Global Automotive Wheel Coating Market Size, Share, Growth Analysis By Coating Type (Powder Coating, Liquid Coating, Ceramic Coating, Chrome Plating, Misc), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Performance and Sports Cars, Off-road Vehicles), By Substrate (Steel, Alloys, Carbon Fiber, Composite Materials, Misc), By Rim Size (13”-15”, 16”-18”, 19”-21”, Above 21”), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154914

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

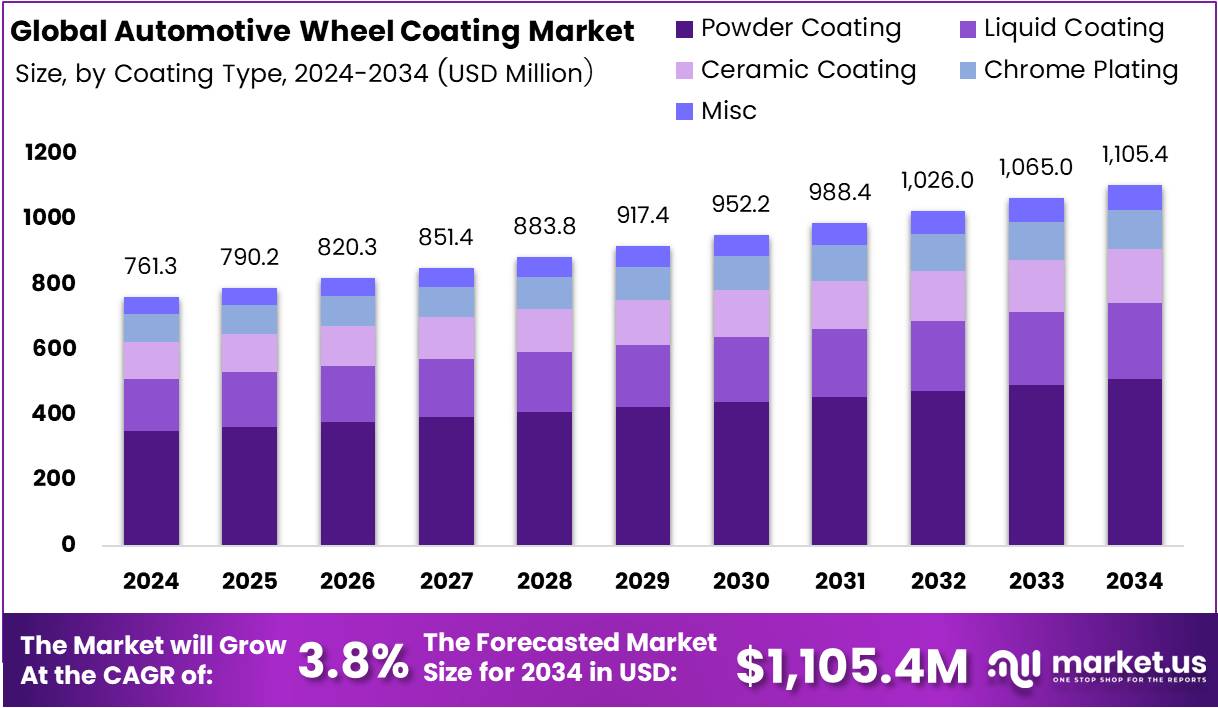

The Global Automotive Wheel Coating Market size is expected to be worth around USD 1105.4 Million by 2034, from USD 761.3 Million in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The Automotive Wheel Coating Market is evolving rapidly due to increasing demand for durability, aesthetics, and corrosion resistance. These coatings not only enhance visual appeal but also improve performance under harsh conditions. As more automakers invest in quality finishes, the demand for high-performance coatings continues to rise globally.

Moving forward, automakers are exploring innovative materials to meet consumer expectations for premium finishes. Lightweight alloys, carbon fiber, and composite materials require specialized coatings, which is boosting product innovation. As a result, manufacturers are introducing advanced coating technologies tailored to each substrate, supporting market differentiation.

In addition, stricter environmental regulations are encouraging the adoption of low-VOC and sustainable coating solutions. Governments are actively promoting eco-friendly practices in automotive manufacturing, which creates an opportunity for green coatings. This shift aligns with the industry’s long-term sustainability goals, pushing R&D investments in waterborne and powder coatings.

