Global Carbohydrase Market Size, Share, And Industry Analysis Report By Source (Microbial, Plant, Animal), By Type (Alpha amylase, Beta glucanase, Cellulase, Others), By Application (Food and Beverage, Bakery and confectionary, Animal Feed, Pharmaceutical, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171591

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

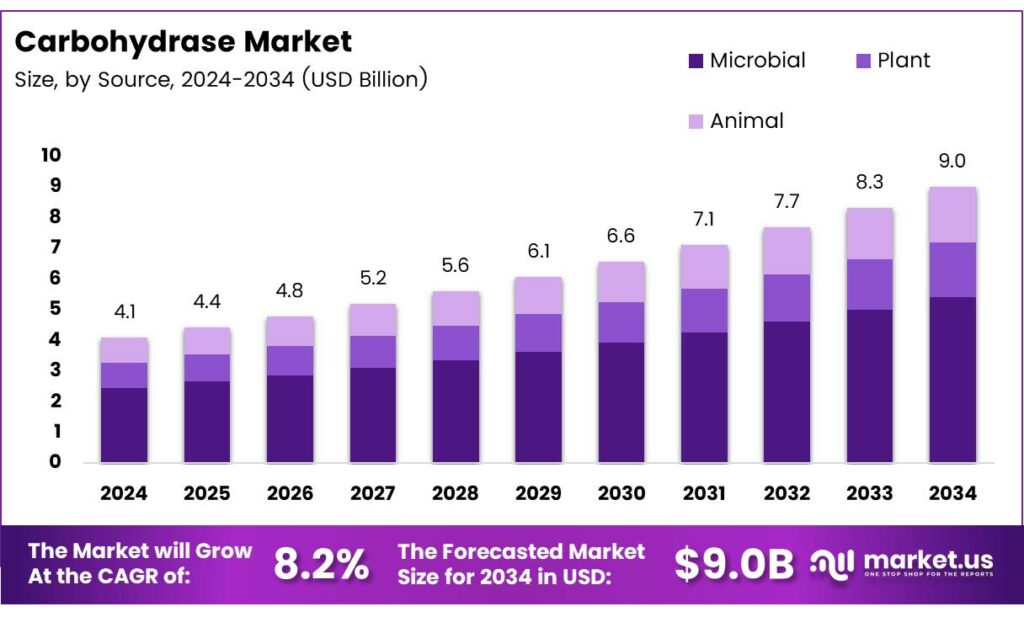

The Global Carbohydrase Market size is expected to be worth around USD 9.0 billion by 2034, from USD 4.1 billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

The Carbohydrase Market represents a growing biotechnology segment supporting food processing, nutrition enhancement, animal feed optimization, and industrial biocatalysis. It covers enzymes such as amylase, cellulase, maltase, and isomaltase, which help convert complex carbohydrates into digestible sugars. This market benefits from rising demand for clean-label products, improved digestion solutions, and efficient carbohydrate conversion technologies.

Across the food and beverage industry, manufacturers increasingly use carbohydrases to improve texture, sweetness, and fermentation efficiency. Their ability to accelerate hydrolysis creates opportunities for sugar reduction strategies and starch modification. As consumer preference shifts toward functional foods, enzyme-enabled production methods are becoming more valuable, encouraging wider adoption across bakery, brewing, dairy, and plant-based categories.

- Carbohydrates supply nearly 50% of adult calorie intake, making efficient breakdown essential. Key dietary carbs include disaccharides—lactose, sucrose, maltose along with starches and glycogen. Enzymes such as maltase, which splits α1,4 bonds in 5–9–unit oligosaccharides, and isomaltase, which targets α1,6 bonds, enable this process. As lactase activity drops to <10% after childhood, reliance on supplemental enzymes rises. These digestive shifts continue to strengthen demand for carbohydrase-based solutions across food, health, and industrial sectors.

In the healthcare and nutrition fields, carbohydrases are gaining relevance due to rising digestive disorders and the need for targeted enzyme supplementation. Their application extends to lactose management, starch breakdown, and gut-friendly fermentation processes. This broad scope continues to attract investment in enzyme formulation, clinical validation, and nutraceutical development.

