Global Fertilizer Additives Market Size, Share, And Business Benefits By Form (Granular, Prilled, Powdered, Others), By Type (Dust Control Agent, Anticaking Agent, Antifoaming Agent, Hydrophobing Agent, Corrosion Inhibitor, Others), By Crop (Cereals and Grains, Oilseeds, Fruits and Vegetables, Turf and Omamentals, Others), By Application (Urea, Monoammonium Phosphate, Triple Super Phosphate, Diammonium Phosphate, Ammonium Nitrate, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155860

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

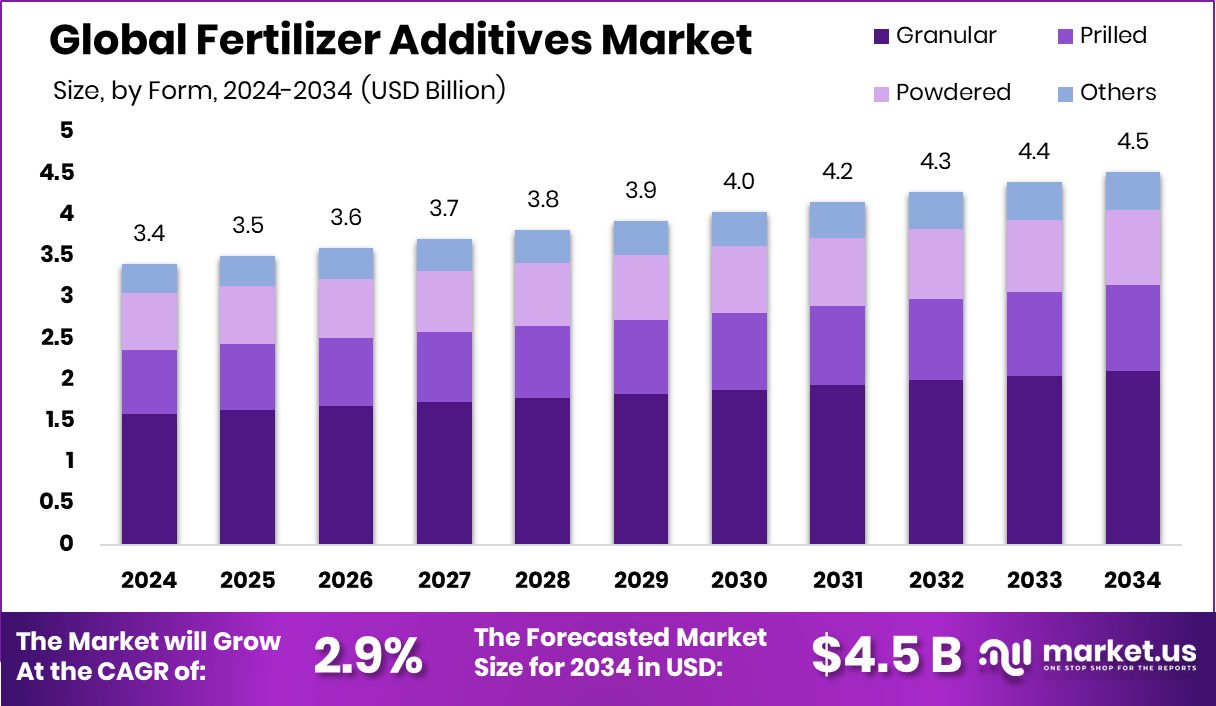

The Global Fertilizer Additives Market is expected to be worth around USD 4.5 billion by 2034, up from USD 3.4 billion in 2024, and is projected to grow at a CAGR of 2.9% from 2025 to 2034. Sustainable farming practices boosted the Asia Pacific Fertilizer Additives Market, securing a 57.20% share.

Fertilizer additives are chemical or biological substances that are blended with fertilizers to enhance their performance and efficiency. They play a key role in improving nutrient absorption, reducing losses caused by leaching or volatilization, and ensuring that crops get the maximum benefit from applied fertilizers.

