Global Chitin Market Size, Share Analysis Report By Derivative Type (Glucosamine, Chitosan, Others), By End-Use (Healthcare, Food And Beverages, Agrochemical, Cosmetics and Toiletries, Waste and Water Treatment, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160539

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

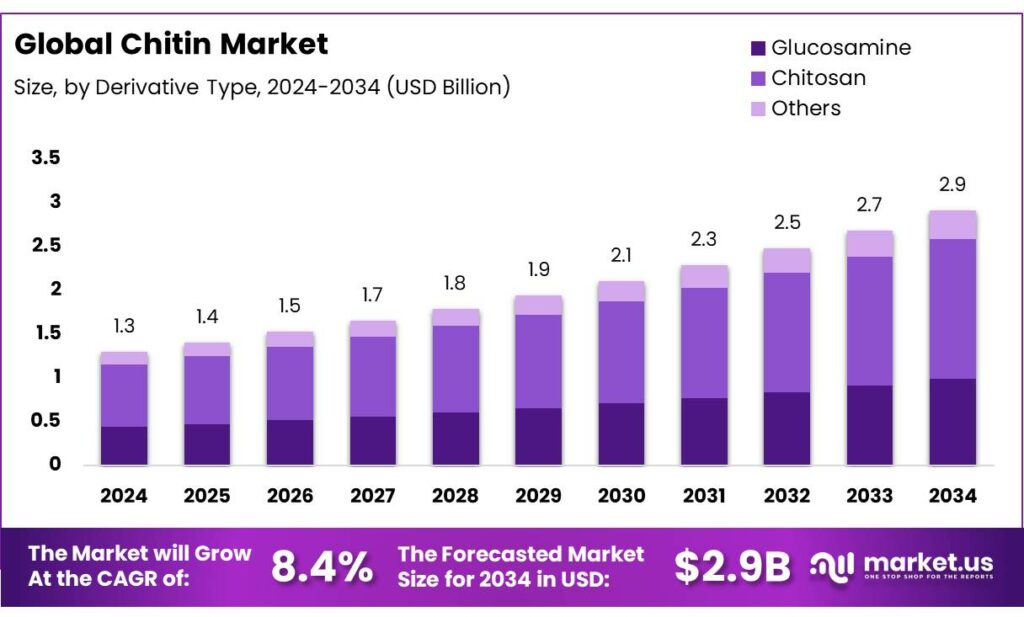

The Global Chitin Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034.

The Indian government’s initiatives are pivotal in fostering the chitin industry. The Pradhan Mantri Matsya Sampada Yojana (PMMSY), launched in 2019, aims to enhance fish production and processing, thereby increasing the availability of raw materials for chitin production. The scheme targets an increase in fish production to 700 thousand tonnes and aims to provide employment opportunities to 5.5 million people in the next five years.

Additionally, the government’s focus on promoting organic fertilizers supports the adoption of chitin-based products in agriculture, aligning with the global shift towards sustainable farming practices.

The chitin industry is characterized by its reliance on marine by-products, particularly from crustaceans such as shrimp and crabs. In India, the annual production potential of chitin from shrimp shells is estimated at 3,560 tonnes.

Government initiatives have further bolstered the chitin sector. The Ministry of Agriculture and Farmers Welfare has been actively promoting the use of organic fertilizers, including chitin-based products, through various schemes and subsidies. These measures aim to enhance soil health and reduce dependency on chemical fertilizers, aligning with the government’s vision of sustainable agriculture.

Key Takeaways

- Chitin Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 8.4%.

- Chitosan maintained a dominant position in the chitin derivative market, capturing more than a 54.80% share.

