Global Humic Acid Market By Concentration (Upto 30%, 30-60% And Above 60%), By Form (Solid And Liquid), By Mode Of Application (Foliar Treatment, Soil Treatment, Seed Treatment, And Others), By Crop Type (Cereals And Grains, Oilseeds And Pulses, Fruits And Vegetables, Turf And Ornamentals And Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 150636

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

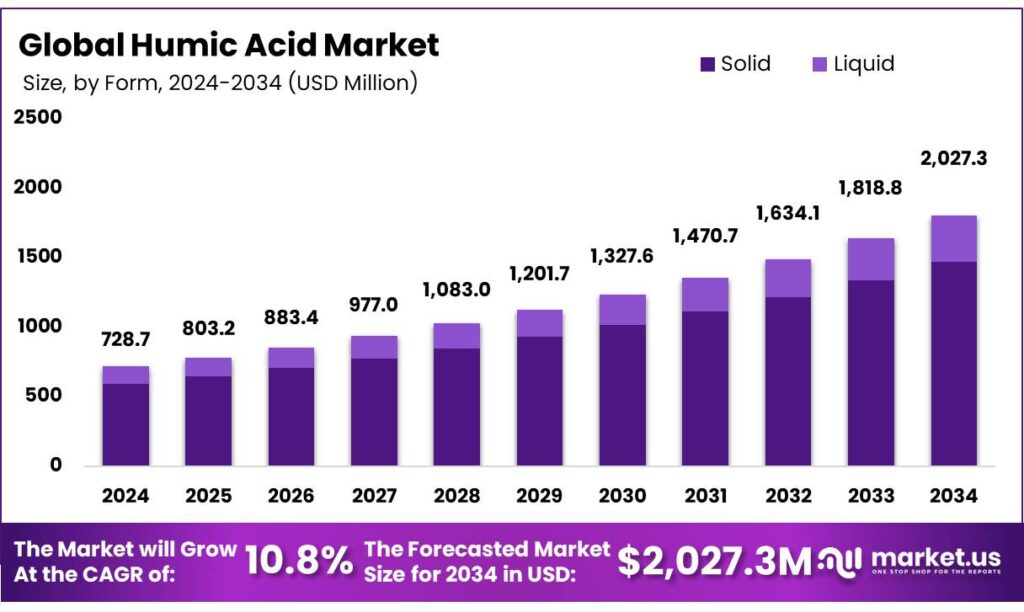

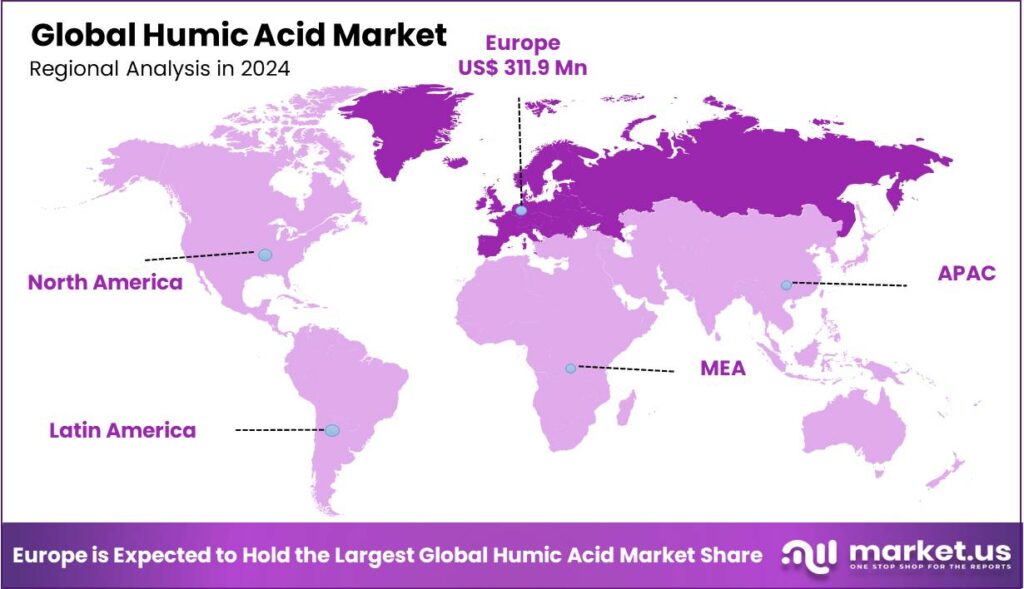

The Global Humic Acid Market size is expected to be worth around USD 2,027.32 Million by 2034, from USD 728.7 Million in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 43.10% share, holding USD 0.5 Billion revenue.

The global humic acid market is experiencing accelerating growth driven by the urgent need to restore soil health, boost agricultural productivity, and transition toward sustainable, low-input farming systems. With rising soil degradation, declining organic matter, and mounting yield pressure from population growth and climate change, farmers worldwide are increasingly adopting humic acid–based inputs to enhance soil structure, improve nutrient-use efficiency, and strengthen crop resilience.

Policy support is significantly shaping this landscape: the United States and the European Union are promoting soil regeneration and reduced reliance on synthetic fertilizers, while global organic farmland—now exceeding 76.4 million hectares—continues to expand. Europe leads the market due to strong regulatory frameworks under the European Green Deal and Farm to Fork Strategy, which prioritize organic farming and soil carbon restoration.

