Global Data Historian Market Size, Industry Analysis Report By Component (Software, Services), By Deployment Mode (On-Premise, Cloud), By Enterprise Size (Large Enterprise, SMEs), By End-user Industry (Energy & Utilities, Oil & Gas, Chemical, Pharmaceutical, Manufacturing, Other End-user Industries), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159441

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business Benefits

- Role of Generative AI

- North America Market Size

- By Component

- By Deployment Mode

- By Enterprise Size

- By End-User Industry

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

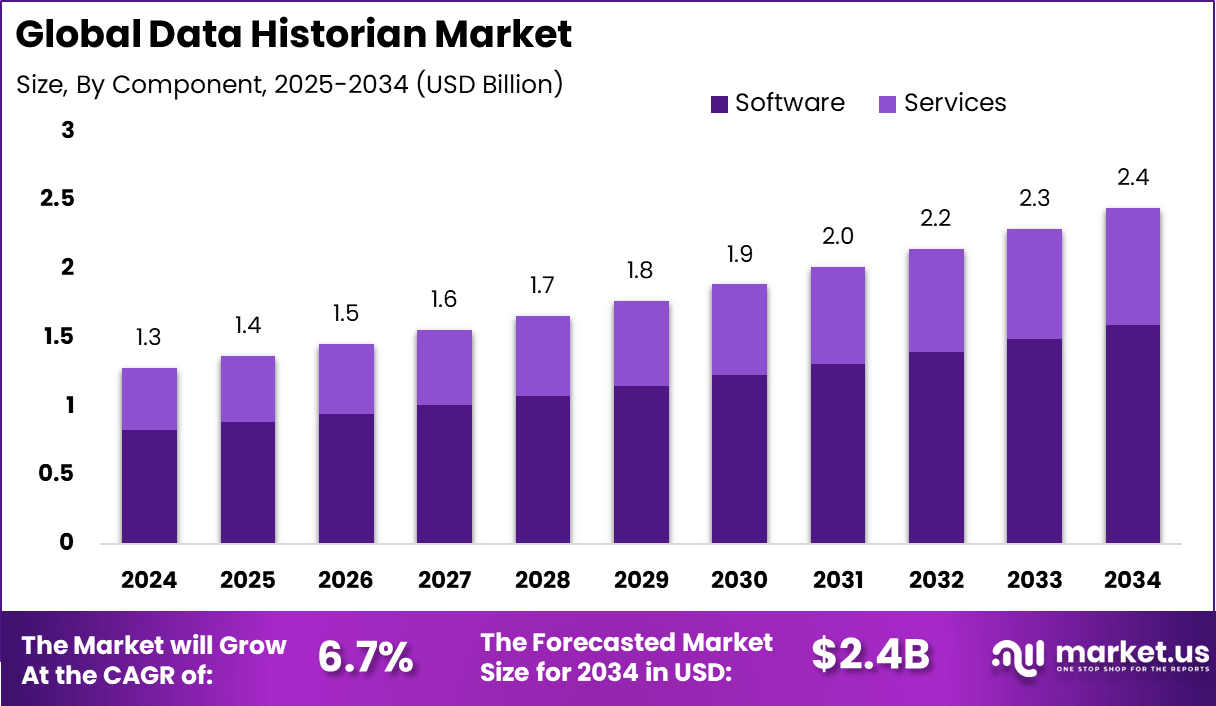

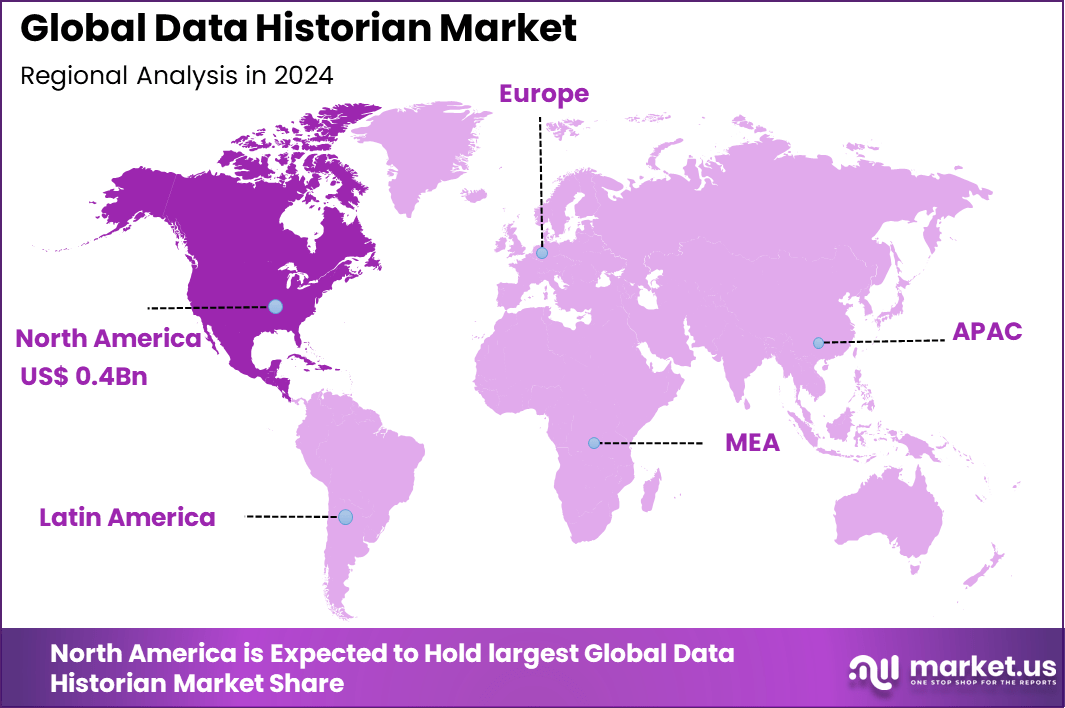

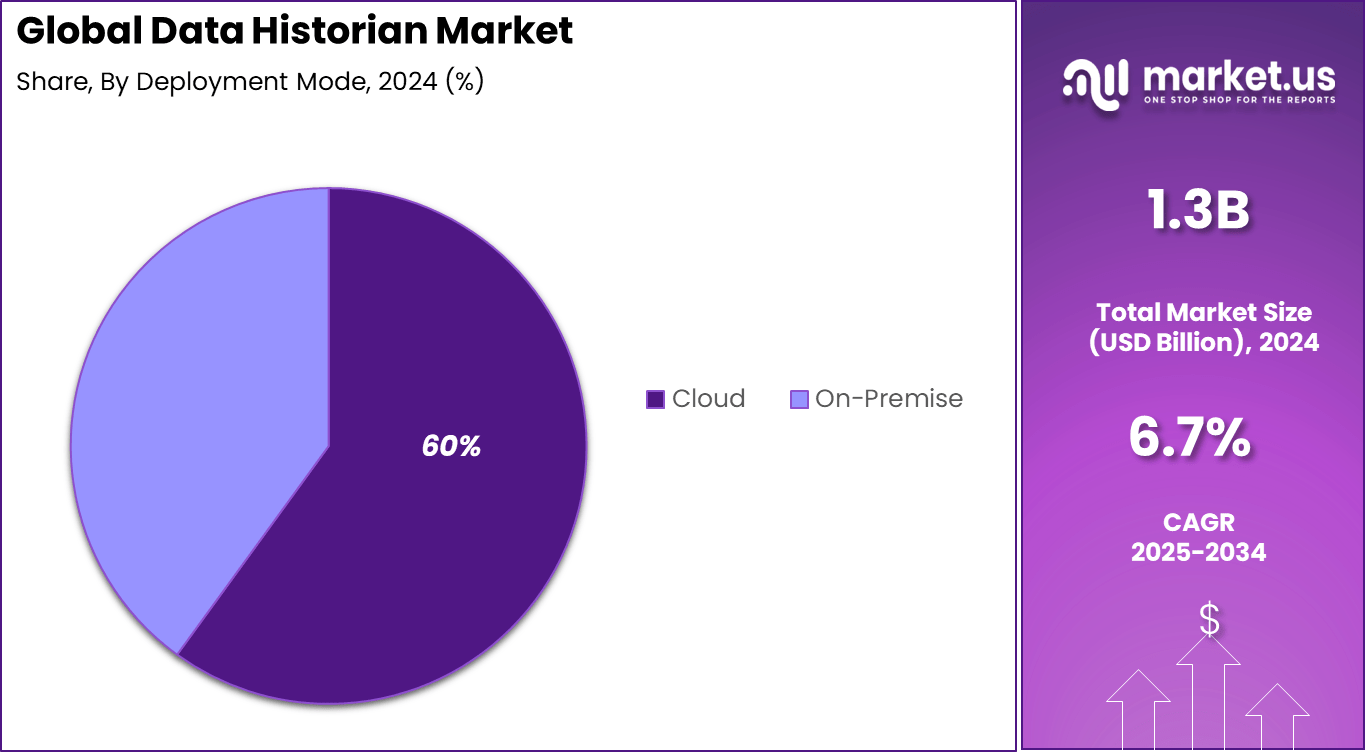

The Global Data Historian Market size is expected to be worth around USD 2.4 Billion By 2034, from USD 1.3 billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 32.8% share, holding USD 0.4 Billion revenue.

The Data Historian Market involves software and service solutions that collect, store, manage, and analyze time-series and process data from industrial operations, sensors, control systems, and machines. A data historian is specialized for high frequency, sequential data and is optimized for efficient compression, fast retrieval, and long term data retention. These systems underpin process analytics, trend analysis, predictive maintenance, operational visibility, and regulatory record keeping.

