Global Dipropylene Glycol Monomethyl Ether Market Size, Share, And Business Benefits By Product Type (Industrial Grade, Cosmetic Grade, Reagent Grade, Others), By Formulation Type (Solvent-based Formulations, Water-based Formulations, Emulsions, Others), By End-User Industry (Chemicals, Pharmaceuticals, Food and Beverage, Automotive, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149755

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

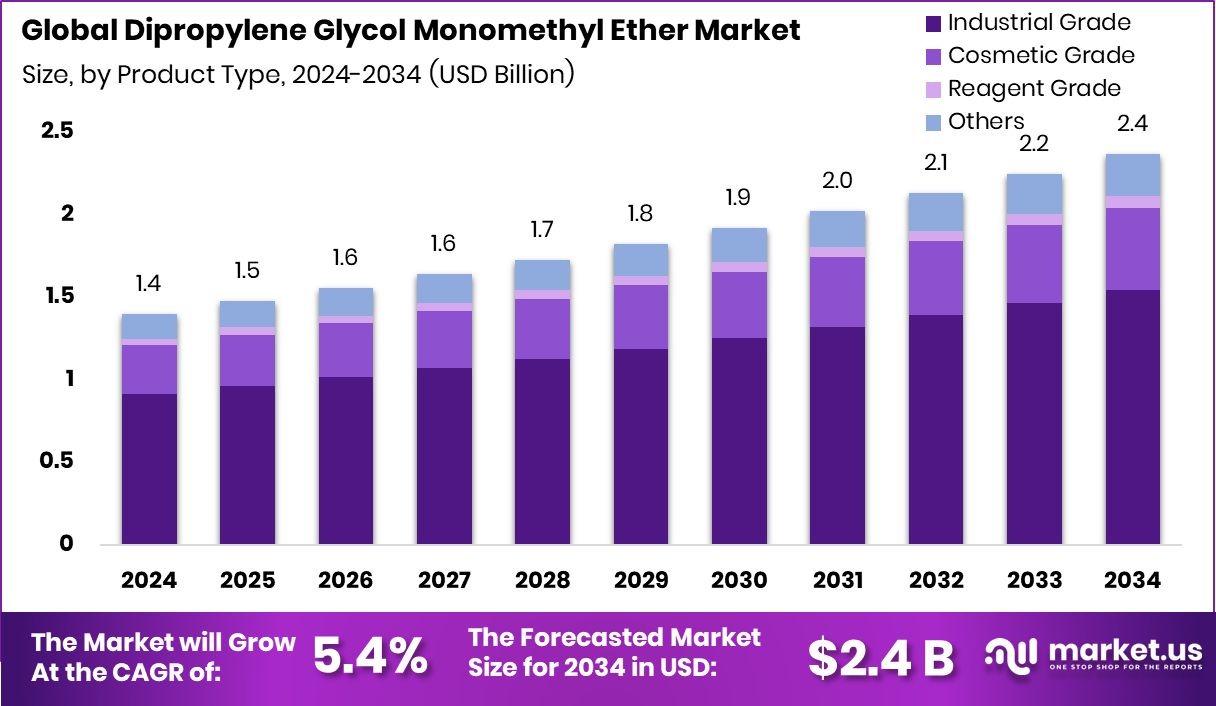

Global Dipropylene Glycol Monomethyl Ether Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.4 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034. Strong demand from industrial applications fueled Asia-Pacific’s 43.20% market share in 2024.

Dipropylene Glycol Monomethyl Ether (DPM) is a colorless, low-odor organic solvent derived from propylene oxide. It belongs to the glycol ether family and is commonly used for its excellent solvency, low volatility, and compatibility with water and organic compounds. DPM is often found in formulations for paints, coatings, cleaning agents, and inks due to its ability to dissolve various resins and polymers.

The Dipropylene Glycol Monomethyl Ether market is growing steadily, driven by its broad use across multiple industries. Demand is especially strong in paints and coatings, where it improves flow and leveling. The cleaning sector also relies on DPM for its ability to break down oils and greases without strong odors. As industries increasingly shift toward low-VOC and eco-friendly solvents, DPM fits the bill due to its lower toxicity and mild scent.

One of the major growth factors is the rising use of water-based coatings and cleaners, where DPM helps maintain performance while meeting environmental regulations. Governments in Asia and Europe are pushing for VOC reductions, indirectly boosting DPM usage.

