Global Feed Pigment Market Size, Share, And Enhanced Productivity By Type (Carotenoids, Curcumin, Caramel, Spirulina, Others), By Source (Natural, Synthetic), By Livestock (Swine, Poultry, Ruminants, Aquatic animals, Others), By Application (Egg Yolk Coloration, Poultry Skin Coloration, Fish Flesh Coloration, Pet Food Enhancement, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170789

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

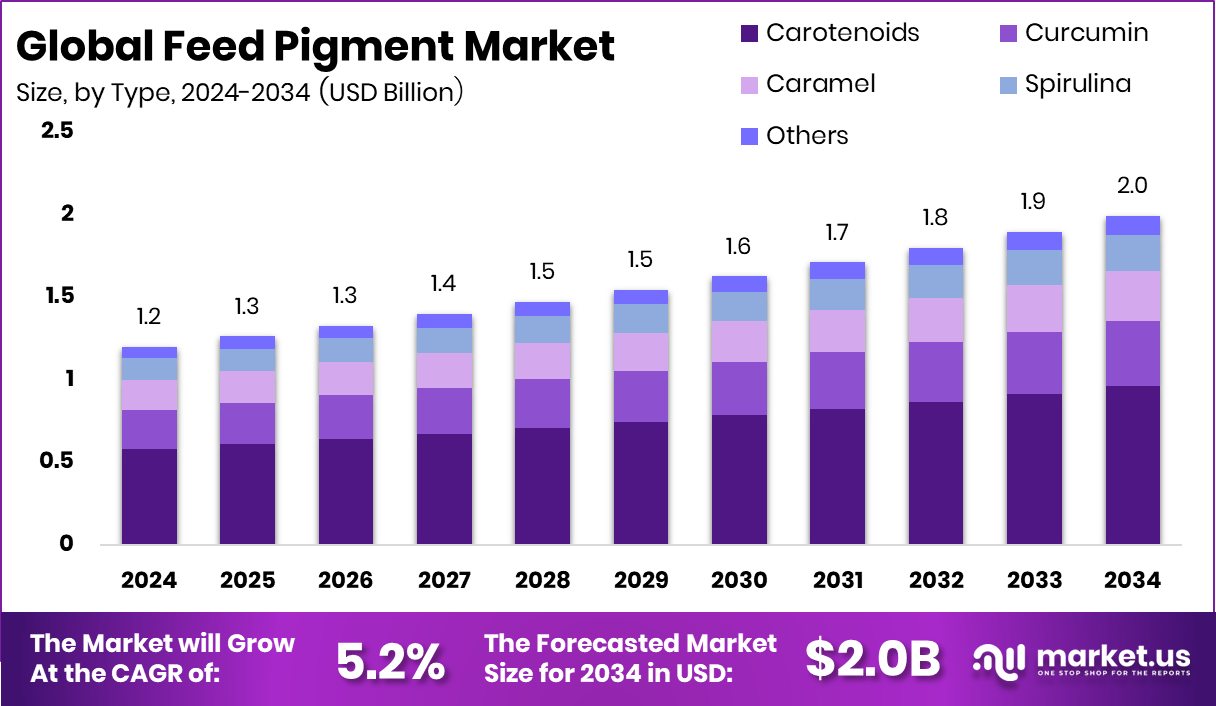

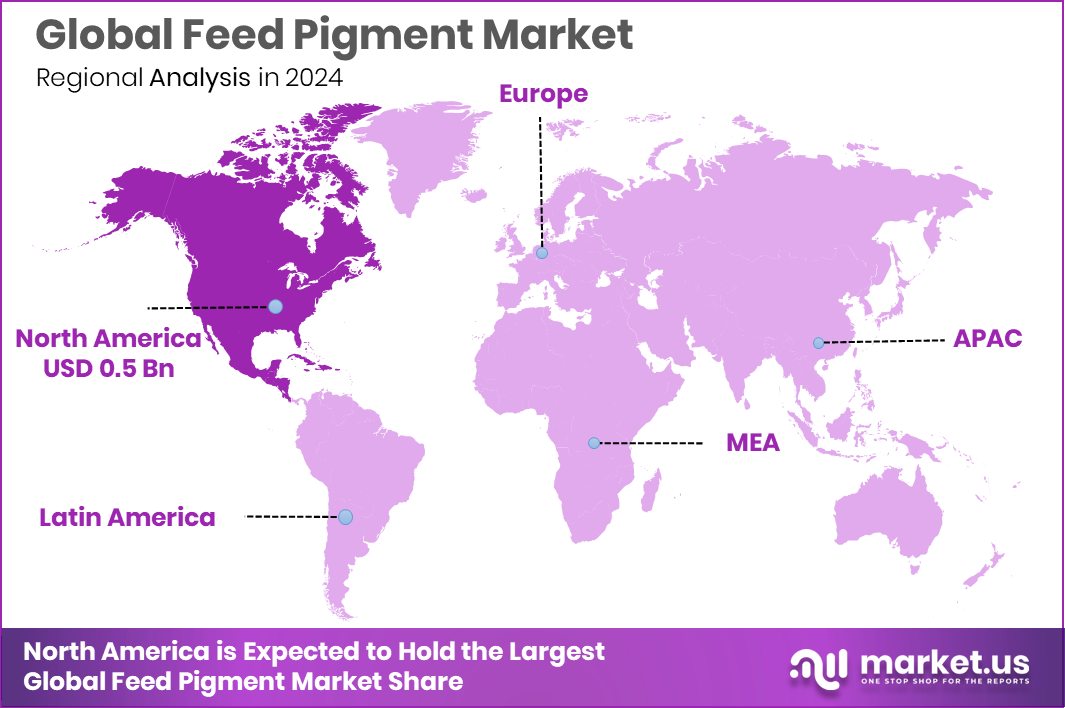

The Global Feed Pigment Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. North America led the feed pigment market at 45.80% share, totaling USD 0.5 Bn.

Feed pigment refers to natural or synthetic coloring substances added to animal feed to enhance the visual appearance of animal-derived products such as eggs, meat, and fish. These pigments help achieve consistent color in egg yolks, poultry skin, and aquaculture species, which strongly influences buyer acceptance and perceived quality. Beyond appearance, feed pigments support uniformity in production systems and help farmers meet market expectations more reliably.

The feed pigment market represents the supply and use of these coloring ingredients across livestock, poultry, aquaculture, and pet nutrition. This market grows alongside structured feed manufacturing, where visual quality has become a commercial requirement rather than an option. Increasing regulation around feed safety and traceability further strengthens the role of standardized pigment solutions in modern animal nutrition.

