Global Electronic Toll Collection Market Size, Share, Statistics Analysis Report By Pay Tolls (Prepaid, Post-paid), By Technology (Radio-frequency Identification (RFID), Dedicated Short-range Communication (DSRC), Other Technologies), By Offering (Hardware, Back Office & Other Services), By Application (Highways, Urban Areas), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143138

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Imapct of AI on ETC Market

- U.S. ETC Market Size

- Pay Tolls Analysis

- Technology Analysis

- Offering Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

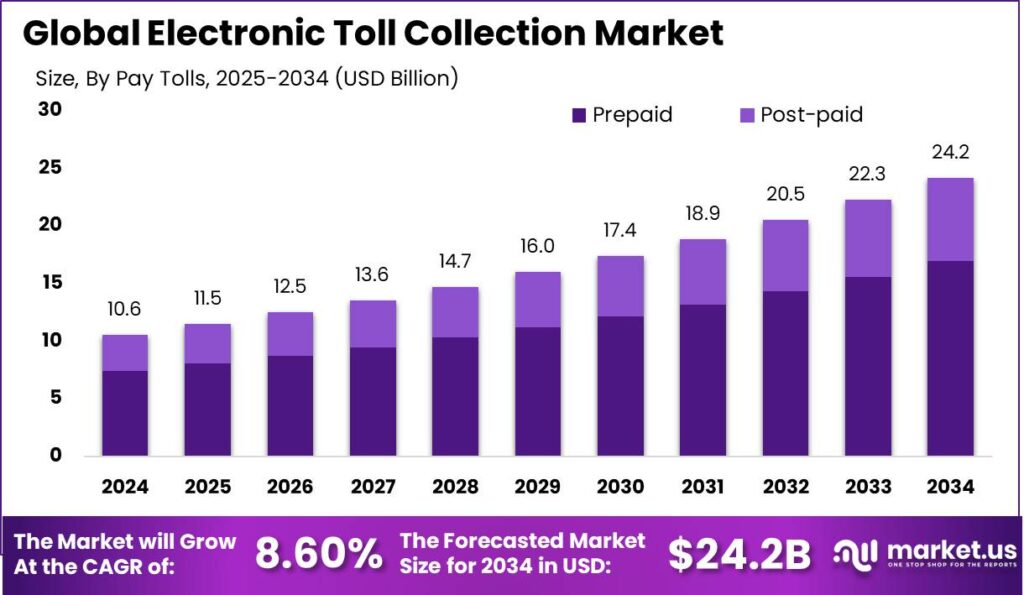

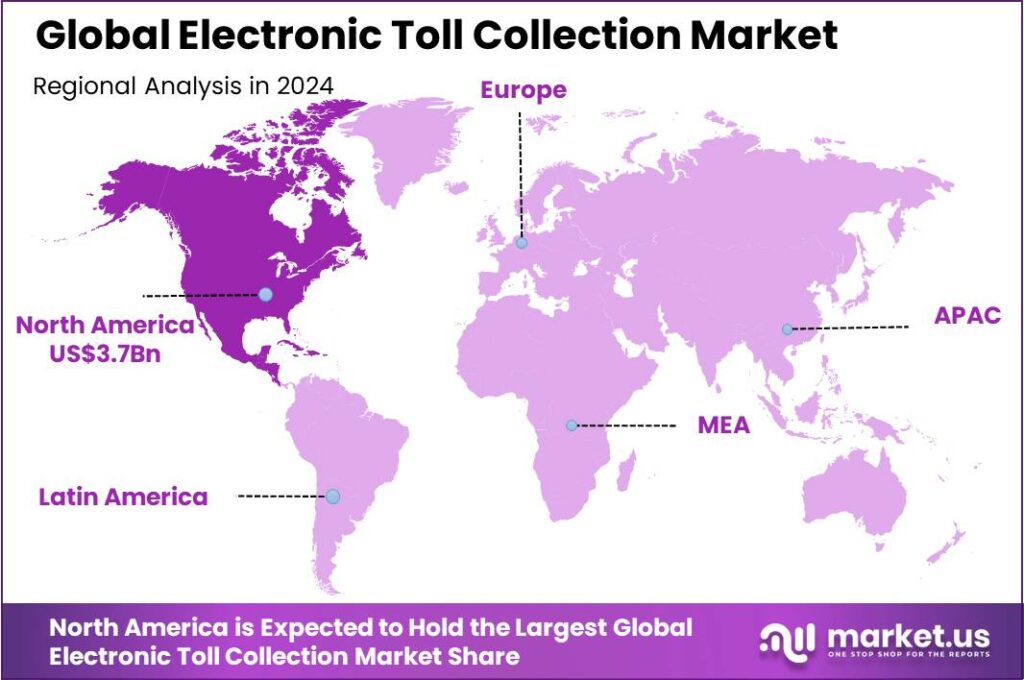

The Global Electronic Toll Collection Market size is expected to be worth around USD 24.2 Billion By 2034, from USD 10.6 Billion in 2024, growing at a CAGR of 8.60% during the forecast period from 2025 to 2034. In 2024, North America held the dominant market position in the global ETC market, accounting for more than 35.7% of the market share, with revenues amounting to USD 3.7 billion.

Electronic Toll Collection (ETC) is a highly efficient automated system designed to collect toll charges from vehicles without necessitating a stop at toll booths. It leverages digital technologies like RFID (Radio Frequency Identification), GPS tracking, and automatic number plate recognition (ANPR) to facilitate real-time toll payments.

This system is integral to modern road networks, allowing for uninterrupted traffic flow, reduced congestion, and efficient toll transactions. These technologies enable the detection and classification of vehicles as they approach toll points, where toll amounts are electronically deducted from the driver’s prepaid account or linked payment method, enhancing travel efficiency and compliance with toll regulations.

The electronic toll collection market is driven by the need to alleviate traffic congestion, minimize toll transaction times, and reduce environmental impact by decreasing vehicle idling times. As urbanization increases and road infrastructure continues to expand, the adoption of ETC systems is becoming more widespread.

This adoption is supported by the benefits of improved traffic management, operational efficiency, and enhanced safety on toll roads. Key market players are continuously innovating to integrate advanced technologies such as AI and IoT to optimize these systems further.

