Global Digital Wound Measurement Devices Market By Product (Product and Software), By Wound Type (Chronic Wounds and Acute Wounds), By Technique (2D and 3D), By End User (Hospitals, Specialty clinics, Nursing Homes, Home Care Settings, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151612

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

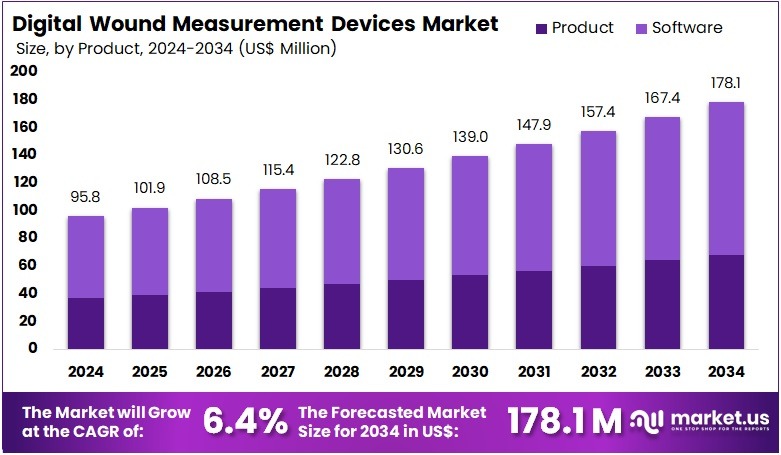

The Digital Wound Measurement Devices Market size is expected to be worth around US$ 178.1 million by 2034 from US$ 95.8 million in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034.

The global digital wound measurement devices market is experiencing significant growth, driven by technological advancements and the increasing prevalence of chronic wounds. These devices utilize advanced technologies, such as imaging sensors and software algorithms, to accurately assess wound dimensions, depth, and healing progress.

In the United States, over 6.5 million individuals suffer from chronic wounds, which result in an annual healthcare cost of US$ 25 billion in 2022. The Australian Wound Management Association estimates that around 400,000 Australians live with chronic wounds or ulcers at any given time. In Germany, chronic wounds affect approximately 4 million people, with the prevalence increasing each year. A report by Müller-Bühl U, identified 786,407 prevalent and 196,602 incident chronic wounds, with 326,334 and 172,026 patients undergoing wound-related treatments in 2021. In the Middle East and North Africa (MENA) region had over 35 million people diagnosed with diabetes, a number projected to double by 2040.

Key drivers of this growth include the rising prevalence of chronic wounds, driven by an aging global population and increasing incidences of conditions like diabetes and obesity. Technological advancements in 3D imaging, artificial intelligence, and mobile connectivity are also enhancing the accuracy and efficiency of wound assessments. Additionally, the adoption of telehealth services has accelerated the demand for remote wound monitoring solutions, enabling healthcare providers to manage patient care more effectively.

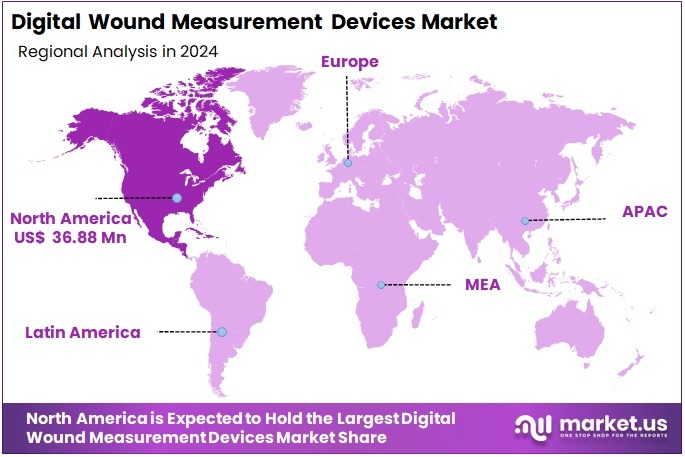

However, challenges such as the high costs of these devices and the need for proper training for healthcare professionals remain significant barriers to widespread adoption. The initial investment and maintenance costs of digital wound measurement devices can be prohibitive, especially for smaller healthcare facilities. Regionally, North America dominates the market due to advanced healthcare infrastructure and high adoption rates of innovative medical technologies. Meanwhile, Asia-Pacific is expected to witness the highest growth rate, driven by rapid urbanization, increasing healthcare awareness, and the rising prevalence of chronic diseases.

