Global Caustic Soda Market Size, Share Analysis Report By Form (Solid, Liquid), By Purity (Up to 50%, 50 to 70%, 70 to 90%, Above 90%), By Production Method (Mercury Cell, Membrane Cell, Diaphragm Cell), By Application (Organic Chemicals, Inorganic Chemicals, Alumina, Paper and Pulp, Soaps and Detergents, Textile, Water Treatment, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146349

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

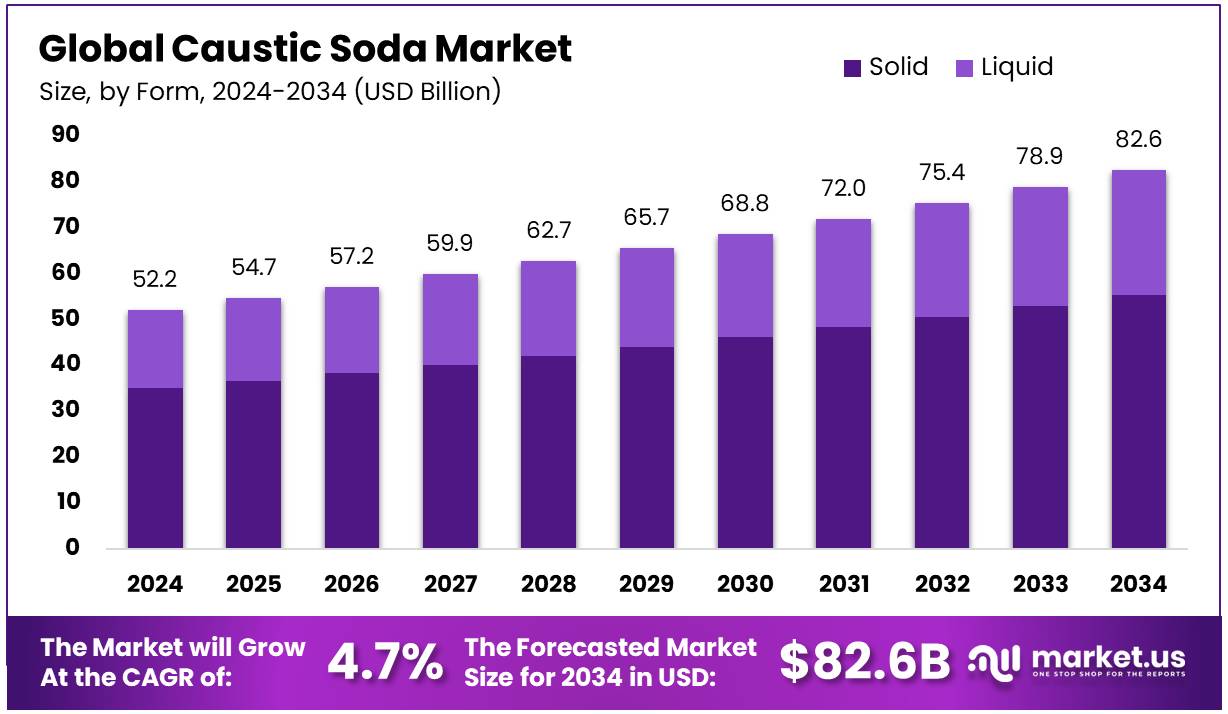

The Global Caustic Soda Market size is expected to be worth around USD 82.6 Bn by 2034, from USD 52.2 Bn in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

Caustic soda, also known as sodium hydroxide (NaOH), is a highly versatile chemical compound with wide-ranging applications across various industries. It is primarily used in the manufacture of pulp and paper, alumina, soaps and detergents, petroleum products, and other chemicals. Caustic soda is an essential raw material in industries such as chemicals, automotive, water treatment, and food and beverage. It is produced industrially through the Chlor-alkali process, where electrolysis of aqueous sodium chloride (salt) solution generates chlorine gas and sodium hydroxide.

- According to data from the Tennessee Department of Health, approximately 56% of caustic soda produced is utilized in various industries, while 25% is specifically used in the paper industry, highlighting its critical role in both manufacturing processes and industrial applications.

Globally, the caustic soda market has seen significant growth driven by its essential use in various industries. The demand for caustic soda is especially strong in emerging economies, where industrialization, urbanization, and expanding manufacturing sectors fuel its consumption.