These additives also help in preventing caking, improving handling, and maintaining the quality of fertilizers during storage and transportation. A Namibian firm won a US$150 million contract to supply fertilizer to Malawi, showing the rising importance of efficient fertilizer solutions in global agriculture.

The fertilizer additives market refers to the global trade and usage of these substances across agriculture and related industries. The market is shaped by the rising need for higher crop yields, efficient nutrient management, and sustainable farming practices. Growing concerns about soil health and the environmental impacts of conventional fertilizers are also encouraging farmers and policymakers to adopt additives that make fertilizers more effective and eco-friendly.

Governments worldwide drop over US$600 billion each year on farming support—but most of it doesn’t go toward green or high-tech improvements, which underlines the opportunity for better allocation toward additives.

One of the major growth factors is the increasing global demand for food, which puts pressure on agricultural productivity. With shrinking arable land, farmers rely on efficient fertilizer use to maximize output, driving the adoption of additives that reduce nutrient losses. A St. Pete–based agritech startup raised more than US $10 million in a new funding round, highlighting investor interest in innovations that improve fertilizer performance.

The demand for fertilizer additives is also being fueled by government initiatives promoting sustainable agriculture. Many regions are encouraging controlled use of fertilizers with performance-enhancing additives to reduce pollution and improve soil fertility. Worm Power, a leader in vermicompost, secured a US$900,000 USDA grant to expand its organic fertilizer production, which further supports the shift toward eco-friendly practices in agriculture.

A key opportunity lies in the rising shift toward precision farming and advanced agricultural technologies. As farmers adopt modern methods, they seek additives that optimize fertilizer efficiency, making this market an important link between traditional farming and future-ready agricultural solutions.

Key Takeaways

- The Global Fertilizer Additives Market is expected to be worth around USD 4.5 billion by 2034, up from USD 3.4 billion in 2024, and is projected to grow at a CAGR of 2.9% from 2025 to 2034.

- In the Fertilizer Additives Market, granular form leads with 46.6%, showing strong farmer adoption.

- Dust control agents hold 26.9% in the Fertilizer Additives Market, reflecting demand for safe handling solutions.

- Cereals and grains dominate fertilizer additives usage with 44.7%, highlighting their role in global food security.

