Global Ethiprole Market Size, Share, And Business Benefits By Formulation Type (Liquid, Powders), By Crop Type (Cereal Crops, Fruits and Vegetables, Oilseeds, Plantations, Others), By Application (Agricultural Insecticide, Pest Control, Public Health, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157229

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

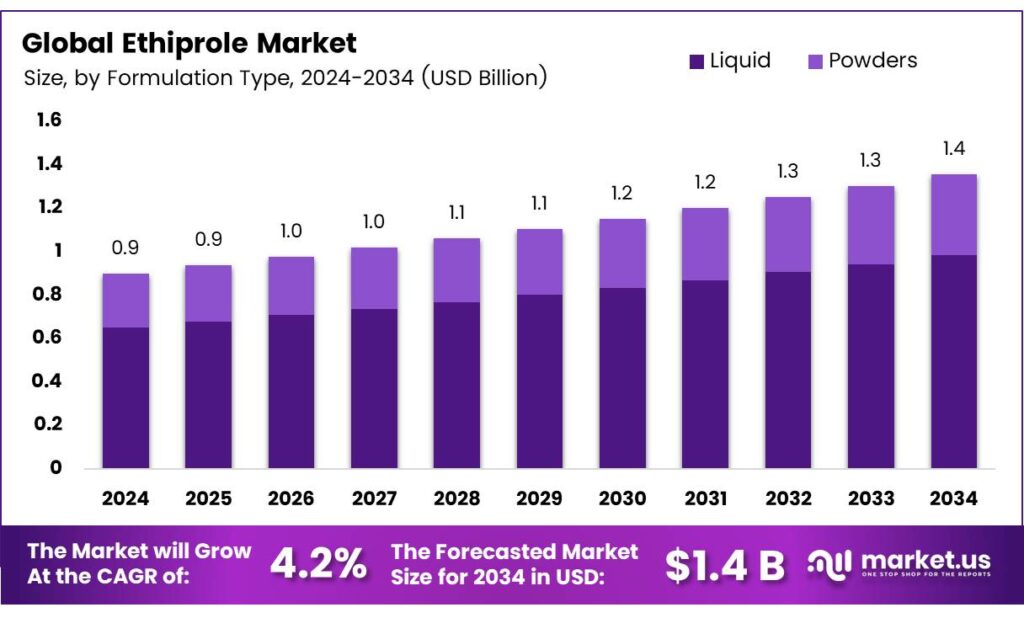

The Global Ethiprole Market size is expected to be worth around USD 1.4 Billion by 2034, from USD 0.9 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

Ethiprole, a phenylpyrazole insecticide, differs from fipronil by having an ethylsulfinyl group instead of a trifluoromethylsulfinyl group. This study examines their photochemistry, metabolism, action at the gamma-aminobutyric acid (GABA) receptor, and insecticidal potency. When exposed to sunlight as a thin film, ethiprole primarily undergoes oxidation, reduction, and desethylsulfinylation, but not desulfinylation, whereas fipronil mainly undergoes desulfinylation.

Ethiprole forms its sulfone metabolite more quickly than fipronil in human CYP3A4 in vitro and in mouse brain and liver in vivo. Both compounds’ sulfide, sulfoxide, sulfone, and desulfinyl derivatives show high biological activity in GABA receptor assays (using human recombinant beta3 homomer and house fly head membranes) with EBOB, and in topical toxicity tests on house flies, with and without the P450-inhibiting synergist piperonyl butoxide.

Ethiprole, a non-systemic phenyl-pyrazole insecticide, effectively targets a broad spectrum of insects. CODEX has set no Maximum Residue Limits (MRLs) for ethiprole in Canada or Mexico. Bayer CropScience LP is advocating for import tolerances for rice and tea. While ethiprole is not registered for crop use in the U.S. or Canada, it is approved for tea in Japan and rice in Brazil, Indonesia, Japan, Thailand, and Vietnam, with conditional registration for rice in China.