Market growth is supported by rising investments in animal health, food safety, and agricultural research. Public funding programs such as MDARD’s USD 286,000 Food Safety Education grants, USD 57,000 for horticulture research, and over USD 1.8 million for projects creating agricultural jobs indicate strong institutional backing for feed and food-quality improvements. These initiatives indirectly strengthen demand for consistent, compliant feed inputs, including pigments.

Demand is expanding due to rapid growth in pet food and specialty animal nutrition. Recent funding activity highlights this momentum, including Drools Pet Food securing USD 60 million, Pure Pet Food raising USD 19 million, and Good Dog Food receiving USD 4.5 million. Smaller but notable rounds, such as USD 1.46 million for insect-based dog food and USD 1.01 million for plant-based dog food, also reflect rising premiumization trends.

Opportunities are emerging as innovation and sustainability gain focus across animal nutrition. Supportive funding, such as USD 250,000 for strategic stock enhancement initiatives and £250,000 for English pet food development, points to continued ecosystem expansion.

Key Takeaways

- The Global Feed Pigment Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Carotenoids dominate the Feed Pigment Market by type, holding 48.2% share due to strong pigmentation efficiency.

- Synthetic sources lead the Feed Pigment Market with 62.3% share, supported by consistent quality and scalability.

- Poultry dominates the Feed Pigment Market by livestock, accounting for 42.7% share, driven by egg demand.

