Global Drug Discovery Outsourcing Market By Drug Type (Small Molecule and Large Molecule), By Service Type (Target Identification & Screening, Target Discovery & Validation, Hit Identification/High-Throughput Screening, Hit-to-Lead Development, Lead Optimization, Preclinical Testing Services and Others), By Therapeutic Area (Oncology, Neurology/CNS Disorders, Infectious Diseases, Cardiovascular Diseases, Immunology & Inflammatory Disorders, Metabolic & Endocrine Disorders, Respiratory Diseases, Gastrointestinal Disorders, Rare/Orphan Diseases, Ophthalmology Diseases, Dermatology Diseases and Others), By End-User (Pharmaceutical & Biotechnology Companies and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172190

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

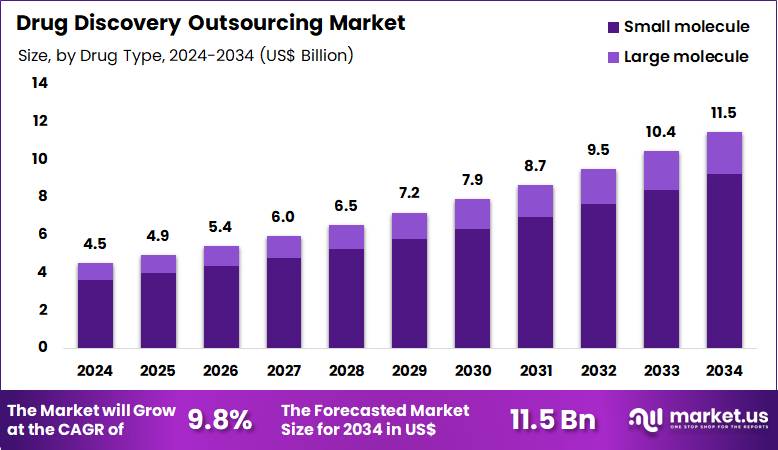

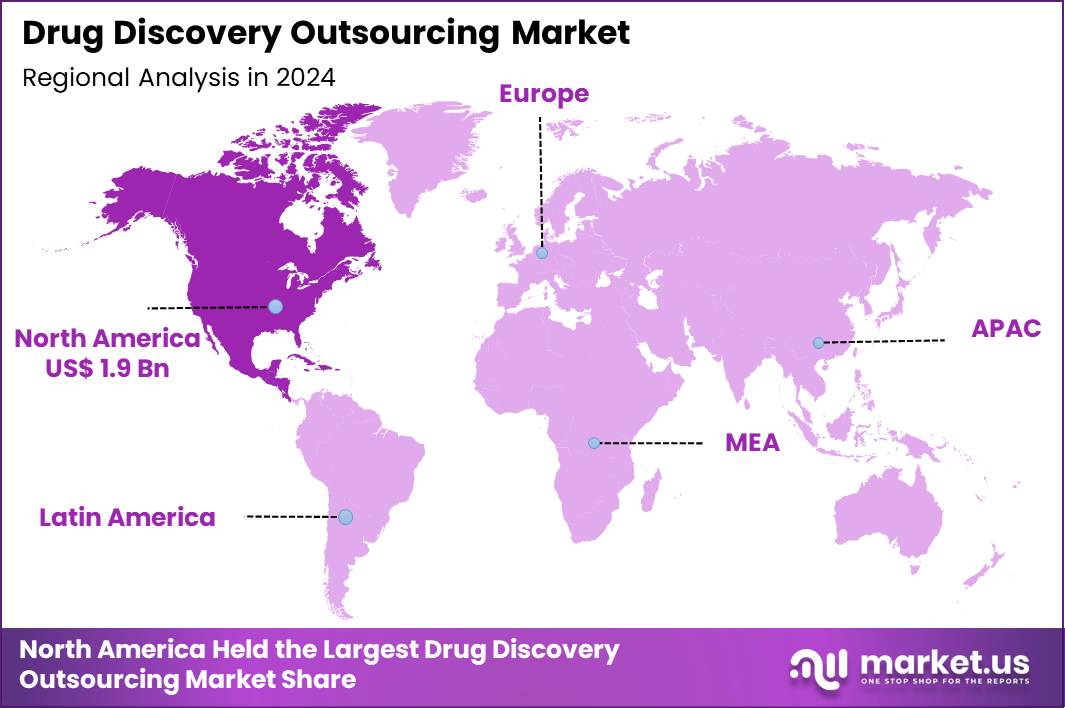

The Global Drug Discovery Outsourcing Market size is expected to be worth around US$ 11.5 Billion by 2034 from US$ 4.5 Billion in 2024, growing at a CAGR of 9.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.3% share with a revenue of US$ 1.9 Billion.

