Global Hemostasis Testing Systems Market By Product Type (Laboratory Analyzers, Consumables, and Point-of-Care Testing Systems), By Application (Hemophilia, Acquired Bleeding Disease, and von Willebrand Disease), By End-user (Hospitals, Diagnostic Laboratories, Academic Institutions, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169881

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

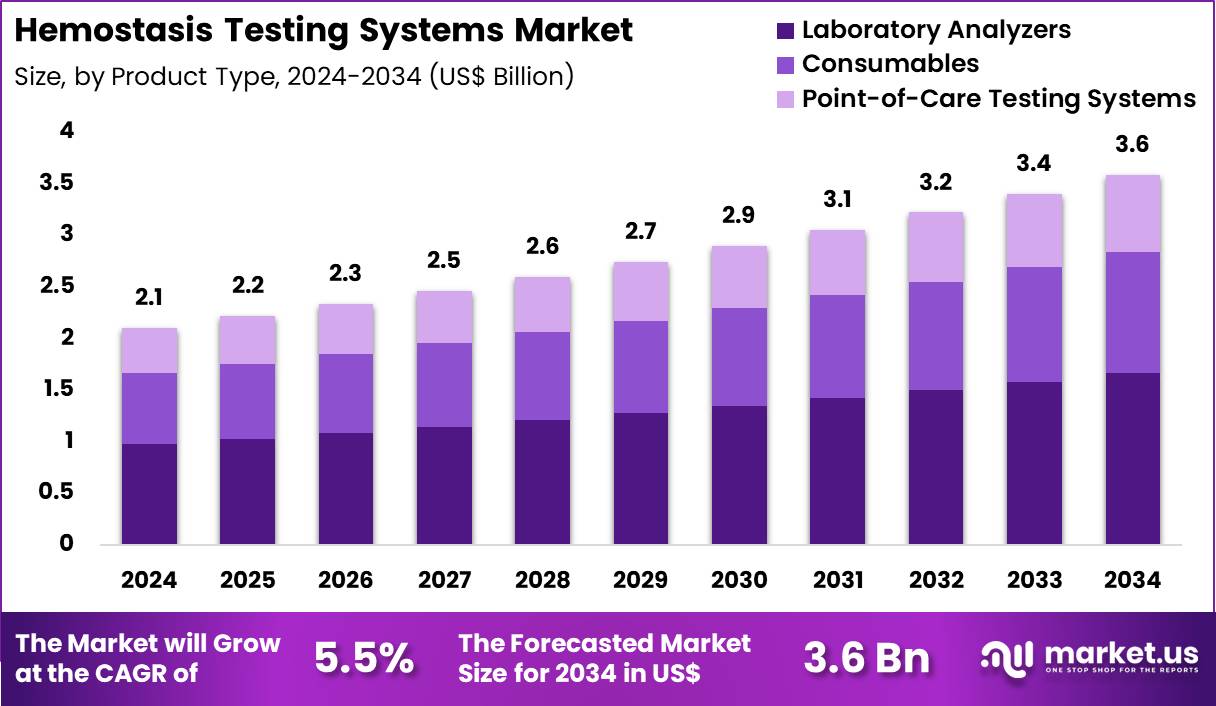

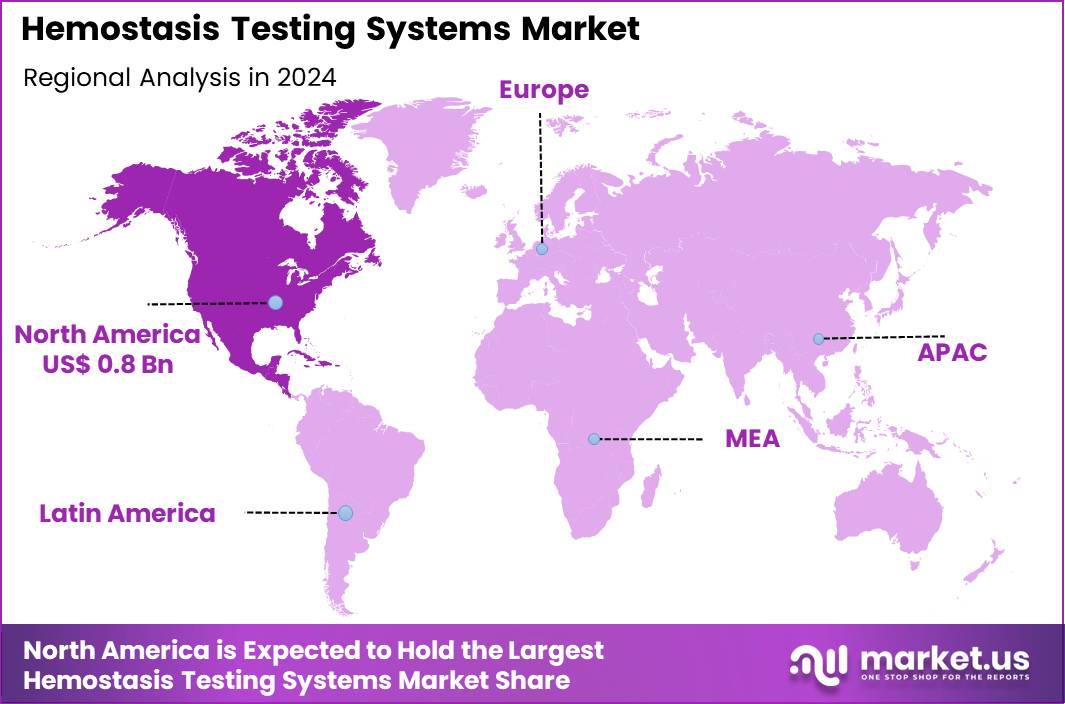

Global Hemostasis Testing Systems Market size is expected to be worth around US$ 3.6 Billion by 2034 from US$ 2.1 Billion in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.4% share with a revenue of US$ 0.8 Billion.

Increasing prevalence of cardiovascular procedures and anticoagulant therapy propels the Hemostasis Testing Systems market, as clinicians demand precise monitoring to balance bleeding and thrombotic risks effectively. Manufacturers integrate viscoelastic testing and chromogenic assays into automated platforms that deliver comprehensive coagulation profiles within minutes.

These systems enable perioperative bleeding management through thromboelastography in cardiac surgery, therapeutic drug monitoring for direct oral anticoagulants in atrial fibrillation patients, trauma-induced coagulopathy assessment via rapid clot formation kinetics, and lupus anticoagulant confirmation in recurrent miscarriage evaluations.

High-volume automation creates opportunities for centralized laboratories to consolidate prothrombin time, activated partial thromboplastin time, and specialty testing on single instruments. Siemens Healthineers launched the Atellica HEMA 570 and HEMA 580 analyzers in May 2023, introducing intelligent automation that streamlines workflows and accelerates result reporting for coagulation disorders. This advancement directly enhances throughput and diagnostic confidence in demanding clinical environments.