The primary driving factors of the ETC market include the increasing demand for effective traffic management solutions and the need to reduce traffic congestion on toll roads. The integration of ETC systems helps in significantly lowering the time spent at toll booths, which directly contributes to reduced traffic jams and lower vehicle emissions.

Based on data from the Press Information Bureau (PIB), the Electronic Toll Collection (ETC) system, facilitated through FASTag, has demonstrated significant growth in recent years. In the calendar year 2022, the total toll collection via FASTag at both national and state highway fee plazas reached Rs. 50,855 crore, marking an increase of approximately 46% compared to Rs. 34,778 crore in 2021.

The daily average toll collection through FASTag in December 2022 was Rs 134.44 crore, with the highest single-day collection recorded at Rs. 144.19 crore on December 24, 2022. Furthermore, the volume of FASTag transactions also showed a robust growth of about 48% in 2022, rising from 219 crore transactions in 2021 to 324 crore transactions in 2022.

The expansion of FASTag usage is evident with 6.4 crore FASTags issued to date. Additionally, the total number of FASTag-enabled fee plazas across India increased to 1,181 in 2022, up from 922 in the previous year. This includes 323 state highway fee plazas.

Demand for electronic toll collection systems is on the rise due to their ability to significantly improve traffic flow and reduce delays at toll plazas. Studies have shown that implementing ETC can decrease delays by over 85% at toll plazas, thus saving millions of vehicle-hours per year.

Key Takeaways

- The Global Electronic Toll Collection Market size is expected to reach USD 24.2 Billion by 2034, growing from USD 10.6 Billion in 2024, with a CAGR of 8.60% during the forecast period from 2025 to 2034.

- In 2024, the prepaid segment dominated the electronic toll collection market, holding more than 70% of the market share.

- The Radio-frequency Identification (RFID) segment also held a dominant market position in 2024, capturing more than 49% of the share within the Electronic Toll Collection (ETC) market.

- In 2024, the Hardware segment had a dominant position, holding more than 57% of the market share in the Electronic Toll Collection (ETC) market.

