Global Contact Lens Solution Market By Product Type (Multi-purpose, Hydrogen Peroxide-based), By Usage (480mL, 360mL, and 120mL), By Distribution Channel (Retail, E-commerce, and Eye Care Professionals), By Material (Hybrid Lens, SMEs Gas Permeable, and Silicone Hydrogel), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157276

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

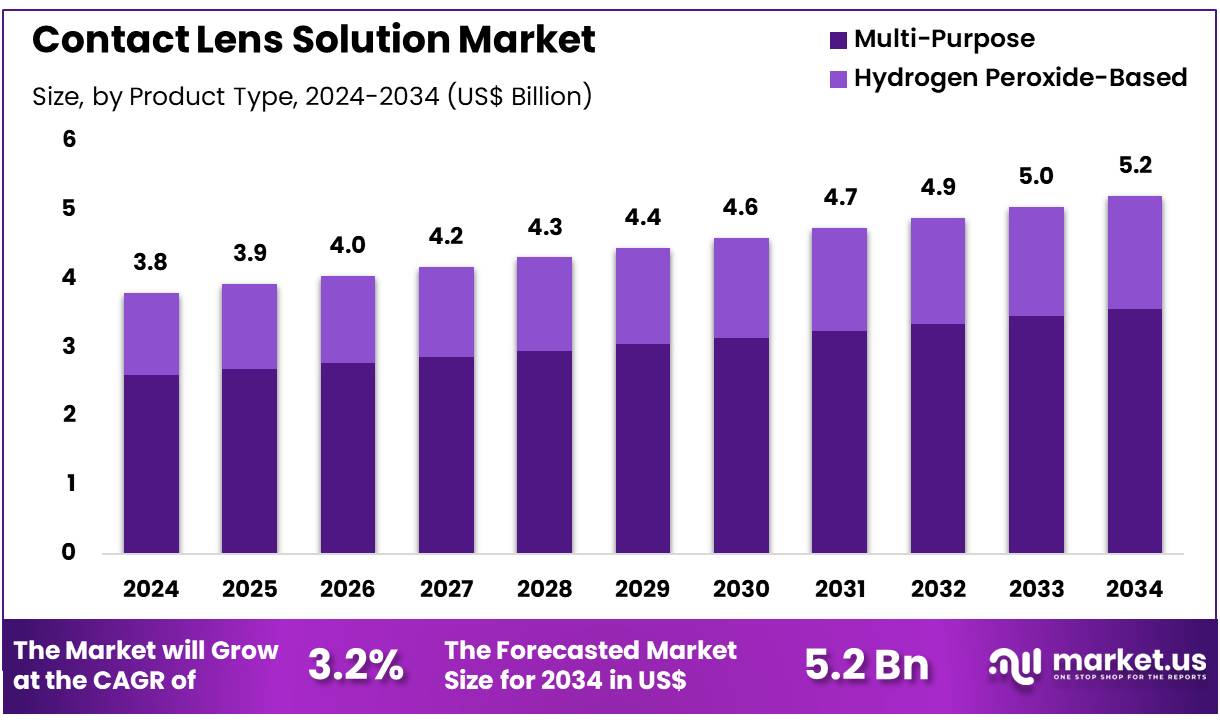

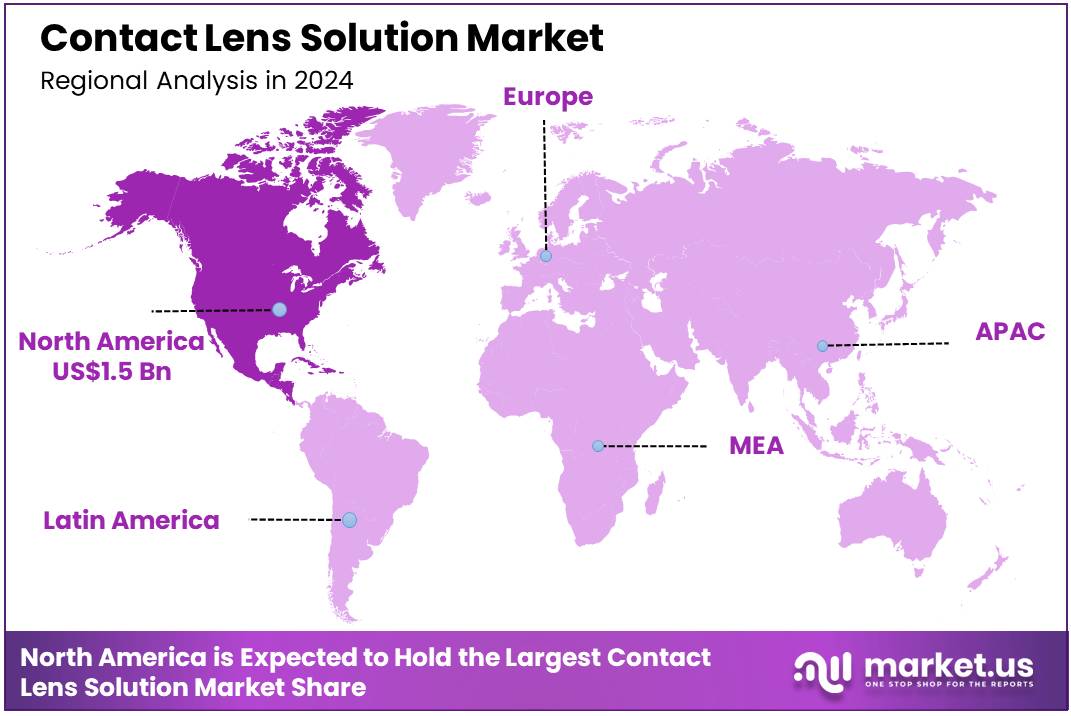

Global Contact Lens Solution Market size is expected to be worth around US$ 5.2 Billion by 2034 from US$ 3.8 Billion in 2024, growing at a CAGR of 3.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.2% share with a revenue of US$ 1.5 Billion.

The rising prevalence of vision impairment and the growing adoption of contact lenses are primary drivers of the contact lens solution market. Contact lenses are a widely used method for vision correction, but their effectiveness hinges on proper care and cleaning to avoid infections and discomfort.

According to the World Health Organization (WHO), in 2023, over 2.2 billion people worldwide suffer from vision impairment, with a significant portion of these cases caused by uncorrected refractive errors. This vast patient base creates an ongoing demand for corrective lenses and the maintenance solutions needed to ensure their safety and longevity. As more individuals opt for contact lenses over traditional glasses, the market for cleaning and care solutions continues to expand.

Increased consumer awareness of eye health and the importance of specialized lens care are shaping key trends in the market. The Centers for Disease Control and Prevention (CDC) has stressed the importance of proper lens hygiene, revealing that nearly all contact lens wearers engage in at least one behavior that heightens their risk of infection. This highlights the need for effective cleaning solutions and comprehensive patient education.