Growing complexity in pharmaceutical research pipelines compels companies to outsource critical drug discovery functions, accessing specialized expertise without expanding internal infrastructure. Biopharmaceutical firms increasingly delegate hit-to-lead identification processes, leveraging high-throughput screening to evaluate vast compound libraries for potential therapeutic candidates in oncology programs. These services support lead optimization efforts, refining molecular structures to enhance potency, selectivity, and pharmacokinetic properties for small molecule therapeutics.

Outsourcing providers conduct target validation studies, confirming biological relevance and druggability in neurological disorder pathways. Companies utilize outsourced assay development for biomarker identification, enabling precise measurement of disease progression in cardiovascular indications.

In July 2024, Exscientia plc entered into a collaboration with Amazon Web Services to integrate advanced cloud-based AI and machine learning tools into its drug discovery platform. The partnership supports greater automation across research workflows, accelerating compound discovery while reducing operational complexity and development costs through data-driven laboratory processes.

Pharmaceutical developers seize opportunities to outsource preclinical pharmacology assessments, evaluating efficacy and safety profiles in models for infectious disease interventions. Service providers offer computational chemistry modeling to predict binding affinities, streamlining candidate selection for immunology-focused therapies. These outsourced capabilities extend to ADME-Tox profiling, identifying metabolic liabilities early to mitigate risks in metabolic disorder drug development.

Opportunities expand in fragment-based drug design applications, generating novel scaffolds for challenging targets in rare genetic conditions. Firms capitalize on outsourced structural biology services, employing crystallography and cryo-EM to elucidate protein-ligand interactions for precision medicine initiatives. Companies pursue integrated discovery platforms that combine virtual screening with wet-lab validation, enhancing efficiency in respiratory disease therapeutic pipelines.

Market specialists deploy generative AI frameworks to revolutionize de novo molecule design, outperforming traditional methods in exploring chemical space for novel antibiotics. Developers incorporate quantum computing simulations into outsourced workflows, achieving higher accuracy in predicting molecular behaviors for neurodegenerative treatments. Industry participants advance organ-on-chip models for toxicity screening, providing human-relevant data in outsourced preclinical evaluations.

Innovators refine multi-omics integration techniques to uncover new targets in autoimmune disease pathways. Companies emphasize robotic high-content screening systems that automate phenotypic assays for complex cellular models in inflammation research. Ongoing collaborations prioritize closed-loop AI systems that iteratively refine designs based on real-time experimental feedback, transforming outsourced discovery for broader therapeutic modalities.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.5 Billion, with a CAGR of 9.8% and is expected to reach US$ 11.5 Billion by the year 2034.

- The drug type segment is divided into small molecule and large molecule, with small molecule taking the lead in 2024 with a market share of 80.4%.

- Considering service type, the market is divided into target identification & screening, target discovery & validation, hit identification/high-throughput screening, hit-to-lead development, lead optimization, preclinical testing services and others. Among these, lead optimization held a significant share of 30.1%.

- Furthermore, concerning the therapeutic area segment, the market is segregated into oncology, neurology/CNS disorders, infectious diseases, cardiovascular diseases, immunology & inflammatory disorders, metabolic & endocrine disorders, respiratory diseases, gastrointestinal disorders, rare/orphan diseases, ophthalmology diseases, dermatology diseases and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 27.9% in the market.