Opportunities are further amplified by emerging carbon markets and soil carbon programs, where humic acids play a central role in enhancing soil organic carbon and enabling farmers to generate carbon credits. At the same time, digital advancements—particularly the integration of Artificial Intelligence—are transforming product development, quality control, and application precision, linking humic acid adoption to data-driven regenerative agriculture.

However, the market faces restraints from the growing availability of substitutes such as seaweed extracts, amino acids, and microbial biostimulants, which offer targeted agronomic benefits and strong scientific validation. Despite these challenges, humic acid remains essential to global efforts to rebuild degraded soils, mitigate climate impacts, and support long-term farm productivity, positioning it as a cornerstone of future sustainable agriculture systems.

- According to the OECD-FAO Agricultural Outlook, global food consumption is projected to grow by approximately 1.3% annually over the next decade. Much of this rise is driven by middle-income countries—especially India, Southeast Asia, and parts of Africa—where calorie intake per capita is expected to increase by 7% by 2034. This intensification in food demand directly fuels the need for Biostimulants such as Humic Acid to maintain and extend agricultural productivity.

Key Takeaways

- The global humic acid market was valued at USD 728.70 million in 2024.

- The global humic acid market is projected to grow at a CAGR of 10.8% and is estimated to reach USD 2,027.32 million by 2034.

- Between concentrations, 30-60% accounted for the largest market share of 54.4%.

- Among form, solid accounted for the majority of the market share at 82.8%.

- Among mode of applications, soil treatment accounted for 65.0% of the humic acid market share.