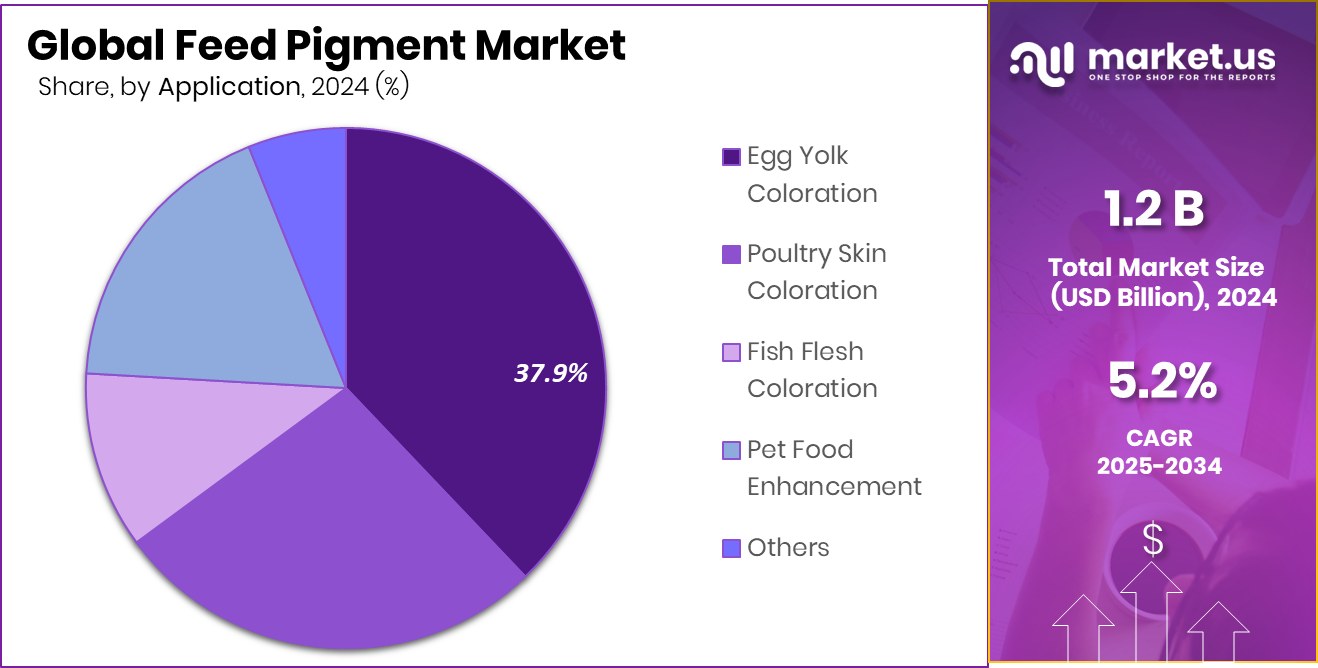

- Egg yolk coloration leads the Feed Pigment Market by application with a 37.9% share globally across regions.

- In North America, the feed pigment market reached a 45.80% share with USD 0.5 Bn.

By Type Analysis

In Feed Pigment Market, carotenoids dominate the type segment with a 48.2% share globally.

In 2024, Carotenoids held a dominant market position in the By Type segment of the Feed Pigment Market, with a 48.2% share. This leadership reflects their strong acceptance in feed formulations where consistent and visible pigmentation outcomes are required. Carotenoids are widely valued for their stable coloring performance, making them a preferred choice for producers focused on uniform product quality.

The 48.2% share also indicates sustained demand driven by large-scale feed production systems that prioritize efficiency and predictable results. Their dominance highlights how standardized pigment solutions continue to play a central role in feed pigment applications, especially where color consistency directly influences downstream market value and buyer preference.

By Source Analysis

In the Feed Pigment Market, synthetic sources lead supply, accounting for 62.3% share.

In 2024, Synthetic held a dominant market position in the By Source segment of the Feed Pigment Market, with a 62.3% share. This strong share underscores the importance of reliable, scalable, and cost-effective pigment sources within commercial feed operations. Synthetic pigments are widely adopted due to their uniform quality and dependable supply, supporting large-volume feed manufacturing needs.

The 62.3% share reflects the segment’s alignment with industrial feed production requirements, where consistency and performance stability are critical. This dominance indicates that synthetic sources remain a cornerstone in feed pigment sourcing, particularly in systems where controlled outcomes and standardized formulations are essential for market competitiveness.

By Livestock Analysis

In Feed Pigment Market, poultry dominates livestock demand, representing 42.7% consumption.

In 2024, Poultry held a dominant market position in the By Livestock segment of the Feed Pigment Market, with a 42.7% share. This leading position highlights the strong linkage between feed pigmentation and poultry production systems, where visual attributes play a key role in product differentiation. Poultry feed applications consistently demand effective pigmentation to meet market expectations.

The 42.7% share demonstrates how poultry remains a primary consumption base for feed pigments, driven by large-scale production volumes and well-established feeding practices. This dominance reflects the segment’s structural importance, positioning poultry as a central driver of demand within the overall feed pigment market.

By Application Analysis

In the feed pigment market, egg yolk coloration drives applications, holding 37.9% share.

