Global Coconut Water Market By Nature (Organic, Conventional), By Packaging (Tetra Pack, Plastic Bottle, Cans, Pouches, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150667

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

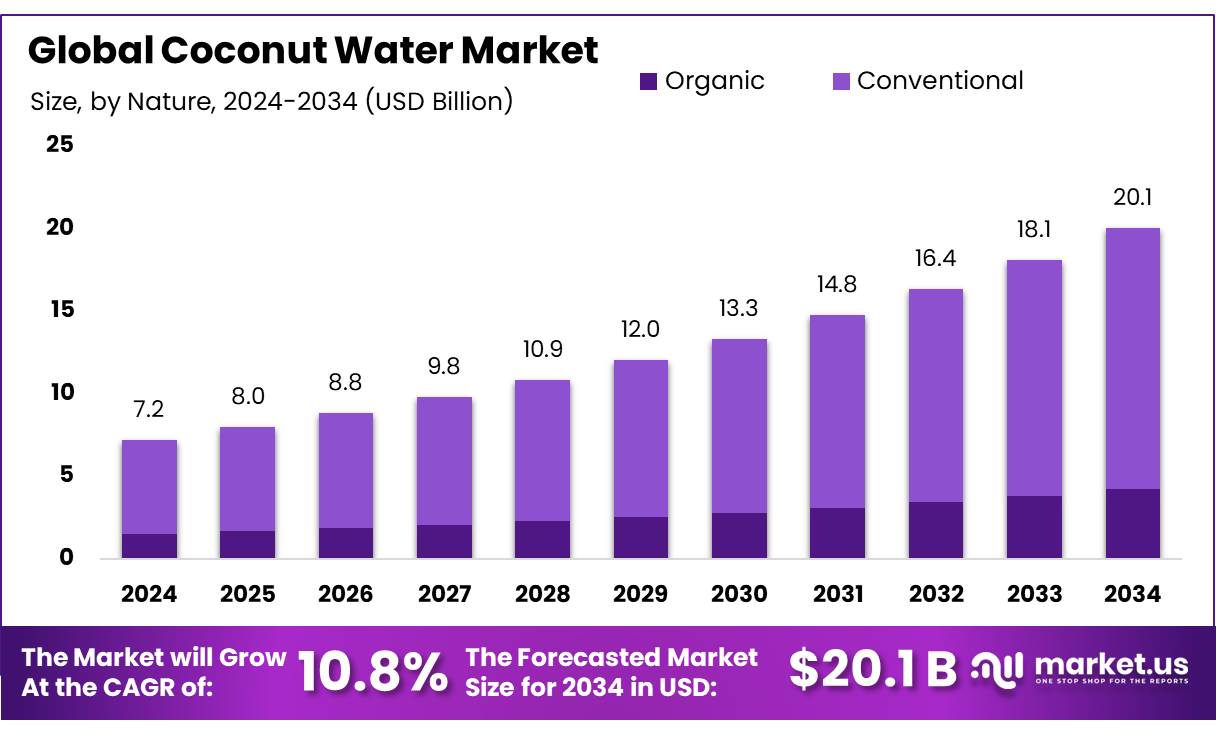

The Global Coconut Water Market size is expected to be worth around USD 20.1 Billion by 2034, from USD 7.2 Billion in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034.

The coconut water concentrate industry has experienced significant growth, driven by increasing consumer demand for healthy, natural beverages. Coconut water concentrate, a dehydrated form of coconut water, offers advantages such as extended shelf life, reduced transportation costs, and versatility in various applications, including beverages, food products, and cosmetics.

India stands as a leading producer of coconuts globally, with a production of approximately 11.7 million metric tonnes in 2018, contributing significantly to the coconut water concentrate industry. The Coconut Development Board (CDB), under the Ministry of Agriculture and Farmers’ Welfare, plays a pivotal role in promoting coconut cultivation and processing. The CDB’s initiatives have led to a 20–25% growth in the domestic industry, highlighting the sector’s potential and the effectiveness of government support.

The Indian government has implemented several programs to bolster the coconut industry. The National Horticulture Mission (NHM) and state-level schemes aim to enhance coconut cultivation and processing capabilities. These initiatives focus on increasing productivity, promoting organic farming, and establishing processing units, thereby improving the supply chain and reducing production costs.

