Global Cannabis Packaging Market Size, Share, Growth Analysis By Type (Rigid, Flexible), By Application (Recreational Use, Medical Use), By Material (Plastic, Glass, Paper, Metal), By Product (Bottles & Jars, Blisters & Clamshells, Tins, Pouches, Tubes, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152821

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

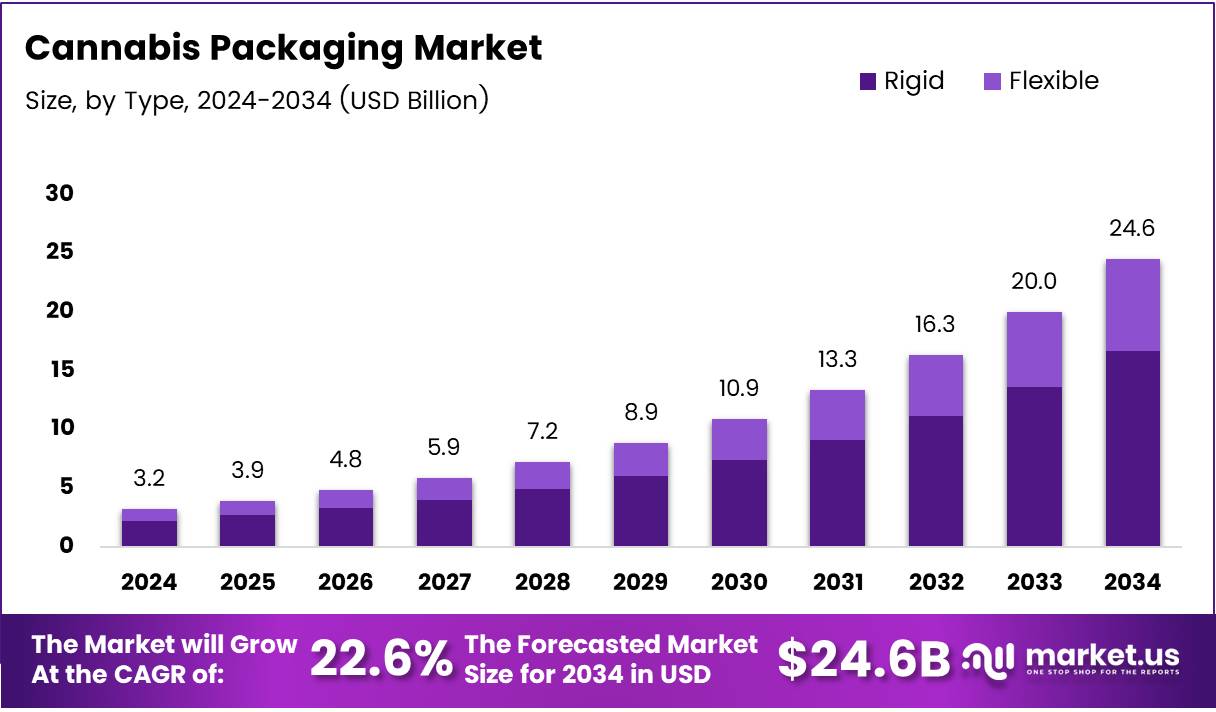

The Global Cannabis Packaging Market size is expected to be worth around USD 24.6 Billion by 2034, from USD 3.2 Billion in 2024, growing at a CAGR of 22.6% during the forecast period from 2025 to 2034.

The cannabis packaging market is evolving rapidly as demand for cannabis products continues to increase. Packaging plays a critical role in protecting the product, ensuring safety, and enhancing brand appeal. With the growing emphasis on premium packaging and sustainability, companies are focusing on creating innovative packaging solutions that cater to consumer preferences while complying with regulatory standards.

One of the key drivers in the market is the need for secure and child-resistant packaging. As cannabis products are becoming more accessible in various regions, regulations are becoming stricter, particularly in areas where products are legally sold to consumers. Packaging needs to meet these standards to ensure safety and avoid legal complications, influencing manufacturers to invest in advanced packaging technologies.

As the industry matures, opportunities in cannabis packaging are expanding. Innovations in materials, such as biodegradable plastics and sustainable solutions, are gaining traction. The shift towards eco-friendly packaging reflects broader consumer trends toward sustainability. Companies that invest in green packaging solutions are likely to find favor with environmentally-conscious consumers and create a competitive edge in the market.