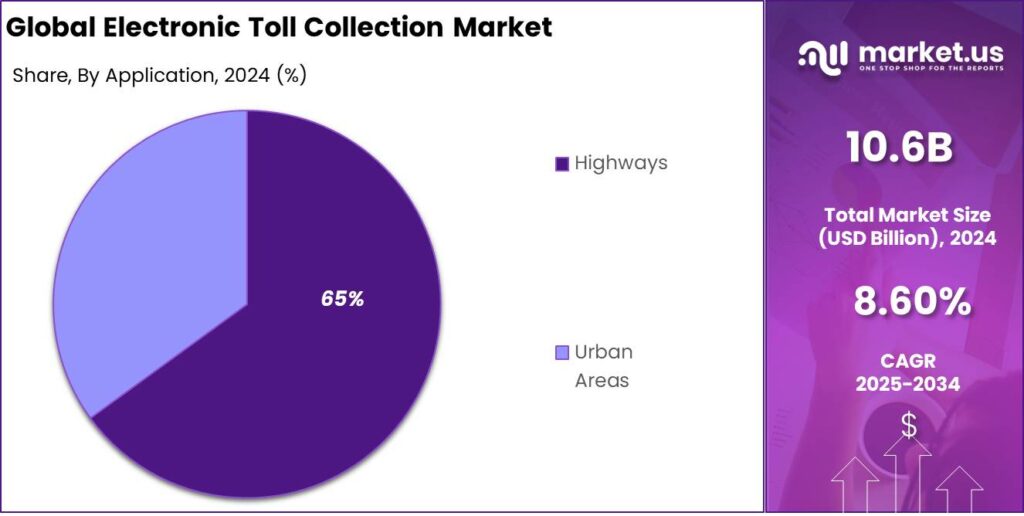

- The Highways segment in 2024 dominated the market, capturing more than 65% of the share in the Electronic Toll Collection (ETC) market.

- In 2024, North America held the dominant market position in the global Electronic Toll Collection (ETC) market, accounting for more than 35.7% of the market share, with revenues amounting to USD 3.7 billion.

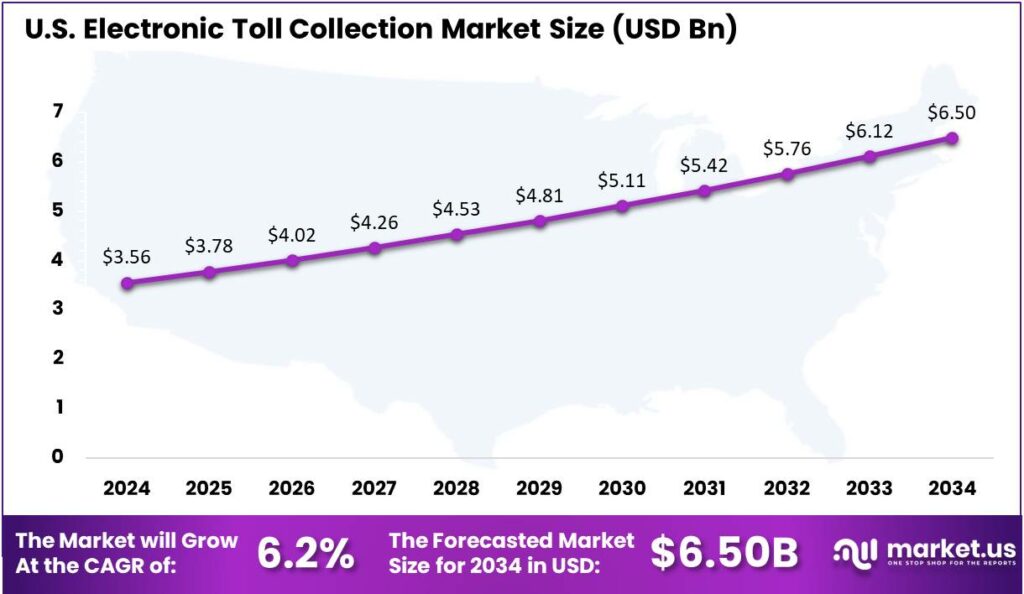

- The U.S. Electronic Toll Collection (ETC) market was valued at USD 3.56 billion in 2024 and is projected to grow at a CAGR of 6.2%.