In Japan, ethiprole is formulated as a 100-200 g/L suspension concentrate (SC) for rice and tea, a 20 g/kg granule 2% GR, and a 5 g/kg dustable powder 0.5% DP for rice. The agricultural sector remains the largest consumer of Ethiprole, driven by the need for effective pest control to ensure high crop yields. Crop protection chemicals like Ethiprole play a vital role in ensuring food security. Adoption is particularly strong in Asia-Pacific countries such as China and India, where rice and cotton cultivation cover millions of hectares.

Key Takeaways

- The Global Ethiprole Market is expected to reach USD 1.4 billion by 2034 from USD 0.9 billion in 2024, with a CAGR of 4.2%.

- Liquid formulations dominated in 2024, holding a 72.4% share due to ease of application and high efficacy.

- Cereal Crops led in 2024 with a 38.7% share, driven by extensive rice, wheat, and maize cultivation.

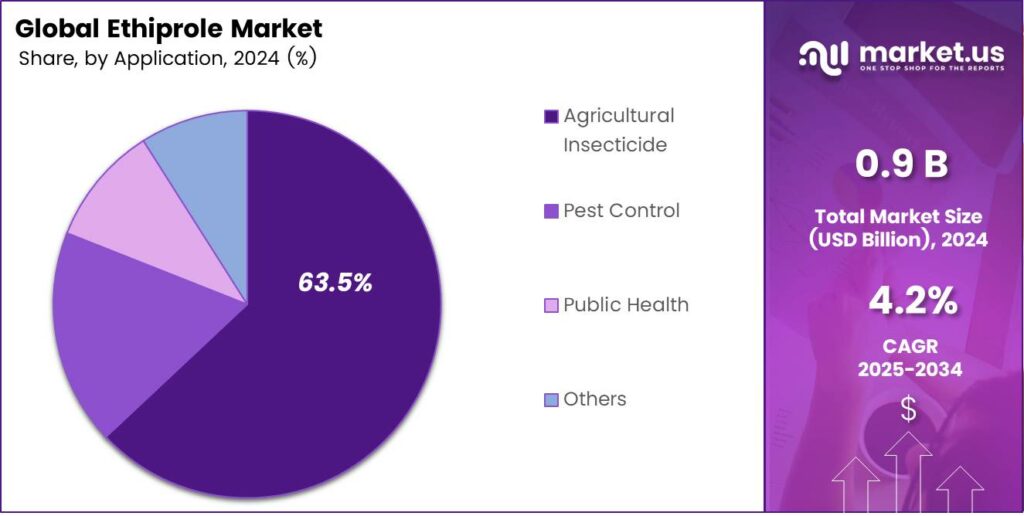

- Agricultural Insecticide applications held a 63.5% share in 2024, fueled by pest pressures on major crops.

