Global Ventilators Market By Product Type (Ventilator Machines (ICU Ventilators, Emergency & Transport Ventilators, and Others) and Accessories (Ventilator Masks, Filters, and Others)), By Type (Adult and Pediatric & Neonatal), By Interface (Non-Invasive Ventilators (CPAP, BiPAP, and Others) and Invasive Ventilators), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, Home Healthcare, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142132

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

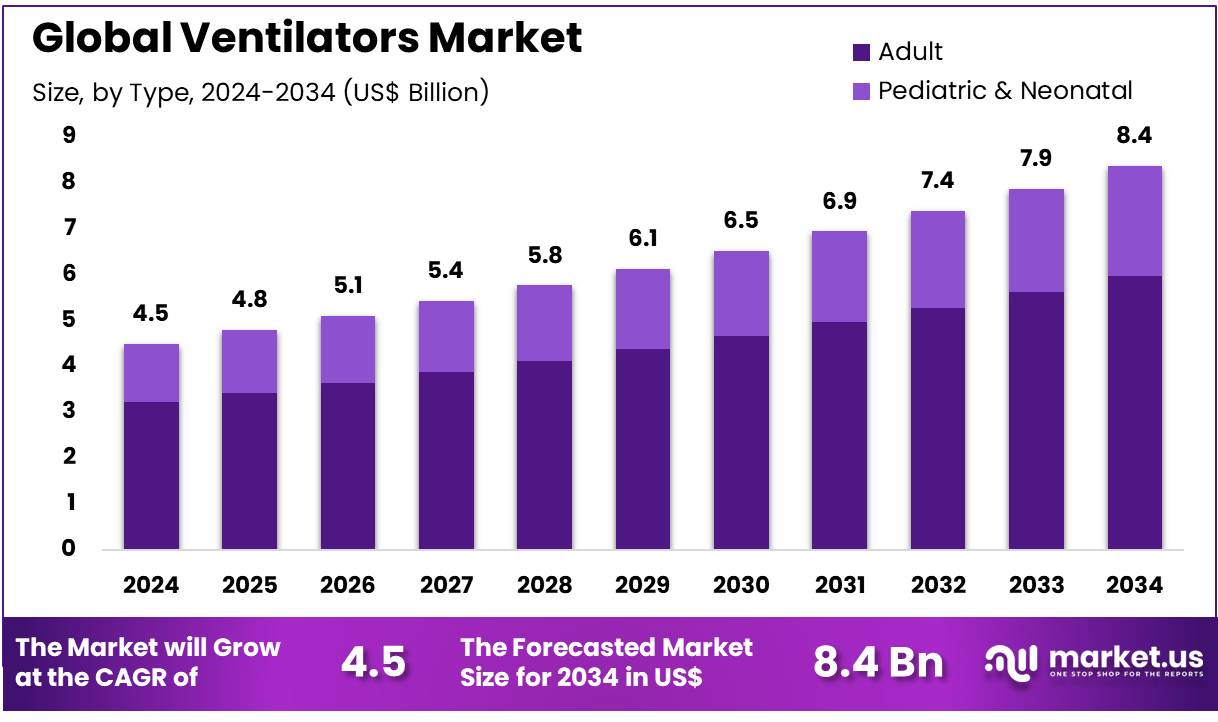

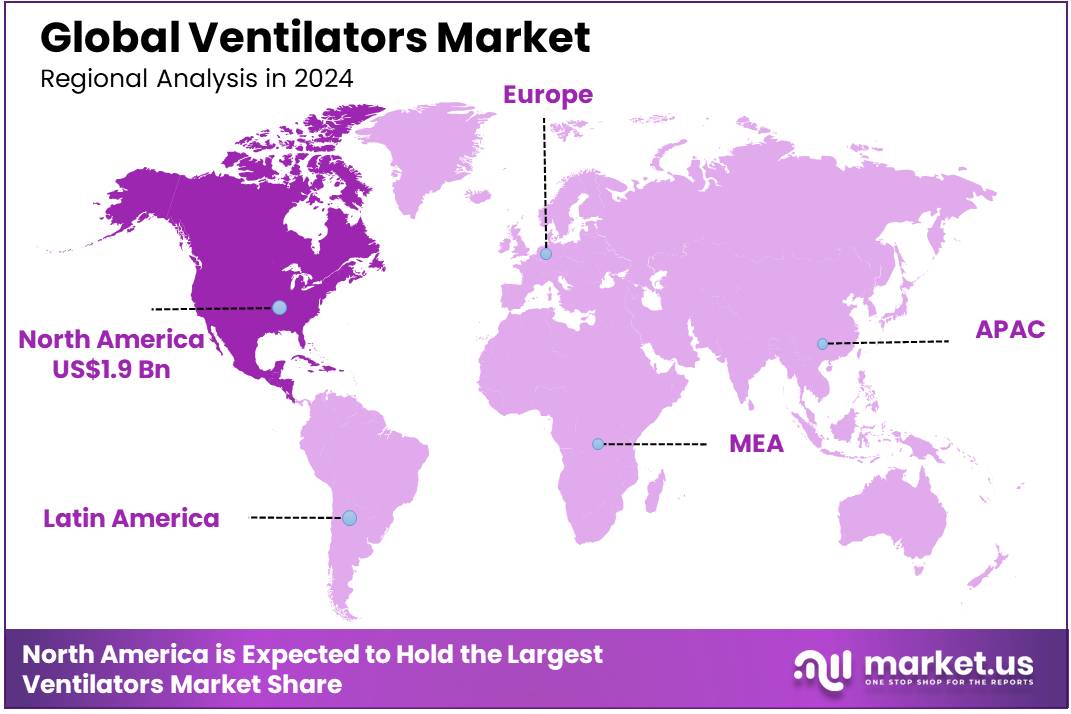

Global Ventilators Market size is expected to be worth around US$ 8.4 billion by 2034 from US$ 4.5 billion in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 41.2% share with a revenue of US$ 1.9 Billion.

Increasing prevalence of respiratory disorders, including chronic obstructive pulmonary disease (COPD), acute respiratory distress syndrome (ARDS), and neuromuscular diseases, is driving demand in the ventilators market. Growing incidences of obstructive sleep apnea (OSA) are further accelerating the need for non-invasive ventilation solutions to improve patient outcomes. As of October 2023, research from the National Council on Aging estimated that nearly 39 million adults in the US and approximately 936 million individuals worldwide are affected by OSA.

This sleep disorder, which disrupts normal breathing patterns and lowers oxygen levels, has been linked to an increased risk of cardiovascular and metabolic conditions. Rising geriatric population, which is more susceptible to age-related respiratory complications, is expanding the adoption of home-based ventilators for long-term care. Increasing technological advancements, such as portable and wearable ventilators, are enhancing mobility and comfort for patients requiring continuous respiratory support.

Growing demand for high-frequency ventilators in neonatal and pediatric care is improving survival rates in premature infants with underdeveloped lungs. Expanding integration of artificial intelligence (AI) and remote monitoring in ventilators is optimizing respiratory therapy and reducing hospital readmissions. Rising healthcare investments in critical care infrastructure are strengthening market growth, particularly in intensive care units (ICUs) and emergency departments.

Increasing use of ventilators in anesthesia management and post-surgical recovery is broadening their clinical applications. The growing trend of personalized ventilation settings, including adaptive support ventilation, is enhancing patient-specific respiratory care. Expanding telehealth and home healthcare services are driving demand for non-invasive ventilators that enable effective respiratory management outside hospital settings.

Rising awareness of ventilator-associated pneumonia (VAP) prevention is encouraging innovations in closed-loop ventilation systems with automated weaning protocols. Increasing collaborations between medical device companies and research institutions are fostering the development of next-generation ventilators with improved efficiency and reduced dependency on invasive procedures. As respiratory disorders continue to rise, and healthcare systems prioritize critical care advancements, the ventilators market is poised for significant growth in the coming years.

