Global Biodiesel Fuel Market By Blend (B100, B20, B10, B5), By Production Technology (Conventional Alcohol Trans-esterification, Pyrolysis, Hydro Heating), By Feedstock (Vegetable Oil, Animal Fats), By Application (Fuel, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150026

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

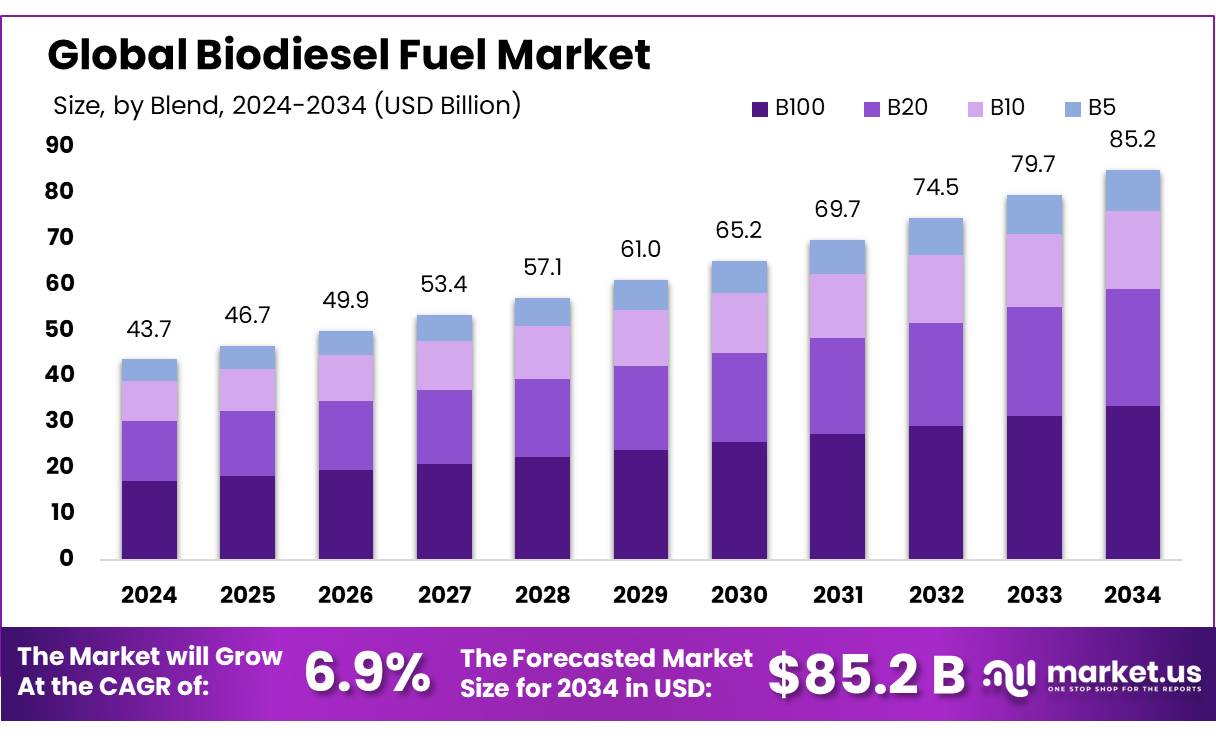

The Global Biodiesel Fuel Market size is expected to be worth around USD 85.2 Billion by 2034, from USD 43.7 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Biodiesel, derived from non-edible oils, used cooking oil (UCO), and animal fats, offers a renewable alternative to conventional diesel. Cellulose-based biofuels, produced from agricultural residues like straw and bagasse, represent second-generation biofuels that do not compete with food crops, aligning with India’s food security objectives.

The industrial scenario for biodiesel in India is evolving. In 2023, the country produced approximately 200 million liters of biodiesel, utilizing about 33% of its 600 million-liter production capacity. Notably, UCO accounted for 35% of this production, while animal fats and tallow contributed around 3%. This indicates a significant reliance on waste-derived feedstocks, promoting a circular economy. However, challenges such as limited feedstock availability and high raw material costs have constrained full-capacity utilization.

