Global Distarch Phosphate Market Size, Share, And Business Benefits By Raw Material Source (Corn Starch, Potato Starch, Wheat Starch, Tapioca Starch, Rice Starch), By Functional Properties (Thickeners, Stabilizers, Gelling Agents, Emulsifiers, Moisture Retention Agents), By Degree of Substitution (Low Substitution, Medium Substitution, High Substitution), By Application, Food and Beverage (Textile, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156760

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

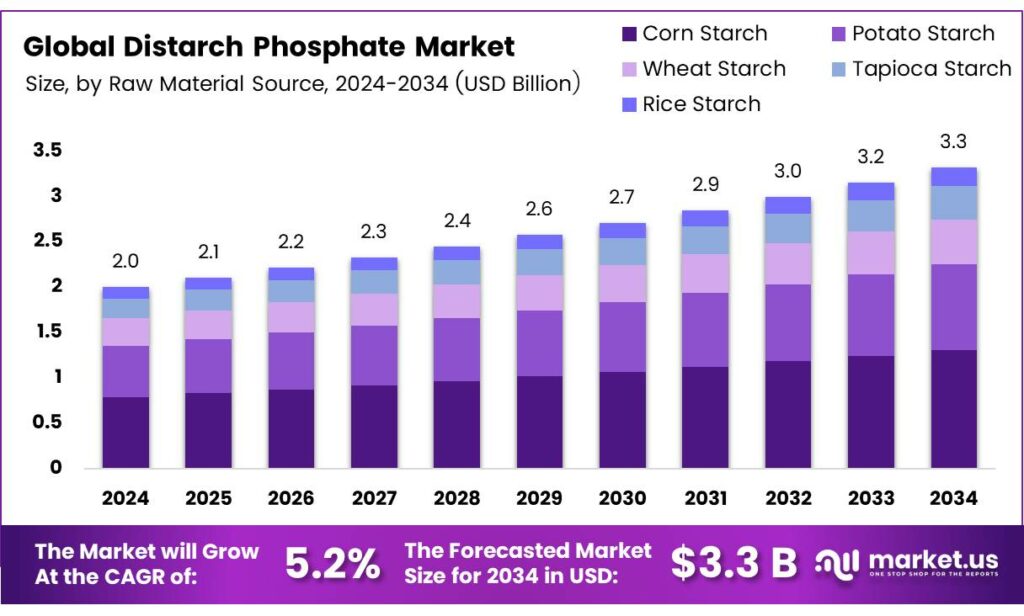

The Global Distarch Phosphate Market size is expected to be worth around USD 3.3 billion by 2034, from USD 2.0 billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Distarch Phosphate (DSP) modified food starch is recognized as Generally Recognized as Safe (GRAS) for use as a source of dietary fiber and for functional roles such as thickening or texturizing in foods, when applied at levels consistent with good manufacturing practices. DSP is widely used in everyday food products, including bread, ready-to-eat cereals, cereal bars, and other processed foods.

It is produced from food-grade starches such as potato, corn, tapioca, wheat, or other suitable starch sources. For clarity, the term DSP is used throughout to refer to distarch phosphate modified food starch. Ingredion has determined the GRAS status of DSP based on scientific procedures consistent with guidance issued by the U.S. Food and Drug Administration (FDA).

DSP is typically used across seventeen food categories, with serving sizes ranging from 3.5 to 7.0 grams per serving and an average intake of 5 grams per serving. Based on these categories, the U.S. per capita mean intake has been estimated at 16.8 to 34.5 grams per day, while the 90th percentile intake is higher, between 33.6 and 69.0 grams per day. Food starch modified using phosphorus oxychloride (POCh) is already recognized as an approved food additive.

The determination was further evaluated by experts with the necessary scientific training and experience to assess the safety of DSP in its intended food uses. Supporting analytical data, published research, and related information that form the basis for this determination are available for FDA review at Keller and Heckman LLP in Washington, D.C., or will be provided to the agency upon request.

The modification involves esterification of starch with POCh at levels up to 0.1%, as outlined in the Food Chemicals Codex (FCC) monograph for modified food starch. However, Ingredion has proposed manufacturing DSP using higher levels of POCh. A review of this approach shows that whether the starch is modified with 0.1% or 4.5% POCh, the resulting end product contains residual phosphorus levels of less than 0.4% in potato starch and less than 0.5% in wheat starch.