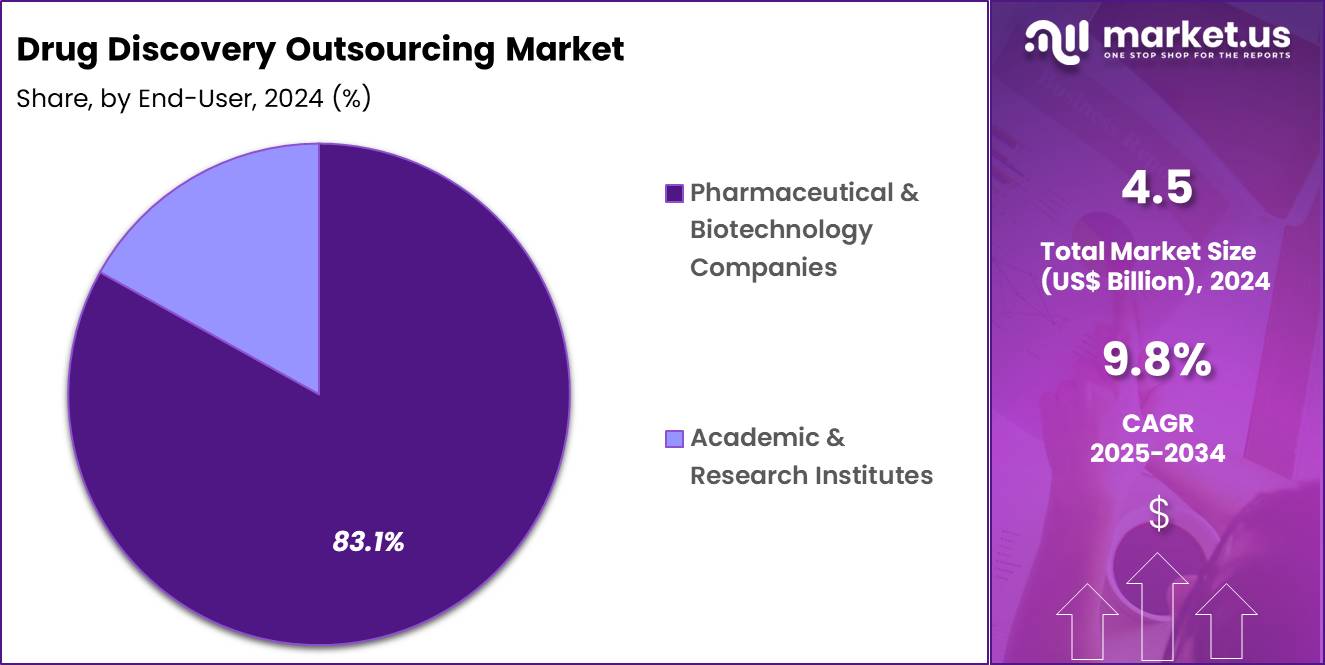

- The end-user segment is segregated into pharmaceutical & biotechnology companies and academic & research institutes, with the pharmaceutical & biotechnology companies segment leading the market, holding a revenue share of 83.1%.

- North America led the market by securing a market share of 42.3% in 2024.

Drug Type Analysis

Small molecule drug discovery, holding 80.4%, is expected to dominate because medicinal chemistry workflows, structure–activity optimization, and scalable synthesis favor outsourced execution. Pharmaceutical pipelines continue to rely on small molecules for oral bioavailability, predictable pharmacokinetics, and cost-efficient manufacturing.

Contract partners provide deep expertise in chemistry libraries, computational modeling, and rapid iteration cycles that accelerate timelines. Increasing pressure to reduce R&D risk encourages sponsors to externalize chemistry-intensive stages to specialized vendors. Mature regulatory pathways and extensive historical data further support confidence in outsourced small molecule programs.

Access to global talent pools improves hit quality and optimization speed. Flexible engagement models help sponsors scale projects up or down quickly. These factors keep small molecule outsourcing anticipated to remain the dominant drug type.

Service Type Analysis

Lead optimization, holding 30.1%, is projected to dominate service demand because this stage determines developability, safety margins, and clinical success probability. Sponsors prioritize outsourcing to access integrated ADME, toxicology, and medicinal chemistry capabilities under tight timelines. Advanced CRO platforms enable parallel optimization across potency, selectivity, and pharmacokinetics, reducing late-stage attrition.

Competitive pipelines require rapid convergence on candidates with balanced profiles, which specialized vendors deliver efficiently. Data-driven design and predictive modeling strengthen decision-making during optimization cycles. Outsourcing also spreads fixed costs and improves capital efficiency. Global capacity and automation increase throughput without sacrificing quality. These dynamics keep lead optimization expected to remain the leading service segment.

Therapeutic Area Analysis

Oncology, holding 27.9%, is expected to dominate because cancer drug pipelines remain the most active across targets, modalities, and indications. High unmet need and premium pricing potential attract sustained investment and accelerate discovery programs. Outsourcing partners provide disease models, biomarker strategies, and translational expertise that shorten discovery timelines.

Precision oncology increases assay complexity, favoring vendors with advanced screening and validation platforms. Rapid target turnover and combination strategies benefit from flexible external resources. Global trial-readiness considerations influence early discovery decisions, reinforcing outsourced support. Continuous innovation and funding maintain momentum. These factors keep oncology anticipated to remain the dominant therapeutic area.

