Global Hydraulic Fracturing Market Size, Share Analysis Report By Well Type (Horizontal, Vertical), By Technology (Plug and Perf, Sliding Sleeve), By Fluid Type (Slick Water-based Fluid, Foam-based Fluid, Gelled Oil-based Fluid, Others), By Application (Shale Gas, Tight Oil, Tight Gas), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153737

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

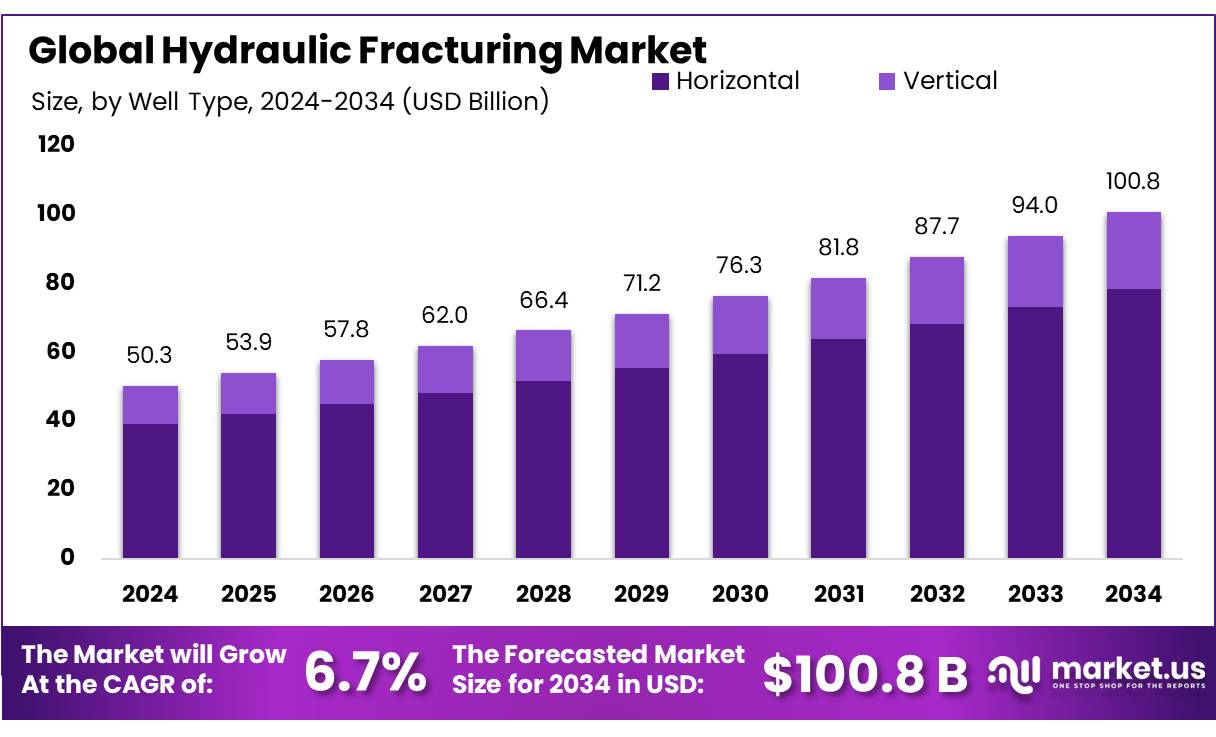

The Global Hydraulic Fracturing Market size is expected to be worth around USD 100.8 Billion by 2034, from USD 50.3 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.8% share, holding USD 21.5 Billion revenue.

Introducing hydraulic fracturing concentrates, these are the chemical additives and proppants mixed with water to create high-pressure fluid for the stimulation of tight oil and gas reservoirs. The concentrates typically comprise proppants (such as silica sand or ceramic beads) and a range of chemical additives including surfactants, biocides, scale inhibitors, friction reducers, and anti‑corrosion agents. The purpose is to create fractures in shale or tight rock formations and to prop open those fractures for hydrocarbons to flow.

