Global Galactooligosaccharides Market By Source (Plants, Animals, Microorganisms), By Form (Liquid, Powder), By Function Type ( Prebiotic, Sweetener), By Application (Food and Beverage, Dietary Supplements) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150565

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

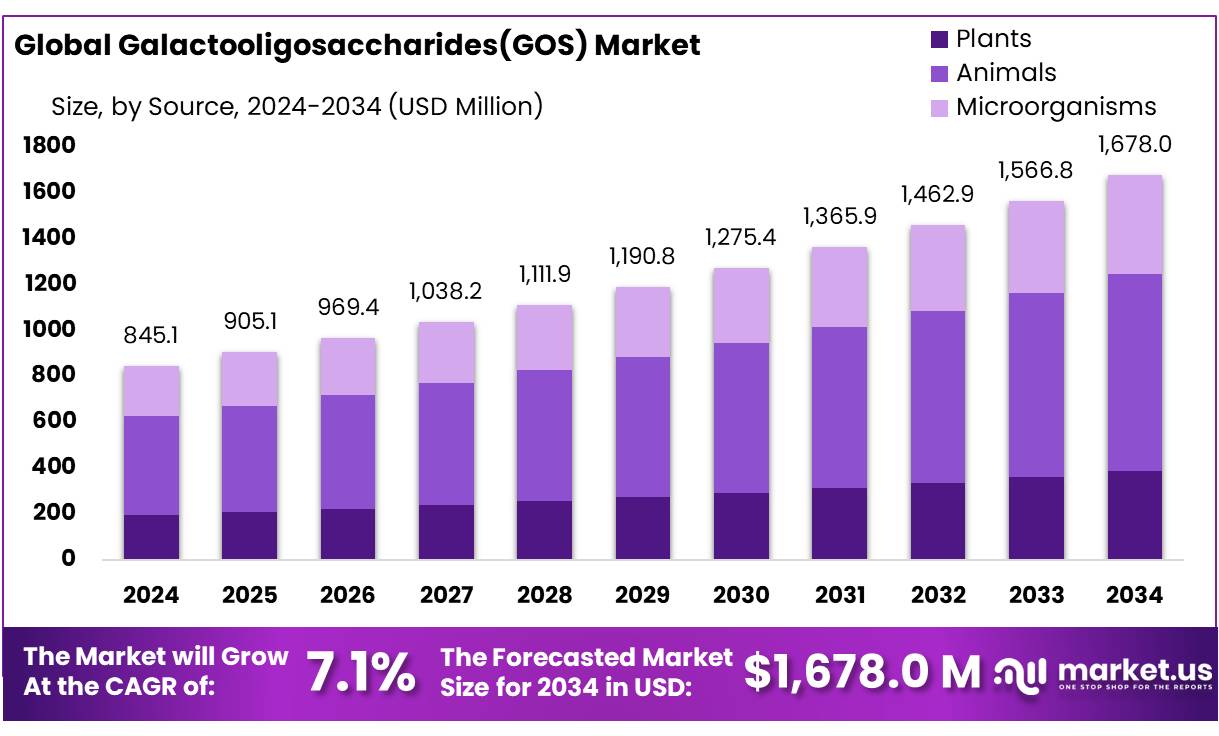

The Global Galactooligosaccharides Market size is expected to be worth around USD 1678.0 Million by 2034, from USD 845.1 Million in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

The galactooligosaccharides (GOS) market has experienced pronounced expansion in recent years, driven by increasing recognition of its health benefits. As a naturally derived prebiotic obtained via enzymatic conversion of lactose, GOS promotes the growth of beneficial gut microbiota such as bifidobacteria and lactobacilli, which contributes to digestive health, immune modulation, and potential reduction of atopic dermatitis in infants.