Key factors driving this market include growth in industrial IoT deployments and digitalization of factories, which generate vast volumes of sensor and machine data. Organizations seek consolidated and reliable historical data to monitor performance trends, detect anomalies, and improve decision making. Regulatory requirements and compliance frameworks in energy, utilities, chemical, and process industries necessitate maintaining detailed operational records over time.

Demand is driven primarily by digitization, the surge of connected IoT devices, and a shift to real-time performance monitoring and predictive analytics. Regulatory requirements play a powerful role, with more than 15,000 facilities in the U.S. alone subject to strict rules on risk management and process safety that necessitate long-term data retention. Power plants, manufacturing facilities, and pipeline operators face mandates for detailed recordkeeping, with penalties for non-compliance sometimes reaching over 1.3 million dollars per violation.

Key Insight Summary

- By component, Software accounted for 65%, showing the central role of data historian software solutions in managing time-series data.

- By deployment, Cloud-based models held 60%, reflecting the growing preference for scalable and remote-access data storage.

- By enterprise size, Large Enterprises dominated with 72%, underscoring their greater need for complex data management systems.

- By end-user industry, Oil & Gas led with 26%, highlighting its reliance on historian systems for monitoring operations and optimizing production.

- Regionally, North America held a 32.8% share, reinforcing its strong position in adopting advanced data management technologies.

Analysts’ Viewpoint

Cloud technologies and the adoption of AI-driven analytics are increasing steadily, making it simpler for businesses to deploy scalable historian solutions across distributed sites, and to utilize advanced anomaly detection algorithms for quality control and early warning of failures.

Investments focus on integrating IoT streams, AI, and high-performance analytics to improve maintenance regimes, energy efficiency, and asset optimization. Manufacturing facilities globally achieve on average 8.2% energy savings when employing robust monitoring systems, which can mean annual savings of more than 54,000 dollars per facility in the current energy environment.

Organizations choose data historian solutions for their business benefits – real-time access to vast event histories, easier troubleshooting, performance improvement, and demonstrably lower costs associated with preventive maintenance and optimized energy consumption. Increasing adoption also comes from collaborative and distributed teams being able to analyze operational data via cloud platforms from any device, simplifying data sharing and compliance audits.

Investment and Business Benefits

Investment opportunities in the Data Historian market are solid; the surge of digital transformation across manufacturing and utilities, along with the demand for analytics-driven decision-making, is attracting investments towards both startups and established vendors. Integration of advanced analytics and expansion into emerging markets like India, China, and Southeast Asia create new growth avenues, with over 10% annual regional growth expected in Asia Pacific.

