Global Ceramic Cookware Market Size, Share, And Business Benefits By Product (Cookware Sets, Skillet and Frying Pans, Dutch Ovens and Stock Pots, Saute Pan, Saucepans, Grill Pans and Griddles, Others), By End-use (Residential, Commercial), By Distribution Channel (Supermarket/ Hypermarket, Specialty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157405

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

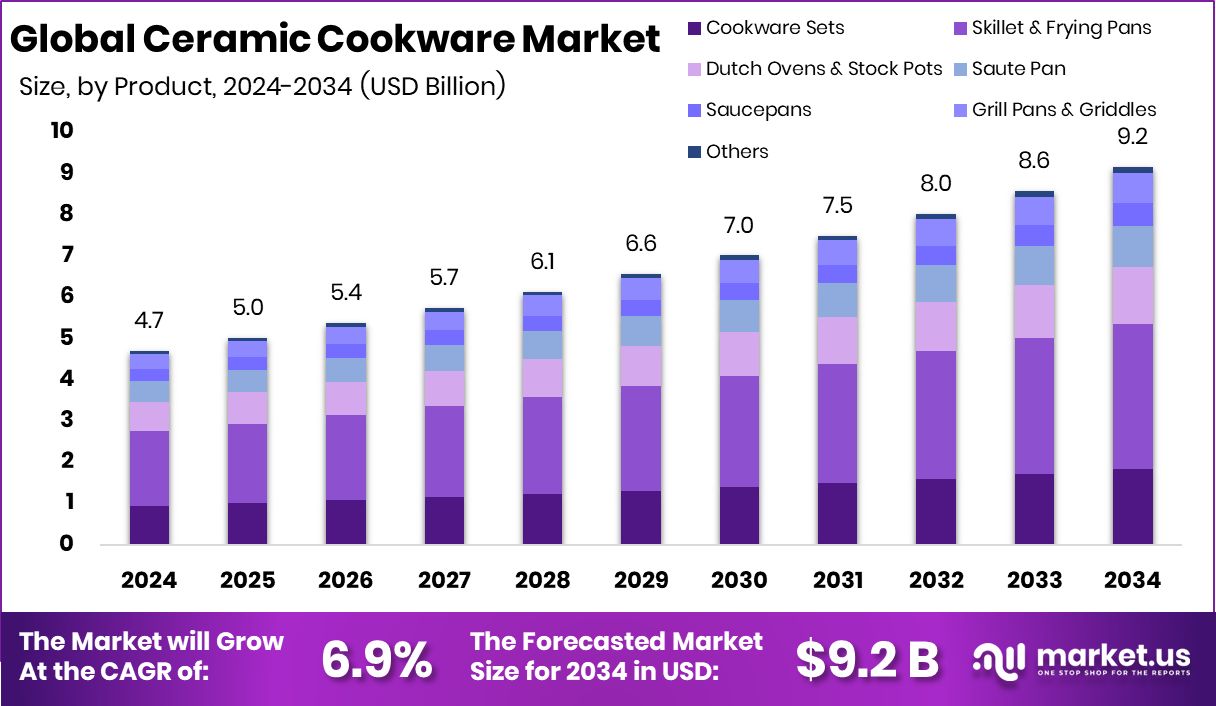

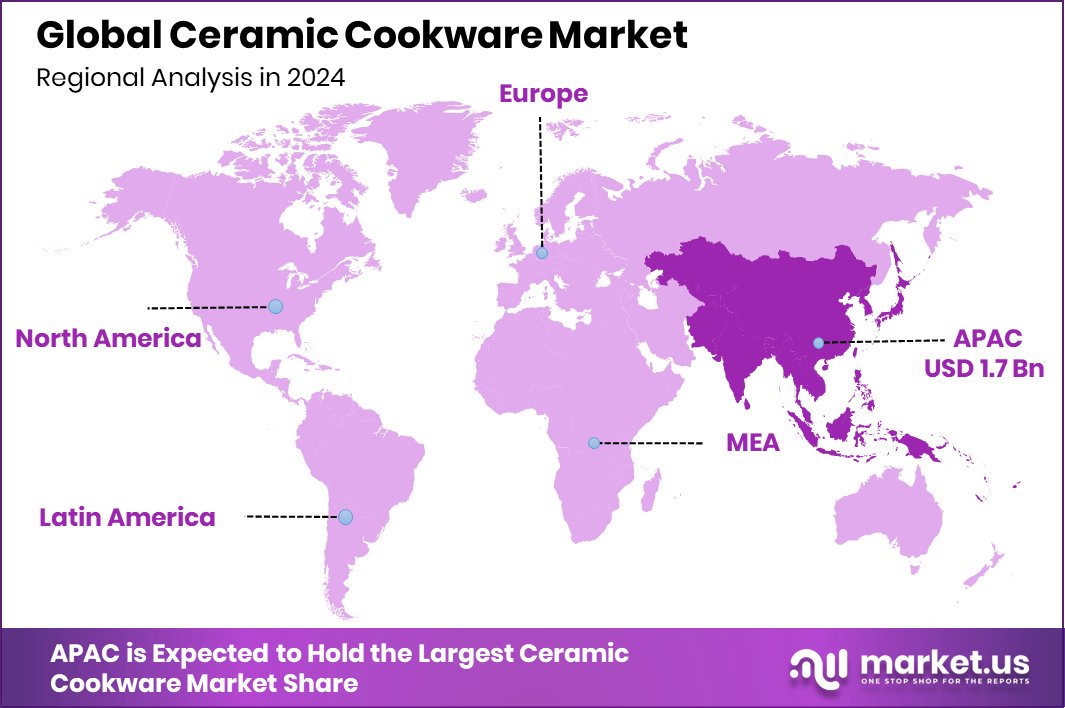

The Global Ceramic Cookware Market is expected to be worth around USD 9.2 billion by 2034, up from USD 4.7 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. Asia Pacific’s 37.80% share, reaching USD 1.7 Bn, highlights strong consumer preference for ceramic cookware.

Ceramic cookware refers to pots, pans, and kitchen utensils that are either made entirely from ceramic materials or coated with a ceramic layer over a metal base. It is valued for its non-stick surface, even heat distribution, and ability to cook food with minimal oil. Unlike traditional cookware, ceramic options are free from harmful chemicals like PTFE and PFOA, making them a healthier and more eco-friendly choice for everyday cooking. According to an industry report, Cumin Co. secures $1.5M funding to grow its healthy cookware line in India.