The U.S. Food and Drug Administration (FDA) has affirmed GOS as Generally Recognized As Safe (GRAS), citing no observed adverse effect levels (NOAEL) up to 2,000 mg/kg/day in toxicology studies and confirming its well tolerated profile in both infants and adults. In the UK, the Food Standards Agency’s recent assessment reaffirms GOS as a non digestible prebiotic fiber produced through enzymatic conversion of milk lactose.

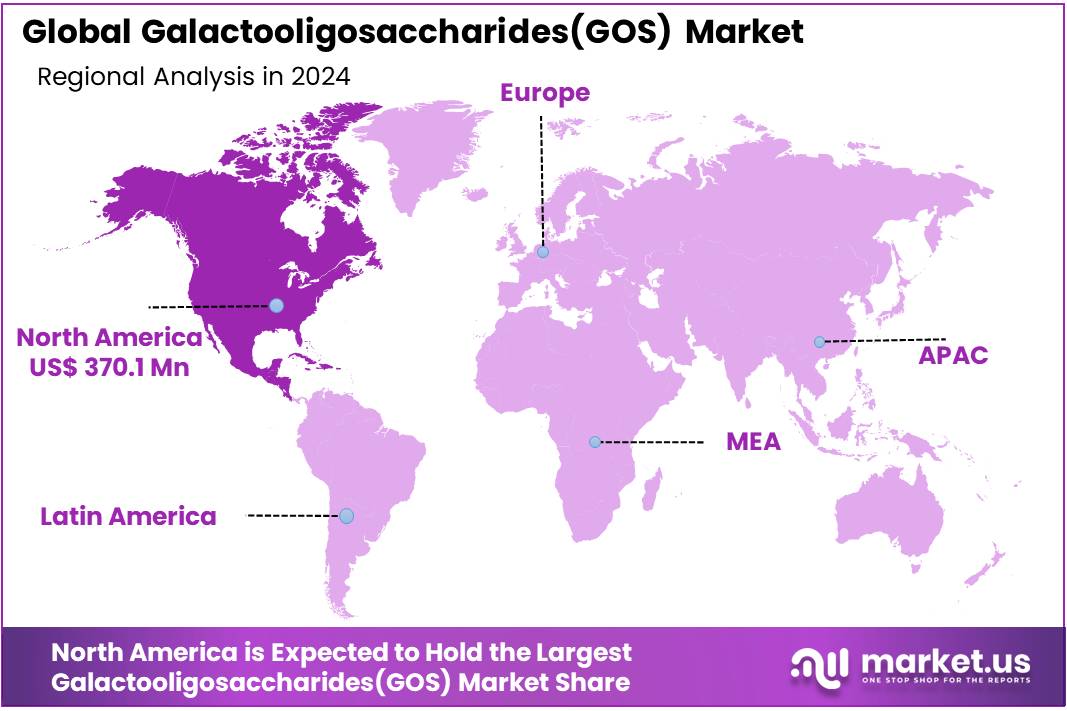

Production capacity is concentrated in regions with robust dairy infrastructure and enzyme manufacturing capabilities—North America, Europe, and Asia Pacific. In 2025, North America is estimated to hold approximately 30% of the global GOS market (USD 0.29–0.39 billion), followed by Europe (~28%) and APAC (~23.5%). GOS concentrates are increasingly integrated into infant nutrition, dietary supplements, animal feed, and pharmaceuticals, driven by regulatory approvals and application versatility.

Key driving factors Rising consumer awareness around gut health—over 60% of global consumers value gut health foods—has propelled demand for prebiotic fibers such as GOS. Additionally, government or regulatory endorsements (e.g., FDA GRAS status, UK’s Food Standards Agency approving increased use in supplements) support safe inclusion in food systems. Increased incidence of premature births—7.9% in England and Wales in 2022—further underscores the importance of prebiotic supplementation in infant nutrition.

Key Takeaways

- Galactooligosaccharides Market size is expected to be worth around USD 1678.0 Million by 2034, from USD 845.1 Million in 2024, growing at a CAGR of 7.1%.

- Animals held a dominant market position, capturing more than a 51.3% share of the global Galactooligosaccharides (GOS) market.