Key Takeaways

- In 2024, the market for ventilators generated a revenue of US$ 4.5 billion, with a CAGR of 6.4%, and is expected to reach US$ 8.4 billion by the year 2033.

- The product type segment is divided into ventilator machines and accessories, with ventilator machines taking the lead in 2023 with a market share of 64.3%.

- Considering type, the market is divided into adult and pediatric & neonatal. Among these, adult held a significant share of 71.5%.

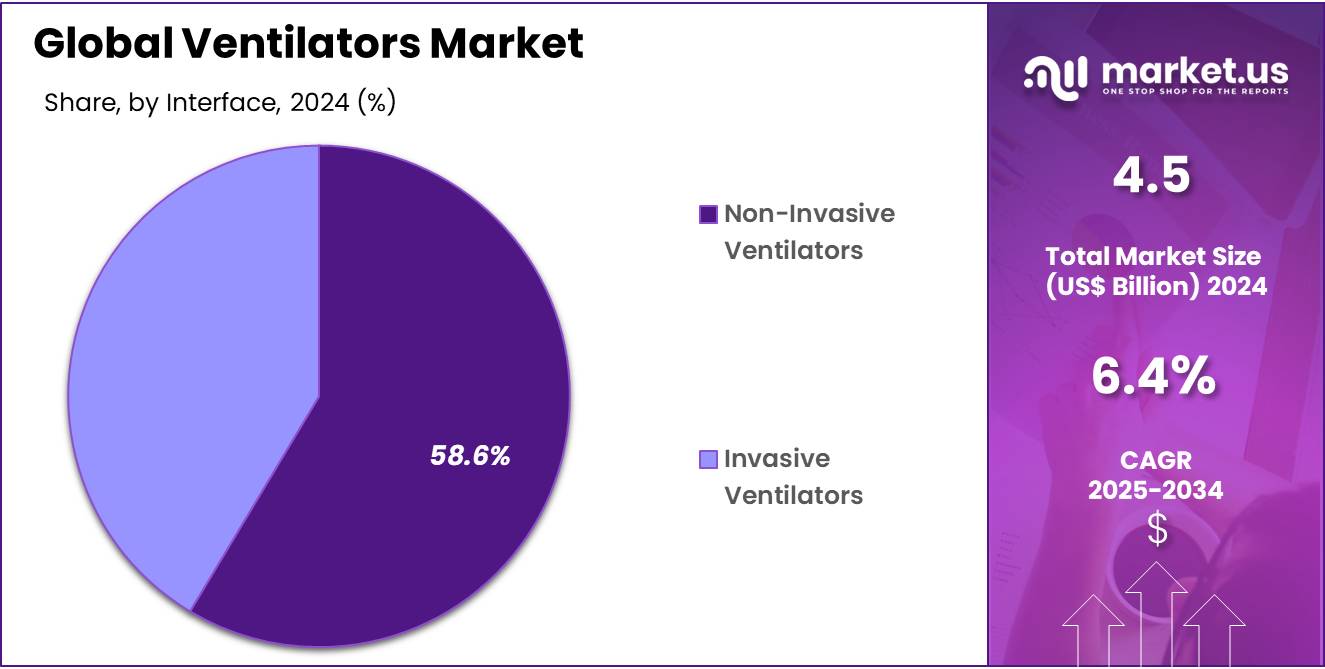

- Furthermore, concerning the interface segment, the market is segregated into non-invasive ventilators and invasive ventilators. The non-invasive ventilators sector stands out as the dominant player, holding the largest revenue share of 58.6% in the ventilators market.

- The end-user segment is segregated into hospitals & clinics, ambulatory surgical centers, home healthcare, and others, with the hospitals & clinics segment leading the market, holding a revenue share of 52.8%.

- North America led the market by securing a market share of 41.2% in 2023.

Product Type Analysis

The ventilator machines segment led in 2023, claiming a market share of 64.3% owing to the rising demand for advanced life-support technologies in critical care settings. The increasing prevalence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD), asthma, and pneumonia, is likely to drive the adoption of ventilator machines across hospitals, particularly in intensive care units (ICUs).