One of the major growth factors for ceramic cookware is the rising consumer preference for safe and chemical-free cooking options. With increasing awareness of food safety and health, people are shifting toward cookware that does not release toxins when heated. Ceramic coatings, being naturally non-toxic, are strongly benefiting from this demand shift. According to an industry report, The Indus Valley raises $1.1M backed by Rukam Capital, DSG Consumer Partners, and The Chennai Angels.

The demand for ceramic cookware is also driven by lifestyle changes and the growing trend of home cooking. Consumers now look for cookware that is not only functional but also stylish and easy to clean. Ceramic cookware fits well into modern kitchens due to its attractive finishes and lightweight design, making it popular among younger households. According to an industry report, Cookware startup Caraway raises $5.3M to explore fresh product categories.

An important opportunity for the ceramic cookware market lies in the increasing global push toward sustainable and eco-friendly products. As governments and consumers prioritize environmentally conscious choices, ceramic cookware, which avoids synthetic chemicals and lasts longer, has the chance to expand its reach further into mainstream households. This shift creates room for wider adoption across both developing and developed markets. According to an industry report, Direct-to-consumer cookware brand Caraway raises $35M for expansion.

Key Takeaways

- The Global Ceramic Cookware Market is expected to be worth around USD 9.2 billion by 2034, up from USD 4.7 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- Ceramic Cookware Market saw Skillets and Frying Pans dominate with 38.5%.