The digital wound measurement devices market is poised for substantial growth, fueled by technological innovations and the increasing demand for efficient wound care solutions. Despite challenges such as high costs and the need for specialized training, the benefits of accurate and timely wound assessment are driving widespread adoption across various healthcare settings.

Key Takeaways

- In 2024, the market for Digital Wound Measurement Devices generated a revenue of US$ 95.8 million, with a CAGR of 6.4%, and is expected to reach US$ 178.1 million by the year 2034.

- The product type segment is divided into Product and Software with Software taking the lead in 2024 with a market share of 61.7%.

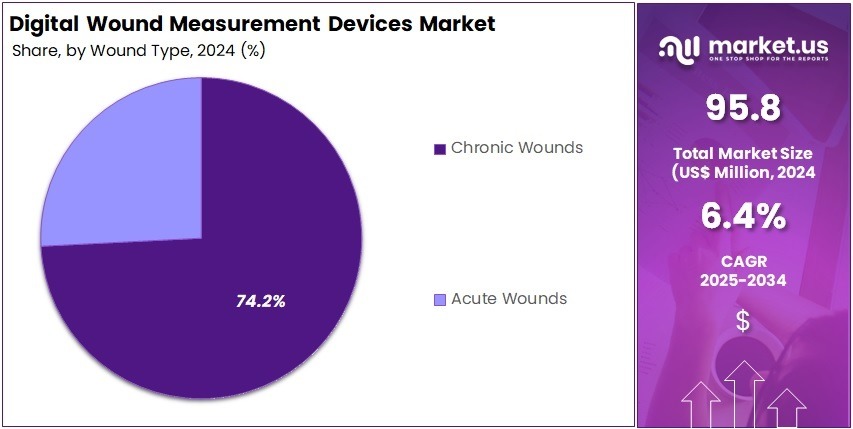

- By Wound Type, the market is bifurcated into Chronic Wounds and Acute Wounds, with Chronic Wounds leading the market with 74.2% of market share.

- By Technique, the market is segmented into 2D and 3D, with 3D taking the lead in the global market with a market share of 65.2%.

- Furthermore, concerning the End-User segment, the market is segregated into Hospitals, Specialty clinics, Nursing Homes, Home Care Settings, and Others. Hospitals stands out as the dominant segment, holding the largest revenue share of 41.9% in the Digital Wound Measurement Devices market.

- North America led the market by securing a market share of 38.5% in 2024.

Product Analysis

In the digital wound measurement devices market, the software segment is a key driver of growth, with significant adoption across healthcare settings. Software solutions dominated the market with 61.7% market share used in digital wound measurement devices are crucial for processing data captured by imaging technologies, such as 3D cameras or sensors. These software platforms enable healthcare professionals to accurately analyze wound dimensions, depth, and healing progress, providing a comprehensive view of the wound’s condition over time.

The software segment includes applications for wound documentation, data analysis, and integration with electronic health records (EHRs), making it easier for clinicians to track patient progress. These software tools also offer features like AI-powered analytics, helping identify patterns or potential complications, which aids in decision-making and treatment planning.

Software solutions in this market are often integrated with telemedicine platforms, enabling remote monitoring and consultation. This is especially beneficial in managing patients with chronic wounds, as it allows healthcare providers to monitor wound healing without requiring frequent in-person visits. The increasing demand for efficiency and accuracy in wound care management has made software an essential component of digital wound measurement devices.

As healthcare continues to embrace digital transformation, the software segment is expected to expand, offering more advanced features, including AI and machine learning capabilities, which further enhance its potential in wound care. In October 2021, Essity, a company specializing in hygiene and health, is introducing Cutimed Wound Navigator, a digital solution designed for wound assessment. This innovative mobile app records essential wound characteristics, generates an assessment, and assists healthcare professionals in selecting the most appropriate wound care product, ensuring patients receive the most suitable treatment.

Wound Type Analysis

In the digital wound measurement devices, the chronic wounds segment holds a dominant position in the market with 74.2% of market share due to the rising global prevalence of conditions that lead to long-term wound care needs, such as diabetes, obesity, and vascular diseases. Chronic wounds, including diabetic foot ulcers, pressure ulcers, venous leg ulcers, and arterial ulcers, often fail to heal in a timely manner and require continuous monitoring.

Digital wound measurement devices provide accurate, consistent, and real-time assessments that help healthcare professionals track the healing process, evaluate treatment effectiveness, and adjust care plans accordingly. The use of advanced technologies like 3D imaging and AI-powered software enhances the ability to assess wound size, depth, and other critical factors over time, improving outcomes and reducing complications.