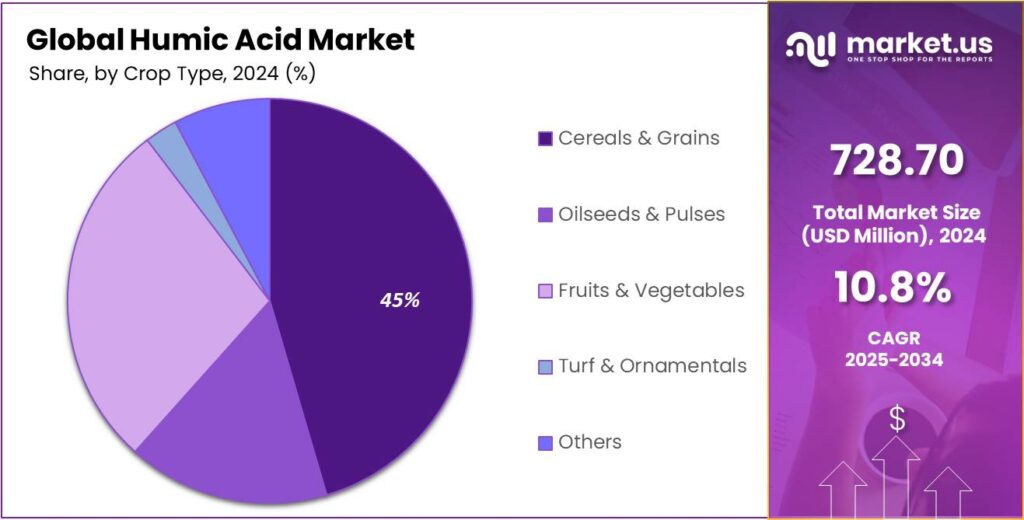

- Based on crop type, cereals & grains accounted for 45.5% of the market share

- Europe is estimated as the largest market for humic acid with a share of 42.8% of the market share.

Concentration Analysis

The Humic Acid Market Was Dominated By 30-60% Concentrations

Based on concentration, the market is further divided into Upto 30%, 30-60% & Above 60%. As of 2024, the 30-60% dominated the humic acid market with a 54.4% share primarily because it offers the ideal balance between effectiveness, cost efficiency, and broad applicability across crop types and soil conditions. Products within this concentration range deliver stronger soil-conditioning, nutrient-chelation, and root-enhancement benefits than lower-concentration formulations, while remaining more affordable and easier to handle than highly concentrated alternatives. This makes them the preferred choice for large-scale growers in field crops, horticulture, and commercial plantations who seek measurable yield improvements without significant increases in input costs.

Form Analysis

The Humic Acid Market Was Dominated By the Solid Form

The humic acid market was segmented into solid and liquid forms. Among them, solid humic acid accounted for 82.8% of the total market share, reflecting its broad applicability, ease of handling, and strong compatibility with conventional fertilizer application methods. Farmers and distributors favor granules due to their uniform nutrient release, storage stability, and suitability for large-scale agricultural operations. Additionally, solid formulations integrate seamlessly into mechanized spreading systems, further boosting adoption across major crop-producing regions and reinforcing their leadership within the overall humic acid market.

Mode Of Application Analysis

Soil treatment accounted for 65.0% of the humic acid market share in 2024 because humic substances are most effective when applied directly to the soil, where they enhance organic matter content, improve nutrient availability, and strengthen overall soil structure. Farmers widely prefer soil application because it delivers long-lasting benefits such as better water retention, increased microbial activity, and improved cation exchange capacity, all of which support sustainable crop productivity. Soil treatment is also highly versatile, suitable for use in field crops, horticulture, and degraded soils requiring rehabilitation. As global agriculture continues prioritizing soil health and regenerative practices, humic acid soil treatments remain the dominant mode of application, driving their substantial market share.

Crope Type Analysis

Based on the crope type, the market is further divided into cereals & grains, oilseeds & pulses, fruits & vegetables, turf & ornamentals & others. Among them, cereals & grains accounted for 45.5% of the market share primarily because these crops dominate global agricultural acreage and rely heavily on soil-enhancing inputs to maintain high productivity. Humic acid is widely used in cereal and grain cultivation—such as wheat, corn, rice, and barley—because it improves soil structure, enhances nutrient uptake, and boosts root development, all of which are essential for meeting growing food demand. These crops are often grown in large-scale, nutrient-depleted soils, making humic acid an economical and effective solution for restoring fertility and increasing yields.

Key Market Segments

By Concentration

- Upto 30%

- 30-60%

- Above 60%

By Form

- Solid

- Granules

- Powder

- Liquid

By Mode Of Application

- Foliar Treatment

- Soil Treatment

- Seed Treatment

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamentals

- Others

Drivers

Soil Health & Yield Pressure Boosting the Humic Acid Market Growth.