Government initiatives have been instrumental in driving the biofuel sector. The National Policy on Biofuels (2018) set ambitious targets, including a 5% biodiesel blend in diesel by 2030 . To support this, the government launched the Pradhan Mantri JI-VAN Yojana, providing financial assistance for setting up second-generation bio-refineries utilizing lignocellulosic biomass . Additionally, the Sustainable Alternative Towards Affordable Transportation (SATAT) initiative aims to establish 5,000 compressed biogas plants, further promoting biofuel adoption.

Driving factors for the growth of biodiesel and cellulose-based biofuels include the need to reduce dependence on fossil fuel imports, mitigate greenhouse gas emissions, and enhance energy security. India’s commitment to the Paris Agreement and its target to achieve 500 GW of non-fossil fuel-based capacity by 2030 underscore the importance of biofuels in the energy mix . Moreover, utilizing agricultural residues for biofuel production provides an additional income stream for farmers and addresses waste management issues.

Future growth opportunities are substantial. The International Energy Agency (IEA) estimates that achieving a 5% biodiesel blend by 2030 would require nearly 4.5 billion liters of biodiesel annually . This necessitates scaling up production capacities and diversifying feedstock sources. Investments in research and development for efficient conversion technologies, along with supportive policies, are crucial for realizing this potential. Furthermore, integrating biofuels into sectors like aviation, through initiatives such as the indicative blending targets for biojet fuel, can open new avenues for market expansion.

Key Takeaways

- Biodiesel Fuel Market size is expected to be worth around USD 85.2 Billion by 2034, from USD 43.7 Billion in 2024, growing at a CAGR of 6.9%.

- 100 held a dominant market position, capturing more than a 39.3% share of the global biodiesel fuel market.

- Conventional Alcohol Trans-esterification held a dominant market position, capturing more than a 74.6% share.

- Vegetable Oil held a dominant market position, capturing more than a 67.4% share of the global biodiesel fuel market.

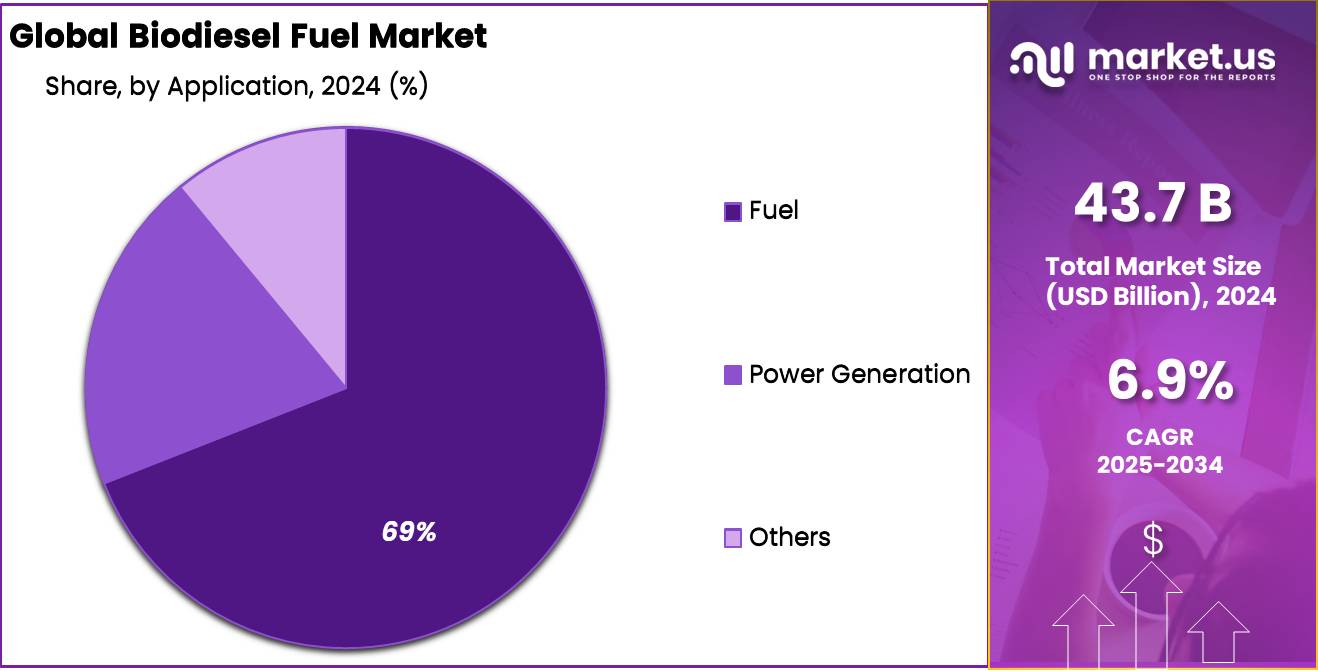

- Fuel held a dominant market position, capturing more than a 69.1% share in the biodiesel fuel market.

