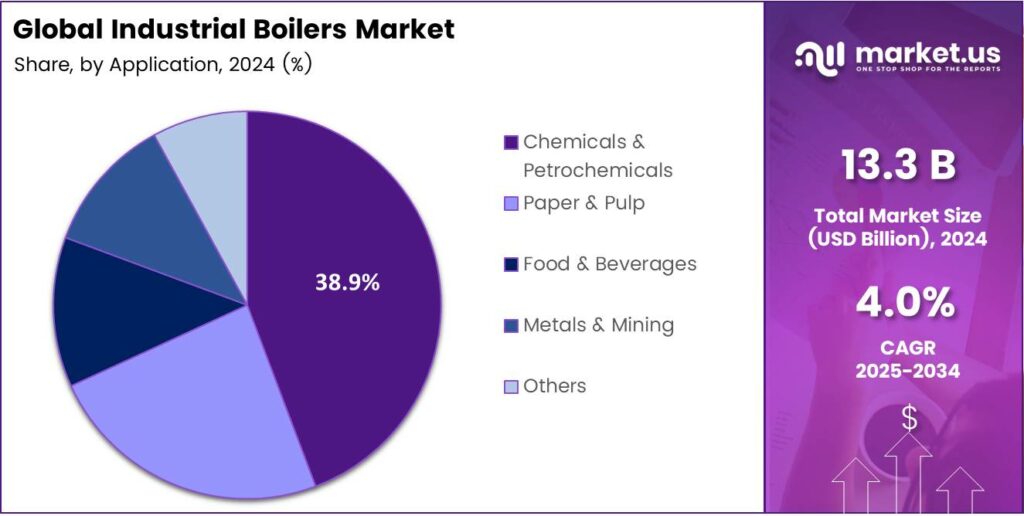

- Chemicals and Petrochemicals are the largest application area, accounting for 38.9% share.

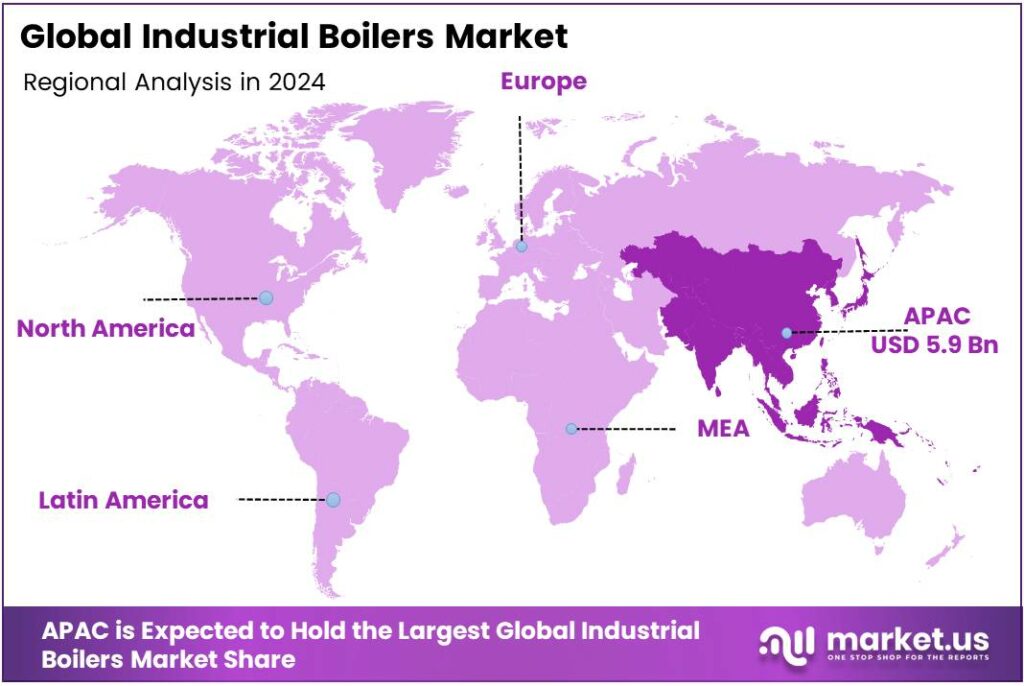

- The Asia Pacific region leads the global market with a dominant 44.8% share worth USD 5.9 billion.

By Type Analysis

Package Boiler dominates with 68.2% due to its quick installation and compact design.