The rise of premium cannabis products is also influencing packaging trends. High-quality, attractive packaging is seen as an essential part of the overall consumer experience. As the market expands, the importance of packaging as a marketing tool is growing, making it a key focus for brands seeking to differentiate themselves in a crowded market.

According to 420packaging, over 70% of cannabis consumers consider the environmental impact when making purchasing decisions. Moreover, Axios reports that consumers are willing to pay up to 26% more for cannabis products with unique or collectible packaging. This preference for premium, environmentally-conscious packaging is creating significant opportunities for companies to enhance their offerings and cater to these evolving consumer demands.

In addition, Axios also found that 57% of survey respondents believe cannabis makes a great gift when packaged in premium branding, a sentiment that rises to 69% among millennials. This growing trend is driving packaging companies to explore creative, attractive, and functional designs that appeal to consumers looking for cannabis products as gifts or collectibles.

Key Takeaways

- Global Cannabis Packaging Market size is expected to reach USD 24.6 Billion by 2034, growing at a CAGR of 22.6% from 2025 to 2034.

- Rigid packaging led the By Type Analysis segment in 2024, holding 65.9% market share due to demand for secure and durable packaging.

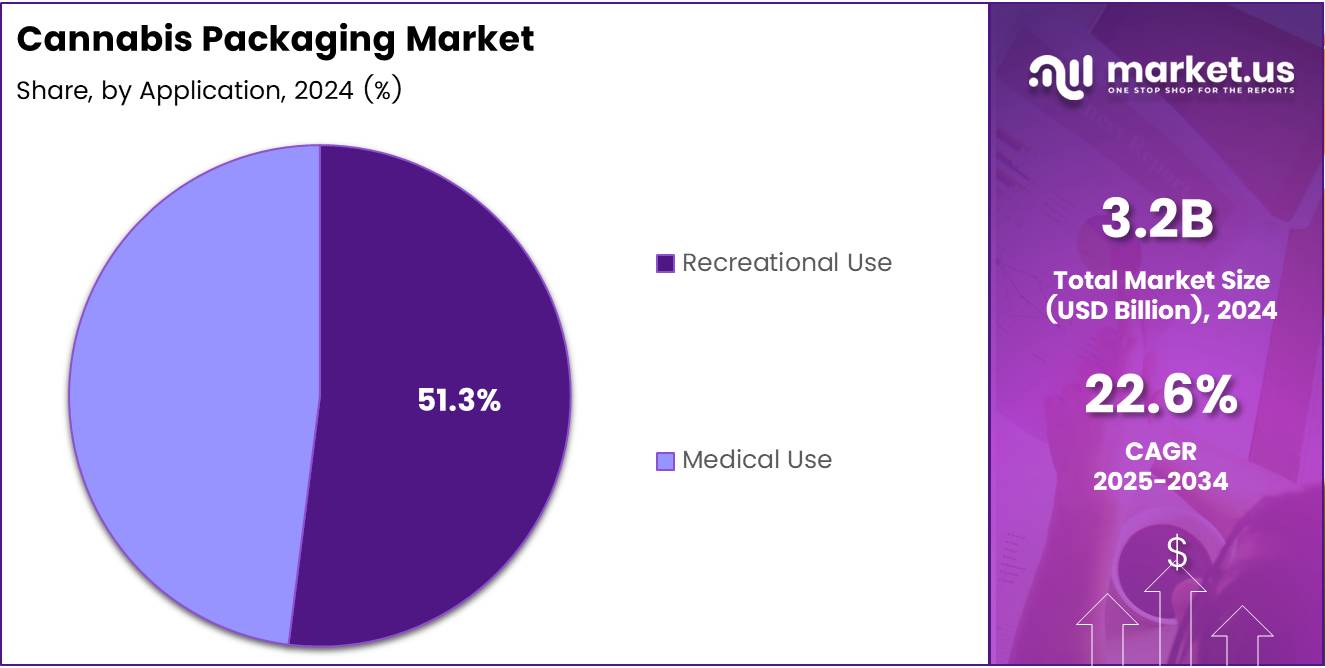

- Recreational use dominated the By Application segment with a 51.3% share in 2024, driven by increasing legalization for recreational cannabis.