India’s export of coconut water has shown promising growth. Between October 2023 and September 2024, India exported 2,091 shipments of coconut water, marking a 38% increase compared to the previous year. The primary export destinations include the United States, Nepal, and the United Arab Emirates, indicating a strong international demand for Indian coconut water products.

Key Takeaways

- Coconut Water Market size is expected to be worth around USD 20.1 Billion by 2034, from USD 7.2 Billion in 2024, growing at a CAGR of 10.8%.

- Conventional coconut water held a dominant market position, capturing more than a 79.3% share of the global market.

- Tetra Pack held a dominant market position, capturing more than a 49.2% share.

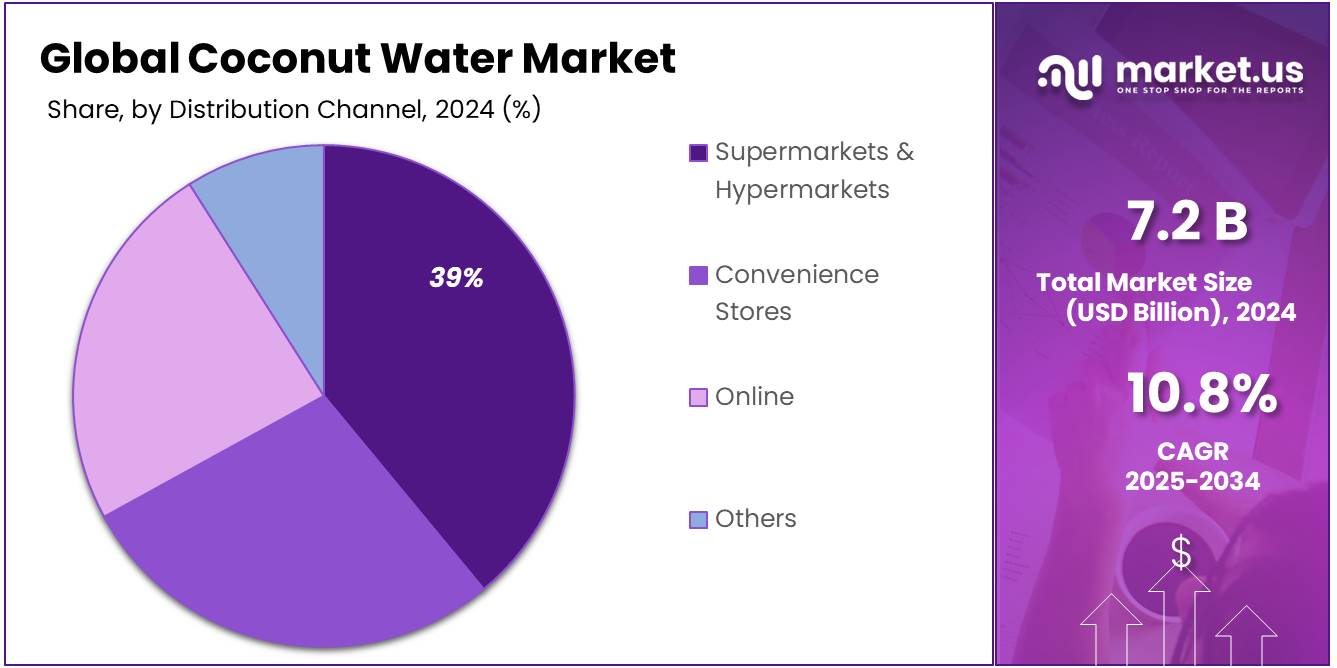

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 39.9% share of the global coconut water market.

