Global Caprylic Acid Market By Source (Natural, Coconut Oil, Palm Oil, Human Milk, Others, Synthetic), By Form (Liquid, Powder, Others), By Application (Personal Care, Pharmaceutical, Food And Beverages, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158831

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

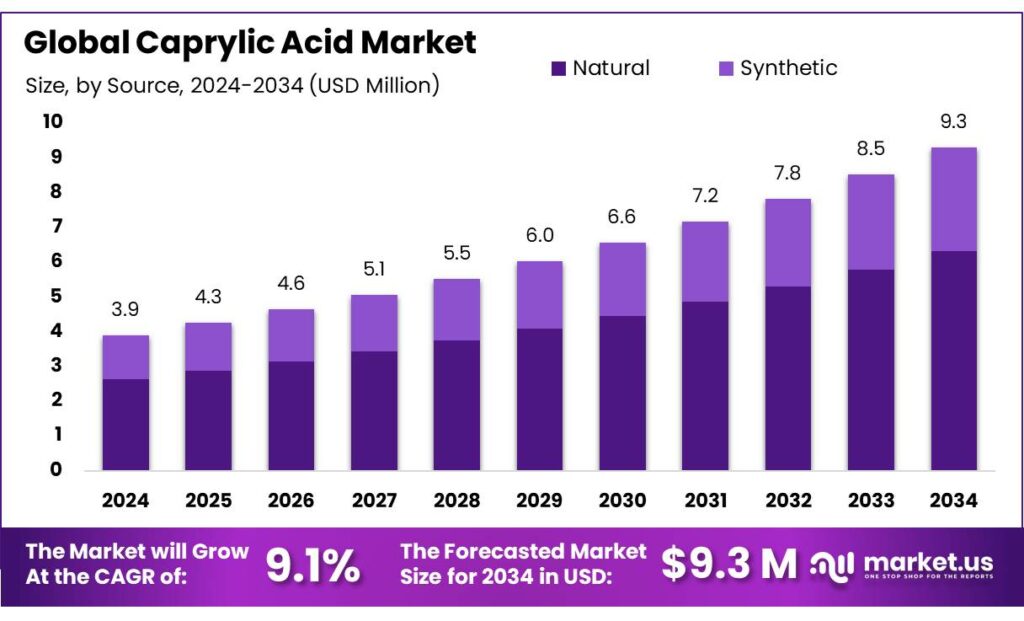

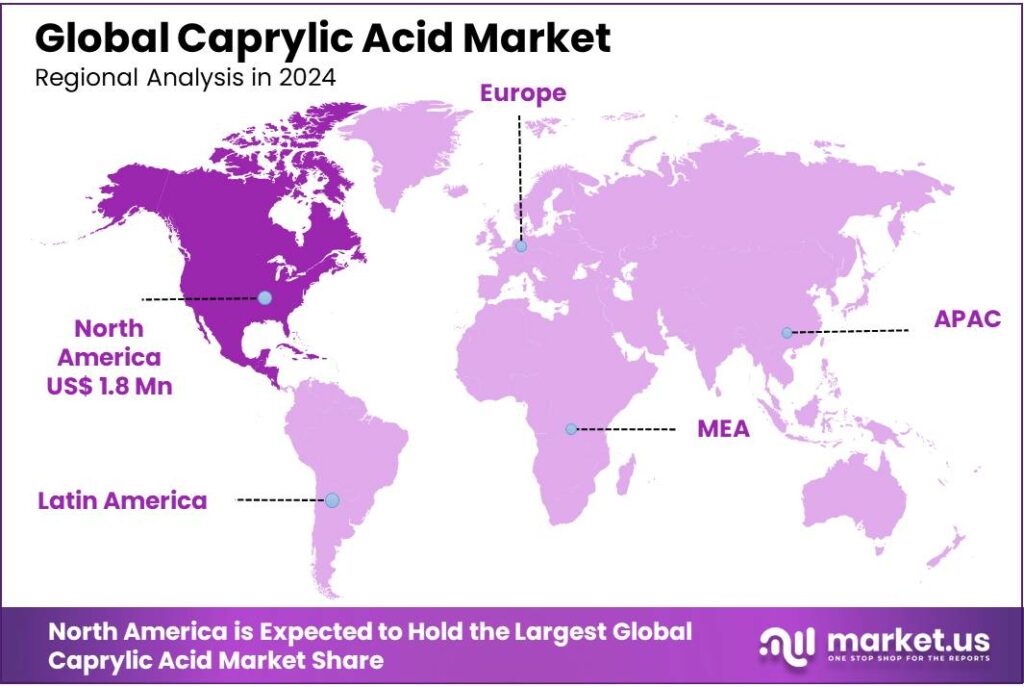

The Global Caprylic Acid Market size is expected to be worth around USD 9.3 Million by 2034, from USD 3.9 Million in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 46.3% share, holding USD 1.8 Million in revenue.

Caprylic acid, also known as octanoic acid, is a medium-chain fatty acid (MCFA) that is widely utilized across various industries, including food and beverages, pharmaceuticals, personal care, and agriculture. It is primarily derived from coconut oil and palm kernel oil, with smaller quantities found in the milk of certain animals. In the chemical industry, it plays a crucial role as a versatile intermediate in the synthesis of esters and as a key ingredient in manufacturing surfactants and detergents.

According to the U.S. Department of Agriculture (USDA), coconut oil production, a primary source of caprylic acid, has been steadily growing, contributing to the increasing availability of caprylic acid. In 2023, the global production of coconut oil reached 3.5 million metric tons, reinforcing the production capacity of caprylic acid.