Demand is also growing from the personal care and cosmetics industry, where DPM is used as a solvent for fragrances and active ingredients. Its gentle nature makes it suitable for skin-contact products, especially in creams, lotions, and deodorants.

Key Takeaways

- Global Dipropylene Glycol Monomethyl Ether Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.4 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034.

- Industrial grade Dipropylene Glycol Monomethyl Ether accounts for 65.3% due to wide industrial solvent applications.

- Solvent-based formulations dominate the market with a 57.7% share, driven by superior dissolving and blending capabilities.

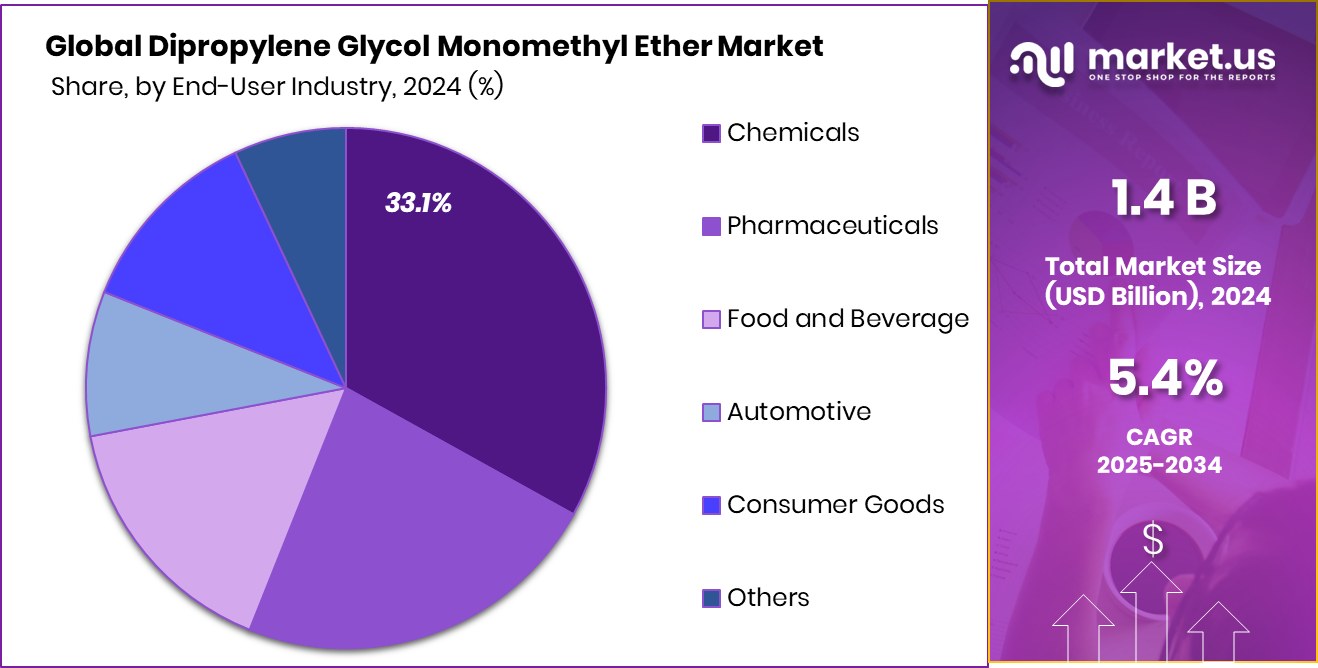

- The chemicals industry leads end-use, holding 33.1%, fueled by consistent demand for effective and safe solvents.