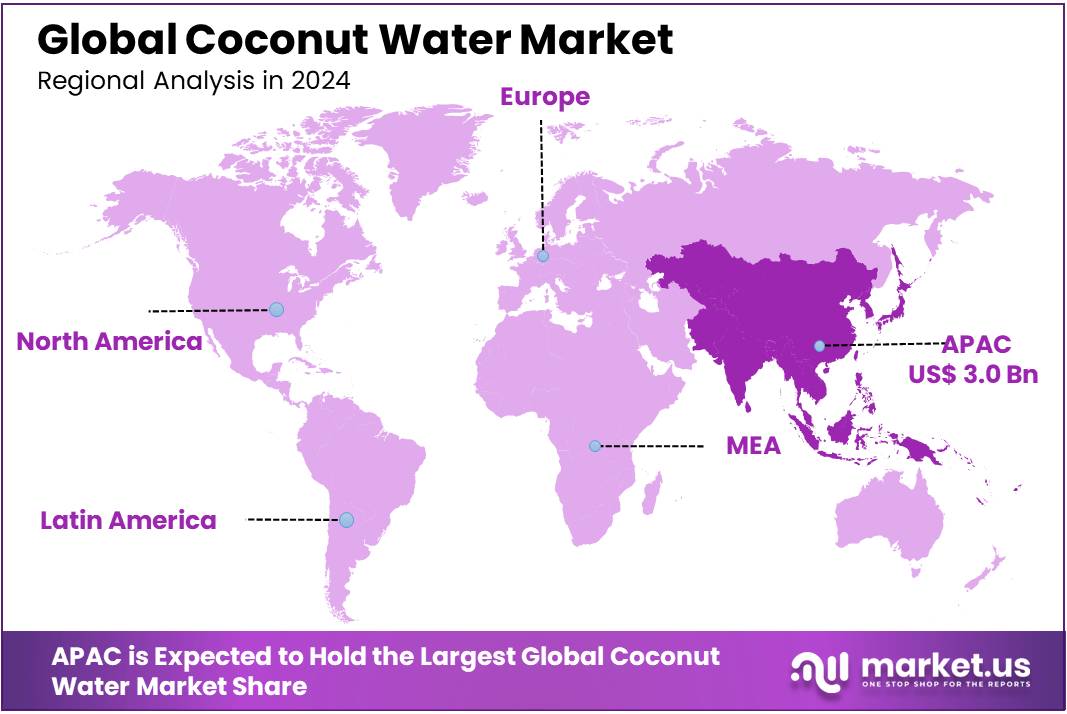

- Asia-Pacific (APAC) region held a dominant position in the global coconut water market, capturing 41.9% of the total market share with an estimated value of USD 3.0 billion.

By Nature

Conventional Coconut Water dominates with 79.3% share in 2024 due to its wide-scale availability and lower price point.

In 2024, Conventional coconut water held a dominant market position, capturing more than a 79.3% share of the global market. This segment has remained the first choice among consumers and manufacturers alike, largely because it is more affordable and widely available compared to its organic counterpart.

Conventional coconut water is sourced from large-scale plantations using standard farming practices, allowing for consistent supply volumes and lower production costs. Its strong presence across mainstream retail channels, especially in supermarkets and convenience stores, has further helped maintain its high market share. Additionally, in developing regions where price sensitivity is higher, conventional options continue to outperform due to their budget-friendly appeal. This dominance is expected to continue in 2025, driven by steady demand from both established and emerging markets.

By Packaging

Tetra Pack dominates coconut water packaging with 49.2% share in 2024, driven by convenience and longer shelf life.

In 2024, Tetra Pack held a dominant market position, capturing more than a 49.2% share in the global coconut water packaging segment. Its lightweight structure, ease of storage, and ability to preserve the drink without refrigeration have made it the preferred choice among both manufacturers and consumers. Tetra Pack packaging not only extends the shelf life of coconut water but also maintains its natural taste and nutritional quality without needing preservatives.

As on-the-go consumption continues to rise, especially in urban areas, the portability of Tetra Packs has contributed to their growing popularity. Their strong presence across retail shelves in countries like the U.S., Brazil, and India also supports this lead. Going into 2025, the demand for eco-friendly, recyclable packaging further supports Tetra Pack’s stronghold in this segment.

By Distribution Channel

Supermarkets & Hypermarkets lead with 39.9% share in 2024 as shoppers prefer easy access and trusted retail formats.

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 39.9% share of the global coconut water market by distribution channel. This leadership can be credited to the strong retail networks and wide shelf visibility these stores offer, making it convenient for consumers to discover and purchase coconut water during regular grocery shopping.

Many leading supermarket chains stock multiple coconut water brands, offering both conventional and organic options, which gives consumers the flexibility to compare prices and choose based on preferences. Promotional pricing, bulk offers, and in-store displays further enhance visibility and sales volume in this channel. In 2025, this trend is expected to persist, especially in urban regions where consumers rely on modern trade for their beverage needs.