The chemical sector remains the largest consumer, utilizing caustic soda in the production of a wide range of chemicals. Furthermore, increased focus on environmental sustainability and water treatment has led to higher demand for caustic soda in industrial and municipal water purification processes. The market is expected to continue expanding due to industrial growth, technological advancements, and the increasing need for caustic soda in green manufacturing practices.

Key Takeaways

- The global caustic soda market was valued at USD 52.2 billion in 2024.

- The global caustic soda market is projected to grow at a CAGR of 4.7 % and is estimated to reach USD 82.6 billion by 2034.

- Among forms, solid accounted for the largest market share of 67.1%.

- Among purity, 70 to 90% accounted for the majority of the market share at 36.2%.

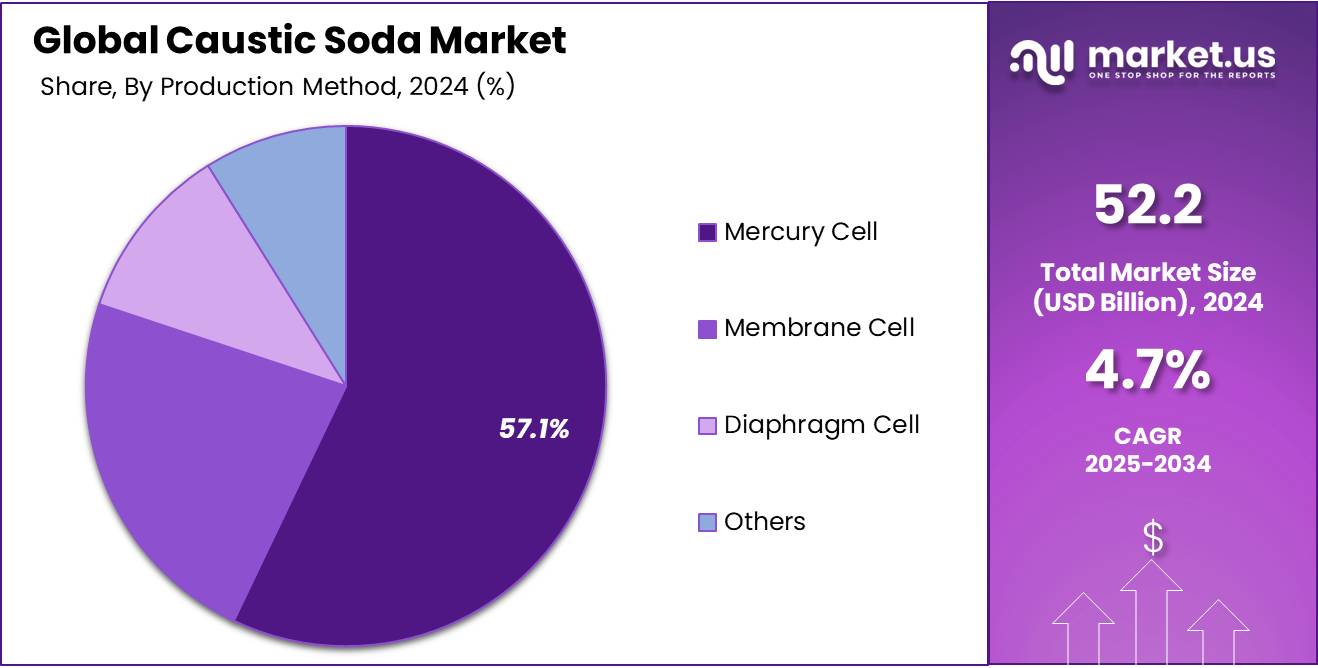

- By production method, membrane cells accounted for the largest market share of 57.1%.

- By application, organic chemicals accounted for the majority of the market share at 39.1%.