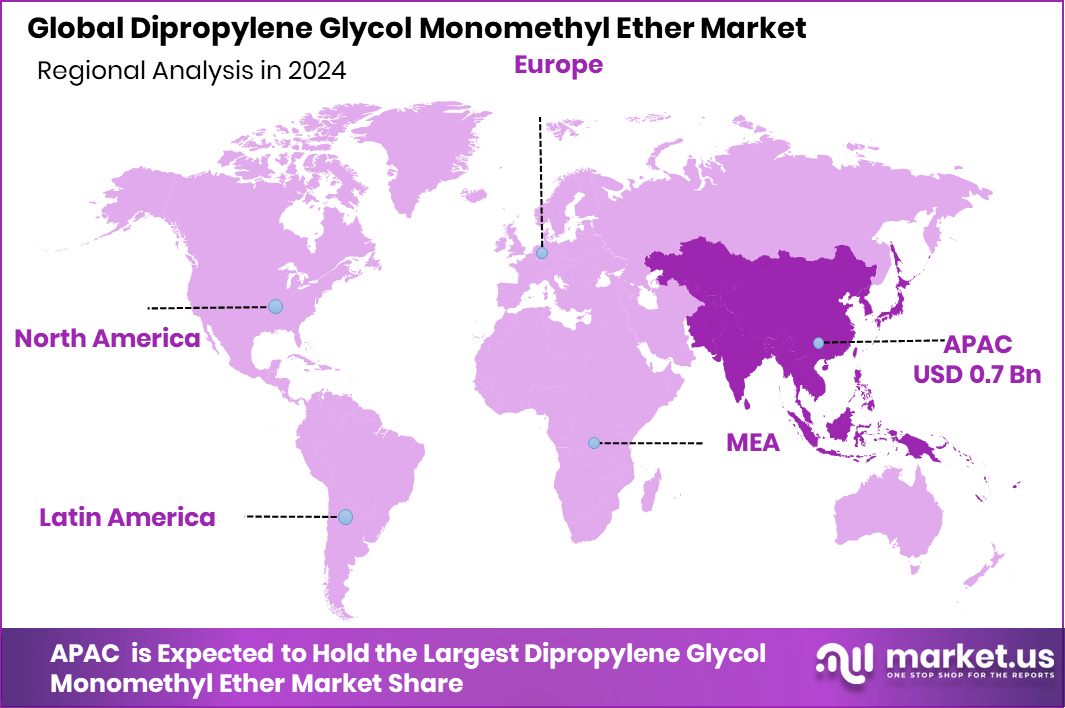

- The Asia-Pacific Dipropylene Glycol Monomethyl Ether market was valued at USD 0.7 billion.

By Product Type Analysis

Industrial grade dominates the dipropylene glycol monomethyl ether market with 65.3% share.

In 2024, Industrial Grade held a dominant market position in the By Product Type segment of the Dipropylene Glycol Monomethyl Ether Market, with a 65.3% share. This dominance is primarily attributed to the widespread use of industrial-grade DPM across paints, coatings, cleaners, and degreasers.

Its ability to blend well with both water and oil-based formulations makes it a versatile choice in manufacturing and maintenance processes. Industries favor industrial-grade DPM for its strong solvency, lower odor, and compliance with regulatory standards that demand reduced volatile organic compounds (VOCs) in solvents.

The significant share also reflects consistent demand from sectors such as automotive refinishing, industrial cleaning, and printing inks, where performance, cost-efficiency, and safety are key priorities. Additionally, this grade’s balanced evaporation rate and solvent strength make it ideal for large-scale applications in factories and processing units.

With tightening global environmental norms and the gradual replacement of harsher solvents, industrial-grade DPM is increasingly being adopted as a safer and effective alternative. The segment’s growth is likely to remain strong as end-use industries continue to seek cleaner, high-performance solvents to meet evolving operational and environmental standards.

By Formulation Type Analysis

Solvent-based formulations hold a 57.7% share in the Dipropylene Glycol Monomethyl Ether market.

In 2024, Solvent-based Formulations held a dominant market position in the By Formulation Type segment of the Dipropylene Glycol Monomethyl Ether Market, with a 57.7% share. This dominance is largely due to the continued reliance on solvent-based systems in industrial and commercial applications where performance and drying time are critical. Dipropylene Glycol Monomethyl Ether, known for its strong solvency and low volatility, plays a key role in enhancing the flow, leveling, and film formation of solvent-based coatings and cleaners.

Industries such as automotive, printing, and heavy-duty cleaning favor solvent-based formulations for their ability to perform under demanding conditions, especially where water-based systems may fall short. DPM’s compatibility with resins, pigments, and other formulation components further supports its usage in these segments.

Despite a global shift toward low-VOC and eco-friendly products, many regions still rely on solvent-based systems due to infrastructure constraints and performance requirements. This has sustained the demand for DPM in such applications.

The high share of solvent-based formulations is also reflective of market inertia in industrial settings, where existing processes and equipment are optimized for solvent-based chemistry. As such, this segment continues to be a primary consumer of DPM across multiple downstream sectors.