Moreover, the shift toward electric vehicles (EVs) is influencing design aesthetics, including wheels. EV makers are focusing on futuristic and performance-driven wheel designs, increasing the need for advanced coatings that offer both thermal protection and superior finishes. This transition opens new growth channels across regions focused on EV adoption.

Significantly, the market benefits from expanding automotive production in Asia-Pacific and North America. Rising vehicle ownership, coupled with growth in performance and off-road vehicles, increases demand for coated wheels. As consumer interest in customized and aftermarket wheels grows, so does the need for high-quality coatings that ensure long-term reliability.

Government investments are also playing a key role. In countries like India and China, subsidies for automotive innovation and localization of production support coating demand. Meanwhile, stricter US and EU regulations regarding emissions and chemical usage are accelerating the shift to safer, compliant coating solutions.

Technological advancements further support this market. Players are integrating smart coating technologies such as anti-scratch, anti-corrosion, and self-healing properties. These features are increasingly preferred by OEMs and consumers alike, driving both replacement and new coating demand in premium vehicle segments.

According to Nanoglans, ceramic coating offers up to 5 years of protection and is easier to maintain, making it a popular option for performance vehicles. This reinforces the growing appeal of high-end coatings. Ceramic, powder, and liquid coatings now dominate segment-wise revenue due to their durability and aesthetics.

The automotive wheel coating market is witnessing strong momentum due to material innovation, sustainability trends, and regulatory shifts. With rising consumer interest in style and durability, and increasing government investments, the industry is positioned for significant growth over the coming years.

Key Takeaways

- The Global Automotive Wheel Coating Market is projected to reach USD 1105.4 Million by 2034, up from USD 761.3 Million in 2024, growing at a CAGR of 3.8%.

- Powder Coating led the coating type segment in 2024 with a 46.2% share due to its corrosion resistance and eco-friendly benefits.

