Global Dermatology Devices Market By Product Type (Diagnostic Devices, Treatment Devices, Light Therapy Devices, Radiofrequency (RF) Devices, Cryotherapy Devices, Microdermabrasion Devices, Liposuction Devices and Others), By Application (Medical Applications, Aesthetic & Cosmetic Applications, By Age Group (Below 19 Years, 20-39 Years, 40-59 Years and 60+ Years), By End-User (Hospitals, Dermatology/Cosmetology Clinics, Medical Spas/Aesthetic Centers and Homecare Settings), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171624

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

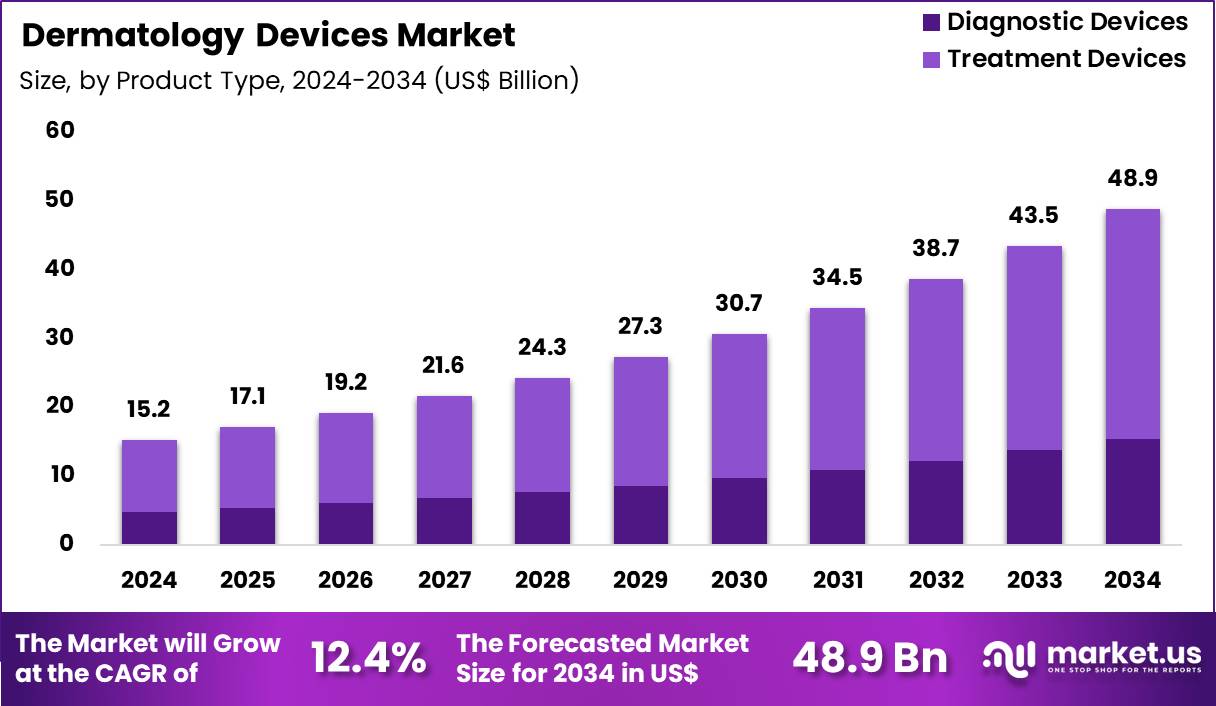

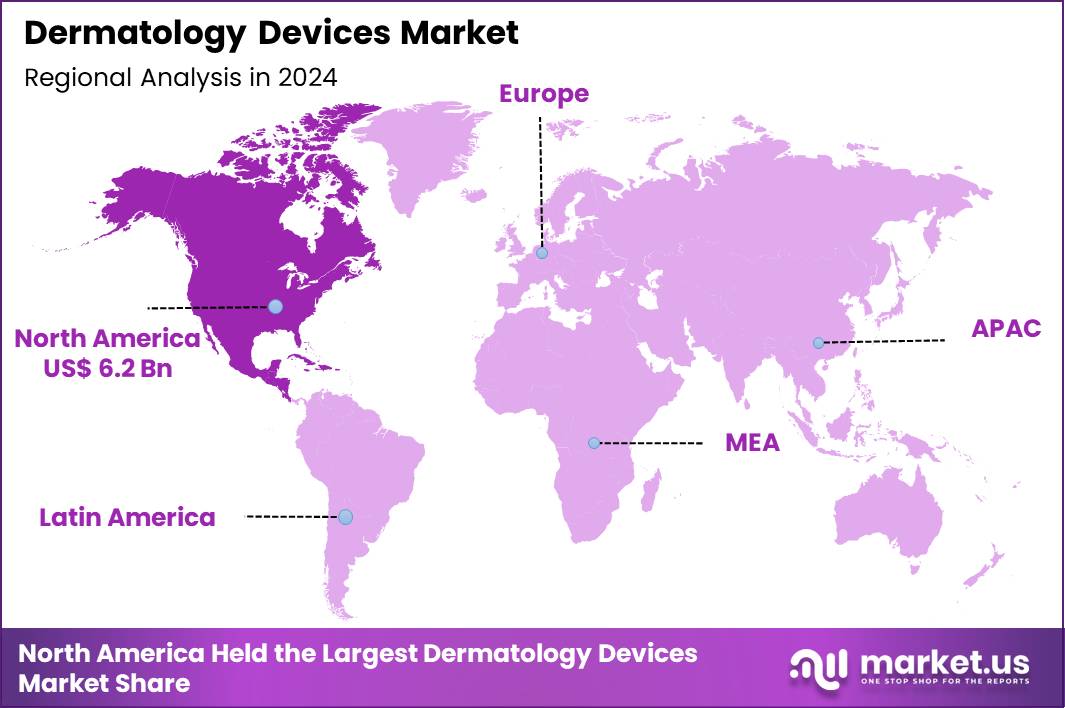

The Global Dermatology Devices Market size is expected to be worth around US$ 48.9 Billion by 2034 from US$ 15.2 Billion in 2024, growing at a CAGR of 12.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.7% share with a revenue of US$ 6.2 Billion.

Growing prevalence of skin disorders propels adoption of advanced dermatology devices that enable precise diagnosis and effective treatment of conditions ranging from acne to melanoma. Dermatologists increasingly deploy imaging systems to capture high-resolution visuals for monitoring pigmented lesions and detecting early signs of skin cancer. These devices support laser-based therapies that target vascular lesions, reducing redness and improving cosmetic outcomes in rosacea patients.

Clinicians utilize microsurgical tools for excisional biopsies, ensuring accurate removal of suspicious growths while minimizing scarring. Energy-based platforms facilitate skin resurfacing procedures that address wrinkles and uneven texture through controlled thermal injury.