Governments across various regions have also played a crucial role in supporting the growth of the caprylic acid market. For instance, the European Union’s Green Deal aims to foster sustainability and innovation in the chemical industry, providing financial incentives for the development of bio-based chemicals like caprylic acid.

Additionally, in the United States, the Renewable Fuel Standard (RFS) program, overseen by the Environmental Protection Agency (EPA), supports the use of bio-based chemicals, enhancing the adoption of caprylic acid in biofuel production and other renewable energy applications.

According to the U.S. Department of Energy, bio-based chemicals are forecasted to comprise 30% of the chemical market by 2035, offering a significant opportunity for the caprylic acid market to expand. Additionally, the increasing demand for natural antimicrobial agents in food preservation, coupled with growing consumer awareness regarding product safety, positions caprylic acid as a key player in ensuring food security and hygiene.

Key Takeaways

- Caprylic Acid Market size is expected to be worth around USD 9.3 Million by 2034, from USD 3.9 Million in 2024, growing at a CAGR of 9.1%.

- Natural Caprylic Acid held a dominant market position, capturing more than a 67.9% share of the global market.

- Liquid Caprylic Acid held a dominant market position, capturing more than a 56.7% share.

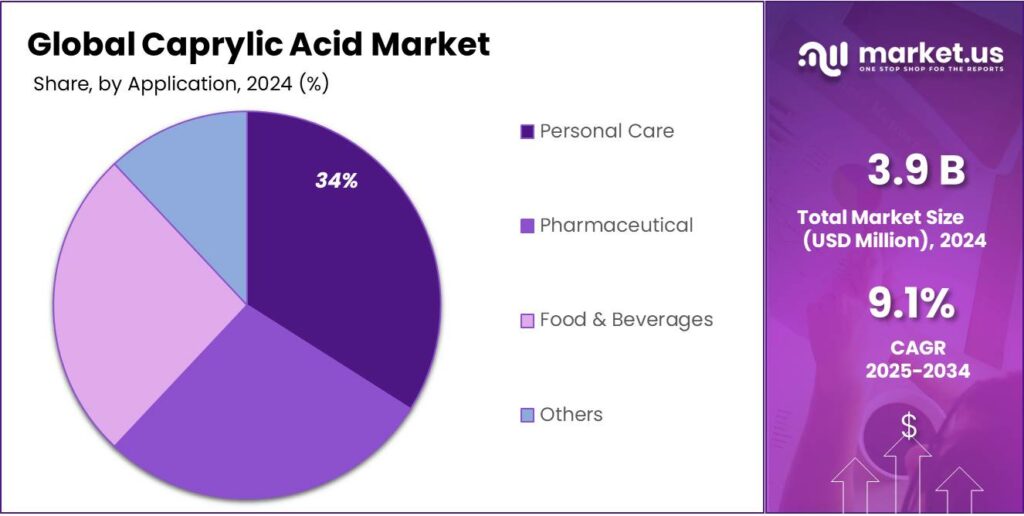

- Personal Care held a dominant market position, capturing more than a 34.6% share of the caprylic acid market.