From a business benefits perspective, Data Historian solutions help industrial organizations gain clear operational visibility, optimize production cycles, and cut maintenance costs through predictive analytics. Improved decision-making, reduced waste, and better compliance reduce risk and enhance business resilience, while energy monitoring and sustainability tracking align with global corporate social responsibility priorities.

Role of Generative AI

Generative AI is transforming how organizations manage and utilize data historian platforms. In 2025, about 65% of enterprises are actively integrating these advanced AI solutions, automating everything from anomaly detection to predictive modeling in operational systems.

Accelerated adoption means more companies now use generative AI to analyze streams of plant and equipment data, leading to far more actionable real-time insights. Organizations are seeing an impressive return, with an average of $3.70 generated for every $1 invested in generative AI technologies.

Data historian tools now leverage AI to offer hyper-accurate pattern detection and anomaly reporting, helping industrial teams minimize unplanned downtime while improving productivity and compliance tracking. This surge is matched by the rapid increase in AI patent filings, with a record-breaking 78,000 new applications in 2025 globally, reflecting a fierce competitive race in AI innovation.

Aspect Details and Statistics Enterprise Adoption Around 65% of enterprises are incorporating generative AI into data historian platforms Return on Investment On average, $3.70 is generated for every $1 invested in generative AI solutions Impact on Data Analytics AI enhances real-time insight generation, improving anomaly detection and predictive maintenance AI Innovation Activity Over 78,000 AI-related patent applications filed globally in 2025, signifying intense competition Use Cases Automating pattern detection, anomaly reporting, and enabling proactive operational decisions North America Market Size

In 2024, North America held a dominant market position, capturing more than 32.8% share and generating USD 0.4 billion in revenue in the data historian market. The region’s leadership is largely driven by its advanced industrial base, particularly in sectors such as oil and gas, manufacturing, power generation, and pharmaceuticals, where real-time data collection and storage are critical.

Companies in the United States and Canada have been early adopters of data historian systems to enhance operational efficiency, optimize asset performance, and ensure regulatory compliance, which has significantly boosted market growth. The dominance of North America is also reinforced by its strong focus on digital transformation and Industrial IoT (IIoT) integration.

The region benefits from robust investments in cloud platforms, edge computing, and advanced analytics, allowing businesses to derive actionable insights from large volumes of historical process data. Additionally, the presence of leading software providers and technology innovators ensures continuous advancements in scalability, cybersecurity, and interoperability, making North America a frontrunner in adopting next-generation historian solutions.

By Component

In 2024, Software accounted for 65% of the data historian market. The dominance of software is linked to its ability to collect, store, and analyze massive volumes of time-series data in real time, helping enterprises improve operational efficiency. Advanced historian software also provides flexible integration with industrial automation systems and visualization tools, enabling organizations to gain actionable insights from data across multiple assets.

The rising demand for advanced data analytics and predictive maintenance has further strengthened the role of software over hardware. Companies are prioritizing sophisticated platforms that not only store large datasets but also allow advanced querying, pattern detection, and seamless connectivity with cloud and enterprise applications.

By Deployment Mode

In 2024, Cloud deployment accounted for 60% of the market share. The move toward cloud-hosted historian solutions is driven by the flexibility and scalability they provide for storing massive operational datasets at a lower cost compared to on-premise systems. Cloud platforms also simplify real-time collaboration, allowing stakeholders in different locations to access and analyze process data.

In addition, cloud-based historians support advanced features such as AI-driven analytics, remote monitoring, and integration with enterprise applications like ERP systems. This trend aligns with industrial digitalization, as enterprises seek to centralize data management and unlock greater agility in decision-making.

By Enterprise Size

In 2024, Large enterprises led the market with 72% share. These organizations often deal with highly complex operations that generate vast amounts of structured and unstructured data, making data historians a critical tool for performance optimization. Their ability to invest in advanced historian platforms ensures they can extract deeper insights from historical data while maintaining regulatory compliance.