Furthermore, the growing number of patients requiring mechanical ventilation due to COVID-19 and other infectious diseases has amplified the need for ventilator machines. Hospitals are expected to prioritize the acquisition of high-quality ventilator machines to enhance patient care and outcomes, contributing to the growth of this segment.

Type Analysis

The adult held a significant share of 71.5% as healthcare systems respond to the increasing burden of respiratory diseases in adult populations. Factors such as the aging population, rising incidences of chronic diseases like COPD, and an increased demand for emergency ventilation in adults are expected to drive the adoption of ventilators designed for adults.

As the number of critically ill adults requiring mechanical ventilation rises, hospitals will focus on providing optimal respiratory care, leading to the higher use of adult ventilators. This growth is further fueled by advancements in ventilator technology, offering better customization and patient comfort, which are anticipated to make these products even more widely used in adult care settings.

Interface Analysis

The non-invasive ventilators segment had a tremendous growth rate, with a revenue share of 58.6% owing to the growing preference for less invasive respiratory support techniques. Devices such as CPAP and BiPAP are gaining popularity in the management of obstructive sleep apnea, COPD, and other respiratory conditions, as they allow patients to avoid the complications associated with invasive ventilation.

Non-invasive ventilators offer advantages such as reduced risk of infections and faster recovery times, making them a preferred option for patients in both hospital and home settings. The segment is anticipated to expand with the growing recognition of non-invasive ventilation’s effectiveness in treating a wide range of respiratory disorders, leading to increased adoption across various healthcare settings.

End-user Analysis

The hospitals & clinics segment grew at a substantial rate, generating a revenue portion of 52.8% due to as healthcare providers continue to invest in advanced respiratory care technologies. Hospitals, in particular, will see continued demand for ventilators due to the increasing number of patients suffering from acute respiratory failure, chronic lung diseases, and post-surgery recovery.

The rising number of intensive care unit (ICU) admissions and the growing complexity of patient care will necessitate the use of ventilators in hospitals. Additionally, hospitals are focusing on improving patient outcomes and respiratory support capabilities, which is likely to drive further investments in ventilator systems, contributing to the growth of the segment in both urban and rural healthcare settings.

Key Market Segments

Product Type

- Ventilator Machines

- ICU Ventilators

- Emergency & Transport Ventilators

- Others

- Accessories

- Ventilator Masks

- Filters

- Others

Type

- Adult

- Pediatric & Neonatal

Interface

- Non-Invasive Ventilators

- CPAP

- BiPAP

- Others

- Invasive Ventilators

End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Home Healthcare

- Others

Drivers

Rising Prevalence of Respiratory Diseases Driving the Ventilators Market

Increasing cases of respiratory disorders are expected to drive demand for ventilators as more patients require critical respiratory support. In 2023, the Centers for Disease Control and Prevention (CDC) reported that approximately 4.3% of US adults had been diagnosed with Chronic Obstructive Pulmonary Disease (COPD), emphysema, or chronic bronchitis, highlighting the increasing burden of respiratory illnesses that drive ventilator demand.

Rising air pollution levels, occupational hazards, and smoking-related diseases contribute to the growing prevalence of respiratory conditions. Infectious diseases, including influenza and pneumonia, frequently require ventilatory support, particularly among elderly patients and those with weakened immune systems. The increasing incidence of acute respiratory distress syndrome (ARDS) and post-COVID complications further strengthens market growth.

Healthcare institutions continue to invest in advanced ventilatory solutions to improve patient outcomes and reduce mortality rates. Technological advancements, such as non-invasive ventilation and portable ventilators, enhance accessibility for home-based and long-term care patients. Rising awareness about early diagnosis and treatment of respiratory diseases encourages the use of ventilators in emergency and intensive care settings.