- Plastic was the leading material in the cannabis packaging market, accounting for 51.9% of the market share in 2024.

- Bottles & Jars led the By Product Analysis category, holding 49.2% market share, driven by demand for secure and fresh-preserving packaging.

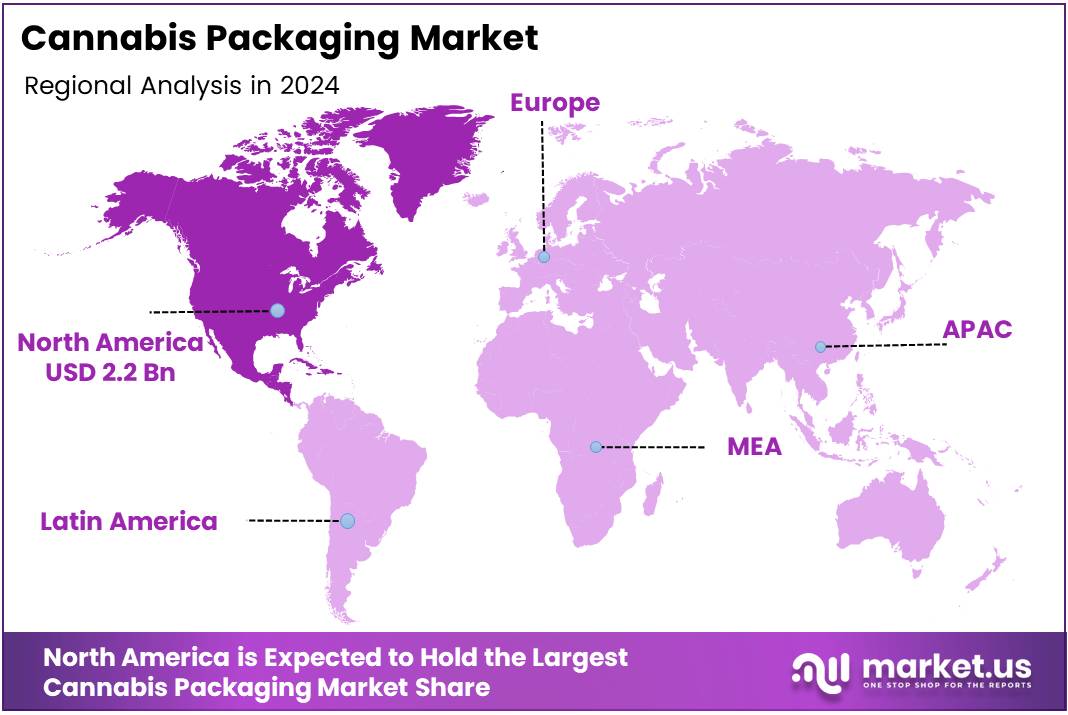

- North America held the largest market share of 69.2%, valued at USD 2.2 billion in 2024, propelled by increasing cannabis legalization.

Type Analysis

Rigid Packaging Dominates with 65.9% Market Share in Cannabis Packaging

In 2024, the rigid segment led the By Type Analysis segment of the cannabis packaging market, holding a substantial market share of 65.9%. This dominance is attributed to the growing demand for secure and durable packaging solutions for cannabis products.

Rigid packaging provides enhanced protection, which is crucial for preserving the quality and safety of the products during storage and transportation. Additionally, rigid packaging materials offer better tamper-evidence features, which are vital for consumer trust.

The flexible segment, while growing, accounted for a smaller portion of the market. However, flexible packaging is favored for its lightweight, cost-effective nature, and ability to accommodate various shapes and sizes of products. As sustainability concerns rise, flexible packaging’s ability to be more easily recyclable has led to increased adoption, though rigid packaging still dominates in overall market share.

Application Analysis

Recreational Cannabis Packaging Leads with 51.3% Market Share in Application Segment

In 2024, the recreational use segment led the cannabis packaging market with a dominant share of 51.3%. This growth is driven by the increasing legalization of cannabis for recreational purposes across various regions. As more areas legalize cannabis, there is a rising demand for packaging solutions tailored to this specific market.