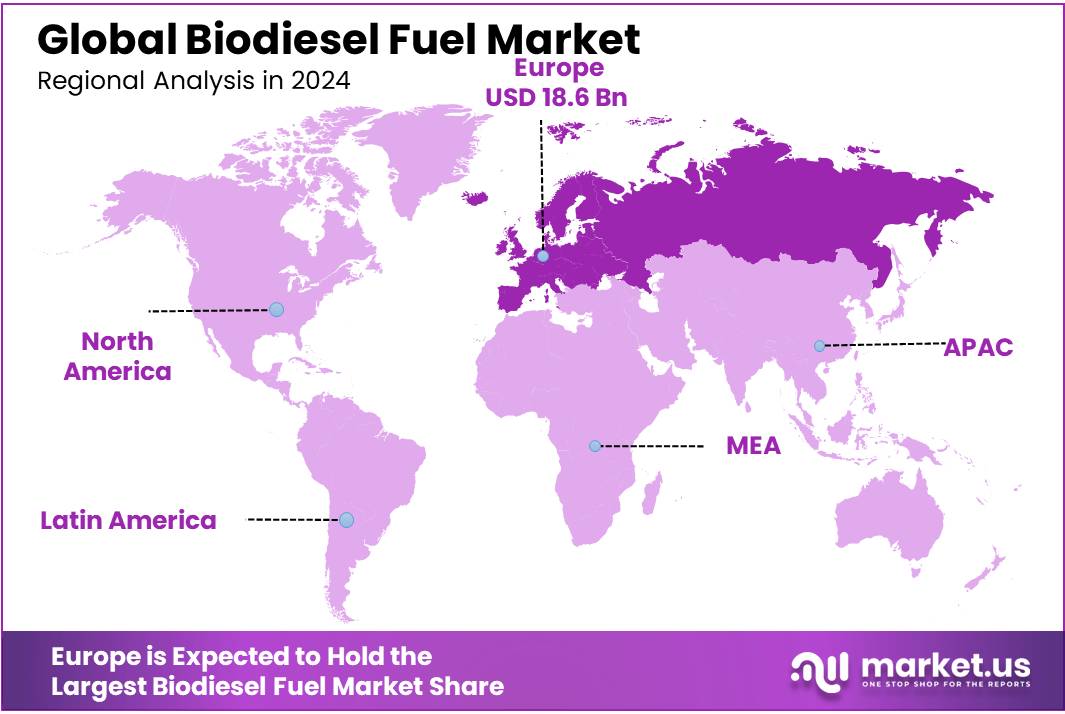

- Europe solidified its position as the leading region in the global biodiesel market, capturing a substantial 42.7% share, equivalent to a market value of approximately USD 18.6 billion.

By Blend

B100 Leads with 39.3% Share Owing to Its Pure Renewable Composition and Industrial Preference

In 2024, B100 held a dominant market position, capturing more than a 39.3% share of the global biodiesel fuel market by blend. This dominance reflects a growing industrial shift toward fully renewable fuel options, especially in sectors aiming to minimize carbon emissions without modifying existing diesel engines. The preference for B100 is particularly strong among transportation fleets, heavy machinery, and agricultural operations that prioritize sustainability and fuel independence.

Compared to lower blends like B20 or B5, B100 offers the highest environmental benefits as it consists of 100% biodiesel with no petroleum diesel content. Moreover, several national policies and procurement programs in 2024 favored B100 for government and public transport use, contributing to its expanded adoption. The increasing availability of biodiesel derived from used cooking oil, animal fats, and non-edible oilseeds also supported the growth of B100 usage in 2024. This segment is expected to remain at the forefront in 2025, driven by stricter emissions regulations and growing awareness of lifecycle carbon reductions.

