Global Digital Power Meter Market Size, Share, And Enhanced Productivity By Phase (Single Phase Power Meter, Three Phase Power Meter), By Product Type (Digital Meter Type, Electrical Meter Type, Electromechanical Meter Type, Electronic Meter Type), By Application (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171127

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

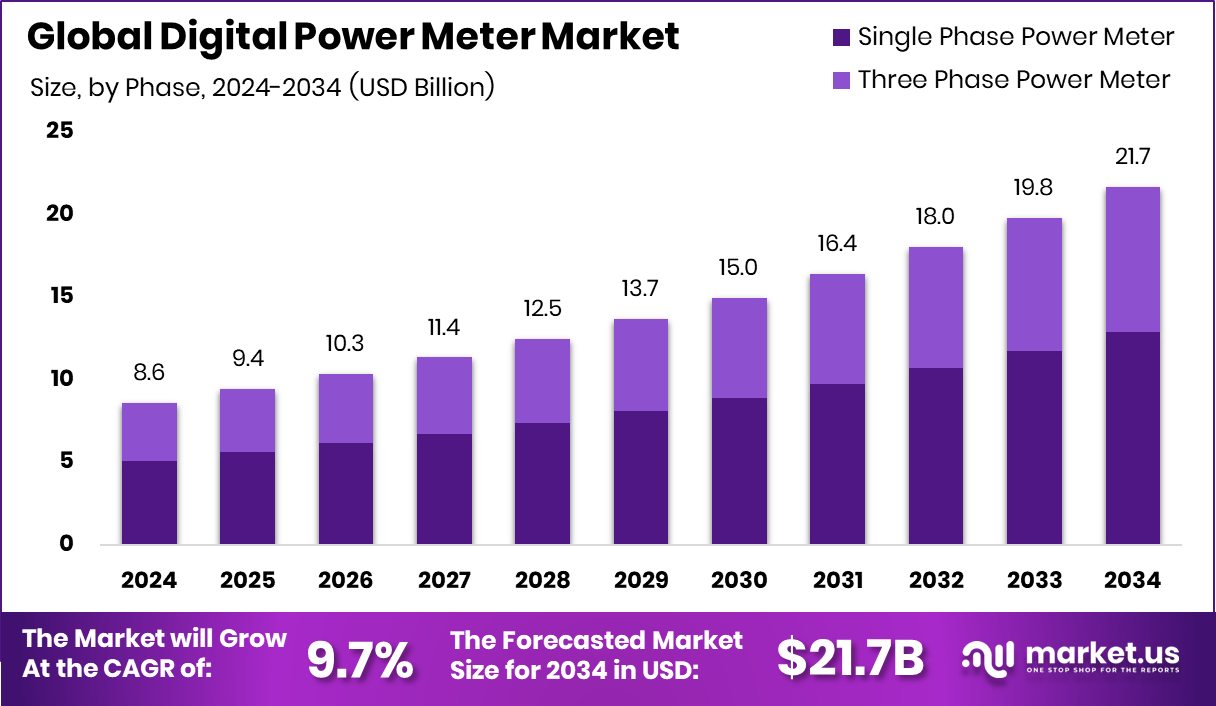

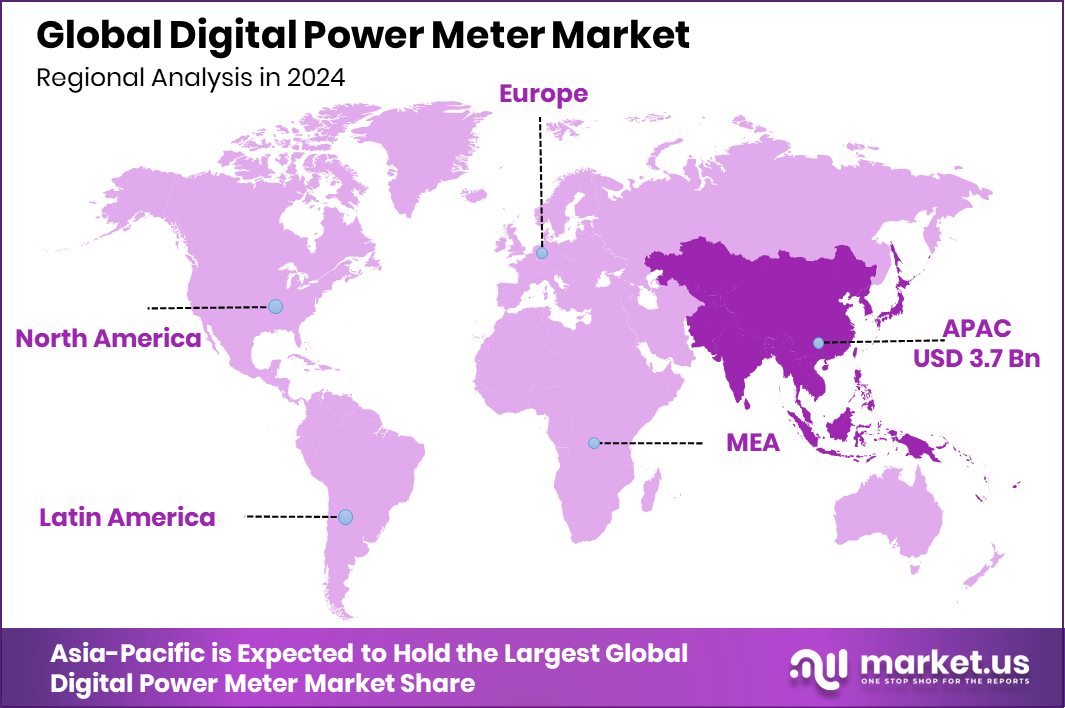

The Global Digital Power Meter Market is expected to be worth around USD 21.7 billion by 2034, up from USD 8.6 billion in 2024, and is projected to grow at a CAGR of 9.7% from 2025 to 2034. Asia-Pacific accounts for 43.60% of the Digital Power Meter Market, representing USD 3.7 Bn.

A Digital Power Meter is an electronic device used to measure electricity consumption accurately in real time. Unlike old mechanical meters, it records data digitally, helping users clearly understand how much power they consume. These meters improve billing accuracy, reduce manual errors, and support better energy monitoring for households and utilities. They also help detect power losses and unusual usage patterns, making electricity management more transparent and reliable.

The Digital Power Meter Market refers to the broader ecosystem of manufacturing, installation, and use of these meters across homes, commercial spaces, and power networks. The market exists because power systems are moving toward precise measurement, accountability, and smarter energy use. Governments and utilities rely on digital meters to modernize grids, improve billing systems, and manage electricity demand more efficiently.

