Global DC Fuel Transfer Pump Market Size, Share, And Industry Analysis Report By Type (Below 1 Hp, Above 1 Hp), By Application (Construction, Mining, Agriculture, Military, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170913

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

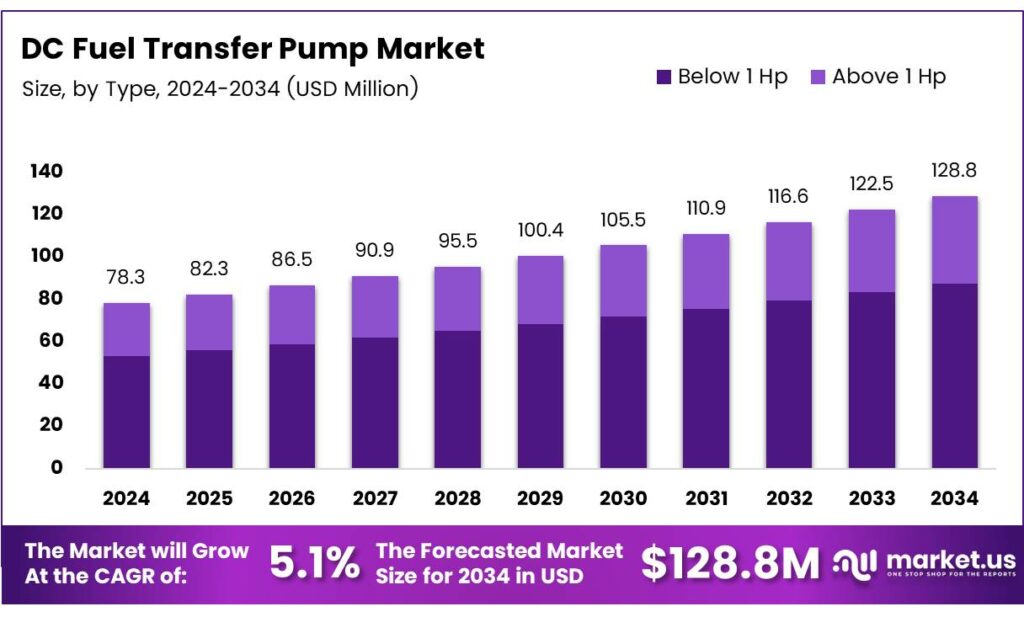

The Global DC Fuel Transfer Pump Market size is expected to be worth around USD 128.8 million by 2034, from USD 78.3 million in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The DC Fuel Transfer Pump Market is a reliability-driven equipment segment. It supports fuel handling across agriculture, construction, mining, marine, and remote energy operations. Demand rises as users prioritize mobility, safety, and accurate fuel dispensing in off-grid or infrastructure-limited locations. It covers compact pumping systems designed for diesel and similar fuels using direct current power.

These systems enable controlled fuel movement from storage to equipment. They reduce downtime, fuel losses, and manual handling risks, while supporting predictable operations in field-based industrial environments. DC fuel transfer pumps are perfect for remote locations with limited grid access, operating on 12V, 24V, or 220V power supplies. They come equipped with mechanical or digital meters, suction and delivery pipes, filling nozzles, and optional automatic valves for precise fuel dispensing.

These pumps offer a maximum flow rate of 60 liters per minute and a head of up to 10 meters, balancing portability with efficiency for use in agriculture fleets, construction sites, and mobile fuel stations. Growth potential is further boosted by electrification trends, with brushless DC (BLDC) motors already adopted in aerospace under FAA and industry standards on 270V or 540V DC buses.

- Material reliability standards further influence innovation pathways. According to NASA propulsion research documentation, rocket engines endure temperatures from −252 °C to 3300 °C and thermal shock rates of 3900 °C per second. While extreme, these benchmarks push the expectations for advanced materials and motor durability across industrial equipment supply chains.

Government investments and regulations indirectly support this market through initiatives such as energy access, defense modernization, and rural infrastructure programs. Ministries of energy and transport promote safe fuel handling, emission control, and equipment standardization. These policies encourage the adoption of metered, leak-resistant DC pumping systems over unregulated manual transfer methods.

Key Takeaways

- The Global DC Fuel Transfer Pump Market is projected to grow from USD 78.3 million in 2024 to USD 128.8 million by 2034, registering a 5.1% CAGR.

- The Below 1 HP segment dominated the market in 2024 with a share of 67.3%, driven by portable and light-duty applications.