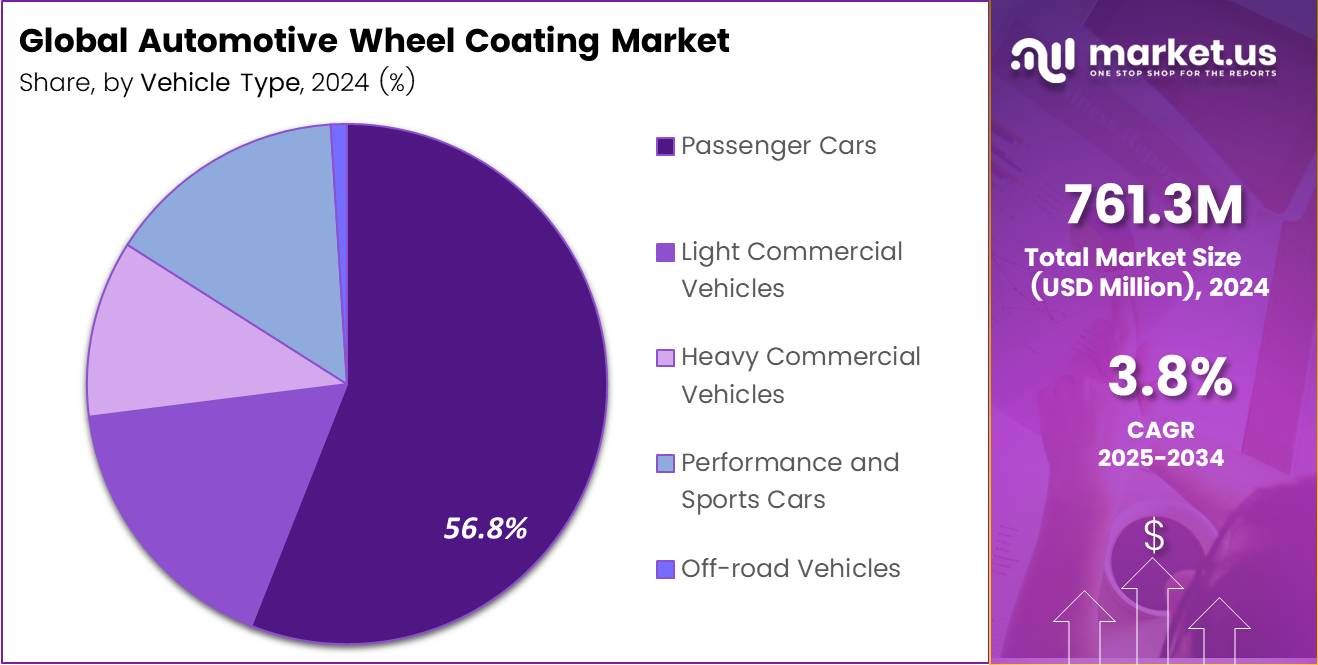

- Passenger Cars dominated by vehicle type in 2024 with a 56.8% market share, driven by global production and aesthetic demand.

- Steel was the top substrate in 2024, holding a 41.4% share for its cost-effectiveness and coating compatibility.

- 13”-15” rim size category led the market in 2024 with a 44.9% share, mainly used in compact and economy vehicles.

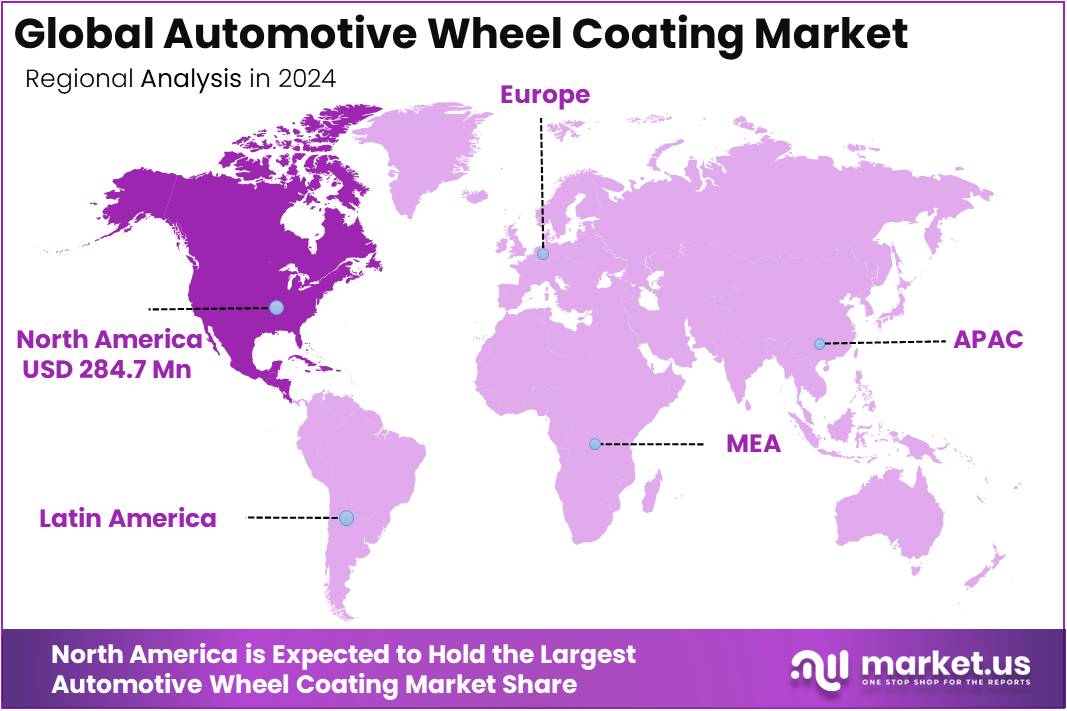

- North America was the leading regional market in 2024, accounting for 37.4% share or USD 284.7 Million, supported by advanced automotive manufacturing and eco-friendly trends.

Coating Type Analysis

Powder Coating leads with 46.2% due to its cost-efficiency and durability.

In 2024, Powder Coating held a dominant market position in By Coating Type Analysis segment of Automotive Wheel Coating Market, with a 46.2% share. This coating type is widely favored for its excellent resistance to corrosion, superior finish quality, and environmental advantages.