Brookfield launched a USD 100 billion AI infrastructure fund, backed by Nvidia and KIA, highlighting rising investment in digital power and data systems that depend on accurate energy measurement. Such investments indirectly support demand for digital power meters as electricity monitoring becomes critical for advanced digital infrastructure.

Demand is rising as governments focus on reducing household energy costs and improving efficiency. In the UK, discussions around cutting household energy bills by up to £200 per year highlight the need for better tracking of electricity usage. At the same time, although 100% of electricity consumers pay for smart meter costs, only about 2% currently have meters installed, such as in the Bescom region, where around 3 lakh out of one crore consumers are expected to receive smart meters, showing a great unmet demand.

Opportunities remain strong due to large-scale rollout projects. A recent example is a company winning a ₹3,467 crore project to install 76 lakh smart meters, showing how mass deployment programs can rapidly expand market size. Smaller initiatives, such as £30,000 regional grants supporting local digital and creative projects, also contribute by encouraging technology adoption and awareness, indirectly strengthening long-term market growth.

Key Takeaways

- The Global Digital Power Meter Market is expected to be worth around USD 21.7 billion by 2034, up from USD 8.6 billion in 2024, and is projected to grow at a CAGR of 9.7% from 2025 to 2034.

- In the Digital Power Meter Market, single-phase meters dominate phase segmentation with 59.3% share.

- Within the Digital Power Meter Market, digital meter types lead product segmentation, holding 44.2% share.