Imapct of AI on ETC Market

The impact of artificial intelligence (AI) on the electronic toll collection (ETC) market is profound, reshaping how tolls are managed and collected across global transportation networks. The following points detail AI’s transformative effects on this industry:

- Enhanced Efficiency and Traffic Management: AI technologies are instrumental in improving the efficiency of toll collection systems, significantly reducing congestion. By employing machine learning algorithms, AI systems can optimize traffic flow and toll booth operations, ensuring smoother transit through toll plazas.

- Dynamic Pricing Models: AI facilitates the adoption of dynamic pricing in toll collection. Prices can be adjusted in real-time based on traffic conditions, time of day, and vehicle flow. This approach not only manages congestion effectively but also maximizes revenue during peak times, contributing to a more responsive transportation infrastructure.

- Reduction in Physical Infrastructure: The integration of AI in ETC systems allows for the reduction of physical infrastructures, such as toll booths and manual toll collectors. Automated license plate recognition (ALPR) and RFID technologies enable vehicles to pass through tolls without stopping, which lowers operational costs and minimizes environmental impact.

- Improved Security and Fraud Prevention: AI enhances the security of toll collection systems by better monitoring and analyzing vehicle data to prevent fraud and evasion. Advanced recognition technologies can detect and report discrepancies in vehicle information, thus safeguarding revenue and ensuring compliance.

- Customer Experience and Operational Costs: AI-powered toll collection systems offer a seamless, user-friendly experience for drivers, reducing wait times and eliminating the need for physical transactions. These systems are not only convenient but also cost-effective for operators, as they reduce the need for extensive manpower and maintenance.

U.S. ETC Market Size

The U.S. Electronic Toll Collection (ETC) market was estimated at USD 3.56 billion in the year 2024. It is projected to grow at a compound annual growth rate (CAGR) of 6.2%.

This growth can be attributed to several factors including the increasing adoption of cashless transactions among consumers, government initiatives to enhance transportation infrastructure, and the rising need for traffic management solutions. Electronic toll collection systems facilitate efficient vehicle flow at toll booths, reducing congestion and minimizing delays.

Moreover, advancements in technology such as RFID, GPS/GNSS technology, DSRC (Dedicated Short-Range Communications), and video analytics are playing a pivotal role in enhancing the accuracy and reliability of electronic toll collection systems. As the U.S. government continues to invest in smart transportation projects, the ETC market is expected to see significant expansion, further driven by the integration of these systems with smart city initiatives.

In 2024, North America held a dominant market position in the global Electronic Toll Collection (ETC) market, capturing more than a 35.7% share with revenues amounting to USD 3.7 billion. This leading stance can be attributed to a robust transportation infrastructure and a high adoption rate of advanced traffic management solutions across the United States and Canada.

The market’s growth in North America is further propelled by significant governmental support through initiatives aimed at enhancing road safety and efficiency. The U.S. Department of Transportation, for instance, has been actively investing in Intelligent Transportation Systems (ITS), which integrate ETC as a core component.

The presence of key market players in the region, constantly innovating and expanding their offerings, strengthens market dominance. These companies improve ETC system technology and integrate interoperability across states and provinces, simplifying toll collection for interstate and transnational travel.

Moreover, the rising trend towards digitalization and smart city initiatives in North American cities is expected to offer substantial growth opportunities for the ETC market. As urban areas continue to grow, the demand for scalable, efficient, and less labor-intensive toll collection solutions is likely to surge, thereby supporting the expansion of the ETC market in this region.

Pay Tolls Analysis

In 2024, the prepaid segment held a dominant position in the electronic toll collection market, capturing more than a 70% share. This prevalence is primarily attributed to the convenience and efficiency offered by prepaid toll payment methods.

The significant market share of the prepaid segment is also bolstered by the enhanced traffic flow it supports. By minimizing the transaction time at toll booths, prepaid systems reduce congestion and enable smoother traffic movement across toll plazas. This is crucial in densely populated regions or busy corridors where high traffic volume can lead to substantial delays.

The security features of prepaid electronic toll collection systems strengthen their market leadership. Linked to secure, user-specific accounts with encrypted data transmission, they reduce the risk of theft or fraud, appealing to users who prioritize the safety of their financial transactions and personal information.

The dominance of the prepaid segment is strengthened by promotional strategies and discounts from toll operators. Incentives like discounted rates or bonus credits encourage adoption, boosting customer satisfaction, loyalty, and frequent use, which drives the sustained growth of the prepaid ETC market.