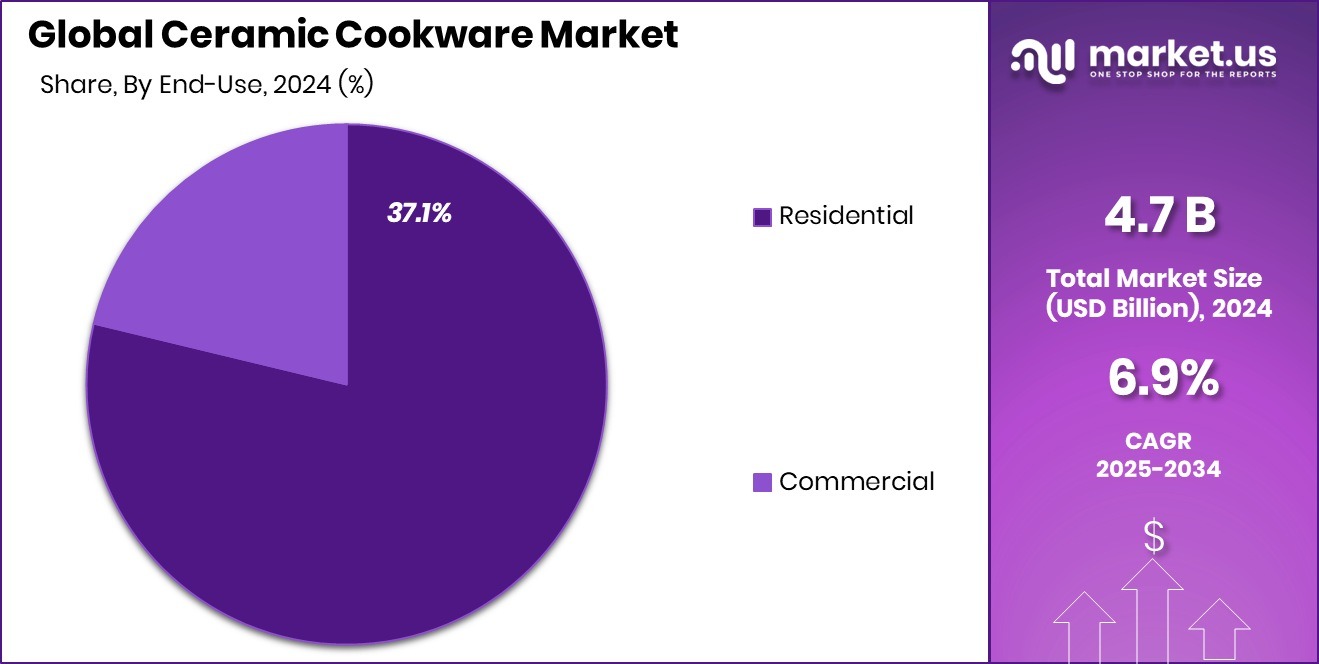

- Residential use led the Ceramic Cookware Market strongly, holding 85.3% share.

- Supermarket/Hypermarket drove Ceramic Cookware Market sales, capturing 37.1%.

- Growing household demand across the Asia Pacific, valued at USD 1.7 Bn, supports the 37.80% regional share.

By Product Analysis

By Product, skillets and frying pans hold 38.5% share, reflecting strong household cooking preference globally.

In 2024, Skillet and Frying Pans held a dominant market position in the By Product segment of the Ceramic Cookware Market, with a 38.5% share. This strong presence reflects the everyday necessity of skillets and frying pans in both household and professional kitchens.

Their versatility for preparing a wide range of dishes—from sautéed vegetables and stir-fries to seared meats and breakfast items—has made them the most commonly used type of cookware among consumers. The ceramic coating enhances their appeal, offering a healthier, non-stick cooking experience that requires minimal oil while ensuring easy cleanup, a feature highly valued in busy modern lifestyles.

The dominance of this product type is also tied to consumer preference for durable, safe, and aesthetically appealing cookware. Skillets and frying pans made with ceramic are perceived as safer alternatives to traditional non-stick cookware, aligning with the growing demand for chemical-free cooking solutions.

Their lightweight nature and ability to maintain even heating further boost their adoption across global households. With the continued trend of home cooking and rising awareness about healthier meal preparation, the 38.5% market share of skillets and frying pans highlights their role as the backbone of the ceramic cookware market, sustaining consistent demand.

By End-use Analysis

By End-use, residential usage dominates with an 85.3% share, highlighting the rising adoption of ceramic cookware in homes.

In 2024, Residential held a dominant market position in the by-end-use segment of the Ceramic Cookware Market, with an 85.3% share. This overwhelming dominance is driven by the rising culture of home cooking, health-conscious lifestyles, and the growing preference for safer, non-toxic cookware.

Ceramic cookware has become a staple in households due to its natural non-stick surface, even heat distribution, and chemical-free properties, making it particularly attractive for families seeking healthier meal preparation. The ability to cook with less oil while ensuring easy cleaning has further strengthened its adoption in daily residential use.

