Global Imitation Jewellery Market Size, Share, Growth Analysis By Product Type (Necklaces, Earrings, Bracelets, Rings, Anklets, Brooches), By End User (Women, Men, Unisex), By Distribution Channel (Online, Offline, Wholesale), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140457

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

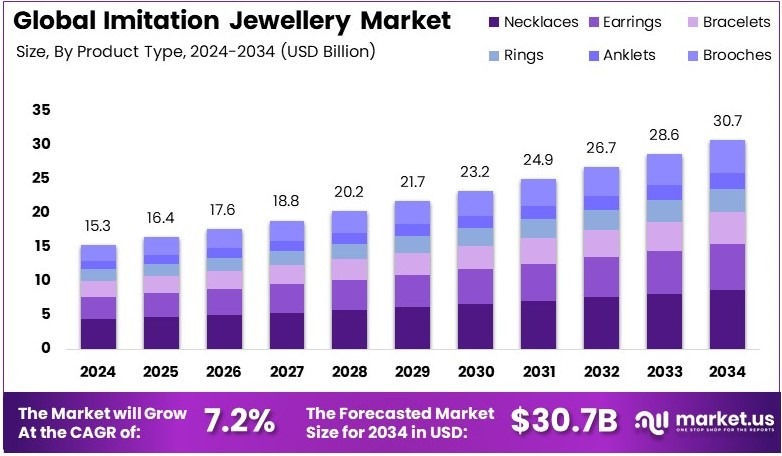

The Global Imitation Jewellery Market size is expected to be worth around USD 30.7 Billion by 2034, from USD 15.3 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

Imitation jewellery consists of accessories made from non-precious materials to mimic the appearance of real gold, silver, or gemstone jewellery. It offers stylish designs at affordable prices, catering to fashion-conscious consumers.

The imitation jewellery market involves the design, production, and sales of artificial jewellery items. It thrives on providing cost-effective, fashionable alternatives to expensive, genuine jewellery, appealing to a broad consumer base.

The imitation jewellery market is experiencing robust growth, driven by increasing consumer interest and favorable economic factors. As per OEC, in 2023, India’s exports of imitation jewellery amounted to a substantial $152 million, with major contributions going to the United States, the United Kingdom, and Spain, which imported $28.2 million, $18.2 million, and $11.8 million respectively.

Moreover, the escalating price of gold, which reached a record high of $2,942.70 per ounce in early 2025, has significantly influenced consumer preferences. As gold becomes less affordable, more consumers, especially in regions with higher disposable incomes, are opting for imitation jewellery.

For example, the United States, which leads with an average gross disposable income of $54,854 per household, sees substantial demand. Similarly, countries like Luxembourg and Switzerland with high disposable incomes of $49,860 and $43,035 respectively also reflect strong markets for these products.

The shift towards imitation jewellery is not merely a matter of cost but also a reflection of changing fashion trends and a growing emphasis on sustainable and ethical consumption choices. Consumers are increasingly drawn to the variety and versatility offered by imitation pieces, which can be frequently updated to match current trends without the same financial or ethical costs associated with real gems and metals.

This trend is supported by the broader market dynamics where the competition among manufacturers is intensifying to produce high-quality, attractive pieces that capture the evolving consumer preferences, thereby broadening the market’s scope and potential for further expansion.

Key Takeaways

- Imitation Jewellery Market was valued at USD 15.3 Billion in 2024 and is projected to reach USD 30.7 Billion by 2034 with a CAGR of 7.2%.

- In 2024, Necklaces dominate the product segment with 28.4%, driven by trendy design and affordability factors across markets.

- In 2024, the Women segment leads with 70.2%, reflecting strong consumer preference and rising fashion awareness in retail.

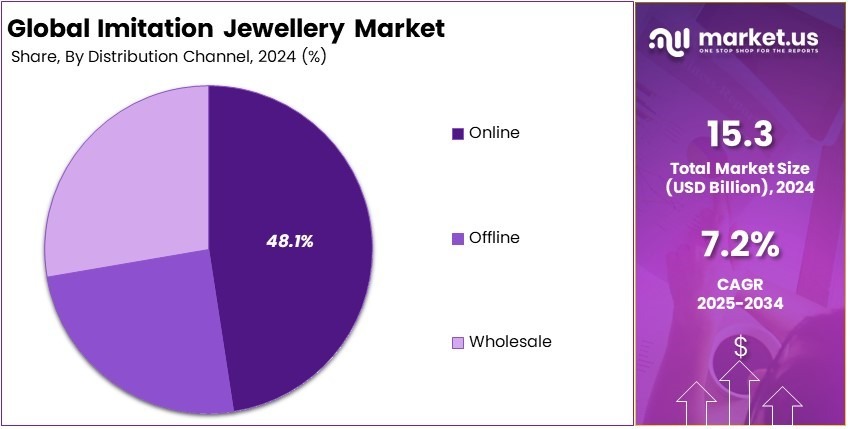

- In 2024, Online channels capture 48.1% of distribution, driven by e-commerce growth and improved digital access globally.

