Global Energy Storage Market Size, Share Analysis Report By Technology (Pumped Storage, Electrochemical Storage, Electromechanical Storage, Thermal Storage, Others), By Application (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164445

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

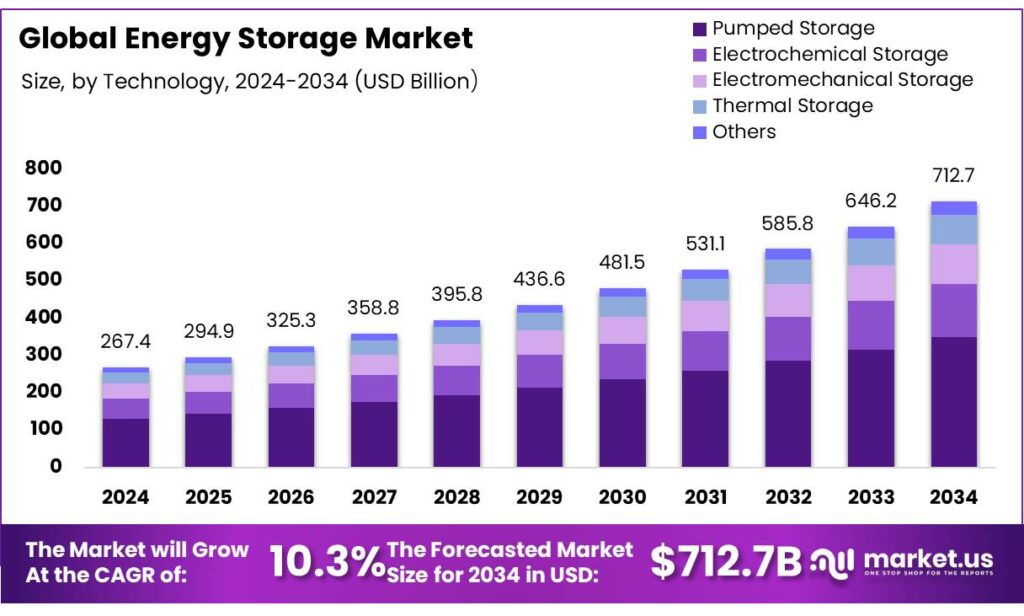

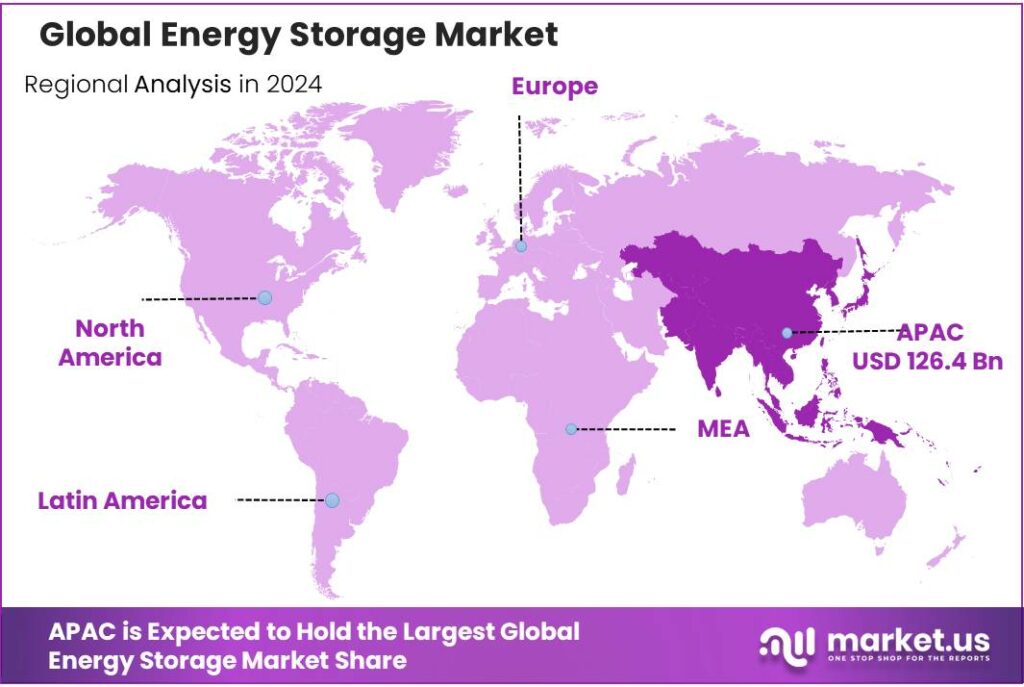

The Global Energy Storage Market size is expected to be worth around USD 712.7 Billion by 2034, from USD 267.4 Billion in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 47.3% share, holding USD 126.4 Billion in revenue.