In response, manufacturers are developing more advanced cleaning formulations, including multi-purpose and hydrogen peroxide-based solutions, designed to enhance cleaning efficiency and promote safer wear. Additionally, sustainability is gaining momentum, as evidenced by Bausch + Lomb’s recycling program, which collected over 84 million used products by April 2024, reflecting a shift towards eco-friendly practices that appeal to environmentally conscious consumers.

Consolidation and specialization in the eye care sector are opening up new avenues for market growth. The demand for customized lenses, particularly in orthokeratology and for managing complex eye conditions, is driving the need for specialized care products that are compatible with these advanced materials. In January 2025, Advanced Vision Technologies, EyePrint Prosthetics, and Wave Contact Lens System merged to form Wave Eye Care, combining their expertise to offer a full range of specialty lenses. This merger underscores the industry’s focus on delivering comprehensive solutions that not only include custom lenses but also the specialized care products required for their proper use, enhancing patient comfort and safety.

Key Takeaways

- In 2024, the market for contact lens solution generated a revenue of US$ 3.8 Billion, with a CAGR of 3.2%, and is expected to reach US$ 5.2 Billion by the year 2034.

- The product type segment is divided into multi-purpose, hydrogen peroxide-based, with multi-purpose taking the lead in 2023 with a market share of 68.5%.

