Global Electrophoresis Market By Product Type (Electrophoresis Instruments, Reagents & Consumables, Gel Documentation Systems and Software), By Application (Genomics & Molecular Biology, Proteomics & Protein Characterization, Medical Research, Food, Environmental & Agricultural Testing, Pharmaceutical & Bioprocess Quality Control and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Hospitals & Diagnostic Laboratories and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171888

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

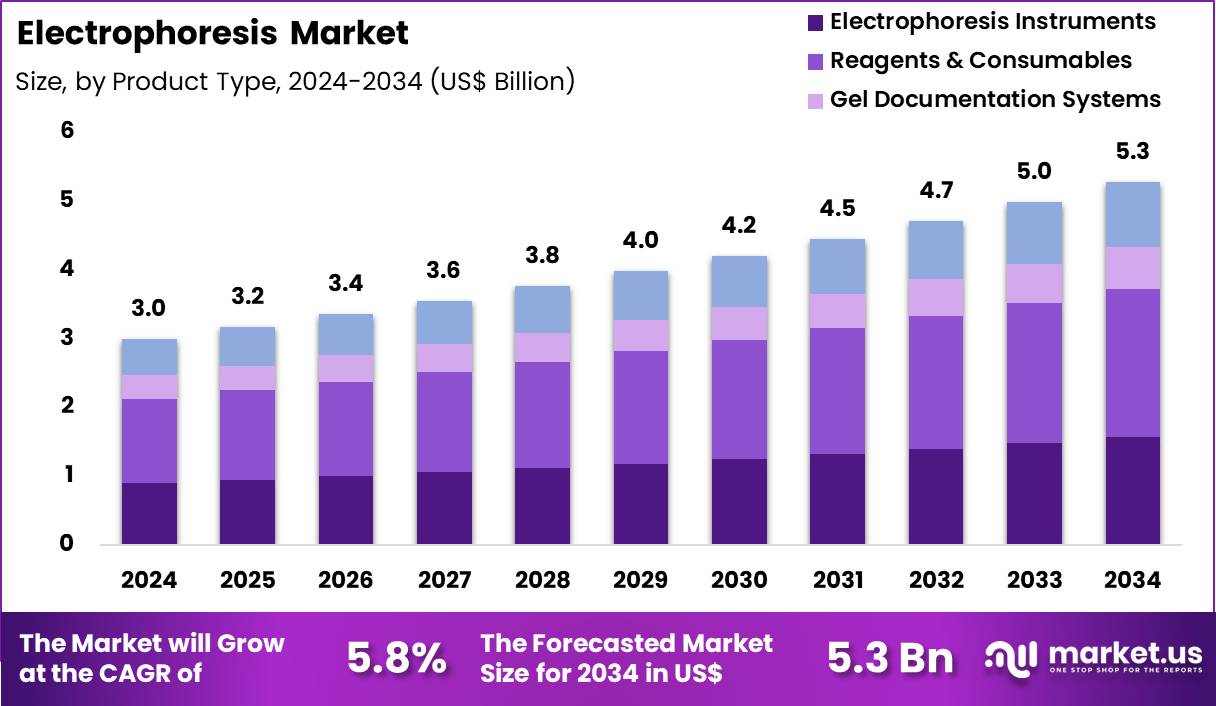

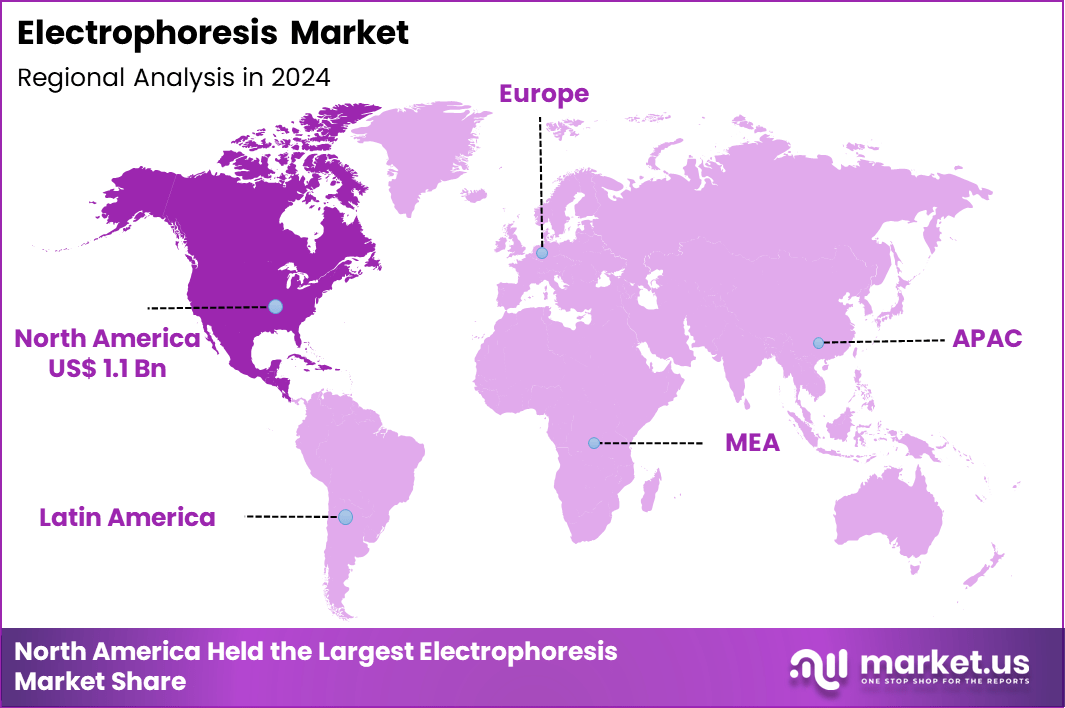

The Global Electrophoresis Market size is expected to be worth around US$ 5.3 Billion by 2034 from US$ 3.0 Billion in 2024, growing at a CAGR of 5.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.2% share with a revenue of US$ 1.1 Billion.

Growing advancements in molecular biology research propel the adoption of electrophoresis techniques that enable precise separation and analysis of nucleic acids and proteins in diverse scientific investigations. Researchers extensively apply gel electrophoresis to resolve DNA fragments during genome sequencing projects, facilitating accurate mapping and variant identification. These methods support protein characterization in proteomics studies, allowing detection of post-translational modifications critical for understanding cellular functions.

Laboratories employ capillary electrophoresis for high-resolution separation of charged analytes in forensic DNA profiling and paternity testing. Clinicians utilize these systems in hemoglobinopathy screening to differentiate variant hemoglobins and diagnose disorders like sickle cell anemia.

In September 2025, Merck KGaA partnered with a specialist artificial intelligence company to apply AI-based analytics to electrophoresis data interpretation. By improving pattern recognition, reducing manual analysis time, and enhancing reproducibility, the collaboration increases the usability and efficiency of electrophoresis workflows, encouraging broader adoption across research and diagnostic laboratories.