The animal nutrition sector is driving additional growth. Carbohydrases help improve feed utilization and reduce antinutritional factors, lowering production costs for poultry and livestock. Regulatory bodies promoting sustainable agriculture and resource-efficient feed systems are encouraging enzyme use, strengthening market momentum. Industries prioritize formulations that improve nutrient availability while supporting lower emissions through better digestion efficiency.

Key Takeaways

- The Global Carbohydrase Market is projected to reach USD 4.1 billion in 2024 and is projected to hit USD 9.0 billion by 2034 at a CAGR of 8.2%.

- Microbial Sources dominated the market with a 69.2% share in 2024, driven by high efficiency and industrial scalability.

- Alpha Amylase led the type segment with a 42.9% share due to its extensive use in starch processing and food manufacturing.

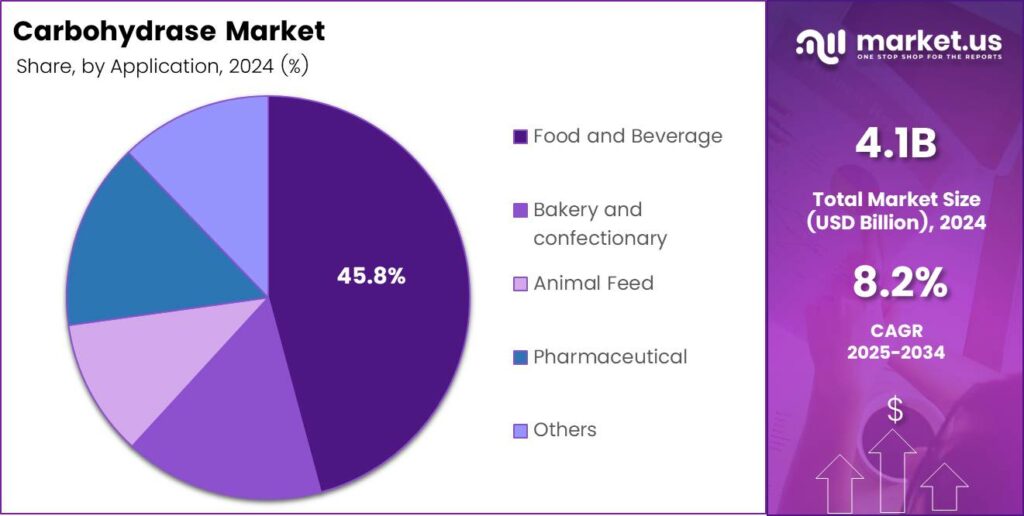

- Food and Beverage emerged as the top application area with a 45.8% share, supported by strong enzymatic processing needs.

- Online Distribution Channels held the leading position with a 67.3% share, driven by convenience and better accessibility.