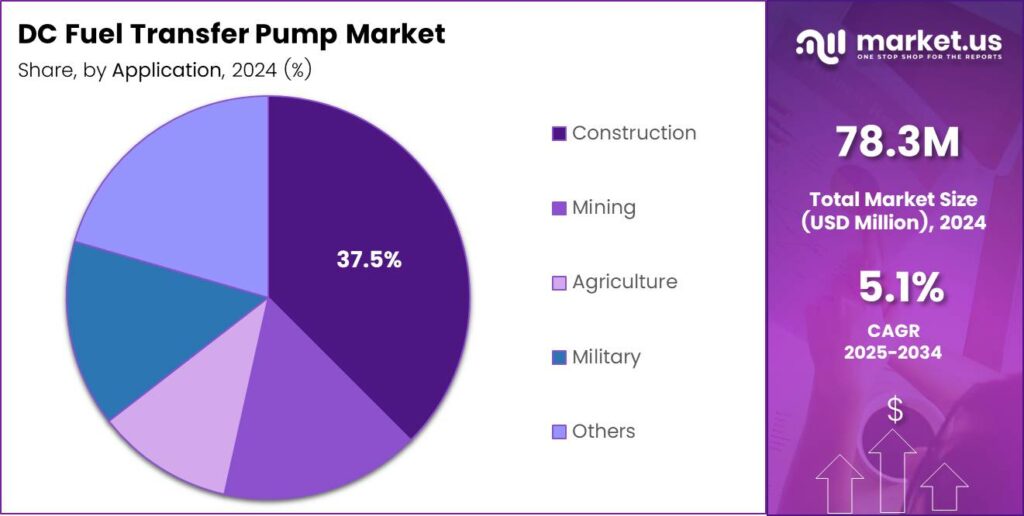

- Construction emerged as the leading segment in 2024, accounting for 37.5% of total market demand.

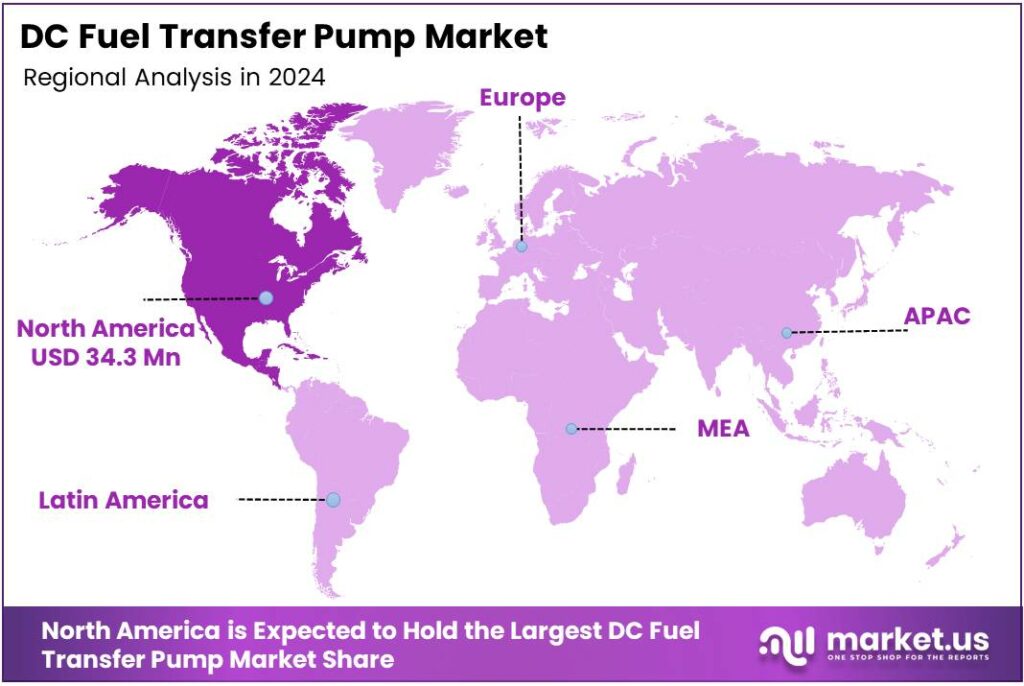

- North America held the largest regional share at 43.9% in 2024, with market revenue of approximately USD 34.3 million.

By Type Analysis

Below 1 Hp dominates with 67.3% due to its suitability for light-duty and portable fuel transfer needs.

In 2024, Below 1 Hp held a dominant market position in the By Type Analysis segment of the DC Fuel Transfer Pump Market, with a 67.3% share. This segment is widely preferred for small-scale fuel transfer tasks, especially in remote locations. Moreover, its compact size supports easy handling and energy-efficient operations.

