Global Corporate Entertainment Market Size, Share, Growth Analysis By Event Type (Conferences, Retreats, Office Parties, Team Building Events, Award Ceremonies, Board Meetings, Product Launches), By Organizational Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Industry (IT and Telecom, Finance, Media and Entertainment, Manufacturing, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139653

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

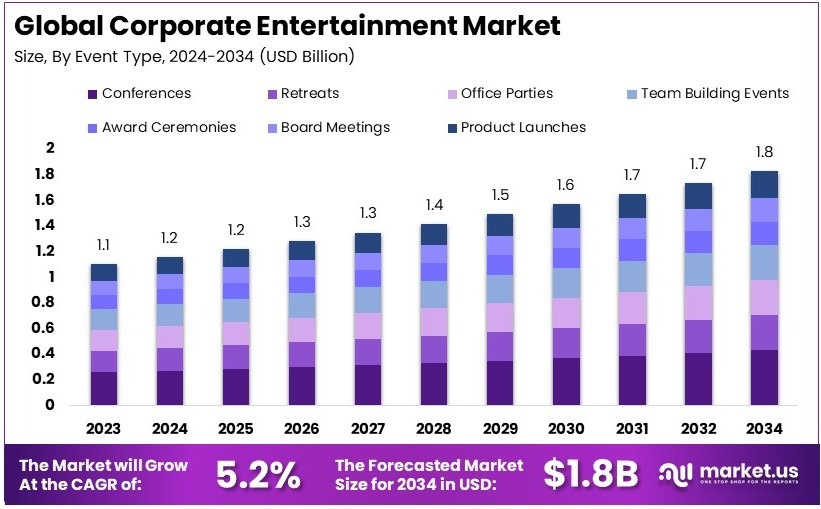

The Global Corporate Entertainment Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Corporate entertainment is a service offering that organizes events for companies. It includes team building, client meetings, and employee rewards. It enhances corporate culture and builds professional relationships. It comprises live shows, dinners, and recreational activities. It is planned to align with business goals and corporate image with utmost precision.

The corporate entertainment market is the economic sector that provides entertainment services to businesses. It involves vendors, event planners, and venues that specialize in corporate events. This market focuses on organizing experiences for companies. It includes products and services aimed at improving employee engagement and client relationships across diverse industries.

In the industry of corporate entertainment, U.S. companies are increasingly recognizing the importance of employee engagement to bolster productivity and reduce turnover. Annually, over $720 million is invested in these initiatives, according to The Conference Board.

Furthermore, this investment is crucial as disengaged employees can significantly impact financial performance, with U.S. companies losing between $450 to $550 billion each year due to lack of engagement, as highlighted by HR Cloud.

Additionally, the landscape of corporate events has evolved significantly, adapting to the digital age with a notable shift towards hybrid and virtual events formats. In 2022, 40% of events organized by marketers worldwide were virtual, marking a 5% increase from the previous year. Consequently, this adaptability ensures that corporate entertainment continues to thrive despite changing work environments and technological advancements.

Moreover, the broader U.S. media and entertainment (M&E) industry plays a pivotal role, valued at $649 billion and representing 23% of the global market. According to recent data, the motion picture and sound recording industry in the U.S. attracted $35.2 billion in foreign direct investment in 2023, while the radio and cable broadcasting sector drew in $8.9 billion.

On the local front, corporate entertainment significantly boosts regional economic activities by creating jobs and promoting local cultures through events. Moreover, government regulations and investments shape the market by ensuring fair competition and fostering an environment conducive to sustainable growth. Hence, these factors collectively enhance the market’s attractiveness and viability, promising continued growth and opportunities for innovation in the sector.

Key Takeaways

- The Corporate Entertainment Market valued at USD 1.1 Billion will reach USD 1.8 Billion by 2034 with a 5.2% CAGR.

- In 2024, the Conferences segment dominates the market with a 23.4% share, highlighting its essential role in corporate engagements.

- In 2024, Large Enterprises lead with a 61.5% share, underscoring their significant influence on market dynamics.