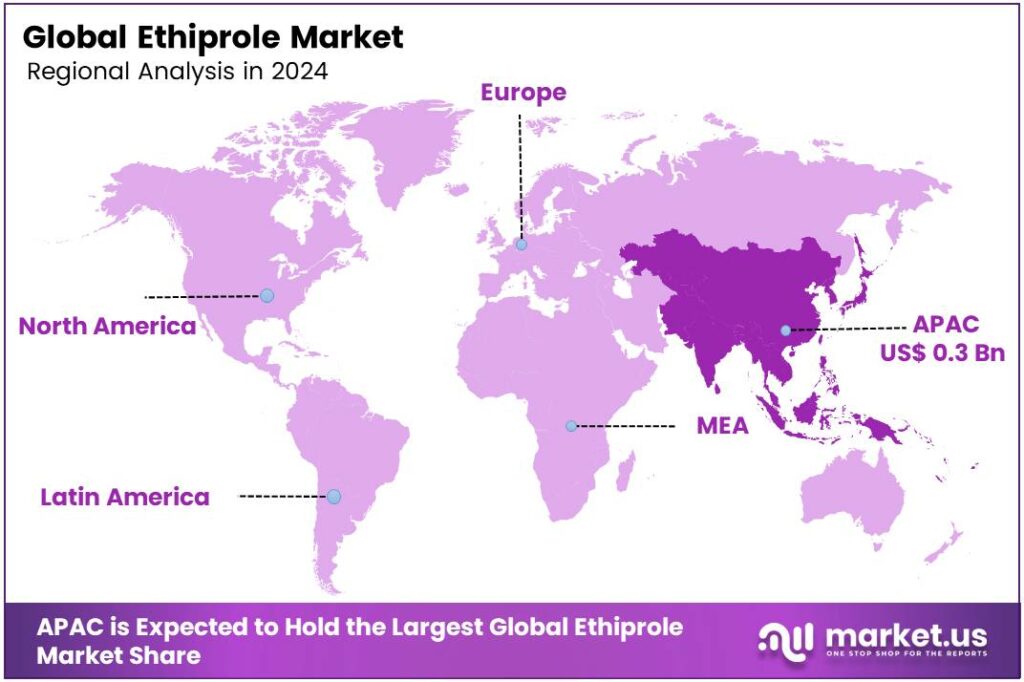

- Asia Pacific commanded 43.7% of market revenues in 2024, roughly USD 0.3 billion, led by intensive agriculture.

Analyst Viewpoint

The Ethiprole market is gaining momentum as a key player in the global agricultural sector, driven by the urgent need for effective pest control that aligns with sustainable farming practices. Ethiprole’s targeted action against pests like beetles and thrips makes it a go-to solution for farmers, particularly in high-growth regions like Asia-Pacific and Latin America.

Consumer trends leaning toward organic and chemical-free produce could also challenge demand in certain markets. Additionally, the high costs of developing advanced formulations may strain smaller players, creating a competitive gap. Investors should focus on firms with strong regulatory expertise and diversified portfolios to mitigate these risks.

Farmers, the primary consumers, value Ethiprole for its rapid action and prolonged residual effects, which reduce the need for frequent applications. However, there’s a growing consumer push for organic farming, particularly in developed markets, which could limit Ethiprole’s appeal. Educating farmers about its low toxicity and environmental benefits compared to traditional insecticides could help maintain demand.

By Formulation Type

Liquid Formulation Leads with 72.4% Share

In 2024, Liquid held a dominant market position, capturing more than a 72.4% share in the global ethiprole market. The preference for liquid formulations is strongly linked to their ease of application, uniform distribution, and higher absorption efficiency, making them more effective in pest control practices across major crops.

Farmers and large-scale cultivators continue to opt for liquid forms due to their compatibility with modern spraying equipment, which ensures precise coverage and reduced wastage. The adoption of liquid ethiprole formulations is expected to remain strong, particularly in regions with extensive cultivation of cereals, soybeans, and horticultural crops.

With farming systems increasingly adopting mechanized spraying methods, liquid formulations provide cost-effectiveness and operational convenience, further supporting their market dominance. Additionally, liquid-based solutions often demonstrate faster action against resistant pest species, making them the preferred choice in integrated pest management strategies.

By Crop Type

Cereal Crops Lead with 38.7% Market Share

In 2024, Cereal Crops held a dominant market position, capturing more than a 38.7% share in the global ethiprole market. This dominance is largely driven by the extensive cultivation of rice, wheat, and maize, which together account for the majority of global food consumption.

Farmers in Asia-Pacific, Latin America, and parts of Africa rely heavily on ethiprole to protect these staple crops from destructive pests such as planthoppers, stem borers, and leaf beetles, ensuring stable yields and food security. The demand for ethiprole in cereal crops is expected to remain strong as global population growth continues to push for higher grain production.

Governments and agricultural bodies are prioritizing crop protection measures to minimize losses, particularly in regions where cereals contribute significantly to national diets and exports. Ethiprole’s effectiveness against resistant pest strains positions it as a crucial solution for sustainable cereal farming.

By Application

Agricultural Insecticide Dominates with 63.5% Share

In 2024, Agricultural Insecticide held a dominant market position, capturing more than a 63.5% share in the global ethiprole market. The strong demand for this application is closely tied to the rising pest pressures on major crops such as rice, soybeans, maize, and vegetables.

