Global Waste Heat Recovery Market Size, Share, And Business Benefits By Source (Exhaust Gases, Flue Gases, Process Heat, Engine Heat, Others), By Technique (Boilers, Heat Exchangers, Absorption Chiller, Heat Recovery Steam Generator , Others), By Application (Temperature Control, Pre-Heating Systems, Electricity Generation, Others), By End Use (Oil and Gas, Chemical and Petroleum, Cement, Marine, Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143373

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

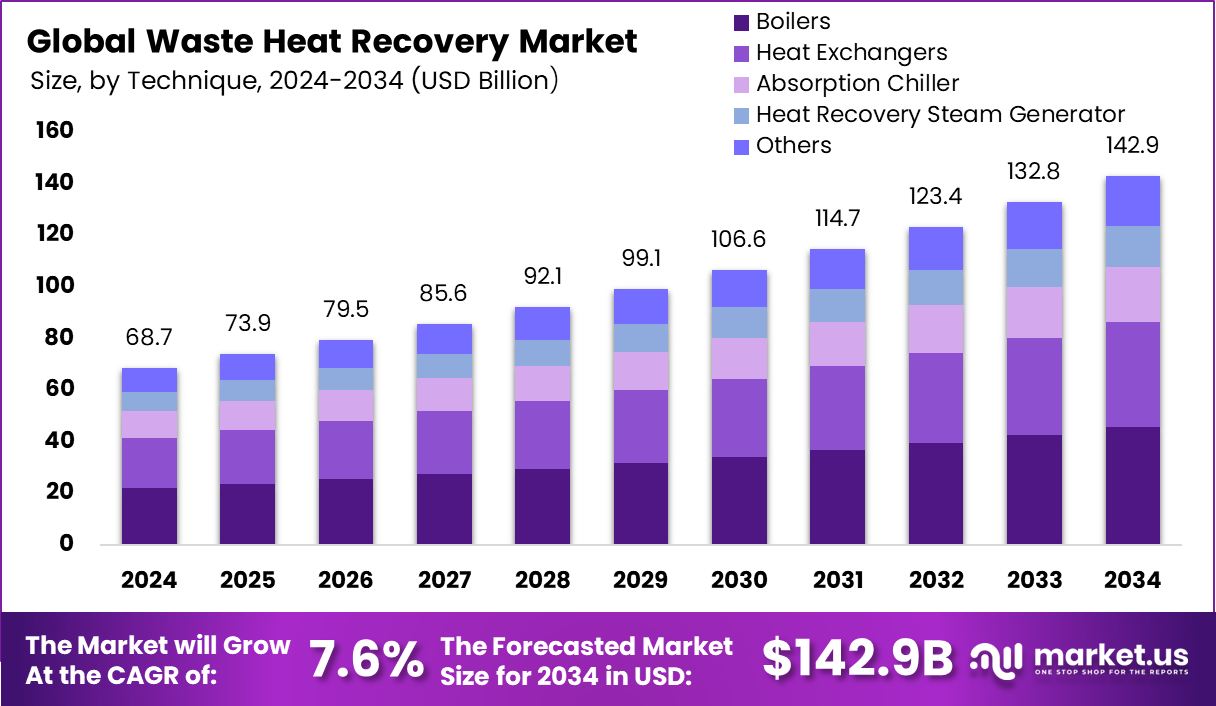

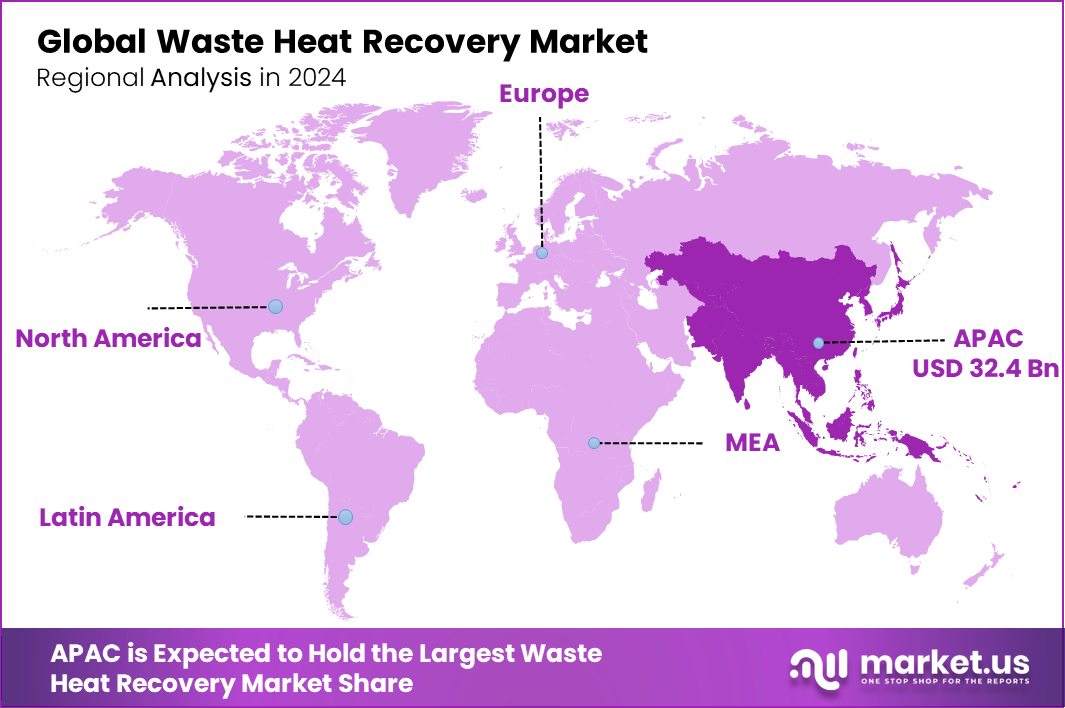

Global Waste Heat Recovery Market is expected to be worth around USD 142.9 billion by 2034, up from USD 68.7 billion in 2024, and grow at a CAGR of 7.6% from 2025 to 2034. With a 47.30% market share, Asia-Pacific led the Waste Heat Recovery sector, generating USD 32.4 billion in revenue.

Waste Heat Recovery (WHR) is the process of capturing and reusing excess heat generated by industrial processes, power plants, and other energy-intensive operations. Instead of letting this heat dissipate into the environment, WHR systems convert it into usable energy, reducing overall fuel consumption and emissions. Common applications include power generation, preheating combustion air, and industrial heating.