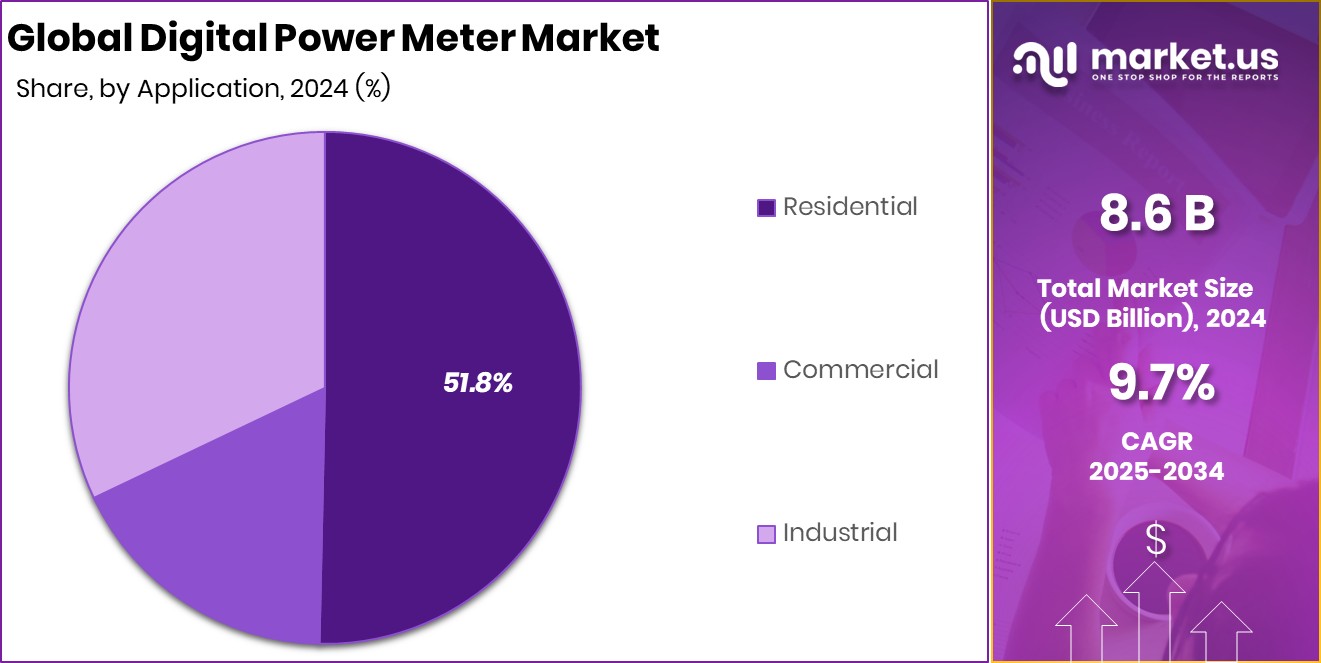

- In the Digital Power Meter Market, residential applications lead usage demand, accounting for 51.8% share.

- Asia-Pacific region dominates the Digital Power Meter Market, holding 43.60% and USD 3.7 Bn.

By Phase Analysis

Single phase power meters dominate the Digital Power Meter Market, holding 59.3% share globally.

In 2024, Single Phase Power Meter held a dominant market position in the By Phase segment of the Digital Power Meter Market, with a 59.3% share. This dominance reflects the widespread use of single-phase electricity connections across everyday power consumption environments. The segment benefits from its suitability for standard voltage requirements and its ability to deliver accurate measurements for routine electricity usage.

The strong share of 59.3% also highlights consistent demand driven by the replacement of conventional meters with digital solutions that offer better reliability and transparency. Utilities and end users continue to rely on single-phase digital meters due to their ease of installation, stable performance, and compatibility with existing distribution systems. As a result, this segment remains a key volume contributor within the overall digital power meter landscape, supporting steady market penetration and long-term adoption.

By Product Type Analysis

Digital meter types lead the Digital Power Meter Market with a 44.2% adoption share.

In 2024, Digital Meter Type held a dominant market position in the By Product Type segment of Digital Power Meter Market, with a 44.2% share. This leadership indicates a clear transition toward modern metering solutions that provide precise readings and improved data handling compared to traditional alternatives. The segment’s strength lies in its ability to support accurate billing and consistent power monitoring.