- North America held a dominant position in the global Caprylic Acid market, capturing a substantial 46.3% share, valued at USD 1.8 million.

By Source Analysis

Natural Caprylic Acid Source Dominates with 67.9% Share in 2024 Due to Growing Consumer Demand for Organic and Sustainable Products

In 2024, Natural Caprylic Acid held a dominant market position, capturing more than a 67.9% share of the global market. This growth can be attributed to the increasing preference for natural and organic ingredients across various industries, particularly in the food, pharmaceutical, and cosmetics sectors. Consumers are increasingly inclined toward products that are sustainably sourced and free from synthetic chemicals, driving demand for natural sources of caprylic acid.

The trend toward clean and green products has further propelled the use of natural caprylic acid, as it aligns with the rising consumer focus on health-conscious and eco-friendly choices. With greater awareness of the health benefits of natural oils, including their antimicrobial properties, the demand for natural caprylic acid is expected to maintain strong growth momentum through 2025 and beyond.

By Form Analysis

Liquid Caprylic Acid Leads with 56.7% Market Share in 2024 Due to Its Versatility and Ease of Use

In 2024, Liquid Caprylic Acid held a dominant market position, capturing more than a 56.7% share. This is primarily due to its wide range of applications in various industries, including food, cosmetics, and pharmaceuticals. The liquid form offers ease of use, making it ideal for incorporation into formulations and product mixtures. Its liquid state enhances its versatility, allowing for seamless blending with other ingredients, whether for use in skincare products, nutritional supplements, or food preservatives.

As industries increasingly prioritize convenience and efficiency in production, the demand for liquid caprylic acid is expected to continue growing, maintaining a leading position through 2025. This form’s popularity also aligns with the rising trend of consumers seeking ready-to-use, easily absorbable products, further boosting its market dominance.

By Application Analysis

Personal Care Dominates with 34.6% Share in 2024 Due to Rising Consumer Demand for Natural Ingredients

In 2024, Personal Care held a dominant market position, capturing more than a 34.6% share of the caprylic acid market. This growth is driven by the increasing consumer preference for natural and organic ingredients in skincare and haircare products. Caprylic acid is valued in the personal care industry for its moisturizing, antimicrobial, and emulsifying properties, making it a key ingredient in a variety of products, such as lotions, shampoos, and facial cleansers.

As the demand for clean beauty products continues to rise, caprylic acid’s role in formulating gentle, effective, and eco-friendly personal care products is expected to further propel its market share in the coming years. This trend is likely to continue through 2025 as consumers prioritize safer, sustainably sourced ingredients in their beauty routines.

Key Market Segments

By Source

- Natural

- Coconut Oil

- Palm Oil

- Human Milk

- Others

- Synthetic

By Form

- Liquid

- Powder

- Others

By Application

- Personal Care

- Pharmaceutical

- Food & Beverages

- Others

Emerging Trends

Increased Adoption of Caprylic Acid in Clean Label and Organic Products

A prominent trend in the caprylic acid market is the rising adoption of the ingredient in clean label and organic products. Consumers today are becoming more health-conscious and are increasingly seeking products with simple, natural, and recognizable ingredients. This shift in consumer preferences is driving the demand for clean label ingredients like caprylic acid, which is known for its naturally sourced properties, making it a favorite among manufacturers of organic and clean-label products.

Caprylic acid, a naturally occurring medium-chain fatty acid found in coconut oil and palm kernel oil, is gaining popularity in the food industry as a clean label emulsifier, preservative, and flavor enhancer.

- According to the Clean Label Project, over 70% of consumers are actively looking for products with fewer artificial ingredients and more natural components. This trend is particularly prominent in food products such as dairy alternatives, plant-based beverages, and processed foods, where caprylic acid is used to improve texture and extend shelf life without relying on synthetic chemicals.

Additionally, the trend of using organic coconut oil in food production has further fueled the demand for caprylic acid. Organic coconut oil, often seen as a premium product, is experiencing increasing demand in both the U.S. and Europe. The price of organic coconut oil, which is directly tied to the production of caprylic acid, has risen significantly in recent years.