Farmers increasingly prefer ethiprole-based insecticides because of their proven ability to control resistant pests like planthoppers, beetles, and locusts, ensuring higher crop protection and yield stability. The agricultural insecticide segment is projected to maintain its leadership, as global food demand continues to rise along with population growth.

With climate variability creating favorable conditions for pest outbreaks, reliance on effective crop protection solutions like ethiprole is expected to intensify. The segment’s dominance is also reinforced by government-backed programs promoting integrated pest management, where ethiprole plays a role due to its efficiency and compatibility with other control measures.

Key Market Segments

By Formulation Type

- Liquid

- Powders

By Crop Type

- Cereal Crops

- Fruits and Vegetables

- Oilseeds

- Plantations

- Others

By Application

- Agricultural Insecticide

- Pest Control

- Public Health

- Others

Drivers

Strong Demand for Crop Protection in the Asia Pacific Driving Ethiprole Use

Picture a farmer in rural Asia waking before dawn, walking through fields of rice or sugarcane. She’s seen pests destroy her hard work and hopes to feed her family and perhaps sell some harvest. Globally, over 3.70 million tonnes of active pesticidal ingredients were applied in agriculture, marking a 4% increase and a 13% rise over the past decade.

That growth reflects how critical crop protection has become as populations swell and food demand grows. Within this landscape, the Asia Pacific stands out. In that region alone, countries use about 3.5 Mt of ingredients, nearly half of all pesticide exports globally, which amounted to USD 21.7 billion in value.

India and China, among other developing nations, are fueling this demand with the increasing adoption of modern farming practices seeking higher yields and better pest control solutions. Ethiprole’s selectivity and compatibility with Integrated Pest Management make it a practical choice, helping reduce broader chemical load while targeting specific pests

Restraints

Strict EU Residue Rules Hold Back Ethiprole’s Reach

Regulatory limits around ethiprole create a big hurdle for its use, especially for producers exporting to or selling within the EU. When a crop contains ethiprole residues above the LOQ, buyers face delays at customs, forced rejections, or worse losses in both income and reputation.

Further complicating things, enforcement methods have become sharper. The European Food Safety Authority (EFSA) confirms that for dry goods, residue controls must detect ethiprole down to a validated LOQ commonly 0.002 mg/kg, making any detectable residue precarious.

These tight requirements also ripple into global trade. Countries exporting to the EU must adjust application timing, lower rates, or sometimes drop ethiprole altogether. For a farmer in, say, South Asia, that can mean watching pests close up or switching to another product, often with shaky supply or higher cost.

Opportunity

Soaring Global Rice Production Fuels Demand for Effective Pest Defenses like Ethiprole

A rice farmer in Southeast Asia, hands stained with earth, eyes full of hope as she inspects her green paddies. Every ear of rice is life supporting her children’s meals and perhaps a little extra to sell at the village market. With global rice production climbing, the burden to protect crop health grows too.

Rice is a cornerstone of nutrition for billions. And right now, the world is seeing its largest ever rice harvest. According to the UN’s Food and Agriculture Organization, global rice production is forecast to reach 543 million tonnes in the 2024/25 season, a record high thanks to favorable growing conditions, especially in India, Cambodia, and Myanmar.

More rice planted and harvested means more opportunities for pests like planthoppers and stem borers to attack. Farmers need reliable tools that are effective yet carefully used. Ethiprole, known for its targeted action and compatibility with integrated pest management, fits this need. Its role becomes more impactful when rice acreage and yield are expanding.

Trends

Growing Push for Integrated Pest Management Sparks Responsible Ethiprole Use

Integrated Pest Management (IPM) is not just a concept; it’s becoming a movement. True to the FAO definition, IPM blends chemical and non-chemical methods to fight pests while protecting both human and environmental health. This emerging focus and support from government bodies is encouraging farmers to use tools like ethiprole more responsibly, reducing over-application and preserving health.

IPM’s growth is backed by impressive outcomes. Analyzing 85 IPM projects across Asia and Africa, researchers found average yield increases of 41%, alongside reductions in pesticide use by 31% a real testament to smarter pest control. This shows that when farmers embrace IPM, they don’t lose out; they gain more yield and reduce chemical use.