In July 2023, Canfield Scientific participated in the 25th World Congress of Dermatology held in Singapore, where it showcased a range of advanced dermatology imaging and analysis systems through live, in-person demonstrations. Platforms such as IntelliStudio, VEOS, DermaGraphix, and VECTRA WB360 highlighted ongoing innovation in skin imaging, documentation, and clinical decision support, reinforcing the role of advanced visualization technologies within the global dermatology devices market.

Manufacturers explore opportunities to integrate radiofrequency devices into protocols for non-invasive skin tightening, stimulating collagen production in aging skin treatments. Developers engineer intense pulsed light systems to manage hyperpigmentation disorders, offering customizable wavelengths for diverse skin types and tones. These technologies expand applications in hair reduction therapies, delivering targeted energy to follicles for long-term epilation in hirsutism cases.

Opportunities emerge in cryotherapy units that treat actinic keratosis lesions, freezing precancerous cells to prevent progression to squamous cell carcinoma. Companies advance electrosurgical instruments for precise wart removal, combining cutting and coagulation functions to enhance procedural efficiency. Firms invest in hybrid laser platforms that combine ablative and non-ablative modalities, broadening utility in scar revision and tattoo fading procedures.

Industry pioneers incorporate artificial intelligence algorithms into diagnostic imaging devices, automating lesion segmentation and risk assessment for malignant melanoma detection. Developers refine optical coherence tomography systems to provide cross-sectional views of subsurface structures, aiding evaluation of inflammatory dermatoses like psoriasis. Market participants launch portable dermatoscopes with polarized lighting to eliminate glare, improving visualization of subsurface features in basal cell carcinoma screening.