The global humic acid market is experiencing robust growth as farmers gradually recognize the need to rebuild soil organic carbon, enhance water retention, and improve nutrient-use efficiency—all while reducing dependence on synthetic fertilizers. Modern agricultural practices have led to soil degradation, erosion, and loss of organic matter, resulting in declining yields and ecosystem instability.

Healthy soils serve as dynamic systems that sustain both agricultural productivity and environmental quality, contributing to functions such as carbon sequestration, water regulation, and nutrient cycling. This growing awareness has accelerated the adoption of humic acid-based soil amendments, which improve soil structure, stimulate microbial activity, and enhance nutrient availability.

The rising yield pressure from population growth and climate variability further amplifies the demand for soil conditioners capable of boosting productivity under resource constraints. Humic acid facilitates nutrient retention and improves water-holding capacity, ensuring resilience against drought and nutrient leaching—key issues in degraded agricultural zones.

Simultaneously, the market is benefiting from policy-driven demand in regions such as the United States and the European Union, where soil health policies encourage the adoption of biologically derived inputs. These initiatives aim to reduce synthetic fertilizer dependency, minimize nitrate runoff, and mitigate greenhouse gas emissions, directly positioning humic acid as a key player in carbon-smart agriculture.

- Total organic-certified land in the U.S. has steadily trended upward since 2000, reaching 4.89 million acres in 2021. Market access for organic producers has grown significantly: in 2021, 55.6% of organic food sales occurred through conventional grocery retailers, surpassing natural food stores.

- Federal support has risen in parallel, with authorized USDA funds for the Organic Agriculture Research & Extension Initiative increasing from $3 million in 2002 to $50 million in 2023.

- In 2021, a total of 76.4 million hectares of land worldwide were managed under organic agricultural practices, representing 1.6% of the global farmland area. During the same year, the area of organic farmland grew by 1.7%, reflecting the continued expansion of organic farming systems across the globe.

Restraints

The Availability Of Substitutes May Hamper The Product

The humic acid market faces a significant restraint due to the increasing availability of substitute biostimulants that offer comparable or even superior agronomic benefits. Seaweed extracts, amino acids, vitamins, microbial amendments, and trace minerals are gaining popularity as farmers seek solutions that enhance soil health, nutrient uptake, and stress tolerance with greater precision.

Seaweed-based products, for instance, contain natural plant hormones and micronutrients that promote strong root development, improve resilience to drought and salinity, and consistently boost yields—advantages championed by leading innovators such as Acadian Plant Health and BASF. Microbial biostimulants, including beneficial fungi and bacteria, further intensify competition by enhancing soil microbiome activity, nitrogen fixation, and nutrient solubilization, often delivering faster or more targeted results than humic acids under specific stress conditions.

Likewise, amino acid and vitamin formulations are becoming favored for their rapid impact on photosynthesis and stress recovery, particularly in high-value horticultural crops. As these alternatives become more accessible, cost-effective, and scientifically validated, farmers increasingly diversify their input strategies based on crop needs and environmental conditions. Meanwhile, quality inconsistencies and limited standardization within the humic acid sector make it harder to compete in regions with strict regulatory performance requirements, ultimately shifting market momentum toward more technologically advanced biostimulants.

Opportunity

Carbon Markets and Soil Programs Create Opportunities

Carbon markets and soil programs present a significant opportunity for the global humic acid market, as they create direct economic incentives for farmers to adopt soil health–enhancing practices that increase soil organic carbon (SOC)—a process in which humic substances play a central role. Humic acids, being organic molecules derived from decomposed plant and microbial matter, contribute substantially to carbon sequestration by stabilizing organic carbon in soil aggregates, improving microbial biomass, and reducing carbon losses through erosion and mineralization.

As carbon markets—both compliance-based and voluntary—gain global traction, farmers and agribusinesses can monetize these ecological benefits by generating tradable carbon credits from SOC improvements.

Moreover, the integration of digital ag-tech and remote sensing enables precise measurement and modeling of carbon sequestration outcomes, increasing transparency and investor confidence in carbon markets. As global carbon prices rise and governments introduce “payment for ecosystem services” frameworks, demand for proven soil enhancers like humic acid will accelerate. These products not only help farmers earn carbon credits but also improve soil fertility, water retention, and long-term productivity, creating a feedback loop of economic and ecological value.