Below 1 HP are commonly used where mobility and low power consumption matter. Additionally, these pumps operate efficiently on 12V DC or 24V DC power supplies, making them ideal for vehicles, farms, and off-grid applications. As a result, demand remains strong across diverse end users.

Above 1 HP pumps address higher flow and pressure requirements in more demanding operations. These pumps are designed for continuous usage and handle thicker fuels efficiently. Consequently, they are preferred in industrial environments where reliability and faster fuel transfer are operational priorities.

By Application Analysis

Construction leads with 37.5% driven by high fuel consumption at infrastructure project sites.

In 2024, Construction held a dominant market position in the By Application Analysis segment of the DC Fuel Transfer Pump Market, with a 37.5% share. Construction sites rely heavily on diesel-powered equipment. Therefore, DC fuel transfer pumps ensure efficient on-site refueling and reduce operational downtime.

Mining applications demand rugged and reliable fuel transfer solutions. Pumps used in this segment must withstand harsh environments and long operating hours. As a result, DC fuel transfer pumps are increasingly used to support mobile refueling needs in isolated mining locations.

Agriculture represents a steady application area due to the widespread use of diesel machinery. Farmers prefer DC fuel transfer pumps for tractors and generators, especially in rural areas. Additionally, their compatibility with battery power supports uninterrupted field operations.

Military usage focuses on mobility and rapid deployment. DC fuel transfer pumps support field logistics by enabling quick refueling in off-grid conditions. Meanwhile, the Others segment includes marine, automotive servicing, and small industrial uses, where compact design and ease of operation drive consistent demand.

Key Market Segments

By Type

- Below 1 Hp

- Above 1 Hp

By Application

- Construction

- Mining

- Agriculture

- Military

- Others

Emerging Trends

Shift Toward Portable, Smart, and Energy-Efficient Fuel Handling Solutions Shapes Trends

A key trend in the DC fuel transfer pump market is the growing preference for portable and compact designs. End users increasingly value lightweight pumps that can be easily moved between sites without complex installation. Another important trend is the adoption of smart features. Digital flow meters, display boards, and automatic nozzles are becoming more common.

- These features help users monitor fuel consumption accurately and reduce spillage, improving overall efficiency. The International Energy Agency (IEA), global oil demand growth slowed markedly in 2024, increasing by only 0.8% (1.5 EJ or 830 thousand barrels per day) — a fraction of the growth seen in previous years.

Energy efficiency is also gaining attention. Manufacturers are focusing on brushless DC motors that offer longer life, lower heat generation, and better performance. This supports longer operating hours with minimal battery drain. Safety-focused designs are shaping the market as well. Improved sealing, anti-leak systems, and better material choices like stainless steel enhance durability.

Drivers

Rising Demand for Reliable Fuel Transfer in Remote Locations Drives Market Growth

The DC fuel transfer pump market is mainly driven by the growing need for reliable fuel handling in remote and off-grid locations. Industries such as construction, mining, agriculture, and defense often operate far from grid electricity, where DC pumps powered by 12V or 24V batteries become essential. These pumps allow smooth fuel transfer directly from storage tanks to equipment, reducing downtime.

- National energy data from the U.S. Energy Information Administration (EIA) shows that petroleum products made up about 38% of total energy consumption in the United States, with the transportation sector alone accounting for around 37% of all energy use.

The increasing use of diesel-powered machinery and generators. Backup power systems, mobile generators, and field equipment all require safe and accurate fuel transfer. DC fuel transfer pumps with flow rates up to 60 liters per minute support faster refueling, improving productivity on job sites.

Restraints

High Initial Cost and Maintenance Challenges Limit Market Adoption

One major restraint in the DC fuel transfer pump market is the higher upfront cost compared to basic manual fuel transfer methods. Small farmers and local contractors often hesitate to invest in powered pumps due to budget constraints, especially in price-sensitive regions.

- Maintenance requirements also act as a limiting factor. DC pumps include motors, seals, and electrical components that require periodic inspection. In many regions, gasoline and diesel still make up a large share of transport energy—in the United States, petroleum accounted for about 38% of total energy consumption.

In dusty or harsh environments, wear and tear can increase maintenance frequency, adding to operating costs over time. Another challenge is limited flow capacity compared to large AC-powered pumps. While DC pumps are ideal for portability, they may not meet the needs of large fuel depots or high-volume industrial applications.

Growth Factors

Expansion of Mobile Equipment and Rural Energy Projects Creates New Opportunities

The DC fuel transfer pump market has strong growth opportunities due to expanding rural energy and mobile equipment usage. Rural electrification projects increasingly depend on diesel generators, creating steady demand for compact fuel transfer solutions.