Growing adoption of point-of-care coagulation testing accelerates the Hemostasis Testing Systems market, as emergency departments and intensive care units deploy portable analyzers to guide immediate resuscitation and reversal decisions. Diagnostic firms engineer cartridge-based devices that quantify fibrinogen levels and platelet function from whole blood samples without centrifugation.

Applications encompass massive transfusion protocol activation in hemorrhagic shock, heparin resistance detection during cardiopulmonary bypass, von Willebrand disease screening via ristocetin cofactor activity, and disseminated intravascular coagulation scoring in sepsis management. Decentralized testing opens avenues for bedside decision-making and reduced transfusion-related complications. Healthcare networks increasingly incorporate these systems into stroke units for rapid antiplatelet therapy verification.

Rising integration of global normalized ratio self-monitoring invigorates the Hemostasis Testing Systems market, as patients on vitamin K antagonists perform frequent testing to maintain therapeutic ranges and minimize adverse events. Technology providers launch user-friendly devices with cloud connectivity that transmit results directly to anticoagulation clinics for dose adjustments. These solutions support warfarin management in mechanical heart valve recipients, pulmonary embolism prophylaxis optimization, deep vein thrombosis recurrence prevention, and stroke risk reduction in non-valvular atrial fibrillation.

Remote monitoring capabilities create opportunities for virtual clinic models and improved patient adherence through real-time feedback. Pharmaceutical developers actively seek these platforms for clinical trials evaluating novel reversal agents and extended-interval anticoagulants. This patient-centric approach transforms chronic anticoagulation care delivery.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.1 Billion, with a CAGR of 5.5%, and is expected to reach US$ 3.6 billion by the year 2034.

- The product type segment is divided into laboratory analyzers, consumables, point-of-care testing systems, with laboratory analyzers taking the lead in 2024 with a market share of 46.5%.