Holding a 44.2% share, digital meter types continue to gain preference due to their dependable performance and alignment with evolving power management needs. Their growing adoption reflects increasing emphasis on efficiency, transparency, and operational control within electricity measurement systems. This segment’s sustained dominance underscores its central role in shaping how electricity consumption is tracked and managed across the market.

By Application Analysis

Residential applications drive the Digital Power Meter Market, accounting for 51.8% demand.

In 2024, Residential held a dominant market position in the By Application segment of the Digital Power Meter Market, with a 51.8% share. This leading share points to the high concentration of digital meter installations within households, where accurate tracking of electricity usage is increasingly important. Residential users form the largest base of electricity consumers, supporting consistent demand for digital metering solutions.

With a 51.8% share, the residential segment reflects growing awareness around energy usage monitoring and billing accuracy. Digital power meters in homes help users better understand consumption patterns while supporting utilities in managing large customer bases efficiently. This strong position highlights the residential sector’s influence on overall market volumes and reinforces its role as a primary driver of digital power meter adoption.

Key Market Segments

By Phase

- Single Phase Power Meter

- Three Phase Power Meter

By Product Type

- Digital Meter Type

- Electrical Meter Type

- Electromechanical Meter Type

- Electronic Meter Type

By Application

- Residential

- Commercial

- Industrial

Driving Factors

Smart Grid Expansion Accelerates Digital Meter Adoption

The Digital Power Meter Market is strongly driven by ongoing smart grid expansion and large-scale meter deployment programs. Utilities are actively upgrading legacy infrastructure to improve billing accuracy, reduce losses, and gain real-time visibility into electricity usage. This shift directly increases demand for digital power meters that support automated data collection and remote monitoring.

Recent developments show steady momentum, such as Romania’s Delgaz Grid completing a 10,000 smart meter rollout in Iași, demonstrating how utilities are prioritizing modern metering at the local level. In parallel, public investment is supporting grid modernization, with Ottawa announcing $2 million in funding to Maritime Electric for smart grid upgrades in Prince Edward Island.

Private players are also scaling rapidly, reflected in HPL Electric and Power securing smart meter orders worth Rs 545 crore, indicating strong utility procurement activity. Together, these initiatives highlight how infrastructure upgrades and targeted investments are pushing consistent adoption of digital power meters.

Restraining Factors

High Deployment Costs Slow Digital Meter Rollouts

One major restraining factor in the Digital Power Meter Market is the high upfront cost of large-scale deployment and system integration. Installing digital and smart meters requires not only the device itself but also supporting communication networks, software platforms, and skilled manpower. Many utilities delay rollouts due to budget pressure and long payback periods, especially in regions with regulated tariffs. Even when funding is announced, uncertainty around allocation and execution timelines can slow decision-making.

For instance, discussion by the U.S. Department of Energy on how to best use $3 billion in infrastructure bill funding for smart grids has raised expectations but also created delays as utilities wait for clarity before committing. Market reactions show sensitivity to order flow, such as smart meter stocks jumping 8% after receiving a ₹65 Cr order, highlighting how deployment depends heavily on funding certainty.

Growth Opportunity

Large-Scale Smart Meter Financing Unlocks Market Expansion

A key growth opportunity in the Digital Power Meter Market is the creation of dedicated financing platforms that accelerate nationwide deployments. High initial costs have often slowed adoption, but structured funding now allows utilities to scale installations without heavy upfront strain.

A clear example is India’s Genus launching a $2bn smart meter funding platform, which directly supports the mass rollout of digital and smart meters across power distribution networks. This approach enables faster replacement of conventional meters, improves billing accuracy, and strengthens grid visibility.

By easing capital constraints, such funding models open doors for long-term contracts and sustained demand for digital power meters. The availability of large, ring-fenced capital also builds confidence among utilities to plan multi-year deployment programs, creating a stable growth path for the market while improving energy accountability and operational efficiency.

Latest Trends

Rapid Smart Meter Adoption Across Emerging Utilities

A major latest trend in the Digital Power Meter Market is the steady rise in on-ground smart meter installations by utilities aiming to modernize billing systems. Adoption is no longer limited to pilots and is moving into wider consumer rollout phases. This is visible in India, where over 14,000 Bescom consumers have installed smart meters, showing growing acceptance at the household level. At the same time, utilities in emerging markets are placing large bulk orders to accelerate deployment.