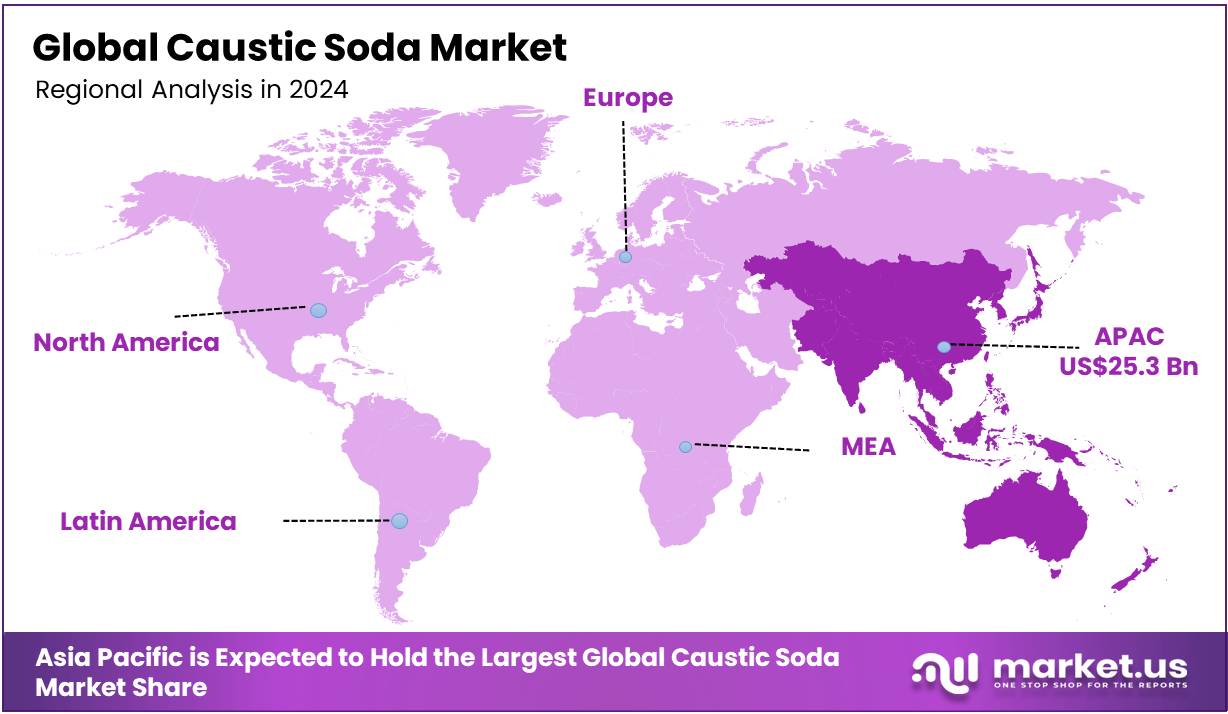

- Asia Pacific is estimated as the largest market for caustic soda with a share of 48.5% of the market share.

Form Analysis

The Solid Segment Held a Major Market Share

The caustic soda market is segmented based form into solid, and liquid. In 2024, the solid segment held a significant revenue share of 67.1%. Due to its ease of handling, longer shelf life, and wide applicability in industries such as chemicals, textiles, and paper production. Solid caustic soda is preferred for its stability during storage and transportation, making it the go-to choice for large-scale industrial applications. Additionally, its cost-effectiveness and versatility in various manufacturing processes contribute to its dominant market position.

Purity Analysis

The 70-90% Purity Dominates Market Share

Based on purity, the market is further separated into up to 50%, 50 to 70%, 70 to 90%, and above 90%. The predominance of the 70 to 90%, commanding a substantial 36.2% market share in 2024. Due to its widespread use in industries such as chemical manufacturing, water treatment, and paper production, where this purity range meets the required specifications for various applications.

The 70 to 90% caustic soda offers a balance between performance and cost-effectiveness, making it a preferred choice for large-scale industrial processes. Additionally, its availability and versatility in meeting diverse industrial needs contribute to its dominant market share.

Production Method Analysis

The Membrane Cells Method Majorly Used For Production

Based on the production method, the market is distributed into mercury cells, membrane cells, and diaphragm cells. Among these, membrane cells held the majority of the market share with 57.1% market share in 2024. Due to their superior environmental and energy efficiency compared to other methods.

Membrane cells produce caustic soda with lower energy consumption and minimal emissions, making them more sustainable and compliant with increasingly stringent environmental regulations. Additionally, the membrane cell process produces high-purity caustic soda, which is crucial for industries requiring precise quality standards, further driving its market dominance.

Application Analysis

The Organic Chemicals Segments Dominated the Market

Based on application, the market is further separated into organic chemicals, inorganic chemicals, alumina, paper & pulp, soaps & detergents, textiles, water treatment, pharmaceuticals, and others. The predominance of organic chemicals commanding a substantial 39.1% market share in 2024. Due to the widespread use of caustic soda in the production of key organic chemicals such as sodium derivatives, solvents, and plastics.