Packaging for recreational cannabis is designed to appeal to a wide range of consumers. It focuses on being attractive, convenient, and secure, ensuring that products are both appealing and safe for consumers. The variety of packaging styles helps meet the preferences of different customer segments.

On the other hand, the medical use segment, while important, held a smaller market share. Medical cannabis packaging emphasizes enhanced protection, child-resistant features, and clear labeling to comply with regulatory requirements. However, it has yet to surpass recreational use packaging in terms of market size, primarily due to the larger consumer base for recreational products.

Material Analysis

Plastic Packaging Leads with 51.9% Market Share in Material Segment of Cannabis Packaging

In 2024, plastic dominated the cannabis packaging market in the By Material Analysis segment, capturing a share of 51.9%. This dominance can be attributed to the material’s versatility, lightweight nature, and cost-effectiveness.

Plastic packaging offers ease of customization, which is essential for brands seeking to differentiate their products in the competitive cannabis market. Additionally, plastic packaging is widely accessible and has a relatively low production cost, making it a preferred choice for many cannabis producers.

While plastic holds the largest market share, glass, paper, and metal materials also play crucial roles in the market. Glass, known for its premium appearance and ability to preserve product quality, holds appeal in the high-end cannabis packaging sector. Paper and metal are more commonly used for sustainable packaging solutions, though they each capture smaller shares compared to plastic.

Product Analysis

Bottles & Jars Dominate with 49.2% Share in Cannabis Packaging Product Segment

In 2024, the Bottles & Jars segment led the By Product Analysis category in the cannabis packaging market, capturing a dominant share of 49.2%. This segment’s leadership is primarily driven by the widespread use of glass and plastic bottles for cannabis products, which effectively preserve the integrity and freshness of the contents. Bottles & Jars are popular for packaging oils, tinctures, and edibles, as they provide a secure, air-tight seal that ensures product quality.

Other packaging categories, including Blisters & Clamshells, Tins, Pouches, and Tubes, also play significant roles in the market. While Bottles & Jars remain the top choice, flexible packaging options like pouches and tubes are increasingly favored for their convenience, portability, and cost-effectiveness, particularly for lower-priced cannabis products.

Despite the growing adoption of flexible packaging, Bottles & Jars continue to dominate the market due to their higher-end appeal and their ability to meet stringent regulatory requirements. These factors reinforce their leading position in the cannabis packaging sector.

Key Market Segments

By Type

- Rigid

- Flexible

By Application

- Recreational Use

- Medical Use

By Material

- Plastic

- Glass

- Paper

- Metal

By Product

- Bottles & Jars

- Blisters & Clamshells

- Tins

- Pouches

- Tubes

- Others

Drivers

Increasing Legalization of Cannabis Fuels Packaging Market Demand

The ongoing legalization of cannabis across various regions is one of the primary drivers for the cannabis packaging market. As more countries and states legalize cannabis, the need for packaging that complies with local laws and regulations increases. This, in turn, spurs demand for customized and compliant packaging solutions.

Sustainable packaging has gained importance in the cannabis market, as consumers and companies alike focus on eco-friendly products. The rising awareness of environmental concerns pushes manufacturers to adopt packaging materials that are biodegradable or recyclable. This growing demand for sustainable packaging is a key driver of market growth.

Technological advancements in packaging design and materials are revolutionizing the cannabis packaging industry. Innovations such as tamper-evident seals, odor-proof bags, and child-resistant features are increasingly popular. These advancements provide both safety and convenience, driving the demand for better and more sophisticated packaging solutions in the cannabis sector.

As the cannabis market expands with new product offerings such as edibles, concentrates, and topicals, the demand for specialized packaging also increases. Each new product category requires unique packaging solutions, which accelerates market growth. This expanding product diversity directly impacts packaging demand and encourages innovation in packaging designs and materials.

Restraints

Regulatory Challenges and Market Education Restrict Cannabis Packaging Growth

The cannabis packaging market faces significant challenges due to stringent regulatory policies. Governments impose strict regulations on cannabis packaging to ensure safety, compliance, and protection for consumers. These regulations can limit the variety of packaging solutions available and increase the cost of packaging materials.

Packaging solutions that meet both safety and environmental standards are still limited. Manufacturers struggle to balance eco-friendliness with the stringent safety requirements set by regulatory authorities. This creates a gap in the market for packaging that satisfies both concerns, leading to a slow pace in the development of such solutions.