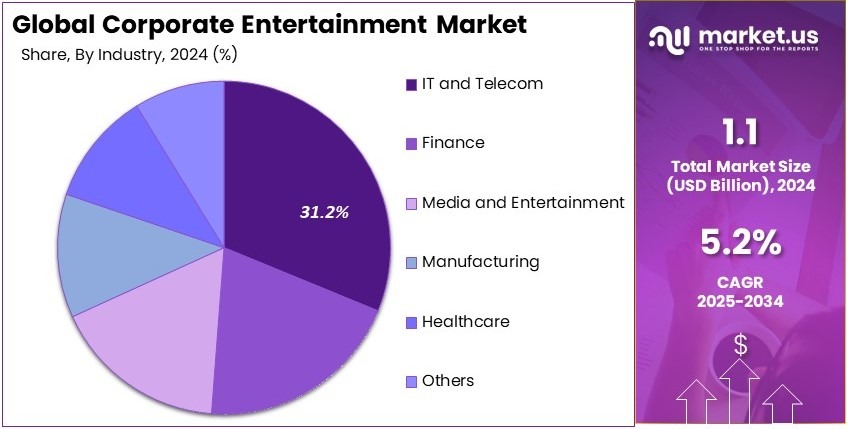

- In 2024, the IT and Telecom segment captures a 31.2% share, driven by high demand for innovative communication solutions.

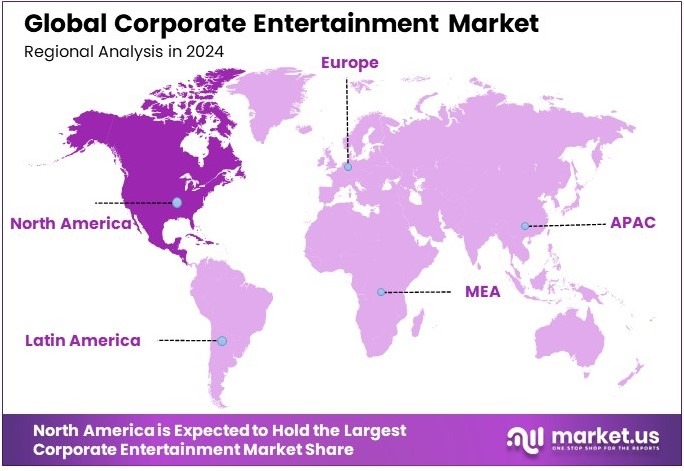

- In 2024, North America dominates, driving substantial corporate entertainment growth with strong market influence and emerging innovation trends.

Type Analysis

Conferences dominate with 23.4% due to high demand for professional networking opportunities.

The corporate entertainment market is increasingly leveraging conferences, which have emerged as the dominant sub-segment. Accounting for 23.4% of the market, conferences are essential for businesses aiming to foster professional relationships and showcase industry advancements.

Companies prioritize these events to facilitate networking, exchange ideas, and highlight new research or products which directly contributes to their growth and industry relevance.

Retreats involve off-site meetings and team bonding exercises, playing a crucial role in employee engagement and organizational culture strengthening. They offer a unique opportunity for team members to disconnect from regular work settings and build stronger bonds, enhancing teamwork and collaboration.

Office parties serve as informal gatherings that boost morale and encourage informal networking among colleagues. These events are crucial for maintaining a relaxed and communicative work environment, supporting employee satisfaction and retention.

Organizational Size Analysis

Large Enterprises dominate with 61.5% due to their extensive resource pools and broad geographic presence.

In the corporate entertainment market, large enterprises hold a significant lead, primarily due to their ability to invest in larger, more elaborate events. These corporations often operate across multiple regions, necessitating frequent large-scale events such as award ceremonies and product launches to ensure cohesive corporate culture and brand consistency across global offices.

Small and Medium Enterprises (SMEs) focus on more localized, intimate events that reflect their organizational culture and close-knit employee relationships. These events are vital for SMEs to foster a sense of belonging and loyalty among employees, promoting a strong internal community. Such activities help SMEs to enhance employee motivation and commitment, which is crucial for their growth and stability in the market.

Industry Analysis

The IT and Telecom industry leads with 31.2% due to rapid technological advancements and the need for constant knowledge updating.

Within the corporate entertainment market, the IT and Telecom sector stands out, driven by the fast-paced nature of technological advancements and the continuous need for professionals to stay updated through interactive events like product launches and tech conferences. This necessity positions IT and Telecom as a critical player in driving the market’s growth.

The Finance sector utilizes corporate events to foster trust and client relationships, which are vital for business growth. These events often include high-profile gatherings that promote brand reliability and client loyalty.

Meanwhile, the Media and Entertainment industry uses such events to celebrate creativity and innovation, essential for networking and collaboration among creatives. These gatherings are pivotal in fostering a vibrant community that thrives on sharing ideas and pushing creative boundaries.