Innovators enhance photodynamic therapy light sources with tunable spectra, optimizing activation of photosensitizers in acne vulgaris management. Companies prioritize multifunctional consoles that integrate ultrasound guidance for filler injections, ensuring accurate placement in dermal rejuvenation. Ongoing advancements emphasize teledermatology-compatible tools that transmit high-fidelity images, supporting remote consultations for chronic eczema monitoring.

Key Takeaways

- In 2024, the market generated a revenue of US$ 15.2 Billion, with a CAGR of 12.4%, and is expected to reach US$ 48.9 Billion by the year 2034.

- The product type segment is divided into diagnostic devices and treatment devices, with treatment devices taking the lead in 2024 with a market share of 68.5%.

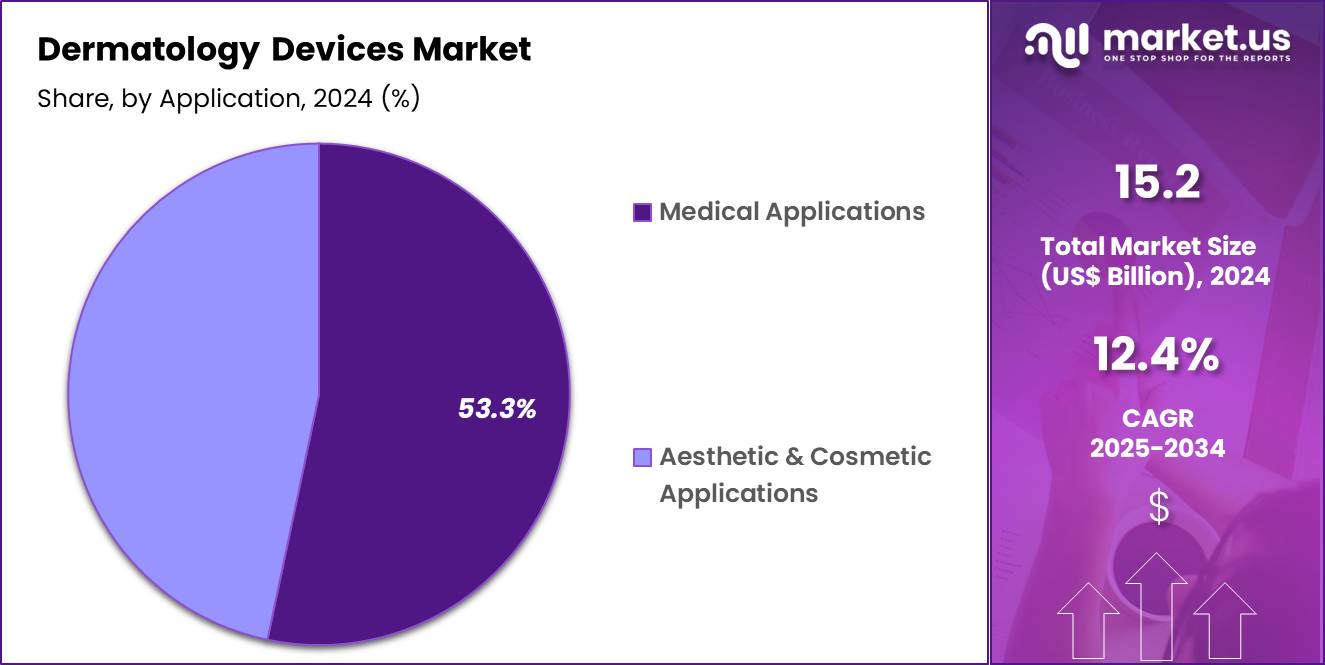

- Considering application, the market is divided into medical applications and aesthetic & cosmetic applications. Among these, medical applications held a significant share of 53.3%.

- Furthermore, concerning the age group segment, the market is segregated into below 19 years, 20-39 years, 40-59 years and 60+ years. The 20-39 years sector stands out as the dominant player, holding the largest revenue share of 35.6% in the market.

- The end-user segment is segregated into hospitals, dermatology/cosmetology clinics, medical spas/aesthetic centers and homecare settings, with the hospitals segment leading the market, holding a revenue share of 38.1%.