- Powder held a dominant market position, capturing more than a 67.4% share of the global Galactooligosaccharides (GOS) market.

- Prebiotic held a dominant market position, capturing more than a 73.1% share of the global Galactooligosaccharides (GOS) market.

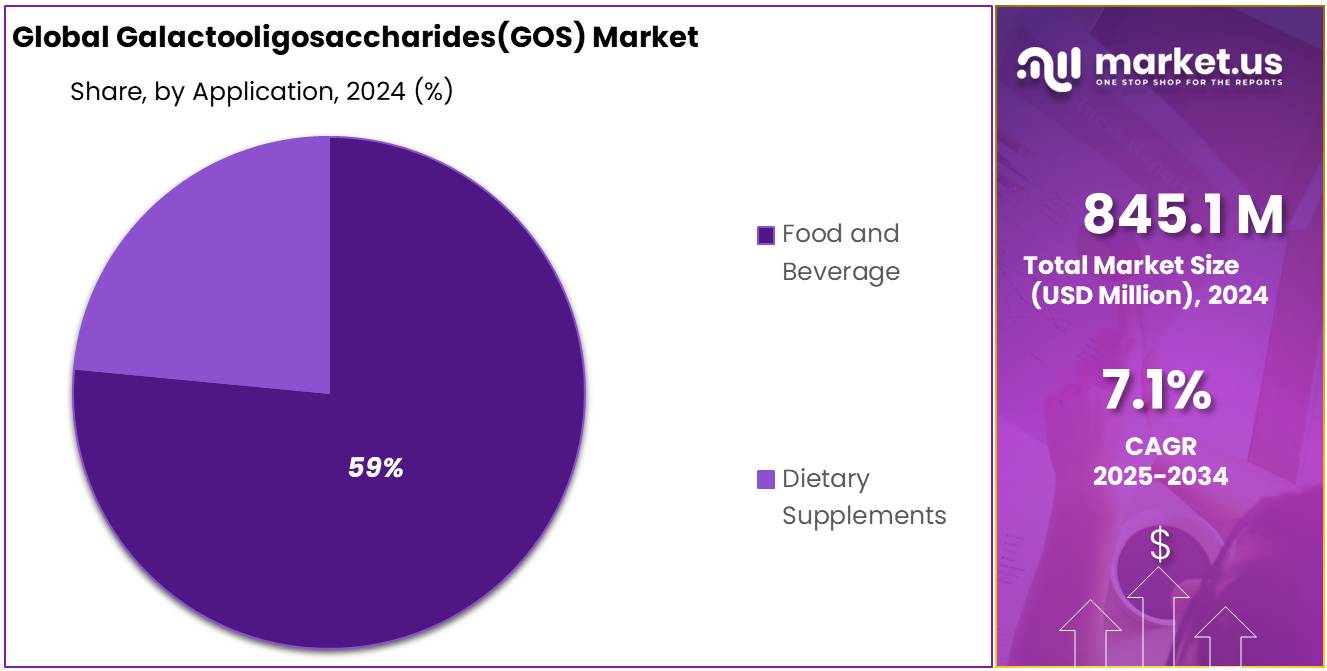

- Food and beverage held a dominant market position, capturing more than a 59.5% share of the global Galactooligosaccharides (GOS) market.

- North America emerged as the leading regional market for Galactooligosaccharides (GOS), capturing approximately 43.8% of the global market and driving revenues of about USD 370.1 million.

By Source

Animal-Based GOS dominates with 51.3% in 2024 driven by high lactose content in dairy sources and established processing technologies.

In 2024, animals held a dominant market position, capturing more than a 51.3% share of the global Galactooligosaccharides (GOS) market. This strong lead is mainly due to the widespread use of cow’s milk-derived lactose, which serves as the primary substrate for enzymatic production of GOS. Animal sources, particularly bovine dairy, remain the most accessible and cost-efficient input for GOS manufacturing due to their rich lactose content and consistent quality.