The expansion of healthcare infrastructure in emerging economies creates new opportunities for ventilator manufacturers. Government initiatives promoting better respiratory healthcare and funding for ICU expansions further contribute to market expansion. The increasing adoption of wearable and remote monitoring ventilators is anticipated to revolutionize respiratory care. Strong collaborations between medical device companies and research institutions continue to improve ventilator efficiency and patient safety.

Restraints

Complications Associated with Ventilators as a Restraint in the Ventilators Market

Growing concerns about ventilator-associated complications are expected to restrain market expansion by limiting long-term ventilatory support. Prolonged ventilator use increases the risk of ventilator-associated pneumonia (VAP), which can lead to severe infections and extended hospital stays.

Patients on mechanical ventilation face a higher likelihood of lung damage, including barotrauma and volutrauma, due to excessive airway pressure. Long-term ventilation dependency can result in diaphragm atrophy and weakened respiratory muscles, complicating the weaning process.

The use of invasive ventilators often necessitates sedation and prolonged ICU admissions, increasing overall healthcare costs. The risk of hospital-acquired infections further discourages unnecessary ventilator use, prompting healthcare professionals to explore alternative treatment options. Frequent ventilator adjustments and monitoring require skilled healthcare personnel, creating operational challenges in under-resourced settings. Ongoing research focuses on improving ventilator designs and reducing complications, yet safety concerns remain a significant factor influencing market dynamics.

Opportunities

Growth in the Home Healthcare Sector as an Opportunity in the Ventilators Market

Rising demand for home-based respiratory care is expected to create significant growth opportunities for ventilators as patients seek convenient and cost-effective treatment options. In 2023, the US Bureau of Labor Statistics (BLS) projected that employment in home health and personal care services would grow by 21% from 2023 to 2033, significantly outpacing the average for all occupations.

This expansion reflects the rising demand for ventilators in home healthcare settings. Increased prevalence of chronic respiratory diseases, including COPD and obstructive sleep apnea, has driven the need for portable ventilatory solutions. Advancements in non-invasive ventilation technology have made at-home respiratory therapy more accessible and efficient.

Patients with neuromuscular disorders and other long-term conditions benefit from ventilators designed for home use, reducing dependency on hospital-based care. Telehealth integration and remote monitoring capabilities enhance the effectiveness of home ventilatory support. Government healthcare programs and insurance coverage improvements facilitate access to at-home ventilator therapy for eligible patients.

Ventilator manufacturers continue to innovate, developing compact, energy-efficient, and user-friendly devices tailored for home environments. The growing preference for patient-centered care models aligns with the expansion of ventilator accessibility in home healthcare.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the ventilators market. On the positive side, global healthcare spending has increased, particularly in response to rising respiratory diseases and pandemics, leading to greater demand for ventilators in hospitals and critical care settings.

Additionally, governments worldwide have recognized the need to strengthen healthcare infrastructure, particularly in low- and middle-income countries, driving investments in respiratory care technology. However, supply chain disruptions, such as those caused by geopolitical tensions and trade restrictions, can hinder the production and distribution of ventilators.

Rising healthcare costs may limit accessibility in certain regions, especially for low-income patients. Despite these challenges, advancements in technology and the ongoing focus on improving healthcare infrastructure are likely to propel market growth, improving ventilator availability and affordability in the future.

Latest Trends

Rising Adoption of Portable and Wearable Ventilators Driving the Market:

Rising adoption of portable and wearable ventilators has become a significant trend driving the market. High patient demand for more flexible, home-based care solutions is expected to continue as advancements in ventilator technology lead to the development of compact, battery-powered devices. These innovations allow patients with respiratory conditions to manage their health more effectively in non-hospital settings.

The trend is likely to continue, with these portable systems anticipated to become increasingly integrated into home healthcare and emergency medical services. In 2022, a review published by the PMC highlighted that portable ventilators have gained significant traction for their ability to provide effective mechanical ventilation at home, offering patients greater mobility and comfort. This growing trend reflects the rising demand for solutions that offer better flexibility and convenience in respiratory care management.