End-User Analysis

Pharmaceutical and biotechnology companies, holding 83.1%, are projected to dominate end-user demand because they manage the largest and most diverse discovery portfolios. Competitive pressure to advance multiple programs simultaneously drives reliance on external capacity. Outsourcing improves speed, cost control, and access to specialized technologies without permanent overhead. Portfolio management strategies favor variable-cost models aligned to milestone outcomes.

Strategic partnerships with CROs enhance continuity from discovery through preclinical stages. Global expansion and virtual R&D models further increase outsourcing intensity. Governance frameworks and quality systems support compliant execution at scale. These drivers keep pharmaceutical and biotechnology companies expected to remain the primary end users.

Key Market Segments

By Drug Type

- Small molecule

- Large molecule

By Service Type

- Target Identification & Screening

- Target Discovery & Validation

- Hit Identification/High-Throughput Screening

- Hit-to-Lead Development

- Lead Optimization

- Preclinical Testing Services

- Others

By Therapeutic Area

- Oncology

- Neurology/CNS Disorders

- Infectious Diseases

- Cardiovascular Diseases

- Immunology & Inflammatory Disorders

- Metabolic & Endocrine Disorders

- Respiratory Diseases

- Gastrointestinal Disorders

- Rare/Orphan Diseases

- Ophthalmology Diseases

- Dermatology Diseases

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

Drivers

Increasing number of novel drug approvals is driving the market

The drug discovery outsourcing market is strongly driven by the increasing number of novel drug approvals, which signals robust activity in early-stage research that frequently depends on external specialized providers. Pharmaceutical and biotechnology companies outsource critical discovery functions to access advanced platforms in areas such as target validation, high-throughput screening, and structural biology.

This approach enables faster progression through preclinical stages while managing internal resource constraints. Larger firms utilize outsourcing to augment capacity during peak pipeline demands. Smaller entities, often originating many innovative candidates, rely heavily on contract research organizations for comprehensive discovery support. The approval numbers reflect successful outcomes from outsourced efforts, reinforcing confidence in external collaborations.

Outsourcing facilitates risk distribution across multiple projects in uncertain discovery environments. Global networks of service providers offer diverse expertise and geographic advantages. The U.S. Food and Drug Administration approved 37 novel drugs in 2022 and a record 55 in 2023. These elevated figures highlight sustained innovation momentum that necessitates efficient discovery partnerships.

Regulatory pathways favoring novel mechanisms further encourage outsourced exploration of new targets. Strategic outsourcing aligns with corporate goals to optimize R&D productivity. Overall, this driver accelerates market growth by supporting the delivery of diverse therapeutic candidates.

Restraints

Concerns over intellectual property protection and confidentiality are restraining the market

The drug discovery outsourcing market faces restraints from persistent concerns regarding intellectual property protection and confidentiality when transferring proprietary information to third-party providers. Sponsors worry about potential unauthorized use or leakage of molecular structures, assay data, and strategic insights during collaborative projects. Differences in legal systems across jurisdictions complicate enforcement of non-disclosure agreements and patent rights.

Historical cases of disputes have made companies more cautious in selecting partners. Comprehensive IP audits and legal reviews add time and expense to partnership initiation. Smaller organizations may lack negotiating leverage for favorable terms with larger service providers. Ongoing monitoring of outsourced activities requires dedicated internal oversight resources.

Geopolitical factors influence perceptions of risk in certain outsourcing destinations. Contractual limitations sometimes restrict full data access for sponsors. These issues can lead to selective outsourcing only for non-core activities. Preference for in-house control persists for high-value assets despite cost implications. Such restraints slow broader adoption of outsourcing in sensitive discovery phases. Careful partner vetting remains essential to address these challenges.

Opportunities

Growing emphasis on rare disease therapeutics is creating growth opportunities

The drug discovery outsourcing market presents expanding opportunities through the heightened emphasis on therapeutics for rare diseases, where specialized expertise in niche biology and modeling is often outsourced. Orphan indications typically involve complex pathways requiring targeted discovery approaches beyond standard capabilities. Biotechnology firms focusing on rare conditions frequently lack extensive infrastructure, prompting reliance on external providers for hit identification and optimization.