The established infrastructure for dairy collection and processing, especially across North America and Europe, has further solidified the leadership of animal-based GOS production in the market. In terms of value, animal-derived GOS products continued to outperform plant or synthetic alternatives in both volume and application diversity throughout 2024 and into early 2025, maintaining their popularity across infant nutrition, dietary supplements, and functional food formulations.

By Form

Powder Form leads with 67.4% in 2024 owing to its longer shelf life and easy integration in food applications.

In 2024, powder held a dominant market position, capturing more than a 67.4% share of the global Galactooligosaccharides (GOS) market. This leadership is mainly attributed to its stability, longer shelf life, and ease of transportation and storage compared to liquid forms. Powder GOS is widely used in infant formula, nutritional supplements, and dairy-based products where precise dosing and dry blending are preferred.

Manufacturers also favor the powder format because it retains functionality over longer periods and simplifies logistics for global trade. Throughout 2024 and into early 2025, demand for powdered GOS has remained strong, especially in regions with active food processing sectors such as Europe and Asia-Pacific, supporting its continued dominance in both volume and revenue.

By Function Type

Prebiotic Function tops with 73.1% in 2024, backed by rising gut health awareness and use in infant nutrition.

In 2024, prebiotic held a dominant market position, capturing more than a 73.1% share of the global Galactooligosaccharides (GOS) market. This strong performance is largely due to growing consumer awareness around digestive wellness and the important role of prebiotics in supporting beneficial gut bacteria. GOS, when used as a prebiotic, enhances the growth of bifidobacteria and lactobacilli—crucial for maintaining a healthy gut microbiome.

Its widespread inclusion in infant formulas, functional foods, and dietary supplements has driven consistent demand. Particularly in 2024 and early 2025, the surge in demand for clean-label, gut-friendly products in both developed and emerging economies has reinforced the prebiotic function as the core driver of GOS applications across the food and healthcare sectors.

By Application

Food and Beverage dominates with 59.5% in 2024 due to high demand for functional ingredients in daily diets.

In 2024, food and beverage held a dominant market position, capturing more than a 59.5% share of the global Galactooligosaccharides (GOS) market. This strong lead is mainly because GOS is increasingly being used in everyday food items like dairy products, baked goods, and health drinks to support gut health. As consumers continue to look for foods that offer both taste and wellness, GOS has become a preferred ingredient in functional formulations.

Its ability to blend easily with various food matrices without affecting taste or texture has made it a go-to additive for manufacturers. Throughout 2024 and into 2025, the trend of fortifying foods with prebiotics has grown stronger across regions like North America, Europe, and Asia, further pushing food and beverage applications to the forefront of GOS consumption.

Key Market Segments

By Source

- Plants

- Animals

- Microorganisms

By Form

- Liquid

- Powder

By Function Type

- Prebiotic

- Sweetener

By Application

- Food and Beverage

- Dietary Supplements

Drivers

Rising Consumer Focus on Digestive Health Fuels GOS Market Growth

A key driving force behind the expansion of the Galactooligosaccharides (GOS) market is the heightened public attention to gut health and its connection to overall wellness. In the United States, research has shown that approximately 61% of consumers are concerned about maintaining digestive health, and 43% actively seek products that improve gut function. This consumer insight underscores a growing demand for ingredients that support microbial balance and digestive function—attributes strongly associated with GOS.

Galactooligosaccharides act as selective substrates for beneficial gut bacteria such as Bifidobacteria and Lactobacilli. Scientific studies continue to validate these effects, with one recent investigation demonstrating that GOS supplementation significantly enhances bifidobacteria populations and may alleviate symptoms of lactose intolerance . These findings contribute to the credibility of health claims and strengthen manufacturers’ motivations to include GOS in a variety of products.