Technique Analysis

In the digital wound measurement devices market, the 3D technique segment is rapidly gaining dominance with 65.2% market share due to its ability to provide more accurate, detailed, and comprehensive assessments of wound dimensions. 3D imaging technology captures both the surface area and depth of a wound, enabling healthcare professionals to monitor changes in shape and size with greater precision over time. This technique is particularly beneficial for complex wounds, as it provides an in-depth view of the wound’s morphology, allowing for better treatment planning and more effective monitoring of healing progress.

Additionally, 3D wound measurement technology can generate 3D models, which are invaluable for documenting wound conditions and tracking improvements or complications. The integration of artificial intelligence (AI) with 3D imaging further enhances the analytical capabilities of the technology, helping identify trends or signs of infection.

End-User Analysis

In the digital wound measurement devices market, hospitals are the largest end-user segment with 41.9% market share due to their extensive use of advanced medical technologies and the need for accurate, real-time wound assessments in treating severe or chronic cases. Hospitals typically handle a wide range of complex wound types, such as diabetic foot ulcers, pressure ulcers, and post-surgical wounds, all of which require precise monitoring to ensure proper healing.

Digital wound measurement devices enable healthcare providers in hospitals to track wound healing more efficiently, improve patient outcomes, and optimize treatment plans through accurate and detailed data analysis. Specialty clinics are also a significant segment, as they focus on providing targeted wound care services, such as dermatology, podiatry, and vascular care. These clinics require specialized equipment to assess and monitor wounds, particularly chronic wounds that require ongoing care and management. Digital wound measurement devices in specialty clinics help improve the accuracy of assessments, enhance documentation, and support clinical decision-making.

Key Market Segments

By Product

- Product

- Software

By Wound Type

- Chronic Wounds

- Acute Wounds

By Technique

- 2D

- 3D

By End User

- Hospitals

- Specialty clinics

- Nursing Homes

- Home Care Settings

- Others

Drivers

Increasing Prevalence of Chronic Wounds

The rising prevalence of chronic wounds is one of the primary drivers of growth in the digital wound measurement devices market. Chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, are becoming more common due to the increasing global incidence of chronic conditions like diabetes, obesity, and vascular diseases. As per recent estimates by U.S. Centers for Medicare and Medicaid Services in 2022, chronic wounds affect 10.5 million of U.S. Medicare beneficiaries. Chronic wounds impact the quality of life of nearly 2.5% of the total population of the United States.

As these conditions become more widespread, the need for advanced wound care solutions that can efficiently monitor and manage these long-term wounds is increasing. Digital wound measurement devices offer healthcare providers precise, consistent, and real-time data on wound size, depth, and healing progress, enabling better decision-making and more effective treatment plans.

These devices allow for early detection of complications, such as infections, and track the effectiveness of treatments, leading to improved patient outcomes. The growing demand for accurate and efficient wound management in both healthcare settings and home care environments is driving the widespread adoption of digital wound measurement technologies. The ability to remotely monitor chronic wounds is also contributing to the growth, as patients can receive care without frequent visits to healthcare facilities, reducing strain on healthcare systems and offering convenience for patients.

Restraints

High Initial Costs and Maintenance

A significant restraint for the digital wound measurement devices market is the high initial investment and ongoing maintenance costs associated with these advanced technologies. While the long-term benefits of improved wound care are evident, the upfront cost of purchasing digital wound measurement devices, as well as the cost of software licenses and necessary training, can be prohibitive for smaller healthcare facilities, specialty clinics, and home care providers.

In addition to the initial investment, these devices may require regular maintenance, software updates, and support services to ensure optimal performance, adding to the operational costs. Smaller clinics or rural healthcare providers with limited budgets may find it difficult to justify the expense, especially when traditional wound measurement methods are available.

This financial barrier can slow down the adoption rate of digital wound measurement devices, particularly in developing regions where healthcare infrastructure is less advanced. Furthermore, the complexity of these devices often requires specialized training for healthcare professionals, which can incur additional costs. Overcoming these financial and operational challenges is critical to expanding the market and ensuring broader accessibility to these advanced wound care solutions.

For example, MolecuLight i:X is FDA-cleared and provides advanced digital wound measurement capabilities, including real-time fluorescence imaging to detect regions with high bacterial loads, and automated wound area, length, width, and depth measurement without direct patient contact. The costs range from US$ 4,345 to US$ 6,717, which is approximately £3,317 to £5,127. In the NHS, the cost for each healed wound varies from £698 to £3,998 per person, while the cost for an unhealed wound ranges from £1,719 to £5,976 per person.

