Global Fungicides Market Size, Share, And Business Benefits By Product (Triazoles and Diazoles, Inorganics, Benzimidazoles, Dithiocarbamtes, Biofungicides, Others), By Mode Of Action (Multi-Site Inhibitors (Chloronitriles, Dithiocarbamates), Single-Site Inhibitors (Strobilurins, Triazoles)), By Application (Foliar Treatment, Chemigation, Seed Treatment, Others), By Crop Type (Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155196

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

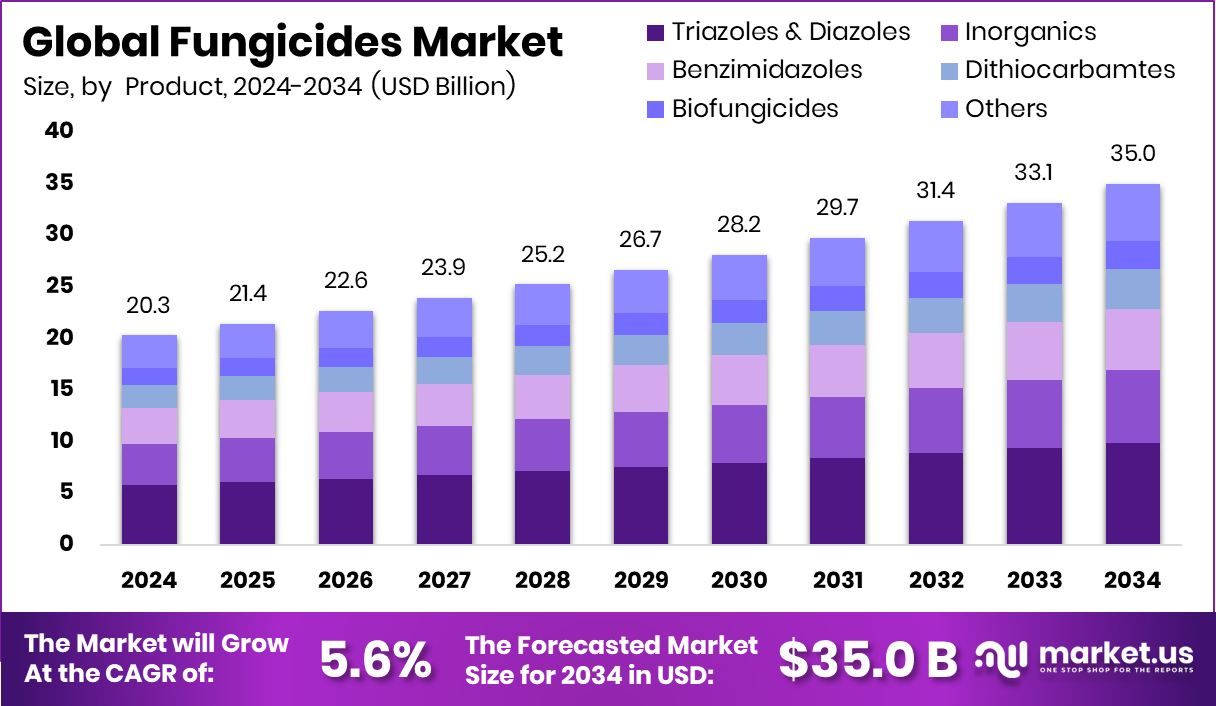

The Global Fungicides Market is expected to be worth around USD 35.0 billion by 2034, up from USD 20.3 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034. Strong agriculture sector drives Asia Pacific’s 43.80% fungicide demand growth.

Fungicides are chemical or biological substances used to prevent, kill, or inhibit the growth of fungi and fungal spores that cause plant diseases. These diseases, such as rusts, mildews, and blights, can severely damage crops, reduce yields, and affect quality. Fungicides are applied in agriculture, horticulture, and forestry to protect plants at different growth stages, ensuring healthy production and food security. Recently, BioPrime secured $6 million to create advanced bio-fungicides and bio-insecticides, signaling growing investment in sustainable fungal control solutions.