Technology Analysis

In 2024, the Radio-frequency Identification (RFID) segment held a dominant market position within the Electronic Toll Collection (ETC) market, capturing more than a 49% share. This technology’s leading status can be primarily attributed to its cost-effectiveness and ease of integration into existing infrastructure.

RFID’s prominence in the market is further bolstered by its high reliability and low maintenance costs. Unlike other technologies that may require significant initial investments and higher ongoing operational costs, RFID systems are relatively inexpensive to install and maintain.

Moreover, the technology’s scalability plays a critical role in its adoption. RFID systems can be easily scaled up to cover more lanes or extended to entire networks of roads with minimal incremental costs. This flexibility allows for seamless expansion as traffic volumes grow, making RFID a preferred choice for long-term infrastructure projects.

RFID’s integration with traffic management systems reinforces its leading role. By supplying real-time data to traffic centers, it enhances toll collection and supports broader traffic monitoring, helping develop smart transportation networks that optimize traffic flow and overall efficiency.

Offering Analysis

In 2024, the Hardware segment held a dominant position within the Electronic Toll Collection (ETC) market, capturing more than a 57% share. This segment’s leadership can be primarily attributed to the essential role that hardware components play in the functioning of toll collection systems.

Key hardware components include toll tags, transponders, treadles, and antennae, which are critical for the seamless automatic detection and recording of toll transactions. The robust demand for these components is driven by their necessity in both new installations and the upgrade of existing infrastructure to support increased traffic volumes and to enhance operational efficiencies.

The Hardware segment’s dominant position is strengthened by advancements in RFID and DSRC technologies, improving the accuracy and reliability of ETC systems. These innovations reduce transaction errors, traffic congestion, and processing times, ensuring continued market growth driven by the demand for efficient toll collection solutions.

The growth of the Hardware segment is driven by significant government investments in transportation infrastructure, including smart highways and managed lanes with electronic toll systems. This support fosters the implementation of new systems and the modernization of existing networks, relying on advanced hardware components.

Application Analysis

In 2024, the Highways segment held a dominant market position within the Electronic Toll Collection (ETC) market, capturing more than a 65% share. This dominance is primarily due to the critical need for efficient toll collection systems on highways to manage high traffic volumes and minimize congestion.

The Highways segment is strengthened by significant government investments in infrastructure, focusing on modernizing highway networks and integrating ETC technologies. This investment, driven by economic development and regional integration goals, positions highway tolling as a key strategic priority.

The Highways segment benefits from advanced toll collection technologies like RFID, video analytics, and GPS, ensuring accurate, non-stop tolling at highway speeds. This reduces idle times, emissions, and improves user experience, highlighting the segment’s leadership in both efficiency and environmental sustainability.

The expansion of highway networks in emerging economies greatly contributes to the Highways segment’s dominance. As new highways are built and existing ones upgraded, the need for ETC systems grows, driving demand for installations, upgrades, and maintenance, ensuring sustained growth and market leadership.

Key Market Segments

By Pay Tolls

- Prepaid

- Post-paid

By Technology

- Radio-frequency Identification (RFID)

- Dedicated Short-range Communication (DSRC)

- Other Technologies

By Offering

- Hardware

- Back Office & Other Services

By Application

- Highways

- Urban Areas

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Improved traffic safety and flow

Electronic Toll Collection (ETC) systems have significantly improved traffic flow and safety on toll roads. By allowing vehicles to pass through toll points without stopping, ETC reduces congestion and minimizes the stop-and-go conditions that often lead to accidents. This seamless process not only decreases travel time but also enhances fuel efficiency, contributing to a smoother and safer driving experience.

For instance, In June 2024, the central government, along with associated agencies, announced the initiation of a Global Navigation Satellite System (GNSS)-based electronic toll collection system in India. This development represents a significant technological advancement in the nation’s toll collection mechanisms, aiming to enhance efficiency and accuracy in toll transactions across various transportation corridors.

Moreover, ETC systems enable dynamic toll pricing, allowing officials to adjust toll rates in real-time to manage traffic volumes effectively. Higher tolls during peak hours can discourage excessive road usage, while lower tolls during off-peak times can encourage drivers to utilize less congested routes, leading to an overall balanced traffic distribution.