The Waste Heat Recovery market is driven by the growing emphasis on energy efficiency and sustainable industrial practices. Industries such as cement, steel, oil & gas, and chemicals are actively integrating WHR systems to lower energy costs and carbon footprints. The market is expanding as governments implement stricter emission regulations and industries seek cost-effective ways to optimize energy consumption.

The increasing global energy demand and rising fuel prices are major growth drivers for WHR solutions. Industries are under pressure to maximize efficiency and reduce dependency on non-renewable energy sources, making WHR a practical investment. Additionally, stringent environmental policies and carbon reduction targets are encouraging industries to adopt energy-efficient solutions, boosting market expansion.

The demand for WHR is also rising due to its cost-saving potential. Companies investing in WHR benefit from reduced energy expenses and enhanced operational efficiency, leading to higher profitability. The adoption of WHR in power plants, district heating, and commercial buildings is also growing, further widening the market scope.

Key Takeaways

- Global Waste Heat Recovery Market is expected to be worth around USD 142.9 billion by 2034, up from USD 68.7 billion in 2024, and grow at a CAGR of 7.6% from 2025 to 2034.

- Exhaust gases contribute 37.50% to the Waste Heat Recovery Market growth.

- Boilers hold a 32.40% share in Waste Heat Recovery adoption worldwide.

- Pre-heating systems account for 31.20% in Waste Heat Recovery utilization globally.