Government dietary bodies have also contributed to this momentum. The USDA and HHS Dietary Guidelines for Americans (2020–2025) emphasize the inclusion of prebiotic fibers as part of a healthy dietary pattern. Furthermore, USDA programs such as “MyPlate” actively promote fiber-rich foods and prebiotic components across diverse populations . This regulatory support fosters an environment in which food producers feel confident in formulating new offerings that leverage gut-health messaging.

Restraints

Occasional Digestive Discomfort Limits GOS Adoption

While Galactooligosaccharides (GOS) are valued for supporting gut health, one important barrier to their broader acceptance is the potential for gastrointestinal side effects when consumed in high amounts. Many people start using prebiotic fibers like GOS with optimism, but without a gradual introduction. This sudden increase can lead to bloating, gas, abdominal cramps, and in some cases diarrhea or constipation.

Medical sources, including WebMD, indicate that GOS is likely safe when consumed in doses under 20 grams per day, but higher intake levels may trigger flatulence, stomach cramps, or diarrhea. While these symptoms are typically mild, they can dissuade consumers from adopting larger doses or using products with significant GOS content.

A lack of clear consumption guidelines further hampers market confidence. Although clinical studies often employ daily intake levels of 4–5 grams of prebiotic fibers (including GOS), formal dietary recommendations for GOS are not yet established by authoritative bodies. Without clear benchmarks, both manufacturers and consumers are left uncertain, which may slow innovation in higher-dose applications or broader fortification strategies.

From a regulatory standpoint, bodies such as the European Food Safety Authority (EFSA) accept GOS as a dietary fiber ingredient but do not allow it to be marketed with specific “prebiotic” health claims under EU rules. This cautious label environment limits the ability to communicate benefits directly, reducing consumer awareness and demand in regions like the EU.

Opportunity

Expansion in Infant Formula Fortification with GOS

One of the most significant opportunities for Galactooligosaccharides (GOS) lies in its expansion within the infant formula market. As breast milk remains the gold standard, infant formulas enriched with prebiotics like GOS are increasingly viewed as beneficial replacements when breastfeeding is not possible. Studies have demonstrated that even low levels of GOS—around 0.24 g per 100 mL of formula—can help soften stool consistency and promote digestive outcomes similar to those observed in breastfed infants

A systematic review analyzed 18 trials involving 1,675 infants, finding that formulas supplemented with a 9:1 ratio of short-chain GOS to long-chain FOS were well tolerated and improved gut health and immunity in healthy infants and toddlers. This growing body of research lends credibility to using GOS in infant nutrition, especially as parents and healthcare providers seek functional ingredients with proven benefits.

Government interventions are amplifying this opportunity. In May 2025, the U.S. FDA and Department of Health and Human Services launched “Operation Stork Speed”, a comprehensive initiative to revise nutrient guidelines for infant formulas—the first such effort since 1998. This initiative includes requests for public input on potential new nutrients and ingredient thresholds. With its known safety profile and documented health benefits, GOS is well-positioned to become part of updated regulatory standards.

Trends

Growing Clean-Label and Prebiotic Food Launch Trend

One of the most significant recent trends in the Galactooligosaccharides (GOS) market is the surge in clean-label food launches featuring prebiotic ingredients. In 2023, nearly 25% of new food products incorporated prebiotic components, reflecting a growing consumer preference for simple, transparent ingredient lists and gut-health functionality. This momentum has extended into 2024 and 2025, suggesting GOS is poised to play an even larger role in functional food innovation.

Consumers today increasingly seek natural, recognizable, and beneficial ingredients. A recent industry survey found that around 70% of global consumers now acknowledge the importance of dietary fiber—such as prebiotics like GOS—for promoting digestion and overall well-being . Manufacturers are responding by formulating products that are not only guilt-free but also demonstrably health-supportive.

Supporting this trend, regulatory bodies have expanded requirements for front-of-pack (FOP) nutrition labels. Leading examples include Nutri‑Score in Europe and traffic-light systems in Mexico and Chile, which make fiber content a visible consideration in purchasing decisions. As governments mandate clearer labeling, food producers are incentivized to include higher fiber content, framing GOS as both a functional and strategic ingredient.