Restraint

Revenue decline from toll evasion.

Despite the advantages of Electronic Toll Collection systems, a significant challenge is the potential revenue loss resulting from toll evasion. The transition to cashless tolling has led to increased instances of unpaid tolls. This substantial loss has been partly attributed to the shift towards cashless tolling, where the absence of physical payment barriers may embolden non-compliant behavior.

Enforcing toll payments in an electronic system can be challenging, especially when dealing with out-of-state or unregistered vehicles. While automated license plate recognition systems can identify violators, the process of issuing fines, pursuing collections, and ensuring compliance often incurs additional administrative costs. Moreover, privacy concerns and legal constraints can limit the effectiveness of enforcement mechanisms.

Opportunity

Integration with Advanced Technologies

The evolution of Electronic Toll Collection systems presents significant opportunities for integration with advanced technologies, enhancing efficiency and user experience. The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) into ETC systems enables the analysis of vast amounts of traffic data, facilitating predictive modeling and real-time decision-making.

Additionally, the integration of ETC systems with connected vehicle technologies and smart infrastructure paves the way for more personalized and efficient transportation experiences. Vehicles equipped with advanced communication systems can interact seamlessly with tolling infrastructure, enabling automated payments and providing drivers with real-time information on toll rates and traffic conditions.

Challenge

Ensuring System Interoperability

One of the critical challenges facing Electronic Toll Collection systems is achieving interoperability across different regions and tolling authorities. The lack of standardized technologies and protocols can lead to fragmentation, where drivers need multiple transponders or accounts to use various toll roads, causing inconvenience and potential confusion.

Achieving nationwide or even global interoperability necessitates collaboration among various stakeholders, including government agencies, toll operators, and technology providers, to establish common standards and protocols.

The European Electronic Toll Service (EETS) seeks to create a unified tolling system for seamless travel across Europe. However, aligning diverse technologies, regulations, and business models remains a challenging task requiring ongoing collaboration and coordination.

Emerging Trends

A notable trend is the adoption of Global Navigation Satellite System (GNSS)-based tolling. GNSS tolling uses satellite positioning to monitor vehicles and charge based on distance, eliminating the need for physical infrastructure. Countries like Germany and Slovakia have adopted this system, streamlining toll operations and reducing congestion.

Another development is the implementation of Multi-Lane Free Flow (MLFF) systems. MLFF allows vehicles to pass through toll points at highway speeds without stopping, using overhead gantries equipped with sensors and cameras to detect and charge vehicles.

Open Road Tolling (ORT) is also gaining traction. ORT eliminates traditional toll booths entirely, relying on electronic toll collection methods such as transponders and automatic number plate recognition (ANPR). This system facilitates uninterrupted traffic flow and has been successfully implemented on highways like Ontario’s Highway 407 in Canada.

Business Benefits

The implementation of Electronic Toll Collection (ETC) systems offers several business advantages. ETC significantly reduces operational costs associated with manual toll collection. By automating the process, expenses related to staffing, cash handling, and toll booth maintenance are minimized.

ETC also enhances traffic flow efficiency. Vehicles equipped with transponders or utilizing ANPR technology can pass through toll points without stopping, reducing congestion and travel time. This improvement in traffic conditions can lead to increased road usage and higher revenue for toll operators.

Moreover, ETC systems provide accurate and timely revenue collection. Automated systems reduce the likelihood of human error and fraud, ensuring that tolls are collected consistently and accurately. This reliability enhances financial planning and resource allocation for infrastructure maintenance and development.

Key Player Analysis

Kapsch TrafficCom AG, headquartered in Austria, is one of the leading players in the ETC market. The company specializes in intelligent transportation systems (ITS), focusing on tolling, traffic management, and fleet management solutions. With a strong presence in Europe, Kapsch provides advanced technologies that help reduce congestion and improve road safety.

Conduent Business Services, a prominent American multinational, is another major player in the electronic tolling sector. Known for its expertise in digital payments, Conduent offers comprehensive ETC solutions, including automated tolling, payment processing, and customer service. Conduent combines technology with customer experience management, offering tailored tolling solutions for both public and private sectors, addressing diverse challenges across geographies.