Regulatory incentives, including extended exclusivity, attract investment into these areas despite smaller patient populations. Outsourced services enable efficient navigation of unique challenges in rare disease target validation. Contract organizations develop dedicated platforms for genetic disorders and enzyme deficiencies. Partnerships facilitate access to patient-derived models and genomic datasets. Increasing scientific understanding of rare genetic mechanisms opens new discovery avenues.

Global initiatives support collaborative research in underserved conditions. The demand for innovative modalities like gene silencing or protein replacement drives specialized outsourcing. These opportunities allow service providers to build expertise in high-value, low-competition segments. Translational advancements from outsourced discovery enhance clinical success rates. Overall, this focus diversifies revenue streams and positions the market for specialized growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics strengthen the drug discovery outsourcing market as surging R&D budgets and accelerating biopharmaceutical innovations compel companies to leverage external partners for cost-effective hit-to-lead optimization and preclinical testing worldwide. Executives at major firms strategically form alliances with specialized CROs in Asia and Europe, harnessing global talent pools to expedite pipelines amid rising demand for novel therapies in oncology and rare diseases.

Lingering inflation and economic volatility, however, inflate operational expenses for outsourced services and strain corporate finances, leading biotech startups to scale back ambitious projects in uncertain funding climates. Geopolitical frictions, particularly U.S.-China tensions and regulatory divergences, routinely disrupt cross-border collaborations and expose intellectual property risks, compelling providers to navigate fragmented supply chains for reagents and data sharing.

Current U.S. tariffs impose elevated duties on imported pharmaceutical intermediates and equipment, especially from China, amplifying outsourcing costs for American drug developers and diminishing appeal for overseas vendors. These tariffs also spark retaliatory actions from key partners that restrict U.S. access to advanced outsourcing capabilities and slow joint innovation efforts.

Still, the tariff environment galvanizes investments in North American CRO expansions and nearshoring strategies, establishing more secure ecosystems that promise enhanced efficiency and sustained market momentum for the long term.

Latest Trends

Accelerated adoption of artificial intelligence in outsourced drug discovery is a recent trend

In 2024 and continuing into 2025, the drug discovery outsourcing market has exhibited a prominent trend toward accelerated adoption of artificial intelligence tools within outsourced workflows to enhance efficiency and predictive accuracy. Service providers integrate AI for virtual compound screening, molecular generation, and toxicity prediction to reduce experimental iterations. Clients seek these capabilities to shorten timelines in lead identification and optimization phases.

Hybrid models combine AI with traditional wet-lab validation for balanced approaches. Contract organizations invest in proprietary algorithms and cloud-based platforms to differentiate offerings. Collaborative projects increasingly incorporate machine learning for multi-parameter optimization. AI assists in repurposing existing compounds for new indications. Data-sharing frameworks enable training of models on combined sponsor-provider datasets.

Regulatory discussions on AI validation support responsible implementation. This trend addresses historical bottlenecks in hit-to-lead transitions. Providers offer flexible AI modules alongside conventional services. Adoption spans both large pharmaceutical clients and emerging biotechs. Ethical considerations around model transparency guide deployment strategies. Overall, AI integration redefines outsourcing value by enabling data-driven discovery paradigms.

Regional Analysis

North America is leading the Drug Discovery Outsourcing Market

In 2024, North America secured a 42.3% share of the global drug discovery outsourcing market, driven by the strategic imperatives of major pharmaceutical and biotechnology firms to optimize research efficiencies amid rising complexities in therapeutic development. Leading entities increasingly delegate target identification and hit-to-lead processes to specialized contract research organizations, capitalizing on advanced capabilities in medicinal chemistry and structural biology.

The surge in venture-backed startups focusing on novel modalities, such as antibody-drug conjugates and RNA therapeutics, necessitates external support for sophisticated screening cascades and bioinformatics analyses. Integration of advanced technologies like cryo-electron microscopy and proteolysis targeting chimeras demands partnerships with providers equipped for rapid iteration cycles. Emphasis on orphan indications and precision medicine amplifies requirements for customized assay development and phenotypic screening platforms.

Collaborative ecosystems between academia and industry facilitate access to diverse compound libraries and phenotypic models. These dynamics enable accelerated pipeline progression while controlling internal expenditures. The U.S. Food and Drug Administration’s Center for Drug Evaluation and Research approved 50 novel drugs in 2024, underscoring the intensive discovery efforts underpinned by outsourced expertise.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry leaders project substantial growth in drug discovery outsourcing services across Asia Pacific throughout the forecast period, as competitive pricing and expanding technical proficiency draw international collaborations. Enterprises in India and Singapore enhance facilities with robotics for parallel synthesis, delivering efficient scaffold hopping and analog generation for global sponsors.