In 2024, Egg Yolk Coloration held a dominant market position in the By Application segment of the Feed Pigment Market, with a 37.9% share. This leadership emphasizes the commercial importance of yolk appearance, which strongly influences consumer perception and purchasing decisions. Feed pigments play a direct role in achieving consistent yolk color outcomes.

The 37.9% share highlights how egg yolk coloration remains a priority application for feed pigments, supported by established feeding strategies focused on visual quality. This dominance reflects steady demand from producers aiming to align egg products with market preferences and quality benchmarks.

Key Market Segments

By Type

- Carotenoids

- Curcumin

- Caramel

- Spirulina

- Others

By Source

- Natural

- Synthetic

By Livestock

- Swine

- Poultry

- Ruminants

- Aquatic animals

- Others

By Application

- Egg Yolk Coloration

- Poultry Skin Coloration

- Fish Flesh Coloration

- Pet Food Enhancement

- Others

Driving Factors

Environmental Controls Limit Feed Pigment Expansion

One major restraining factor in the Feed Pigment Market is the rising focus on environmental protection and ecosystem safety, especially in aquatic and livestock-linked systems. Governments are increasingly cautious about substances that may indirectly affect water bodies, fish habitats, and biodiversity. This regulatory caution slows approvals and increases compliance costs for feed inputs, including pigments, particularly where runoff or waste management is involved.

Public spending patterns reflect this concern. Dal’s Ocean Tracking Network received USD 11.4 million from the Government of Canada to monitor aquatic ecosystems, showing how closely animal-related inputs are now linked to environmental oversight. Similarly, Manitoba invested USD 540K to fight aquatic invasive species and nearly USD 500K to stop the spread of zebra mussels, reinforcing strict monitoring of anything entering food and water systems.

Restraining Factors

Aquatic Conservation Spending Drives Feed Quality Standards

A key driving factor for the Feed Pigment Market is rising public investment in aquatic conservation and habitat protection, which is pushing higher feed quality and traceability standards. Governments are funding programs that protect marine species and aquatic ecosystems, indirectly increasing attention on what enters animal and aquatic feed chains. This focus encourages the use of controlled, standardized feed inputs, including pigments, to reduce environmental stress and improve monitoring outcomes.

The Healey-Driscoll Administration awarded nearly USD 500,000 to support conservation and restoration of endangered marine species and aquatic habitats, reinforcing the link between feed inputs and ecosystem health. At the federal level, the Biden-Harris Administration announced USD 38 million from the Bipartisan Infrastructure Law to protect aquatic species and habitats, further strengthening regulatory oversight. In parallel, Michigan’s Clean Boats, Clean Waters program awarded USD 35,000 to prevent aquatic invasive species spread, highlighting growing scrutiny across aquatic systems.

Growth Opportunity

Low-Emission Livestock Nutrition Opens New Growth Avenues

A major growth opportunity in the Feed Pigment Market is the shift toward low-emission and climate-focused livestock nutrition systems. As methane reduction becomes a priority, feed formulations are being redesigned to support animal efficiency, digestion, and monitoring outcomes. Feed pigments benefit from this shift because modern feed programs increasingly favor well-defined, traceable ingredients that fit into precision nutrition and sustainability-aligned feeding strategies.

Strong funding support highlights this opportunity. Hoofprint Biome raised USD 15 million in Series A funding to advance enzyme-based methane reduction in cattle, showing how feed innovation is accelerating. The Gates Foundation provided USD 1.5 million to Phase Genomics, while a cattle methane vaccine project received USD 9.4 million, reinforcing momentum in feed-linked climate solutions. Additionally, a Husker research team secured USD 5 million to reduce methane emissions from cattle.

Latest Trends

Methane-Reducing Feed Innovations Shape Pigment Integration

A key latest trend in the Feed Pigment Market is the integration of pigments into advanced feed solutions designed for health, efficiency, and emission control. As feed additives become more targeted and science-driven, pigments are increasingly expected to align with broader feed performance goals rather than serve only visual purposes. This trend is visible through strong funding flows into next-generation feed technologies and animal health solutions.

A USD 3.5 million grant was provided to accelerate long-payout methane-reducing feed additive technology, showing long-term confidence in feed innovation. Ruminant Biotech raised USD 17 million at a USD 132 million valuation for its methane-reducing cow pill, highlighting investor interest in feed-based solutions. In parallel, BiomEdit secured USD 20 million in funding and grants to advance poultry antibody technology, while the USDA announced a USD 100 million funding opportunity to combat avian influenza.