In terms of industrial scenario, U.S. Energy Information Administration data indicate that by 2015 hydraulic fracturing wells produced over 4.3 million barrels per day, approximately 50% of total U.S. crude oil output; in 2000, only about 102 000 bpd were produced via approximately 23000 fracked wells (under 2% share). According to the Independent Petroleum Association of America, more than 1.7 million U.S. wells have been completed using the fracking process, yielding cumulatively over seven-billion barrels of oil and some 600-trillion-cubic-feet of natural gas.

Regulatory requirements for disclosure also drive demand for standardized chemical formulations, as exemplified by the U.S. Environmental Protection Agency’s FracFocus Chemical Disclosure Registry, which by March 2013 had recorded over 38000 well disclosures and chemical composition information for more than 37000 wells. Government initiatives such as the EPA’s state‑of‑the‑science study on hydraulic fracturing impacts under the Safe Drinking Water Act are facilitating better transparency and stricter standards on fluid composition and wastewater management.

Key Takeaways

- The global hydraulic fracturing market is projected to reach USD 100.8 billion by 2034, up from USD 50.3 billion in 2024, registering a CAGR of 6.7% during the forecast period.

- In 2024, horizontal wells accounted for a 78.2% share, reflecting their widespread adoption in shale formations for higher recovery efficiency.

- Plug & Perf emerged as the leading fracturing technology in 2024, capturing over 69.8% of the market share due to its operational flexibility and cost-effectiveness.

- Slick water-based fluids dominated the fluid segment with a 56.1% share in 2024, driven by their low viscosity and reduced friction in horizontal well operations.

- Shale gas applications led the market in 2024, holding a 58.3% share, supported by the expansion of shale resource development globally.

- North America was the leading regional market in 2024, accounting for 42.8% share and generating around USD 21.5 billion in revenue, driven by strong shale drilling activity in the U.S. and Canada.

By Well Type Analysis

Horizontal Wells dominate with 78.2% due to higher efficiency in shale formations.

In 2024, Horizontal held a dominant market position, capturing more than a 78.2% share in the global hydraulic fracturing market. This strong lead can be attributed to the increasing use of horizontal drilling across major shale plays, particularly in the United States. Horizontal wells are preferred for their ability to access larger rock surfaces, allowing for better extraction of oil and gas from tight formations. Their efficiency in reaching unconventional reserves has made them the top choice in regions like the Permian Basin and Marcellus Shale.

The technology also allows for multiple stages of fracturing in a single wellbore, reducing the need for new vertical wells and lowering operational costs over time. In 2025, the trend is expected to continue, as drilling contractors and exploration companies focus on maximizing output while minimizing environmental footprint. With growing demand for unconventional resources and stricter regulations on land use, horizontal well adoption is likely to remain strong, sustaining its dominant position in the hydraulic fracturing segment.

By Technology Analysis

Plug & Perf dominates with 69.8% due to its flexibility and proven field performance.

In 2024, Plug & Perf held a dominant market position, capturing more than a 69.8% share in the hydraulic fracturing market by technology. This method has gained wide preference, especially in horizontal well completions, due to its operational simplicity and high reliability across various shale formations. The technique allows operators to isolate multiple zones using composite plugs and then perforate them in stages, giving more control over the fracturing process.

Its adaptability across different geological conditions, especially in mature fields like the Bakken and Permian, has made Plug & Perf a go-to choice for oilfield service providers. By 2025, continued drilling in unconventional reservoirs is expected to maintain this strong demand, as the method supports precision, faster execution, and better stage-by-stage control. This ensures efficient resource recovery while keeping operational costs manageable, reinforcing Plug & Perf’s dominant position in the market.

By Fluid Type Analysis

Slick Water-based Fluid dominates with 56.1% due to its cost-efficiency and low viscosity.