Key Market Segments

By Event Type

- Conferences

- Retreats

- Office Parties

- Team Building Events

- Award Ceremonies

- Board Meetings

- Product Launches

By Organizational Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Industry

- IT and Telecom

- Finance

- Media and Entertainment

- Manufacturing

- Healthcare

- Others

Driving Factors

Strategic Engagement and Digital Innovation Drives Market Growth

Companies are increasing investments in team-building activities and employee engagement programs. They now host events that combine physical and digital experiences. Firms use interactive marketing strategies to boost brand activations. Many organize live shows and virtual meetings to connect with employees and clients.

Corporate hospitality in sports and entertainment has grown significantly. For instance, a multinational firm recently held a hybrid event featuring a live music and online sessions. This mix of experiences makes events more engaging and accessible. Businesses see these strategies as a way to strengthen internal teams and improve public image.

Moreover, digital tools have made it easier to manage hybrid events. Experiential marketing creates memorable moments that drive customer loyalty. Increased spending on virtual platforms supports more flexible event management. Companies also use creative formats to keep employees motivated and satisfied. These methods add value by combining traditional and modern approaches.

The result is a market that grows steadily as firms look for innovative ways to connect with their workforce. Investment in both physical and digital event components sets the stage for long-term market expansion. In summary, higher budgets for team-building, experiential events, virtual integration, and corporate hospitality contribute to robust market growth. Growth continues steadily.

Restraining Factors

High Costs and Regulatory Hurdles Restraints Market Growth

Many companies face high costs when organizing large-scale corporate events. Budget limits often force firms to cut back on entertainment options. Strict government regulations add more challenges. Safety compliance rules make event planning more complex.

Economic uncertainty further restricts spending on corporate events. Firms are cautious during unstable financial times. They worry that reduced budgets may affect event quality. Moreover, cybersecurity concerns impact virtual event planning. Data privacy issues require additional investments in secure technology.

These challenges slow down market growth and create risks for organizers. Businesses feel pressure from unpredictable economic conditions. They worry about reduced participation. Rules on gatherings also limit event sizes. Companies must invest more in safety measures, which raises expenses further.

This combination of high costs, regulatory hurdles, economic uncertainty, and cybersecurity risks makes planning difficult. As a result, some firms delay or cancel events. The market struggles to grow when these restraints are present. Future growth may depend on easing these constraints gradually. Organizers must seek innovative solutions and strategies to overcome these hurdles. This effort will help secure a stable future for the industry.

Growth Opportunities

Global Expansion and Digital Advancements Provides Opportunities

New opportunities are emerging in corporate entertainment. Firms are expanding into developing economies where fresh customer bases await. These markets offer lower competition and strong growth potential.

Many companies are adopting subscription models for small and medium enterprises. This method provides steady revenue and builds customer loyalty. Digital transformation is fueling virtual reality and metaverse integration. Organizers now use VR experiences to create immersive events that capture audience interest. Such innovations attract younger participants and boost engagement.

In addition, eco-friendly event options are gaining ground. Sustainable practices like using renewable energy and reducing waste appeal to environmentally conscious clients. These initiatives can also lower long-term costs. A global brand recently launched a subscription service that featured virtual tours and green practices.

This blend of market expansion, digital innovation, subscription revenue, and sustainability opens new avenues for growth. Companies can tap into evolving consumer trends and adjust to shifting demands. Investment in new technologies and green methods builds a competitive edge.

Emerging Trends

Immersive Engagement and Digital Integration Are Latest Trending Factors

Recent trends are reshaping corporate entertainment. There is a surge in demand for immersive and gamified event experiences. Companies now seek interactive formats that blend fun and work. Many events include games and digital challenges to engage participants.

Blockchain technology is also gaining traction for secure ticketing and access management. This ensures safer transactions and reduces fraud risks. Celebrity and influencer involvement is rising steadily. Their presence boosts event appeal and drives higher attendance.

Moreover, the shift toward hybrid and phygital formats combines physical and digital elements. This trend offers flexibility and broader reach for organizers. For example, a major firm recently hosted an event with live performances and online interactive session. Such formats create memorable experiences that appeal to diverse audiences.

These emerging trends drive innovation across the market. They encourage organizers to experiment with new technologies and creative approaches. Businesses see these developments as a way to increase engagement and brand value.

Regional Analysis

North America Dominates the Corporate Entertainment Market

North America leads the Corporate Entertainment Market, anchored by a strong corporate culture that prioritizes employee engagement and networking events. Cities like New York, Los Angeles, and Toronto are hubs for these events, attracting businesses both domestically and internationally.