By Production Technology

Conventional Alcohol Trans-esterification Leads with 74.6% Share Thanks to Its Proven Efficiency and Industrial Maturity

In 2024, Conventional Alcohol Trans-esterification held a dominant market position, capturing more than a 74.6% share in the biodiesel fuel market by production technology. This method remains the most widely used due to its cost-effectiveness, established processing infrastructure, and relatively simple chemical reaction pathway. It involves reacting vegetable oils or animal fats with methanol or ethanol in the presence of a catalyst, producing biodiesel and glycerin as a byproduct. Its high yield, scalability, and compatibility with a broad range of feedstocks have made it the preferred technology for both small-scale producers and large commercial biodiesel plants.

In 2024, most of the biodiesel produced in major biofuel-producing countries like the U.S., Brazil, and India continued to rely on this method. The technology’s long-standing presence in the market ensures better operational know-how, regulatory clarity, and supply chain stability, which are not yet as fully developed in emerging alternatives like enzymatic or supercritical methods. Heading into 2025, the dominance of Conventional Alcohol Trans-esterification is expected to persist as countries continue to rely on reliable and cost-efficient production methods to meet growing biodiesel blending mandates.

By Feedstock

Vegetable Oil Leads with 67.4% Share Due to Its Abundance and Established Processing Base

In 2024, Vegetable Oil held a dominant market position, capturing more than a 67.4% share of the global biodiesel fuel market by feedstock. This leadership is largely driven by the wide availability of vegetable oils such as soybean, canola, palm, and sunflower oil, which have long served as the primary raw materials for biodiesel production. The processing of vegetable oil into biodiesel is well understood, highly scalable, and supported by existing infrastructure across both developed and developing countries. In nations like the U.S., Brazil, and parts of Southeast Asia, domestic agricultural production of oilseeds ensures a steady supply of raw material for biodiesel plants.

In 2024, vegetable oil-based biodiesel also continued to meet quality standards more consistently compared to alternatives like animal fats or used cooking oil. Furthermore, policies in several countries promoting agricultural value chains and farm-to-fuel programs contributed to the sustained dominance of vegetable oil as the preferred feedstock. Looking ahead into 2025, the segment is expected to retain its lead, although diversification into waste oils and algae may gain pace in the long term as sustainability concerns grow.

By Application

Fuel Application Leads with 69.1% Share as Demand Rises in Transportation and Industrial Sectors

In 2024, Fuel held a dominant market position, capturing more than a 69.1% share in the biodiesel fuel market by application. This strong lead reflects the growing use of biodiesel as a direct replacement or additive for conventional diesel in transportation, logistics, and industrial operations. Governments in multiple regions have expanded their blending mandates, particularly for public buses, freight carriers, and municipal fleets, which rely heavily on diesel engines.

In 2024, countries such as Germany, the U.S., and Indonesia increased their use of biodiesel blends like B20 and B100, with infrastructure already in place to support bulk fuel distribution. The ease of integrating biodiesel into existing diesel engines without requiring modifications has been a key factor in accelerating its adoption. Additionally, fuel usage has been supported by national clean energy strategies and emissions targets, which prioritize low-carbon alternatives in core energy sectors. Looking toward 2025, continued demand from transport and emerging interest from sectors like construction and agriculture are expected to drive further growth in biodiesel as a fuel source.

Key Market Segments

By Blend

- B100

- B20

- B10

- B5

By Production Technology

- Conventional Alcohol Trans-esterification

- Pyrolysis

- Hydro Heating

By Feedstock

- Vegetable Oil

- Canola Oil

- Soybean Oil

- Palm Oil

- Corn Oil

- Others

- Animal Fats

- Poultry

- Tallow

- White Grease

- Others

By Application

- Fuel

- Automotive

- Marine

- Agriculture

- Power Generation

- Others

Drivers

Government-Led Blending Mandates: A Key Driver for Biodiesel Market Expansion

A significant factor propelling the growth of the biodiesel fuel market is the implementation of government-mandated blending programs. These mandates require a specific percentage of biodiesel to be blended with conventional diesel, thereby fostering a consistent demand for biodiesel and encouraging its production and utilization.

In India, the government’s proactive approach is evident through its biodiesel blending initiatives. During the period from April to November 2024, Oil Marketing Companies (OMCs) procured 366.8 million liters of biodiesel for blending purposes, marking a substantial increase from the 292.5 million liters procured during the same period in 2023. This uptick underscores the government’s commitment to enhancing the adoption of biodiesel in the country’s energy mix.

The National Policy on Biofuels further reinforces this commitment by setting an ambitious target of achieving a 5% biodiesel blend in diesel by 2030. According to the International Energy Agency (IEA), meeting this target would necessitate the production of approximately 4.5 billion liters of biodiesel annually.

