Global Stainless Steel Plate Market By Type (304 Stainless Steel Sheet, 310 Stainless Steel Sheet, 316 Stainless Steel Sheet, Series 200, Series 400, Others), By Product Type (Austenitic, Ferritic, Martensitic, Duplex, Others), By Application (Automotive and Transportation, Building and Construction, Consumer Goods, Heavy Industries, Others), By Thickness (3mm and Below, 3mm to 5mm, 5mm and Above), By End-User (Construction, Automotive, Machinery, Aerospace, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139529

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

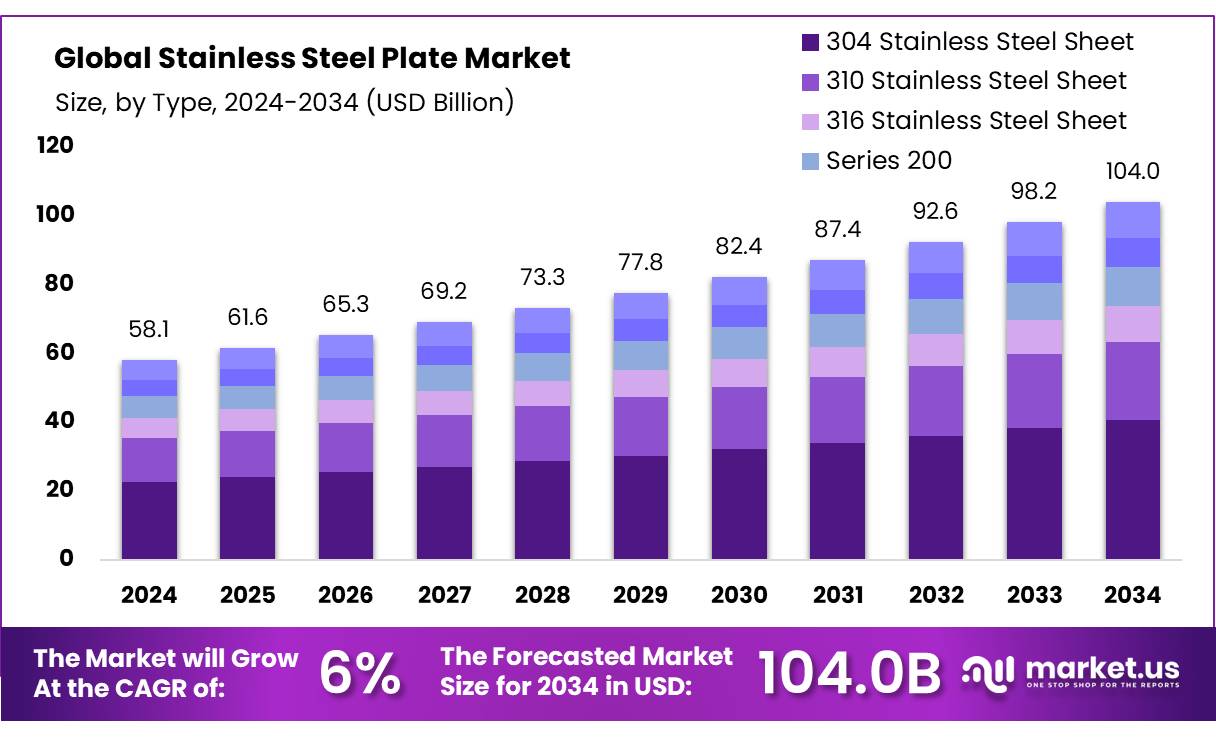

The Global Stainless Steel Plate Market size is expected to be worth around USD 104.0 Bn by 2034, from USD 58.1 Bn in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Stainless Steel Plate Market, also known as inox, corrosion-resistant steel (CRES), and rustless steel, is an iron-based alloy containing a minimum level of chromium that is resistant to rusting and corrosion. Stainless steel’s resistance to corrosion results from the 10.5%, or more, chromium content which forms a passive film that can protect the material and self-heal in the presence of oxygen. It can also be alloyed with other elements such as molybdenum, carbon, nickel and nitrogen to develop a range of different properties depending on its specific use.