In 2024, Slick Water-based Fluid held a dominant market position, capturing more than a 56.1% share in the hydraulic fracturing market by fluid type. This type of fluid is widely used in shale formations due to its low viscosity, which allows it to carry proppants deep into the fractures effectively. Its simple formulation—mainly water mixed with friction reducers—makes it more affordable and easier to handle compared to gel-based or cross-linked fluids.

The fluid’s ability to reduce friction within the wellbore enables high pumping rates, which is crucial in horizontal fracturing operations. By 2025, its dominance is expected to continue, driven by its proven performance in major shale regions and growing demand for cost-effective stimulation methods. Operators are likely to maintain or increase their use of slick water systems as they balance efficiency with environmental and economic considerations.

By Application Analysis

Shale Gas dominates with 58.3% due to rising demand and widespread shale development.

In 2024, Shale Gas held a dominant market position, capturing more than a 58.3% share in the hydraulic fracturing market by application. The strong presence of shale gas can be linked to the rapid expansion of shale plays in North America, particularly the Marcellus, Eagle Ford, and Permian basins. Hydraulic fracturing has become the primary method to unlock gas trapped in tight shale formations, making it the backbone of shale gas production.

The lower emissions profile of natural gas compared to coal has also encouraged many countries to shift toward shale gas as part of their cleaner energy mix. In 2025, this trend is expected to gain further momentum as governments and industries increase investments in domestic gas supplies to ensure energy security. With ongoing drilling activity and technological improvements, shale gas is likely to remain the leading application in the hydraulic fracturing market.

Key Market Segments

By Well Type

- Horizontal

- Vertical

By Technology

- Plug & Perf

- Sliding Sleeve

By Fluid Type

- Slick Water-based Fluid

- Foam-based Fluid

- Gelled Oil-based Fluid

- Others

By Application

- Shale Gas

- Tight Oil

- Tight Gas

Emerging Trends

Advancing Water Reuse in Fracking: A Trend Towards Sustainable Handling

One of the most notable recent trends in hydraulic fracturing is the widespread shift toward treating and reusing produced water. This approach reduces reliance on freshwater, lowers environmental impact, and creates new synergies between the energy and agricultural sectors.

Produced water—briny wastewater that surfaces during fracking—is increasingly treated and reused. In interviews with some operators, many report that over 75% of their fracking operations now use primarily treated produced water, with intentions to push that share past 90% in the near future. In regions like Pennsylvania’s Marcellus Shale, roughly 90% of the wastewater generated has been recycled for further fracking operations as of 2013.

For instance, Texas passed House Bill 49, signed by Governor Greg Abbott in 2025, which allows oil companies to treat and sell fracking wastewater—potentially for crop irrigation or river replenishment. The Permian Basin alone produces about 588 million gallons of wastewater daily, highlighting the scale of both the challenge and opportunity. Meanwhile, New Mexico is crafting new regulations that encourage closed-loop systems and pilot projects for safe reuse and desalination of produced water, backed by a proposed $500 million funding initiative to treat this water as an industrial-grade resource.

These efforts show that hydraulic fracturing is not just relying on ever-growing freshwater withdrawals but is embracing reuse as a sustainable pathway. Advanced technologies—such as membrane filtration, advanced oxidation, and bioremediation—are being deployed to clean and repurpose wastewater for reuse in fracking and even agricultural or industrial applications.

Drivers

Growing Demand for Unconventional Energy Resources Boosts Hydraulic Fracturing Operations

One of the most significant driving forces behind the expansion of hydraulic fracturing is the soaring demand for unconventional energy resources, particularly shale gas and tight oil. As traditional energy reserves become harder to access or begin to decline, countries are turning to unconventional resources to maintain energy security and meet rising industrial and household consumption.

According to data from the U.S. Energy Information Administration (EIA), in 2023, over 80% of U.S. natural gas production came from shale formations that require hydraulic fracturing for extraction. This is a sharp increase compared to just a decade ago, when shale accounted for less than half of the total production. The EIA further estimates that U.S. natural gas consumption will reach 34.9 trillion cubic feet by 2050, driven largely by power generation, manufacturing, and exports of liquefied natural gas (LNG). This continued rise reinforces the need for cost-effective, high-yield extraction techniques like fracking.