These blending mandates not only stimulate the biodiesel market but also contribute to broader objectives such as energy security and environmental sustainability. By reducing reliance on imported fossil fuels, India can enhance its energy independence. Moreover, the increased use of biodiesel, which is a cleaner-burning alternative to conventional diesel, aids in lowering greenhouse gas emissions.

Restraints

Limited Feedstock Availability: A Major Constraint for India’s Biodiesel Market

One of the primary challenges facing India’s biodiesel sector is the limited availability of suitable feedstocks. This scarcity has significantly impacted production capacities and hindered the achievement of blending targets.

In 2024, India produced approximately 226 million liters of biodiesel, representing a mere 33% utilization of its installed capacity of 600 million liters. This underutilization is largely attributed to the inadequate supply of raw materials essential for biodiesel production . The predominant feedstocks—used cooking oil (UCO), animal fats, and non-edible oils—are not available in sufficient quantities to meet the growing demand.

The reliance on edible oils for biodiesel production raises concerns about food security. The diversion of edible oils to fuel production can lead to increased food prices and potential shortages. Recognizing this, the Indian government has emphasized the use of non-edible feedstocks. However, the cultivation of non-edible oilseeds like Jatropha has not yielded the expected results due to agronomic challenges and low yields.

To address the feedstock shortage, the government has implemented measures such as imposing a 50% export duty on B and C-heavy molasses to ensure their availability for domestic ethanol production. While this move aims to bolster ethanol production, it indirectly affects the biodiesel sector by limiting the availability of alternative feedstocks.

Opportunity

Government-Led Blending Mandates: A Key Driver for Biodiesel Market Expansion

A significant factor propelling the growth of the biodiesel fuel market is the implementation of government-mandated blending programs. These mandates require a specific percentage of biodiesel to be blended with conventional diesel, thereby fostering a consistent demand for biodiesel and encouraging its production and utilization.

In India, the government’s proactive approach is evident through its biodiesel blending initiatives. During the period from April to November 2024, Oil Marketing Companies (OMCs) procured 366.8 million liters of biodiesel for blending purposes, marking a substantial increase from the 292.5 million liters procured during the same period in 2023. This uptick underscores the government’s commitment to enhancing the adoption of biodiesel in the country’s energy mix.

The National Policy on Biofuels (2018) further reinforces this commitment by setting an ambitious target of achieving a 5% biodiesel blend in diesel by 2030. According to the International Energy Agency (IEA), meeting this target would necessitate the production of approximately 4.5 billion liters of biodiesel annually.

These blending mandates not only stimulate the biodiesel market but also contribute to broader objectives such as energy security and environmental sustainability. By reducing reliance on imported fossil fuels, India can enhance its energy independence. Moreover, the increased use of biodiesel, which is a cleaner-burning alternative to conventional diesel, aids in lowering greenhouse gas emissions.

Trends

Surging Use of Used Cooking Oil (UCO) as a Sustainable Feedstock in Biodiesel Production

A notable trend in India’s biodiesel sector is the increasing utilization of Used Cooking Oil (UCO) as a sustainable and cost-effective feedstock. This shift is driven by environmental concerns, government initiatives, and the need to reduce reliance on traditional feedstocks like vegetable oils.

Government policies have played a pivotal role in promoting UCO-based biodiesel. The National Policy on Biofuels (2018) identifies UCO as a key non-edible feedstock for biodiesel production. Additionally, the Ministry of Petroleum and Natural Gas has initiated programs to facilitate the collection and conversion of UCO into biodiesel, aiming to establish a robust supply chain .

The environmental advantages of using UCO are significant. Biodiesel derived from UCO contributes to lower greenhouse gas emissions compared to conventional diesel, aligning with India’s commitment to sustainable energy practices. Furthermore, utilizing UCO helps in waste management by preventing improper disposal of used oils, which can cause environmental hazards.

Regional Analysis

Europe Commands 42.7% Share in Biodiesel, Valued at $18.6 Billion in 2024

In 2024, Europe solidified its position as the leading region in the global biodiesel market, capturing a substantial 42.7% share, equivalent to a market value of approximately USD 18.6 billion. This dominance is underpinned by the European Union’s robust renewable energy policies, particularly the Renewable Energy Directive (RED III), which mandates a minimum of 14.5% renewable energy in transport by 2030.