Trends

Integration of Artificial Intelligence is Shaping the Future of the Humic Acid Industry

The integration of Artificial Intelligence (AI) is revolutionizing the humic acid market by transforming the way products are developed, produced, and applied, ushering in a new era of data-driven, sustainable agriculture. Through AI-powered analytics, machine learning algorithms, and digital soil monitoring tools, producers and farmers can now optimize humic acid production and application with unprecedented precision. In manufacturing, AI models analyze raw material characteristics, extraction conditions, and chemical composition to enhance process efficiency, reduce waste, and standardize product quality—addressing one of the industry’s key challenges: variability.

Furthermore, AI and blockchain-based systems are streamlining carbon credit verification by accurately quantifying carbon sequestration achieved through humic acid use, helping farmers monetize sustainable practices. By linking AI analytics with carbon markets, farmers gain new income streams and strengthen their role in climate mitigation. However, as data becomes a valuable resource, data ownership and digital equity are emerging challenges—underscoring the need for policies ensuring fair access and security. Ultimately, the integration of AI in the humic acid sector is reshaping agriculture into an intelligent ecosystem where technology amplifies both productivity and ecological stewardship, bridging the gap between soil science, digital innovation, and global sustainability goals.

Geopolitical Impact Analysis

Geopolitical Scenerios Of The Humic Acid Market.

The global humic acid market is increasingly shaped by geopolitical tensions, particularly the imposition of U.S. tariffs on Chinese and European goods, which has disrupted trade flows and forced producers to reassess their strategies. China, responsible for more than 60% of global humic acid output, faces higher production and export costs due to these tariffs, yet manufacturers have adapted by improving operational efficiency, strengthening quality standards, and expanding technologically advanced production methods. At the same time, they are redirecting exports toward fast-growing markets in Asia-Pacific, Latin America, and Africa, where demand for organic fertilizers continues to rise.

The European Union is also impacted by a 15% U.S. tariff on most EU agricultural and specialty products, creating additional pressure on European biostimulant producers that already contend with high energy and manufacturing costs. As a result, many firms are exploring market diversification, revising pricing models, and investing in U.S. production facilities to mitigate tariff burdens.

In India, the National Biostimulant Industry Federation has called for policy reforms to address both foreign tariffs and domestic regulatory inconsistencies that hinder export growth in the country’s large biostimulant sector. Overall, these geopolitical shifts are accelerating regional production realignments and encouraging innovation and localized manufacturing, ultimately reshaping the humic acid market’s global competitive landscape.

Regional Analysis

Europe Held the Largest Share of the Global Humic Acid Market

Europe dominates the global humic acid market with a 42.8% share largely due to its strong policy-driven shift toward sustainable and organic agriculture. Under the European Green Deal and the Farm to Fork Strategy, the EU is aggressively reducing reliance on synthetic chemicals and promoting bio-based inputs, creating a favorable environment for humic acid adoption. With over 18.5 million hectares of organic farmland and strict regulations such as Regulation (EU) 2018/848, the region has made humic substances integral to improving soil fertility, nutrient efficiency, and climate resilience.

Key countries—including France, Spain, Italy, Austria, and Estonia—have expanded organic acreage, reinforcing demand for natural soil conditioners. Additionally, EU Soil and Biodiversity Strategies emphasize rebuilding soil organic carbon and enhancing microbial life, both core functions of humic acids. Although regulatory processes remain lengthy, Europe’s ambitious target of achieving 25% organic farmland by 2030 ensures continued reliance on humic acids as foundational inputs for regenerative and low-input farming systems.

- As of 2023, the European Union had over 157 million hectares of agricultural land, representing about 38% of the EU’s total land area, Europe’s adoption of Humic Acid is strongly linked to systemic agricultural change. Europe has 3.9% of its total agricultural land being organic.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Product Innovation and robust research & development are the key strategies of major players of Humic Acid market.