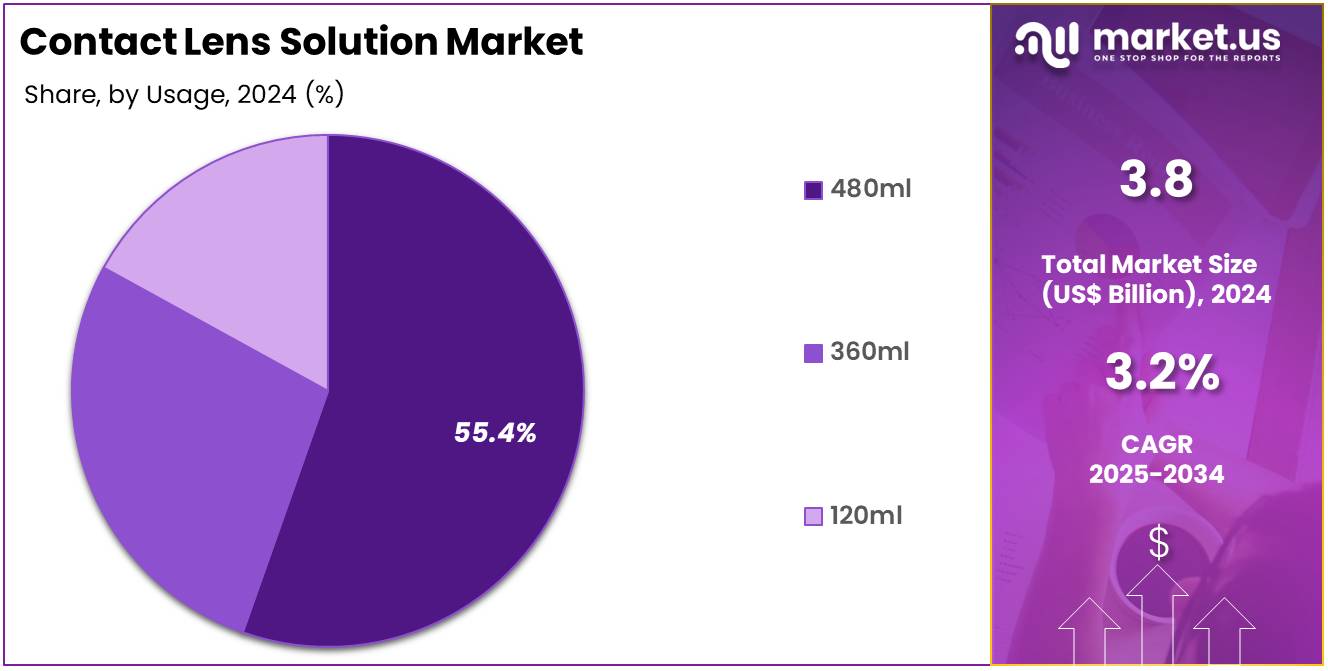

- Considering usage, the market is divided into 480ml, 360ml, and 120ml. Among these, 480ml held a significant share of 55.4%.

- Furthermore, concerning the distribution channel segment, the market is segregated into retail, e-commerce, and eye care professionals. The retail sector stands out as the dominant player, holding the largest revenue share of 52.8% in the contact lens solution market.

- The material segment is segregated into hybrid lens, SMES gas permeable, and silicone hydrogel, with the hybrid lens segment leading the market, holding a revenue share of 47.1%.

- North America led the market by securing a market share of 39.2% in 2023.

Product Type Analysis

Multi-purpose contact lens solutions dominate the market, holding a 68.5% share of the product type segment. Their dominance is driven by the growing demand for convenience and ease of use among contact lens users. Multi-purpose solutions are formulated to clean, disinfect, rinse, and store contact lenses, offering a comprehensive solution for lens care. This ease of use is expected to contribute to their continued growth, particularly as consumers seek user-friendly options that reduce the need for multiple products.