Energy storage sits at the center of power-system decarbonization, balancing variable solar and wind, improving reliability, and cutting curtailment. Today, legacy pumped-storage hydropower still dominates in energy terms: global pumped-hydro capacity stood at ~160 GW in 2021, providing ~8,500 GWh of storage capability—over 90% of worldwide electricity storage.

- REN21 estimates global battery storage capacity grew 120% in 2023 to 55.7 GW, with China jumping to 27.1 GW and the United States reaching 16.2 GW; the UK led Europe at 3.6 GW. Meanwhile, hydropower’s installed fleet reached 1,412 GW in 2023, underscoring PSH’s role in bulk shifting and inertia services. Together, these trends reflect concurrent build-outs of short-duration batteries and long-duration resources that support higher variable renewable energy (VRE) penetration.

The U.S. Department of Energy’s Long Duration Storage Shot targets a 90% cost reduction for ≥10-hour storage by 2030 and is backed by the Storage Innovations 2030 (SI-2030) program and detailed 2023–2024 technology assessments. Internationally, development finance is crowding in capital: the World Bank notes 6.3 GWh of battery storage financed in active projects and an expanding Energy Storage Partnership across 35 countries, catalyzing grid-scale and distributed deployments in emerging markets.

First, cheaper renewables make flexibility indis pensable: 81% of the renewable capacity added in 2023 produced electricity cheaper than fossil alternatives, intensifying the need for storage to firm low-cost wind and solar. Second, policy is mobilizing capital. The EU’s pledge to reach ~1,500 GW of storage by 2030 sets a strong signal for market design, system planning, and interconnection upgrades.

Key Takeaways

- Energy Storage Market size is expected to be worth around USD 712.7 Billion by 2034, from USD 267.4 Billion in 2024, growing at a CAGR of 10.3%.

- Electrochemical Storage held a dominant market position, capturing more than a 48.5% share of the global energy storage market.

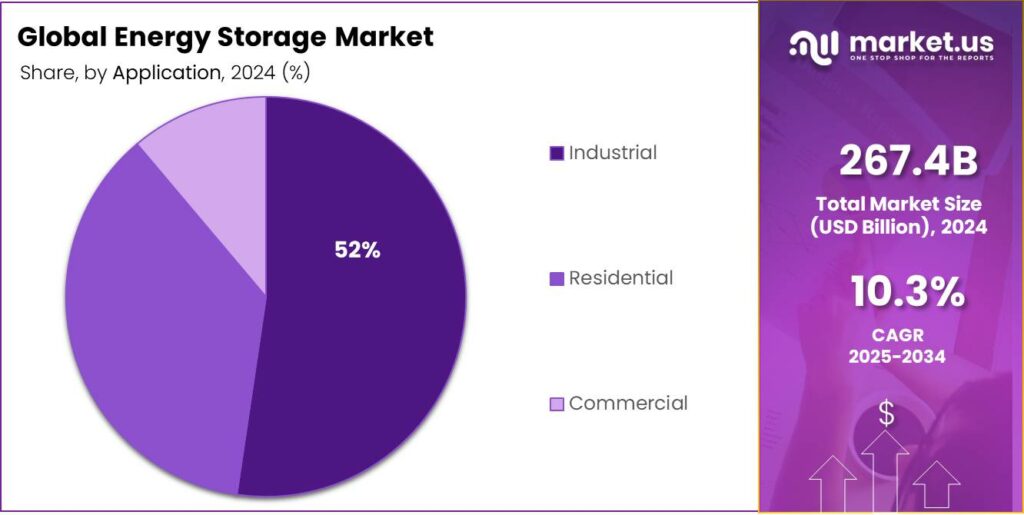

- Industrial held a dominant market position, capturing more than a 51.6% share of the global energy storage market.

- Asia-Pacific (APAC) region held a dominant market position in the global energy storage industry, capturing approximately 47.3% of the total market share and reaching a valuation of around USD 126.4 billion.