The logistics and fleet management sector also presents future potential. Service vehicles, mobile fuel trucks, and emergency response units require lightweight and portable pumping systems. DC pumps fit well into these applications due to their easy installation and low power needs.

Integration of digital meters, automatic shut-off valves, and improved motor efficiency enhances usability. As safety and fuel monitoring standards rise, demand for advanced DC fuel transfer pumps is expected to grow steadily across multiple industries.

Regional Analysis

North America Dominates the DC Fuel Transfer Pump Market with a Market Share of 43.9%, Valued at USD 34.3 Million

North America leads the DC fuel transfer pump market, holding a dominant share of 43.9% and generating around USD 34.3 million in revenue. This strong position is supported by widespread use of portable fuel handling equipment across construction sites, agriculture, logistics hubs, and emergency power systems. High adoption of 12V and 24V DC-powered pumps for remote and off-grid applications further supports market maturity.

Europe represents a stable and technically advanced market for DC fuel transfer pumps, driven by industrial automation and regulated fuel handling practices. Demand is supported by the agriculture sector, municipal services, and small-scale fuel storage applications. Emphasis on efficiency, durability, and compliance with safety norms encourages steady replacement demand. Growth remains moderate, supported by infrastructure maintenance and modernization activities.

Asia Pacific is an emerging growth region, supported by rapid infrastructure development, expanding agricultural activities, and rising use of mobile fuel systems. Increasing construction projects and mechanized farming in developing economies are accelerating the adoption of cost-effective DC pumps. Growth is also supported by expanding rural electrification and demand for portable fuel solutions.

The Middle East and Africa market is driven by fuel handling needs in remote locations, mining operations, and oil-linked service activities. DC fuel transfer pumps are widely used where grid power access is limited. Growth is supported by infrastructure expansion and increasing demand for reliable fuel transfer in harsh environments. However, adoption remains uneven across countries due to varying investment levels.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Fill-Rite remained a steady benchmark in 2024 for rugged DC fuel transfer pumps used in farms, workshops, and fleet fueling points. Its strength lies in reliable metering options and a wide fit with common tank-and-drum setups, which helps buyers standardize maintenance. The brand also benefits from strong channel availability, making replacements and spares easier to source.

GPI in 2024 continued to appeal to users who prioritize straightforward installation and dependable day-to-day performance in mobile fueling and light industrial duty. The portfolio focuses on practical flow rates, compatible accessories, and easy serviceability, keeping the product proposition simple for distributors. This positioning supports repeat purchases in regions where uptime and quick field fixes matter most.

Piusi S.p.A. sustained strong visibility in 2024 by emphasizing compact designs, user-friendly metering, and broad application coverage across agriculture, construction, and workshop fueling. The company tends to compete through feature depth like integrated meters, nozzle options, and system customization—rather than only price. That approach fits professional users looking for cleaner dispensing, traceability, and controlled fuel handling.

Graco in 2024 benefited from its industrial heritage and focus on engineered fluid-handling systems, which support higher-value DC transfer setups and integrated dispensing solutions. Customers often associate the brand with robust build quality, safety-minded accessories, and durability in tougher environments. For large operators, that premium positioning can justify total cost benefits through longer service intervals and consistent performance.

Top Key Players in the Market

- Fill-Rite

- GPI

- Piusi S.p.A.

- Graco

- Intradin Machinery

- YuanHeng Machine

Recent Developments

- In 2025, GPI launched the GPRO V35 Series, a new line of high-performance vane fuel transfer pumps delivering 35 GPM, targeted at heavy-duty, high-volume applications. Available models include 115V/120V AC versions, with variants for extreme temperatures and remote dispensers. This series emphasizes durability and modular design.

- In 2025, Piusi introduced the PRO ONE range of air-operated double diaphragm (AODD) pumps, focused on high performance and efficiency for fluid transfer (applicable to fuels and oils, though not electric/DC). The company has been active in industry events, participating in Energies Expo, SOLUTRANS, and Agritechnica 2025 to showcase digital refueling solutions and smart fuel management systems.

Report Scope

Report Features Description Market Value (2024) USD 78.3 million Forecast Revenue (2034) USD 128.8 million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Below 1 Hp, Above 1 Hp), By Application (Construction, Mining, Agriculture, Military, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fill-Rite, GPI, Piusi S.p.A., Graco, Intradin Machinery, YuanHeng Machine Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  DC Fuel Transfer Pump MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

DC Fuel Transfer Pump MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fill-Rite

- GPI

- Piusi S.p.A.

- Graco

- Intradin Machinery

- YuanHeng Machine