EFKON GmbH, also based in Austria, is a leading provider of tolling solutions for road operators and governments. The company focuses on developing high-performance tolling systems, including electronic and manual toll collection solutions, as well as innovative vehicle identification technology. EFKON excels in integrating advanced communication technologies with real-time data analytics, optimizing toll collection and road network management.

Top Key Players in the Market

- Kapsch TrafficCom AG

- Conduent Business Services

- EFKON GmbH (Austria)

- TransCore Holdings, Inc.

- Thales Group

- Raytheon Technologies Corporation

- Cubic Corporation

- Siemens

- Neology, Inc.

- VINCI

- Feig Electronic GmbH

- Toshiba Corporation

- TRMI Systems Integration

- Magnetic AutoControl

- International Road Dynamics Inc. (IRD)

- Honeywell International, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Perceptics

- Q-Free

- Other Key Players

Top Opportunities Awaiting for Players

- Technological Integration and Advancements: With the rise of artificial intelligence and machine learning, there is a substantial opportunity for the development of smarter, more efficient ETC systems. Innovations such as AI-powered automatic vehicle identification and adaptive tolling solutions are gaining traction.

- Expansion in Emerging Markets: The Asia-Pacific region is expected to be the fastest-growing market for ETC systems. This is due to increasing urbanization, improvements in road infrastructure, and higher adoption of smart transportation solutions. Countries like India and China are rapidly incorporating ETC systems to manage their burgeoning traffic and improve roadway efficiency.

- Public-Private Partnerships (PPPs): Governments are increasingly turning to PPPs to fund infrastructure projects, including ETC systems. This approach can help spread the financial risk and encourage private investment in public infrastructure projects, providing a significant opportunity for ETC companies to expand their operations and implementation scopes.

- Mobile and Account-Based Tolling: There is a growing trend towards mobile payment solutions and account-based tolling, where tolls are charged directly to a registered account based on vehicle identification. This method offers convenience for users and reduces hardware costs for operators, presenting a substantial market opportunity for service providers specializing in software and integrated solutions.

- Regulatory Support and Standardization: Increasing regulatory support for ETC systems, along with efforts towards standardization across regions, can facilitate broader adoption and interoperability of ETC technologies. This is crucial for ensuring seamless travel across different jurisdictions and for the integration of ETC systems into wider smart city frameworks.

Recent Developments

- In April 2024, Kapsch TrafficCom partnered with Hailo Technologies to integrate AI into its tolling and traffic management systems, enhancing efficiency and accuracy.

- In October 2024, Verra Mobility expanded its electronic toll payment programs by partnering with two global rental car companies in Italy. This initiative aimed to provide a faster and more convenient traveling experience for tourists navigating over 4,600 kilometers of toll roads in Italy.

Report Scope

Report Features Description Market Value (2024) USD 10.6 Bn Forecast Revenue (2034) USD 24.2 Bn CAGR (2025-2034) 8.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Pay Tolls (Prepaid, Post-paid), By Technology (Radio-frequency Identification (RFID), Dedicated Short-range Communication (DSRC), Other Technologies), By Offering (Hardware, Back Office & Other Services), By Application (Highways, Urban Areas) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kapsch TrafficCom AG, Conduent Business Services, EFKON GmbH (Austria), TransCore Holdings, Inc., Thales Group, Raytheon Technologies Corporation, Cubic Corporation, Siemens, Neology, Inc., VINCI, Feig Electronic GmbH, Toshiba Corporation, TRMI Systems Integration, Magnetic AutoControl, International Road Dynamics Inc. (IRD), Honeywell International, Inc., Mitsubishi Heavy Industries, Ltd., Perceptics, Q-Free, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Toll Collection MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Electronic Toll Collection MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kapsch TrafficCom AG

- Conduent Business Services

- EFKON GmbH (Austria)

- TransCore Holdings, Inc.

- Thales Group

- Raytheon Technologies Corporation

- Cubic Corporation

- Siemens

- Neology, Inc.

- VINCI

- Feig Electronic GmbH

- Toshiba Corporation

- TRMI Systems Integration

- Magnetic AutoControl

- International Road Dynamics Inc. (IRD)

- Honeywell International, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Perceptics

- Q-Free

- Other Key Players