Liquid Coating followed closely, gaining traction for its flexibility in application and color variety. Though it faces environmental regulations, it remains relevant for certain manufacturing processes and design preferences.

Ceramic Coating also found a niche, especially in high-performance applications, offering enhanced thermal protection and scratch resistance. While not as widely adopted, it continues to grow steadily in performance-driven segments.

Chrome Plating maintained a presence due to its aesthetic appeal, particularly in custom or premium vehicle lines. However, it’s facing a gradual decline as manufacturers shift toward more sustainable solutions.

Miscellaneous coatings, including newer technologies under development, accounted for a smaller market share but present future growth opportunities as innovation and eco-regulations evolve.

Vehicle Type Analysis

Passenger Cars dominate with 56.8% driven by mass demand and production scale.

In 2024, Passenger Cars held a dominant market position in By Vehicle Type Analysis segment of Automotive Wheel Coating Market, with a 56.8% share. The substantial market share is driven by the high volume of passenger car production globally and the rising focus on aesthetics and longevity.

Light Commercial Vehicles captured moderate interest as urban logistics and e-commerce continue to fuel their demand. These vehicles prioritize durable and low-maintenance coatings.

Heavy Commercial Vehicles exhibited consistent but slower growth. While wheel aesthetics are secondary here, corrosion resistance and longevity remain critical factors influencing coating choices.

Performance and Sports Cars, though a smaller segment, contributed notable innovations in coating technologies. This segment prioritizes lightweight coatings with premium finishes, often adopting advanced options like ceramic.

Off-road Vehicles, designed for rugged terrain, continue to demand high-durability coatings. While they occupy a niche segment, their market value is significant due to higher performance requirements.

Substrate Analysis

Steel leads the pack with 41.4% as the preferred substrate for durability and cost.

In 2024, Steel held a dominant market position in By Substrate Analysis segment of Automotive Wheel Coating Market, with a 41.4% share. Steel’s dominance stems from its cost-efficiency, ease of fabrication, and compatibility with a wide range of coating technologies.

Alloys followed closely, particularly aluminum-based options that offer lighter weight and improved performance. These substrates are widely adopted in both passenger and performance vehicles.

Carbon Fiber represented a premium choice, mainly in high-end sports and racing vehicles. While adoption is limited due to high costs, its potential in lightweight applications remains high.

Composite Materials are emerging as innovative alternatives. Though currently occupying a minor share, they are gaining traction for their strength-to-weight ratios and corrosion resistance.

Miscellaneous materials include experimental or specialized substrates tailored to specific vehicle models or design needs. While currently niche, ongoing R&D may increase their future significance.

Rim Size Analysis

13”-15” rules with 44.9% market share due to dominance in entry-level vehicles.

In 2024, 13”-15” held a dominant market position in By Rim Size Analysis segment of Automotive Wheel Coating Market, with a 44.9% share. This size bracket is commonly used in compact and economy cars, contributing to its large share.

16”-18” rims followed, favored for mid-size and premium segment vehicles. This segment is expanding as consumers increasingly opt for larger wheels for style and performance.

19”-21” rims are growing in adoption, especially in SUVs and performance models. These sizes offer enhanced aesthetics and road presence, supporting premium market strategies.

Above 21” remains a specialized segment, primarily associated with luxury vehicles and aftermarket customization. While niche, this category brings high value per unit and influences coating innovation trends.

Key Market Segments

By Coating Type

- Powder Coating

- Liquid Coating

- Ceramic Coating

- Chrome Plating

- Misc

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Performance and Sports Cars

- Off-road Vehicles

By Substrate

- Steel

- Alloys

- Carbon Fiber

- Composite Materials

- Misc

By Rim Size

- 13”-15”

- 16”-18”

- 19”-21”

- Above 21”

Drivers

Surge in Customization Demand Across Premium Vehicle Segments

The growing demand for vehicle personalization, especially in luxury and premium segments, is a major factor driving the automotive wheel coating market. Customers now want their cars to reflect personal style, and unique wheel coatings play a big role in achieving that customized look.

Electric vehicles (EVs) are also pushing the need for stylish coatings. As more people choose EVs, automakers focus not only on performance but also on aesthetics. Wheels are among the most visible parts, and attractive coatings enhance the overall appeal of electric cars.