Biotechnology firms capitalize on opportunities to integrate microfluidic electrophoresis platforms that miniaturize assays for rapid biomarker detection in point-of-care clinical settings. Developers advance two-dimensional electrophoresis techniques to resolve complex protein mixtures, aiding discovery of disease-specific isoforms in cancer research. These systems enable glycan analysis through lectin-based separation, supporting quality control in glycoprotein therapeutic production.

Opportunities expand in next-generation sequencing library preparation, where electrophoresis ensures fragment size selection for optimal sequencing accuracy. Companies pursue automated slab gel systems that streamline workflow integration for high-throughput vaccine purity assessments. Firms invest in isoelectric focusing applications to fractionate antibodies, enhancing characterization in monoclonal antibody development pipelines.

Industry innovators implement machine learning algorithms to automate band detection and quantification in gel images, minimizing subjectivity in protein expression studies. Developers introduce multiplex capillary systems that simultaneously analyze multiple samples for expedited pharmacogenomic testing. Market participants refine pulsed-field gel electrophoresis for large DNA molecule separation, improving microbial strain typing in outbreak investigations.

Companies enhance dielectric electrophoresis for label-free cell sorting, broadening utility in stem cell therapy quality assurance. Researchers prioritize preparative electrophoresis devices that isolate pure nucleic acid populations for downstream cloning and transfection experiments. Ongoing initiatives emphasize hybrid systems combining electrophoresis with mass spectrometry, delivering comprehensive structural insights in metabolomics workflows.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.0 billion, with a CAGR of 5.8%, and is expected to reach US$ 5.3 Billion by the year 2034.