Globally, nations like China and Argentina are also investing in shale development to reduce energy dependence and lower carbon emissions from coal. In response, governments have rolled out strategic support measures. For example, the U.S. Department of Energy has offered technical assistance programs to improve well productivity and environmental safety, ensuring responsible deployment of hydraulic fracturing technologies.

Fracking has also helped stabilize global energy prices by increasing supply, especially when geopolitical disruptions threaten oil and gas trade routes. With energy security becoming a top priority, hydraulic fracturing remains an essential component of national energy strategies.

Restraints

Water Usage and Agricultural Impact Are Slowing Down Fracking Expansion

One major restraint on hydraulic fracturing is its heavy water consumption, which directly affects agricultural regions that are already struggling with water scarcity. Fracking operations require millions of gallons of freshwater per well. This becomes a serious issue in areas where water is also needed for farming and food production.

According to the United States Geological Survey (USGS), the average hydraulic fracturing well uses between 1.5 to 16 million gallons of water during its lifetime. In arid states like Texas and California, where both agriculture and oil drilling are prominent, this puts intense pressure on shared water sources. The USGS has reported that in regions like the Permian Basin, water demand from fracking has tripled in the last ten years, directly competing with irrigation needs.

The U.S. Department of Agriculture (USDA) has also expressed concern that increased water withdrawal for fracking could hurt crop yields. In drought-prone areas, this could lead to long-term damage to food security and farm income. For example, California’s Central Valley — one of the most productive agricultural regions in the world — has seen groundwater levels fall sharply, affecting both farmers and local communities.

To address this, some local governments have introduced water reuse regulations and encouraged fracking companies to use brackish or recycled water instead. However, the cost and infrastructure needed for treatment often discourage small operators from adopting such measures.

Opportunity

Turning Agricultural Wastewater into a Resource for Fracking: A Sustainable Growth Path

A key opportunity for the hydraulic fracturing industry lies in using treated agricultural wastewater as an alternative water source. This approach can reduce pressure on freshwater supplies and promote a more sustainable relationship between the energy and farming sectors.

Every year, large volumes of wastewater are generated by agricultural operations—particularly from livestock farms and food processing facilities. According to the U.S. Environmental Protection Agency (EPA), agriculture is the leading contributor to nutrient pollution in rivers and streams, often because of poorly managed wastewater. The EPA estimates that nearly 1.2 billion gallons of agricultural wastewater are produced daily in the United States alone.

Innovative partnerships between energy companies and large farming operations could treat this wastewater for reuse in fracking, offering a win-win. Instead of discharging wastewater into local water systems, farms could sell it to fracking operators, generating income while reducing their environmental impact.

States like Colorado and Pennsylvania are already exploring these models. For instance, the Colorado Oil and Gas Conservation Commission has encouraged water recycling practices and pilot programs that include agricultural wastewater in non-potable water blending projects for hydraulic fracturing. These initiatives are supported by local water boards and environmental agencies, helping to set standards for treatment and safe usage.

Regional Insights

North America dominates with 42.8% and approximately USD 21.5 billion in market value.

In 2024, North America held a commanding 42.8% share of the global hydraulic fracturing market, representing roughly USD 21.5 billion in regional revenue. This dominance can be attributed to the vast resource base of unconventional shale formations across the United States and Canada, coupled with advanced infrastructure and deep industry expertise

Canada complements this regional strength, particularly in Alberta and British Columbia, where formations like Duvernay, Montney, and Horn River have enabled the drilling of over 170,000 fractured wells. Canadian unconventional gas volumes are estimated at up to 1.3 p cu ft in place, with sustained production using multistage horizontal fracturing methods

Government support and regulatory frameworks in both countries have further facilitated market growth. The U.S. Environmental Protection Agency FracFocus registry and state-level oversight have ensured transparency, while tax incentives and favorable policy in Canada have encouraged investments in hydraulic fracturing infrastructure.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AFG Holdings, through its subsidiary AFGlobal, delivers pressure pumping equipment and advanced technologies tailored for hydraulic fracturing. The company supports upstream operations with engineered solutions including manifolds, power ends, and control systems. Its focus on U.S. shale plays and aftermarket services has helped expand its footprint in North America. AFG emphasizes innovation in durability and efficiency, aiming to meet evolving demands in fracking applications while maintaining safety and cost-effectiveness across its product portfolio.