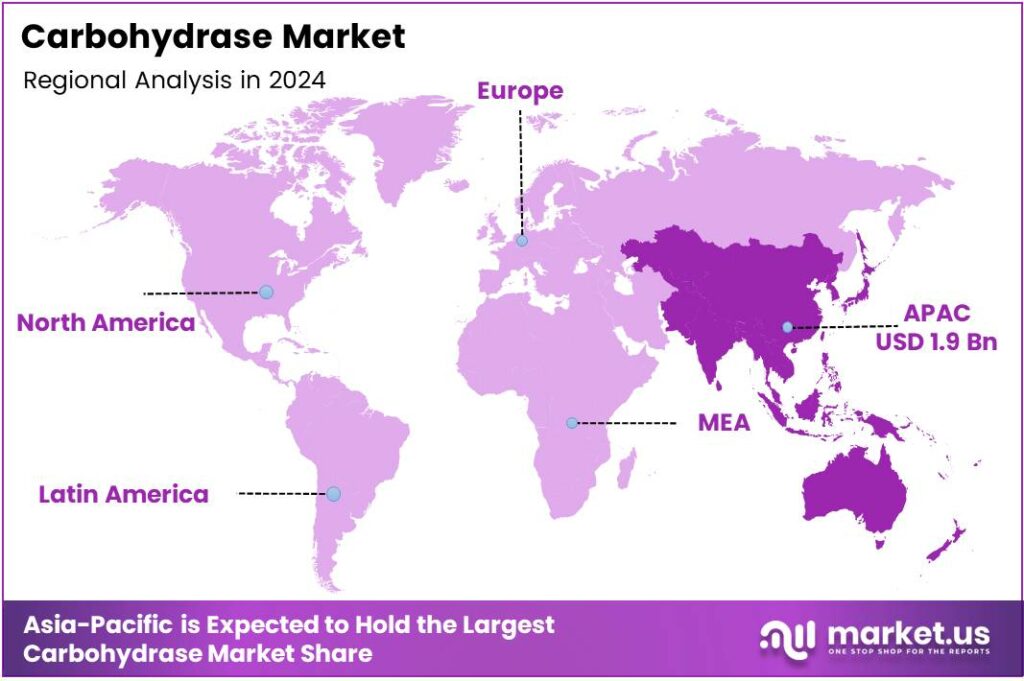

- Asia Pacific dominated the regional market with a 48.2% share valued at USD 1.9 billion, supported by expanding food and industrial enzyme usage.

By Source Analysis

Microbial dominate the segment with 69.2% due to their strong suitability for large-scale industrial enzyme production.

In 2024, Microbial held a dominant market position in the By Source Analysis segment of the Carbohydrase Market, with a 69.2% share. Microbial sources remain preferred because they deliver high enzyme yields, stable performance, and cost-effective scaling. Industries also rely on microbes due to their efficiency and consistent production quality.

Plant sources supported niche applications within the Carbohydrase Market. Although they did not match microbial dominance, plant-derived enzymes gained acceptance for clean-label and natural formulation trends. Producers increasingly explored botanical materials because they offer lower allergen risks and align with rising consumer awareness about plant-based functional ingredients.

Animal sources contributed to specialized pharmaceutical and digestive applications in the Carbohydrase Market. These enzymes demonstrated high specificity and targeted functional benefits. However, adoption remained limited due to regulatory scrutiny, higher sourcing costs, and growing ethical preferences for plant- or microbe-derived alternatives across global industries.

By Type Analysis

Alpha Amylase dominates with 42.9% because of its extensive use across food, brewing, and processing industries.

In 2024, Alpha amylase held a dominant market position in the By Type Analysis segment of the Carbohydrase Market, with a 42.9% share. Its broad use in starch breakdown, baking, and beverage processing strengthened demand. Manufacturers prefer alpha amylase because it improves texture, enhances sweetness, and supports efficient industrial workflows.

Beta-glucanase expanded steadily across brewing, animal feed, and food processing applications. The enzyme played a useful role in reducing viscosity and improving digestibility. Industries adopted beta-glucanase to optimize product quality, strengthen nutritional effectiveness, and enhance processing efficiency in diverse formulation environments.

Cellulase contributed to growing biofuel, textile, and feed segments. Its ability to break cellulose into simpler sugars supported high-value industrial innovations. Cellulase demand grew gradually as companies invested in sustainable technologies and explored enzyme-driven solutions for waste conversion and fiber modification.

By Application Analysis

Food and Beverage dominate with 45.8% because of strong reliance on enzymatic processing for quality and efficiency.

In 2024, Food and Beverage held a dominant market position in the By Application Analysis segment of the Carbohydrase Market, with a 45.8% share. Carbohydrases improved sweetness, texture, and fermentation processes, making them essential for packaged foods, beverages, and large-scale ingredient production.

Bakery and confectionery applications expanded steadily. Carbohydrases helped enhance dough handling, maintain softness, and improve product consistency. Producers relied on these enzymes to reduce processing time while boosting product uniformity, flavor development, and overall consumer appeal in baked goods and sweet categories.

Animal feed usage improved because carbohydrases supported nutrient release and enhanced digestibility. Feed manufacturers adopted these enzymes to increase feed efficiency, reduce waste, and improve animal performance. Rising livestock productivity needs further strengthening of its integration into feed formulations worldwide.

Pharmaceutical demand advanced gradually. Carbohydrases support drug formulation, digestive health products, and controlled metabolic processes. Their ability to enhance therapeutic functions made them useful across specialized treatment applications and nutraceutical developments.

By Distribution Channel Analysis

Online leads with 67.3% due to rising digital adoption and streamlined procurement channels.

In 2024, Online held a dominant market position in the By Distribution Channel Analysis segment of the Carbohydrase Market, with a 67.3% share. Digital platforms enabled faster sourcing, competitive pricing, and wider product availability, supporting strong adoption by food, feed, and industrial buyers.