The fungicides market refers to the global industry involved in manufacturing, distributing, and using fungicidal products for crop protection and plant health management. It covers a wide range of product types, including synthetic and bio-based solutions, catering to different farming practices and environmental regulations. This market plays a critical role in supporting sustainable agricultural productivity. In line with this, Exeter launched a global research initiative, providing £1.7 million for antifungal resistance innovation, reinforcing the industry’s focus on long-term effectiveness.

Rising global food demand, driven by population growth, is pushing farmers to maximize yields, increasing the need for effective fungal control. Climate change, leading to unpredictable weather patterns, has also intensified fungal outbreaks, further boosting fungicide adoption. A $4.75 million grant is supporting research on combating fungicide resistance in the upcoming growing season, reflecting the urgency of addressing emerging challenges.

Demand is steadily increasing due to the expansion of commercial agriculture and higher awareness among farmers about plant disease management. The shift towards high-value crops like fruits and vegetables is also driving fungicide usage.

Key Takeaways

- The Global Fungicides Market is expected to be worth around USD 35.0 billion by 2034, up from USD 20.3 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- In 2024, Triazoles & Diazoles held a 28.3% share, reflecting strong adoption in the fungicides market.

- Single-Site Inhibitors accounted for 68.1% of the Fungicides Market, highlighting their dominance in disease control efficiency.