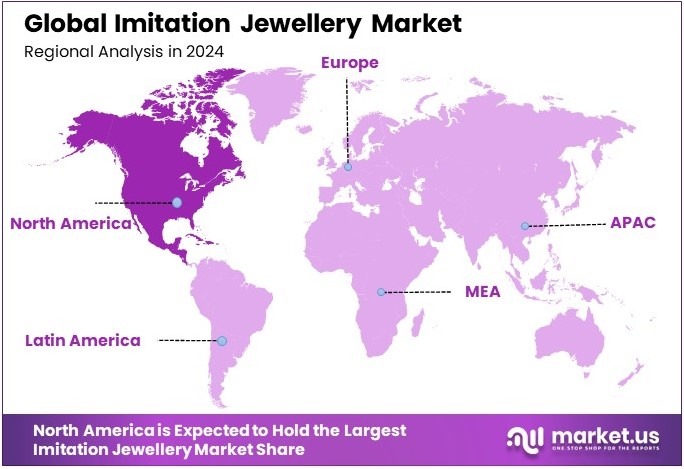

- In 2024, North America remains dominant, contributing significantly to market expansion with substantial consumer demand.

Product Type Analysis

Necklaces dominate with 28.4% due to their universal appeal and versatility in design.

The necklace segment is the largest in the imitation jewellery market, holding a market share of 28.4%. Necklaces have a timeless appeal and are popular among a wide range of consumers, from fashion-forward individuals to those seeking elegant accessories for special occasions.

The variety of styles, materials, and designs available makes necklaces a versatile product, catering to various tastes and budgets. They are commonly used for both daily wear and special events, which further supports their market dominance. Additionally, the rise of celebrity and influencer culture, where necklaces often play a key role in outfits, has contributed to the continued growth of this segment.

On the other hand, earrings, bracelets, rings, anklets, and brooches also hold significant shares in the market. Earrings, for example, are frequently bought for both fashion and practicality. They are less seasonal and can be worn year-round, adding to their consistent demand.

Similarly, bracelets and rings have steady market shares, with bracelets often symbolizing friendship or relationships and rings representing personal style or engagement. Anklets and brooches, while important, occupy smaller market niches, often focusing on specific cultural or fashion trends.

End User Analysis

Women dominate with 70.2% due to their strong preference for fashion accessories and jewellery.

Women are the largest consumer group in the imitation jewellery market, representing 70.2% of the market share. This segment’s dominance is driven by the high demand for jewellery as a fashion accessory. Women often purchase jewellery to complement their outfits, whether for daily wear, work, or special occasions.

In particular, items such as necklaces, earrings, and bracelets are frequently chosen for their ability to enhance personal style. Additionally, women are more likely to purchase multiple jewellery items, making them a key driver of the market. The growing influence of social media, where jewellery trends are heavily showcased by influencers and celebrities, has further fueled this demand.

Men and unisex jewellery segments also contribute to market growth, although they hold smaller shares. Men’s imitation jewellery is typically centered around minimalistic designs, such as cufflinks, rings, and bracelets.

While the men’s segment is growing, it remains smaller due to the traditionally lower demand for accessories compared to women. The unisex segment, catering to both men and women, is increasingly popular in today’s fashion-forward world. Unisex jewellery items often feature neutral designs, broadening their appeal and encouraging purchases from both genders.

Distribution Channel Analysis

Online dominates with 48.1% due to the convenience and expanding e-commerce sector.

Online retail channels account for the largest share in the imitation jewellery market at 48.1%. The convenience of shopping from home, combined with the wide range of products available, has made online shopping the preferred method for many consumers. E-commerce platforms offer the ability to compare prices, read reviews, and access global brands that may not be available in local stores.

Additionally, online retailers often provide discounts and exclusive online collections, which attract consumers looking for both affordability and variety. The growth of social media marketing and influencer partnerships has also played a significant role in promoting jewellery sales through online channels.

In contrast, offline retail channels still play a key role in the market, particularly in physical stores where consumers can see, touch, and try on jewellery. Despite the growing preference for online shopping, offline retail offers a sensory experience that some consumers still value.

Wholesale distribution channels also have a significant role, especially for retailers who source large quantities of imitation jewellery to sell in stores. While wholesale is important for bulk purchasing, it does not have the same growth rate as online retail.