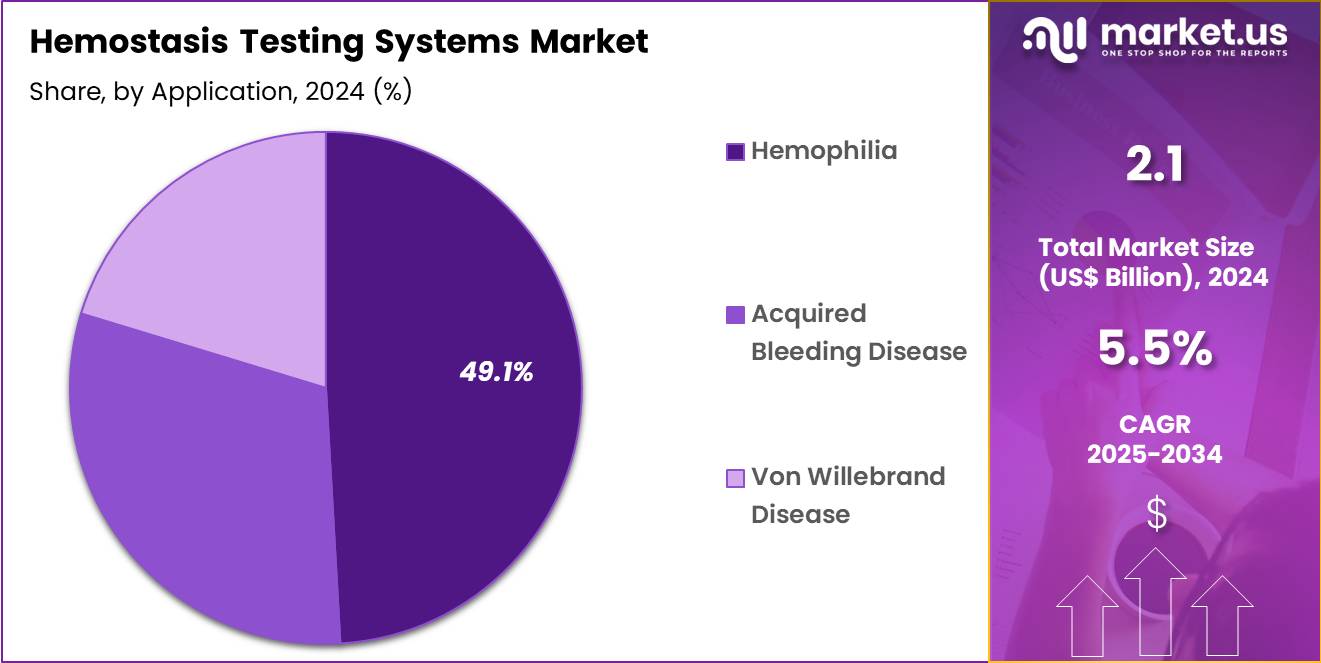

- Considering application, the market is divided into hemophilia, acquired bleeding disease, von willebrand disease. Among these, hemophilia held a significant share of 49.1%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic laboratories, academic institutions, others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 52.4% in the market.

- North America led the market by securing a market share of 37.4% in 2024.

Product Type Analysis

Laboratory analyzers, holding 46.5%, are expected to dominate because advanced coagulation platforms provide the high-throughput capabilities needed for routine and specialized hemostasis testing. Clinical laboratories depend on automated analyzers to measure PT, aPTT, fibrinogen, D-dimer, and factor assays with high accuracy. Growing global incidence of cardiovascular disorders, liver disease, and coagulation abnormalities increases test volumes. Manufacturers introduce analyzers with improved optical and mechanical clot-detection technologies, strengthening performance.

Hospitals expand centralized labs to handle rising patient loads, increasing analyzer installation. Automation reduces manual variability and enhances workflow efficiency. Emerging economies invest in modern coagulation systems to upgrade diagnostic infrastructure. Research programs studying coagulation factors also rely on analyzer-based measurements. These factors keep laboratory analyzers anticipated to remain the leading product type.

Application Analysis

Hemophilia, holding 49.1%, is anticipated to dominate application demand due to the lifelong requirement for continuous monitoring of clotting-factor activity. Patients with hemophilia A and B undergo regular factor assays to guide therapy adjustment and evaluate replacement or gene-therapy response. The growth of prophylactic treatment programs increases testing frequency. Specialized coagulation panels help clinicians detect inhibitors that reduce factor-therapy effectiveness.