The demand for organic chemicals, especially in industries such as petrochemicals and agriculture, drives the substantial use of caustic soda for processes such as neutralization, saponification, and chemical synthesis. Additionally, the versatility of caustic soda in various chemical reactions makes it essential for manufacturing a wide range of organic products.

Key Market Segments

By Form

- Solid

- Liquid

By Purity

- Upto 50%

- 50 to 70%

- 70 to 90%

- Above 90%

By Production Method

- Mercury Cell

- Membrane Cell

- Diaphragm Cell

By Application

- Organic Chemicals

- Inorganic Chemicals

- Alumina

- Paper & Pulp

- Soaps & Detergents

- Textile

- Water Treatment

- Pharmaceutical

- Others

Drivers

Rising Demand of Caustic Soda in Carbon Capture and Sequestration Technologies.

The rising demand for caustic soda is significantly driven by its growing use in carbon capture and sequestration (CCS) technologies. With governments and industries worldwide prioritizing carbon reduction to meet climate goals, CCS is being adopted across key sectors such as chemicals, power, cement, and steel. In these systems, caustic soda (sodium hydroxide) acts as an efficient chemical absorbent, reacting with CO₂ to form stable compounds such as sodium carbonate making it a preferred choice in decarbonisation strategies.

- According to global climate reports, the cement industry accounts for approximately 7% of global CO₂ emissions, with the construction sector emitting around 9.95 Gt/year as of 2019—making it the largest contributor. As the sector targets a 16% reduction in emissions by 2030 and aims for net zero by 2050, the adoption of carbon capture technologies is accelerating. This trend is significantly boosting the demand for caustic soda, a key chemical used in CO₂ absorption and neutralization processes.

- Carbon dioxide (CO₂), responsible for about 55% of global warming, has seen its atmospheric concentration rise by 3% since 1950, according to global climate reports. To combat this trend, the widespread deployment of carbon capture technologies is essential. This growing focus on emission reduction is driving demand for caustic soda, a critical component in CO₂ capture and conversion processes.

Furthermore, supportive government policies and carbon reduction incentives are further fuelling the demand for caustic soda in this space. Its importance in CCS technologies continues to grow, driven by its performance, affordability, and adaptability across a range of industrial processes focused on reducing carbon footprints.

- For instance, the European Union promotes carbon capture through the EU Emissions Trading System (ETS), which sets carbon limits, and the Innovation Fund, which finances large-scale CCS projects under the Green Deal.

- For instance, United Kingdom, Carbon Pricing encourages the use of carbon capture technologies by setting a carbon price floor, while the Carbon Capture and Storage Competition provides funding for CCS projects to help achieve net-zero emissions goals.

- The United States offers the 45Q Tax Credit to incentivize carbon capture and storage, while Canada promotes carbon capture through Carbon Pricing and the Clean Growth Program that funds clean technologies.

These growing emphases on carbon capture technologies are driving the demand for caustic soda, as it plays a critical role in CO₂ absorption and conversion processes across various industries. This trend is supporting the growth of the caustic soda market.

Restraints

Declining Paper Production in Some Industries

The decline in paper production across various industries is significantly affecting the global caustic soda market. This shift is mainly due to the increasing reliance on digital media, stricter environmental regulations, and shifting consumer preferences from traditional print media like newspapers, magazines, and office paper to mobile, laptops, and digital print. As caustic soda key element of the paper manufacturing process, especially in pulping and bleaching, this downshift in paper production is directly reducing the demand for this essential chemical. As the paper industry is one of the largest consumers of caustic soda, its decline caused limited overall market growth for caustic soda.

- According to the Confederation of European Paper Industries (CEPI), preliminary data shows a 13% drop in paper and board production among its member countries, totalling 74.3 million tonnes. This decline reflects the industry’s struggles amid shifting market dynamics and environmental concerns.

The growing shift towards sustainability and stricter environmental policies is a major reason for the limitations on paper manufacturing growth. As paper production heavily relies on trees, deforestation, and global warming are limiting its market growth, which has a direct negative impact on the caustic soda market. Large-scale paper production is being restricted, reducing the demand for caustic soda, especially in regions where the paper industry has traditionally been a major consumer. These changing dynamics are becoming key factors hindering the growth of the caustic soda market.

- According to WWF, over 80% of the world’s intact forests are at risk due to human activities, with the paper industry being a major contributor. This has led to stricter sustainability regulations and a shift toward eco-friendly alternatives, slowing paper industry growth.