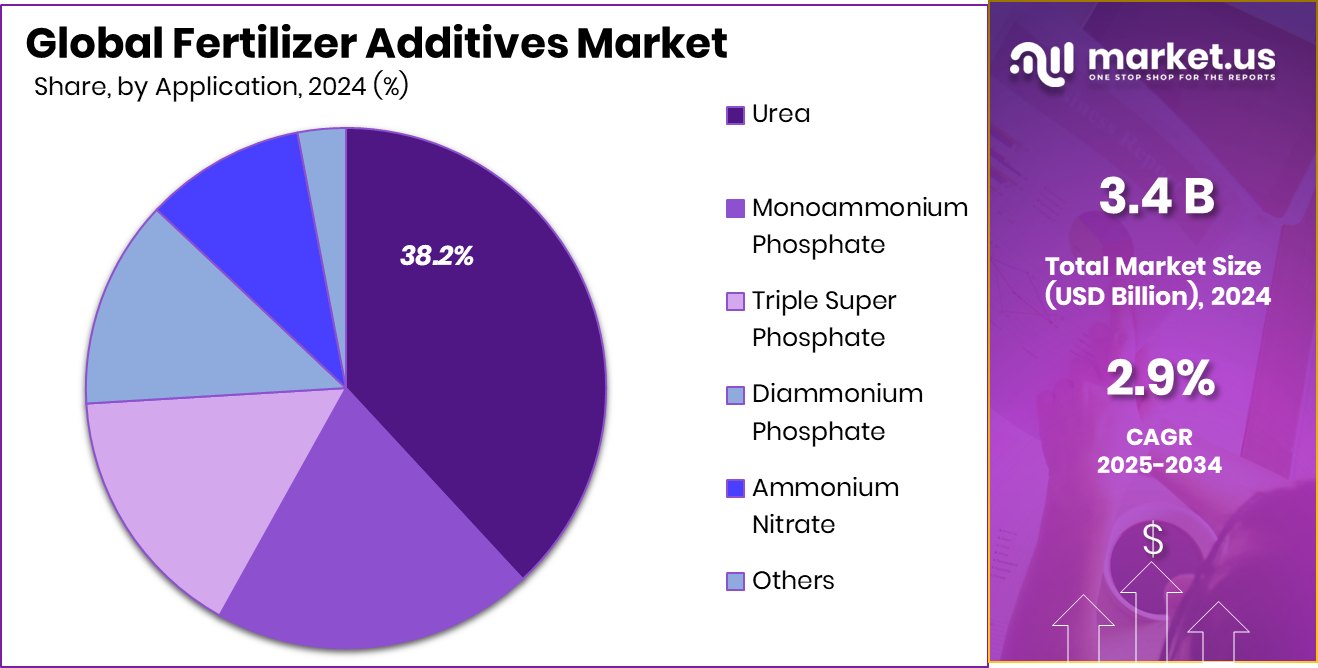

- Urea applications capture 38.2% in the Fertilizer Additives Market, supported by widespread use in agriculture.

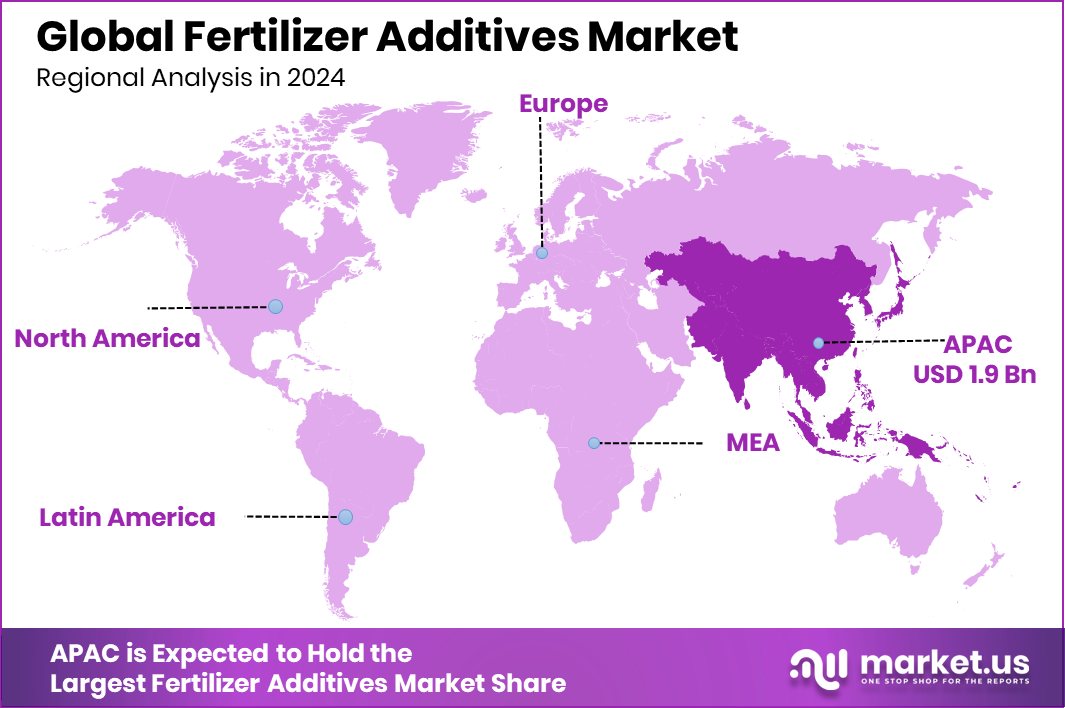

- Asia Pacific Fertilizer Additives Market reached USD 1.9 Bn, highlighting strong agricultural demand.