Emerging economies are witnessing rapid growth in the automotive aftermarket. In regions like Asia-Pacific and Latin America, more consumers are turning to aftermarket services for affordable customization. This trend is fueling the demand for various wheel coating options beyond factory settings.

Technological developments in powder coating formulas are improving both performance and finish. New coating technologies now offer better protection, longer durability, and vibrant colors, attracting both car manufacturers and individual car owners. These innovations support market expansion by meeting modern design and safety standards.

Restraints

High Cost of Advanced Coating Materials

One major restraint in the automotive wheel coating market is the high cost of premium materials. Advanced coatings, especially those with enhanced durability or eco-friendly properties, can significantly increase the overall price, making them less accessible to budget-conscious consumers.

Strict environmental regulations surrounding solvent-based coatings are also limiting market growth. Many traditional coatings contain harmful chemicals, which face bans or restrictions in several countries. Manufacturers must invest in eco-compliant alternatives, which can be costly and require changes in production.

Awareness of wheel coating options remains low in rural and price-sensitive areas. Many consumers still opt for basic wheels due to cost and limited exposure to modern coating technologies. This slows adoption in large market segments that hold potential.

Alloy wheels with complex designs present another challenge. Coating intricate surfaces requires advanced application techniques and skilled labor. This makes the process time-consuming and more expensive, discouraging some manufacturers and customers from investing in high-quality coatings.

Growth Factors

Development of Eco-Friendly and Bio-Based Coatings

Eco-friendly and bio-based coatings present a strong growth opportunity in the automotive wheel coating market. As sustainability becomes a global priority, manufacturers who invest in green formulations can attract both regulators and environmentally conscious consumers.

Smart coatings are also opening new possibilities. These advanced solutions can detect damage, temperature changes, or even rust. Adding such technology to wheel coatings can offer safety and performance advantages, making vehicles more intelligent and reliable.

Strategic partnerships with automotive OEMs are another avenue for growth. By working directly with carmakers, coating manufacturers can ensure their products are applied during production. This guarantees consistent quality and helps in mass adoption.

The rise of e-commerce platforms focused on auto accessories is also boosting the market. Online channels offer consumers easy access to wheel coating products and services, increasing visibility and sales potential. Companies that invest in digital marketing and online retail can reach a broader audience and increase market penetration.

Emerging Trends

Popularity of Matte and Satin Finish Coatings

Matte and satin finishes are gaining popularity in the automotive wheel coating market. These finishes offer a sleek, modern look that many car enthusiasts prefer over traditional glossy styles, especially in luxury and sports vehicles.

DIY wheel coating kits are also trending, with more consumers interested in customizing their cars at home. These kits are easy to use and cost-effective, encouraging car owners to experiment with different finishes and colors. This trend supports steady demand from hobbyists and small-scale auto shops.

Nanotechnology is making coatings stronger and more efficient. Nanocoatings improve resistance to scratches, UV rays, and weather damage. These enhanced features make coatings last longer, reduce maintenance needs, and improve overall vehicle appearance.

Finally, there’s an increased focus on lightweight coatings. Performance vehicles require every part to be as light as possible. Coating solutions that offer protection without adding weight are in high demand. Manufacturers developing such advanced materials are likely to see strong future growth.

Regional Analysis

North America Dominates the Automotive Wheel Coating Market with a Market Share of 37.4%, Valued at USD 284.7 Million

North America emerged as the leading region in the global automotive wheel coating market, capturing a dominant 37.4% market share, with a valuation of USD 284.7 million. The region’s growth is driven by the strong presence of advanced automotive manufacturing, coupled with increasing consumer preference for high-performance and aesthetic wheel coatings. Additionally, stringent environmental regulations are pushing manufacturers toward innovative and eco-friendly solutions.

Europe Automotive Wheel Coating Market Trends

Europe holds a significant position in the automotive wheel coating market due to the region’s well-established automotive industry and rising demand for durable and corrosion-resistant coatings. A growing trend toward electric vehicles and sustainability further stimulates the need for advanced coating technologies in this region.