Authorities in China bolster intellectual property frameworks, assuring secure handling of confidential screening data and virtual library designs. Firms invest in organoid models and high-content imaging, providing nuanced insights into disease-relevant pathways for lead prioritization. Regional networks promote talent development through specialized training in computational drug design and machine learning applications.

Multinational corporations forge long-term alliances, transferring protocols for in silico ADMET predictions and biophysical assays. Local providers adopt global quality standards, ensuring seamless integration into multinational development programs. These advancements establish the region as an indispensable hub, expediting innovative therapeutic breakthroughs worldwide. China’s National Medical Products Administration approved 83 new drugs in 2024, reflecting the maturing biopharmaceutical landscape that strengthens regional outsourcing capacities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Drug Discovery Outsourcing market drive growth by offering integrated, end-to-end services that span target identification, lead optimization, and preclinical development, enabling biopharma clients to compress timelines and control R&D costs. Companies active in the Drug Discovery Outsourcing market expand capabilities through investments in AI-driven screening, advanced bioinformatics, and high-throughput platforms that improve hit quality and decision speed.

Strategic partnerships with biotech startups and large pharmaceutical firms allow providers in the Drug Discovery Outsourcing market to embed early in pipelines and secure long-term, milestone-based engagements. Geographic expansion into Asia and Eastern Europe supports access to specialized talent pools and cost-efficient research infrastructure.

Service differentiation focuses on disease-specific expertise, particularly in oncology, CNS, and rare diseases, where demand for external innovation remains strong. Charles River Laboratories exemplifies leadership in the Drug Discovery Outsourcing market by combining broad discovery services, global laboratory operations, and deep scientific expertise to support clients from early research through IND-enabling stages.

Top Key Players

- IQVIA

- ICON plc

- Syneos Health

- Charles River Laboratories

- Labcorp

- WuXi AppTec

- Parexel

- Albany Molecular Research Inc.

- EVOTEC

- GenScript

- Thermo Fisher Scientific Inc.

- Merck & Co., Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Pharmaron Beijing Co., Ltd.

Recent Developments

- In March 2025, Syngene International Limited expanded its biologics footprint by acquiring a manufacturing facility in the United States from Emergent Manufacturing Operations in Baltimore. The site houses multiple monoclonal antibody production lines, strengthening Syngene’s capabilities in large-scale biologics manufacturing and enabling closer support for clients across both human and animal health segments in North America.

- In October 2024, Samsung Biologics introduced S-HiCon™, a proprietary platform designed to support high-concentration biologic formulations. The platform helps manage formulation challenges such as viscosity and pH instability while improving product stability and delivery efficiency, supporting the growing demand for high-dose biopharmaceutical development and manufacturing.

Report Scope

Report Features Description Market Value (2024) US$ 4.5 Billion Forecast Revenue (2034) US$ 11.5 Billion CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Small Molecule and Large Molecule), By Service Type (Target Identification & Screening, Target Discovery & Validation, Hit Identification/High-Throughput Screening, Hit-to-Lead Development, Lead Optimization, Preclinical Testing Services and Others), By Therapeutic Area (Oncology, Neurology/CNS Disorders, Infectious Diseases, Cardiovascular Diseases, Immunology & Inflammatory Disorders, Metabolic & Endocrine Disorders, Respiratory Diseases, Gastrointestinal Disorders, Rare/Orphan Diseases, Ophthalmology Diseases, Dermatology Diseases and Others), By End-User (Pharmaceutical & Biotechnology Companies and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IQVIA, ICON plc, Syneos Health, Charles River Laboratories, Labcorp, WuXi AppTec, Parexel, Albany Molecular Research Inc., EVOTEC, GenScript, Thermo Fisher Scientific Inc., Merck & Co., Inc., Dalton Pharma Services, Oncodesign, Jubilant Biosys, DiscoverX Corp., QIAGEN, Eurofins SE, Syngene International Limited, Pharmaron Beijing Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Drug Discovery Outsourcing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Drug Discovery Outsourcing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IQVIA

- ICON plc

- Syneos Health

- Charles River Laboratories

- Labcorp

- WuXi AppTec

- Parexel

- Albany Molecular Research Inc.

- EVOTEC

- GenScript

- Thermo Fisher Scientific Inc.

- Merck & Co., Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Pharmaron Beijing Co., Ltd.