By Form Analysis

The Fertilizer Additives Market is led by the granular form, with a 46.6% share.

In 2024, Granular held a dominant market position in the By Form segment of the Fertilizer Additives Market, with a 46.6% share. This leadership is strongly tied to the practical advantages that granular additives bring to modern agriculture. Farmers prefer granular forms because they are easy to apply, blend well with base fertilizers, and ensure a uniform distribution of nutrients across the soil. The granular format also offers higher stability during storage and transportation, minimizing issues such as caking and moisture absorption, which often reduce the effectiveness of other forms.

The dominance of granular additives is also supported by their compatibility with large-scale farming practices, where mechanized spreading equipment is widely used. As crop yields increasingly depend on the efficient performance of fertilizers, granular additives offer a reliable way to improve nutrient retention and minimize losses through leaching or volatilization. This reliability translates into higher productivity per acre, which is especially important given the limited availability of arable land.

Furthermore, government-backed agricultural programs are encouraging the use of advanced fertilizer solutions, and granular additives align well with these initiatives. With rising food demand and the push for sustainable farming, granular additives continue to be the preferred choice, strengthening their hold in the fertilizer additives market.

By Type Analysis

Dust control agents dominate the type segment in the Fertilizer Additives Market at 26.9%.

In 2024, Dust Control Agent held a dominant market position in the By Type segment of the Fertilizer Additives Market, with a 26.9% share. The strength of this segment comes from the growing need to improve fertilizer handling, safety, and efficiency during storage and transportation. Dust formation in fertilizers not only reduces product quality but also creates health hazards for workers and leads to material loss. By suppressing dust, these agents ensure that fertilizers maintain their granule integrity, remain easy to handle, and deliver consistent performance in the field.

The preference for dust control agents is further driven by stricter environmental and workplace safety regulations. As awareness of occupational health risks grows, fertilizer producers and distributors are increasingly adopting additives that minimize airborne particles. This makes dust control agents not only a performance enhancer but also a compliance tool for meeting regulatory standards.

Additionally, the cost savings associated with reduced product loss and improved fertilizer efficiency strengthen the appeal of dust control solutions. Farmers benefit from fertilizers that spread evenly without waste, while manufacturers gain from maintaining higher product quality. These advantages firmly establish dust control agents as a key contributor to operational efficiency and sustainability within the fertilizer additives market.

By Crop Analysis

Cereals and grains drive demand in the Fertilizer Additives Market with 44.7%.

In 2024, cereals and grains held a dominant market position in the by-crop segment of the Fertilizer Additives Market, with a 44.7% share. This leadership is largely because cereals and grains are staple food crops for a majority of the global population, making them central to agricultural production. Farmers across major agricultural regions prioritize these crops to meet rising food security needs, and the use of fertilizer additives plays a crucial role in maintaining consistent yields and crop quality.

The strong demand for cereals such as wheat, rice, and maize further reinforces the reliance on fertilizer additives. With growing populations and increased consumption of grain-based food products, there is mounting pressure on farmers to maximize output from limited arable land. Fertilizer additives provide a cost-effective solution to enhance soil fertility and optimize the use of fertilizers, directly supporting higher yields of cereals and grains.

Moreover, government-backed agricultural initiatives in many countries focus heavily on cereal and grain production, further driving the adoption of advanced fertilizer solutions. These factors combined have firmly established cereals and grains as the leading crop segment within the fertilizer additives market.

By Application Analysis

Urea application accounts for 38.2% in the Fertilizer Additives Market globally.

In 2024, Urea held a dominant market position in the By Application segment of the Fertilizer Additives Market, with a 38.2% share. Urea’s leadership is closely linked to its role as one of the most widely used nitrogen fertilizers in global agriculture. Its high nitrogen content, cost-effectiveness, and adaptability across diverse crops make it a preferred choice for farmers. However, urea faces challenges such as nutrient losses through volatilization and leaching, and this is where fertilizer additives play a crucial role.