Educating the market about the benefits of innovative packaging remains a challenge. Many cannabis producers and consumers are not fully aware of the advancements in packaging technologies that improve safety, freshness, and sustainability. As a result, the adoption of these innovations may be slower than expected, hindering overall market growth.

Growth Factors

Smart Packaging and Cannabis Expansion Offer Growth Opportunities

The integration of smart packaging technologies presents significant growth opportunities in the cannabis packaging market. Smart packaging, which uses technologies such as QR codes and RFID, allows for enhanced consumer engagement and better tracking. This trend is gaining traction as companies seek to offer more interactive and informative packaging solutions.

The adoption of child-resistant packaging solutions is another key opportunity. As safety is a top concern for cannabis products, packaging that prevents children from accessing the contents is increasingly in demand. This requirement, alongside growing legalization, creates a large market for child-resistant packaging solutions.

The rise in online cannabis sales is also driving packaging demand. With the growing number of cannabis products being sold online, packaging must be both secure and appealing. This trend pushes for packaging designs that can withstand shipping and attract consumers, offering a promising growth opportunity for the cannabis packaging market.

The expansion of cannabis-infused products, such as beverages and edibles, is fueling the need for specialized packaging. These products often require unique packaging to maintain freshness and prevent contamination. As more cannabis-infused products enter the market, the demand for packaging solutions that cater to these new product categories continues to grow.

Emerging Trends

Eco-Friendly and Innovative Trends Shape Cannabis Packaging Market

The cannabis packaging market is increasingly focusing on eco-friendly and biodegradable packaging. With the growing concern over plastic waste, many consumers and businesses are opting for packaging materials that are more environmentally responsible. This shift towards sustainable packaging is a major trend driving the market forward.

Personalized packaging solutions are emerging as a popular trend in the cannabis industry. Custom branding and tailored designs allow companies to differentiate themselves in a competitive market. This personalization enhances consumer experience and contributes to the growing demand for unique packaging that stands out on store shelves.

The development of tamper-proof and safety-enhanced packaging is another key trend. Consumers are increasingly concerned about the safety and integrity of cannabis products, particularly with edibles and concentrates. Tamper-evident seals and secure packaging provide reassurance to consumers, creating a growing demand for these solutions.

The rise of branded and premium packaging designs is another trend gaining momentum. As cannabis becomes more mainstream, consumers are willing to pay a premium for products that offer high-quality packaging. This trend is pushing companies to invest in more attractive and upscale packaging to appeal to discerning customers.

Regional Analysis

North America Dominates the Cannabis Packaging Market with a Market Share of 69.2%, Valued at USD 2.2 Billion

North America holds the dominant position in the cannabis packaging market, accounting for 69.2% of the total market share, valued at USD 2.2 billion. The region’s strong growth is driven by the increasing legalization of cannabis in various states and the rising demand for high-quality, innovative packaging solutions. The region is expected to continue leading in terms of market size and growth due to advancements in packaging technology and an expanding consumer base.

Europe Cannabis Packaging Market Trends

Europe is rapidly emerging as a key player in the cannabis packaging market, fueled by the growing acceptance and legalization of cannabis in several countries. The region is witnessing a significant rise in demand for sustainable and eco-friendly packaging options as governments push for environmentally responsible solutions. The European market is expected to grow steadily in the coming years, driven by the rising demand for medical cannabis and premium packaging solutions.

Asia Pacific Cannabis Packaging Market Trends

Asia Pacific is witnessing growing interest in cannabis packaging solutions, primarily due to the increasing medical cannabis adoption in countries like Australia and Thailand. The demand for packaging is expanding as the industry in this region begins to take shape. However, the market remains relatively nascent compared to North America and Europe. The adoption of innovative and secure packaging solutions is expected to gain momentum as regulatory frameworks evolve across the region.

Middle East and Africa Cannabis Packaging Market Trends

The Middle East and Africa cannabis packaging market is in its early stages, with only a few countries exploring cannabis legalization for medical purposes. As these regions begin to explore regulatory frameworks, there is a growing need for high-quality packaging solutions that comply with strict standards. This market is poised for slow yet steady growth as the industry becomes more established in select regions, particularly in countries with progressive medical cannabis policies.