Key Takeaways

- The Global Distarch Phosphate Market is expected to grow from USD 2.0 billion in 2024 to USD 3.3 billion by 2034, at a CAGR of 5.2%.

- Corn starch held a 39.4% share in 2024 due to its cost-effectiveness and versatile applications.

- Thickeners captured a 29.7% market share in 2024, driven by demand in food and beverage products.

- Low Substitution (DS 1-3) led with a 45.6% share in 2024 for balanced stability in food applications.

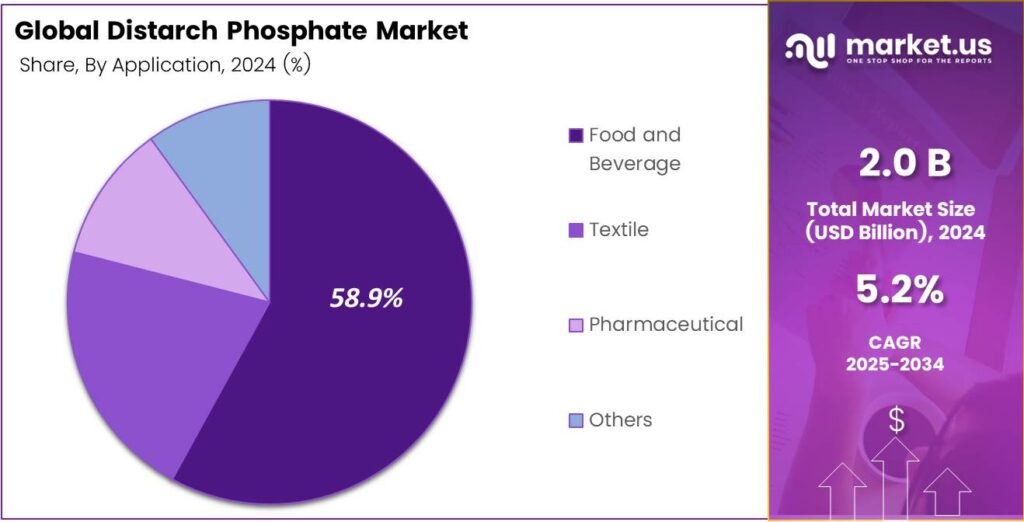

- The Food and Beverage sector held a 58.9% share in 2024, fueled by demand for processed foods.

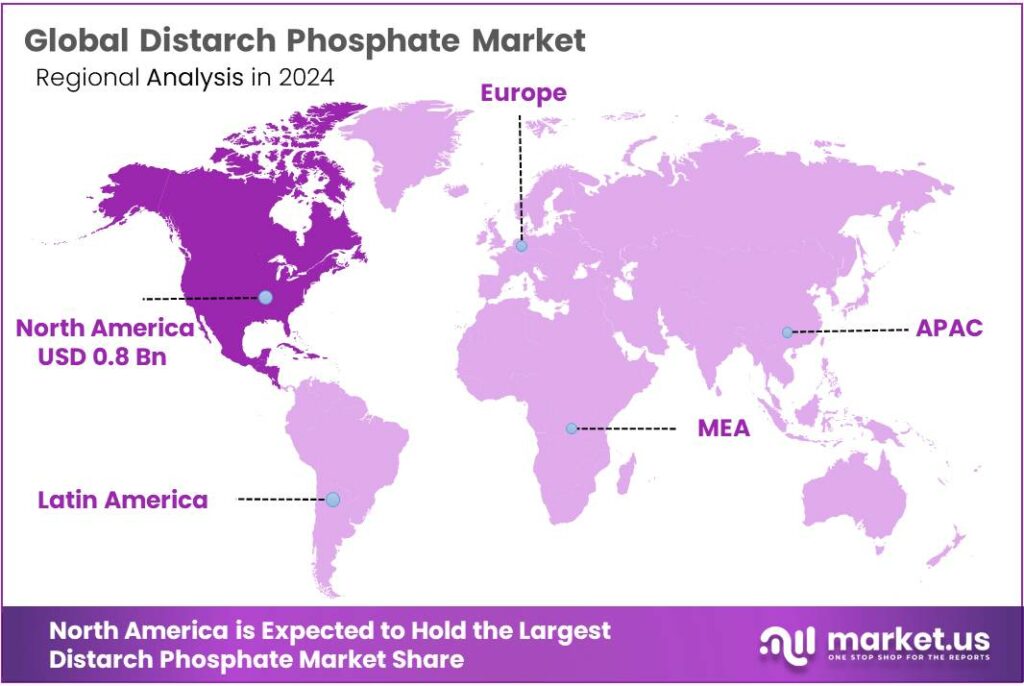

- North America dominated with a 42.6% share, valued at USD 0.8 billion, due to its advanced food processing industry.