Baker Hughes is a leading provider of oilfield services, offering advanced hydraulic fracturing solutions, including fracturing fluids, proppants, and integrated pressure pumping systems. The company emphasizes digital technologies and emissions reduction, supporting environmentally conscious fracking. Its presence in North American shale basins and global operations gives it a competitive edge. Through its focus on remote monitoring and automation, Baker Hughes aims to deliver optimized well productivity while reducing water usage and carbon intensity in fracking operations.

Halliburton is one of the world’s largest oilfield service providers, dominating the hydraulic fracturing sector with its extensive suite of stimulation services. Its technologies—like the Q10 pump and SmartFleet system—offer real-time data, emissions control, and fluid efficiency. Halliburton operates across major shale regions, including the Permian Basin and Bakken. The company continues to lead in automation, digitalization, and water recycling initiatives, aligning fracking performance with sustainability and cost-reduction goals for upstream producers globally.

Top Key Players Outlook

- AFG Holdings, Inc

- Baker Hughes

- Calfrac Well Services Ltd.

- GD Energy Products, LLC

- Halliburton

- Liberty Oilfield Services LLC

- National Energy Services Reunited Corp.

- NexTier Oilfield Solutions

- Patterson-UTI Energy, Inc.

- Petro Welt Technologies AG

- ProPetro Holding Corp.

- Schlumberger

- STEP Energy Services

- TechnipFMC plc

- Trican

- Weatherford

Recent Industry Developments

AFGlobal differentiates itself through patented technology like the DuraStim frac pump, a 6,000 HP system proven in the Permian Basin, offering triple the effective horsepower of conventional units and cutting fleet footprint by over 65% while lowering maintenance needs.

In 2024, Halliburton was a cornerstone of the hydraulic fracturing services market, helping define stimulation across major shale plays. The company generated total revenue of USD 22.9 billion with Completion & Production (C&P) segment contributing approximately USD 13.25 billion, and Drilling & Evaluation (D&E) segment about USD 9.69 billion.

Report Scope

Report Features Description Market Value (2024) USD 50.3 Bn Forecast Revenue (2034) USD 100.8 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Well Type (Horizontal, Vertical), By Technology (Plug and Perf, Sliding Sleeve), By Fluid Type (Slick Water-based Fluid, Foam-based Fluid, Gelled Oil-based Fluid, Others), By Application (Shale Gas, Tight Oil, Tight Gas) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AFG Holdings, Inc, Baker Hughes, Calfrac Well Services Ltd., GD Energy Products, LLC, Halliburton, Liberty Oilfield Services LLC, National Energy Services Reunited Corp., NexTier Oilfield Solutions, Patterson-UTI Energy, Inc., Petro Welt Technologies AG, ProPetro Holding Corp., Schlumberger, STEP Energy Services, TechnipFMC plc, Trican, Weatherford Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydraulic Fracturing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Hydraulic Fracturing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AFG Holdings, Inc

- Baker Hughes

- Calfrac Well Services Ltd.

- GD Energy Products, LLC

- Halliburton

- Liberty Oilfield Services LLC

- National Energy Services Reunited Corp.

- NexTier Oilfield Solutions

- Patterson-UTI Energy, Inc.

- Petro Welt Technologies AG

- ProPetro Holding Corp.

- Schlumberger

- STEP Energy Services

- TechnipFMC plc

- Trican

- Weatherford