In East Africa, Kenya Power received approval to purchase 700,000 meters valued at Sh5.4bn, signaling strong momentum toward digital measurement. These developments highlight a shift from planning to execution, where utilities prioritize faster installation, improved consumption tracking, and reduced manual intervention. The trend reflects increasing confidence in digital power meters as a practical tool for improving operational efficiency and customer transparency.

Regional Analysis

Asia-Pacific Digital Power Meter Market leads with 43.60% share, at USD 3.7 Bn.

Asia-Pacific emerged as the dominating region in the Digital Power Meter Market, accounting for 43.8% of the global share and valued at USD 60.8 Mn, reflecting its strong concentration of electricity consumers and large-scale deployment of digital metering systems. The region’s leadership is supported by expanding urban populations and rising electricity monitoring needs across residential and utility networks, positioning Asia-Pacific as the primary contributor to overall market volumes.

North America represents a mature regional market, characterized by steady adoption of digital power meters for accurate consumption tracking and grid management, supporting stable demand patterns. Europe continues to show consistent uptake of digital metering solutions, driven by structured power distribution systems and the need for transparent energy usage measurement across households and commercial users.

The Middle East & Africa region reflects gradual market development, where digital power meters are increasingly used to improve billing accuracy and reduce losses within electricity networks. Latin America also demonstrates ongoing adoption, supported by the modernization of power infrastructure and the growing awareness of digital measurement benefits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Schneider Electric SE holds a strong strategic position in the global Digital Power Meter Market in 2024 due to its long-standing focus on power management and electrical efficiency solutions. The company’s digital power meters are closely aligned with broader electrical ecosystems, allowing seamless integration with monitoring and control systems. This integrated approach strengthens customer trust and supports consistent adoption across utility, commercial, and industrial settings.

Delta Electronics continues to demonstrate technical depth in digital power metering through its emphasis on precision measurement and reliable electronic design. The company benefits from its strong background in power electronics, which enhances the performance stability of its digital meters. In 2024, Delta Electronics is viewed as a player that balances cost efficiency with dependable functionality, making its offerings suitable for diverse end-use environments where accurate power monitoring is essential.

Techno Meters maintains relevance in the market by focusing on practical digital metering solutions tailored to operational requirements. The company’s strength lies in delivering straightforward, application-focused power meters that meet everyday monitoring needs. In 2024, Techno Meters is seen as a steady contributor to the market, supporting adoption through consistent product availability, ease of use, and alignment with standard electricity measurement practices.

Top Key Players in the Market

- Schneider Electric SE

- Delta Electronics

- Techno Meters

- Hoyt Electrical Instrument Works, Inc.

- Chroma ATE Inc.

- Weschler Instruments

- Sfere Electric

- CSQ Electric

- Eastron Electronic Co., Ltd.

Recent Developments

- In February 2025, Schneider Electric launched its Smart Power Manager feature as part of the Square D QO Smart Panel Solution, aimed at better managing home electrical loads and avoiding costly electrical upgrades. This solution supports smarter energy handling and helps builders and homeowners meet rising electrification needs.

- In November 2024, Delta Electronics presented its latest power and cooling solutions for cloud computing, automotive, and industrial sectors at Electronica 2024 in Munich. At the event, Delta highlighted energy-efficient systems that support high-performance computing and industrial applications — reinforcing its role in advanced power management technology.

Report Scope

Report Features Description Market Value (2024) USD 8.6 Billion Forecast Revenue (2034) USD 21.7 Billion CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Phase (Single Phase Power Meter, Three Phase Power Meter), By Product Type (Digital Meter Type, Electrical Meter Type, Electromechanical Meter Type, Electronic Meter Type), By Application (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Schneider Electric SE, Delta Electronics, Techno Meters, Hoyt Electrical Instrument Works, Inc., Chroma ATE Inc., Weschler Instruments, Sfere Electric, CSQ Electric, Eastron Electronic Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Power Meter MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Power Meter MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schneider Electric SE

- Delta Electronics

- Techno Meters

- Hoyt Electrical Instrument Works, Inc.

- Chroma ATE Inc.

- Weschler Instruments

- Sfere Electric

- CSQ Electric

- Eastron Electronic Co., Ltd.