Opportunity

Emergence of Caustic Soda Powered Emergency Water Purification System.

The growing demand for clean water, driven by rising population and industrialization, is creating a significant opportunity for caustic soda in emergency water purification systems. These systems are important in disaster and conflict zones, providing rapid, portable solutions to treat contaminated water and prevent health risks in areas with limited access to safe drinking water. Caustic soda Powered Emergency Water Purification System can provide scalable, rapid solutions for enhancing water quality through pH adjustment, coagulation, and disinfection. As global water demand rises, these systems will create significant growth opportunities for the caustic soda market.

- According to the World Health Organization, over 2 billion individuals lack access to safe drinking water, with half of the global population projected to live in water-stressed regions by 2025.

- In 2022, 1.7 billion individuals relied on contaminated water, highlighting the need for caustic soda in water purification systems to address microbial contamination risks.

Furthermore, rising water pollution, including both natural and manmade crises such as industrial discharges, agricultural runoff, and chemical contamination, alongside increasing water scarcity, especially in environmentally stressed and water-insecure regions, are heightening the demand for dependable water treatment solutions. As emergency purification systems become more prevalent, the essential role of caustic soda in ensuring water safety positions it as a key beneficiary, creating a strong and growing opportunity for the global caustic soda market.

- According to UNICEF, nearly two-thirds of the global population—around 4 billion individuals—experience severe water scarcity for at least one month annually, with over 2 billion living in regions with inadequate water supply. By 2040, 1 in 4 children is projected to live in areas of extreme water stress. The demand for caustic soda-powered emergency water purification systems is growing.

- According to China’s former State Environmental Protection Administration, over 6,600 water pollution incidents occurred between 2000 and 2008, with major events like the 2005 Songhua River nitrobenzene spill and the 2007 Wuxi Water Crisis highlighting the urgent need for effective and rapid water purification solutions, such as caustic soda-powered emergency systems.

Trends

Rising Demand From The Lithium-Ion Recycling Sector

The growing demand for lithium-ion battery recycling is a key driver for the future growth of the global caustic soda market. As electric vehicle (EV) adoption accelerates, the need for efficient and sustainable battery recycling becomes more urgent. Caustic soda plays a critical role in the hydrometallurgical process of recycling, where it’s used for lithium recovery and separating valuable metals such as cobalt and nickel from spent batteries. The increasing focus on circular economies and stricter regulations around battery disposal are further boosting the demand for caustic soda in recycling operations. As new recycling facilities continue to be developed, the caustic soda market is expected to see consistent growth.

Geopolitical Impact Analysis

Impact of US-China Trade War on the Global Caustic Soda Market

The US-China trade war has significantly impacted the global caustic soda market, with the US imposing a 10% tariff on Chinese goods, including chemicals like caustic soda, as part of a broader $200 billion tariff list. This has led to supply chain disruptions and potential price volatility, as both countries retaliate with tariffs on each other’s imports. These tensions are reshaping global trade dynamics for caustic soda and other key chemicals.

- For instance, the U.S. has implemented a 25% additional tariff on caustic soda imports from China, classified under HTS code 2815.11.00.00 for solid sodium hydroxide and 2815.12.00.00 for aqueous solutions. This tariff was part of the broader $200 billion list of Chinese goods targeted during the U.S.-China trade dispute.

Caustic soda, is by-product of chlorine production, is a critical feedstock in industries like alumina refining and pulp and paper production. However, these industries have faced supply chain disruptions and increased costs. Additionally, these shifts have led to price volatility and supply shortages globally, impacting industries reliant on caustic soda, such as alumina, pulp and paper, and detergents.

- Furthermore, the US has also imposed a 25% tariff on textile and apparel imports from Canada and Mexico, citing national security concerns, which threatens Mexico’s $8.9 billion and Canada’s $2.48 billion exports, leading US buyers to shift orders to cost-effective alternatives in Asia, Latin America, and Europe, with countries like Vietnam, Bangladesh, India, and CAFTA-DR nations poised to benefit.

Caustic soda is essential in the textile industry, enhancing fabric quality through mercerization, dyeing, bleaching, and cleaning, which improves durability, colour absorption, and appearance. The tariffs on imports from Canada and Mexico may increase production costs for the textile industry, leading companies to source materials from alternative suppliers in Asia, Latin America, or Europe. This shift could boost the demand for caustic soda in these regions, impacting global supply and potentially raising prices for textile manufacturers.