By End-User Industry Analysis

The chemical industry accounts for 33.1% of Dipropylene Glycol Monomethyl Ether consumption.

In 2024, Chemicals held a dominant market position in the By End-User Industry segment of the Dipropylene Glycol Monomethyl Ether Market, with a 33.1% share. This leading share reflects the solvent’s integral role in various chemical formulations, particularly in industrial cleaners, degreasers, and chemical intermediates. Its excellent solvency properties, low toxicity, and high boiling point make it a preferred choice in chemical processing and formulation tasks.

Dipropylene Glycol Monomethyl Ether is widely used by chemical manufacturers for blending resins, stabilizing emulsions, and facilitating reactions in solvent systems. The chemical industry values its performance in both organic and aqueous environments, which enables versatile use across a wide range of industrial products. Additionally, DPM’s compatibility with other solvents and ease of handling under strict regulatory frameworks add to its industrial appeal.

The 33.1% market share held by the chemicals segment also underscores the sustained consumption in developing and developed economies alike, where demand for cleaning agents, process chemicals, and industrial fluids remains steady. With growing emphasis on safe and effective solvents, DPM’s continued adoption in chemical manufacturing is expected to support the segment’s strong position within the overall market landscape.

Key Market Segments

By Product Type

- Industrial Grade

- Cosmetic Grade

- Reagent Grade

- Others

By Formulation Type

- Solvent-based Formulations

- Water-based Formulations

- Emulsions

- Others

By End-User Industry

- Chemicals

- Pharmaceuticals

- Food and Beverage

- Automotive

- Consumer Goods

- Others

Driving Factors

Growing Demand for Eco-Friendly Industrial Solvents Globally

One of the main driving factors for the Dipropylene Glycol Monomethyl Ether (DPM) market is the rising demand for eco-friendly and low-toxicity industrial solvents. As industries move away from harsh, high-VOC (volatile organic compound) chemicals, DPM is gaining popularity due to its safer profile and lower environmental impact. It is widely used in paints, coatings, cleaners, and printing inks because it offers good performance while meeting stricter environmental rules.

Government regulations in Europe, North America, and parts of Asia are encouraging companies to switch to greener options, pushing up the use of DPM. This shift is not only about compliance but also about creating safer workplaces and sustainable products, making DPM a go-to solvent in many sectors.

Restraining Factors

Fluctuating Raw Material Prices Affecting Production Stability

A key restraining factor for the Dipropylene Glycol Monomethyl Ether (DPM) market is the frequent fluctuation in raw material prices. DPM is derived from petrochemical sources, and its production cost is directly influenced by changes in crude oil prices. Any instability in the oil market, due to geopolitical tensions, supply chain disruptions, or policy shifts, can lead to unpredictable costs for manufacturers.

This volatility makes it hard for producers to maintain consistent pricing, which can affect long-term contracts and profitability. Industries relying on DPM may look for alternative solvents if pricing becomes too unstable. These fluctuations can limit the market’s steady growth, especially in price-sensitive regions where buyers are more focused on affordability.

Growth Opportunity

Rising Use in Personal Care Product Formulations

A major growth opportunity for the Dipropylene Glycol Monomethyl Ether (DPM) market lies in its increasing use in personal care and cosmetic products. As consumers prefer products with safer and skin-friendly ingredients, DPM is becoming a popular solvent in lotions, creams, perfumes, and deodorants. Its mild scent, low irritation potential, and ability to mix well with fragrances and active ingredients make it ideal for daily-use formulations.

With the global rise in demand for skincare and grooming products, especially in Asia and North America, the use of DPM is expected to grow. Its performance as a carrier and stabilizer supports both product quality and shelf life, making it a valuable ingredient in modern personal care manufacturing.

Latest Trends

Increased Adoption in Water-Based Industrial Applications

A notable trend in the Dipropylene Glycol Monomethyl Ether (DPM) market is its growing use in water-based industrial applications. As industries seek to reduce volatile organic compound (VOC) emissions and enhance workplace safety, DPM’s compatibility with water-based formulations makes it an attractive choice.

Its excellent solvency and low odor contribute to improved product performance in coatings, cleaners, and other industrial products. This shift towards water-based systems aligns with global environmental regulations and the demand for sustainable solutions, positioning DPM as a preferred solvent in various sectors.