- The product type segment is divided into electrophoresis instruments, reagents & consumables, gel documentation systems and software, with reagents & consumables taking the lead in 2023 with a market share of 41.0%.

- Considering application, the market is divided into genomics & molecular biology, proteomics & protein characterization, medical research, food, environmental & agricultural testing, pharmaceutical & bioprocess quality control and others. Among these, medical research held a significant share of 48.3%.

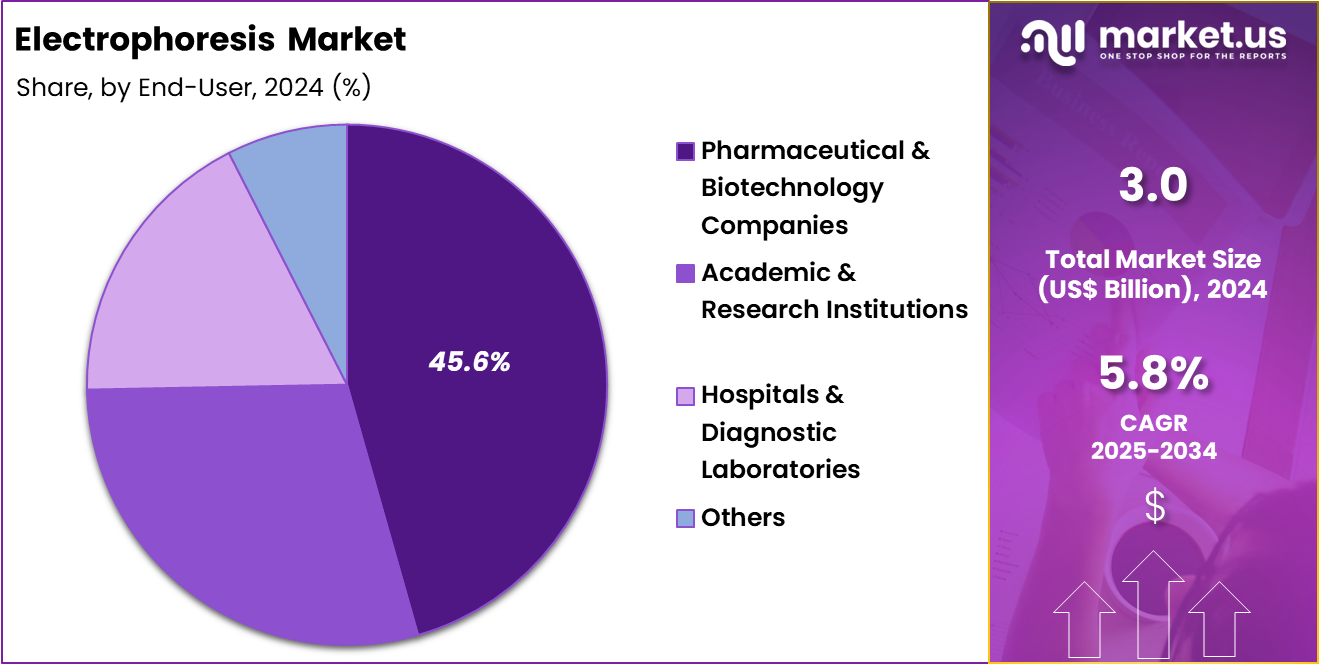

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical & biotechnology companies, academic & research institutions, hospitals & diagnostic laboratories and others. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 45.6% in the market.

- North America led the market by securing a market share of 37.2% in 2024.

Product Type Analysis

Reagents and consumables, holding 41.0%, are expected to dominate because electrophoresis workflows require recurring purchases of buffers, gels, stains, ladders, and cartridges for every run. Laboratories prioritize consistent reagent performance to ensure reproducibility and data integrity across experiments. Rising test volumes in genomics, proteomics, and quality control increase consumption frequency, directly expanding demand.

Continuous innovation in pre-cast gels, safer stains, and ready-to-use buffers improves efficiency and reduces preparation time. Standardization requirements in regulated environments favor validated consumables from trusted suppliers. Expansion of automated electrophoresis systems further increases compatible consumable usage. Academic and industrial labs scale throughput, which multiplies repeat purchases. These factors keep reagents and consumables anticipated to remain the largest product type segment.