Germany stands at the forefront of Europe’s biodiesel production, contributing around 45% of the region’s output in 2024. The country’s emphasis on sustainable energy and advanced production facilities has been instrumental in achieving this leading position . France and Spain also play significant roles, with France focusing on diversified feedstocks and Spain leveraging its agricultural base for biodiesel production.

In terms of consumption, biodiesel represented 7.2% of diesel use by energy in the EU in 2022, with most countries adopting B7 blends as standard diesel fuel. The EU’s commitment to reducing greenhouse gas emissions and dependence on fossil fuels continues to bolster the biodiesel sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ag Processing Inc. (AGP), a major U.S.-based cooperative, is a significant producer of biodiesel, especially from soybean oil. The company operates multiple biodiesel production facilities in Iowa and Missouri, contributing substantially to renewable fuel supply in the Midwest. AGP benefits from strong integration with agricultural supply chains, allowing it to source feedstock efficiently. In 2024, AGP continued expanding its production efficiency to meet regional blending mandates and supported U.S. energy security through reliable biodiesel output.

ADM is a leading player in the global biodiesel market, with extensive refining capabilities across North America and Europe. The company primarily uses vegetable oils, especially soybean and rapeseed, for biodiesel production. In 2024, ADM reinforced its commitment to sustainability by upgrading facilities and increasing biodiesel output in line with U.S. and EU blending regulations. Its vertical integration—from oilseed processing to final fuel—helps ensure cost-effective production and scalability in meeting global renewable fuel demand.

BP has steadily expanded its biofuel operations through its alternative energy division, with biodiesel forming a crucial part of its renewable portfolio. In 2024, BP focused on co-processing biodiesel in existing refineries and explored advanced feedstocks, including used cooking oil and algae. The company’s strategic investments in bioenergy support its broader goal to become a net-zero company by 2050. Its partnerships with agricultural suppliers and refiners help BP scale biodiesel production for European and U.S. markets.

Top Key Players in the Market

- Ag Processing, Inc.

- Archer Daniels Midland Company (ADM)

- BP p.l.c.

- Bunge Ltd.

- Cargill Incorporated

- Eco Fox S.r.l.

- Ecodiesel Colombia S.A.

- Eni S.p.A.

- Esso Italiana S.r.l.

- FutureFuel Corp.

- Ital Bi Oil S.R.L.

- Italiana Petroli S.p.A.

- Kolmar

- Manuelita S.A.

- Masol Continental SRL

Recent Developments

In 2024, Archer Daniels Midland Company (ADM) maintained its significant role in the global biodiesel sector, despite facing challenges. The company’s Refined Products and Other (RPO) segment, which encompasses biodiesel operations, reported an operating profit of $552 million, marking a 58% decline from the previous year.

In 2024, Bunge Ltd. reinforced its position in the biodiesel sector through strategic partnerships and capacity expansions. The company projected a significant increase in U.S. renewable diesel production capacity, anticipating it would reach approximately 5 billion gallons by the end of the year, up from about 2 billion gallons in previous years.

Report Scope

Report Features Description Market Value (2024) USD 43.7 Bn Forecast Revenue (2034) USD 85.2 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Blend (B100, B20, B10, B5), By Production Technology (Conventional Alcohol Trans-esterification, Pyrolysis, Hydro Heating), By Feedstock (Vegetable Oil, Animal Fats), By Application (Fuel, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ag Processing, Inc., Archer Daniels Midland Company (ADM), BP p.l.c., Bunge Ltd., Cargill Incorporated, Eco Fox S.r.l., Ecodiesel Colombia S.A., Eni S.p.A., Esso Italiana S.r.l., FutureFuel Corp., Ital Bi Oil S.R.L., Italiana Petroli S.p.A., Kolmar, Manuelita S.A., Masol Continental SRL Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ag Processing, Inc.

- Archer Daniels Midland Company (ADM)

- BP p.l.c.

- Bunge Ltd.

- Cargill Incorporated

- Eco Fox S.r.l.

- Ecodiesel Colombia S.A.

- Eni S.p.A.

- Esso Italiana S.r.l.

- FutureFuel Corp.

- Ital Bi Oil S.R.L.

- Italiana Petroli S.p.A.

- Kolmar

- Manuelita S.A.

- Masol Continental SRL