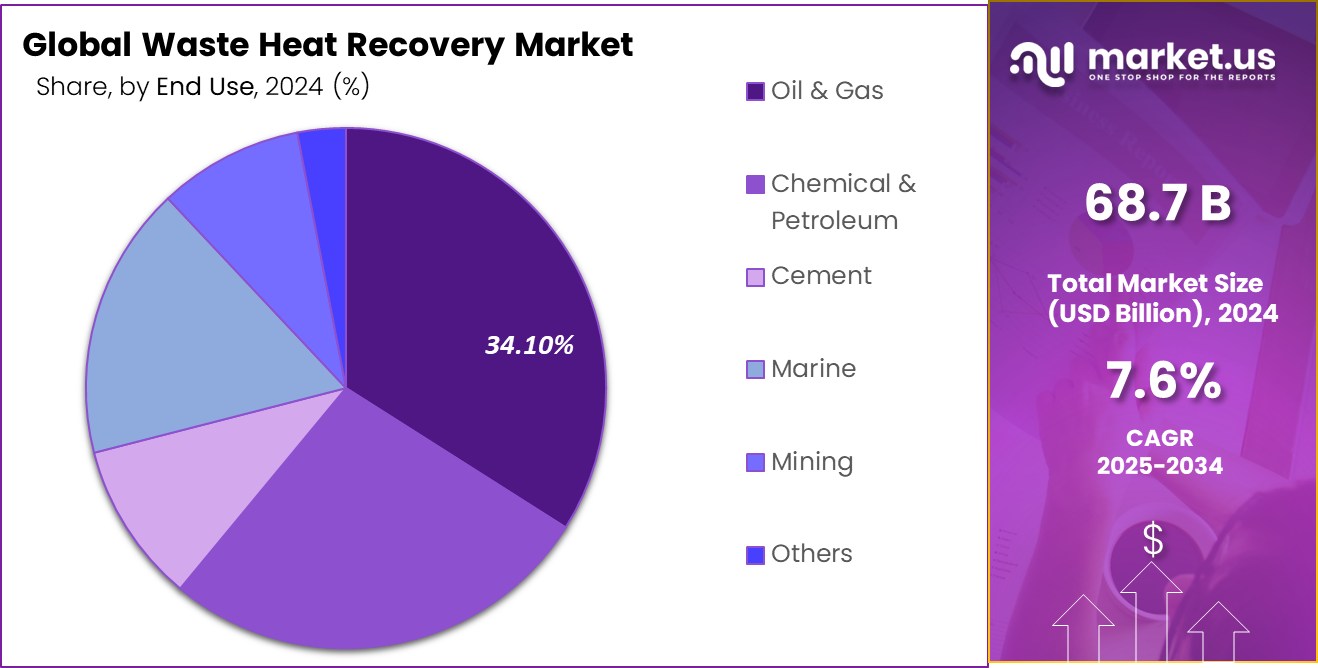

- The oil and gas sector dominates 34.10% of WHR market demand.

- The Waste Heat Recovery Market in Asia-Pacific reached USD 32.4 billion, accounting for 47.30% of global revenue.

By Source Analysis

Exhaust gases contribute 37.50% to the Waste Heat Recovery market, driving efficiency improvements across industrial sectors globally.

In 2024, Exhaust Gases held a dominant market position in the Source segment of the Waste Heat Recovery Market, with a 37.50% share. Exhaust gases from industries such as cement, steel, and petrochemicals represent a significant source of waste heat, driving their leading market share.

The high temperature of exhaust gases provides a reliable opportunity for energy recovery, particularly in power generation and process heating applications. With growing regulatory pressure to reduce industrial emissions, businesses are increasingly investing in waste heat recovery solutions to optimize energy efficiency and lower operational costs.

Flue Gases followed as a key contributor in this segment, benefiting from widespread adoption across thermal power plants and industrial boilers. The implementation of high-efficiency heat exchangers and cogeneration systems has fueled demand for flue gas recovery solutions. Steam and Hot Water, another crucial sub-segment, is gaining traction in district heating and combined heat and power (CHP) applications, particularly in colder regions.