Key Market Segments

By Nature

- Organic

- Conventional

By Packaging

- Tetra Pack

- Plastic Bottle

- Cans

- Pouches

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Drivers

Growing Health Awareness and Electrolyte Benefits

A major driving factor for coconut water’s rising popularity is its naturally rich electrolyte profile, especially high potassium content, which has captured consumer interest as a healthier hydration alternative. According to academic analysis, coconut water contains approximately 2,019 mg of potassium per kg (or about 202 mg per 100 ml), positioning it as an effective natural replenisher for fluid balance and muscle health.

This scientific attribute supports consumer trends favoring low-calorie, minimally processed functional beverages. A recent study by Food and Agriculture Organization (FAO) noted that growing health consciousness and preference for nutrient-rich, clean-label drinks have driven interest in preservation technologies that maximize the retention of coconut water’s natural flavor and electrolyte content.

The increasing global push toward healthier lifestyles is reflected in coconut water consumption patterns. The United States Department of Agriculture (USDA) reports that coconut water imports have grown consistently at roughly 15% per year over the past five years, signalling a robust rise in demand within health-oriented markets.

Government support has further amplified this health-driven uptake. In India, the Coconut Development Board (CDB) under the Ministry of Agriculture has initiated programs to diversify coconut-based products—implicitly including coconut water—through enhanced processing technology, research facilities, and farmer training efforts. The CDB operates several regional demonstration farms, and a central Technology Development Centre near Aluva, Kerala, aimed at boosting quality, efficiency, and supply consistency.

Restraints

Short Shelf-Life and Price Volatility Hamper Coconut Water Growth

One major restraining factor in the coconut water market revolves around its inherently short shelf-life combined with volatile raw material prices. As a fresh, minimally processed beverage, coconut water typically endures a refrigerated shelf life of only 30 days under strict conditions (4°C ±1°C) following heat treatment. In practice, however, many retail outlets fail to maintain these standards, leading to premature spoilage, color shifts, and reduced taste quality—a concern confirmed by quality control reports.

This limited shelf life necessitates reliable cold-chain infrastructure from processing units to store shelves, creating a logistical burden. In regions lacking dependable refrigeration—such as parts of Southeast Asia and Latin America—spoilage rates can rise significantly, disrupting supply chains and increasing costs for both producers and retailers.

Government policies and supportive measures, although helpful, often focus on production rather than post-harvest stability. Organizations like India’s Coconut Development Board (CDB) and FAO offer farmer training and productivity programs. However, only FAO has provided guidance for small-scale processing factories, recommending best practices to extend shelf life in tropical climates. Expanded governmental interest in cold-chain subsidies and processing grants could alleviate logistics costs and reduce waste, but such programs remain limited in coverage and scale.

Opportunity

Booming Export Demand Opens New Horizons

One significant growth opportunity for coconut water stems from soaring exports, particularly highlighted by a 50.8% surge in Indonesia’s endocarp coconut exports, reaching USD 113.6 million last year. While this data directly concerns endocarp products, it signals a strong upward trend in global demand for coconut derivatives—including coconut water—as manufacturers and buyers increasingly seek authentic tropical ingredients.

Reports from Indonesia’s statistics agency (BPS) indicate that the momentum continued into early 2025, with export values in the first two months already tripling compared to the same period in 2024. This dramatic rise suggests favourable international trade conditions, growing consumer interest, and stronger networks through which processed coconut products, such as packaged coconut water, can find stable global markets.

Government and international agencies are actively supporting this export boost. For instance, the Food and Agriculture Organization (FAO) and the Indonesian government have collaborated to develop smallholder infrastructure aimed at increasing supply consistency. Their initiatives have included enhanced processing training and export-focused quality assurance systems—crucial elements for value-added coconut water entering developed markets.

Trends

Surge in Flavored and Sparkling Coconut Water

One of the most recent and noticeable trends in coconut water is the rapid rise of flavored and sparkling variants. In 2023, approximately 35% of new product launches featured flavored coconut water—often blended with tropical fruits like pineapple, mango, or passion fruit—reflecting a clear hunger among younger consumers for more taste diversity

Government and institutional backing are further fueling this trend. In the United States, demand for clean, ethically labeled beverages has encouraged producers to pursue certifications like USDA Organic and Fair Trade, expanding shelf visibility and consumer trust for flavored coconut options.

Meanwhile, Asia-Pacific coconut communities—supported by FAO strategies—have boosted capacity for value-added processing, enabling smaller producers to safely produce flavored and sparkling coconut drinks for export.