- North America led the market by securing a market share of 40.7% in 2024.

Product Type Analysis

Treatment devices, holding 68.5%, are expected to dominate because clinical management of skin disorders increasingly relies on technology-driven interventions rather than manual or pharmaceutical-only approaches. Rising incidence of chronic dermatological conditions such as acne, psoriasis, vitiligo, and skin infections strengthens demand for laser systems, phototherapy units, and energy-based devices.

Continuous technological advancements improve treatment precision, safety, and patient comfort, encouraging broader clinical adoption. Growing preference for minimally invasive procedures supports higher utilization of treatment devices across healthcare settings. Dermatologists increasingly integrate device-based therapies to achieve faster clinical outcomes and reduce long-term medication dependence.

Expansion of outpatient dermatology services further increases procedural volumes. Improved reimbursement coverage for medical dermatology procedures enhances accessibility. Hospitals and clinics invest in advanced devices to improve care quality and competitiveness. These factors keep treatment devices anticipated to remain the dominant product type in this market.

Application Analysis

Medical applications, holding 53.3%, are projected to dominate because diagnosis and treatment of pathological skin conditions represent a core component of dermatological care. Increasing prevalence of infectious skin diseases, inflammatory disorders, and skin cancers drives sustained clinical demand. Aging populations and rising environmental exposure to pollutants increase disease burden, strengthening reliance on medical dermatology solutions.

Device-assisted diagnosis and treatment improve early detection and therapeutic accuracy, supporting better patient outcomes. Physicians prioritize medically necessary interventions over cosmetic procedures in hospital and insurance-supported settings. Integration of dermatology devices into routine clinical workflows accelerates utilization. Public health awareness campaigns promote early medical consultation for skin conditions. These drivers keep medical applications expected to remain the leading application segment.

Age Group Analysis

The 20–39 years age group, holding 35.6%, is expected to dominate because individuals in this demographic actively seek treatment for acne, pigmentation disorders, hair loss, and early signs of skin damage. Lifestyle-related stress, hormonal changes, and increased screen exposure contribute to rising dermatological concerns within this age range.

Higher social awareness and professional engagement encourage timely medical intervention. This group adopts both preventive and corrective dermatology treatments to maintain skin health and confidence. Growing acceptance of device-based therapies supports increased utilization among younger adults. Access to urban healthcare facilities further boosts adoption rates. Digital health awareness and online consultations guide patients toward advanced treatment options. These factors keep the 20–39 years segment anticipated to remain dominant.

End-User Analysis

Hospitals, holding 38.1% , are projected to dominate because they manage complex dermatological cases requiring advanced diagnostic and treatment infrastructure. Hospitals serve as primary referral centers for severe infections, autoimmune skin disorders, and skin cancer management. Availability of multidisciplinary care supports comprehensive treatment planning and follow-up.

Increasing hospital admissions related to chronic diseases indirectly raise dermatology consultations. Hospitals invest in high-end dermatology devices to support teaching, research, and specialized care. Integration with pathology and imaging departments strengthens diagnostic accuracy. Public healthcare funding prioritizes hospital-based dermatology services. These dynamics keep hospitals expected to remain the dominant end-user segment in the dermatology devices market.