The residential segment’s leadership is also supported by changing consumer behavior, where cooking at home is not only viewed as a necessity but also as a lifestyle choice influenced by wellness trends and cost efficiency. The attractive designs and wide variety of colors available in ceramic cookware also appeal to modern households, where kitchen aesthetics play an increasing role in buying decisions.

With 85.3% share, the residential segment underscores how households are the primary growth driver for ceramic cookware, reflecting strong and consistent demand across both developed and emerging markets. This dominance highlights the sustained trust of consumers in ceramic cookware for everyday cooking needs.

By Distribution Channel Analysis

By Distribution Channel, supermarkets and hypermarkets lead at 37.1%, showcasing consumer trust in physical retail purchases.

In 2024, Supermarket/Hypermarket held a dominant market position in the By Distribution Channel segment of the Ceramic Cookware Market, with a 37.1% share. This leadership is largely attributed to the convenience and accessibility these retail formats provide to consumers.

Supermarkets and hypermarkets serve as one-stop destinations where shoppers can physically examine cookware products, compare sizes, designs, and prices, and make immediate purchase decisions. For ceramic cookware, which is often bought based on look, feel, and perceived quality, in-store visibility plays a critical role in influencing customer preference.

The dominance of this channel also reflects the trust consumers place in established retail outlets, which often carry recognized and certified cookware products. Promotional offers, discounts, and attractive product displays in supermarkets and hypermarkets further stimulate buying behavior, making them a primary choice for cookware purchases. Additionally, urban consumers increasingly prefer large-format stores for the assurance of variety and the ability to assess cookware durability before buying.

With a 37.1% share, this channel highlights the continued importance of physical retail in cookware sales, even as other formats grow. The position of supermarkets and hypermarkets underscores their role in driving ceramic cookware adoption by combining convenience, trust, and purchasing confidence.

Key Market Segments

By Product

- Cookware Sets

- Skillet and Frying Pans

- Dutch Ovens and Stock Pots

- Saute Pan

- Saucepans

- Grill Pans and Griddles

- Others

By End-use

- Residential

- Commercial

By Distribution Channel

- Supermarket/ Hypermarket

- Specialty Stores

- Online

- Others

Driving Factors

Rising Health Awareness Boosting Ceramic Cookware Demand

One of the biggest driving factors for the ceramic cookware market is the growing awareness among consumers about health and safety in cooking. People are becoming more conscious of avoiding harmful chemicals like PTFE and PFOA, which are often found in traditional non-stick cookware.

Ceramic cookware stands out because it provides a naturally non-toxic surface that does not release fumes or contaminants when heated. This makes it a safer choice for families who want to prepare healthy meals.

In addition, its non-stick surface allows cooking with less oil, which supports healthier eating habits. With the global shift toward wellness and clean living, the demand for ceramic cookware continues to grow steadily, positioning it as a preferred option for households.

Restraining Factors

Limited Durability and Shorter Lifespan Challenge Growth

A key restraining factor for the ceramic cookware market is its limited durability compared to other cookware types. While ceramic cookware is appreciated for being non-toxic and visually appealing, it often faces issues like chipping, scratching, and wearing out of the non-stick surface over time.

Frequent use at high temperatures or improper handling can shorten its lifespan, leading to replacements more often than with stainless steel or cast-iron cookware. This creates hesitation among cost-conscious buyers who look for long-term value in kitchen investments.

As a result, even though ceramic cookware offers clear health and cooking benefits, its shorter durability remains a drawback, slowing down its wider acceptance in markets that value longevity and toughness.

Growth Opportunity

Eco-Friendly Trends Creating Opportunities for Ceramic Cookware

One major growth opportunity for the ceramic cookware market lies in the rising global focus on eco-friendly and sustainable products. Consumers today are increasingly choosing items that are safe for health and also kind to the environment.

Ceramic cookware fits this demand because it is free from harmful chemicals and often made with environmentally conscious production methods. As governments and organizations promote greener lifestyles, the appeal of ceramic cookware is expected to grow further.

In addition, younger generations are more willing to spend on eco-friendly products that combine safety, style, and sustainability. This shift presents a strong opportunity for ceramic cookware to expand its market reach and establish itself as a preferred choice worldwide.