Regional Analysis

Asia-Pacific leads the coconut water market with 41.9% share valued at USD 3.0 billion, driven by production strength and rising urban demand.

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global coconut water market, capturing 41.9% of the total market share with an estimated value of USD 3.0 billion. This leadership is primarily attributed to the region’s strong coconut-producing economies such as Indonesia, the Philippines, India, Thailand, and Sri Lanka. Together, these countries account for over 73% of global coconut production, according to the Food and Agriculture Organization (FAO).

For instance, Indonesia alone produced nearly 17.1 million tonnes of coconuts in 2022, followed by India at 14.7 million tonnes, supporting a large and stable raw material base for coconut water manufacturing.

Government programs, such as India’s Coconut Development Board initiatives and FAO-backed value chain upgrades in Southeast Asia, are helping standardize processing, improve quality, and expand export capabilities. Moreover, new product launches, especially flavored and organic variants, are gaining popularity in metro cities and export hubs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amy & Brian Naturals is a U.S.-based brand known for offering non-GMO, preservative-free coconut water sourced from young Thai coconuts. Their products are available in both original and flavored variants, including lime and grape. The company focuses on BPA-free packaging and natural hydration targeting fitness-conscious consumers. In 2024, Amy & Brian expanded retail presence across North America and select Asian markets through health-focused retailers and online platforms, strengthening its position in the natural and functional beverage segment.

Blue Monkey Coconut Collection, based in Canada, specializes in 100% pure coconut water and tropical fruit beverages. The brand sources coconuts primarily from Vietnam and Thailand and emphasizes no added sugar or preservatives. In 2024, Blue Monkey launched organic and sparkling coconut water lines, targeting both health and flavor-conscious consumers. The company has a strong footprint in the U.S. and Canadian natural food markets and continues to grow its presence through eco-conscious packaging and clean-label certifications.

C2O Coconut Water is a California-based brand sourcing coconuts from inland groves in Thailand, known for richer taste and lower acidity. The company offers pure coconut water and flavored options like pulp, mango, and pineapple blends. By 2024, C2O had secured shelf space in major U.S. supermarket chains and expanded digital distribution. Its BPA-free packaging and naturally isotonic positioning have made it popular among athletes and wellness consumers, giving it a steady share in the North American coconut water segment.

Top Key Players in the Market

- Amy & Brian Naturals

- Blue Monkey Coconut Collection

- C2O Coconut Water

- Celebes Coconut Corporation.

- Chi Coconut Water

- Cocofina

- Goya Foods, Inc.

- GraceKennedy Limited

- Harmless Harvest

- PepsiCo

- Rubicon Exotic

- Taste Nirvana International, Inc.

- Vita Coco

- Wichy Plantation Company (Pvt) Ltd

- ZICO Rising, Inc.

Recent Developments

In 2024 Amy & Brian Naturals, their 17.5 floz cans retail for about USD 2.79 each (MSRP), with bulk packs of 12 priced at USD 30–33, reflecting strong value positioning.

In 2024, Chi Coconut Water expanded its range to include sparkling coconut water—with 330 ml cans sold at about £1.39 each—featuring zero calories, zero sugar, and clean ingredient labels.

Report Scope

Report Features Description Market Value (2024) USD {{val1}} Forecast Revenue (2034) USD {{val2}} CAGR (2025-2034) {{cagr}}% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Packaging (Tetra Pack, Plastic Bottle, Cans, Pouches, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amy & Brian Naturals, Blue Monkey Coconut Collection, C2O Coconut Water, Celebes Coconut Corporation., Chi Coconut Water, Cocofina, Goya Foods, Inc., GraceKennedy Limited, Harmless Harvest, PepsiCo, Rubicon Exotic, Taste Nirvana International, Inc., Vita Coco, Wichy Plantation Company (Pvt) Ltd, ZICO Rising, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amy & Brian Naturals

- Blue Monkey Coconut Collection

- C2O Coconut Water

- Celebes Coconut Corporation.

- Chi Coconut Water

- Cocofina

- Goya Foods, Inc.

- GraceKennedy Limited

- Harmless Harvest

- PepsiCo

- Rubicon Exotic

- Taste Nirvana International, Inc.

- Vita Coco

- Wichy Plantation Company (Pvt) Ltd

- ZICO Rising, Inc.