Regional Analysis

North America is leading the Ventilators Market

North America dominated the market with the highest revenue share of 41.2% owing to technological advancements and the increasing prevalence of respiratory diseases. Getinge AB’s introduction of software enhancements for its Servo-u and Servo-n ventilators, along with the launch of the Servo-u MR ventilator in April 2021, strengthened the availability of specialized critical care solutions.

The rising incidence of chronic obstructive pulmonary disease (COPD), asthma, and other respiratory disorders fueled demand for advanced ventilation support. Expanding intensive care unit (ICU) capacities in hospitals and long-term care facilities further contributed to market expansion. The adoption of AI-driven and remote monitoring features improved patient outcomes and enhanced ventilator management efficiency.

Government funding for pandemic preparedness and respiratory care programs also played a crucial role in driving innovation and accessibility. Additionally, the growing geriatric population, which is more susceptible to respiratory complications, increased the need for non-invasive and home-based ventilation solutions, reinforcing the market’s expansion across North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare investments and rising cases of respiratory illnesses. Vyaire Medical, Inc.’s donation of ventilators, CPAP/BIPAP devices, and oxygen concentrators to India in May 2021 underscored the region’s need for advanced respiratory care solutions. The expanding prevalence of air pollution-related respiratory conditions is likely to fuel demand for mechanical ventilation systems.

Government initiatives promoting critical care infrastructure and emergency preparedness are expected to accelerate market expansion. Collaborations between international medical device manufacturers and regional healthcare providers are anticipated to improve access to high-quality respiratory support systems.

The rising adoption of portable and home-care ventilation devices is projected to enhance patient management for chronic conditions. Additionally, the expansion of private hospital networks and the growing focus on telehealth integration are likely to further drive demand for advanced ventilatory support across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the ventilators market focus on advancing technology by developing portable and smart ventilation systems to enhance patient care. Companies invest in research and development to integrate artificial intelligence, remote monitoring, and automation for improved respiratory support.

Strategic collaborations with hospitals and emergency care providers help expand accessibility and ensure efficient distribution. Emphasis on cost-effective and energy-efficient designs strengthens market adoption across various healthcare settings. Many players also prioritize regulatory compliance and rapid production scaling to meet surging demand during health crises.

Medtronic is a leading company in this market, offering innovative ventilator solutions such as the Puritan Bennett series, designed for critical and home care settings. The company focuses on continuous product innovation, strong healthcare partnerships, and global expansion to improve respiratory care. Medtronic’s commitment to technological advancements and patient-centric solutions establishes it as a key player in the industry.

Top Key Players

- Zoll Medical

- Medtronic

- Fisher & Paykel

- Getinge

- Nihon Kohden OrangeMed, Inc

- Becton

- Airon Mindray

- Air Liquide

Recent Developments

- In August 2023, Getinge secured FDA clearance for its Servo-air Lite ventilator, an advanced, portable, wall gas-independent device that provides non-invasive mechanical ventilation. Its compact design allows for greater flexibility in patient care, particularly in mobile and emergency healthcare settings.

- In July 2022, Nihon Kohden OrangeMed, Inc. received US FDA approval for its NKV-330 ventilator, a non-invasive respiratory support system designed for critical care scenarios. The device enhances patient outcomes by offering effective ventilation while minimizing the need for intubation.

Report Scope

Report Features Description Market Value (2024) US$ 4.5 billion Forecast Revenue (2034) US$ 8.4 billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ventilator Machines (ICU Ventilators, Emergency & Transport Ventilators, and Others) and Accessories (Ventilator Masks, Filters, and Others)), By Type (Adult and Pediatric & Neonatal), By Interface (Non-Invasive Ventilators (CPAP, BiPAP, and Others) and Invasive Ventilators), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, Home Healthcare, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoll Medical, Medtronic, Fisher & Paykel, Getinge , Nihon Kohden OrangeMed, Inc, Becton, Airon Mindray, and Air Liquide. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zoll Medical

- Medtronic

- Fisher & Paykel

- Getinge

- Nihon Kohden OrangeMed, Inc

- Becton

- Airon Mindray

- Air Liquide