Regional Analysis

In 2024, Asia-Pacific led the market with a 43.20% regional share dominance.

In 2024, Asia-Pacific emerged as the dominant region in the Dipropylene Glycol Monomethyl Ether market, capturing a 43.20% share and reaching a valuation of USD 0.7 billion. This leadership position is supported by strong industrial growth, rising consumption of paints and coatings, and expanding demand for cleaning agents across countries like China, India, and Southeast Asia.

Rapid urbanization and increased manufacturing activity have driven the usage of industrial-grade solvents in this region. In North America, the market showed stable growth due to steady demand in the chemicals and personal care sectors, especially in the United States. Europe maintained a significant share, driven by environmental regulations pushing the adoption of low-VOC solvents such as DPM in coatings and formulations.

Meanwhile, the Middle East & Africa region experienced moderate market traction, primarily supported by the construction and oilfield industries. In Latin America, the market remained in a developing phase, with Brazil and Mexico contributing to demand growth in the industrial and cleaning sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dow Chemicals maintained its leadership in the DPM market by leveraging its robust manufacturing capabilities and comprehensive distribution network. In 2024, Dow reported net sales of $10.4 billion in the fourth quarter, reflecting its broad market reach across multiple chemical segments. The company’s focus on performance materials and coatings, where DPM is a critical component, underscores its role in supplying essential solvents for industrial applications.

BASF demonstrated a strong presence in the DPM market through its extensive global operations and diversified product portfolio. The company’s commitment to innovation and sustainability has positioned it as a key supplier of high-quality solvents, including DPM, catering to various industries such as paints, coatings, and cleaning agents. BASF’s strategic investments in research and development have enabled it to meet the evolving demands of eco-friendly and efficient solvent solutions.

Hannong Chemicals Inc., a prominent South Korean chemical manufacturer, contributed to the DPM market through its specialized production of glycol ethers and related compounds. The company’s emphasis on quality control and technological advancement has enabled it to supply reliable solvent solutions to various industries. Hannong’s strategic focus on expanding its product offerings and enhancing production capabilities has supported its growth in the DPM sector.

Top Key Players in the Market

- BASF

- Dow Chemicals

- Hannong Chemicals Inc.

- HENAN PROSPER CHEMICALS

- Hualun Chemicals

- Jinchangsheng Chemical Technology Co., Ltd

- LyondellBasell Industries Holdings B.V.

- Monument Chemical

- Shell Chemicals

- Shiny Chemical

- Tokyo Chemical Industry Co., Ltd.

- Yida Chemical Co. Ltd

Recent Developments

- In May 2025, BASF expanded its portfolio by introducing Pluriol® A 2400 I, a reactive polyethylene glycol, in the European market. This product is utilized in the production of third-generation superplasticizers for the construction industry, offering improved flow characteristics and durability in concrete applications. The introduction of Pluriol® A 2400 I underscores BASF’s commitment to providing innovative solutions that cater to evolving industry needs.

- In March 2025, LyondellBasell approved a significant expansion project to increase propylene production capacity at its Channelview Complex near Houston. This investment aims to enhance the company’s ability to meet increasing customer demand and improve self-sufficiency in a core business line.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.4 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Industrial Grade, Cosmetic Grade, Reagent Grade, Others), By Formulation Type (Solvent-based Formulations, Water-based Formulations, Emulsions, Others), By End-User Industry (Chemicals, Pharmaceuticals, Food and Beverage, Automotive, Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Dow Chemicals, Hannong Chemicals Inc., HENAN PROSPER CHEMICALS, Hualun Chemicals, Jinchangsheng Chemical Technology Co.Ltd, LyondellBasell Industries Holdings B.V., Monument Chemical, Shell Chemicals, Shiny Chemical, Tokyo Chemical Industry Co. Ltd., Yida Chemical Co. ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dipropylene Glycol Monomethyl Ether MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Dipropylene Glycol Monomethyl Ether MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Dow Chemicals

- Hannong Chemicals Inc.

- HENAN PROSPER CHEMICALS

- Hualun Chemicals

- Jinchangsheng Chemical Technology Co., Ltd

- LyondellBasell Industries Holdings B.V.

- Monument Chemical

- Shell Chemicals

- Shiny Chemical

- Tokyo Chemical Industry Co., Ltd.

- Yida Chemical Co. Ltd