Compared to smaller organizations, large enterprises also focus more on predictive and prescriptive analytics. The use of historian systems allows them to reduce unplanned downtime, improve asset utilization, and optimize energy consumption, which are all vital at scale.

By End-User Industry

In 2024, the oil and gas sector represented 26% of demand for data historians. Operations in this industry are data-intensive, requiring continuous monitoring of equipment, pipeline conditions, drilling parameters, and refinery processes. Data historians play a central role in supporting production efficiency while ensuring safety and regulatory compliance.

The sector’s reliance on historians is also tied to the need for predictive maintenance and failure prevention. By capturing years of sensor data, these systems allow oil and gas operators to better anticipate maintenance needs, avoid equipment failures, and keep critical production processes running smoothly.

Emerging Trends

The most noticeable emerging trend in data historian markets is the fusion of cloud computing with AI-powered analytics. More than 71% of installations still run on traditional on-premises systems, yet cloud deployments are growing at an 8.5% annual clip. This shift makes it possible to scale data collection and real-time analysis across thousands of assets, increasing visibility into all corners of industrial operations.

Another major trend involves the use of digital twins, which enable realistic simulations of critical industrial systems. More facilities are adopting edge computing to reduce data latency and deliver instant processing at the source, improving both responsiveness and reliability. Enhanced cybersecurity – fueled by increasing regulatory pressure – continues to drive demand for historian platforms built with robust threat detection capabilities.

Growth Factors

Growth in this market is propelled by several factors. The widespread adoption of Industrial IoT devices means enormous quantities of production and sensor data are being collected, challenging traditional storage and analysis methods. Companies are demanding real-time analytics, predictive maintenance, and support for high-frequency equipment monitoring – an area where data historian platforms excel with AI assistance.

The chemicals and pharmaceutical sectors, which rely on precise data logging due to strict compliance rules, are finding that AI-integrated solutions help safeguard data integrity and streamline critical processes. Regionally, North America and Europe continue to lead in adoption, though Asia-Pacific is experiencing the fastest growth rates as the industrial base expands and digital transformation intensifies.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premise

- Cloud

By Enterprise Size

- Large Enterprise

- SMEs

By End-user Industry

- Energy & Utilities

- Oil & Gas

- Chemical

- Pharmaceutical

- Manufacturing

- Other End-user Industries

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Consolidated Data

One key driver for the data historian market is the rising need for consolidated data to improve process efficiency and business performance. As industries expand rapidly, they require timely, accurate information for making operational decisions.

Data historians help by collecting and storing large amounts of time-series data from various sources, simplifying analysis for plant managers and engineers. This consolidation allows users to detect equipment changes, fine-tune control loops, and investigate anomalies, which improves overall process performance and decision-making.

For instance, industries like manufacturing and utilities employ data historians to monitor real-time operations and optimize asset performance. By integrating data across disparate systems and locations, organizations can eliminate complexities and enhance productivity. This increased reliance on data historians for performance improvement drives the market growth steadily.

Restraint

Legal Concerns and Data Privacy Issues

A major restraint in the data historian market is the challenge posed by legal concerns and data privacy issues. Collecting and storing extensive operational data increases the risk of misuse or accidental exposure, which can have serious legal consequences for organizations and their customers. Companies must carefully manage how data is processed, used, and retained to comply with laws and avoid identity theft or data breaches.

For example, organizations must ensure contract clauses explicitly define data usage rights and maintain tight security to prevent cyberattacks or data loss. Failure to properly address these concerns can lead to lawsuits, regulatory fines, and loss of customer trust. These legal and privacy challenges limit the unrestrained adoption of data historian solutions.

Opportunity

Growing Need for Industrial 360-Degree Hypervision

An important opportunity in the data historian market lies in the growing demand for 360-degree hypervision in industrial environments. Companies increasingly seek comprehensive oversight of their operations from device level to enterprise-wide systems.

Data historians can integrate time-stamped data from multiple operational technology sources and provide real-time analytics for improved monitoring, predictive maintenance, and quality control. For instance, the rise of Industry 4.0 and smart factories leads to a surge in connected sensors and devices generating massive data.