Investment in the stainless steel plate sector has been robust, driven by the need to increase production capacity and incorporate advanced manufacturing technologies. Steel manufacturers are investing heavily in modernizing plants and equipment to improve efficiency and output quality. For instance, capital expenditures in the sector have seen an annual increase of approximately 15% over the past five years, focusing on sustainability and energy efficiency improvements. This is particularly evident in the adoption of electric arc furnace (EAF) technology, which is less energy-intensive and more environmentally friendly compared to traditional blast furnaces.

The primary driving forces behind the growth of the stainless steel plate market include urbanization and industrialization in emerging economies. The rapid development of infrastructure projects and the expansion of the automotive sector in these regions demand high-strength and durable materials, like stainless steel plates, for construction and manufacturing. Moreover, the rise in standards of living and the increasing demand for consumer goods that use stainless steel, such as home appliances and electronics, further propel the market growth.

Looking ahead, the stainless steel plate market is poised for growth, driven by innovation and the development of high-performance alloys. The trend towards lightweight materials in the automotive and aerospace sectors presents opportunities for high-strength, low-thickness stainless steel plates, which can reduce vehicle weight and improve fuel efficiency. Technological advancements in processing and alloy composition are expected to enhance the properties of stainless steel plates, making them suitable for new applications and operating environments.

Key Takeaways

- Stainless Steel Plate Market size is expected to be worth around USD 104.0 Bn by 2034, from USD 58.1 Bn in 2024, growing at a CAGR of 6.0%.

- 304 Stainless Steel Sheet held a dominant market position, capturing more than a 39.3% share.

- Austenitic stainless steel plates held a dominant market position, capturing more than a 58.3% share.