Application Analysis

Medical research, holding 48.3%, is projected to dominate because electrophoresis remains foundational for DNA, RNA, and protein separation in disease mechanism studies. Translational research programs rely on electrophoresis to validate biomarkers, characterize proteins, and assess genetic variations. Growth in oncology, immunology, and neurological research drives sustained experimental activity that depends on routine gel-based analysis.

Funding for academic and clinical research increases assay volume and method diversity. Integration with downstream techniques such as blotting and mass spectrometry strengthens electrophoresis relevance. Method reliability and low cost support broad adoption across research stages. Training curricula continue to emphasize electrophoresis proficiency, reinforcing long-term use. These dynamics keep medical research expected to remain the leading application segment.

End-User Analysis

Pharmaceutical and biotechnology companies, holding 45.6%, are expected to dominate end-user demand because electrophoresis supports discovery, development, and quality control workflows. Drug developers use electrophoresis to assess purity, stability, and molecular integrity during formulation and release testing. Bioprocess development relies on protein characterization and impurity profiling, which sustains frequent use.

Regulatory expectations for analytical validation encourage standardized, repeatable methods within company labs. Pipeline expansion in biologics increases reliance on protein-focused electrophoretic techniques. Internal laboratories favor scalable, high-throughput solutions that integrate with automated systems. These drivers keep pharmaceutical and biotechnology companies anticipated to remain the dominant end-user segment.

Key Market Segments

By Product Type

- Electrophoresis Instruments

- Horizontal gel electrophoresis systems

- Vertical gel electrophoresis systems

- Capillary electrophoresis analyzers

- Others

- Reagents & Consumables

- Gel Documentation Systems

- Software

By Application

- Genomics & Molecular Biology

- Proteomics & Protein Characterization

- Medical Research

- Food, Environmental & Agricultural Testing

- Pharmaceutical & Bioprocess Quality Control

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Hospitals & Diagnostic Laboratories

- Others

Drivers

Escalating approvals of novel therapeutics is driving the market

The electrophoresis market is propelled by the escalating approvals of novel therapeutics, many of which are complex biologics requiring detailed molecular separation and characterization during development and quality assurance phases. Electrophoresis techniques, including gel-based and capillary formats, are essential for assessing protein purity, glycan profiles, and charge heterogeneity in monoclonal antibodies and recombinant proteins.

These methods support compliance with pharmacopeial standards for identity, strength, and quality testing. Biopharmaceutical manufacturers depend on reliable electrophoretic analysis to validate batch consistency and stability. The surge in innovative therapies amplifies the need for robust analytical tools throughout research, process development, and release testing.

Regulatory expectations for comprehensive data packages further integrate electrophoresis into submission dossiers. Academic and industrial collaborations advance method optimizations aligned with therapeutic pipelines. Global harmonization of analytical guidelines reinforces the role of electrophoresis in international filings.

In 2024, the U.S. Food and Drug Administration’s Center for Drug Evaluation and Research approved 50 novel drugs. This volume underscores the intensive analytical demands placed on separation technologies. Contract research organizations expand electrophoretic capabilities to support sponsor needs. Instrumentation providers innovate systems compatible with high-throughput therapeutic screening. Quality control laboratories invest in validated platforms to handle increased workloads. These dynamics collectively sustain demand for electrophoresis reagents, equipment, and software solutions.

Restraints

Stringent validation requirements for analytical methods are restraining the market

The electrophoresis market encounters limitations from stringent validation requirements mandated for analytical methods used in regulated environments, particularly for pharmaceutical and clinical applications. Protocols must demonstrate specificity, accuracy, precision, linearity, and robustness according to international guidelines.

Extensive documentation and performance qualification extend implementation timelines for new or modified techniques. Transferring methods between laboratories necessitates additional comparability studies and bridging data. Variability in reagent lots or instrument performance can complicate ongoing verification. Resource-intensive lifecycle management includes periodic revalidation and change control procedures.

Smaller organizations may lack expertise or infrastructure for comprehensive compliance. Updates to regulatory expectations prompt retrospective assessments of established methods. Cross-platform differences hinder seamless adoption of advanced formats. These obligations elevate operational complexities and costs without direct revenue generation. Facilities prioritize proven technologies to minimize validation burdens. Emerging techniques face prolonged scrutiny before routine deployment. Such restraints moderate the pace of innovation uptake and market expansion in highly regulated segments.