By Technology Analysis

Electrochemical Storage dominates with 48.5% share driven by rapid battery adoption and grid-scale demand.

In 2024, Electrochemical Storage held a dominant market position, capturing more than a 48.5% share of the global energy storage market. This segment’s leadership was supported by the accelerated deployment of lithium-ion and emerging sodium-ion batteries across both grid-scale and behind-the-meter applications. The rising integration of renewable energy systems, particularly solar and wind, created a sustained need for efficient and flexible storage technologies, positioning electrochemical systems as the preferred solution due to their scalability and declining costs.

Throughout 2024, significant growth was recorded across Asia-Pacific, North America, and Europe, driven by government-backed energy transition programs and large-scale renewable projects. China and the United States accounted for a major portion of new battery installations, reflecting strong policy frameworks supporting grid stability and energy independence. The growing use of electrochemical systems in electric vehicle charging infrastructure and distributed energy management further accelerated segment expansion during the year.

By Application Analysis

Industrial segment dominates with 51.6% share driven by large-scale energy storage integration and grid reliability needs.

In 2024, Industrial held a dominant market position, capturing more than a 51.6% share of the global energy storage market. The segment’s growth was mainly supported by rising investments in large-scale storage systems for manufacturing facilities, power generation units, and utility infrastructure. Industrial users increasingly adopted advanced storage technologies to manage peak load demands, stabilize operations, and reduce energy costs through self-consumption and renewable integration. The growing shift toward sustainable production practices and the need for uninterrupted power supply in energy-intensive industries further reinforced this segment’s leading role.

Industrial storage installations expanded significantly across key markets such as China, the United States, and Germany, where industries are integrating renewables and energy storage to meet net-zero commitments. The use of battery energy storage systems (BESS) in industrial zones helped companies reduce dependence on grid supply, enhance energy security, and achieve operational efficiency. Sectors such as mining, chemical production, and automotive manufacturing showed notable adoption due to their high power requirements and carbon reduction goals.

Key Market Segments

By Technology

- Pumped Storage

- Electrochemical Storage

- Electromechanical Storage

- Thermal Storage

- Others

By Application

- Industrial

- Residential

- Commercial

Emerging Trends

Safety-First Chemistries and Longer Durations Are Becoming Mainstream

A clear trend is reshaping energy storage: the market is pivoting to safer, cost-efficient chemistries (notably LFP) and to longer discharge durations, so batteries can shift growing daytime solar into evening peaks and provide grid-forming stability. Costs continue to fall, unlocking multi-hour projects at scale. IRENA reports the average installed cost of utility-scale battery storage fell to USD 192/kWh in 2024, a ~93% decline since 2010—the single biggest enabler for four-to-eight-hour systems that firm wind and solar.

- The United States added 10.4 GW of new battery capacity in 2024, lifting cumulative utility-scale capacity above 26 GW; batteries were the second-largest new addition after solar, yet still just ~2% of total U.S. utility-scale capacity—implying vast headroom for longer-duration growth.

Policy is hard-coding this shift. At COP, countries endorsed a Global Energy Storage & Grids Pledge targeting ~1,500 GW of storage by 2030 (≈6× 2022 levels), making multi-hour storage a system requirement rather than an option. The European Commission similarly signals rapid uptake: compared with 2024, Europe expects an additional 128 GW / 300 GWh of electrochemical storage on grids by 2030, a scale that points squarely to longer-duration batteries backing variable renewables and electrification.

Operations data show how use-cases are evolving. In U.S. power markets, battery energy-shifting has become the primary use for ~10.5 GW of installed capacity, with operators leaning on four-hour blocks and stacking revenues with ancillary services. The U.S. National Renewable Energy Laboratory’s 2024 Advanced Technology Baseline reflects this reality: LFP is now the primary stationary-storage chemistry, and cost/performance benchmarks are tracked across 2, 4, 6, 8 and 10-hour durations—evidence that planning and procurement are standardizing around longer discharge windows.

Drivers

Significant Cost Decline of Renewables Driving Energy Storage Growth

One major driving factor for the expansion of energy storage is the dramatic and sustained decline in the cost of renewable energy generation. When renewable electricity becomes significantly cheaper than fossil-fuel alternatives, it triggers a need for storage to capture, shift, and manage that low-cost generation—which in turn fuels demand for battery systems, pumped hydro, and other storage technologies.