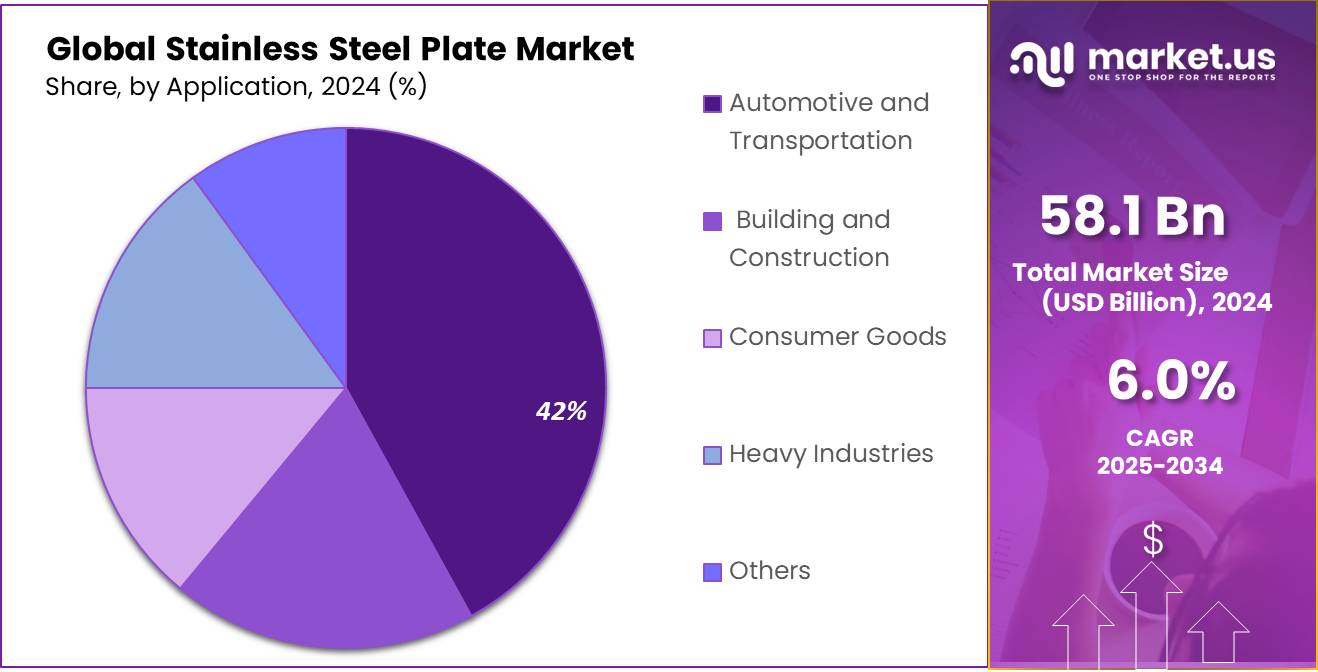

- Automotive and Transportation sector held a dominant market position within the stainless steel plate market, capturing more than a 42.3% share.

- stainless steel plate segment of 3mm and below held a dominant market position, capturing more than a 44.3% share.

- construction sector held a dominant market position in the stainless steel plate industry, capturing more than a 39.2% share.

- Asia Pacific region emerges as the dominant force, capturing a substantial 37.5% market share with a valuation of $21.8 billion.

By Type

In 2024, the 304 Stainless Steel Sheet held a dominant market position, capturing more than a 39.3% share. This type of stainless steel is highly favored for its versatility and durability, making it a preferred choice in various industries including automotive, construction, and food processing. Its resistance to corrosion and oxidation at high temperatures significantly contributes to its widespread use.

Following closely, the 316 Stainless Steel Sheet is also a key player in the market. Known for its enhanced corrosion resistance over 304, especially against chlorides and marine environments, it is particularly useful in areas where exposure to harsh chemicals or saltwater is common.

The 310 Stainless Steel Sheet is notable for its excellent heat resistance, capable of sustaining high temperatures without scaling. This makes it ideal for furnace parts and heat treatment equipment. It is less common than 304 and 316 but vital in high-temperature applications.

The Series 200 and Series 400 stainless steels offer varied characteristics. Series 200 stainless steel is less commonly used but offers certain economic benefits due to its lower nickel content, making it cheaper but slightly less durable than its 300-series counterparts. On the other hand, Series 400 is known for its magnetic properties and higher carbon content, which provides advantages in certain engineering applications, such as automotive exhaust systems.

By Product Type

In 2024, the Austenitic stainless steel plates held a dominant market position, capturing more than a 58.3% share. This category is highly popular due to its corrosion resistance, excellent formability, and weldability, which makes it suitable for a wide range of applications, including kitchen equipment, chemical equipment, and architectural facades. Its non-magnetic properties in an annealed state and its ability to be hardened by cold working rather than heat treatment add to its versatile applications in various industries.

Ferritic stainless steel plates, known for their moderate corrosion resistance and good formability, are used primarily in automotive parts and appliances. These plates are magnetic and have a lower carbon content, which makes them less ductile than austenitic grades but offers advantages in terms of price and resistance to stress corrosion cracking.

Martensitic stainless steel plates, which can be hardened by heat treatment, find their niche in applications requiring high strength and moderate corrosion resistance such as in cutlery, tools, and bearings. They are less resistant to corrosion compared to austenitic and ferritic types but are highly durable and hard.

Duplex stainless steel plates combine the qualities of austenitic and ferritic stainless steel, offering high strength and excellent resistance to corrosion, particularly stress corrosion cracking. They are widely used in environments such as desalination plants, seawater systems, and pulp and paper industries.

By Application

In 2024, the Automotive and Transportation sector held a dominant market position within the stainless steel plate market, capturing more than a 42.3% share. This sector heavily relies on stainless steel plates for their durability and resistance to corrosion, which are crucial for manufacturing components that must withstand harsh operating conditions. Stainless steel is extensively used in vehicle components such as exhaust systems, grilles, and trims, as well as in the larger transportation infrastructure including railway cars, and shipping containers.

The Building and Construction industry also makes significant use of stainless steel plates, particularly for structural elements in high-corrosion environments like coastal areas or for applications requiring a high aesthetic finish. Stainless steel’s strength and resistance to environmental impacts ensure its role in modern architecture and civil engineering.