In 2024, Package Boiler held a dominant market position in the By Type Analysis segment of the Industrial Boilers Market, with a 68.2% share. Industries prefer package units because they reduce installation time, enhance operational flexibility, and support small to medium plants that require reliable and efficient steam generation for daily operations.

In 2024, Field Erected Boiler held a notable position in the By Type segment. These units served large industrial facilities needing high steam output. They were preferred for heavy-duty applications, long production cycles, and custom pressure requirements. Although slower to install, they offered scalability and strong performance for large energy-intensive sites.

By Boiler Type Analysis

Fire Tube dominates with 56.6% due to its ease of operation and lower maintenance.

In 2024, Fire Tube held a dominant market position in the By Boiler Type segment of the Industrial Boilers Market, with a 56.6% share. These systems remained the first choice for small and medium processing units due to their simple design, consistent output, and cost-efficient pressure handling capabilities.

Water Tube held a significant role in the By Boiler Type segment. These boilers were widely used in heavy industries that required high pressure and large steam capacities. Their quick heat transfer, safer handling at high temperatures, and suitability for power plants supported growing adoption.

Others contributed steadily to the By Boiler Type segment. These included hybrid systems and specialised boilers designed for niche industrial settings. Their presence reflected demand for customised heating solutions that balance performance, space, and unique input fuel requirements in various industrial processes.

By Capacity Analysis

10-150 BHP dominates with 32.1% due to its suitability for small and mid-scale industries.

In 2024, 10-150 BHP held a dominant market position in the By Capacity segment of the Industrial Boilers Market, with a 32.1% share. These compact systems served food processing units, hospitals, and commercial facilities that required steady steam output with controlled energy consumption.

151-300 BHP showed steady demand in the By Capacity segment. These boilers aligned well with medium-scale manufacturing units needing higher steam loads. Their efficiency, flexible fuel compatibility, and manageable operating footprint made them reliable choices for growing industrial operations.

301-600 BHP remained important in the capacity segment. These units cater to industries with rising heating needs, supporting applications in petrochemicals, chemicals, and textiles. Their ability to maintain continuous high-volume steam output strengthened their relevance.

Above 600 BHP served heavy manufacturing, metals, and large refineries. These large-capacity boilers handled extreme loads and long production cycles. Their adoption continued in sectors requiring advanced pressure ranges and long-term operational stability.

By Fuel Analysis

Natural Gas dominates with 49.3% due to cleaner emissions and cost efficiency.

In 2024, Natural Gas held a dominant market position in the by-fuel segment of the Industrial Boilers Market, with a 49.3% share. Industries prefer gas-fired systems because they cut emissions, reduce operational costs, and meet stricter environmental regulations.

Coal continued to serve industries where fuel switching remained costly. Coal-based boilers offered high energy density and a stable supply in regions relying on traditional energy sources. However, regulatory pressure gradually influenced adoption trends. Oil offered flexible heating options in remote areas lacking gas infrastructure.

These boilers supported industries needing reliable backup fuel sources. Their adaptability allowed steady use despite cost variations. Others included biomass, waste heat, and alternative fuels. These options gained interest due to sustainability goals and incentives encouraging low-carbon heating solutions across industrial sectors.

By Application Analysis

Chemicals and Petrochemicals dominate with 38.9% due to continuous process heating needs.

Chemicals and Petrochemicals held a dominant market position in the By Application segment of the Industrial Boilers Market, with a 38.9% share. These industries required uninterrupted steam and heat for reaction processes, distillation, and refining, driving strong and consistent boiler demand.

Paper and Pulp sustained large-scale boiler usage due to high thermal loads in pulping and drying operations. Steam supported bleaching, chemical recovery, and moisture removal, keeping boiler systems essential in production lines. Food and Beverages relied on boilers for sterilisation, cooking, and cleaning.

Efficient steam generation helped producers maintain hygiene standards and energy efficiency, strengthening boiler adoption. Metals and Mining use industrial boilers for ore processing, metal finishing, and auxiliary heating. High-pressure and high-temperature operations made robust boiler systems necessary.

Key Market Segments

By Type

- Package Boiler

- Field Erected Boiler

By Boiler Type

- Fire Tube

- Water Tube

- Others

By Capacity

- 10-150 BHP

- 151-300 BHP

- 301-600 BHP

- Above 600 BHP

By Fuel

- Natural Gas

- Coal

- Oil

- Others

By Application

- Chemicals and Petrochemicals

- Paper and Pulp

- Food and Beverages

- Metals and Mining

- Others

Emerging Trends

Growing Shift Toward Energy-Efficient Steam Systems Drives Market Growth

Industrial boilers are increasingly shaped by the rising need for energy-efficient equipment. Many factories now prefer high-efficiency boilers because they help reduce fuel use and lower operating costs. This shift is becoming stronger as companies look for ways to cut energy waste and improve long-term savings.