Governments and international organizations are stepping up. The FAO’s International Code of Conduct on Pesticide Management offers a shared framework to guide safe pesticide lifecycle from production to disposal and helps regulators build better laws and support systems.

Regional Analysis

Asia Pacific leads with a 43.7% share and a USD 0.3 Billion market value.

The Asia Pacific region is the unequivocal leader in the global Ethiprole market, commanding approximately 43.7% of total revenues, equating to about USD 0.3 billion. This commanding share reflects the predominance of intensive agriculture across major economies such as China, India, Thailand, Vietnam, and Indonesia, where Ethiprole is critical for crop protection, especially in high-value, staple crops like rice, sugarcane, and vegetables.

Growth in the region is bolstered by escalating demand for improved crop quality, increased shelf life, and heightened resistance to pests (notably planthoppers, leaf miners, thrips, phyllids, and aphids). These factors are prompting widespread adoption of Ethiprole for rice and sugarcane protection, where it offers high efficacy and enhanced crop yields.

Furthermore, low labor costs, a large-scale agricultural workforce, and favorable regulatory environments (particularly within emerging markets like China and India) enable widespread manufacturing activity and rapid deployment of Ethiprole formulations.

Leading players such as Bayer CropScience and others are increasingly focusing on expanding production, launching innovations, and forging partnerships within the region to leverage this demand. Aggressive crop protection needs, widespread cultivation of rice and sugarcane, and favorable regulatory environments foster APAC dominance. Meanwhile, lower adoption in North America and Europe is due to rising environmental and health concerns.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF leverages its global crop-protection footprint, deep expertise in formulation chemistry, and robust supply-chain reliability to integrate ethiprole within holistic pest management programs. The company emphasizes resistance-management rotations across phenylpyrazoles (IRAC 2B) and complementary modes of action, targeting pests in rice, cotton, and horticulture across Asia-Pacific and Latin America.

Bayer combines its legacy in discovery chemistry with regulatory expertise to sustain ethiprole as part of a diversified insecticide portfolio. It focuses on resistance stewardship, effective performance in flooded-rice systems, and scalable manufacturing. With commercial reach across Asia and strategic registrations in high-pressure zones for planthoppers and leafhoppers, Bayer ensures revenue resilience.

Adama distinguishes itself through rapid market access, broad expertise in off-patent chemistries, and localized formulations tuned for hot, humid Asian environments. Ethiprole aligns with Adama’s farmer-centric approach, offering clear label claims and simple rotation guidelines. The company leverages strong distribution networks in India and Southeast Asia, alongside targeted marketing to rice-growing communities.

Top Key Players in the Market

- BASF

- Bayer

- Adama Agricultural Solutions

- Nufarm

- Sumitomo Chemical

- Syngenta

- UPL Limited

- Meghmani Organics Ltd.

- SRIRAMCHEM

Recent Developments

In 2024, BASF has been focusing on innovative crop protection solutions, including insecticides, but there is no specific mention of ethiprole. BASF emphasizes integrated pest management and sustainable agriculture, with products like Imidacloprid-based insecticides for seed treatment and foliar applications.

In 2024, Bayer announced expansions in its crop protection pipeline, emphasizing digital farming tools and integrated pest management. While ethiprole is still used in markets like Asia, Bayer’s recent focus is on biologicals and precision application technologies.

Report Scope

Report Features Description Market Value (2024) USD 0.9 Billion Forecast Revenue (2034) USD 1.4 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation Type (Liquid, Powders), By Crop Type (Cereal Crops, Fruits and Vegetables, Oilseeds, Plantations, Others), By Application (Agricultural Insecticide, Pest Control, Public Health, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Bayer, Adama Agricultural Solutions, Nufarm, Sumitomo Chemical, Syngenta, UPL Limited, Meghmani Organics Ltd., SRIRAMCHEM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF

- Bayer

- Adama Agricultural Solutions

- Nufarm

- Sumitomo Chemical

- Syngenta

- UPL Limited

- Meghmani Organics Ltd.

- SRIRAMCHEM