Analyst Viewpoint

Distarch phosphate, a modified starch widely used as a thickener, stabilizer, and emulsifier in food products like sauces, soups, and baked goods, is riding the wave of growing consumer demand for processed and convenience foods. The global push for clean-label and non-GMO ingredients is a key driver, as distarch phosphate fits the bill by enhancing texture without synthetic additives.

Investing in companies innovating with sustainable sourcing or expanding production capacity here could yield strong returns, especially as consumer preferences shift toward healthier, transparent ingredients. However, the investment landscape isn’t without its challenges. Regulatory scrutiny is tightening, with bodies like the FDA and EU setting strict guidelines on modified starches to ensure safety and compliance, which can increase production costs and squeeze margins.

Environmental concerns around starch sourcing and processing also pose risks, as sustainable practices are becoming non-negotiable for consumers. Technological advancements, like automation in production, are a double-edged sword—while they boost efficiency and product quality, they require significant upfront investment. Volatility in raw material prices, particularly corn and potatoes, adds another layer of uncertainty.

By Raw Material Source

Corn Starch Leads with 39.4% Share in 2024

In 2024, Corn Starch held a dominant market position, capturing more than a 39.4% share in the global distarch phosphate market. The widespread use of corn starch as a raw material source is mainly due to its abundant availability, cost-effectiveness, and versatile application in food, pharmaceutical, and industrial sectors.

Corn starch is highly preferred for producing distarch phosphate because it provides consistent quality, functional stability, and strong binding properties, making it suitable for products such as bakery goods, sauces, dairy formulations, and convenience foods. The growth of this segment is also supported by the extensive use of corn starch in dietary and health-oriented food categories, where distarch phosphate functions as a thickener and texturizer.

The corn starch segment is expected to maintain its leadership, driven by expanding production capacities in regions such as North America and Asia-Pacific, where corn is cultivated on a large scale. This strong foundation not only ensures supply stability but also enhances the cost competitiveness of corn starch over other raw materials like potato, tapioca, and wheat.

By Functional Properties

Thickeners Lead with 29.7% Share in 2024

In 2024, Thickeners held a dominant market position, capturing more than a 29.7% share in the global distarch phosphate market. This strong performance is closely tied to the growing use of distarch phosphate as a reliable thickening agent in a wide range of food and beverage products.

Its ability to provide stability, enhance texture, and maintain viscosity under different processing conditions makes it particularly valuable in soups, sauces, gravies, bakery fillings, and dairy formulations. Consumers’ increasing preference for convenience foods and ready-to-eat meals has also amplified the demand for thickeners, with distarch phosphate playing a central role in achieving the desired product consistency.

Beyond the food industry, distarch phosphate’s thickening properties are being leveraged in pharmaceuticals, where it is used in tablet formulations and liquid medicines to ensure uniformity and stability. Similarly, in the cosmetics and personal care sector, its functionality supports smooth formulations in creams and lotions.

By Degree of Substitution

Low Substitution (DS 1-3) Dominates with 45.6% Share in 2024

In 2024, Low Substitution (DS 1-3) held a dominant market position, capturing more than a 45.6% share in the global distarch phosphate market. This strong lead is largely due to the wide adoption of low substitution grades in mainstream food applications, where moderate modification provides the right balance of stability and functionality.

Low DS starches are highly suitable for baked goods, cereals, sauces, and confectionery products, as they deliver the desired texture and viscosity without excessive alteration of the natural starch structure. Their compatibility with clean-label requirements has also contributed to their widespread use, as food companies aim to meet consumer expectations for minimally processed yet functional ingredients.

The preference for low substitution is particularly visible in the processed food sector, where demand continues to rise with urbanization and busy lifestyles. The segment is projected to maintain its leadership as low DS starches strike a balance between cost efficiency and performance, making them attractive for large-scale manufacturers in both developed and emerging markets.