The increasing adoption of soft contact lenses, which require more frequent cleaning and maintenance, is also expected to support the growth of multi-purpose solutions. The continuous improvement in the formulation of these solutions, offering enhanced disinfecting properties and greater comfort, further drives consumer preference for multi-purpose options. As consumers increasingly prioritize convenience, multi-purpose solutions are likely to remain the preferred choice in the contact lens solution market.

Usage Analysis

The 480ml size holds the largest share of 55.4% in the usage segment. This growth can be attributed to the popularity of the 480ml packaging for providing value and convenience to consumers. A larger volume is ideal for regular contact lens users who prefer a product that lasts longer, reducing the frequency of repurchasing. The increased use of contact lenses, especially among younger consumers and those using lenses for medical purposes, drives the demand for this larger packaging.

Additionally, the affordability of larger sizes compared to smaller bottles is expected to make 480ml packaging an attractive option. As the trend of long-term lens wear increases, especially in the working population, the demand for larger solution bottles is likely to continue growing. Retailers also benefit from offering this packaging size, as it helps reduce restocking frequency and serves as a more economical option for both consumers and distributors.

Distribution Channel Analysis

Retail accounts for 52.8% of the distribution channel segment in the contact lens solution market. This segment’s dominance is driven by the accessibility and convenience offered by retail outlets, which allow consumers to purchase contact lens solutions during their regular shopping trips. The widespread availability of these products in supermarkets, drugstores, and other retail stores ensures that consumers have easy access to their preferred brands and sizes.

Retail channels benefit from the high foot traffic and impulse buying behavior, especially in locations with high concentrations of contact lens users. The growth in retail sales is also supported by the increasing adoption of contact lenses as a popular choice for vision correction, along with a growing awareness of the importance of proper lens care. Retailers are expected to continue expanding their contact lens solution offerings, further driving the growth of this segment.

Material Analysis

Hybrid lenses dominate the material segment with a 47.1% share, driven by their combination of the benefits of both rigid gas-permeable and soft lenses. Hybrid lenses are expected to experience continued growth due to their unique design that offers the sharp vision of rigid lenses with the comfort of soft lenses. This combination makes them a preferred choice for individuals with specific vision correction needs, such as those with astigmatism or irregular corneas.

The rise in the demand for specialized lenses for complex vision needs is expected to drive the growth of hybrid lenses in the market. Additionally, as more individuals seek long-term comfort without sacrificing visual clarity, hybrid lenses are likely to gain popularity, further boosting their share in the contact lens material segment. Technological advancements that improve the comfort and fit of hybrid lenses are anticipated to drive consumer preference for these lenses, contributing to their sustained growth in the market.

Key Market Segments

By Product Type

- Multi-purpose

- Hydrogen Peroxide-based

By Usage

- 480mL

- 360mL

- 120mL

By Distribution Channel

- Retail

- E-commerce

- Eye Care Professionals

By Material

- Hybrid Lens

- SMEs Gas Permeable

- Silicone Hydrogel

Drivers

The rising number of contact lens wearers globally is driving the market.

The contact lens solution market is experiencing significant growth, primarily driven by the expanding global population of contact lens wearers. This trend is fueled by a combination of factors, including a growing preference for visual aesthetics over traditional eyeglasses and the demand for vision correction that accommodates active lifestyles. For many consumers, contact lenses offer a convenient and discreet way to manage vision issues while participating in sports, social events, and other daily activities.

As the number of people with vision problems continues to grow, so does the market for the products they use. According to the US Centers for Disease Control and Prevention (CDC), approximately 45 million people in the United States wear contact lenses. This large and consistent consumer base represents a fundamental driver of demand for the solutions required for cleaning, disinfecting, and storing their lenses, making the market both robust and sustainable.

Restraints

The increasing popularity of daily disposable contact lenses is restraining the market.

A significant restraint on the market is the rising popularity and adoption of daily disposable contact lenses. These single-use lenses are designed to be worn for one day and then discarded, completely eliminating the need for a cleaning solution. This modality appeals to consumers who prioritize convenience, hygiene, and a simplified lens care routine. The growth of the daily disposable segment directly impacts the market for multi-purpose and hydrogen peroxide solutions, which are necessary for longer-wear lenses.