By Technique Analysis

Boilers dominate with 32.40%, efficiently converting waste heat into reusable energy, reducing operational costs and environmental impact.

In 2024, Boilers held a dominant market position in the By Technique segment of the Waste Heat Recovery Market, with a 32.40% share. The widespread use of waste heat boilers across industries such as power generation, cement, and chemicals has propelled their market leadership.

These systems efficiently capture and utilize waste heat from exhaust gases and industrial processes to produce steam, which is then used for electricity generation or process heating. The growing emphasis on improving energy efficiency and reducing fuel dependency has driven the adoption of waste heat boilers, particularly in energy-intensive industries.

Heat Exchangers followed as a significant segment, benefiting from technological advancements in plate, shell-and-tube, and regenerative heat exchangers. Their application in recovering low- and medium-grade waste heat from industrial equipment has made them a preferred solution for optimizing operational efficiency.

Additionally, Regenerative Thermal Oxidizers (RTOs) and Organic Rankine Cycle (ORC) Systems are gaining momentum, especially in regions with stringent emission control regulations. These techniques enable efficient heat recovery and conversion into electricity, further expanding their adoption.

By Application Analysis

Pre-heating systems account for 31.20%, optimizing energy consumption and enhancing productivity across manufacturing, power, and process industries.

In 2024, Pre-Heating Systems held a dominant market position in the By Application segment of the Waste Heat Recovery Market, with a 31.20% share. These systems play a crucial role in improving energy efficiency by utilizing waste heat to preheat combustion air, feedwater, or raw materials in industrial processes.

Industries such as cement, steel, and petrochemicals have increasingly adopted pre-heating solutions to reduce fuel consumption and lower overall operational costs. The growing emphasis on sustainability and stringent energy efficiency regulations have further accelerated the adoption of pre-heating systems across manufacturing and processing industries.

Electricity Generation followed as a key application, driven by the rising demand for self-sufficient energy solutions in industrial plants. Organic Rankine Cycle (ORC) technology and steam turbines have enabled industries to convert low- and medium-grade waste heat into electricity, reducing their dependence on external power sources.

Additionally, Steam Generation remains a vital application, particularly in power plants and heavy industrial sectors where waste heat is recovered to produce steam for internal use.

By End-Use Analysis

The oil and gas sector leads with 34.10%, leveraging Waste Heat Recovery for enhanced sustainability and energy savings.

In 2024, Oil and Gas held a dominant market position in the By End Use segment of the Waste Heat Recovery Market, with a 34.10% share. The energy-intensive nature of oil and gas operations, including refining, gas processing, and petrochemical production, has driven the widespread adoption of waste heat recovery systems.

These systems play a critical role in capturing excess heat from exhaust gases, process heaters, and compressors, improving overall energy efficiency while reducing fuel consumption. The sector’s growing focus on emission reduction and sustainability has further boosted investments in advanced waste heat recovery technologies.

Cement followed as a key end-use industry, benefiting from high-temperature kiln operations that generate significant waste heat. The integration of heat exchangers and boilers in cement manufacturing has enabled efficient heat recovery for power generation and process heating. Additionally, chemical and Petrochemical industries have emerged as strong adopters, leveraging waste heat recovery to optimize operational efficiency and lower energy costs.

The increasing industrialization across emerging economies, coupled with rising energy costs, is expected to drive further growth in the waste heat recovery market. As regulatory frameworks tighten and industries seek cost-effective energy solutions, waste heat recovery adoption in oil and gas and other high-energy sectors will continue to expand.