- As of 2023, the average cost of organic coconut oil in the U.S. was around USD 2,200 per metric ton, which is roughly 20-30% higher than conventional coconut oil prices. This price surge is reflective of both the growing demand for organic products and the need for sustainable sourcing.

Drivers

Growing Demand for Clean Label Products in the Food and Beverage Industry

One of the major driving factors for the caprylic acid market is the increasing demand for clean label products in the food and beverage industry. Consumers are becoming more health-conscious, looking for natural, safe, and non-synthetic ingredients in their food. As clean label trends continue to gain traction, food manufacturers are increasingly adopting natural additives, including caprylic acid, to cater to this demand.

According to the U.S. Food and Drug Administration (FDA), caprylic acid is classified as a Generally Recognized as Safe (GRAS) substance, which reinforces its position as a safe and approved ingredient for use in food products. This regulatory support is pivotal in increasing its adoption among food manufacturers, especially in the U.S. market. As per a report by the Food and Agriculture Organization (FAO), there has been a significant rise in the usage of natural food preservatives, with caprylic acid being a key player due to its bioactive properties.

Furthermore, the increasing popularity of plant-based and dairy-free alternatives is also driving the demand for caprylic acid. For example, plant-based milk, cheese, and yogurt are growing rapidly in the market. These products often require additives to enhance shelf life and maintain texture, which has created a surge in demand for caprylic acid.

- In fact, as of 2024, the global plant-based milk market is projected to exceed USD 30 billion, growing at a rate of 10.5% annually, according to the Plant-Based Foods Association (PBFA). This growing sector in the food industry directly correlates with increased usage of natural ingredients like caprylic acid.

Restraints

High Cost of Caprylic Acid Production

One of the primary restraining factors for the growth of the caprylic acid market is the high cost of production. Despite its widespread use in the food, pharmaceutical, and cosmetic industries, the manufacturing process of caprylic acid remains expensive due to the raw materials and processes involved. Caprylic acid is mainly derived from coconut oil and palm kernel oil, both of which have witnessed fluctuating prices over the years. The volatility in the prices of these raw materials often impacts the cost-effectiveness of caprylic acid production, making it a costly ingredient for manufacturers.

- In 2023, coconut oil prices soared to over USD 1,800 per metric ton, up from an average of USD 1,400 in previous years, due to a combination of factors such as extreme weather conditions affecting coconut crops in Southeast Asia and rising global demand for coconut-based products. This fluctuation directly affects the production cost of caprylic acid, as the oil is a key raw material in its production.

Furthermore, the growing emphasis on sustainability in the food industry has led to an increase in demand for organic coconut oil, which is even more expensive than conventional coconut oil. Organic coconut oil can cost up to 50% more than its non-organic counterpart. This trend has a direct impact on caprylic acid production costs, as manufacturers strive to source organic oils to meet the rising demand for “clean label” and organic products.

Another factor contributing to the high cost of caprylic acid is the refining process. The extraction and purification of caprylic acid from coconut oil or palm kernel oil require specialized equipment and energy-intensive processes, which adds to the overall cost.

- According to a report by the International Trade Centre (ITC), the refining process for medium-chain fatty acids such as caprylic acid requires sophisticated chemical engineering techniques, which contribute to a significant portion of the production cost.

Opportunity

Expansion of Plant-Based and Vegan Food Products

One of the most significant growth opportunities for the caprylic acid market lies in the booming plant-based and vegan food sectors. As consumers increasingly shift towards plant-based diets, whether for health, ethical, or environmental reasons, the demand for clean, natural ingredients like caprylic acid in these products is on the rise. Caprylic acid, known for its versatility and mild antimicrobial properties, plays a crucial role in preserving the freshness of plant-based food products while also acting as an emulsifier, which is essential in dairy-free alternatives like vegan cheeses, plant-based milks, and dairy-free yogurts.

- According to the Plant-Based Foods Association (PBFA), the U.S. plant-based food sector reached USD 7 billion in 2023, with plant-based milk products alone accounting for over USD 2.5 billion of that total. This surge in plant-based food consumption is particularly driven by the increasing demand for dairy-free and vegan alternatives, and caprylic acid is increasingly being used to ensure the quality and stability of these products.