Opportunities

Integration with Telemedicine and Remote Monitoring

One of the most promising opportunities in the digital wound measurement devices market is the integration of these devices with telemedicine and remote monitoring solutions. As healthcare shifts towards more patient-centered care and the demand for telehealth services continues to grow, digital wound measurement devices can play a critical role in improving patient outcomes and reducing healthcare costs.

Remote monitoring allows healthcare providers to assess wounds from a distance, track healing progress, and make adjustments to treatment plans without the need for frequent in-person visits. This is particularly beneficial for patients with chronic wounds, such as those with diabetes or vascular conditions, who require long-term care. By integrating digital wound measurement devices with telemedicine platforms, patients can receive continuous care in the comfort of their homes, reducing the strain on hospitals and clinics while improving patient convenience and satisfaction.

The ongoing advancements in digital health technologies, coupled with the growing acceptance of telehealth, present a significant growth opportunity for the market. As patients become more comfortable with remote healthcare solutions, the demand for digital wound measurement devices that facilitate telemedicine applications is expected to rise, driving market growth.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions, such as inflation, healthcare spending, and economic recessions, can affect the market’s growth trajectory. During periods of economic downturn or financial instability, healthcare budgets may face cuts, leading to reduced spending on advanced medical technologies, including digital wound measurement devices.

Smaller clinics and healthcare providers in economically constrained regions may find it difficult to afford these technologies, thus slowing down the adoption rate. On the other hand, an improving economy often leads to increased healthcare investments, which can accelerate the adoption of advanced wound care solutions, including digital devices. Additionally, rising healthcare costs are pushing healthcare systems to seek more efficient solutions, such as digital wound measurement devices, that can help in reducing prolonged treatment durations and hospital visits.

Geopolitical factors, including political instability, trade wars, and regulatory changes, can disrupt the market in different ways. Trade tariffs, for instance, may increase the cost of importing the components used in digital wound measurement devices, impacting pricing and market accessibility, especially in emerging markets.

Regulatory policies, particularly in developed countries, may also influence the approval and usage of new medical technologies. Stringent regulations can slow down the introduction of innovative digital wound care solutions, while favorable regulations in some regions can lead to faster adoption. Moreover, geopolitical tensions may affect the availability and distribution of digital wound measurement devices across borders, especially in regions experiencing conflicts or instability.

Latest Trends

Adoption of AI and Machine Learning in Wound Care

A significant trend in the digital wound measurement devices market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance wound care. AI-powered algorithms can analyze wound images and data captured by digital measurement devices to provide accurate, automated assessments of wound size, depth, and healing progress. These technologies can detect subtle changes that might be missed by human clinicians, enabling earlier detection of complications such as infection, poor healing, or the need for more advanced treatments.

Furthermore, AI and ML can help predict the healing trajectory of wounds, allowing healthcare providers to tailor treatment plans to individual patient needs and optimize outcomes. The integration of AI into wound care not only improves the accuracy and efficiency of wound assessments but also helps reduce clinician workload by automating routine tasks. The growing emphasis on personalized healthcare and precision medicine is also driving the adoption of AI and ML in wound care, as these technologies enable more targeted and effective treatment strategies. As AI continues to evolve, its role in wound management will likely expand, offering new possibilities for improving patient outcomes and enhancing the overall quality of care.

Regional Analysis

North America is leading the Digital Wound Measurement Devices Market

North America is the leading region in the digital wound measurement devices market with 38.5% market share. This dominance is primarily attributed to the region’s advanced healthcare infrastructure, high adoption rates of innovative medical technologies, and a significant burden of chronic wounds. The United States, in particular, is a major contributor to this market leadership.

The prevalence of chronic conditions such as diabetes and obesity has led to a higher incidence of chronic wounds, including diabetic foot ulcers and pressure ulcers. This trend drives the demand for precise and efficient wound care solutions. Additionally, the aging population further exacerbates the need for advanced wound management technologies. Digital wound measurement devices, which utilize 3D imaging and artificial intelligence, offer accurate assessments of wound size, depth, and healing progress, thereby improving patient outcomes and reducing healthcare costs.