Regional Analysis

In 2024, Asia Pacific dominated the global caustic soda market, accounting for 48.5% of the total market share, driven by strong demand across a variety of industrial sectors such as pulp and paper, textiles, alumina refining, cleaning products, and water treatment. Countries such as China, India, Japan, and those across Southeast Asia are playing critical roles in supporting this growth.

China dominates production and consumption due to its strong industrial base and growing manufacturing capabilities. Rising urbanization and growing public awareness of hygiene and health are also fueling higher consumption of caustic soda in personal care and household cleaning products.

Furthermore, the region serves as a hub for well-established chemical, aluminum, and textile industries, which are among the largest consumers of caustic soda. This widespread adoption of caustic soda across these industries is driven by its versatility and critical role in various manufacturing processes. In textiles, caustic soda is indispensable for scouring, dyeing, and finishing fabrics, enhancing texture, color consistency, and overall fabric quality.

In aluminum production, particularly in countries such as China and Australia, it is essential for the Bayer process, which extracts alumina from bauxite ore. Moreover, the chemical industry relies on caustic soda as a vital raw material in the production of a broad spectrum of downstream chemicals, cementing its importance across these sectors.

Additionally, governments in these regions are implementing stricter policies regarding water treatment and environmental sustainability, which is driving increased demand for caustic soda in both municipal and industrial water purification processes. Technological advancements and growing investments in green manufacturing practices are expected to influence and shape the future of the caustic soda market in Asia-Pacific, fostering greater efficiency and sustainability in production methods.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the caustic soda market, including Dow Chemical and Olin Corporation, focus on strategies such as technological innovation, operational efficiency, and sustainability to maintain their market leadership. They invest in green technologies to reduce carbon emissions, improve the environmental impact of caustic soda production, and increase energy efficiency. These companies also expand their global presence by strengthening supply chains and entering emerging markets.

Major Players in the Industry

- The Dow Chemical Company

- Meghna Group of Industries

- Olin Corporation

- INEOS Group

- Nuberg EPC

- Tata Chemicals Ltd

- Formosa Plastics Corporation

- PVS Chemicals

- Nobian

- Westlake Corporation

- Aditya Birla Chemicals

- SABIC

- Tosoh Corporation

- Hanwha Chemical Corporation

- Nouryon

- Shin-Etsu Chemicals Co. Ltd

- ERCO Worldwide

- Other Key Players

Recent Development

- In April 2024 – Nuberg EPC secured the EPCM contract from Adani Group for India’s largest 2,200 TPD chlor-alkali project in Mundra, Gujarat, aimed at producing caustic soda and other key chemicals.

- In October 2024 – Nobian and Adven have partnered to build an energy-efficient electric caustic soda evaporation plant in Delfzijl, set to cut CO₂ emissions by 25,000 tons annually and begin operations by 2027. This marks Nobian’s first use of electric heat pump technology in caustic soda production, supporting its goal to be carbon-neutral by 2040.

Report Scope

Report Features Description Market Value (2024) USD 52.2 Bn Forecast Revenue (2034) USD 82.6 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid), By Purity (Up to 50%, 50 to 70%, 70 to 90%, Above 90%), By Production Method (Mercury Cell, Membrane Cell, Diaphragm Cell), By Application (Organic Chemicals, Inorganic Chemicals, Alumina, Paper & Pulp, Soaps & Detergents, Textile, Water Treatment, Pharmaceutical, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape The Dow Chemical Company, Meghna Group of Industries, Olin Corporation, INEOS Group, Tata Chemicals Ltd, Formosa Plastics Corporation, PVS Chemicals, Westlake Corporation, Aditya Birla Chemicals, SABIC, Tosoh Corporation, Hanwha Chemical Corporation, Nouryon, Shin-Etsu Chemicals Co. Ltd, ERCO Worldwide, Nobian, Nuberg EPC, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Dow Chemical Company

- Meghna Group of Industries

- Olin Corporation

- INEOS Group

- Nuberg EPC

- Tata Chemicals Ltd

- Formosa Plastics Corporation

- PVS Chemicals

- Nobian

- Westlake Corporation

- Aditya Birla Chemicals

- SABIC

- Tosoh Corporation

- Hanwha Chemical Corporation

- Nouryon

- Shin-Etsu Chemicals Co. Ltd

- ERCO Worldwide

- Other Key Players