Governments and international organizations are also playing a role in the expansion of plant-based and vegan food sectors, further driving the demand for natural ingredients like caprylic acid. For instance, the European Union has supported the development of plant-based food initiatives through programs like the European Green Deal, which promotes sustainability and environmentally friendly food production practices.

Similarly, in the U.S., the USDA has been backing initiatives to increase the availability and affordability of plant-based products, with particular emphasis on dairy alternatives. These government-backed programs aim to support the expansion of plant-based food production and, by extension, the demand for natural food additives like caprylic acid.

Regional Insights

North America Leads the Caprylic Acid Market with 46.3% Share in 2024, Valued at USD 1.8 Million

In 2024, North America held a dominant position in the global Caprylic Acid market, capturing a substantial 46.3% share, valued at USD 1.8 million. The region’s strong market presence is attributed to the growing demand for caprylic acid in multiple sectors, including personal care, food and beverages, and pharmaceuticals. The shift towards natural, organic, and bio-based ingredients in consumer products has significantly contributed to the region’s growth. North America has witnessed increased consumption of caprylic acid in the formulation of skincare, haircare, and dietary supplements, driven by rising health-conscious consumers.

The U.S. is the leading country in North America, where health and wellness trends have been gaining momentum, particularly in organic and clean beauty products. According to the U.S. Food and Drug Administration (FDA), natural ingredients like caprylic acid are increasingly favored in food and personal care products due to their antimicrobial and skin-friendly properties. Additionally, North American regulations around product safety and sustainability also bolster the use of naturally sourced ingredients such as caprylic acid, making it a preferred choice in various consumer goods.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

VVF L.L.C. is a prominent Indian manufacturer specializing in personal care products, oleochemicals, and specialty chemicals. The company produces caprylic acid derived from 100% vegetable renewable feedstocks, including palm and rapeseed oils. VVF offers a range of specialty fatty acids, such as caprylic, capric, lauric, myristic, palmitic, stearic, oleic, erucic, and behenic acids, catering to industries like personal care, food, and pharmaceuticals.

Emery Oleochemicals is a global producer of natural-based chemicals, specializing in fatty acids and their derivatives. The company offers commercially pure caprylic acid under the product name EMERY® 657, which is a water-white liquid containing approximately 99% caprylic acid. Emery Oleochemicals’ caprylic acid products are used in various applications, including personal care, food, and pharmaceutical industries.

Wilmar International Ltd. is a global agribusiness group with a significant presence in the oleochemical industry. The company manufactures caprylic acid (C8) and capric acid (C10) derived from palm kernel oil through the splitting of fats at high temperature and pressure. Wilmar’s caprylic acid products are used in various applications, including personal care formulations and as intermediates in the production of other chemicals.

Top Key Players Outlook

- VVF L.L.C.

- Oleon NV

- Wilmar International Ltd.

- KLK OLEO

- Emery Oleochemicals

- P & G Chemicals

- Apical Group

- Temix Oleo Srl

- Pacific Oleochemicals, Sdn. Bhd.

- Musim Mas Group

Recent Industry Developments

In 2024 Emery Oleochemicals, reported a revenue of USD 1.2 billion, with caprylic acid accounting for approximately 15% of this total, reflecting a steady demand for its products across various applications.

In 2024 VVF L.L.C, reported a revenue of approximately USD 5.18 billion, with caprylic acid contributing notably to this figure. VVF’s caprylic acid is derived from 100% vegetable renewable feedstocks, including palm and rapeseed oils, and is utilized across various industries such as personal care, food, and pharmaceuticals.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Mn Forecast Revenue (2034) USD 9.3 Mn CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Natural, Coconut Oil, Palm Oil, Human Milk, Others, Synthetic), By Form (Liquid, Powder, Others), By Application (Personal Care, Pharmaceutical, Food And Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape VVF L.L.C., Oleon NV, Wilmar International Ltd., KLK OLEO, Emery Oleochemicals, P & G Chemicals, Apical Group, Temix Oleo Srl, Pacific Oleochemicals, Sdn. Bhd., Musim Mas Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- VVF L.L.C.

- Oleon NV

- Wilmar International Ltd.

- KLK OLEO

- Emery Oleochemicals

- P & G Chemicals

- Apical Group

- Temix Oleo Srl

- Pacific Oleochemicals, Sdn. Bhd.

- Musim Mas Group