Opportunities

Advancements in multi-omics research initiatives are creating growth opportunities

The electrophoresis market stands to benefit from advancements in multi-omics research initiatives that integrate genomic, proteomic, and metabolomic analyses to elucidate disease mechanisms and biomarker discovery. These programs employ electrophoretic separations for protein isoform resolution and nucleic acid fragment sizing in comprehensive profiling workflows.

Collaborative consortia leverage high-resolution techniques to generate datasets informing precision medicine approaches. Funding supports development of orthogonal methods enhancing data reliability across omics layers. Integration with downstream technologies expands utility in systems biology studies. Academic centers build core facilities equipped for multi-modal separations. Industry partnerships translate omics insights into therapeutic targets and diagnostics.

Global efforts address data standardization to facilitate electrophoretic contributions. In 2023, the National Institutes of Health awarded $50.3 million for multi-omics research focused on human health and disease. This investment stimulates demand for specialized electrophoretic platforms and consumables.

Translational projects incorporate separation sciences for validation of omics findings. Training programs cultivate expertise in advanced applications. Interdisciplinary frameworks promote innovative uses beyond traditional boundaries. These opportunities foster diversification and long-term growth in research-oriented market segments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces bolster the electrophoresis market as escalating healthcare investments and booming biopharmaceutical research push laboratories to adopt advanced gel and capillary systems for precise protein and DNA separation. Executives at leading firms strategically roll out automated platforms and eco-friendly reagents, capitalizing on global demand for faster diagnostics in oncology and genomics across thriving economies.

Lingering inflation and economic slowdowns, however, inflate costs for raw materials and energy, compelling manufacturers to raise prices and forcing smaller labs to defer upgrades amid squeezed budgets. Geopolitical frictions, notably U.S.-China trade disputes and regional conflicts, routinely disrupt supplies of critical components like electrodes and buffers, generating production delays and sourcing uncertainties for internationally reliant suppliers.

Current U.S. tariffs impose elevated duties on imported laboratory instruments, particularly from China, amplifying procurement expenses for American distributors and eroding competitive edges in domestic channels. These tariffs also provoke counter-tariffs from trading partners that constrain U.S. exports of innovative electrophoresis technologies and impede multinational R&D alliances.

Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Growing adoption of capillary electrophoresis-mass spectrometry is a recent trend

In 2024 and 2025, the electrophoresis market has shown a marked trend toward growing adoption of capillary electrophoresis coupled with mass spectrometry for enhanced characterization in biopharmaceutical analysis. This hyphenated approach provides superior sensitivity and structural information compared to standalone methods. Developers apply CE-MS for intact protein analysis, peptide mapping, and glycan profiling with minimal sample preparation.

Regulatory interest in multi-attribute methods encourages implementation for release testing. Instrumentation refinements improve interface stability and reproducibility. Academic publications demonstrate applications in charge variant and impurity assessment. Industry forums discuss best practices and case studies highlighting workflow efficiencies. Collaborative roundtables address standardization for broader acceptance. Real-time monitoring capabilities support process analytical technology initiatives.

Compatibility with automation streamlines high-volume testing. Training resources expand to build proficiency in hybrid operations. Data integrity features align with electronic record requirements. Environmental considerations favor reduced solvent consumption relative to alternatives. This trend elevates analytical depth while addressing complexity in modern biologics.

Regional Analysis

North America is leading the Electrophoresis Market

In 2024, North America secured a 37.2% share of the global electrophoresis market, underpinned by expansive biomedical research initiatives and sophisticated laboratory ecosystems. Pharmaceutical developers extensively deploy capillary electrophoresis systems for impurity profiling and stability testing in novel therapeutic candidates.

Research universities integrate automated gel-based platforms to elucidate protein interactions in neurodegenerative disease models. Diagnostic centers adopt high-sensitivity techniques for lipoprotein fractionation, aiding cardiovascular risk stratification. Forensic science divisions utilize short tandem repeat analysis via polyacrylamide gels to resolve complex evidentiary samples.