Newer extended-half-life products and gene-therapy trials require detailed coagulation profiling, expanding test usage. Pediatric hemophilia centres conduct frequent monitoring to optimize early intervention. Global awareness programs promote early diagnosis, increasing screening. Improved access to hematology care in developing regions raises demand for reliable hemostasis testing. These drivers keep hemophilia projected to remain the most influential application segment.

End-User Analysis

Hospitals, holding 52.4%, are expected to dominate end-user adoption because they manage acute bleeding events, surgical procedures, and chronic coagulation disorders. Emergency departments rely on rapid coagulation testing to evaluate trauma, liver failure, and anticoagulant complications. Hospitals maintain comprehensive laboratories equipped with automated analyzers capable of high-volume processing. Multidisciplinary care teams, including hematologists and surgeons, depend on hemostasis tests to guide transfusion, factor replacement, and perioperative management.

Rising rates of major surgeries and invasive procedures strengthen hospital-based testing demand. Intensive-care units conduct frequent coagulation assessments for critically ill patients. Hospitals participate in advanced treatment programs for hemophilia and von Willebrand disease, increasing specialized test volumes. These factors keep hospitals anticipated to remain the dominant end-user segment in the hemostasis testing systems market.

Key Market Segments

By Product Type

- Laboratory Analyzers

- Consumables

- Point-of-Care Testing Systems

By Application

- Hemophilia

- Acquired Bleeding Disease

- von Willebrand Disease

By End-user

- Hospitals

- Diagnostic Laboratories

- Academic Institutions

- Others

Drivers

The Rising Incidence of Venous Thromboembolism Is Driving the Market

The rising incidence of venous thromboembolism represents a critical driver for the hemostasis testing systems market, as it necessitates frequent and accurate coagulation assessments to manage clotting risks effectively. Venous thromboembolism encompasses deep vein thrombosis and pulmonary embolism, conditions that disrupt normal blood flow and heighten the urgency for reliable diagnostic tools.

Healthcare providers increasingly rely on hemostasis analyzers to evaluate coagulation parameters like prothrombin time and activated partial thromboplastin time in at-risk patients. This surge in cases correlates with factors such as prolonged immobility, surgical interventions, and chronic illnesses, amplifying the demand for advanced testing platforms. According to the Centers for Disease Control and Prevention, up to 900,000 people in the United States are affected by venous thromboembolism each year.

Such prevalence underscores the essential role of hemostasis systems in enabling timely interventions that prevent complications like post-thrombotic syndrome. Hospitals and clinics are integrating these systems into routine protocols to monitor therapy efficacy and adjust anticoagulants precisely. The economic burden of untreated cases further incentivizes investment in efficient testing solutions to reduce readmissions and long-term care costs.

As awareness grows through public health campaigns, more individuals seek prophylactic evaluations, bolstering market expansion. Ultimately, this driver positions hemostasis testing as indispensable for improving patient outcomes in high-volume care settings.

Restraints

Inadequate Prophylaxis Implementation Is Restraining the Market

Inadequate implementation of prophylaxis measures serves as a significant restraint on the hemostasis testing systems market, as it perpetuates preventable clotting events and strains diagnostic resources unevenly. Despite established guidelines, many healthcare facilities struggle with consistent application of preventive strategies like anticoagulant administration or compression devices during high-risk periods. This gap results in higher-than-necessary testing volumes for confirmatory diagnostics rather than proactive monitoring, diverting focus from innovative advancements.

Variability in protocol adherence across institutions leads to inconsistent demand, complicating supply chain planning for testing reagents and analyzers. The Centers for Disease Control and Prevention reports that as many as 70% of healthcare-associated venous thromboembolism cases are preventable, yet fewer than half of hospital patients receive these measures. Such underutilization not only elevates morbidity rates but also fosters skepticism toward the cost-effectiveness of expanded testing infrastructure.

Resource-limited settings prioritize acute responses over preventive integration, slowing adoption of next-generation systems. Moreover, clinician training deficiencies contribute to hesitation in deploying comprehensive hemostasis panels routinely. These challenges hinder market penetration in ambulatory and community health environments. Addressing this restraint demands enhanced education and policy enforcement to optimize testing utilization.