The dominance of urea in this segment also reflects its compatibility with large-scale farming systems and its suitability for blending with other nutrients. Fertilizer additives tailored for urea are designed to reduce ammonia emissions and minimize environmental impacts, aligning with sustainability goals set by agricultural authorities worldwide. This not only benefits crop yields but also supports long-term soil health and resource conservation.

With rising global demand for staple crops and increasing government support for efficient fertilizer practices, the application of additives in urea continues to expand. This strong adoption base reinforces urea’s leading role within the fertilizer additives market.

Key Market Segments

By Form

- Granular

- Prilled

- Powdered

- Others

By Type

- Dust Control Agent

- Anticaking Agent

- Antifoaming Agent

- Hydrophobing Agent

- Corrosion Inhibitor

- Others

By Crop

- Cereals and Grains

- Oilseeds

- Fruits and Vegetables

- Turf and Ornamentals

- Others

By Application

- Urea

- Monoammonium Phosphate

- Triple Super Phosphate

- Diammonium Phosphate

- Ammonium Nitrate

- Others

Driving Factors

Rising Food Demand Boosts Fertilizer Additives Market

One of the strongest driving factors for the fertilizer additives market is the rapid rise in global food demand. With the world’s population steadily increasing, farmers face the challenge of producing more crops from limited farmland. This pressure makes fertilizers essential, but to maximize their effectiveness, additives are being used to improve nutrient absorption and reduce wastage.

Fertilizer additives help ensure that crops such as rice, wheat, and maize receive consistent nutrition, leading to higher yields and better quality harvests. They also reduce environmental losses like leaching and gas emissions, making farming more sustainable. As food demand grows year after year, the use of fertilizer additives will remain vital to secure reliable and efficient agricultural output.

Restraining Factors

High Production Costs Limit Fertilizer Additives Growth

A major restraining factor for the fertilizer additives market is the high cost of production and application. Many additives are developed using advanced chemical processes or specialized formulations, which increases their overall price. For farmers, especially in developing regions with limited budgets, the additional cost of using additives on top of regular fertilizers can be difficult to afford.

This often leads to a preference for conventional fertilizers without enhancements, even if they are less efficient. Furthermore, fluctuations in raw material prices and energy costs make production more expensive for manufacturers, which is passed down to end users. As a result, despite their proven benefits, the adoption of fertilizer additives can be slowed by economic constraints.

Growth Opportunity

Precision Farming Creates Big Opportunity for Additives

A key growth opportunity for the fertilizer additives market lies in the rapid adoption of precision farming practices. Farmers are increasingly using advanced technologies such as soil sensors, drones, and GPS-based systems to monitor crop needs with high accuracy. In this approach, efficiency becomes the main focus, and fertilizer additives fit perfectly as they help reduce nutrient losses and improve absorption rates.

By combining precise application with additives, farmers can achieve higher yields while using fewer resources, which lowers costs and supports sustainable agriculture. As governments and organizations promote digital farming methods worldwide, the demand for additives designed for precision farming is set to grow quickly, making this a major opportunity for the industry’s future expansion.

Latest Trends

Eco-Friendly Additives Emerging as Strong Market Trend

One of the latest trends in the fertilizer additives market is the growing focus on eco-friendly and sustainable solutions. Farmers and policymakers are increasingly concerned about the environmental impact of traditional fertilizers, particularly nutrient runoff, soil degradation, and greenhouse gas emissions. To address these issues, manufacturers are developing additives that are biodegradable, low in toxicity, and designed to minimize environmental harm while still improving crop productivity.

These eco-friendly additives support sustainable farming goals and align with global initiatives to reduce chemical dependence in agriculture. As consumer demand for safe and organic food continues to rise, the preference for environmentally responsible fertilizer additives is gaining momentum, shaping the future direction of the market.

Regional Analysis

In 2024, the Asia Pacific dominated the Fertilizer Additives Market with 57.20% regional share.