Key Market Segments

By Source

- Exhaust Gases

- Flue Gases

- Process Heat

- Engine Heat

- Others

By Technique

- Boilers

- Heat Exchangers

- Absorption Chiller

- Heat Recovery Steam Generator

- Others

By Application

- Temperature Control

- Pre-Heating Systems

- Electricity Generation

- Others

By End Use

- Oil and Gas

- Chemical and Petroleum

- Cement

- Marine

- Mining

- Others

Driving Factors

Rising Energy Costs Boost Demand for WHR Solutions

Industries worldwide are struggling with rising energy costs, pushing them to find ways to save power and reduce expenses. Waste Heat Recovery (WHR) systems offer a smart solution by capturing and reusing lost heat from industrial processes. By lowering fuel consumption, WHR helps companies cut operational costs and improve efficiency. Sectors like oil & gas, cement, and chemicals are investing in these systems to remain competitive while meeting sustainability goals.

Additionally, higher electricity prices have made industries look for self-sufficient energy solutions, making WHR even more attractive. As energy costs keep rising, businesses are expected to increase their adoption of WHR technology, further driving market growth in the coming years.

Restraining Factors

High Initial Investment Limits WHR System Adoption

One of the biggest challenges in the Waste Heat Recovery (WHR) Market is the high initial investment required for system installation. Many industries hesitate to adopt WHR due to the significant costs associated with purchasing and integrating advanced heat recovery equipment.

The need for customized solutions, infrastructure upgrades, and a skilled workforce further adds to the expenses, making it difficult for small and medium-sized enterprises (SMEs) to afford these systems.

Additionally, long payback periods can discourage businesses from investing, despite the long-term energy savings. Without strong financial incentives or government subsidies, some industries may delay or avoid implementing WHR solutions, limiting overall market growth. Addressing these cost concerns is crucial for expanding WHR adoption across various sectors.

Growth Opportunity

Industrial Expansion in Emerging Markets Drives Growth

The Waste Heat Recovery (WHR) Market has a strong growth opportunity in emerging economies where industrialization is rising rapidly. Countries in Asia-Pacific, Latin America, and the Middle East are expanding their manufacturing, cement, and petrochemical industries, creating a higher demand for energy-efficient solutions. As industries in these regions seek to reduce energy costs and improve sustainability, WHR adoption is expected to grow.

Government initiatives promoting energy efficiency and carbon reduction further support market expansion. Additionally, increasing foreign investments in industrial projects presents new opportunities for WHR system providers. By offering cost-effective and scalable WHR solutions, companies can tap into these growing markets, helping industries optimize energy use while reducing operational expenses

Latest Trends

Integration of WHR with Renewable Energy Expands

A major trend in the Waste Heat Recovery (WHR) Market is the integration of WHR systems with renewable energy sources like solar and biomass. Industries are looking for ways to enhance sustainability by combining WHR with clean energy solutions to further reduce reliance on fossil fuels. Hybrid systems that use waste heat alongside solar power or bioenergy are gaining traction, especially in regions with strong renewable energy policies.

This approach not only maximizes energy efficiency but also helps industries meet strict carbon reduction targets. As companies focus on net-zero goals, the demand for integrated WHR and renewable energy solutions is expected to grow, driving further innovation in energy recovery technologies.

Regional Analysis

In 2024, Asia-Pacific dominated the Waste Heat Recovery Market with a 47.30% share, valued at USD 32.4 billion.

In 2024, Asia-Pacific dominated the Waste Heat Recovery Market, holding a 47.30% share, valued at USD 32.4 billion. The region’s strong industrial base, particularly in China, India, and Japan, has driven significant adoption of waste heat recovery systems across cement, chemicals, and oil & gas sectors. The push for energy efficiency, coupled with government incentives for sustainable industrial practices, has further fueled market expansion.

North America remains a key market, driven by stringent emission regulations and high energy costs. The United States and Canada are investing in advanced waste heat recovery technologies to improve energy efficiency in manufacturing and power generation.

Similarly, Europe is witnessing steady growth, supported by strict EU energy efficiency directives and increasing adoption of waste heat recovery in industries such as steel and petrochemicals.