Opportunities

Advancements in Point-of-Care Coagulation Analyzers Are Creating Growth Opportunities

Advancements in point-of-care coagulation analyzers offer substantial growth opportunities by facilitating rapid, bedside assessments that enhance clinical decision-making in diverse settings. These portable systems reduce turnaround times from hours to minutes, allowing immediate adjustments to anticoagulation therapies during surgeries or emergencies.

Integration of viscoelastic technologies, such as thrombelastography, provides comprehensive profiles of clot formation and lysis, surpassing traditional lab-based metrics. This capability is particularly valuable in trauma centers and intensive care units where dynamic hemostasis monitoring can avert excessive bleeding or thrombosis. Key players like Haemonetics have expanded portfolios with FDA-approved cartridges that support multi-parameter testing in whole blood samples.

Opportunities arise from partnerships between manufacturers and hospitals to standardize point-of-care protocols, potentially increasing throughput by integrating with electronic health records. Emerging markets in ambulatory surgery centers further amplify potential, as these analyzers minimize patient transfers and optimize workflows.

Regulatory endorsements validate their accuracy, with studies confirming equivalence to central lab results in 95% of cases. As reimbursement models evolve to favor efficient diagnostics, adoption rates could surge among outpatient providers. Collectively, these developments pave the way for broader accessibility and innovation in hemostasis management.

Impact of Macroeconomic / Geopolitical Factors

Economic growth and surging healthcare investments accelerate the hemostasis testing systems market, as clinicians deploy sophisticated diagnostics to tackle escalating coagulation disorders in aging populations worldwide. Inflation, however, surges raw material prices, which squeezes manufacturers’ margins and prompts price hikes that hinder accessibility in resource-limited healthcare facilities.

Geopolitical conflicts, including U.S.-China trade skirmishes, rupture supply chains for vital components sourced from Asia, which delays equipment deliveries and inflates shipping costs for international distributors. These same conflicts, on the flip side, compel regional authorities in Europe and Asia-Pacific to invest in homegrown manufacturing, which sparks technological breakthroughs and reduces reliance on volatile global networks.

The U.S. tariffs effective in 2025 impose a 10% baseline duty on imported medical devices, escalating to 54% for Chinese-origin hemostasis systems, which burdens smaller suppliers and elevates operational expenses for domestic labs. Yet, these tariffs motivate U.S. firms to localize production, which creates jobs and enhances supply stability against external shocks. Despite such challenges, the market’s strong growth at a 5.4% CAGR through 2035 underscores its vitality. In the final analysis, robust patient needs and innovative advancements drive the hemostasis testing systems sector toward expansive opportunities and reliable global delivery.

Latest Trends

The FDA Clearance of the TEG 6s Hemostasis Analyzer in 2024 Is a Recent Trend

The FDA clearance of the TEG 6s Hemostasis Analyzer by Haemonetics Corporation in 2024 exemplifies a pivotal trend toward cartridge-based viscoelastic testing for real-time coagulation guidance. This approval, granted on March 29, 2024, introduces the Global Hemostasis-HN assay cartridge, designed for citrated whole blood analysis in perioperative settings. The system measures key parameters including reaction time, clot kinetics, and maximum amplitude, aiding in transfusion decisions during cardiovascular procedures.

Its drug-insensitive optical detection method ensures reliability across patient populations, reducing interferences common in older technologies. This innovation aligns with the growing emphasis on personalized hemostasis management, particularly in high-bleeding-risk surgeries where timely data can decrease blood product usage by up to 30%. Haemonetics reported enhanced workflow efficiency, with the analyzer processing samples in under 10 minutes per test.

The clearance builds on prior viscoelastic platforms, incorporating user-friendly interfaces for broader clinician adoption. Market response has been positive, with initial deployments in major U.S. hospitals demonstrating reduced variability in test results. This trend signals a shift toward automated, point-of-care solutions that integrate seamlessly into operating rooms. As similar approvals proliferate, it fosters competition and further refines diagnostic precision. In summary, the TEG 6s advancement underscores 2024’s focus on actionable, technology-driven hemostasis insights.

Regional Analysis

North America is leading the Hemostasis Testing Systems Market

North America accounted for 37.4% of the overall market in 2024, and the region saw strong growth as hospitals expanded coagulation-testing capacity to manage rising surgical volumes, cardiovascular procedures, and anticoagulation therapy monitoring. Emergency departments increased reliance on rapid PT/INR, aPTT, fibrinogen, and D-dimer testing to support timely clinical decisions for trauma and thrombotic events.