Agricultural biotechnology entities apply the method for transgene verification in genetically modified crops. Environmental monitoring programs employ isoelectric focusing to assess ecotoxicological impacts on aquatic species. These multifaceted utilizations propel technological refinements, cementing regional preeminence in molecular separation sciences. The National Science Foundation reported that U.S. higher education institutions expended $97.9 billion on research and development in fiscal year 2022, with substantial allocations to life sciences driving analytical tool adoption.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts foresee vigorous advancement in electrophoretic methodologies across Asia Pacific throughout the forecast period, as nations aggressively bolster scientific infrastructure and innovation ecosystems. Governments establish state-of-the-art core facilities equipped with multidimensional separation instruments to accelerate pharmacogenomic investigations. Biotechnology firms implement pulsed-field systems to ensure plasmid supercoiling integrity in viral vector production.

Academic consortia pioneer microfluidic devices for high-throughput nucleotide sizing in hereditary disorder screenings. Clinical laboratory networks introduce automated analyzers for rapid hemoglobin variant identification in high-prevalence zones. Startups engineer compact capillary units tailored for resource-limited settings, facilitating on-site food authenticity testing.

Industry alliances standardize protocols for glycan analysis in biosimilar comparability studies. These proactive strategies harness burgeoning talent pools and policy support, elevating precision analytics to address regional health and industrial challenges. The World Intellectual Property Organization noted that Asia-origin applicants submitted 68.3% of all global patent applications in 2023, signaling intensified inventive activity in related technologies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the electrophoresis market accelerate growth by advancing automated and high-resolution separation platforms that support genomics, proteomics, and clinical diagnostics with faster turnaround and higher reproducibility. Companies expand adoption by integrating instruments with digital imaging, data analysis software, and laboratory information systems to streamline workflows in research and diagnostic laboratories.

Product strategies emphasize compact, user-friendly systems and pre-cast consumables that reduce hands-on time and improve consistency for high-throughput environments. Commercial leaders pursue global expansion through distributor partnerships and localized support in emerging research hubs and clinical markets.

Innovation efforts also focus on application-specific solutions for oncology, infectious disease, and protein characterization to diversify revenue streams. Bio-Rad Laboratories exemplifies a leading participant in the electrophoresis market through its broad portfolio of gel, capillary, and microfluidic systems, strong brand presence in life sciences, and sustained investment in research tools that support laboratories worldwide.

Top Key Players

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Lonza Group Ltd.

- Danaher

- QIAGEN

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- GE Healthcare

- Harvard Bioscience, Inc.

- Shimadzu Corporation

- SARSTEDT AG & Co. KG

- UniEquip Laborgerätebau & Vertriebs GmbH

- Helena Biosciences

Recent Developments

- In August 2025, Thermo Fisher Scientific introduced a new generation of electrophoresis systems focused on improving analytical speed and result consistency for protein studies. By enabling laboratories to process higher sample volumes with greater precision, this launch supports the expanding use of proteomics in research and clinical workflows, directly stimulating demand for advanced electrophoresis platforms.

- In July 2025, Bio-Rad Laboratories strengthened its electrophoresis technology roadmap through the acquisition of a microfluidics-focused biotechnology company. The integration of microfluidic design capabilities allows Bio-Rad to develop more compact, automated, and high-performance electrophoresis solutions, accelerating innovation and intensifying competition within the global electrophoresis equipment market.

Report Scope

Report Features Description Market Value (2024) US$ 3.0 Billion Forecast Revenue (2034) US$ 5.3 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electrophoresis Instruments (Horizontal Gel Electrophoresis Systems, Vertical Gel Electrophoresis Systems, Capillary Electrophoresis Analyzers and Others), Reagents & Consumables, Gel Documentation Systems and Software), By Application (Genomics & Molecular Biology, Proteomics & Protein Characterization, Medical Research, Food, Environmental & Agricultural Testing, Pharmaceutical & Bioprocess Quality Control and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Hospitals & Diagnostic Laboratories and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Merck KGaA, Lonza Group Ltd., Danaher, QIAGEN, Agilent Technologies, Inc., PerkinElmer, Inc., GE Healthcare, Harvard Bioscience, Inc., Shimadzu Corporation, SARSTEDT AG & Co. KG, UniEquip Laborgerätebau & Vertriebs GmbH, Helena Biosciences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Lonza Group Ltd.

- Danaher

- QIAGEN

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- GE Healthcare

- Harvard Bioscience, Inc.

- Shimadzu Corporation

- SARSTEDT AG & Co. KG

- UniEquip Laborgerätebau & Vertriebs GmbH

- Helena Biosciences