Key Market Segments

By Product Type

- Necklaces

- Earrings

- Bracelets

- Rings

- Anklets

- Brooches

By End User

- Women

- Men

- Unisex

By Distribution Channel

- Online

- Offline

- Wholesale

Driving Factors

Growing Demand for Affordable Luxury Drives Market Growth

The imitation jewellery market is experiencing significant growth driven by increasing consumer preference for affordable luxury jewellery products. Many consumers seek the appearance and prestige of high-end jewellery without the associated high costs. Imitation jewellery offers an attractive alternative, allowing individuals to enjoy luxury-like items at a more accessible price point.

Rising fashion trends and celebrity endorsements have also played a crucial role in boosting the market. Celebrities and influencers often showcase imitation jewellery, making it more desirable among the general public. Additionally, the increased availability of high-quality imitation jewellery at lower price points has made it easier for consumers to access stylish and durable options.

The expansion of online retail channels has further driven market growth. Consumers now have greater access to a wide variety of imitation jewellery through e-commerce platforms, providing convenience and accessibility. This trend is especially important for reaching younger, tech-savvy consumers who prefer to shop online, contributing to the overall expansion of the market.

Restraining Factors

Competition and Perception Restrain Market Growth

Despite the growth, there are several factors that restrain the imitation jewellery market. One significant challenge is the competition from authentic, high-end jewellery brands, which continue to dominate the luxury jewellery sector. These established brands have loyal customer bases and can offer products with perceived higher value and longevity.

Additionally, imitation jewellery is often perceived as having lower value and durability compared to real jewellery, which can limit its appeal to certain consumers. Some buyers still associate high-quality jewellery with authenticity, making it harder for imitation options to gain acceptance in premium segments of the market.

Environmental concerns also pose a challenge. The use of non-recyclable materials in the production of imitation jewellery has raised awareness about sustainability issues. This can deter environmentally conscious consumers from purchasing these products. Furthermore, price sensitivity among consumers can limit the demand for premium imitation jewellery, as many buyers are primarily interested in affordable options rather than high-end alternatives.

Growth Opportunities

Sustainable and Customizable Options Provide Growth Opportunities

There are numerous growth opportunities for the imitation jewellery market, particularly with the increasing popularity of sustainable and eco-friendly options. As consumer awareness about environmental issues grows, demand for imitation jewellery made from recyclable or sustainable materials is rising. This shift opens new opportunities for brands to appeal to eco-conscious buyers.

Another area of opportunity lies in the bridal and occasion-based jewellery segment, which continues to expand. Imitation jewellery offers a more affordable option for customers seeking elegant pieces for special occasions such as weddings or parties. The customization and personalization of imitation jewellery are also growing trends, allowing companies to cater to niche markets with tailored offerings.

Furthermore, the expansion of the market in emerging economies, where the middle class is growing, presents significant opportunities. In these regions, the demand for fashionable and affordable jewellery is increasing, allowing imitation jewellery brands to tap into new consumer segments.

Emerging Trends

Technological Integration and Bold Designs Are Latest Trending Factors

Recent trends in the imitation jewellery market include the rise of digital and 3D-printed jewellery designs. These technologies allow for the creation of intricate and customized designs that may not have been possible with traditional manufacturing methods. This trend is appealing to consumers looking for unique and personalized pieces that stand out.

Another exciting development is the integration of imitation jewellery with wellness and smart technology. Wearable technology, such as health-monitoring jewellery, is gaining popularity, combining fashion with functionality. This trend is expected to grow as consumers look for jewellery that not only looks good but also offers additional benefits.

The increasing demand for hypoallergenic materials in costume jewellery is another trend, as consumers seek pieces that are safe for sensitive skin. Additionally, there is a growing interest in bold, statement jewellery pieces influenced by modern art, reflecting consumers’ desire for unique, attention-grabbing accessories.

Regional Analysis

North America Dominates with 38.4% Market Share in the Imitation Jewellery Market

North America holds a dominant 38.4% share of the global imitation jewellery market, valued at approximately USD 2.50 billion. This substantial market share is driven by a combination of high disposable income, a strong fashion culture, and increasing demand for affordable alternatives to real jewellery. The growing consumer base, especially among millennials and Gen Z, contributes to this trend.

North America’s leadership in the imitation jewellery market can be attributed to various factors. A major driver is the rising demand for stylish yet affordable jewellery, especially in the U.S. and Canada, where consumers prioritize fashion over price. Additionally, marketing strategies and celebrity endorsements have significantly influenced buying behaviors, with many consumers preferring imitation pieces as trendy alternatives to luxury jewellery.

The region’s vast retail network, including online and offline channels, has also contributed to the rapid growth. E-commerce platforms such as Amazon and Etsy have made imitation jewellery widely accessible. Furthermore, North America’s growing focus on sustainability has spurred interest in ethically sourced, eco-friendly imitation jewellery made from recycled or alternative materials.