Laboratories upgraded fully automated hemostasis analyzers to improve throughput and reduce turnaround times across high-acuity settings. Growth also accelerated as cancer centers and dialysis units broadened coagulation monitoring for complex patient populations.

The Centers for Disease Control and Prevention reported 900,000 venous thromboembolism (VTE) cases annually in the United States (CDC – “Venous Thromboembolism (Blood Clots)” 2023), and this substantial clinical burden significantly increased demand for precise coagulation testing. Diagnostic manufacturers introduced high-sensitivity reagents and point-of-care devices that enhanced accessibility. These developments collectively strengthened North America’s market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record strong growth during the forecast period as regional hospitals increase screening for clotting disorders amid rising cardiovascular disease, cancer prevalence, and surgical interventions. Clinical laboratories invest in modern coagulation analyzers to meet growing test volumes driven by larger patient inflows in urban medical centers.

Governments enhance stroke-prevention and anticoagulation-therapy programs, boosting demand for precise coagulation monitoring. Private diagnostic networks expand decentralized testing services across India, China, Japan, and Southeast Asia, improving accessibility for rural populations. Medical universities intensify research focused on thrombosis and hematologic conditions, increasing the need for advanced hemostasis platforms.

The National Health Commission of China reported 4.56 million new stroke cases in 2022 (China NHC – “China Stroke Prevention Report 2022”), underscoring the region’s escalating requirement for coagulation testing. Manufacturers strengthen regional reagent and analyzer distribution. These factors collectively position Asia Pacific for sustained market growth over the forecast horizon.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major vendors drive growth by launching fully automated coagulation analyzers along with reagent-rental packages that reduce processing time and lower upfront costs for laboratories, prompting adoption across hospital networks. They extend their footprint in emerging regions through distribution agreements coupled with comprehensive technical training and maintenance support for diagnostic centers that lack advanced lab infrastructure.

They broaden their product range by integrating platelet-function assays, thromboelastography and D-dimer tests into unified platforms, enabling laboratories to manage multiple haemostasis markers with a single instrument. They reinforce clinical confidence by publishing real-world performance data and ensuring their new assays align with international diagnostic guidelines to support accurate haemostasis management. They speed up innovation by acquiring niche reagent suppliers or investing in point-of-care companies that deliver rapid clotting tests tailored for outpatient clinics and surgical suites.

One major player, Sysmex Corporation, designs and markets a wide array of coagulation and hematology analyzers, operates manufacturing and service facilities globally, and leverages its diverse diagnostics portfolio, global sales infrastructure and reagent supply network to deliver haemostasis testing solutions to hospitals and reference labs worldwide, solidifying its leadership position in the market.

Top Key Players

- F. Hoffmann‑La Roche Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

- Abbott Laboratories

- Danaher Corporation

- Helena Laboratories Corporation

- HORIBA Ltd.

- Medtronic Plc

Recent Developments

- In March 2025, Werfen began commercial distribution of the ACL TOP Family 70 Series in North America after receiving 510(k) clearance from the FDA. These systems are built for large hospital and reference labs that require fast, dependable coagulation testing, offering high-throughput performance and consistent analytical quality.

- In March 2024, Trivitron Healthcare introduced a new portfolio of coagulation analyzers produced in collaboration with Diagon Ltd. The lineup spans fully automated instruments, semi-automated models, and point-of-care options, allowing healthcare providers to perform coagulation testing in a range of clinical environments.

Report Scope

Report Features Description Market Value (2024) US$ 2.1 Billion Forecast Revenue (2034) US$ 3.6 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Laboratory Analyzers, Consumables, and Point-of-Care Testing Systems), By Application (Hemophilia, Acquired Bleeding Disease, and von Willebrand Disease), By End-user (Hospitals, Diagnostic Laboratories, Academic Institutions, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape F. Hoffmann‑La Roche Ltd., Siemens Healthineers AG, Sysmex Corporation, Abbott Laboratories, Danaher Corporation, Helena Laboratories Corporation, HORIBA Ltd., Medtronic Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hemostasis Testing Systems MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Hemostasis Testing Systems MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- F. Hoffmann‑La Roche Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

- Abbott Laboratories

- Danaher Corporation

- Helena Laboratories Corporation

- HORIBA Ltd.

- Medtronic Plc