Major players in the humic acid market maintain a competitive edge by focusing on product innovation, advanced extraction technologies, and high-purity formulations tailored to specific crops and soil conditions. They increasingly invest in research collaborations, sustainability-driven product lines, and co-formulations combining humic substances with microbial or nutrient enhancers. Companies also expand their global footprint through strategic partnerships, capacity expansions, and entry into emerging markets. Additionally, strong branding, regulatory compliance, and data-backed performance trials help differentiate products in a rapidly evolving biostimulant landscape.

The Major Players in The Industry

- Nutrien Ltd

- Syngenta AG

- The Andersons Inc.

- FMC Corporation

- Mineral Technologies Inc.

- Sikko Industries Ltd.

- Biolchim S.p.A.

- Black Earth Humic LP

- Cifo Srl

- Desarrollo Agrícola y Minero, S.A.

- Grow More, Inc.

- Tagrow Co., Ltd.

- Humintech GmbH

- Nutri-Tech Solutions Pty Ltd

- HGS BioScience

- Haihang Group

- Criyagen Agri & Biotech Private Limited

- Zhengzhou Shengda Khumic Biotechnology Co. Ltd

- Agbest Technology Co. Limited

- Joshi Agrochem Pharma Private Limited

- Jiloca Industrial SA

- Other Key Players

Key Development

October 2025: HGS BioScience, backed by Paine Schwartz Partners, announced the acquisition of NutriAg Ltd., a Toronto-based leader in bionutritional technologies. This move strengthens HGS’s presence in the North American biostimulant and bionutritional markets by combining its expertise in humic and fulvic acid products with NutriAg’s advanced crop nutrition portfolio and R&D capabilities.

February 2023: The Andersons, Inc. introduced MicroMark DG, a new line of granular micronutrient products featuring its patented Dispersing Granule (DG) Technology. This innovation enhances blending, spreading, and nutrient availability by breaking granules into micro-particles in the soil. The initial offerings — MicroMark DG Blitz and MicroMark DG Humic — provide essential nutrients and humic acid for improved soil health and plant nutrition across various crop applications.

Report Scope

Report Features Description Market Value (2024) USD 728.70 Mn Forecast Revenue (2034) USD 2,027.32 Mn CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Concentration (Upto 30%, 30-60% & Above 60%), Form (Solid & Liquid), Mode Of Application (Foliar Treatment, Soil Treatment, Seed Treatment, & Others), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turf & Ornamentals & Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Nutrien Ltd, Syngenta AG, The Andersons Inc., FMC Corporation, Mineral Technologies Inc., Sikko Industries Ltd., Biolchim S.p.A., Black Earth Humic LP, Cifo Srl, Desarrollo Agrícola y Minero, S.A., Grow More, Inc., Tagrow Co., Ltd., Humintech GmbH, Nutri-Tech Solutions Pty Ltd., HGS BioScience, Haihang Group, Criyagen Agri & Biotech Private Limited, Zhengzhou Shengda Khumic Biotechnology Co. Ltd., Agbest Technology Co. Limited, Joshi Agrochem Pharma Private Limited, Jiloca Industrial SA & others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Nutrien Ltd

- Syngenta AG

- The Andersons Inc.

- FMC Corporation

- Mineral Technologies Inc.

- Sikko Industries Ltd.

- Biolchim S.p.A.

- Black Earth Humic LP

- Cifo Srl

- Desarrollo Agrícola y Minero, S.A.

- Grow More, Inc.

- Tagrow Co., Ltd.

- Humintech GmbH

- Nutri-Tech Solutions Pty Ltd

- HGS BioScience

- Haihang Group

- Criyagen Agri & Biotech Private Limited

- Zhengzhou Shengda Khumic Biotechnology Co. Ltd

- Agbest Technology Co. Limited

- Joshi Agrochem Pharma Private Limited

- Jiloca Industrial SA

- Other Key Players