In June 2021, Homecare HomebaseSM (HCHB), the leading software for home health and hospice in the U.S., is joining forces with Swift Medical, a global leader in digital wound care, to deliver high-quality, cost-effective care through an integrated solution. As part of this expanded collaboration, Swift Medical will become HCHB’s exclusively preferred wound care technology partner, offering an enhanced integration that streamlines workflows and eliminates the need for double documentation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Digital Wound Measurement Devices market includes ARANZ Medical Limited, Bruin Biometrics, LLC, eKare, Inc., Essity Aktiebolag, KroniKare, MolecuLight, Inc., Swift Medical, The Perceptive Solutions, Tissue Analytics (Net Health Company), WoundVision, WoundMatrix, Inc., Kent Imaging Inc., Hitachi Healthcare Americas, Rubitection Inc., Kadmon Holdings Inc., and Other Prominent Players.

ARANZ Medical is a New Zealand-based company specializing in advanced wound imaging and measurement technologies. Their flagship product, the Silhouette® system, is a 3D wound measurement, imaging, and documentation platform that utilizes laser-assisted technology to accurately assess wound dimensions, depth, and volume. Bruin Biometrics, based in Los Angeles, is a technology company focused on developing biometric sensor-based medical devices.

Their leading product, the Provizio® SEM Scanner, is a handheld, wireless device designed for early detection of pressure injury risk by assessing sub-epidermal moisture levels. eKare, Inc., headquartered in Fairfax, Virginia, is an advanced wound imaging and data analytics company. Their flagship product, inSight®, is a mobile-based wound assessment platform that leverages computer vision and artificial intelligence to provide accurate, real-time wound measurements and documentation.

Top Key Players in the Digital Wound Measurement Devices Market

- ARANZ Medical Limited

- Bruin Biometrics, LLC

- eKare, Inc.

- Essity Aktiebolag

- KroniKare

- MolecuLight, Inc.

- Swift Medical

- The Perceptive Solutions

- Tissue Analytics (Net Health Company)

- WoundVision

- WoundMatrix, Inc.

- Kent Imaging Inc.

- Hitachi Healthcare Americas

- Rubitection Inc.

- Kadmon Holdings Inc.

- Other Prominent Players

Recent Developments

- In January 2024: Swift Medical, a digital health technology company focused on wound care providers, is excited to announce the successful completion of an US$ 8M financing round, co-led by existing investors BDC Capital’s Women in Technology Venture Fund and funds managed by Virgo Investment Group. Swift employs artificial intelligence to enhance clinical and economic outcomes in both chronic and acute wound care, and this funding will accelerate the development of its technological advancements.

- In June 2023: Swift Medical, a digital health technology company dedicated to improving clinical and economic outcomes in wound care, has announced a strategic partnership with Corstrata, a leader in virtual wound care delivery, to enhance and broaden access to high-quality wound care. Through this collaboration, joint customers will have access to Corstrata’s team of certified Wound, Ostomy, Continence (WOC) nurses and Swift’s advanced AI-powered wound care platform, which provides superior wound imaging, documentation, collaboration, and decision support tools.

- In October 2021: MolecuLight Inc., a leader in point-of-care fluorescence imaging for real-time detection of wounds with elevated bacterial loads, has announced the launch of the MolecuLightDX™. This new point-of-care device model is specifically designed to meet the unique needs of emerging wound care market segments in the USA.

Report Scope

Report Features Description Market Value (2024) US$ 95.8 million Forecast Revenue (2034) US$ 178.1 million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Product and Software), By Wound Type (Chronic Wounds and Acute Wounds), By Technique (2D and 3D), By End User (Hospitals, Specialty clinics, Nursing Homes, Home Care Settings, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ARANZ Medical Limited, Bruin Biometrics, LLC, eKare, Inc., Essity Aktiebolag, KroniKare, MolecuLight, Inc., Swift Medical, The Perceptive Solutions, Tissue Analytics (Net Health Company), WoundVision, WoundMatrix, Inc., Kent Imaging Inc., Hitachi Healthcare Americas, Rubitection Inc., Kadmon Holdings Inc., and Other Prominent Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Wound Measurement Devices MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Wound Measurement Devices MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ARANZ Medical Limited

- Bruin Biometrics, LLC

- eKare, Inc.

- Essity Aktiebolag

- KroniKare

- MolecuLight, Inc.

- Swift Medical

- The Perceptive Solutions

- Tissue Analytics (Net Health Company)

- WoundVision

- WoundMatrix, Inc.

- Kent Imaging Inc.

- Hitachi Healthcare Americas

- Rubitection Inc.

- Kadmon Holdings Inc.

- Other Prominent Players