Key Market Segments

By Product Type

- Diagnostic Devices

- Dermatoscopes

- Confocal microscopes & OCT imaging units

- Other imaging devices

- Biopsy instruments

- Treatment Devices

- Laser systems

- CO₂ lasers

- Er:YAG lasers

- Nd:YAG lasers

- Diode lasers

- Pulsed-dye lasers

- Others

- Light Therapy Devices

- Intense Pulsed Light (IPL) devices

- LED phototherapy devices

- Others

- Radiofrequency (RF) devices

- Cryotherapy devices

- Microdermabrasion Devices

- Liposuction Devices

- Others

- Laser systems

By Application

- Medical Applications

- Skin cancer diagnosis

- Psoriasis, Eczema

- Pigmentation disorders

- Others

- Aesthetic & Cosmetic Applications

- Hair removal

- Tattoo removal

- Skin resurfacing & rejuvenation

- Skin tightening & body contouring

- Cellulite Reduction

- Vascular lesion treatment

- Acne & acne-scar treatment

- Others

By Age Group

- Below 19 years

- 20-39 years

- 40-59 years

- 60+ years

By End-User

- Hospitals

- Dermatology/Cosmetology clinics

- Medical spas/Aesthetic centers

- Homecare Settings

Drivers

Rising prevalence of skin cancer is driving the market

The dermatology devices market is significantly driven by the escalating prevalence of skin cancer worldwide, which heightens the demand for advanced diagnostic and treatment devices such as dermatoscopes, imaging systems, and ablative lasers. Skin cancer, encompassing melanoma and non-melanoma types, represents one of the most common malignancies, necessitating early detection tools for improved prognosis.

Diagnostic devices enable precise identification of suspicious lesions through magnified visualization and digital mapping. Treatment devices, including lasers and electrosurgical equipment, facilitate minimally invasive removal of cancerous tissues with reduced scarring. Increased ultraviolet exposure and lifestyle factors contribute to higher incidence rates across diverse populations. Public health campaigns emphasizing sun protection and regular screenings further amplify device utilization in clinical settings.

Dermatologists rely on these technologies for biopsy guidance and therapeutic interventions in oncology-focused practices. Collaborative research between device manufacturers and healthcare institutions advances device efficacy for skin cancer management. According to the American Cancer Society, an estimated 100,640 new cases of invasive melanoma were diagnosed in the United States in 2024. This statistic highlights the ongoing epidemiological pressure fueling market expansion.

Global awareness initiatives support broader adoption of preventive and curative devices. Regulatory approvals for innovative detection systems align with rising case volumes. Technological integrations enhance accuracy in high-risk patient evaluations. Overall, this driver sustains investment in dermatology devices tailored to oncologic applications.

Restraints

High costs of advanced dermatology devices are restraining the market

The dermatology devices market faces considerable restraints due to the elevated costs associated with acquiring and maintaining sophisticated equipment, which can limit accessibility for smaller practices and facilities in resource-constrained settings. Premium pricing for lasers, radiofrequency systems, and high-resolution imaging devices reflects substantial research and development expenditures.

Operational expenses include regular calibration, software updates, and specialized training for operators. Economic pressures on healthcare budgets may prioritize essential services over elective aesthetic technologies. Reimbursement inconsistencies for certain procedures further discourage investment in costly platforms. Emerging markets encounter additional barriers from import duties and currency fluctuations affecting affordability. Maintenance contracts and disposable components add recurring financial burdens.

Competition from lower-cost alternatives or traditional methods influences purchasing decisions. Supply chain disruptions can exacerbate pricing volatility for critical parts. These elements collectively hinder widespread proliferation of cutting-edge dermatology devices across varied practice environments. Smaller clinics may defer upgrades, impacting patient access to optimal care.

Manufacturers navigate pricing strategies to balance innovation with market penetration. Long-term cost-benefit analyses are essential for justifying expenditures. Such restraints necessitate strategic financing options to mitigate adoption challenges.

Opportunities

Increasing FDA clearances for innovative dermatology devices is creating growth opportunities

The dermatology devices market offers notable growth opportunities through the rising number of clearances granted by the U.S. Food and Drug Administration for novel technologies, facilitating rapid introduction of enhanced diagnostic and therapeutic solutions. These approvals validate safety and efficacy, encouraging manufacturer investment in research pipelines. Cleared devices often incorporate advanced features like improved energy delivery or imaging resolution for superior clinical outcomes.

Expanded indications broaden application scopes in both medical and aesthetic dermatology. Partnerships between developers and regulatory experts streamline submission processes. Post-clearance market entry enables competitive differentiation in crowded segments. Clinicians gain access to tools addressing unmet needs in skin rejuvenation and lesion management. Global harmonization trends may extend opportunities to international markets.