By Application

Food and Beverage Leads with 58.9% Share in 2024

In 2024, Food and Beverage held a dominant market position, capturing more than a 58.9% share in the global distarch phosphate market. The segment’s leadership is strongly driven by the rising demand for processed and convenience foods worldwide, where distarch phosphate is widely used as a thickener, stabilizer, and texturizer.

Its ability to enhance product consistency, improve shelf life, and maintain stability during processing makes it a preferred choice for applications in bakery products, dairy, sauces, soups, confectionery, and frozen meals. The growing popularity of ready-to-eat meals and packaged food products has further fueled the adoption of distarch phosphate in this segment.

The food and beverage segment is expected to retain its leadership as consumer preferences continue to shift toward convenient, longer-lasting, and health-oriented food options. The increasing incorporation of functional ingredients in food formulations, coupled with global urbanization trends, has reinforced the need for reliable starch modifications such as DSP.

Key Market Segments

By Raw Material Source

- Corn Starch

- Potato Starch

- Wheat Starch

- Tapioca Starch

- Rice Starch

By Functional Properties

- Thickeners

- Stabilizers

- Gelling Agents

- Emulsifiers

- Moisture Retention Agents

By Degree of Substitution

- Low Substitution (DS 1-3)

- Medium Substitution (DS 4-12)

- High Substitution (DS > 12)

By Application

- Food and Beverage

- Textile

- Pharmaceutical

- Others

Drivers

Longevity and Reduced Food Waste in Frozen Convenience Foods

There’s a gentle, yet powerful reason more and more frozen meals, our breakfasts, quick dinners, and snack veggies wouldn’t feel right without a little help from distarch phosphate (DSP). It’s a kind of starch that helps keep food creamy and intact even after freezing and thawing. The United Nations Environment Programme’s 2024 Food Waste Index Report reveals a heartbreaking truth.

Households alone dispose of 631 million tonnes of food each year, which equates to over one billion meals wasted every day. That’s nearly 20 % of all food available to consumers, highlighting how big the opportunity is to curb this loss. This waste isn’t small change; it’s a real blow to both our wallets and our world. When food degrades or looks soggy and off, people toss it, even if it’s still safe to eat.

Restraints

Consumer’s Clean-Label Preference

The European Food Safety Authority, the biggest challenge facing Distarch phosphate isn’t about its chemistry; it’s about how people feel about the food they eat. There’s been a real shift in what folks want on their shelves: simpler ingredients, less processing, clean labels.

Eurobarometer, commissioned by the European Food Safety Authority, 36% of Europeans say they are concerned about additives such as colors, preservatives, or flavorings in food and drinks. When someone sees modified starch or distarch phosphate on a label, they may hesitate, even if it’s safe and helps food quality. In a world where many people believe no additives means healthier or more natural, such ingredients can feel foreign.

This consumer mindset puts pressure on food makers to either reformulate or risk losing trust. The clean‑label movement continues to grow. Although I couldn’t find a precise number for modified starch, other IFIC data shows more than half of Americans limit processed foods to some extent, and no additives or no artificial ingredients are among the top label claims people look for.

Opportunity

Boosting Stability in Frozen & Convenience Foods

When I think about what really lifts distarch phosphate forward, the first thing that comes to mind is its role in the booming world of frozen and ready-to-eat meals. In everyday kitchens, life feels busier than ever quick breakfasts, a dinner ready in minutes, or a reliable meal waiting in the freezer.

Distarch phosphate steps in beautifully here; it’s a special kind of modified starch (E 1412) that helps keep sauces, pie fillings, and gravies smooth and consistent even after freezing and thawing. In the EU, for example, phosphated distarch phosphate is officially approved as a freeze–thaw‑stable thickener in foods like frozen gravies and pie fillings, showing how trusted it is for this exact need.

Governments, too, are helping this growth. Many places, including India, are investing in cold-chain infrastructure to reduce food waste and boost the reach of frozen or perishable goods—even in small towns. All this means more demand for reliable ingredients that keep quality intact during transport and storage.

Trends

Rise of Plant-Based & Clean-Label Foods

It’s really heartening how more of us are thinking about what we eat, wanting food that’s simple, trustworthy, and kind to our bodies. One emerging trend that’s quietly lifting distarch phosphate is its growing acceptance in the plant‑based and clean‑label movement.