Latest Trends

Stylish and Colorful Designs Driving Consumer Preference

A key latest trend in the ceramic cookware market is the growing demand for stylish and colorful designs. Modern consumers no longer see cookware as just a utility; they view it as part of their kitchen’s overall look and lifestyle. Ceramic cookware, available in a variety of vibrant colors, sleek finishes, and elegant shapes, fits this trend perfectly.

Many households, especially younger buyers, prefer cookware that looks attractive when placed on shelves or even directly on dining tables. This blend of function and style is pushing ceramic cookware ahead of traditional options. The trend of matching cookware with kitchen décor continues to gain popularity, making aesthetics a strong influence on purchase decisions in this market.

Regional Analysis

In 2024, the Asia Pacific dominated the Ceramic Cookware Market with a 37.80% share worth USD 1.7 Bn.

The Ceramic Cookware Market shows significant regional diversity, with Asia Pacific emerging as the dominant region in 2024. Holding a 37.80% share valued at USD 1.7 billion, Asia Pacific’s leadership is fueled by its vast population base, rising disposable incomes, and a cultural inclination toward home-cooked meals.

Consumers in countries like China, India, and Japan are increasingly adopting ceramic cookware due to its non-toxic, eco-friendly, and visually appealing qualities, aligning with the region’s shift toward healthier lifestyles. Rapid urbanization and the expansion of modern retail formats such as supermarkets and hypermarkets have also boosted the availability and visibility of ceramic cookware across the region.

While North America and Europe continue to show steady adoption driven by health-conscious consumers, the growth trajectory in the Asia Pacific is stronger because the younger population prefers modern, stylish kitchenware, and the expanding middle class.

Meanwhile, markets in the Middle East & Africa and Latin America are gradually adopting ceramic cookware, influenced by changing cooking habits and exposure to global kitchenware trends. However, Asia Pacific’s 37.80% share clearly positions it as the dominant force, highlighting its critical role in shaping the global ceramic cookware market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tramontina USA has maintained its reputation by offering high-quality and durable ceramic cookware that appeals to a broad customer base. The company’s emphasis on versatile product lines and accessibility through multiple retail channels has ensured a consistent presence in households. Its ability to balance functionality with affordability continues to make it a preferred choice for everyday consumers.

Our Place, on the other hand, has capitalized on modern kitchen trends, gaining popularity with younger buyers. Its focus on multi-functional cookware designed to save space and simplify cooking resonates strongly with urban households. The brand’s storytelling, stylish aesthetics, and emphasis on sustainability have positioned it as more than just cookware—it has become part of a lifestyle movement.

Williams-Sonoma Inc. has leveraged its premium branding and extensive retail network to strengthen its role in the ceramic cookware market. By combining high-end quality with an experiential shopping model, the company appeals to consumers who value both performance and design. Its ability to integrate cookware into a broader home and lifestyle offering further enhances its brand loyalty.

Top Key Players in the Market

- Tramontina USA.

- Our Place

- Williams-Sonoma Inc.

- Wayfair LLC

- Sunbeam Products, Inc.

- Nordic Ware.

- The Cookware Company (USA), LLC.

- Meyer Group

- Fissler GmbH

Recent Developments

- In September 2024, Williams-Sonoma exclusively expanded its Tucci by GreenPan line, introducing 34 new pieces. These additions—designed in collaboration with Stanley Tucci—feature PFAS-free ceramic nonstick coatings, stylish ‘stay-cool’ handles, and enhanced shapes and colors.

- In February 2024, during Wayfair’s Presidents’ Day sale, the Gotham Steel 10-piece ceramic non-stick cookware set featured prominently, discounted from $200 to $79—highlighting Wayfair’s role in offering compelling ceramics deals during major promotional events.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 9.2 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cookware Sets, Skillet and Frying Pans, Dutch Ovens and Stock Pots, Saute Pan, Saucepans, Grill Pans and Griddles, Others), By End-use (Residential, Commercial), By Distribution Channel (Supermarket/ Hypermarket, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tramontina USA., Our Place, Williams-Sonoma Inc., Wayfair LLC, Sunbeam Products, Inc., Nordic Ware., The Cookware Company (USA), LLC., Meyer Group, Fissler GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ceramic Cookware MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Ceramic Cookware MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tramontina USA.

- Our Place

- Williams-Sonoma Inc.

- Wayfair LLC

- Sunbeam Products, Inc.

- Nordic Ware.

- The Cookware Company (USA), LLC.

- Meyer Group

- Fissler GmbH