The Fertilizer Additives Market shows varied regional growth, shaped by differences in agricultural practices, policy support, and food demand. In 2024, the Asia Pacific emerged as the dominating region, holding 57.20% of the market share and reaching a value of USD 1.9 billion. This strong lead is driven by the region’s vast agricultural base in countries such as India, China, and Southeast Asia, where fertilizers are essential for meeting the food requirements of large populations.

Government programs promoting balanced fertilizer use and sustainable farming practices further encourage the adoption of additives, making the Asia Pacific the center of growth in this market. North America and Europe display steady adoption, supported by advanced farming systems and strict environmental regulations that push the use of additives for efficiency and soil protection.

Meanwhile, Latin America shows promise due to expanding agricultural exports, while the Middle East & Africa rely on fertilizer additives to improve yields in nutrient-deficient soils. However, none match the scale and demand momentum of the Asia Pacific, which leads the global landscape.

The combination of population growth, food security needs, and government-backed initiatives firmly positions the Asia Pacific as the largest and fastest-growing region in the fertilizer additives market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ArrMaz Products Inc. has positioned itself as a strong player with expertise in specialty chemical solutions for fertilizer efficiency. The company’s focus on dust control, anti-caking agents, and performance enhancers aligns closely with rising demand for high-quality fertilizers, particularly in regions where large-scale farming dominates.

Chemipol S.A. has gained recognition for its innovative chemical formulations, particularly additives that improve fertilizer stability and shelf life. Its research-driven approach and adaptability to regional agricultural needs give it an edge in emerging markets where storage and handling issues remain critical.

ChemSol, LLC operates with a strong emphasis on customized solutions, offering additives that cater to specific fertilizer blends. Its flexibility and customer-centric approach have made it a valuable partner for medium to large-scale fertilizer producers looking to optimize efficiency and reduce wastage.

Clariant AG, with its broad chemical portfolio and global presence, has focused heavily on sustainability and eco-friendly solutions. Its ability to align product development with environmental regulations and green agriculture policies has strengthened its position in Europe and other regulated markets.

Top Key Players in the Market

- ArrMaz Products Inc.

- Chemipol S.A.

- ChemSol, LLC

- Clariant AG

- Dorf Ketal Chemicals (I) Pvt. Ltd.

- KAO Corporation

- LignoStar

- Michelman Inc.

- Novochem Group

- Solvay

- Tolsa SA

Recent Developments

- In September 2024, Solvay announced it would cease production of trifluoroacetic acid (TFA) and its fluorinated derivatives at its Salindres plant in France, reducing its operations in that chemical segment.

- In April 2024, Chemipol introduced an improvement in its agrochemical granulation auxiliaries by integrating two of its key products—Binderpol and Chemisyl. These additives enhance the fertilizer granulation process by promoting uniform granule size, reducing dust, and improving granule strength (Binderpol), while preventing moisture-related caking and regulating water absorption (Chemisyl).

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 4.5 Billion CAGR (2025-2034) 2.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Granular, Prilled, Powdered, Others), By Type (Dust Control Agent, Anticaking Agent, Antifoaming Agent, Hydrophobing Agent, Corrosion Inhibitor, Others), By Crop (Cereals and Grains, Oilseeds, Fruits and Vegetables, Turf and Omamentals, Others), By Application (Urea, Monoammonium Phosphate, Triple Super Phosphate, Diammonium Phosphate, Ammonium Nitrate, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ArrMaz Products Inc., Chemipol S.A., ChemSol, LLC, Clariant AG, Dorf Ketal Chemicals (I) Pvt. Ltd., KAO Corporation, LignoStar, Michelman Inc., Novochem Group, Solvay, Tolsa SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fertilizer Additives MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Fertilizer Additives MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ArrMaz Products Inc.

- Chemipol S.A.

- ChemSol, LLC

- Clariant AG

- Dorf Ketal Chemicals (I) Pvt. Ltd.

- KAO Corporation

- LignoStar

- Michelman Inc.

- Novochem Group

- Solvay

- Tolsa SA