Offline channels remained essential for bulk buyers requiring technical support and relationship-driven procurement. Physical distributors ensured reliable supply chains, personalized service, and on-site guidance. Although their share was lower, offline networks continued supporting traditional industrial customers.

Key Market Segments

By Source

- Microbial

- Plant

- Animal

By Type

- Alpha amylase

- Beta glucanase

- Cellulase

- Others

By Application

- Food and Beverage

- Bakery and Confectionery

- Dairy Supplements

- Beverages

- Others

- Animal Feed

- Pharmaceutical

- Others

By Distribution Channel

- Online

- Offline

Emerging Trends

Growing Shift Toward Enzyme-Based Sustainable Processing Drives Market Trends

The food industry is increasingly moving toward sustainable manufacturing practices. Carbohydrases reduce chemical usage and energy consumption by supporting natural processing methods. This aligns with global sustainability goals and strengthens enzyme adoption across production lines.

- IFF highlighted that using specific exogenous enzymes allows breweries to replace up to 40% of traditional malted barley with unmalted barley. It has a massive impact on our planet. By using these carbohydrases, a brewery can reduce its carbon footprint by roughly 10%, its land use by 21%, and its water consumption by a staggering 17%. This trend is driven by the realization that we can’t keep using resources the way we used to.

Personalized nutrition is also emerging as a major trend. Carbohydrases help create products tailored for digestive health, low-sugar diets, and improved nutrient availability. This trend is especially strong in premium and health-focused food categories. The rise of plant-based and alternative protein products is another influential factor.

Drivers

Rising Use of Carbohydrases in Food Processing Supports Market Demand

Carbohydrases are becoming essential in the food industry because they help improve texture, flavor, and shelf life. Many bakery and beverage companies now use enzymes to make products more consistent and cost-effective. This rising industrial adoption continues to push enzyme usage in everyday food applications.

- The World Health Organization (WHO) has been a major influence here, strongly recommending that adults and children reduce their daily intake of free sugars to less than 10% of their total energy intake for better health. In some regions, sugar intake currently accounts for as much as 9% to 15% of daily energy, which is why governments and health organizations are pushing for reformulation.

Growing consumer interest in clean-label and natural ingredients further boosts demand. Carbohydrase helps reduce chemical additives by supporting natural processing methods. As food manufacturers work to meet cleaner standards, enzymes provide a safer and more efficient solution. The global rise in packaged and processed foods encourages companies to adopt enzyme-based processes.

Restraints

High Production Costs Limit Carbohydrase Market Expansion

Producing high-quality carbohydrase requires specialized fermentation systems, controlled environments, and strict purity standards. These factors increase operational costs for enzyme manufacturers, making the final product relatively expensive for small food processors and emerging industries.

- Regulatory challenges also act as restraints. Enzymes used in food and feed must meet strict safety approvals before commercialization. The bioscience leader Novonesis reported that their Advanced Protein Solutions (which include enzymes for plant-based foods) contributed strongly to their growth, with a notable organic sales increase of 10% in the final quarter of 2024.

Carbohydrases can lose activity when exposed to high temperatures or unsuitable storage conditions. This forces companies to invest in protective formulations, which adds to overall production expenses. Limited awareness of enzymatic benefits in developing countries further slows adoption. Many small and medium food producers still rely on traditional processing methods due to cost sensitivity.

Growth Factors

Expanding Demand for Functional and Nutrient-Rich Foods Creates New Opportunities

Consumers worldwide are shifting toward foods that support better digestion, improved metabolism, and overall wellness. Carbohydrases help break down complex carbohydrates, creating products that are easier to digest. This opens strong opportunities in the functional foods and dietary supplements segments.

Animal feed producers also offer a large growth space. Carbohydrases improve nutrient absorption in livestock, reducing feed costs and boosting productivity. With growing demand for protein and sustainable farming, enzyme-rich feeds are becoming more attractive to producers.

Biofuel production presents another major opportunity. Carbohydrases convert starch-rich biomass into fermentable sugars, improving ethanol yields. As governments promote renewable energy, demand for efficient processing enzymes is likely to rise. Enzymes enable better dough handling, improved sweetness, and enhanced texture, allowing companies to launch new premium products.