People want ingredients they can pronounce (or at least feel good about), and distarch phosphate, especially versions like hydroxypropyl distarch phosphate, can step in almost invisibly, working hard for texture and stability while staying low on the label. In fact, production of such modified starches for plant‑based foods is climbing.

The U.S. Food and Drug Administration has confirmed that hydroxypropyl distarch phosphate is safe for use in foods, which gives manufacturers the confidence to include it in cleaner‑label recipes. At the same time, the European Food Safety Authority approves similar starches under clear conditions, letting product developers lean into natural‑feeling formulations without compromising on safety

Regional Analysis

North America Dominates with 42.6%, USD 0.8 Billion Market Share

The North American region is the undisputed leader in the global distarch phosphate market, holding a commanding revenue share of 42.6%, valued at approximately USD 0.8 billion. This dominance is primarily fueled by a robust and technologically advanced food processing industry, which is a major consumer of modified starches like distarch phosphate.

The region’s strong demand stems from the widespread use of this ingredient as a critical texturizer, stabilizer, and thickener across a diverse range of applications, including convenience foods, dairy desserts, bakery fillings, and meat processing. High consumer spending on processed and packaged foods, coupled with a persistent demand for products with improved shelf stability and superior texture, continues to propel market growth.

Furthermore, the presence of major global food and industrial manufacturers, alongside leading starch production companies, creates a highly integrated and innovative supply chain. The market is characterized by a high degree of product innovation, with manufacturers focusing on developing clean-label and non-GMO variants to align with evolving consumer preferences.

Stringent yet clear food safety regulations from the FDA also provide a stable framework for production and commercialization, ensuring product quality and safety, which further consolidates the region’s significant market position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Biochem Technology leverages advanced enzymatic processes to manufacture high-purity distarch phosphate. It serves diverse sectors, including food, pharmaceuticals, and textiles, emphasizing customised solutions and stringent quality control. With strong R&D capabilities and a focus on sustainable production, the company has expanded its global footprint, particularly in Asia-Pacific markets.

Cargill Incorporated dominates the distarch phosphate market through extensive sourcing, production scale, and innovation. Its products are widely used as stabilisers and thickeners in processed foods, beverages, and industrial applications. With a focus on sustainability and clean-label trends, Cargill invests heavily in R&D to enhance functionality and meet evolving consumer demands.

Tate & Lyle PLC excels in producing distarch phosphate for food, beverage, and industrial markets. Known for innovation, it offers texturants and stabilisers that improve product performance and meet health-conscious trends (e.g., reduced sugar, fat). With a strong focus on science-driven solutions and sustainability, the company maintains a robust global presence, particularly in Europe and the Americas.

Top Key Players in the Market

- Biochem Technology Group Company Limited

- Cargill, Incorporated

- Tate Lyle PLC

- Emsland Group

- Henan Haishengyuan Food Ingredients Co., Ltd.

- Ingredion Incorporated

- Avebe U.A

- Roquette Frères S.A.

Recent Developments

- In 2024, Biochem Technology Group is involved in producing modified starches, which are used in food processing, pharmaceuticals, and other industries for their functional properties, like thickening and stabilizing. The company is recognized as a player in the modified starch market, including distarch phosphate.

- In 2024, Cargill acquired the technology and intellectual property of Fugeia, a Belgium-based functional food technology company. This included a proprietary arabinoxylan oligosaccharide ingredient derived from wheat bran fibre, which has prebiotic and antioxidant functionality.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material Source (Corn Starch, Potato Starch, Wheat Starch, Tapioca Starch, Rice Starch), By Functional Properties (Thickeners, Stabilizers, Gelling Agents, Emulsifiers, Moisture Retention Agents), By Degree of Substitution (Low Substitution, Medium Substitution, High Substitution), By Application, Food and Beverage (Textile, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Biochem Technology Group Company Limited, Cargill, Incorporated, Tate Lyle PLC, Emsland Group, Henan Haishengyuan Food Ingredients Co., Ltd., Ingredion Incorporated, Avebe U.A., Roquette Frères S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Distarch Phosphate MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Distarch Phosphate MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Biochem Technology Group Company Limited

- Cargill, Incorporated

- Tate Lyle PLC

- Emsland Group

- Henan Haishengyuan Food Ingredients Co., Ltd.

- Ingredion Incorporated

- Avebe U.A

- Roquette Frères S.A.