Regional Analysis

North America dominates with 43.8% in 2024, generating USD 370.1 million in GOS revenue

In 2024, North America emerged as the leading regional market for Galactooligosaccharides (GOS), capturing approximately 43.8% of the global market and driving revenues of about USD 370.1 million. This dominance reflects the region’s health-focused consumer base and mature food processing infrastructure.

Regulatory endorsement played an essential role. Both the U.S. Food and Drug Administration and Health Canada have recognized GOS as safe for use in food and beverages, including infant formula, under established dietary fiber classifications. Coupled with dietary guidelines that encourage increased fiber and prebiotic intake, these conditions have encouraged manufacturers to adopt GOS across a wide range of formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Clasado is the developer of Bimuno® GOS, a scientifically validated prebiotic ingredient supported by over 120 publications and 20+ clinical trials. With health claims approved in the EU, UK, and Health Canada, Bimuno® stands out for its low effective dosage (as little as 380 mg) and targeted bifidogenic impact. Clasado focuses on delivering stable, versatile formats (syrups and powders), positioning Bimuno® for use in synbiotics, supplements, and functional foods.

Danone employs GOS as part of its patented scGOS/lcFOS (9:1) blend, extensively researched and included in over 40 clinical studies and 75 scientific papers. This blend features prominently in its early-life nutrition portfolio, including Aptamil formulas containing both GOS/FOS and HMOs, aiming to mimic breast milk benefits. Danone’s global R&D network and regulatory dialogue ensure rigorous evidence backing its functional ingredients in infant, clinical, and general nutrition products.

DuPont drives innovation through technologies like Nurica™, which enzymatically transforms lactose into GOS during dairy processing, achieving up to a 35% sugar reduction. Its enzyme systems and ion-exchange resins support both GOS production and sugar-cutting in dairy matrices. By integrating GOS generation directly in dairy manufacturing, DuPont enables producers to deliver prebiotic-enhanced, lower-sugar products at scale—aligning with consumer demand for reduced-sugar, health-conscious choices.

Top Key Players in the Market

- Abbott Laboratories

- BeneoOrafti

- Clasado

- Danone

- DuPont de Nemours, Inc.

- FrieslandCampina Ingredients

- Ingredion Incorporated

- Kerry Group plc

- Mead Johnson Nutrition

- Tate Lyle

- VITALUS NUTRITION INC

- Yakult Honsha Co., Ltd.

Recent Developments

In 2024, Abbott’s Pedialyte AdvancedCare® formula included 3.2 g of GOS per liter to support electrolyte balance and gut health in children.

In 2024, Danone continued its leadership in the Galactooligosaccharides (GOS) market, particularly through its early-life nutrition brands. The company’s unique blend—scGOS/lcFOS in a 9:1 ratio—was featured in infant formulas that were the subject of at least 18 clinical studies involving 1,675.

Report Scope

Report Features Description Market Value (2024) USD 845.1 Mn Forecast Revenue (2034) USD 1678.0 Mn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plants, Animals, Microorganisms), By Form (Liquid, Powder), By Function Type (Prebiotic, Sweetener), By Application (Food and Beverage, Dietary Supplements) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abbott Laboratories, BeneoOrafti, Clasado, Danone, DuPont de Nemours, Inc., FrieslandCampina Ingredients, Ingredion Incorporated, Kerry Group plc, Mead Johnson Nutrition, Tate Lyle, VITALUS NUTRITION INC, Yakult Honsha Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Galactooligosaccharides(GOS) MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Galactooligosaccharides(GOS) MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- BeneoOrafti

- Clasado

- Danone

- DuPont de Nemours, Inc.

- FrieslandCampina Ingredients

- Ingredion Incorporated

- Kerry Group plc

- Mead Johnson Nutrition

- Tate Lyle

- VITALUS NUTRITION INC

- Yakult Honsha Co., Ltd.