Regional Analysis

Asia Pacific Dominates the Carbohydrase Market with a Market Share of 48.2%, Valued at USD 1.9 Billion

Asia Pacific leads the global Carbohydrase Market, supported by strong food processing activity, rising demand for bakery and beverage enzymes, and expanding industrial applications. With a dominant 48.2% share valued at USD 1.9 billion, the region benefits from robust manufacturing hubs, increasing adoption of enzymatic solutions, and supportive government programs promoting bio-based processing technologies.

North America shows steady growth driven by advanced food manufacturing systems, high consumption of processed foods, and strong penetration of industrial enzymes across pharmaceuticals and biofuel production. The region also benefits from structured regulatory frameworks that support improved food quality, sugar reduction technologies, and clean-label product innovation.

Europe remains a mature market shaped by stringent food safety regulations, advanced bakery and brewing industries, and growing interest in sustainable enzyme-based processing. The region emphasizes efficiency, clean-label compliance, and energy-saving enzymatic technologies, supporting stable demand across food, feed, and industrial bioprocessing sectors.

The U.S. represents a key market within North America, driven by high innovation rates, strong R&D capabilities, and widespread use of carbohydrase in baking, beverages, nutraceuticals, and biofuel production. The country’s advanced manufacturing ecosystem and clean-label consumer preferences continue to support stable long-term growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Novozymes continues to set the pace in 2024 by scaling carbohydrase solutions that help food, beverage, and animal nutrition producers improve yield and process consistency. Its strength is deep fermentation know-how and application support, which lets customers fine-tune enzyme performance across different raw materials. The company’s steady focus on efficiency and lower processing losses keeps it central to large-volume buyers.

AB Enzymes stands out in 2024 for being highly application-driven, often winning business where customers need targeted performance in baking, brewing, starch processing, or feed. The company’s value proposition is practical: reliable enzymes, responsive technical service, and customization that helps manufacturers hit quality specs while controlling operating costs. This makes it attractive for mid-to-large processors seeking predictable outcomes.

DSM (including its nutrition and biosciences capabilities) remains influential in 2024 by positioning carbohydrases as part of broader “performance ingredient” toolkits for health, taste, and efficiency. It typically competes on formulation expertise and end-use insights—helping clients optimize recipes, manage viscosity, and improve digestibility. Its global customer relationships and compliance focus also support adoption in regulated food and nutrition markets.

DuPont keeps a strong 2024 footprint through integrated enzyme platforms that align with industrial and food processing needs, especially where process stability and scale matter. Its market advantage is combining enzyme science with process engineering support, helping customers reduce variability and improve throughput. Buyers often view DuPont as a dependable partner for long-run supply security and performance assurance.

Top Key Players in the Market

- Novozymes

- AB Enzymes

- DSM

- DuPont

- Amano Enzymes

- Kerry Ingredients

- Rochem

- Biocatalysts Ltd.

- BBI Enzymes

- Green Enzymes

Recent Developments

- In 2025, Novonesis highlighted the use of AI-powered biology to design proteins and create biosolutions, enhancing enzyme efficiency for sustainable applications in medicine and environmental challenges. The company collaborated with Noma to develop innovative flavors using fermentation and biosolutions, leveraging enzymes to transform raw materials.

- In 2025, AB Enzymes, part of Associated British Foods, emphasized regulatory approvals for food enzymes through GRAS notices submitted to the FDA. Amendments to GRAS Notice 1173 for invertase enzyme preparation aligned lead specifications with industry standards.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Billion Forecast Revenue (2034) USD 9.0 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Microbial, Plant, Animal), By Type (Alpha amylase, Beta glucanase, Cellulase, Others), By Application (Food and Beverage, Bakery and confectionery, Animal Feed, Pharmaceutical, Others), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Novozymes, AB Enzymes, DSM, DuPont, Amano Enzymes, Kerry Ingredients, Rochem, Biocatalysts Ltd., BBI Enzymes, Green Enzymes Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Novozymes

- AB Enzymes

- DSM

- DuPont

- Amano Enzymes

- Kerry Ingredients

- Rochem

- Biocatalysts Ltd.

- BBI Enzymes

- Green Enzymes