The FDA cleared multiple dermatology-related devices in recent years, including expansions for laser systems in 2024. This momentum supports diversified portfolios for device companies. Training programs accompany launches to ensure proficient utilization. Patient demand for FDA-cleared options reinforces market traction. Intellectual property protections sustain innovation cycles. These opportunities position the sector for accelerated expansion amid evolving dermatologic care demands.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics bolster the dermatology devices market as escalating healthcare investments and a burgeoning aging population worldwide propel clinics to integrate laser therapies, cryosurgery tools, and diagnostic imaging for enhanced skin condition management. Executives at leading firms strategically unveil AI-enhanced devices and portable units, capturing robust demand from cosmetic procedures and chronic dermatological treatments in expanding economies.

Lingering inflation and global economic slowdowns, however, inflate costs for electronic components and R&D, compelling manufacturers to hike prices and prompting hospitals to delay acquisitions amid squeezed budgets. Geopolitical frictions, notably U.S.-China trade disputes and regional conflicts, routinely disrupt supplies of key semiconductors and raw materials, generating production delays and sourcing challenges for globally dependent suppliers.

Current U.S. tariffs impose elevated duties up to 25 percent on imported medical devices from China, amplifying procurement expenses for American distributors and eroding competitive pricing in domestic healthcare channels. These tariffs also incite reciprocal barriers from trading partners that constrain U.S. exports of advanced dermatology technologies and impede multinational clinical collaborations.

Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Growing integration of artificial intelligence in dermatology devices is a recent trend

In 2024 and extending into 2025, the dermatology devices market has experienced a prominent trend toward the growing integration of artificial intelligence to augment diagnostic precision and treatment personalization. AI algorithms enhance image analysis in dermatoscopes and confocal microscopes, aiding in the differentiation of benign and malignant lesions. Machine learning models process vast datasets to predict treatment responses for conditions like acne or psoriasis.

Real-time feedback mechanisms in laser systems optimize energy parameters based on skin type and condition. Hybrid platforms combine AI with fractional technologies for safer resurfacing procedures. Regulatory clearances for AI-enabled devices have accelerated adoption in clinical workflows. Developers focus on convolutional neural networks for pattern recognition in pigmented lesions. Cloud-based connectivity facilitates remote consultations and data sharing. Ethical frameworks address algorithmic bias to ensure equitable performance across skin tones. This trend elevates diagnostic confidence while reducing interpretive variability among practitioners.

Educational initiatives prepare dermatologists for AI-assisted tools. Cybersecurity protocols safeguard patient data in connected systems. Scalability supports integration in both large institutions and private practices. Overall, AI integration transforms dermatology devices into intelligent systems promoting efficient, evidence-based care.

Regional Analysis

North America is leading the Dermatology Devices Market

North America accounted for 40.7% of the overall market in 2024, and the region experienced strong growth as demand increased for diagnostic, therapeutic, and aesthetic skin-care technologies across clinical and outpatient settings. Dermatology clinics expanded use of laser, light-based, and energy-based systems to manage acne, psoriasis, pigmentation disorders, and skin rejuvenation procedures.

Rising awareness of early skin-cancer detection encouraged wider adoption of dermatoscopes and imaging devices in routine screenings. Growth in minimally invasive cosmetic procedures further supported device utilization in private practices. The Centers for Disease Control and Prevention reported that approximately 5 million people in the United States receive treatment for skin cancer each year, reinforcing the need for advanced diagnostic and treatment equipment.

Technological innovation improved precision and patient comfort, increasing clinician adoption. Favorable reimbursement for medical dermatology procedures strengthened purchasing activity. These factors collectively drove market expansion across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness sustained growth during the forecast period as rising urbanization, pollution exposure, and lifestyle changes increase the prevalence of dermatological conditions. Hospitals and specialty clinics expand adoption of advanced systems to address acne, eczema, vitiligo, and photoaging across diverse populations. Medical aesthetics continues to gain traction as disposable income rises and cultural acceptance grows.

Governments strengthen skin-cancer awareness and early-diagnosis initiatives, supporting uptake of diagnostic equipment. Private dermatology chains expand rapidly across China, India, South Korea, and Southeast Asia, boosting demand for modern treatment platforms. The Australian Institute of Health and Welfare reported more than 16,800 new melanoma cases in Australia in 2022, highlighting the region’s need for effective dermatology technologies. Local manufacturing and training programs improve accessibility and affordability. These dynamics position Asia Pacific for strong and consistent growth ahead.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the dermatology devices market drive growth by expanding energy-based and minimally invasive platforms that address rising demand for aesthetic, surgical, and clinical skin treatments. Companies strengthen market traction through continuous device innovation that improves treatment precision, safety profiles, and procedure versatility across acne, hair removal, skin rejuvenation, and lesion management.