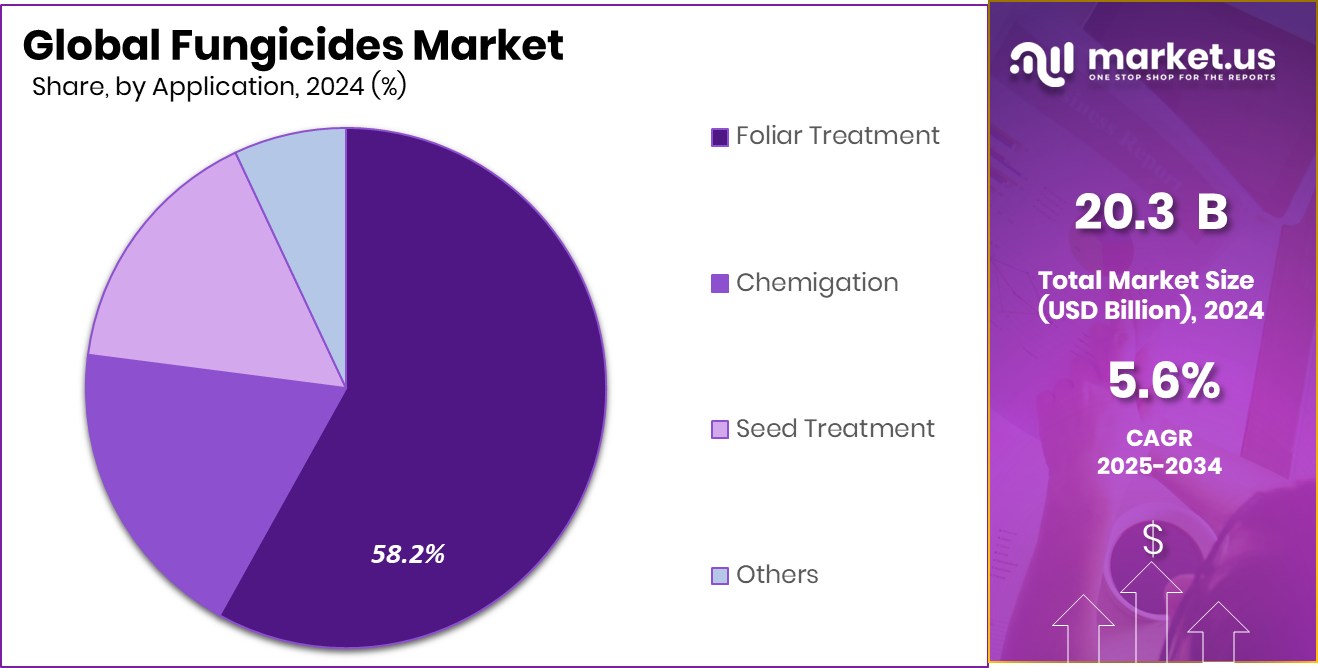

- Foliar treatment captured 58.2% share of the Fungicides Market, showing its wide preference for crop disease management.

- Fruits and Vegetables represented 36.8% of the Fungicides Market, driven by rising demand for high-quality produce.

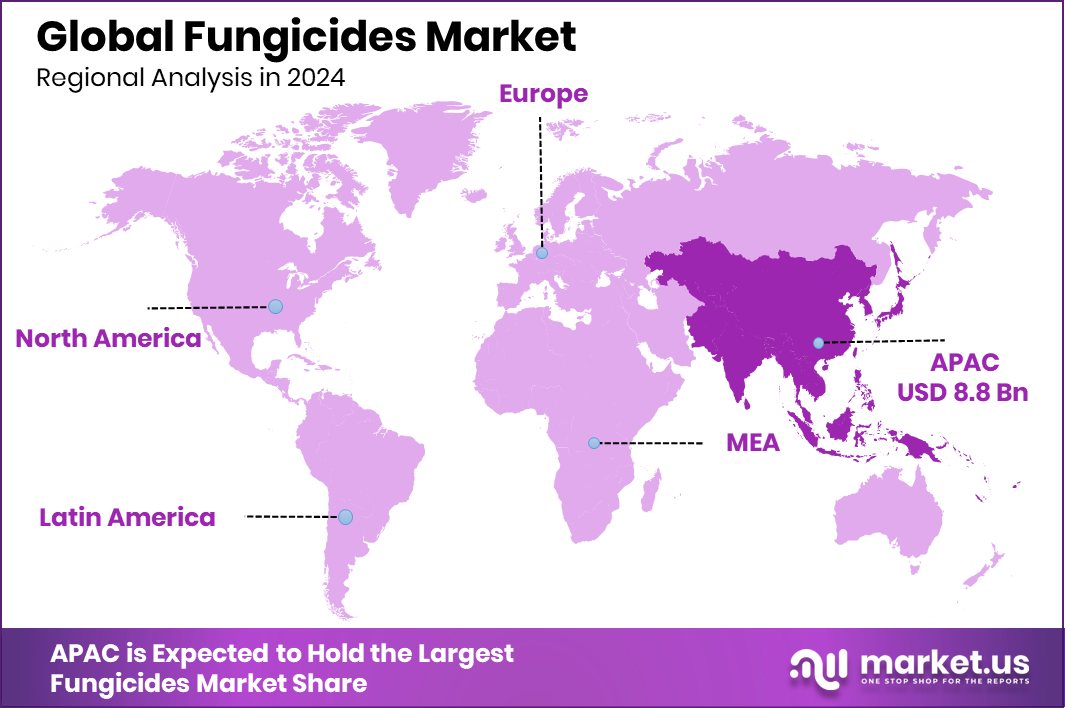

- The Asia Pacific fungicides market was valued at USD 8.8 Bn.

By Product Analysis

Triazoles & Diazoles hold a 28.3% share in the Fungicides Market.

In 2024, Triazoles and Diazoles held a dominant market position in the By Product segment of the Fungicides Market, with a 28.3% share. These compounds are widely recognized for their broad-spectrum activity and systemic action, making them highly effective in controlling a variety of fungal diseases across cereals, fruits, vegetables, and ornamental crops. Their ability to inhibit ergosterol biosynthesis in fungi ensures prolonged protection, which is especially important in regions facing persistent fungal pressures due to humid and fluctuating climates.