Consumer Goods, another key application segment, includes the use of stainless steel plates in appliances, cutlery, and various household items. The aesthetic appeal of stainless steel combined with its hygienic properties makes it a preferred choice for many manufacturers of consumer products.

Heavy Industries such as shipbuilding, chemical plants, and water treatment facilities rely on stainless steel plates for their critical properties of strength and corrosion resistance. These industries prefer stainless steel plates for their ability to withstand aggressive environments and heavy wear.

By Thickness

In 2024, the stainless steel plate segment of 3mm and below held a dominant market position, capturing more than a 44.3% share. This thickness range is particularly favored for its versatility and widespread application across multiple industries. Plates of this thickness are commonly used in automotive body panels, domestic appliances, and architectural trim and paneling, where precision and aesthetic finish are required alongside structural integrity.

Moving up in thickness, the 3mm to 5mm range is crucial for industries where slightly heavier and more durable plates are necessary, such as in construction equipment, heavy machinery, and transport infrastructure. This thickness strikes a balance between toughness and workability, making it suitable for environments that experience moderate levels of mechanical stress and environmental exposure.

For plates of 5mm and above, the applications shift towards more demanding environments such as the marine industry, large structural components in construction, and heavy-duty pressure vessels. This segment caters to needs where the highest levels of durability and resistance to pressure or corrosion are required. The robustness of thicker stainless steel plates ensures longevity and performance in harsh or critical settings.

By End-User

In 2024, the construction sector held a dominant market position in the stainless steel plate industry, capturing more than a 39.2% share. This substantial market share is primarily due to the extensive use of stainless steel plates in structural applications, which require materials that provide both strength and resistance to environmental elements. Stainless steel’s durability and aesthetic appeal make it a preferred choice for both interior and exterior architectural elements, as well as in infrastructure projects like bridges and tunnels.

Following construction, the automotive sector also represents a significant portion of the market. Stainless steel plates are utilized in automotive manufacturing to enhance vehicle strength without adding excessive weight, crucial for areas such as chassis and safety components where performance and safety standards are stringent.

The machinery sector is another prominent user of stainless steel plates, leveraging the material’s resistance to wear and corrosion which is essential for machinery exposed to harsh working conditions or corrosive environments. This makes stainless steel plates ideal for use in heavy machinery and industrial equipment.

Aerospace is a smaller yet vital segment of the stainless steel plate market. In this industry, the materials’ high strength-to-weight ratio and resistance to atmospheric corrosion are highly valued, particularly for components like engine parts, landing gear, and structural elements of aircraft.

Key Market Segments

By Type

- 304 Stainless Steel Sheet

- 310 Stainless Steel Sheet

- 316 Stainless Steel Sheet

- Series 200

- Series 400

- Others

By Product Type

- Austenitic

- Ferritic

- Martensitic

- Duplex

- Others

By Application

- Automotive and Transportation

- Building and Construction

- Consumer Goods

- Heavy Industries

- Others

By Thickness

- 3mm and Below

- 3mm to 5mm

- 5mm and Above

By End-User

- Construction

- Automotive

- Machinery

- Aerospace

- Others

Drivers

Rising Demand in Construction and Infrastructure Projects

A major driving factor for the stainless steel plate market is the increased demand from the construction and infrastructure sectors. The use of stainless steel in these areas is driven by its strength, durability, and corrosion resistance, qualities that are essential for building frameworks, bridges, and public transport facilities. According to industry insights, there is a growing trend in the use of stainless steel for architectural cladding, structural supports, and in large public infrastructure, influenced by urbanization and industrial development.

Government initiatives also play a critical role in boosting the stainless steel plate market. For instance, national policies aimed at enhancing public infrastructure, like the United States’ Bipartisan Infrastructure Law, which allocates billions of dollars towards improvements in transportation, utilities, and energy systems, implicitly support the increased use of durable materials such as stainless steel. This law underscores the movement towards more sustainable and long-lasting construction materials in government-funded projects.

Moreover, the push towards green buildings and sustainable construction practices encourages the use of materials that are both eco-friendly and provide long-term cost savings through reduced maintenance and replacement needs. Stainless steel, being highly recyclable and requiring minimal upkeep due to its corrosion resistance, fits well within these criteria.