For example, a 2024 contact lens report showed that for the majority of US optometrists, their go-to initial modality for first-time contact lens wearers was daily disposables, with 74.6% of them reaching for daily lenses. This widespread professional preference is a strong indicator of the future market direction, posing a clear headwind for the traditional contact lens solution segment.

Opportunities

The development of multi-purpose and specialized solutions is creating growth opportunities.

The market is presented with significant opportunities through the continuous innovation in product development, specifically the creation of multi-purpose and specialized solutions. Consumers are seeking products that offer more than just a basic cleaning function; they want solutions that can address specific needs like dry eye, sensitivity, or the unique requirements of certain lens materials. Manufacturers are responding by developing all-in-one solutions that combine cleaning, disinfecting, and protein removal into a single product, simplifying the user experience.

Additionally, new formulations are emerging that contain enhanced moisturizing agents to improve comfort for wearers, particularly for those who suffer from digital eye strain. While the FDA does not provide a public list of new approvals for solutions, it does approve new medical devices, including contact lenses and solutions. For example, the FDA’s medical device approval database for 2022 shows approvals for various eye care products and components, indicating the ongoing regulatory process that enables innovation in this space.

Impact of Macroeconomic / Geopolitical Factors

The contact lens solution market is navigating a complex macroeconomic and geopolitical landscape that impacts both consumer behavior and the stability of its supply chain. In the US, a recent report by The Vision Council in Q2 of 2025 noted a modest change in consumer spending, with an increasing number of consumers purchasing less expensive options. Geopolitical tensions and trade policies also present significant challenges. A new US tariff, implemented under the International Emergency Economic Powers Act, imposes an additional 20% duty on certain Chinese-origin materials, with total duties on some components reaching as high as 50% to 100%.

This directly affects the cost of production for lens care products and related packaging. Despite these headwinds, the market demonstrates resilience and growth potential. The FDA continues to approve new solutions for consumer use, with over a dozen new formulations gaining approval in 2024. This consistent innovation and strong consumer base ensure continued investment in the sector, helping manufacturers adapt to a challenging economic environment.

Latest Trends

The development of solutions with enhanced moisturizing and comfort-enhancing properties is a recent trend.

A significant trend in 2024 is the accelerating development of contact lens solutions with enhanced moisturizing and comfort-enhancing properties, directly addressing the widespread issue of digital eye strain. As screen time for work, education, and entertainment has increased, so has the prevalence of eye discomfort, dryness, and fatigue among contact lens wearers. In response, manufacturers are formulating products that provide a cushion of moisture, helping lenses feel fresh and comfortable throughout the day. This trend is a strategic adaptation to a major consumer need.

A 2024 report on digital eye strain among contact lens wearers highlights the issue, with 99% of respondents who experience digital eye strain having tried at least one method for reducing symptoms. This widespread consumer problem has created a clear and quantifiable demand for solutions that go beyond basic hygiene to deliver a superior comfort experience, positioning them as an essential part of a modern daily eye care routine.

Regional Analysis

North America is leading the Contact Lens Solution Market

The North American contact lens solution market held a commanding 39.2% share of the global market in 2024. This leadership is directly attributed to the high prevalence of refractive errors, a large and growing base of contact lens wearers, and a strong emphasis on eye hygiene and health. The United States has a particularly significant population with vision impairment. According to the CDC’s Vision Health Initiative, approximately 37 million Americans use contact lenses, a figure that includes both corrective and cosmetic wearers.

Furthermore, the high prevalence of myopia and other refractive errors in the region drives a consistent need for vision correction. A 2022 article from NVISION Eye Centers reports that about 34 million Americans over 40 are nearsighted. The market is also fueled by a trend toward daily disposable lenses, which, despite being replaced frequently, still require cleaning and hydration solutions for proper care before and after use. The robust retail and e-commerce infrastructure makes a wide variety of lens care products easily accessible to consumers across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific contact lens solution market is anticipated to experience robust growth during the forecast period. This is largely a result of a massive and rising prevalence of myopia, particularly among the younger population, and increasing disposable incomes. The region’s dense populations and urbanization contribute to a high incidence of eye conditions that require vision correction. A 2022 meta-analysis on the prevalence of amblyopia found the highest prevalence in North America, but also highlighted that Asia had a significant prevalence of 1.16%.