The Middle East & Africa is emerging as a developing market, particularly in oil-rich nations focusing on industrial energy optimization. Latin America is seeing gradual adoption, with industrial expansion in Brazil and Mexico creating opportunities for waste heat recovery integration.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, leading players in the global Waste Heat Recovery (WHR) market are focusing on technological advancements, strategic partnerships, and regional expansion to strengthen their market presence. Companies such as ABB Ltd., John Wood Group PLC, Boustead International Heaters Ltd., and Doosan Heavy Industries & Construction Co. Ltd. are driving innovation in waste heat recovery technologies to meet the rising global demand for energy efficiency solutions.

ABB Ltd. remains a key player in the WHR market, leveraging its expertise in automation and power solutions to enhance industrial energy recovery systems. With increasing industrialization, ABB is capitalizing on smart heat recovery solutions, integrating digital monitoring and automation to optimize efficiency.

John Wood Group PLC continues to expand its WHR portfolio, focusing on providing customized energy efficiency solutions for oil & gas, power, and process industries. The company’s commitment to sustainability-driven engineering solutions positions it well in a market that is increasingly adopting carbon reduction strategies.

Boustead International Heaters Ltd. specializes in designing and manufacturing high-efficiency waste heat recovery units for industrial applications. Its strong presence in the oil & gas and petrochemical sectors makes it a crucial supplier for industries seeking to reduce energy costs and emissions.

Doosan Heavy Industries & Construction Co. Ltd. is actively engaged in large-scale waste heat recovery projects, particularly in the power generation sector. With a focus on advanced heat exchanger technologies, Doosan is expanding its footprint in Asia and the Middle East, where industrial growth is fueling WHR demand.

Top Key Players in the Market

- ABB Ltd.

- John Wood Group PLC

- Boustead International Heaters Ltd.

- Doosan Heavy Industries & Construction Co. Ltd.

- Echogen Power Systems

- GEA Group AG

- General Electric Company

- HRS Heat Exchangers Ltd.

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Heavy Industries Ltd.

- Ormat Technologies Inc.

- Robert Bosch GmbH

- Schneider Electric

- Siemens AG

- Thermax Limited, TLV CO., LTD

Recent Developments

- In December 2024, Wood secured a significant $17 million contract with a leading petrochemical company in the Middle East to install a new heat recovery unit. This project is expected to reduce CO₂ emissions by approximately 110 kilotonnes annually, equivalent to removing 22,000 cars from the road.

- In 2024, Echogen has raised approximately $59 million in funding, with notable investors including the U.S. Department of Energy. The company employs around 21 people, reflecting its focused and specialized team.

Report Scope

Report Features Description Market Value (2024) USD 68.7 Billion Forecast Revenue (2034) USD 142.9 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Exhaust Gases, Flue Gases, Process Heat, Engine Heat, Others), By Technique (Boilers, Heat Exchangers, Absorption Chiller, Heat Recovery Steam Generator , Others), By Application (Temperature Control, Pre-Heating Systems, Electricity Generation, Others), By End Use (Oil and Gas, Chemical and Petroleum, Cement, Marine, Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., John Wood Group PLC, Boustead International Heaters Ltd., Doosan Heavy Industries & Construction Co. Ltd., Echogen Power Systems, GEA Group AG, General Electric Company, HRS Heat Exchangers Ltd., Kawasaki Heavy Industries Ltd., Mitsubishi Heavy Industries Ltd., Ormat Technologies Inc., Robert Bosch GmbH, Schneider Electric , Siemens AG, Thermax Limited, TLV CO., LTD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Waste Heat Recovery MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Waste Heat Recovery MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- John Wood Group PLC

- Boustead International Heaters Ltd.

- Doosan Heavy Industries & Construction Co. Ltd.

- Echogen Power Systems

- GEA Group AG

- General Electric Company

- HRS Heat Exchangers Ltd.

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Heavy Industries Ltd.

- Ormat Technologies Inc.

- Robert Bosch GmbH

- Schneider Electric

- Siemens AG

- Thermax Limited, TLV CO., LTD