Restraints

High Costs and Availability of Alternative Materials

One of the major restraining factors for the growth of the stainless steel plate market is the high cost associated with the production and procurement of stainless steel. This cost is largely due to the prices of raw materials such as nickel and chromium, which are volatile and can significantly affect the overall cost of stainless steel. Economic downturns and fluctuations in the global commodities market can exacerbate this issue, making stainless steel less economically viable for manufacturers and consumers.

Additionally, the availability of alternative materials such as aluminum and composite materials, which are often cheaper and offer similar attributes in terms of strength and durability, poses a competitive threat to the stainless steel industry. Industries such as automotive and aerospace, where weight reduction is crucial, increasingly opt for these lighter materials to improve fuel efficiency and reduce emissions.

Government initiatives around recycling and sustainable materials also influence market dynamics by promoting the use of recycled materials. For example, the European Union’s policies on circular economy and waste management encourage industries to reduce waste and increase the use of recycled materials, which can impact the demand for newly manufactured stainless steel products.

The combined impact of high production costs and the competitive pressure from alternative materials can restrain market growth and shift industry preferences towards more cost-effective or environmentally sustainable options. These factors are critical in strategic decision-making for businesses operating within the stainless steel plate market and for policymakers aiming to balance economic and environmental objectives.

Opportunity

Expansion in Renewable Energy and High-Tech Industries

A significant growth opportunity for the stainless steel plate market is its expanding role in renewable energy projects and high-tech industrial applications. As global emphasis shifts towards sustainable energy solutions, stainless steel is increasingly favored for its durability and resistance to corrosion in harsh environmental conditions. For instance, stainless steel is essential in the construction of wind turbines, solar panels, and bioenergy facilities where its strength and longevity can significantly reduce maintenance costs and extend the lifespan of such installations.

Government initiatives around the world are bolstering this trend. For example, the European Green Deal and the U.S. Infrastructure Bill allocate substantial funds for renewable energy projects, which are expected to drive increased demand for stainless steel. This governmental support underscores the strategic role of durable materials in achieving long-term sustainability goals.

Furthermore, the technology sector, including large-scale data centers and semiconductor manufacturing plants, also presents significant opportunities for stainless steel plates. These facilities require materials that can withstand rigorous conditions and maintain high levels of cleanliness and precision. Stainless steel’s hygienic properties make it ideal for use in environments that are sensitive to particulate contamination, which is crucial for semiconductor manufacturing.

This growing demand in renewable energy and high-tech industries represents a promising frontier for the stainless steel plate market. By capitalizing on these opportunities, manufacturers can not only expand their market share but also align with global sustainability and technological advancement trends.

Trends

Increasing Adoption of Sustainable and Recycled Materials in Stainless Steel Production

A major trend shaping the stainless steel plate market is the increasing focus on sustainability, particularly through the adoption of recycled materials in the production process. As environmental regulations tighten and corporate responsibility grows in importance, the stainless steel industry is seeing a significant shift towards the use of recycled stainless steel and scrap materials.

Governments and international bodies are fostering this trend through various initiatives and regulatory frameworks that encourage recycling and sustainability in industrial practices. For instance, the European Union’s Circular Economy Action Plan aims to increase the efficiency of resource use, including the promotion of recycling within the metals sector. This policy supports the stainless steel industry in moving towards a more sustainable production model.

Moreover, advancements in production technology are making it easier and more cost-effective to recycle stainless steel, which has traditionally been a challenge due to its complex alloy compositions. Modern metallurgical techniques are improving the purity and quality of recycled stainless steel, making it comparable to products made from virgin materials.

This trend is not only seen as a growth opportunity but is also becoming a necessity as consumers and corporate buyers increasingly demand environmentally friendly materials. Manufacturers who adopt these practices can gain a competitive edge in markets that value sustainability, which is becoming a decisive factor in purchasing decisions across various industries.