- For example, the International Renewable Energy Agency (IRENA) reports that between 2010 and 2023 the global cost of battery storage projects fell by 89%.

This cost decline matters in a practical way: cheaper renewables mean more generation at low marginal cost, more variability, and thus greater need for flexible storage to smooth daily and seasonal flows. The International Energy Agency (IEA) found that in 2023, approximately 96% of new utility-scale solar PV and onshore wind capacity had lower generation costs than new coal and gas plants.

As renewables take a growing share of electricity supply, storage becomes more than a backup—it becomes an enabler of the new electricity paradigm. In many markets the cheapest electricity is now from renewables, which creates an economic imperative to capture it when abundant and deploy it when needed. Government policies reflect this: the United Nations notes that over 90% of new renewable projects now produce power more cheaply than fossil alternatives.

When generation costs drop rapidly, the economics shift: storage projects benefit from flatter basis spreads, more time-shiftable value, and improved monetisation of arbitrage, capacity, and ancillary services. Storage becomes viable not merely for emergencies, but for everyday optimisation of the grid. The interplay between cheaper renewables and storage means each accelerates the other: as more cheap intermittent generation comes online, more storage is required to manage it; as more storage is deployed, it enables greater utilization of renewables.

Restraints

Grid Interconnection & Transmission Bottlenecks

A single, stubborn barrier is slowing energy storage everywhere: getting projects connected to strong grids fast enough. Interconnection queues are swollen and studies take too long, holding back batteries that could firm renewables and cut peak prices. In the United States alone, ~2,300–2,600 GW of generation and storage is waiting in queues—far more than today’s installed capacity—with many projects ultimately withdrawn as delays mount. Regulators have begun to respond: the U.S. Federal Energy Regulatory Commission’s Order No. 2023 set new, faster cluster-study rules and prods for timely milestones, with compliance plans approved through September 2024—a meaningful step, but the backlog remains large.

Behind the queues sits an even bigger structural gap: not enough modern wires and substations to carry flexible power where and when it’s needed. The International Energy Agency (IEA) estimates that to meet national climate targets, annual grid investment must nearly double to >USD 600 billion by 2030, after a decade of stagnation—especially at the distribution level where storage often connects. Today’s spending is roughly ~USD 300 billion/year, far short of what’s required to integrate the record ~507 GW of renewable capacity added in 2023.

The bottleneck is sharper in emerging economies, where demand is rising but capital is scarce. The World Bank highlights the need for concessional finance to unlock battery storage at scale; its programs aim to blend public and private funds—e.g., a US$1 billion global storage initiative launched to mobilize ~US$4 billion more, and a separate US$750 million multi-phase program proposal to kick-start grid-connected BESS markets. Meanwhile, the IEA’s Net Zero pathway underscores that ~USD 600 billion/year for grids through 2030 is the benchmark to keep storage-enabling infrastructure on track.

Opportunity

Co-locating Storage with EV Fast Charging And Data Centers

The clearest growth opening for energy storage is at the edge of the grid—pairing batteries with public fast-charging hubs and power-hungry data centers. Electric mobility is scaling at record pace, and chargers are arriving even faster. In 2024, more than 1.3 million public charging points were added worldwide—over 30% growth year-on-year, with China hosting ~65% of the global public chargers and ~60% of the electric light-duty vehicle stock. These hubs create sharp, local peaks that storage can shave, stabilize and back up, improving uptime and lowering demand charges.

Policy momentum is directly funding this build-out and invites storage to the table. In the United States, the federal NEVI program provides $5 billion (FY 2022–2026) to help states deploy corridor-based fast charging; states had $3.3 billion allocated through FY 2025 and $527 million awarded or obligated by February 2025—with the first wave of stations opening across multiple states. Batteries colocated at these sites can right-size grid interconnections and keep stations running during outages.

- The U.S. Department of Energy reinforced this with a $1.25 billion loan guarantee to EVgo to deploy ~7,500 high-power chargers at ~1,100 stations, where onsite storage can buffer 350 kW peaks and share power among ports.