The strong adoption rate of Triazoles and Diazoles is also linked to their compatibility with integrated pest management programs, allowing farmers to combine them with other control methods for enhanced efficiency. Furthermore, ongoing advancements in formulation technology have improved their residual activity and rainfastness, enabling consistent performance even under adverse weather conditions.

Increasing awareness among growers about the economic losses caused by fungal infestations has also spurred demand, as these products help maintain crop quality and yield. With the agriculture sector focusing on sustainable disease control, regulatory approvals, and targeted application techniques are expected to further strengthen the role of Triazoles and Diazoles in the fungicides market, reinforcing their position as a preferred choice among modern farming communities.

By Mode Of Action Analysis

Single-Site Inhibitors dominate the Fungicides Market with 68.1% global share.

In 2024, Single-Site Inhibitors held a dominant market position in the By Mode of Action segment of the Fungicides Market, with a 68.1% share. These fungicides work by targeting specific biochemical pathways in fungi, delivering precise and highly effective control over a wide range of plant diseases. Their targeted mechanism reduces the risk of unintended effects on non-target organisms, making them a preferred choice for high-value crops such as fruits, vegetables, and specialty grains.

The strong market share is driven by their ability to provide rapid action, longer residual protection, and compatibility with modern precision farming practices. Farmers value Single-Site Inhibitors for their ability to control resistant fungal strains, an increasing concern in intensive agriculture. Additionally, advancements in formulation have improved application efficiency, enabling lower doses without compromising performance.

Regulatory support for targeted, low-toxicity solutions has further encouraged adoption, especially in regions with strict pesticide use regulations. The growing emphasis on crop quality for both domestic consumption and export markets also underpins demand, as these inhibitors help maintain optimal yield and appearance. With rising investment in R&D to develop novel molecules and resistance management strategies, Single-Site Inhibitors are expected to sustain their leadership in the fungicides market in the coming years.

By Application Analysis

Foliar treatment accounts for 58.2% in the global fungicides market.

In 2024, Foliar Treatment held a dominant market position in the By Application segment of the Fungicides Market, with a 58.2% share. This method involves the direct application of fungicides onto the leaves, stems, and other aerial parts of plants, allowing for rapid absorption and immediate protection against fungal pathogens. Its dominance is largely attributed to its ability to provide targeted and uniform coverage, which ensures quick action against diseases like powdery mildew, rusts, and leaf spots.

Foliar treatments are especially valued in high-value horticultural crops, where disease outbreaks can cause significant economic losses and impact product quality. The growing adoption of advanced spraying technologies, such as drone-assisted and electrostatic spraying, has further enhanced the efficiency and precision of foliar applications, reducing wastage and improving cost-effectiveness. Farmers prefer foliar treatment for its versatility, as it can be used both as a preventive and curative measure, offering flexibility in disease management schedules.

The segment’s strong market share is also supported by favorable climatic conditions in key agricultural regions that make plants more susceptible to foliar diseases. With continuous innovation in formulation for better leaf adherence and rainfastness, foliar treatment is expected to retain its leading role in fungicide application methods.

By Crop Type Analysis

The fruits and Vegetables segment leads with 36.8% fungicides market share.

In 2024, Fruits and Vegetables held a dominant market position in the By Crop Type segment of the Fungicides Market, with a 36.8% share. This dominance is driven by the high susceptibility of these crops to fungal diseases such as blights, mildews, rusts, and anthracnose, which can cause severe yield losses and compromise quality. Since fruits and vegetables are often consumed fresh, maintaining their appearance, taste, and shelf life is crucial, making effective fungal control a top priority for growers.

The intensive cultivation practices and high market value of these crops justify the frequent and precise application of fungicides, ensuring both productivity and profitability. Increasing global demand for fresh produce, supported by rising health-conscious consumption trends, has further accelerated fungicide use in this category. Export-oriented production, particularly in regions with strict phytosanitary standards, also fuels the adoption of advanced fungicidal solutions to meet quality requirements.