- The IEA’s Renewables 2025 report notes that global industrial heat demand is expected to increase by about 14% (roughly +16 EJ), and that renewables could provide approximately 44% of that additional heat demand over the period. In simple terms, for every 100 units of added industrial‐heat demand, nearly 44 of them could be met by renewable energy sources like bioenergy, solar thermal, geothermal or electrified heat via renewables.

In addition, industries such as chemicals, food processing, pharmaceuticals, and power generation are expanding their operations. This expansion directly increases the demand for steam generation systems. As production capacities grow, companies are upgrading or replacing old boilers with modern, efficient models to support higher output and stable performance.

Drivers

Rising Industrial Expansion Boosts Boiler Adoption

Growing industrial activity is a major force driving the Industrial Boilers Market. As manufacturing units, chemical plants, refineries, food processors, and textile factories expand production, they require reliable steam and heat generation systems. Industrial boilers help maintain consistent temperature, improve processing efficiency, and support continuous operations, making them essential for large-scale industries that run around the clock.

Another key driver is the increasing shift toward energy-efficient boiler technologies. Many industries are replacing old, inefficient boilers with modern systems that use less fuel and produce higher steam output. This helps companies lower operating costs while meeting strict emission standards. Advancements such as automated controls, improved combustion efficiency, and low-NOx burners are further accelerating the adoption of these technologies.

Additionally, strong government support for clean industrial operations is promoting new boiler installations. Policies focused on reducing carbon emissions, improving workplace safety, and upgrading outdated equipment encourage industries to invest in advanced boilers. Incentives for energy conservation and industrial modernisation are also pushing companies toward high-efficiency models.

Restraints

High Operational Costs Limit Broader Industrial Boiler Adoption

Rising operational costs remain a major restraint for the Industrial Boilers Market. Many industries face higher fuel expenses, especially when using coal, oil, or natural gas. These fuels continue to fluctuate in price, making long-term planning difficult for manufacturers. As a result, companies often delay new boiler installations to manage expenses better.

- The global industry sector consumed around 156 exajoules (EJ) of energy, representing roughly 39% of total energy-related emissions. Within that, the generation of industrial heat (for boilers and other process heat) makes up about two-thirds of industrial energy demand and nearly one-fifth of global energy consumption.

Maintenance and safety compliance add another layer of challenge. Industrial boilers operate under high pressure and high temperature, making routine inspections essential. However, the cost of skilled technicians, spare parts, and downtime discourages frequent maintenance. These factors increase operational risks and make adoption less attractive for industries with limited budgets.

Growth Factors

Rising Industrial Automation Creates New Boiler Opportunities

Growing automation across manufacturing plants is creating fresh opportunities for the industrial boilers market. Many factories are upgrading old systems to support faster production, and this shift requires modern boilers that offer better efficiency and stable steam generation. As industries aim to reduce downtime, demand for advanced boiler models continues to rise.

Another opportunity comes from the increasing focus on clean energy and emission control. Companies are replacing outdated, fuel-heavy boilers with cleaner alternatives such as natural-gas-fired and biomass-based units. These upgrades help industries meet environmental rules while also cutting energy costs, making sustainable boilers an attractive investment.

Governments in developing regions are also boosting industrial growth through infrastructure spending and incentives. This creates a strong need for reliable steam systems in power plants, refineries, and new industrial zones. As a result, companies offering energy-efficient, compact, and low-maintenance boilers are well-positioned to benefit from long-term market expansion.

Regional Analysis

Asia Pacific Dominates the Industrial Boilers Market with a Market Share of 44.8%, Valued at USD 5.9 Billion

Asia Pacific leads the global industrial boilers market, driven by rapid industrialisation, rising manufacturing output, and expanding chemical and food processing sectors. The region’s strong energy demand and continuous investments in power generation support this growth. With a dominant share of 44.8% and a value of USD 5.9 billion, the Asia Pacific benefits from large-scale infrastructure development and supportive government policies promoting efficient industrial heating systems.