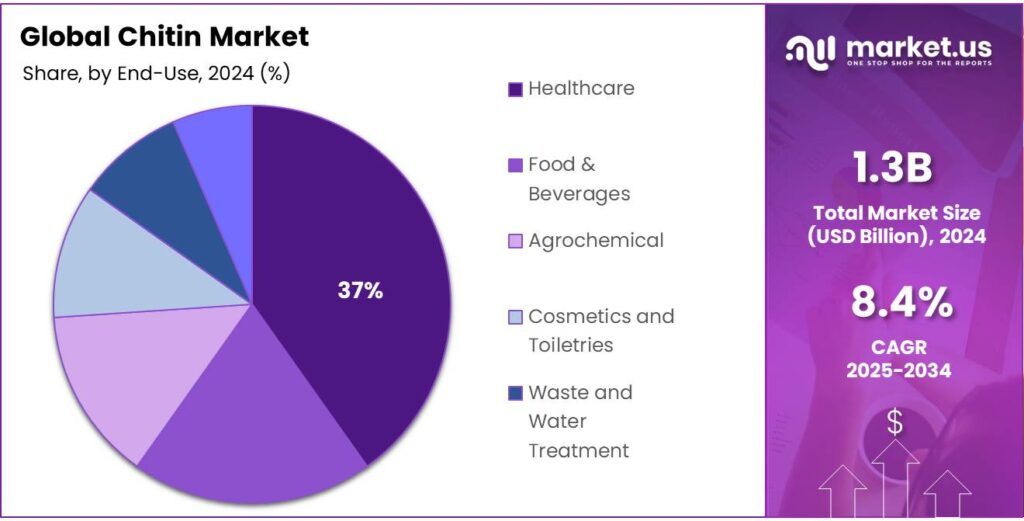

- Healthcare sector maintained a dominant position in the chitin market, capturing more than a 37.4% share.

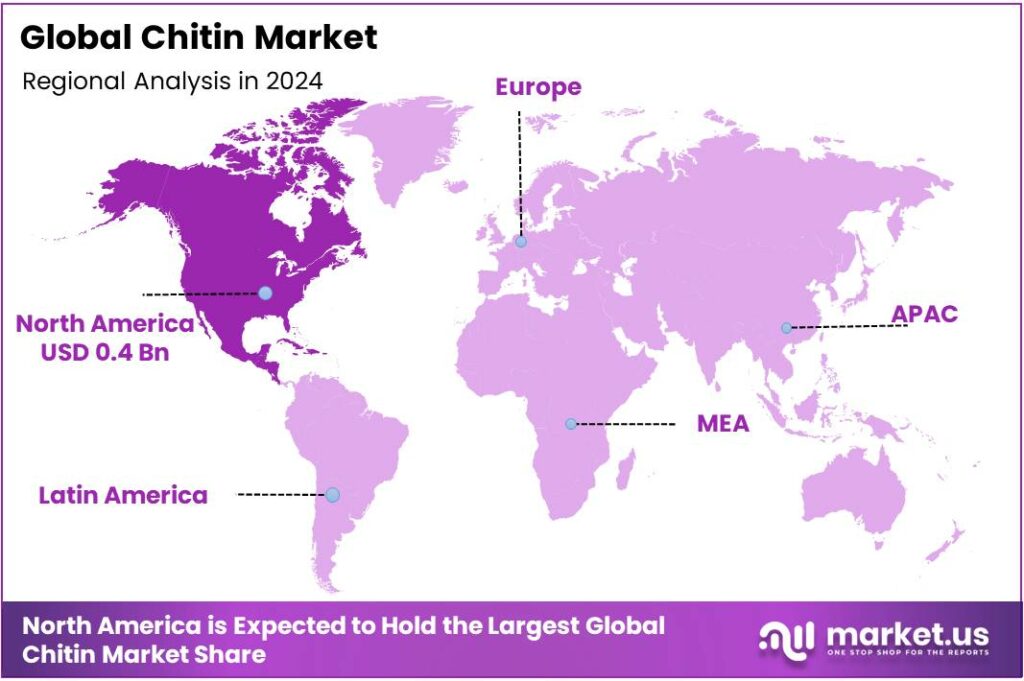

- North America held a dominant position in the global chitin market, capturing a 34.7% share, translating to approximately USD 0.4 billion.

By Derivative Type Analysis

Chitosan Dominates the Chitin Derivative Market with Over 54.80% Share in 2024

In 2024, chitosan maintained a dominant position in the chitin derivative market, capturing more than a 54.80% share. This prevalence is attributed to chitosan’s superior solubility, biocompatibility, and biodegradability, which make it highly suitable for applications in pharmaceuticals, agriculture, and food industries.

The widespread adoption of chitosan can be attributed to its diverse applications across various sectors. In the pharmaceutical industry, chitosan is utilized for drug delivery systems, wound dressings, and as a fat-binding agent in weight management products. Its role as a natural biopolymer aligns with the growing consumer demand for sustainable and natural alternatives in health-related products. Additionally, chitosan’s efficacy in water treatment processes, particularly in wastewater management, has bolstered its demand in environmental applications.

By End-Use Analysis

Healthcare Sector Leads Chitin Market with 37.4% Share in 2024

In 2024, the healthcare sector maintained a dominant position in the chitin market, capturing more than a 37.4% share. This prominence is attributed to the increasing applications of chitin and its derivatives, particularly chitosan, in biomedical and pharmaceutical fields. Chitosan’s biocompatibility and biodegradability make it an ideal candidate for various medical applications, including drug delivery systems, wound healing, and tissue engineering.