This creates an opportunity for data historians to serve as central repositories, enabling remote management, enhanced operational insights, and faster issue resolution. Businesses adopting these solutions can optimize their processes and reduce downtime, expanding market potential.

Challenge

Data Complexity and Integration with IIoT

A significant challenge facing the data historian market is handling increasing data complexity and integration with Industrial Internet of Things (IIoT) systems. While IIoT generates vast volumes of real-time data, data historians traditionally require more time to extract and analyze this information. Additionally, integrating heterogeneous industrial data sources while maintaining accuracy and security remains complex.

For example, IIoT devices produce sensor data at high velocity and volume, demanding scalable and flexible data storage solutions. Legacy data historian systems may struggle to keep pace with these demands without modernization. Overcoming such integration and performance challenges is critical for data historians to remain relevant in increasingly digitized industrial settings.

Competitive Analysis

In the data historian market, Siemens, ABB, Emerson Electric, Honeywell International, and AVEVA (Schneider Electric) are the leading providers. Their platforms are widely used in process industries such as oil and gas, utilities, and manufacturing to collect, store, and analyze time-series data. These companies leverage global presence and advanced integration to deliver real-time monitoring and efficiency in large-scale industries.

Other significant players including Rockwell Automation, IBM, and Yokogawa Electric strengthen the market with industrial automation and data management expertise. Their historian solutions support predictive maintenance, process optimization, and regulatory compliance. By combining software with analytics and cloud integration, they help enterprises unlock greater value from industrial data and align with Industry 4.0 initiatives.

Emerging and specialized firms such as Inductive Automation, InfluxData, and sorba.ai add innovation to the market. Their platforms emphasize flexibility, open-source integration, and AI-driven insights for both mid-sized and large enterprises. By offering cost-effective and customizable historian solutions, these players broaden accessibility and foster digital transformation across industries.

Top Key Players in the Market

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- AVEVA (Schneider Electric)

- Honeywell International Inc.

- Rockwell Automation

- IBM

- Yokogawa Electric Corporation

- Inductive Automation, LLC.

- InfluxData Inc.

- sorba.ai

- Other Key Players

Recent Developments

- July 2025, AVEVA announced collaboration with NVIDIA to leverage AI and virtual reality for industrial digital twin enhancement, expected to further advance their data historian and analytics offerings.

- June 2025, Yokogawa Electric updated its Exaquantum Plant Information Management System with support for cloud environments like Azure and AWS, adding OPC UA server features and improved performance for its historian functionality.

- May 2025, ABB completed the acquisition of BrightLoop, a move to enhance its electrification business by integrating advanced power electronics technology. Earlier, in January 2024, ABB made three significant technology acquisitions including Meshmind to strengthen its AI, Industrial IoT, and machine vision capabilities, expanding its software research and development globally.

- July 2024, Emerson Electric launched the Ovation™ 4.0 Automation Platform integrated with generative AI aimed at improving data usage and predictive performance in power and water operations, leveraging Microsoft Azure’s OpenAI service initially.

- In June 2024, Honeywell launched Honeywell Batch Historian, a digital software solution that provides manufacturers with contextualized data history for reporting and analytics. The solution is designed to improve efficiency and cost-effectiveness, supporting Honeywell’s focus on the automation megatrend.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.4 Bn CAGR(2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premise, Cloud), By Enterprise Size (Large Enterprise, SMEs), By End-user Industry (Energy & Utilities, Oil & Gas, Chemical, Pharmaceutical, Manufacturing, Other End-user Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., Emerson Electric Co., Siemens AG, AVEVA (Schneider Electric), Honeywell International Inc., Rockwell Automation, IBM, Yokogawa Electric Corporation, Inductive Automation, LLC., InfluxData Inc., SORBA.ai, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- AVEVA (Schneider Electric)

- Honeywell International Inc.

- Rockwell Automation

- IBM

- Yokogawa Electric Corporation

- Inductive Automation, LLC.

- InfluxData Inc.

- sorba.ai

- Other Key Players