Furthermore, a 2022 study on a large population in China reported a 54.75% prevalence of myopia in adults, demonstrating a substantial patient pool for these products. The market’s expansion is further supported by a growing consumer base that views contact lenses as a fashion accessory, particularly cosmetic lenses, which necessitates proper care and hygiene. This combination of a large consumer base, a growing acceptance of aesthetic and corrective treatments, and a skilled workforce is likely to fuel the market’s growth, allowing it to address the high consumer demand for eye care.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the contact lens solution market are driving growth through several key strategies. They are heavily investing in product innovation, particularly in preservative-free and hydrogen peroxide-based systems that offer superior disinfection and cater to users with sensitive eyes. Companies are also pursuing strategic acquisitions and partnerships to expand their product portfolios and access new technologies.

Furthermore, they are broadening their market reach by targeting emerging economies and implementing aggressive digital marketing campaigns to appeal to a younger, more tech-savvy audience. This combination of innovation and strategic business development is crucial for maintaining a competitive edge.

Alcon, a global leader in eye care, has solidified its position in the market by providing a comprehensive portfolio of vision care solutions. The company’s business model is centered on a deep commitment to research and development, which has led to the creation of flagship products like Opti-Free and Clear Care. Alcon’s strategy involves leveraging its global distribution network to ensure widespread product availability and focusing on consumer education to promote proper eye hygiene. The company’s emphasis on quality and innovation makes it a key partner for many eye care professionals and consumers worldwide.

Top Key Players

- The Cooper Companies, Inc

- Johnson & Johnson Vision Care, Inc

- INTEROJO

- FreshKon (Oculus Private Limited)

- CLB VISION (EYE WOOT Sdn Bhd)

- Ciba Vision (Alcon)

- Bruno Vision Care

- Bausch + Lomb

- Allergan

- Alcon

Recent Developments

- In May 2025, Bausch + Lomb launched Zenlens CHROMA HOA, a state-of-the-art scleral contact lens in the US designed to correct higher-order aberrations. By targeting complex optical distortions, it improves visual clarity, particularly for individuals affected by issues like halos and glare. This breakthrough in wavefront-guided technology offers a customized solution for patients with specific visual needs, setting a new standard in precision optics.

- In April 2025, Bruno Vision Care received FDA approval for Deseyne, an innovative daily disposable contact lens. The lens incorporates bioactive elements that gradually release hydrating agents throughout the day, enhancing wearer comfort and ensuring extended usability without the typical discomfort associated with long-term wear.

- In March 2025, Bausch + Lomb introduced Arise, a pioneering orthokeratology lens fitting system in the US The system utilizes advanced cloud technology and integrates with corneal topographers to design lenses with precision, based on 3D data. The Arise system also features the first FDA-approved Ortho-K lens with toric peripheral curves, offering a more personalized solution for overnight myopia correction, particularly for patients with astigmatism.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 Billion Forecast Revenue (2034) US$ 5.2 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Multi-purpose, Hydrogen Peroxide-based), By Usage (480mL, 360mL, and 120mL), By Distribution Channel (Retail, E-commerce, and Eye Care Professionals), By Material (Hybrid Lens, SMEs Gas Permeable, and Silicone Hydrogel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Cooper Companies, Inc, Johnson & Johnson Vision Care, Inc, INTEROJO, FreshKon (Oculus Private Limited), CLB VISION (EYE WOOT Sdn Bhd), Ciba Vision (Alcon), Bruno Vision Care, Bausch + Lomb, Allergan, Alcon. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Contact Lens Solution MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Contact Lens Solution MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Cooper Companies, Inc

- Johnson & Johnson Vision Care, Inc

- INTEROJO

- FreshKon (Oculus Private Limited)

- CLB VISION (EYE WOOT Sdn Bhd)

- Ciba Vision (Alcon)

- Bruno Vision Care

- Bausch + Lomb

- Allergan

- Alcon