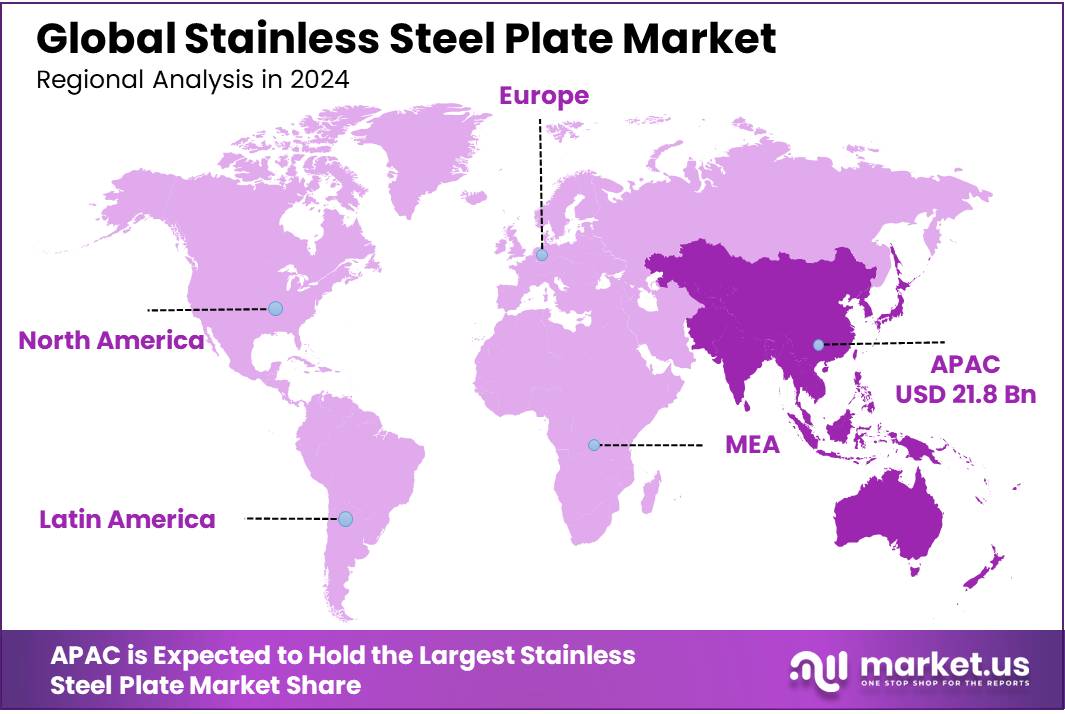

Regional Analysis

In the global stainless steel plate market, the Asia Pacific region emerges as the dominant force, capturing a substantial 37.5% market share with a valuation of $21.8 billion. This leadership is driven by rapid industrialization and urbanization in major economies such as China, India, and Japan. The region benefits from robust manufacturing sectors, significant infrastructure projects, and an expanding automotive industry, all of which demand high volumes of stainless steel plates.

Europe also maintains a significant stake in the market, leveraging its advanced manufacturing capabilities and stringent environmental regulations that push for high-quality, sustainable materials. The region’s focus on recycling and reducing carbon emissions aligns well with the production of stainless steel plates, making it a key player in promoting sustainable manufacturing practices.

North America follows closely, with its market driven by the demand from the construction and automotive sectors. The region’s commitment to infrastructure development and renovation, coupled with technological advancements in manufacturing processes, supports its steady demand for stainless steel plates.

The Middle East & Africa and Latin America markets, while smaller in comparison, are experiencing growth due to increasing investments in construction and infrastructure. The Middle East, in particular, benefits from the ongoing development in oil and gas sectors, which require large quantities of stainless steel for pipelines and other constructions. Latin America is gradually catching up, with Brazil and Mexico leading the way in industrial and urban development projects that require extensive use of stainless steel plates.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The stainless steel plate market features a robust and competitive landscape dominated by several key global players. Acerinox S.A., ArcelorMittal S.A., and Baosteel Group Corporation are among the industry leaders, each boasting extensive production capacities and a strong global distribution network. These companies are well-known for their innovation in manufacturing processes and commitment to sustainability, which are crucial for maintaining their competitive edge in the market.