Commercial strategies focus on deepening relationships with dermatology clinics, aesthetic centers, and hospitals through training programs, financing models, and service-led engagement. Firms scale globally by targeting emerging markets with growing medical aesthetics adoption and by aligning products with regional regulatory pathways.

Digital integration, including treatment planning software and data-driven performance tracking, supports clinician confidence and repeat utilization. Cutera exemplifies a key participant in the dermatology devices market through its specialized portfolio of laser and energy-based systems, focused R&D capabilities, and strong presence among aesthetic and dermatology professionals worldwide.

Top Key Players

- Lumenis

- Alma Lasers

- Candela Medical

- Cutera

- Fotona

- Lutronic Corporation

- Sciton

- Solta Medical, Inc.

- Syneron Medical Ltd.

- Canfield Scientific, Inc.

- 3Gen

- Aesthetic Group

- Ambicare Health

- Image Derm, Inc

- Zimmer MedizinSysteme

- Quanta System

- DEKA

- Biolitec

- Venus Concept

- Sharplight Technologies

Recent Developments

- In April 2023, Canfield Scientific achieved ISO 9001:2015 and ISO 13485:2016 certifications for its quality management systems. These certifications strengthen regulatory compliance and product reliability, supporting wider clinical adoption of dermatology devices across hospitals, specialty clinics, and aesthetic centers, which is a key consideration within the market scope.

- In February 2023, Candela Corporation received regulatory clearance from Health Canada for its Frax Pro dual-wavelength non-ablative fractional laser and the Nordlys multi-application platform featuring Selective Waveband Technology. The approval expanded access to advanced laser-based dermatology treatments in the Canadian market, reflecting continued growth in energy-based aesthetic and therapeutic devices covered under the dermatology devices market landscape.

Report Scope

Report Features Description Market Value (2024) US$ 15.2 Billion Forecast Revenue (2034) US$ 48.9 Billion CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Diagnostic Devices (Dermatoscopes, Confocal Microscopes & OCT Imaging Units, Other Imaging Devices and Biopsy Instruments) and Treatment Devices (Laser Systems (CO₂ Lasers, Er:YAG Lasers, Nd:YAG Lasers, Diode Lasers, Pulsed-Dye Lasers and Others), Light Therapy Devices (Intense Pulsed Light (IPL) Devices, LED Phototherapy Devices and Others), Radiofrequency (RF) Devices, Cryotherapy Devices, Microdermabrasion Devices, Liposuction Devices and Others)), By Application (Medical Applications (Skin Cancer Diagnosis, Psoriasis, Eczema, Pigmentation Disorders and Others) and Aesthetic & Cosmetic Applications (Hair Removal, Tattoo Removal, Skin Resurfacing & Rejuvenation, Skin Tightening & Body Contouring, Cellulite Reduction, Vascular Lesion Treatment, Acne & Acne-Scar Treatment and Others)), By Age Group (Below 19 Years, 20-39 Years, 40-59 Years and 60+ Years), By End-User (Hospitals, Dermatology/Cosmetology Clinics, Medical Spas/Aesthetic Centers and Homecare Settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lumenis, Alma Lasers, Candela Medical, Cutera, Fotona, Lutronic Corporation, Sciton, Solta Medical, Inc., Syneron Medical Ltd., Canfield Scientific, Inc., 3Gen, Aesthetic Group, Ambicare Health, Image Derm, Inc, Zimmer MedizinSysteme, Quanta System, DEKA, Biolitec, Venus Concept, Sharplight Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lumenis

- Alma Lasers

- Candela Medical

- Cutera

- Fotona

- Lutronic Corporation

- Sciton

- Solta Medical, Inc.

- Syneron Medical Ltd.

- Canfield Scientific, Inc.

- 3Gen

- Aesthetic Group

- Ambicare Health

- Image Derm, Inc

- Zimmer MedizinSysteme

- Quanta System

- DEKA

- Biolitec

- Venus Concept

- Sharplight Technologies