Additionally, innovations in bio-fungicides and residue-free formulations are gaining traction among fruit and vegetable growers, aligning with the growing demand for sustainable and safe crop protection methods. With changing climate patterns increasing disease incidence, the need for reliable fungal control in fruits and vegetables is expected to keep this segment at the forefront of the fungicides market.

Key Market Segments

By Product

- Triazoles and Diazoles

- Inorganics

- Benzimidazoles

- Dithiocarbamtes

- Biofungicides

- Others

By Mode Of Action

- Multi-Site Inhibitors

- Chloronitriles

- Dithiocarbamates

- Single-Site Inhibitors

- Strobilurins

- Triazoles

By Application

- Foliar Treatment

- Chemigation

- Seed Treatment

- Others

By Crop Type

- Fruits and Vegetables

- Cereals and Grains

- Oilseeds and Pulses

- Others

Driving Factors

Rising Crop Diseases Driving Strong Fungicide Demand

One of the biggest driving factors for the fungicides market is the rising occurrence of crop diseases caused by fungi. Changes in climate, such as higher humidity and unpredictable rainfall, are creating favorable conditions for fungal growth, leading to more frequent and severe outbreaks. Crops like wheat, rice, fruits, and vegetables are especially at risk, and even a small infection can cause major yield losses and lower quality.

Farmers are increasingly using fungicides to protect their harvests and secure their income. This demand is further boosted by the global need for more food to feed a growing population. As a result, fungicides have become an essential tool in modern farming to ensure healthy crops and stable agricultural production.

Restraining Factors

Stringent Regulations Limiting Fungicide Usage and Growth

A key restraining factor for the fungicides market is the strict regulations on their production, sale, and use. Many countries have implemented tough rules to protect the environment, human health, and beneficial organisms from the harmful effects of certain chemical fungicides. These regulations often require long and costly approval processes for new products, making it challenging for manufacturers to introduce innovations quickly.

In some regions, older fungicides are being banned or restricted, reducing the available options for farmers. Additionally, strict residue limits on crops, especially for exports, force growers to follow precise application schedules, which can be difficult in changing weather conditions. These factors slow market growth and push the industry towards safer and more eco-friendly alternatives.

Growth Opportunity

Rising Demand for Eco-Friendly Bio-Fungicide Solutions

A major growth opportunity in the fungicides market lies in the increasing demand for eco-friendly bio-fungicides. These products are made from natural sources like beneficial bacteria, fungi, or plant extracts, making them safer for the environment, farmers, and consumers. With growing awareness about food safety and sustainability, many countries are promoting the use of bio-based crop protection methods through subsidies and supportive policies.

Bio-fungicides also help in managing resistance problems, as they work differently from conventional chemicals. Their popularity is rising, especially in organic farming and high-value crops like fruits and vegetables. As research and technology improve their effectiveness and shelf life, bio-fungicides are expected to capture a bigger share of the market in the coming years.

Latest Trends

Adoption of Precision Agriculture for Fungicide Application

One of the latest trends in the fungicides market is the growing adoption of precision agriculture for applying these products. Farmers are increasingly using advanced tools like drones, GPS-guided sprayers, and sensors to monitor crop health and detect fungal infections early. This technology allows fungicides to be applied only where and when needed, reducing waste, lowering costs, and minimizing environmental impact.

Precision application also helps in following strict residue regulations and improving crop quality for export markets. By combining real-time data with targeted spraying, farmers can control diseases more effectively while using smaller amounts of chemicals. This shift towards smarter, data-driven farming is making fungicide use more efficient, sustainable, and profitable for modern agriculture.

Regional Analysis

In 2024, the Asia Pacific captured 43.80% market share.