The region’s robust economy, high corporate spending, and sophisticated event planning infrastructure make it ideal for hosting large-scale corporate gatherings. The presence of numerous Fortune 500 companies further boosts demand for high-quality corporate entertainment services.

The future influence of North America in the global Corporate Entertainment Market looks promising. The continuing focus on enhancing corporate culture and improving employee satisfaction is expected to sustain high levels of investment in corporate events, solidifying the region’s top position.

Regional Mentions:

- Europe: Europe has a strong presence in the Corporate Entertainment Market, known for exclusive and upscale corporate events. Its rich cultural heritage and top-tier event venues attract international corporate events.

- Asia Pacific: The Asia Pacific region is rapidly expanding its influence in the Corporate Entertainment Market due to economic growth and increasing corporate investments in countries like China and India. The region’s unique cultural elements are appealing for corporate functions.

- Middle East & Africa: Growth in the Corporate Entertainment Market in the Middle East and Africa is fueled by investments in luxurious event venues and the growing presence of international corporations, especially in cities like Dubai and Johannesburg.

- Latin America: Latin America is experiencing growth in the Corporate Entertainment Market, with its vibrant culture and economic improvements. Brazil and Mexico are emerging as popular locations for corporate events, offering distinctive local experiences.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The corporate entertainment market is led by major media and entertainment companies that provide high-quality experiences across various platforms. These companies dominate the industry by leveraging strong brand recognition, extensive content libraries, and strategic partnerships.

The Walt Disney Company is a global leader in entertainment, offering corporate event experiences through its theme parks, resorts, and content-driven engagements. Its strong brand presence and diverse entertainment options make it a top choice for corporate clients seeking immersive experiences.

Comcast plays a key role in corporate entertainment through its subsidiary, NBCUniversal. The company offers event production, digital content, and live entertainment solutions. Its expertise in television, film, and digital media strengthens its influence in the market.

Warner Bros. Discovery brings a powerful mix of media production, live entertainment, and corporate event solutions. With a vast portfolio of movies, television networks, and event services, the company attracts businesses looking for high-quality entertainment experiences.

Sony is a major player with its strong presence in film, television, and music. The company provides corporate entertainment solutions through live events, exclusive screenings, and interactive experiences. Its technology and content capabilities make it a preferred partner for corporate clients.

These top companies drive the corporate entertainment market by investing in innovative content, digital solutions, and immersive experiences. Their strong financial backing and brand loyalty ensure continued market dominance.

Major Companies in the Market

- Comcast

- The Walt Disney Company

- Sony

- Warner Bros. Discovery

- Paramount Global

- Amazon

- Netflix

- NBCUniversal

- Endeavor

- Jack Morton Worldwide

- Delaware North

- Zee Entertainment

- Sun TV Network

Recent Developments

- Plastribution: On June 2024, Plastribution announced the Festival of Polymer Innovation (FOPI) to emulate a festival atmosphere that inspires learning and idea-sharing among professionals. The event’s “Mainstage” will feature industry leaders showcasing the latest manufacturing technologies and innovations, along with live entertainment from UK plastics sector bands and musical talents.

- Red Bull Technology: On March 2024, Red Bull Technology reported significant growth in its corporate events sector at the MK-7 venue in Milton Keynes, noting a 40% year-on-year increase in venue hire and a 46% rise in factory tours in 2023. Plans for 2024 include expanding factory tour open days, hosting live race screenings, and introducing new offerings such as “Train Like an F1 Driver” and “Build a Nose Cone” team-building activities to enhance the brand experience.

- Venu Holding Corporation: On December 2024, Venu Holding Corporation announced plans to develop four new live entertainment facilities in McKinney, TX; El Paso, TX; Broken Arrow, OK; and Oklahoma City, OK, over the next 24 months.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 1.8 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Event Type (Conferences, Retreats, Office Parties, Team Building Events, Award Ceremonies, Board Meetings, Product Launches), By Organizational Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Industry (IT and Telecom, Finance, Media and Entertainment, Manufacturing, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Comcast, The Walt Disney Company, Sony, Warner Bros. Discovery, Paramount Global, Amazon, Netflix, NBCUniversal, Endeavor, Jack Morton Worldwide, Delaware North, Zee Entertainment, Sun TV Network Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Corporate Entertainment MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Global Corporate Entertainment MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Comcast

- The Walt Disney Company

- Sony

- Warner Bros. Discovery

- Paramount Global

- Amazon

- Netflix

- NBCUniversal

- Endeavor

- Jack Morton Worldwide

- Delaware North

- Zee Entertainment

- Sun TV Network