Asia Pacific Automotive Wheel Coating Market Trends

Asia Pacific is experiencing rapid growth in the automotive wheel coating segment, attributed to the expansion of automotive production hubs in countries like China, India, and Japan. The increasing disposable income and changing consumer preferences for visually appealing and protective coatings continue to bolster market development in this region.

Middle East and Africa Automotive Wheel Coating Market Trends

The Middle East and Africa region is witnessing a gradual rise in demand for automotive wheel coatings, supported by an expanding automotive aftermarket and rising awareness of coating benefits. Harsh climatic conditions in parts of the region further encourage the adoption of protective coatings to extend vehicle longevity.

Latin America Automotive Wheel Coating Market Trends

Latin America is showing steady progress in the automotive wheel coating market, primarily fueled by increasing vehicle ownership and a recovering automotive sector. Economic improvements in countries like Brazil and Mexico are contributing to rising consumer interest in maintaining vehicle aesthetics and performance.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Wheel Coating Company Insights

In 2024, the global Automotive Wheel Coating Market has seen dynamic developments shaped by the strategic movements of key players.

Accuride Corporation continues to reinforce its position by focusing on high-performance wheel systems and coatings that cater to commercial vehicle requirements. Their emphasis on durability and corrosion resistance aligns well with industry needs for longevity and safety.

Afton Chemical Corporation plays a critical role with its specialized lubricant additives that support coating performance. Their commitment to research-driven product enhancements contributes to the overall efficiency and sustainability of automotive coatings.

BASF SE, a global chemical leader, leverages its advanced coating technologies to offer superior finish quality and environmental compliance. Their innovation pipeline is particularly strong in waterborne coatings and low-VOC solutions, helping OEMs meet tightening regulations.

Borbet, known for its premium alloy wheels, integrates aesthetically appealing yet functionally robust coatings. Their expertise in combining design excellence with protective solutions supports their status as a preferred supplier for luxury and performance vehicles.

These players are instrumental in pushing technological boundaries and setting new standards in the automotive wheel coating segment. The market outlook for 2024 reflects steady growth, largely driven by advancements in materials science, eco-friendly solutions, and rising consumer demand for visually striking and corrosion-resistant wheels. As vehicle manufacturers seek more efficient, durable, and customizable finishes, the strategic innovations from these companies are shaping the competitive landscape and fostering sustainable growth.

Top Key Players in the Market

- Accuride Corporation

- Afton Chemical Corporation

- BASF SE

- Borbet

- Chevron Oronite Company LLC

- Citic Dicastal

- Cummins Inc.

- Dorf Ketal Chemicals India Pvt. Ltd.

- Eastman Chemical Company

- Enkei

Recent Developments

- In Feb 2023, Nippon Paint transformed five Chinese automotive coatings companies into wholly-owned subsidiaries.

This strategic consolidation was completed for a total of 6.7 billion yen (approximately 344 million yuan) to strengthen its automotive coatings business in China. - In Jun 2025, Wheel+ Artdeshine unveiled a breakthrough polymer coating enhanced with carbon nanotubes (CNT).

The new formula offers a 53.5% increase in hardness and a 29.8% boost in dirt repellency, delivering superior, long-lasting protection for wheels.

Report Scope

Report Features Description Market Value (2024) USD 761.3 Million Forecast Revenue (2034) USD 1105.4 Million CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Coating Type (Powder Coating, Liquid Coating, Ceramic Coating, Chrome Plating, Misc), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Performance and Sports Cars, Off-road Vehicles), By Substrate (Steel, Alloys, Carbon Fiber, Composite Materials, Misc), By Rim Size (13”-15”, 16”-18”, 19”-21”, Above 21”) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Accuride Corporation, Afton Chemical Corporation, BASF SE, Borbet, Chevron Oronite Company LLC, Citic Dicastal, Cummins Inc., Dorf Ketal Chemicals India Pvt. Ltd., Eastman Chemical Company, Enkei Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Wheel Coating MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Wheel Coating MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accuride Corporation

- Afton Chemical Corporation

- BASF SE

- Borbet

- Chevron Oronite Company LLC

- Citic Dicastal

- Cummins Inc.

- Dorf Ketal Chemicals India Pvt. Ltd.

- Eastman Chemical Company

- Enkei