Batteries can clip 15-minute peaks, provide frequency response, arbitrage off-peak energy, and enable sites where distribution upgrades would otherwise be prohibitive or slow. Meanwhile, the system-level storage base is expanding to support these distributed uses: in 2024, U.S. utility-scale battery capacity exceeded 26 GW, after 10.4 GW of new additions that year, and is forecast for another record build in 2025. This backbone improves wholesale price signals and revenues for colocated batteries at the retail edge.

Regional Insights

Asia-Pacific dominates with 47.3% share valued at USD 126.4 billion, driven by strong renewable integration and government-led energy transition programs.

In 2024, the Asia-Pacific (APAC) region held a dominant market position in the global energy storage industry, capturing approximately 47.3% of the total market share and reaching a valuation of around USD 126.4 billion. The regional growth was primarily driven by large-scale renewable energy integration, rapid industrialization, and increasing electrification of transport and manufacturing sectors.

Countries such as China, Japan, South Korea, and India accounted for the majority of new installations, supported by national targets for carbon neutrality and aggressive grid modernization initiatives. China, in particular, led the regional landscape with extensive deployment of grid-connected battery systems and renewable co-location projects, contributing to over 40 GW of new energy storage capacity additions in 2024.

Japan and South Korea continued to expand their commercial and industrial storage markets, with government programs supporting distributed storage adoption and backup power solutions for smart grids. Meanwhile, India demonstrated strong progress through policy reforms under its National Energy Storage Mission, encouraging both domestic manufacturing and integration of battery systems in solar and wind projects. The growing demand for electric vehicles and data centers further strengthened the need for energy storage infrastructure across the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Altairnano: Altairnano is a U.S.-based developer of energy storage systems built around nanostructured lithium titanate oxide (LTO) battery cells. Their proprietary chemistry delivers high cycle life (over 16,000 cycles claimed) and fast charge/discharge capability in harsh environments. The company positions itself for grid-stability and renewable integration use-cases, offering systems like a 2.0 MW module.

GENERAL ELECTRIC (GE): GE, now represented in its energy business by GE Vernova, is a major diversified industrial player offering power-conversion and storage solutions. Its “Reservoir” platform provides modular battery-storage + power-electronics systems (1.2 MW/4 MWh spec) and the company has committed to expanding its solar & storage power-electronics manufacturing capacity to ~9 GW per year.

Ecoult: Ecoult, originally spun out of Australia’s CSIRO in 2007, focused on commercialising a hybrid ultracapacitor/lead-acid battery technology (UltraBattery) and EV charging/energy-storage solutions. It delivered integrated C&I and residential energy-storage systems and EV charging infrastructure through its LiHub and Harmony ESS product lines.

Top Key Players Outlook

- Altairnano

- Ecolt

- Electrovaya

- GENERAL ELECTRIC

- Langley Holdings plc

- LG Chem

- Maxwell Technologies, Inc.

- Saft

- Showa Denko Materials Co., Ltd.

- The Furukawa Battery Co., Ltd.

- Kokam

- Fluence

- Samsung SDI Co., Ltd.

Recent Industry Developments

In 2024 Langley Holdings plc, reported revenues of approximately USD 1.5 billion, with the Power Solutions division accounting for about 50% of that figure and employing over 5,000 people globally.

In 2024, LG Chem’s battery exposure ran through its affiliate LG Energy Solution (LGES) and its own cathode-materials business. LGES posted KRW 25.6 trillion revenue and KRW 575.4 billion operating profit for 2024, while LG Chem reported KRW 48.916 trillion consolidated revenue and KRW 916.8 billion operating profit.

Report Scope

Report Features Description Market Value (2024) USD 267.4 Bn Forecast Revenue (2034) USD 712.7 Bn CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Pumped Storage, Electrochemical Storage, Electromechanical Storage, Thermal Storage, Others), By Application (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Altairnano, Ecolt, Electrovaya, GENERAL ELECTRIC, Langley Holdings plc, LG Chem, Maxwell Technologies, Inc., Saft, Showa Denko Materials Co., Ltd., The Furukawa Battery Co., Ltd., Kokam, Fluence, Samsung SDI Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Altairnano

- Ecolt

- Electrovaya

- GENERAL ELECTRIC

- Langley Holdings plc

- LG Chem

- Maxwell Technologies, Inc.

- Saft

- Showa Denko Materials Co., Ltd.

- The Furukawa Battery Co., Ltd.

- Kokam

- Fluence

- Samsung SDI Co., Ltd.