Regional Analysis

North America feed pigment market held a 45.80% share, valued at USD 0.5 Bn.

North America dominated the Feed Pigment Market, holding a 45.80% share and reaching a value of USD 0.5 Bn, reflecting its strong position in commercial livestock and poultry production systems. The region benefits from structured feed manufacturing practices, high adoption of formulated feed, and consistent demand for quality-driven animal products.

Europe represents a mature market, supported by established feed standards and steady use of pigments to maintain visual quality and product uniformity across livestock outputs.

Asia Pacific shows expanding market relevance due to its large livestock base and growing focus on productivity and feed efficiency, even though the market remains more fragmented.

Middle East & Africa demonstrate gradual growth, driven by rising commercial farming activities and increasing awareness of feed quality improvements. Latin America maintains a stable presence in the feed pigment market, supported by its role as a major livestock-producing region with increasing attention to feed optimization.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF SE continues to hold a strong strategic position in the global Feed Pigment Market due to its deep expertise in chemical manufacturing and formulation science. The company’s pigment portfolio benefits from integrated production capabilities, allowing consistent quality and reliable supply for large-scale feed producers. BASF’s long-standing relationships with feed manufacturers support steady adoption across livestock segments where color consistency and performance stability are essential.

Royal DSM N.V. is viewed as a technology-driven player with a clear focus on precision nutrition and performance-oriented feed solutions. In feed pigments, DSM’s strength lies in combining scientific know-how with application-level understanding, enabling pigments that align closely with animal nutrition goals. Its structured approach to product development and customer support reinforces trust among commercial feed formulators seeking predictable and compliant pigment solutions.

Kemin Industries, Inc. stands out for its application-focused strategy and close engagement with feed producers. The company emphasizes practical performance, helping customers optimize pigment usage within real-world feed systems. Kemin’s market role is strengthened by its ability to tailor solutions for specific livestock needs, making it a preferred partner for producers prioritizing efficiency, visual quality, and operational reliability in feed pigmentation.

Top Key Players in the Market

- BASF SE

- Royal DSM N.V

- Kemin Industries, Inc.

- Behn Meyer Holding AG

- Nutrex NV

- Novus International, Inc.

- Biorigin

- Phytobiotics Futterzusatzstoffe GmbH

- Synthite Industries Ltd.

Recent Developments

- In August 2025, DSM-Firmenich Animal Nutrition & Health, the division that includes DSM’s animal nutrition business, opened a new feed additive plant in Jadcherla, Hyderabad, India. This facility covers 11,200 m², builds on local production, and strengthens its ability to serve feed producers with key products like Mycofix® Secure and Mycofix® Shield solutions that protect feed quality and animal health. This move supports its position in the Asia-Pacific and enhances supply capabilities for regional feed markets.

- In March 2025, Kemin Industries introduced PROSIDIUM™, a new solution to improve feed biosecurity. This product helps feed producers reduce pathogens like Salmonella and viral risks in animal feed, making feed safer for livestock and poultry. It was presented at the VIV Asia tradeshow in Bangkok and is based on novel peroxy acids that reduce pathogen levels and continue protecting the feed surface. This development enhances Kemin’s animal feed product range by addressing safety challenges directly.

- In December 2024, BASF signed an agreement to sell its Food and Health Performance Ingredients business to Louis Dreyfus Company (LDC). This deal includes the production site in Illertissen, Germany, and is part of BASF’s effort to refine its portfolio toward core nutrition ingredients. This sale impacts the broader nutrition portfolio, although it is focused on food and health ingredients rather than specific feed pigment products.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carotenoids, Curcumin, Caramel, Spirulina, Others), By Source (Natural, Synthetic), By Livestock (Swine, Poultry, Ruminants, Aquatic animals, Others), By Application (Egg Yolk Coloration, Poultry Skin Coloration, Fish Flesh Coloration, Pet Food Enhancement, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Royal DSM N.V, Kemin Industries, Inc., Behn Meyer Holding AG, Nutrex NV, Novus International, Inc., Biorigin, Phytobiotics Futterzusatzstoffe GmbH, Synthite Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Royal DSM N.V

- Kemin Industries, Inc.

- Behn Meyer Holding AG

- Nutrex NV

- Novus International, Inc.

- Biorigin

- Phytobiotics Futterzusatzstoffe GmbH

- Synthite Industries Ltd.