The growing demand for natural and sustainable materials in healthcare products has further propelled the adoption of chitin-based solutions. For instance, chitosan’s role in enhancing the efficacy of drug formulations and its use in developing advanced wound care products have been significant contributors to its market share in the healthcare sector. Additionally, the increasing focus on personalized medicine and regenerative therapies has opened new avenues for the utilization of chitin derivatives in medical applications.

Key Market Segments

By Derivative Type

- Glucosamine

- Chitosan

- Others

By End-Use

- Healthcare

- Food & Beverages

- Agrochemical

- Cosmetics and Toiletries

- Waste and Water Treatment

- Others

Emerging Trends

Active and Intelligent Chitosan-Based Food Packaging

A significant trend in the chitin industry is the development of active and intelligent chitosan-based food packaging materials. These innovations aim to enhance food preservation, extend shelf life, and provide real-time information about the condition of packaged foods.

Active packaging involves incorporating bioactive agents into packaging materials to interact with the food or its environment, thereby improving food quality and safety. Chitosan, a biopolymer derived from chitin, is particularly suitable for this purpose due to its antimicrobial properties, biodegradability, and non-toxicity. Studies have shown that chitosan-based films can effectively inhibit the growth of various foodborne pathogens, including Escherichia coli and Salmonella species, thereby reducing the risk of foodborne illnesses.

Intelligent packaging, on the other hand, incorporates sensors or indicators that can monitor and communicate the condition of the food product. For example, chitosan films can be combined with natural additives such as anthocyanins to create colorimetric indicators that change color in response to changes in pH or the presence of spoilage microorganisms. This real-time monitoring allows consumers and producers to assess the freshness of the product without opening the packaging.

The adoption of chitosan-based active and intelligent packaging aligns with global trends towards sustainability and food safety. Governments and international organizations are increasingly supporting the development and implementation of such technologies. For instance, the European Union’s Horizon 2020 program has funded several projects focused on developing biodegradable and active packaging solutions, including those based on chitosan.

Drivers

Government Initiatives and Policy Support

Governments worldwide are increasingly recognizing the environmental impact of single-use plastics and are implementing policies to promote sustainable alternatives. This regulatory shift is significantly influencing the growth of the chitin industry, particularly in the food sector.

For instance, the European Union has been proactive in encouraging the use of biodegradable materials. Under the European Green Deal, there is a concerted effort to reduce plastic waste and promote the use of bio-based materials. This includes support for innovations in biodegradable packaging, such as chitin-based products, which are gaining traction as sustainable alternatives to traditional plastics.

Similarly, in the United States, the Department of Agriculture’s Sustainable Packaging Innovation Lab is funding projects that explore biodegradable packaging solutions. One such initiative involves the development of antimicrobial packaging materials derived from chitin, aiming to extend the shelf life of food products and reduce food waste. This aligns with the growing consumer demand for eco-friendly packaging options.

In Asia, countries like Japan and South Korea are also implementing policies to encourage the use of biodegradable materials. These policies are fostering innovation in the chitin industry, leading to the development of new applications in food packaging and preservation.

Restraints

High Production Costs and Economic Constraints

One of the most significant challenges hindering the widespread adoption of chitin and its derivative, chitosan, is the high cost associated with their production. Despite the abundance of raw materials—primarily crustacean shells from shrimp, crabs, and lobsters—the extraction and purification processes are energy-intensive and require specialized equipment, leading to elevated production costs.

For instance, at the pilot scale, the production cost of chitin has been estimated at approximately $125 per kilogram, with the cost decreasing to around $100 per kilogram at larger scales due to economies of scale. However, these costs remain substantially higher than those of other biodegradable materials, such as cellulose nanocrystals, which are priced below $10 per kilogram.

This high production cost poses a significant barrier to the commercialization of chitin-based products, especially in price-sensitive markets. To make chitin more competitive with other materials, ongoing research is focused on optimizing extraction processes to reduce costs. Advancements in biotechnology, such as the development of more efficient enzymes and fermentation techniques, hold promise for lowering production costs in the future

While alternative methods, such as enzymatic and microbial extraction, offer more environmentally friendly approaches, they are often slower and may not achieve the same level of purity or yield as chemical methods. Additionally, the cost of enzymes and the need for controlled fermentation conditions can add to the overall expense

Opportunity

Insect-Derived Chitin: A Sustainable and Cost-Effective Alternative

The chitin industry is exploring insect-derived sources as a sustainable and cost-effective alternative to traditional crustacean-based chitin. Insects such as Hermetia illucens (black soldier fly), Zophobas morio (superworm), and Tenebrio molitor (mealworm) are rich in chitin and can be cultivated with minimal resources. This approach aligns with global sustainability goals and offers a promising solution to the challenges faced by the chitin industry.