Other significant players include Nippon Steel Corporation, POSCO, and Outokumpu Oyj, which are recognized for their technological advancements and high-quality products. These companies have a strong foothold in various regions, further diversified by strategic mergers and acquisitions that have expanded their market reach and product portfolios.

Additionally, companies like Jindal Stainless Limited and Tata Steel Limited play critical roles in regional markets, particularly in Asia, which is a vital area for stainless steel production due to its rapid industrial growth and extensive construction activities. Newer entrants and regional players such as Yieh United Steel Corp. (YUSCO) and Tsingshan Holding Group are also making significant inroads in the market, challenging established companies by offering competitive pricing and specialized products.

Top Key Players

- Acerinox S.A.

- Aperam S.A.

- ArcelorMittal S.A.

- Baosteel Group Corporation

- Jindal Stainless Limited

- Nippon Steel Corporation

- Outokumpu Oyj

- POSCO

- Sandvik AB

- Tata Steel Limited

- Thyssenkrupp AG

- AK Steel Holding Corporation

- Allegheny Technologies Incorporated (ATI)

- JFE Steel Corporation

- Nisshin Steel Co., Ltd.

- Yieh United Steel Corp. (YUSCO)

- Shandong Iron and Steel Group Co., Ltd.

- Anshan Iron and Steel Group Corporation (Ansteel)

- Hebei Iron and Steel Group Co., Ltd.

- Tsingshan Holding Group

Recent Developments

In 2024, Aperam S.A. continued to strengthen its position in the stainless steel plate sector, showcasing resilience and strategic growth. Throughout the year, Aperam reported a robust financial performance with a net income of EUR 231 million, marking a significant increase from the previous year.

In 2024, ArcelorMittal S.A. continued to play a pivotal role in the stainless steel plate sector, demonstrating a strong financial performance and strategic growth. The company reported an EBITDA of $7.1 billion for the year, reflecting its resilient operational efficiency and the benefits derived from its diverse regional and product portfolio.

Report Scope

Report Features Description Market Value (2024) USD 58.1 Bn Forecast Revenue (2034) USD 104.0 Bn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (304 Stainless Steel Sheet, 310 Stainless Steel Sheet, 316 Stainless Steel Sheet, Series 200, Series 400, Others), By Product Type (Austenitic, Ferritic, Martensitic, Duplex, Others), By Application (Automotive and Transportation, Building and Construction, Consumer Goods, Heavy Industries, Others), By Thickness (3mm and Below, 3mm to 5mm, 5mm and Above), By End-User (Construction, Automotive, Machinery, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Acerinox S.A., Aperam S.A., ArcelorMittal S.A., Baosteel Group Corporation, Jindal Stainless Limited, Nippon Steel Corporation, Outokumpu Oyj, POSCO, Sandvik AB, Tata Steel Limited, Thyssenkrupp AG, AK Steel Holding Corporation, Allegheny Technologies Incorporated (ATI), JFE Steel Corporation, Nisshin Steel Co., Ltd., Yieh United Steel Corp. (YUSCO), Shandong Iron and Steel Group Co., Ltd., Anshan Iron and Steel Group Corporation (Ansteel), Hebei Iron and Steel Group Co., Ltd., Tsingshan Holding Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stainless Steel Plate MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Stainless Steel Plate MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Acerinox S.A.

- Aperam S.A.

- ArcelorMittal S.A.

- Baosteel Group Corporation

- Jindal Stainless Limited

- Nippon Steel Corporation

- Outokumpu Oyj

- POSCO

- Sandvik AB

- Tata Steel Limited

- Thyssenkrupp AG

- AK Steel Holding Corporation

- Allegheny Technologies Incorporated (ATI)

- JFE Steel Corporation

- Nisshin Steel Co., Ltd.

- Yieh United Steel Corp. (YUSCO)

- Shandong Iron and Steel Group Co., Ltd.

- Anshan Iron and Steel Group Corporation (Ansteel)

- Hebei Iron and Steel Group Co., Ltd.

- Tsingshan Holding Group