North America shows steady demand for industrial boilers due to the modernisation of ageing power plants and a strong emphasis on energy-efficient technologies. Environmental regulations encourage industries to shift toward low-emission boiler systems. The region also benefits from technological innovation and improved steam generation solutions across oil & gas, chemicals, and manufacturing sectors.

Europe maintains a stable position supported by strict emission standards and the rising adoption of clean combustion technologies. Industrial players are upgrading existing boiler units to improve efficiency and reduce operational costs. The region’s strong presence in food processing, pharmaceuticals, and district heating networks continues to support demand for advanced industrial boilers.

The U.S. market is driven by strong industrial automation adoption and continuous modernisation of thermal power and manufacturing units. Emphasis on low-emission, fuel-flexible boilers aligns with federal clean energy goals. The country benefits from technological leadership and high replacement demand across heavy industries, boosting long-term market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Industrial Boilers Market in 2024 shows steady advancement driven by efficiency upgrades, clean-energy transitions, and industrial capacity expansion. Among the leading participants,

Thermax Ltd. continues to strengthen its market presence through energy-efficient steam and power-generation solutions. The company’s focus on waste-heat recovery and low-emission boiler technologies positions it well in sectors such as chemicals, food processing, and pharmaceuticals, where customers increasingly prioritise operational cost savings.

Siemens AG maintains a strong influence through its automation, digital monitoring, and advanced control systems that support boiler optimisation. Its integration of smart sensors and industrial IoT helps clients reduce downtime, improve fuel flexibility, and comply with tighter global emission regulations. Siemens’ emphasis on digitalisation aligns with the rising demand for predictive maintenance in heavy industries.

Bharat Heavy Electricals Ltd. (BHEL) plays a central role in large-capacity utility boilers, especially in power generation and heavy industrial applications. Its expertise in supercritical and subcritical boiler technologies supports regions investing in modernised thermal-power infrastructure. BHEL’s manufacturing strength and long-standing industry relationships enhance its competitiveness in large engineering projects.

Forbes Marshall remains a significant player in process boilers and steam engineering systems, particularly for mid-scale manufacturing facilities. The company’s integrated offerings—combining boilers, controls, and efficiency-enhancement tools—help industries reduce steam losses and fuel consumption. Its precision-driven approach makes it a preferred supplier for sectors seeking reliable, cost-efficient steam solutions.

Top Key Players in the Market

- Thermax Ltd.

- Siemens AG

- Bharat Heavy Electricals Ltd.

- Forbes Marshall

- Mitsubishi Heavy Industries Ltd.

- Harbin Oil Corporation

- Cheema Boilers Limited

- IHI Corporation

- AC Boilers

- Dongfang Oil Corporation Ltd.

Recent Developments

- In 2024, Thermax’s subsidiary Thermax Babcock & Wilcox Energy Solutions Ltd. (TBWES) secured a repeat order worth ₹ 516 crore for a 300 MW project (phase II of a 600 MW greenfield project) in Botswana. Scope: two 550 TPH CFBC boilers plus design, engineering, manufacturing, supply, erection-supervision, commissioning, and performance testing.

- In 2025, BHEL announced that it secured a Steam Generator (Boiler) island package order (supercritical technology) at the 2×660 MW Raghunathpur TPS Phase-II in West Bengal. Scope: design, engineering, manufacturing, supply, erection, testing & commissioning of Steam Generator (Boiler) island package.

Report Scope

Report Features Description Market Value (2024) USD 13.3 Billion Forecast Revenue (2034) USD 19.7 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Package Boiler, Field Erected Boiler), By Boiler Type (Fire Tube, Water Tube, Others), By Capacity (10-150 BHP, 151-300 BHP, 301-600 BHP, Above 600 BHP), By Fuel (Natural Gas, Coal, Oil, Others), By Application (Chemicals and Petrochemicals, Paper and Pulp, Food and Beverages, Metals and Mining, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Thermax Ltd., Siemens AG, Bharat Heavy Electricals Ltd., Forbes Marshall, Mitsubishi Heavy Industries Ltd., Harbin Oil Corporation, Cheema Boilers Limited, IHI Corporation, AC Boilers, Dongfang Oil Corporation Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Industrial Boilers MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Boilers MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermax Ltd.

- Siemens AG

- Bharat Heavy Electricals Ltd.

- Forbes Marshall

- Mitsubishi Heavy Industries Ltd.

- Harbin Oil Corporation

- Cheema Boilers Limited

- IHI Corporation

- AC Boilers

- Dongfang Oil Corporation Ltd.