Regional Mentions:

- Europe: Europe holds a significant share in the imitation jewellery market, driven by countries like France and Italy, known for their fashion influence. The growing demand for affordable luxury and eco-friendly products in European countries is propelling the market forward.

- Asia Pacific: Asia Pacific is witnessing rapid growth in imitation jewellery, with countries like India and China contributing significantly to the market share. Rising disposable incomes, urbanization, and changing fashion trends are driving the growth of affordable jewellery alternatives.

- Middle East & Africa: The Middle East and Africa region are gradually embracing imitation jewellery, particularly in urban areas. The demand is being fueled by increasing disposable incomes and the rising popularity of fashion jewellery as a status symbol.

- Latin America: Latin America is slowly increasing its demand for imitation jewellery, driven by a focus on affordable luxury in markets such as Brazil and Mexico. The region’s growing middle class is contributing to the expansion of this market.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Imitation Jewellery Market, several key players are shaping the landscape through innovation, market reach, and a focus on quality. Major companies include LVMH, Richemont, Tiffany & Co., and Pandora, each playing a vital role in this market.

LVMH (Moët Hennessy Louis Vuitton) stands as a dominant force in the luxury segment of imitation jewellery. The company’s diverse portfolio, including brands like Bulgari and Chaumet, has made it a leader in both fine jewellery and high-end costume jewellery markets.

Richemont, the parent company of iconic brands such as Cartier and Van Cleef & Arpels, has also made significant strides in the imitation jewellery market through its subsidiary brands that cater to a broader range of consumers. Richemont’s emphasis on craftsmanship and timeless design resonates strongly with customers seeking affordable luxury. Their ability to create high-quality imitation pieces that closely mimic fine jewellery drives their growth.

Tiffany & Co., known for its premium jewellery, has made moves to expand its reach within the imitation jewellery market, offering collections that blend affordability with the brand’s signature elegance. Tiffany’s shift towards more inclusive pricing strategies allows it to cater to a wider audience, including those interested in more affordable options without compromising brand identity.

Pandora is a significant player, particularly in the affordable segment. The brand has built a reputation for providing stylish, customizable jewellery at an accessible price point. Pandora’s strength lies in its wide appeal, particularly among millennials and Gen Z, and its strong digital presence, which continues to drive its market expansion.

These players leverage a mix of innovation, brand heritage, and global presence to maintain leadership in the highly competitive imitation jewellery market.

Major Companies in the Market

- Swarovski

- Pandora

- Cartier

- Billig Jewelers, Inc.

- BaubleBar Inc.

- Stuller, Inc.

- LVMH Moët Hennessy Louis Vuitton

- H&M Group

- Zara (Inditex)

- The Colibri Group

- Avon Products, Inc.

- DCK Group

- Buckley London

Recent Developments

- SonicWall and Banyan Security (January 2024): SonicWall acquired Banyan Security to enhance its zero-trust network access (ZTNA) and security service edge (SSE) offerings. This acquisition aims to strengthen SonicWall’s position in providing cloud-based security solutions, particularly in the context of growing hybrid work environments.

- Watches of Switzerland and Roberto Coin (May 2024): Watches of Switzerland expanded into the jewellery sector by acquiring distribution rights for the Roberto Coin brand in North and Central America. This strategic move aims to drive growth and diversify the company’s offerings beyond watches.

- Kalyan Jewellers and Candere (May 2024): Kalyan Jewellers, an Indian multinational jewellery company, completed the full acquisition of Candere, an e-commerce jewellery platform. This move enhances Kalyan’s online presence and aligns with the growing trend of digital jewellery retail.

Report Scope

Report Features Description Market Value (2024) USD 15.3 Billion Forecast Revenue (2034) USD 30.7 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Necklaces, Earrings, Bracelets, Rings, Anklets, Brooches), By End User (Women, Men, Unisex), By Distribution Channel (Online, Offline, Wholesale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Swarovski, Pandora, Cartier, Billig Jewelers, Inc., BaubleBar Inc., Stuller, Inc., LVMH Moët Hennessy Louis Vuitton, H&M Group, Zara (Inditex), The Colibri Group, Avon Products, Inc., DCK Group, Buckley London Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Imitation Jewellery MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Global Imitation Jewellery MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Swarovski

- Pandora

- Cartier

- Billig Jewelers, Inc.

- BaubleBar Inc.

- Stuller, Inc.

- LVMH Moët Hennessy Louis Vuitton

- H&M Group

- Zara (Inditex)

- The Colibri Group

- Avon Products, Inc.

- DCK Group

- Buckley London