Latin America Cannabis Packaging Market Trends

Latin America is beginning to witness developments in the cannabis industry, with certain countries legalizing cannabis for medical use. As the market continues to evolve, the demand for cannabis packaging solutions will increase, especially for medical products. The Latin American market is still in its formative stages, with regulatory and supply chain infrastructure slowly developing to meet the growing needs of the industry.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Cannabis Packaging Company Insights

In 2024, Greenlane Holdings, Inc. continues to play a significant role in the global cannabis packaging market by providing a wide range of packaging solutions designed to meet the growing demands for cannabis products. The company focuses on innovative packaging designs, emphasizing sustainability and regulatory compliance.

SANNER has positioned itself as a leading provider of high-quality packaging solutions with a strong focus on child-resistant and secure cannabis packaging. Their expertise in safety and sustainability has helped them gain traction in the highly regulated cannabis sector.

Norkol Packaging LLC (Grow Cargo) is recognized for its versatile cannabis packaging solutions, catering to both the medical and recreational cannabis markets. Their products, which include premium packaging options, are designed to enhance product visibility while ensuring compliance with local regulations.

Dymapak has emerged as a key player by specializing in innovative, eco-friendly packaging options that meet both aesthetic and functional demands. Known for their commitment to reducing environmental impact, Dymapak’s products are gaining popularity among cannabis producers focused on sustainability.

These four companies represent a strong foundation for the growing cannabis packaging market, each contributing unique solutions to address the industry’s evolving needs for security, sustainability, and compliance.

Top Key Players in the Market

- Greenlane Holdings, Inc.

- SANNER

- Norkol Packaging LLC (Grow Cargo)

- Dymapak

- Amcor Plc

- Guangdong Bowe Packaging Co., Ltd.

- Elevate Packaging

- GPA Global

- Green Rush Packaging

- RXD Co

- J.L. CLARK

- Origin Pharma Packaging

- CurTec Nederland B.V.

- Berry Global Inc.

- Kaya Packaging

- KacePack

- Diamond Packaging

- Seidel GmbH & Co. KG

- IMPAK CORPORATION

- Cannaline Cannabis Packaging Solutions

- N2 Packaging Systems LLC

Recent Developments

- In June 2025, LEEF Brands announced the successful completion of its acquisition of the New York license, expanding its footprint in the rapidly growing cannabis market. This acquisition aligns with the company’s strategic goals to enhance its operations and expand distribution capabilities in key U.S. markets.

- In July 2024, ATS successfully completed its acquisition of Paxiom, a move that significantly strengthens ATS’s automation solutions portfolio. The acquisition is expected to accelerate ATS’s growth and enhance its market position within the packaging and automation industry.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 24.6 Billion CAGR (2025-2034) 22.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rigid, Flexible), By Application (Recreational Use, Medical Use), By Material (Plastic, Glass, Paper, Metal), By Product (Bottles & Jars, Blisters & Clamshells, Tins, Pouches, Tubes, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Greenlane Holdings, Inc., SANNER, Norkol Packaging LLC (Grow Cargo), Dymapak, Amcor Plc, Guangdong Bowe Packaging Co., Ltd., Elevate Packaging, GPA Global, Green Rush Packaging, RXD Co, J.L. CLARK, Origin Pharma Packaging, CurTec Nederland B.V., Berry Global Inc., Kaya Packaging, KacePack, Diamond Packaging, Seidel GmbH & Co. KG, IMPAK CORPORATION, Cannaline Cannabis Packaging Solutions, N2 Packaging Systems LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Greenlane Holdings, Inc.

- SANNER

- Norkol Packaging LLC (Grow Cargo)

- Dymapak

- Amcor Plc

- Guangdong Bowe Packaging Co., Ltd.

- Elevate Packaging

- GPA Global

- Green Rush Packaging

- RXD Co

- J.L. CLARK

- Origin Pharma Packaging

- CurTec Nederland B.V.

- Berry Global Inc.

- Kaya Packaging

- KacePack

- Diamond Packaging

- Seidel GmbH & Co. KG

- IMPAK CORPORATION

- Cannaline Cannabis Packaging Solutions

- N2 Packaging Systems LLC