In 2024, Asia Pacific emerged as the dominant region in the global fungicides market, holding a 43.80% share valued at USD 8.8 billion. The region’s leadership is driven by its vast agricultural base, high dependence on crop protection chemicals, and diverse climatic conditions that favor the prevalence of fungal diseases. Countries such as China, India, and Japan are major consumers, with intensive cultivation of cereals, fruits, vegetables, and plantation crops requiring consistent fungicide applications to ensure yield and quality.

Rapid urbanization and rising income levels in the region are boosting demand for fresh, high-quality produce, further supporting fungicide use. Additionally, government initiatives promoting modern farming techniques and integrated pest management are improving adoption rates, particularly in emerging economies. Technological advancements, such as precision spraying and improved formulations, are also contributing to efficient and targeted fungicide usage.

While other regions such as North America, Europe, the Middle East & Africa, and Latin America contribute significantly to global demand, Asia Pacific’s combination of large-scale agricultural production and high disease pressure keeps it at the forefront. With ongoing investments in sustainable crop protection solutions and the rise of bio-fungicides, the region is expected to maintain its leading position in the fungicides market over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nufarm Ltd. focuses on providing a broad range of crop protection products, with fungicides playing a critical role in safeguarding high-value crops across diverse climates. The company’s commitment to formulation innovation and farmer-focused solutions strengthens its competitive edge.

FMC Corporation stands out with its investment in R&D for novel active ingredients, aiming to deliver targeted, sustainable solutions that address resistance management and regulatory demands. Its portfolio reflects a balance between synthetic and bio-based fungicides, aligning with market trends toward eco-friendly products.

BASF Agricultural Solutions maintains a strong global footprint, offering advanced fungicidal products backed by extensive field research and precision application support, enabling farmers to achieve consistent results even in challenging conditions. The company’s integration of digital farming tools further enhances fungicide efficiency.

Cheminova A/S, known for its cost-effective yet reliable crop protection range, continues to expand its fungicide offerings in both developed and emerging markets, catering to diverse agricultural practices. Collectively, these companies are focusing on product innovation, environmental safety, and application efficiency, which are key drivers in a market shaped by rising disease pressure, climate variability, and stricter regulations.

Top Key Players in the Market

- Nufarm Ltd.

- FMC Corporation

- BASF Agricultural Solutions

- Cheminova A/S

- Bayer CropScience

- Syngenta AG

- Lanxess AG

- Adama Agricultural Solutions

- Simonis B.V.

- Rallis

Recent Developments

- In July 2025, at Cultivate ’25 in Columbus, Ohio, Nufarm unveiled Ensemble™ fungicide, a new broad-spectrum protectant and systemic designed for first-response control of root, stem, and foliar diseases in various ornamental plants. This highlighted their continued innovation in greenhouse and nursery disease management.

- In November 2024, FMC completed the sale of its Global Specialty Solutions (GSS) business to Envu. While this segment mainly served non-crop markets like golf courses and pest control, its divestment allows FMC to concentrate fully on advancing its core crop protection technologies, including fungicides.

Report Scope

Report Features Description Market Value (2024) USD 20.3 Billion Forecast Revenue (2034) USD 35.0 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Triazoles and Diazoles, Inorganics, Benzimidazoles, Dithiocarbamtes, Biofungicides, Others), By Mode Of Action (Multi-Site Inhibitors (Chloronitriles, Dithiocarbamates), Single-Site Inhibitors (Strobilurins, Triazoles)), By Application (Foliar Treatment, Chemigation, Seed Treatment, Others), By Crop Type (Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nufarm Ltd., FMC Corporation, BASF Agricultural Solutions, Cheminova A/S, Bayer CropScience, Syngenta AG, Lanxess AG, Adama Agricultural Solutions, Simonis B.V., Rallis Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nufarm Ltd.

- FMC Corporation

- BASF Agricultural Solutions

- Cheminova A/S

- Bayer CropScience

- Syngenta AG

- Lanxess AG

- Adama Agricultural Solutions

- Simonis B.V.

- Rallis