Insect farming requires significantly less land, water, and feed compared to traditional livestock, making it an environmentally friendly option. For instance, black soldier fly larvae can be grown on organic waste, converting it into high-quality protein and chitin. This process not only provides a valuable raw material but also contributes to waste reduction and nutrient recycling.

Economically, insect-derived chitin presents a more affordable alternative. The production cost of chitosan from insects has been reported to be as low as $8.39 per kilogram in Ecuador, compared to $14 per kilogram in Spain . This cost advantage is attributed to the efficient use of resources and the scalability of insect farming.

Regional Insights

North America Leads Chitin Market with 34.7% Share in 2024

In 2024, North America held a dominant position in the global chitin market, capturing a 34.7% share, translating to approximately USD 0.4 billion in market value. The United States was the primary contributor, accounting for over 70% of the regional consumption, with more than 2,800 metric tons utilized, predominantly in pharmaceuticals and cosmetics. Canada also played a significant role, investing in fungal-derived chitin research through over 75 active university-led projects, reflecting the region’s commitment to sustainable and innovative applications of chitin.

The growth of the chitin market in North America can be attributed to several factors. The increasing demand for biodegradable and sustainable materials has driven the adoption of chitin-based products across various industries, including agriculture, medicine, and food packaging. In the pharmaceutical sector, chitosan, a derivative of chitin, is widely used in drug delivery systems, wound dressings, and as a fat-binding agent in weight management products. Its biocompatibility and biodegradability make it an attractive alternative to synthetic materials.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Primex Ehf, based in Iceland, specializes in the sustainable production of high-quality chitosan derived from shrimp shells harvested in the North Atlantic Ocean. Their products, including ChitoClear® and LipoSan Ultra®, are renowned for their purity and are widely used in the pharmaceutical, food, and agriculture industries. The company’s adherence to stringent environmental standards underscores its commitment to sustainability.

Located in Germany, Heppe Medical Chitosan GmbH focuses on producing high-purity chitin and chitosan derivatives for the pharmaceutical and cosmetic industries. Their offerings include over 100 different chitosan variants, tailored to meet specific industry requirements. The company’s emphasis on quality and long-term delivery capabilities has established it as a trusted supplier in the biopolymer sector.

Founded in 1994, Golden-Shell Pharmaceutical Co., Ltd., based in China, is one of the largest manufacturers of chitin and its derivatives globally. The company produces a wide range of products, including glucosamine, chitosan, and oligosaccharides, serving over 30 countries. Their extensive product portfolio and international reach highlight their significant presence in the global chitin market.

Top Key Players Outlook

- Kitozyme S.A.

- Primex Ehf

- Heppe Medical Chitosan GmbH

- Advanced Biopolymers AS

- Golden-Shell Pharmaceutical Co., Ltd.

- G.T.C. Bio Corporation

- Panvo Organics Pvt. Ltd.

- Bio21 Co., Ltd.

- Kunpoong Bio Co., Ltd.

- FMC Corporation

Recent Industry Developments

Advanced Biopolymers AS, founded in 2010 and headquartered in Trondheim, Norway, is a specialized company focused on producing high-quality chitosan with a narrow degree of acetylation (DA) between 0.25 and 0.60.

In 2023, Panvo Organics reported a 15% increase in market share, attributed to the success of its chitosan-based products in enhancing crop yield and soil health

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Derivative Type (Glucosamine, Chitosan, Others), By End-Use (Healthcare, Food And Beverages, Agrochemical, Cosmetics and Toiletries, Waste and Water Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kitozyme S.A., Primex Ehf, Heppe Medical Chitosan GmbH, Advanced Biopolymers AS, Golden-Shell Pharmaceutical Co., Ltd., G.T.C. Bio Corporation, Panvo Organics Pvt. Ltd., Bio21 Co., Ltd., Kunpoong Bio Co., Ltd., FMC Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kitozyme S.A.

- Primex Ehf

- Heppe Medical Chitosan GmbH

- Advanced Biopolymers AS

- Golden-Shell Pharmaceutical Co., Ltd.

- G.T.C. Bio Corporation

- Panvo Organics Pvt. Ltd.

- Bio21 Co., Ltd.

- Kunpoong Bio Co., Ltd.

- FMC Corporation